1

Contents

CERTIFICATION APPLICATION OVERVIEW ..................................................................................................... 2

KEY DEFINITIONS ........................................................................................................................................... 3

ADDITIONAL AND ALTERNATIVE REQUIREMENTS AND PROVISIONS BY CDFI TYPE ..................................... 5

APPLICATION PROCESS ................................................................................................................................. 9

APPLICANT BASIC INFORMATION ............................................................................................................... 12

LEGAL ENTITY .............................................................................................................................................. 29

PRIMARY MISSION ...................................................................................................................................... 33

FINANCING ENTITY ...................................................................................................................................... 51

TARGET MARKET ......................................................................................................................................... 67

DEVELOPMENT SERVICES ............................................................................................................................ 79

ACCOUNTABILITY ........................................................................................................................................ 83

NON-GOVERNMENTAL ENTITY ................................................................................................................... 97

NATIVE CDFI DESIGNATION ...................................................................................................................... 100

2

CERTIFICATION APPLICATION OVERVIEW

COMMUNITY DEVELOPMENT FINANCIAL INSTITUTIONS FUND (CDFI FUND) MISSION

The mission of the CDFI Fund is to expand economic opportunity for underserved people and

communities by supporting the growth and capacity of a national network of community development

lenders, investors and financial service providers.

COMMUNITY DEVELOPMENT FINANCIAL INSTITUTION (CDFI) CERTIFICATION

“CDFI Certification” or “CDFI Certified” is defined as the official U.S. Department of the Treasury

designation issued by the CDFI Fund to entities that provide financing activities to underserved people

and communities. CDFI Certification does not constitute an opinion by the CDFI Fund as to the

effectiveness or financial viability of an entity.

In order to be certified as a CDFI, an entity must meet each of the following criteria

1

:

- Be a legal entity;

- Have a primary mission of promoting community development;

- Be a financing entity that predominantly engages in the provision of arm’s-length

2

, on-balance

sheet

3

Financial Products

4

and/or Financial Services and has done so for at least one full fiscal

year;

- Primarily serve one or more Target Markets with its arm’s-length, on-balance sheet Financial

Products and, if elected, Financial Services;

- Provide Development Services in conjunction with its arm’s-length, on-balance sheet Financial

Products;

- Maintain accountability to each component of its CDFI Certification Target Market; and

- Be a non-governmental

5

entity.

1

In some cases, the entity as well as its affiliates may be subject to some or all of the listed criteria.

2

Entities that are Controlled by a Certified CDFI and seek to participate in the CDFI Fund’s Bond Guarantee Program (BG

Program) can meet the Certification requirements using Financial Product activity that is not arm’s-length, as long as the

activity is by and between such entities and their Controlling CDFIs. Such activity must be pursuant to operating agreements

that include management and ownership provisions and are in a form and substance acceptable to the CDFI Fund (see 12 C.F.R.

1805.201(b)(2)(C)(iii)).

3

Unless otherwise noted, balance sheet also refers to statement of financial position or statement of financial condition, which

shows an organization’s assets, liabilities, and owner's equity (or stockholders' equity); based on entity type.

4

The CDFI Fund recognizes the following types of Financial Products – loans; Equity Investments; loan guarantees; debt with

equity features; the purchase of loans originated by Certified CDFIs; the purchase of certain loans from organizations that are

not certified as CDFIs; and any similar financing activity pre-approved by the CDFI Fund.

5

A CDFI that is operated or Controlled by a Tribal Government is eligible to apply for certification. Indian tribes are not agencies

or instrumentalities of the U.S. or any state.

3

KEY DEFINITIONS

All capitalized terms in this Application are defined herein, in 12 C.F.R. Part 1805, or 12 U.S.C. 4701 et

seq.

KEY DEFINITIONS FOR IDENTIFYING AFFILIATES/SUBSIDIARIES

Affiliate: a company or entity that Controls, is Controlled by, or operates under common Control with

another company.

Subsidiary: a company that is owned or Controlled directly, or indirectly, by another company.

Control, Controlled or Controlling:

(1) Ownership, control, or power to vote 25% or more of the outstanding shares of any class of

voting securities of any company, directly or indirectly or acting through one or more other

persons;

(2) Control in any manner over the election of a majority of the directors, trustees, general partners

or individuals exercising similar functions of any company; or

(3) Power to exercise, directly or indirectly, a controlling influence over the management, credit, or

investment decisions or policies of any company.

Spinoff: A newly created entity formed by one or more separate entities that has received the financing

assets and activities of the original entity(ies) for the purpose of continuing such financing activities and

becoming a Certified CDFI.

KEY DEFINITIONS OF REGULATED FINANCING ENTITIES

Depository Institution Holding Company (DIHC): a bank holding company or a savings and loan holding

company, as defined in section 3 of the Federal Deposit Insurance Act (12 U.S.C. 1813(w)(1)).

Insured Depository Institution (IDI): any bank or thrift with deposits insured by the Federal Deposit

Insurance Corporation.

Insured Credit Union: any credit union with member accounts insured by the National Credit Union Share

Insurance Fund.

State-Insured Credit Unions: credit unions that are regulated by and/or have insurance for their member

accounts from a state agency or instrumentality.

State: refers to any of the 50 U.S. states, the District of Columbia or any territory of the United States,

Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, and Northern Mariana Islands.

4

ELIGIBLE FINANCIAL PRODUCTS

The CDFI Fund recognizes the following types of Financial Products for CDFI Certification purposes:

- Loans;

- Equity Investments;

- Loan guarantees;

- Forgivable loans that require at least one payment within 12 months of the loan closing date;

- Purchase of loans originated by Certified CDFIs;

- Purchase of loans originated by entities that do not have the CDFI Certification, but were made to

members of the Applicant’s Target Market(s);

- Credit cards;

- Lines of credit; and

- Debt with equity features.

Unless otherwise indicated, to be recognized as a Financial Product the related transactions must be arm’s-

length and on-balance sheet. Financial Product transactions originated during the reporting fiscal year that

may have been sold or paid off by the last day of the reporting fiscal year should be included in the Financial

Product activity data, even though they no longer appear on-balance sheet.

Any similar financing activity not listed above must be approved separately by the CDFI Fund to be

recognized as a Financial Product. If the Applicant is uncertain the Financial Product it offers aligns with the

Financial Product type(s) listed above, the Applicant should obtain clarification. To obtain clarification, the

Applicant must submit a Service Request in AMIS in advance of an Application submission for the CDFI

Fund’s consideration.

ELIGIBLE FINANCIAL SERVICES

The CDFI Fund recognizes the following types of Financial Services for CDFI Certification purposes:

- Checking accounts;

- Savings and share accounts;

- Check cashing;

- Money orders;

- Certified checks;

- Automated teller machines;

- Money market accounts;

- Safe deposit box services; and

- Any similar services not listed above must be specially approved by the CDFI Fund to be recognized

as a Financial Service).

The CDFI Fund recognizes all of the above Financial Services for the purpose of the CDFI Certification

criterion, except the Target Market test. For the purposes of the Target Market criterion, only the direct

holding of depository accounts will be accepted as an eligible Financial Service. Depository accounts include:

savings/share accounts, checking accounts, certificates of deposit, and money market accounts.

5

OBTAINING PRE-APPPROVAL TO INCLUDE SIMILAR FINANCIAL PRODUCTS, SIMILAR FINANCIAL

SERVICES, NEW TARGETED POPULATIONS, OR DEVELOPMENT SERVICES

Applicants seeking approval to include Financial Products, Financial Services, new Targeted Populations,

or Development Services that are not currently recognized or previously approved by the CDFI Fund,

must submit a Service Request in AMIS for the CDFI Fund’s consideration in advance of an Application

submission. The request must include the name and description of the Financial Product, Financial

Service, Targeted Population, and/or Development Service being proposed. Applicants should provide a

narrative describing the significant unmet capital, financial services and/or development services needs

as rationale for the request. Any supporting evidence (e.g., study, survey) must have been conducted

within the past five years, from a third-party source, and pertain specifically to the proposed request.

ADDITIONAL AND ALTERNATIVE REQUIREMENTS AND PROVISIONS BY

CDFI TYPE

REQUIREMENTS FOR DEPOSITORY INSTITUTION HOLDING COMPANIES (DIHCs), AFFILIATES OF DIHCs,

AND SUBSIDIARIES OF INSURED DEPOSITORY INSTITUTIONS (IDIs)

If the entity seeking CDFI Certification is a Depository Institution Holding Company (DIHC), an Affiliate of

a DIHC, or a Subsidiary of an Insured Depository Institution (IDI), it must meet the CDFI Certification

requirements based on a review of its compliance with those requirements, as well as a collective

review of the following Affiliates:

- Any Affiliate that is a DIHC or an IDI that Controls the Applicant;

- If an Applicant is a DIHC, any Affiliate that the Applicant Controls that directly engages in the

provision of Financial Products and/or Financial Services; or

- Any Affiliate that is mutually Controlled with the Applicant by a DIHC or an IDI and that directly

engages in the provision of Financial Products and/or Financial Services.

DIHCs, Affiliates of DIHCs, and Subsidiaries of IDIs may obtain or maintain CDFI Certification only if:

- they individually meet each of the CDFI Certification requirements (DIHCs can meet the Target

Market requirements based on the activity of an Affiliate(s));

- all of their relevant Affiliates individually meet Primary Mission, Accountability, and

Development Services requirements; and

- they and their relevant Affiliate(s) meet the Target Market Test in the aggregate.

6

PRIMARY MISSION REQUIREMENTS FOR CERTIFICATION APPLICANTS WITH AFFILIATES

For DIHCs, Affiliates of DIHCs, and Subsidiaries of IDIs, including Subsidiaries of a Tribal

Government, the CDFI Certification Primary Mission requirements must be met by all relevant

Affiliates, as described in the “Requirements for DIHCs, Affiliates of DIHCs, and Subsidiaries of

IDIs” above, to the collective CDFI certification review.

For all other Applicants, the CDFI Certification Primary Mission requirements must be met by

any Affiliate of the Applicant that Controls the Applicant or that directly engages in the provision

of Financial Products and/or Financial Services.

For more information, see the Primary Mission section of the Application form and the guidance

materials.

ADDITIONAL PROVISIONS FOR MEETING THE CDFI CERTIFICATION REQUIREMENTS

The following policies detail how different types of entities can meet the CDFI Certification requirements

in a manner consistent with their structure:

ENTITIES CONTROLLED BY TRIBAL GOVERNMENTS – PRIMARY MISSION REQUIREMENTS

Entities Controlled by a Tribal Government are eligible to apply for CDFI Certification. Indian

tribes are not agencies or instrumentalities of the U.S. or any State. An entity’s affiliation with a

Tribal Government will not affect its ability to meet the non-governmental entity criteria.

The CDFI Certification Applicant and/or relevant Affiliates that are Controlled by a Tribal

Government will need to demonstrate that it meets the Primary Mission requirements; the

Tribal Government is not required to meet Primary Mission requirements.

DEPOSITORY INSTITUTION HOLDING COMPANIES (DIHCs), INSURED DEPOSITORY INSTITUTIONS (IDIs),

INSURED CREDIT UNIONS, AND STATE-INSURED CREDIT UNIONS – FINANCING ENTITY REQUIREMENTS

As regulated and insured financial institutions, DIHCs, IDIs, Insured Credit Unions, and State-

Insured Credit Unions automatically meet the CDFI Certification Financing Entity requirements,

provided they have been engaged in eligible financing for at least one full fiscal year prior to

submission of the Application.

DIHCs THAT DO NOT ENGAGE IN THEIR OWN FINANCIAL PRODUCT OR FINANCIAL SERVICES ACTIVITY –

TARGET MARKET REQUIREMENTS

A DIHC that does not directly provide Financial Products or Financial Services may meet the

Target Market requirements by relying on the collective activity of its Affiliates, if:

the DIHC’s legal entity documentation is dated at least 12 months prior to the

submission of the CDFI Certification Application; and

at least one Affiliate has been engaged in closing Financial Products transactions or

completing Financial Services activities for at least one full fiscal year prior to submission

of the Application.

7

ENTITIES APPLYING FOR CERTIFICATION SOLELY FOR PARTICIPTION AS ELIGIBLE CDFIS IN THE CDFI

BOND GUARANTEE (BG) PROGRAM – FINANCING ENTITY AND ARM’S-LENGTH TRANSACTION

REQUIREMENTS

Entities applying for Certification solely for participation as Eligible CDFIs in the CDFI Fund’s CDFI

Bond Guarantee Program (BG Program) that are unable to meet CDFI Certification Financing

Entity requirements based on their own status, will be considered Financing Entities if they are

Controlled by a Certified CDFI. Such entities may also need to meet additional parameters and

restrictions established via the applicable Notice of Guarantee Availability for the particular CDFI

Fund BG Program Application round (see 12 CFR 1805.201(b)(2)(C)(ii)).

Entities applying for Certification solely for participation as Eligible CDFIs in the CDFI Fund’s CDFI

BG Program must be Controlled by a Certified CDFI and meet CDFI Certification requirements

using on-balance sheet Financial Product activity and Development Services activity that is not

arm’s-length, provided that the activity is by and between such entities and their Controlling

Certified CDFIs. Such activity must be pursuant to operating agreements that include

management and ownership provisions, and that are in a form and substance acceptable to the

CDFI Fund (see 12 CFR 1805.201(b)(2)(C)(iii)).

Entities certified under this provision are not eligible for CDFI Fund funding programs other than

the BG Program. If such an entity seeks access to other CDFI Fund programs, it must apply for

CDFI Certification using the regular Application process and demonstrate it meets all of the

regular requirements for CDFI Certification.

SPINOFF ENTITIES – PRIMARY MISSION, FINANCING ENTITY AND TARGET MARKET REQUIREMENTS

An entity spun off from one or more non-CDFI certified entities that offer arm’s-length, on-

balance sheet Financial Products is eligible to seek CDFI Certification, even if it has less than one

full fiscal year financing activity of its own. Such entities must be able to meet the requirements

of the CDFI Certification provision for Spinoff entities outlined in the Financing Entity and Target

Market sections.

In addition, if an Applicant seeks to use the CDFI Certification provision for Spinoff entities, it

must meet the Primary Mission timeframe requirement by demonstrating that either the

Applicant, or an entity from which the Applicant received Financial Products, had an appropriate

primary mission of community development in place throughout the six full months completed

immediately prior to submission of the CDFI Certification Application.

An entity spun off from a CDFI is not eligible for this provision.

For more detail on these policies, please see the instructions for each relevant CDFI Certification

criterion in the CDFI Certification Application form, and in the guidance materials.

8

OTHER CONDITIONS

ACCOUNTABILITY REQUIREMENTS – FINANCIAL INTEREST POLICY

Governing Board and Advisory Board members who are principals

6

or staff members of the Applicant

organization or its Subsidiaries, Affiliates, or whose family members are principals or staff members,

cannot be used to demonstrate Target Market Accountability.

TARGET MARKET - TRANSACTION LEVEL REPORT

All Applicants must complete and submit a Transaction Level Report (TLR) before beginning an

Application for CDFI Certification. The TLR is a data collection tool that provides a method to evaluate

the extent to which an entity serves distressed areas and underserved populations. Data provided

through the TLR will be used to determine the share of an entity’s Financial Products and/or Financial

Services that are deployed to the entity’s proposed Target Market(s). For additional information on the

TLR, review the related CDFI Transaction Level Report documents.

TRANSITION FROM GOVERNMENT CONTROL TO NON-GOVERNMENTAL ENTITY

If an Applicant was previously Controlled by a government or government-Controlled entity, it can

demonstrate that it is no longer controlled by a government entity if its governance, organizing

documents, and board’s activities demonstrate that it allows for an election or appointment of a non-

governmentally controlled board, and such board remains non-governmentally controlled for one year

from the date of the change. The date and authorizing signature of approval of the non-governmentally

controlled board must be clearly displayed in the organizing documents.

OBTAINING PRE-APPROVAL FOR FINANCIAL PRODUCTS, FINANCIAL SERVICES, TARGET MARKETS AND

TARGET MARKET ASSESSMENT METHODS

The CDFI Certification Application identifies the list of Financial Products, Financial Services, Target

Market and Target Market assessment methodologies approved by the CDFI Fund. Approved Financial

Products, Financial Services, and Target Market assessment methodologies must be used exactly as

approved, unless and until modification of the method is authorized by the CDFI Fund.

If an Applicant seeks recognition of an additional Financial Product or Financial Service, or use of an

alternative or modified Target Market assessment method, it can submit a service request through AMIS

for the CDFI Fund’s consideration. If new Financial Products, Financial Services, or assessment

methodologies are approved, the CDFI Fund will update the list of pre-approved Financial Products,

Financial Services, or assessment methodologies as appropriate, so that they are made available to

other Applicants and Certified CDFIs as well.

6

The CDFI Fund defines Principal as an individual that retains ownership, Control or power to vote 25% or more of

the outstanding shares of voting securities of the Applicant.

9

APPLICATION PROCESS

1) Review the “Certification as a Community Development Financial Institution” and “Definitions”

sections of the CDFI Program Revised Interim Regulations, 12 CFR Part 1805, available on the

CDFI Fund’s public website—www.cdfifund.gov. Note, capitalized words or phrases throughout

the CDFI Certification Application are defined terms that can be found in the Interim Regulation

or the Community Development Banking and Financial Institutions Act of 1994 (12 U.S.C. 4701

et seq.).

2) Review the Application and supplemental Application guidance documents provided on the CDFI

Fund’s CDFI Certification webpage.

3) Refer to guidance materials on how to access and use the CDFI Fund’s online portal, Awards

Management Information System (AMIS).

4) Create or access an existing account for the Applicant entity in AMIS using the guidance

materials located on the CDFI Fund’s webpage.

5) Review and update the Applicant’s Employer Identification Number (EIN) on the organization

detail page in AMIS, if needed. Note: Each CDFI Certification Applicant must have its own valid

EIN and be a legal entity at the time it submits the CDFI Certification Application. The EIN

documentation provided in the “Legal Entity” section must match the organization’s name and

EIN in AMIS.

6) Review and update the Applicant’s contact information on the “organization detail” page in

AMIS, if needed. At least one Authorized Representative must be identified in order to submit a

completed CDFI Certification Application. Anyone listed as a contact in the Applicant’s online

account can fill out the CDFI Certification Application. However, only a contact designated as an

Authorized Representative will be able to make submissions. Note: An Authorized

Representative must be a person who is authorized to act and legally bind on behalf of the

Applicant. Consultants cannot be identified as an Authorized Representative.

7) Email systems and firewalls should be set to accept messages generated by AMIS. Contact the

AMIS Help Desk via an AMIS Service Request for assistance, if needed.

8) Applicants must provide additional Basic Information and Legal Entity documentation for

relevant Affiliates in the Applicant’s account in AMIS and/or within the CDFI Certification

Application. Note: Legal documents not written in English must be translated.

9) Review and update information on Applicant’s relevant Affiliates in AMIS, as needed.

10) Applicant must determine if its Financial Products, Financial Services, Target Market and Target

Market assessment methods match the CDFI Fund’s pre-approved lists, or request their

approval from the CDFI Fund, prior to submitting the Application. If any Financial Product,

Financial Service, Target Market, or Target Market assessment methods are not used by the

Applicant as approved by the CDFI Fund, the Applicant is prohibited from presenting them in the

10

CDFI Certification Application. See “Obtaining Pre-Approval for Financial Products, Financial

Services, Target Markets, and Target Market Assessment Methods” p. 8.

11) Upload transactional data to the Transaction Level Report (TLR) collection tool that supports the

proposed Target Market and Accountability criteria using the eligible American Community

Survey (ACS) dataset approved by the CDFI Fund. Note: This step must be completed BEFORE

beginning the Application.

a. Manual TLR data entry – To manually enter transactions, select the “CDFI TLR” tab in

AMIS.

b. File upload of data – To upload a file of transaction records, select “TLR

Import/Export/Certify” tab in AMIS.

12) If required, create a Target Market map(s) using the guidance materials for the CDFI Fund’s

Community Impact Mapping System (CIMS). The Applicant will not be able to attach or submit a

map that has not been created in AMIS. If an AMIS-created map is not created, or the analysis

demonstrates that the geography is not eligible, the respective Target Market will not be

approved.

13) The following Application sections will require the Applicant to confirm and/or update

information in the Applicant’s “Organization Detail Page” in AMIS: Basic Information, Target

Market and Accountability.

14) Submit the CDFI Certification Application in AMIS. Upon submission of the CDFI Certification

Application, the Applicant’s contacts identified in AMIS will receive notification that the

Application has been received.

15) The Application cannot be reopened for modification by the Applicant after submission in AMIS.

16) If approved, a CDFI Certification Agreement for approved Applications and a Certified CDFI Logo

toolkit will be sent to the Applicant’s Authorized Representative via email. An Authorized

Representative must electronically review, sign and return the CDFI Certification Agreement

within ten (10) business days via AMIS. A copy of the executed Agreement will be available in

their AMIS account for future reference. Note: Upon Certification, certain organizational

information about the Applicant and its activities may be posted on the CDFI Fund’s public

website for the purpose of creating a public list and description of Certified CDFIs. A copy of the

CDFI Certification Agreement can be found on the CDFI Fund website.

17) If declined, a determination letter will be sent to the Applicant’s Authorized Representative via

email. Applicants that receive denials can request a debriefing through the submission of a

Service Request via AMIS. New CDFI Certification Applications can be submitted with or without

a debriefing.

18) Upon Certification, the CDFI shall comply with all record retention and access requirements set

forth in the Uniform Requirements at 2 C.F.R. 200.334-338. Public access to Recipient records

shall be maintained in accordance with the Uniform Requirements at 2 C.F.R. 200.337, including

access applicable under the Freedom of Information Act (5 U.S.C. § 552) (FOIA). The CDFI shall

maintain all CDFI Certification-related records for a minimum of ten years after submission of

11

the document(s) or record(s) to the CDFI Fund. The CDFI shall maintain documentation

supporting the data reported to the CDFI Fund.

19) Upon Certification, the CDFI will be required to meet annual reporting requirements through the

submission of an Annual Certification and Data Collection Report and Transaction Level Report,

no later than 180 days after its fiscal year end or as requested by the CDFI Fund.

In addition to the above, all Applicants should note the following:

Applications may be rejected if they contain inconsistencies in the Applicant’s name and in related or

required documents.

Applications that contain incomplete or inaccurate information may be declined for CDFI Certification

without a full review.

Upon designation as a Certified CDFI, entities must continue to meet all Certification requirements.

The CDFI Certification can be revoked if the entity fails to provide documentation demonstrating it

meets the Certification requirements.

In addition, upon Certification, certain organizational information about the Applicant and its

activities may be posted on the CDFI Fund’s public website for the purpose of creating a public list and

description of Certified CDFIs.

The CDFI Certification status cannot be transferred to another entity. Applicants that are acquired or

merge with another entity while the Certification Application review is in progress will not be

reviewed, regardless of whether the Applicant is the surviving entity; the merger or acquisition is

considered a material event. In such cases, the surviving entity must submit a new Certification

Application after the merger or acquisition is consummated.

Additional Questions and Resources

If you have questions regarding the CDFI Certification Application process, you may contact the CDFI

Fund Office of Certification Policy and Evaluation team by submitting a Service Request in AMIS.

Information regarding the CDFI Certification Application and the Application process can also be

obtained by visiting the CDFI Fund’s CDFI Certification webpage.

The following sections include specific guidance, questions, and data points for Applicants to complete the

CDFI Certification Application in AMIS. The Application contains conditional questions that will appear in

AMIS only for those Applicants to which the questions apply, based upon financial institution type and/or

responses to other questions. In this document, which is for illustrative purposes only, such questions are

generally identified and/or appear nested below the questions to which they apply.

12

APPLICANT BASIC INFORMATION

The Basic Information section of the CDFI Certification Application collects general information about

the CDFI Certification Applicant and its Affiliates that must be reviewed in connection with CDFI

Certification requirements. Certain information in this section will be auto-populated based on data

from the Applicant’s AMIS account.

To ensure accurate data is auto-populated into the Application’s Basic Information section, Applicant

and Affiliate AMIS accounts must be up to date.

To complete the Basic Information section, the Applicant should:

- Review auto-populated information in the Basic Information fields for accuracy. If information is

missing or inaccurate, submit all updates and make corrections in the Organization Detail Page

in AMIS. For assistance with technical issues, submit a Service Request in AMIS.

- Complete the unpopulated Basic Information fields.

- Attach copies of all required documentation in the Basic Information section of the Application.

The Applicant and/or Affiliate names listed in the Application and in AMIS should match those listed in

any uploaded documentation. The Application will be rejected if the names differ, unless sufficient

documentation or explanation can be provided.

Section

Question or purpose of data field

Response

BI1

Applicant - Entity Name

[Auto-populated from the

Applicant’s AMIS account.]

BI2

Applicant - Financial Institution Type

[Auto-populated from the

Applicant’s AMIS account.]

BI3

Applicant – Depository Institution Holding

Company

Select Yes or No.

BI4

Applicant – Minority Depository Institution as

designated by the FDIC or NCUA

Select Yes or No.

BI5

Applicant – Employer Identification Number

(EIN)

[Auto-populated from the

Applicant’s AMIS account.]

BI6

Applicant – Unique Entity Identifier

[Auto-populated from Applicant’s

AMIS account.]

BI7

Applicant – Date of

Incorporation/Organization/Establishment

[Auto-populated from the

Applicant’s AMIS account.]

BI8

Applicant – Fiscal Year End Month

[Auto-populated from the

Applicant’s AMIS account.]

BI9

Applicant – Fiscal Year End Day

[Auto-populated from the

Applicant’s AMIS account.]

BI10

Does the Applicant engage in its own arm’s-

length, on-balance sheet Financial Product or

Select Yes or No.

13

Section

Question or purpose of data field

Response

Financial Services activity and can it meet the

CDFI Certification requirements based on its

own Financial Product and/or Financial Services

activity?

BI10.1

If No, identify the CDFI Certification

provision(s) the Applicant seeks to

use that enables it to use the

Financial Product or Financial

Services activity of an Affiliate(s) or

to use on-balance sheet Financial

Product activity that is not arm’s-

length to meet the CDFI Certification

requirements.

Select one:

- Applicant is applying for

Certification solely to

participate in the BG

Program and is an Affiliate

of a Controlling Certified

CDFI.

- Applicant is a DIHC relying

on the activity of an

Affiliate(s) to meet the

CDFI Certification

requirements.

BI11

Have at least 12 full months passed since the

date the Applicant’s incorporation/organization/

establishment documentation was filed with or

approved by the appropriate authorizing

agency?

Yes or No.

BI11.1

If Yes, what is the earliest date that

the Applicant can demonstrate that

it closed an arm’s-length, on-balance

sheet Financial Product or

completed a Financial Services

transaction?

Enter date.

BI11.2

If No, identify the exception(s) to the

CDFI Certification requirement that

12 full months must have passed

since an entity began its financing

activity that the Applicant seeks to

use.

Select all that apply:

- Applicant is participating in

the BG Program and is an

Affiliate of a Controlling

Certified CDFI.

- Applicant seeks to use the

CDFI Certification provision

for Spinoff entities.

- Applicant is a DIHC relying

on the activity of an

Affiliate(s) to meet the CDFI

Certification requirements.

BI12

If the Applicant seeks to use a CDFI Certification

provision for entities seeking Certification solely

for participating in the CDFI Fund’s Bond

Guarantee Program (BG Program):

Identify a Certified CDFI that Controls the

Applicant.

Select the Certified CDFI Affiliate

from Picklist.

14

Section

Question or purpose of data field

Response

BI13

If the Applicant is a DIHC that does not engage

directly in the provision of Financial Products

and/or Financial Services:

Does the Applicant have at least one Affiliate(s)

that has engaged in the provision of arm’s-

length, on-balance sheet Financial Products or

Financial Services for at least one full fiscal year

prior to submission of the CDFI Certification

Application?

Yes or No.

BI14

Is the CDFI Certification Applicant an Affiliate of

a Depository Institution Holding Company

(DIHC)?

Yes or No.

BI15

Is the CDFI Certification Applicant a Subsidiary of

an Insured Depository Institution (IDI)?

Yes or No.

BI16

Does the Applicant issue stock?

Yes or No.

BI16.1

If Yes, attach stock certificate

summary report that indicates

voting securities held.

Attach document(s).

BI17

If the Applicant seeks to use the CDFI Certification provision for Spinoff entities:

BI17.1

Can the Applicant demonstrate that

at least one Financial Product it

currently offers was transferred to

the Applicant by at least one

Affiliate?

Yes or No.

If No, the Applicant is not eligible

to use the CDFI Certification

provision for Spinoff entities.

BI17.2

Can the Applicant demonstrate that

at least one of its currently-offered,

transferred Financial Products has

been offered by the Applicant

and/or an original entity from which

it received the Financial Product

activity for at least one full fiscal

year prior to submission of this

Application?

Yes or No.

If No, the Applicant is not eligible

to use the CDFI Certification

provision for Spinoff entities.

Subsequent to the receipt of any

transferred Financial Products, can

the Applicant demonstrate that it

has closed at least one such

Financial Product using its own

capital?

Yes or No.

If No, the Applicant is not eligible

to use the CDFI Certification

provision for Spinoff entities.

BI17.3

Can the Applicant demonstrate that

for either the Applicant or an

Affiliate from which it received

Financial Product activity, an

acceptable primary mission has

been in place for at least the

Yes or No.

If No, the Applicant is not eligible

for CDFI Certification.

15

Section

Question or purpose of data field

Response

immediate six months completed

prior to submission of the CDFI

Certification Application?

BI18

Does the Applicant have a parent/controlling

entity, or any Affiliates that engage in the

provision of Financial Products or Financial

Services?

Select Yes or No.

BI19

Applicant bylaws or similar documentation:

Attach a copy of the Applicant’s governing or

managing board-approved or owner-approved

bylaws, partnership agreement, or similar

documentation.

Attach documentation.

BI20

Applicant bylaws or similar documentation:

Indicate how governing or managing

board/owner-approval of the Applicant’s bylaws,

partnership agreement, or similar document and

the date of approval is evidenced in the attached

documentation.

Select all that apply:

- Documentation indicates

the date approved by the

governing or managing

board or the owner and is

signed by an officer(s) of

the governing/managing

board, owner, or

authorized representative.

- A statement attached to

the documentation

indicates the date

approved by the governing

or managing board or

owner and is signed by an

officer(s) of the

governing/managing

board, owner, or

authorized representative.

- Official

governing/managing board

meeting minutes signed by

an officer(s) of the

governing/managing board

show the date of the

governing/managing board

meeting at which the

documentation was

approved and clearly

indicate governing/

managing board approval

16

Section

Question or purpose of data field

Response

of the documentation at

that meeting.

- Other.

B120.1

If “Other,” explain.

Provide explanation.

BI21

If governing or managing board or owner-

approval and/or the date of approval of the

Applicant’s bylaws, partnership agreement, or

similar document is not evidenced within the

relevant document itself:

Attach additional documentation that evidences

approval.

Attach documentation.

BI22

Designate an Authorized Representative for the

CDFI Certification Application.

Select Authorized Representative.

BI23

Designate a Point of Contact for the CDFI

Certification Application.

Select Point of Contact.

BASIC INFORMATION – BOARD AND EXECUTIVE STAFF DEMOGRAPHIC INFORMATION

Provide the following information about the members of the Applicant’s Governing Board and Executive

Staff.

7

If a Governing Board or Executive Staff members race and ethnicity are not known, that individual

should be counted as “Non-Hispanic White/Non-Minority.”

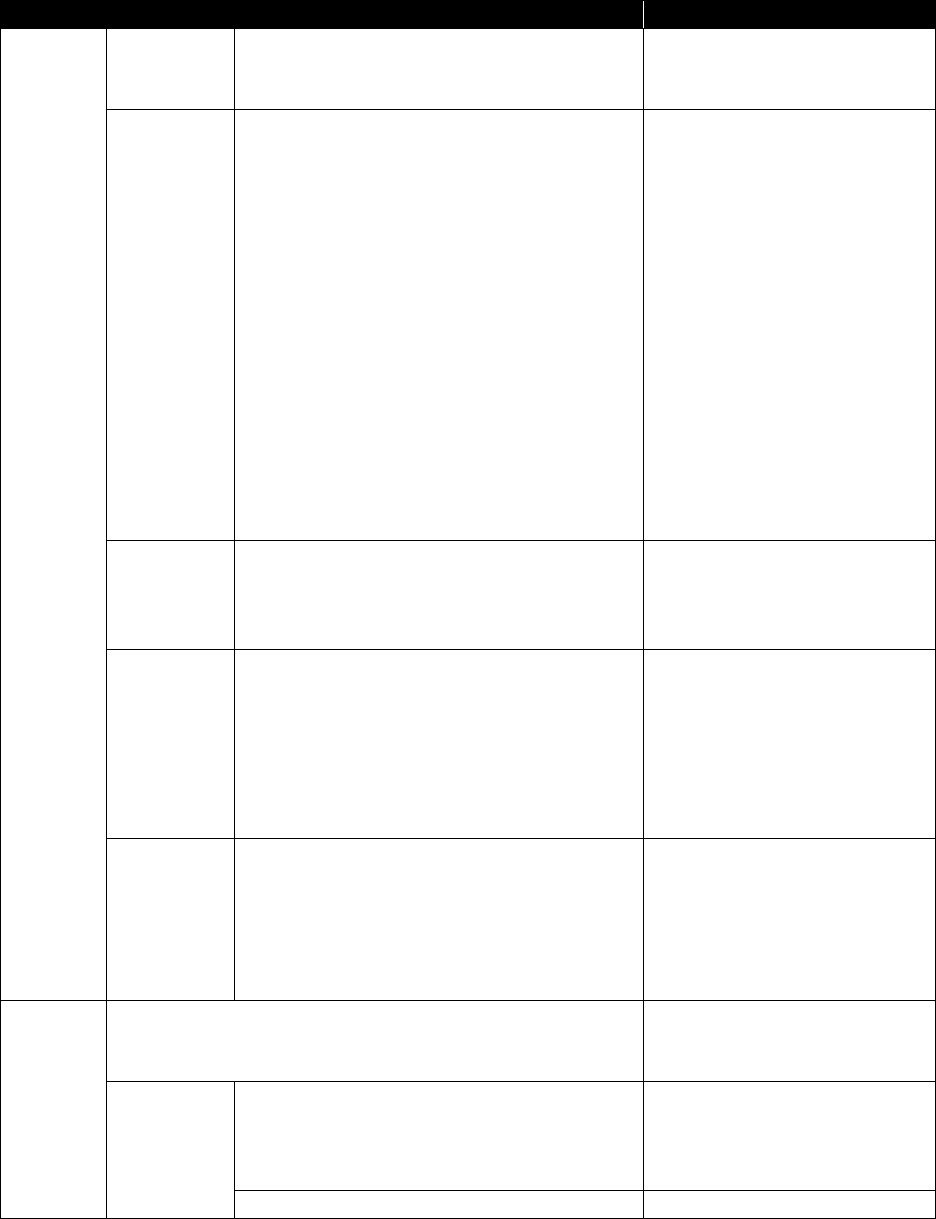

Section

Question or purpose of data field

Response

BI-DI1

Indicate the total number of Governing Board

members.

Enter number.

BI-DI2

Indicate the total number of Governing Board

members who identify as a member of a

minority population.

Enter number.

BI-DI3

Percentage of Governing Board members who

identify as a member of a minority

8

population.

[Auto-calculated].

BI-DI3.1

Indicate the number of Governing

Board members who identify as

Black.

Enter number.

BI-DI3.2

Percentage of Governing Board

members who identify as Black.

[Auto-calculated].

7

Executive Staff means all directors and executive officers (e.g. President, Vice-President, Chief Financial Officer) of

a company vested with the powers to manage and supervise the day-to-day affairs of an organization.

8

As defined in section 523 of Division N of the Consolidated Appropriations Act, 2021, Public Law 116-260, the

term “minority” means “any Black American, Hispanic American, Asian American, Native American, Native Alaskan,

Native Hawaiian, or Pacific Islander.” For purposes of this Application, the CDFI Fund relies on definitions

established by the 1997 Office of Management and Budget (OMB) standards on race and ethnicity.

17

Section

Question or purpose of data field

Response

BI-DI3.3

Indicate the number of Governing

Board members who identify as

Asian.

Enter number.

BI-DI3.4

Percentage of Governing Board

members who identify as Asian.

[Auto-calculated].

BI-DI3.5

Indicate the number of Governing

Board members who identify as

Native American.

Enter number.

BI-DI3.6

Percentage of Governing Board

members who identify as Native

American.

[Auto-calculated].

BI-DI3.7

Indicate the number of Governing

Board members who identify as

Native Alaskan.

Enter number.

BI-DI3.8

Percentage of Governing Board

members who identify as Native

Alaskan.

[Auto-calculated].

BI-DI3.9

Indicate the number of Governing

Board members who identify as

Native Hawaiian.

Enter number.

BI-DI3.10

Percentage of Governing Board

members who identify as Native

Hawaiian.

[Auto-calculated].

BI-DI3.11

Indicate the number of Governing

Board members who identify as

Pacific Islander.

Enter number.

BI-DI3.12

Percentage of Governing Board

members who identify as Pacific

Islander.

[Auto-calculated].

BI-DI3.13

Indicate the number of Governing

Board members who identify as

Hispanic.

Enter number.

BI-DI3.14

Percentage of Governing Board

members who identify as Hispanic.

[Auto-calculated].

BI-DI3.15

Indicate the number of Governing

Board members who identify as

Non-Hispanic White/Non-Minority.

Enter number.

BI-DI3.16

Percentage of Governing Board

members who identify as Non-

Hispanic White/Non-Minority.

[Auto-calculated].

BI-DI4

Indicate the number of Governing Board

members who identify as female.

Enter number.

BI-DI5

Percentage of Governing Board members who

identify as female.

[Auto-calculated].

BI-DI6

Indicate the number of Governing Board

members who identify as male.

Enter number.

18

Section

Question or purpose of data field

Response

BI-DI7

Percentage of Governing Board members who

identify as male.

[Auto-calculated].

BI-DI8

Indicate the number of Governing Board

members who identify as non-binary.

Enter number.

BI-DI9

Percentage of Governing Board members who

identify as non-binary.

[Auto-calculated].

BI-DI10

Indicate the total number of Executive Staff.

Enter number.

BI-DI11

Indicate the total number of Executive Staff who

identify as a member of a minority population.

Enter number.

BI-DI12

Percentage of Executive Staff who identify as a

member of a minority population.

[Auto-calculated].

BI-DI2.1

Indicate the number of Executive

Staff who identify as Black.

Enter number.

BI-DI2.2

Percentage of Executive Staff who

identify as Black.

[Auto-calculated].

BI-DI2.3

Indicate the number of Executive

Staff who identify as Asian.

Enter number.

BI-DI2.4

Percentage of Executive Staff who

identify as Asian.

[Auto-calculated].

BI-DI2.5

Indicate the number of Executive

Staff who identify as Native

American.

Enter number.

BI-DI2.6

Percentage of Executive Staff who

identify as Native American.

[Auto-calculated].

BI-DI2.7

Indicate the number of Executive

Staff who identify as Native Alaskan.

Enter number.

BI-DI2.8

Percentage of Executive Staff who

identify as Native Alaskan.

[Auto-calculated].

BI-DI2.9

Indicate the number of Executive

Staff who identify as Native

Hawaiian.

Enter number.

BI-DI2.10

Percentage of Executive Staff who

identify as Native Hawaiian.

[Auto-calculated].

BI-DI2.11

Indicate the number of Executive

Staff who identify as Pacific Islander.

Enter number.

BI-DI2.12

Percentage of Executive Staff who

identify as Pacific Islander.

[Auto-calculated].

BI-DI2.13

Indicate the number of Executive

Staff who identify as Hispanic.

Enter number.

BI-DI2.14

Percentage of Executive Staff who

identify as Hispanic.

[Auto-calculated].

BI-DI2.15

Indicate the number of Executive

Staff who identify as Non-Hispanic

White/Non-Minority.

Enter number.

19

Section

Question or purpose of data field

Response

BI-DI2.16

Percentage of Executive Staff who

identify as Non-Hispanic White/Non-

Minority.

[Auto-calculated].

BI-DI13

Indicate the number of Executive Staff who

identify as female.

Enter number.

BI-DI14

Percentage of Executive Staff who identify as

female.

[Auto-calculated].

BI-DI15

Indicate the number of Executive Staff who

identify as male.

Enter number.

BI-DI16

Percentage of Executive Staff who identify as

male.

[Auto-calculated].

BI-DI17

Indicate the number of Executive Staff who

identify as non-binary.

Enter number.

BI-DI18

Percentage of Executive Staff who identify as

non-binary.

[Auto-calculated].

BI-DI19

Indicate the race/ethnicity of the Applicant’s

Chief Executive Officer/Executive Director.

Select all that apply:

- White

- Black

- Asian

- Native American

- Native Alaskan

- Native Hawaiian

- Pacific Islander

- Hispanic

BI-DI20

Indicate the gender of the Applicant’s Chief

Executive Officer/Executive Director.

Select one:

- Female

- Male

- Non-Binary

BASIC INFORMATION – AFFILIATES

CDFI Certification Applicants that have Affiliates relevant to the CDFI Certification review, as indicated

below, must identify those Affiliates and present information regarding them in the Affiliates section of

the Application, and elsewhere, as noted in the different section instructions.

In order for Affiliate information to auto-populate the CDFI Certification Application, where indicated, an

Affiliate record must be created on the Applicant’s AMIS Organization Profile page.

DIHCs or Affiliates of DIHCs

If the Applicant is a DIHC or an Affiliate of a DIHC, it must identify any Affiliate in its family of entities

that meets any of the following criteria:

- The Affiliate directly engages in Financial Product and/or Financial Services activity and the

Applicant is a DIHC that Controls the Affiliate;

20

- The Affiliate is a DIHC that Controls the Applicant; or

- The Affiliate directly engages in Financial Product and/or Financial Services activity and the

Affiliate and the Applicant are under the mutual Control of a DIHC.

Subsidiaries of IDIs

If the Applicant is the Subsidiary of an IDI, it must identify any Affiliate in its family of entities that meets

any of the following criteria:

- The Affiliate is an IDI that Controls the Applicant; or

- The Affiliate directly engages in Financial Product and/or Financial Services activity and the

Affiliate and the Applicant are under the mutual Control of an IDI.

Applicants that are not DIHCs, Affiliates of DIHCs, or Subsidiaries of IDIs

In addition to presenting Affiliates relevant to any alternative CDFI Certification provision, a CDFI

Certification Applicant that is not a DIHC, an Affiliate of a DIHC, or a Subsidiary of an IDI, must identify

any Affiliate in its family of entities that meets any of the following criteria for consideration in

connection with the Primary Mission requirements:

- The Affiliate Controls the Applicant, except if the Controlling entity is a Tribal Government;

- The Affiliate directly engages in Financial Product and/or Financial Services activity and the

Applicant and the Affiliate are under the mutual Control of another entity; or

- The Affiliate directly engages in Financial Product and/or Financial Services activity and the

Applicant Controls the Affiliate.

Applicants seeking Certification solely for participating in the CDFI Fund’s Bond Guarantee Program (BG

Program)

Applicants seeking to use the CDFI Certification provision for entities seeking Certification solely for

participating in the CDFI Fund’s BG Program must, in addition to presenting Affiliates relevant to other

CDFI Certification requirements, present information on their Controlling Certified CDFI(s).

Spinoff Entities

Applicants seeking to use the CDFI Certification provision for Spinoff entities, must identify and present

for review the original entity(ies) from which they received spun-off Financial Product or Financial

Services activity.

Section

Question or purpose of data field

Response

BI-A01

Affiliate – Entity Name

Identify Affiliate.

BI-A02

Affiliate – Employer Identification Number (EIN)

[Auto-populated from the

Applicant’s AMIS account.]

21

Section

Question or purpose of data field

Response

BI-A03

Affiliate – Unique Entity Identifier

[Auto-populated from the

Applicant’s AMIS account.]

BI-A04

Affiliate – Date of

Incorporation/Organization/Establishment

[Auto-populated from the

Applicant’s AMIS account.]

BI-A05

Is the Affiliate a Certified CDFI?

Yes or No.

If Yes:

BI-A05.1

Does the Applicant seek to use

the CDFI Certification provision

for BG Program participation,

solely to participate in the CDFI

Fund’s BG Program?

Yes or No.

BI-A05.2

Does the Affiliate Control the

Applicant?

Yes or No.

BI-A06

Is the Affiliate a Certified Community

Development Entity (CDE)?

Yes or No.

BI-A07

Is the Affiliate’s sole line of business the

administration of another federal financing

program(s)?

Yes or No.

If Yes:

BI-A07.1

Identify the other federal

financing program(s).

Enter name(s).

BI-A08

If the Applicant is a DIHC or an Affiliate of a

DIHC:

Identify the relationship between the Applicant

and the Affiliate.

Select one:

- The Affiliate is a DIHC

that Controls the

Applicant.

- The Affiliate directly

engages in Financial

Product and/or Financial

Services activity and it

and the Applicant are

under the mutual Control

of a DIHC.

- The Affiliate directly

engages in Financial

Product and/or Financial

Services activity and the

Applicant is a DIHC that

controls the Affiliate.

BI-A09

If the Applicant is a Subsidiary of an IDI:

Identify the relationship between the Applicant

and the Affiliate.

Select one:

- The Affiliate is an IDI that

Controls the Applicant.

- The Affiliate directly

engages in Financial

22

Section

Question or purpose of data field

Response

Product and/or Financial

Services activity and it

and the Applicant are

under the mutual Control

of an IDI.

BI-A10

If the Applicant is not a DIHC, an Affiliate of a

DIHC, or a Subsidiary of an IDI:

Identify the relationship between the Applicant

and the Affiliate.

Select one:

- The Affiliate Controls the

Applicant (do not include

Tribal Governments).

- The Affiliate is Controlled

by the Applicant and

directly engages in the

provision of Financial

Products and/or Financial

Services.

- The Affiliate and

Applicant are mutually

Controlled by another

entity and the Affiliate

directly engages in the

provision of Financial

Products and/or Financial

Services.

BI-A11

If the Applicant seeks to use the CDFI

Certification provision for Spinoffs in order to

meet the Financing Entity and Target Market

criteria:

Identify the relationship between the Applicant

and the original entity from which it received

Spinoff Financial Product activity.

Select one:

- The entity Controlled the

Applicant at the time it

transferred Financial

Product activity to the

Applicant.

- The entity was Controlled

by the Applicant at the

time it transferred

Financial Product activity

to the Applicant.

- The entity and Applicant

were mutually Controlled

by another entity at the

time it transferred

Financial Product activity

to the Applicant.

BI-A12

If the Applicant relies on the Affiliate to provide

Development Services and the Affiliate

Select one:

- The Affiliate currently

Controls the Applicant.

23

Section

Question or purpose of data field

Response

relationship was not identified in any of the

other Affiliate relationship data fields:

Identify the relationship between the Applicant

and the Affiliate.

- The Affiliate is currently

Controlled by the

Applicant.

- The Affiliate and

Applicant are currently

mutually Controlled by

another entity.

BI-A13

If the Applicant seeks to use the CDFI

Certification provision for BG Program

participation, solely to participate in the CDFI

Fund’s BG Program and such Affiliate is a

Certified CDFI that Controls the Applicant:

What is the earliest date that the Affiliate can

demonstrate that it closed an arm’s-length, on-

balance sheet Financial Product or completed a

Financial Services transaction?

Enter date.

BI-A14

If the Applicant is a DIHC that is relying on the

activity of its Affiliate(s) to meet the Target

Market requirements:

Is this Affiliate a depository institution that

currently provides Financial Services?

Yes or No.

BI-A15

If the Applicant seeks to use the CDFI

Certification provision for Spinoff entities and

the Applicant received spin-off Financial Product

activity from this entity:

Is the Applicant currently offering at least one

arm’s-length, on-balance sheet Financial Product

that was spun off t by the original entity?

Yes or No.

If No, the Applicant is not eligible

to use the special CDFI

Certification provision for Spinoff

entities.

If Yes:

BI-A15.1

Identify at least one Financial

Product that was spun off to the

Applicant by the original entity.

Enter name.

BI-A15.2

Provide the earliest date the

original entity can demonstrate it

closed a spin off Financial Product

currently offered by the

Applicant.

Enter date.

If the Applicant has multiple Affiliates that need to be reviewed in connection with one or more of

the CDFI Certification requirements, repeat the “Affiliate – Basic Information” data entry for each

applicable Affiliate.

24

APPLICANT – FINANCIAL PRODUCTS AND FINANCIAL SERVICES BASIC INFORMATION

To be eligible for CDFI Certification, an entity must provide at least one Financial Product or be eligible

to rely on the Financial Product activity of an Affiliate(s).

Financial Services can be used to meet the CDFI Certification requirements by depository institutions

(i.e., bank/thrifts, credit unions, or bank/thrift holding companies) only.

BASIC INFORMATION - FINANCIAL PRODUCT INFORMATION – APPLICANT

Section

Question or purpose of data field

Response

BI-FP01

Is the Applicant a DIHC that does not directly

offer any arm’s-length, on-balance sheet

Financial Products?

Yes or No.

BI-FP02

Is the Applicant a participant in the CDFI Fund’s

BG Program and seeks to use the CDFI

Certification provision for such entities that

allows on-balance sheet Financial Product

activity that is not arm’s-length to meet the

CDFI Certification requirements solely for the

purposes of participating in the BG Program?

Yes or No.

25

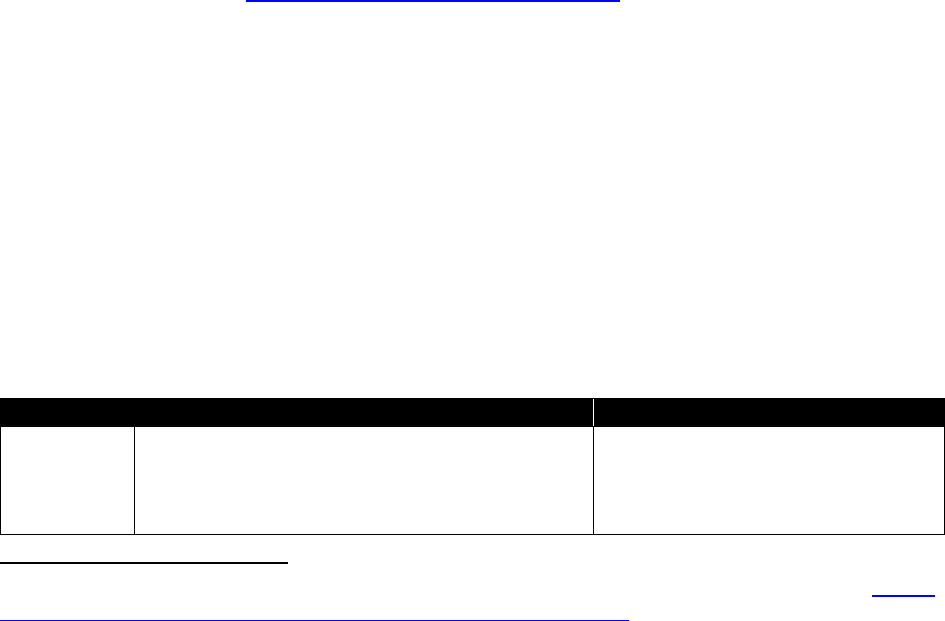

For each of the Applicant’s Financial Product purposes, complete “Basic Information – Financial Product Information – Table 1” with information

on all of the Applicant’s arms-length Financial Products.

(Simulated Table – Actual display may differ)

Basic Information Table 1: Financial Product Information

Financial Product

Purpose

Financial Product

Transaction Type

(Select all that apply)

Financial

Product Names

Enter Financing

Amount

Offered

(Minimum)

Enter Financing

Amount

Offered

(Maximum)

Enter

Minimum

Interest Rate

at Origination

Enter

Maximum

Interest Rate

at Origination

Enter

Weighted

Average

Interest Rate

Enter

Repayment

Period

(Minimum)

Enter

Repayment

Period

(Maximum)

- Home Purchase

- Home Improvement

- Real Estate–

Construction/

Permanent/

Acquisition w/o

Rehabilitation–

Commercial

- Real Estate–

Construction—

Housing-Multi

Family

- Real Estate—

Construction–

Housing–Single

Family

- Real Estate—

Rehabilitation–

Commercial

- Real Estate—

Rehabilitation—

Housing—Multi

Family

- Real Estate—

Rehabilitation—

Housing—Single

Family

- Consumer

- Non-Real Estate

Business

-Loans

-Lines of credit

-Credit Card

-Equity

Investments

-Debt with Equity

features

-Loan guarantees

-Loans purchased

from Certified

CDFIs

-Loans directed to

the Applicant’s

proposed Target

Market purchased

from entities

without CDFI

Certification

-Other similar

financing (pre-

approved by the

CDFI Fund)

26

Basic Information Table 1: Financial Product Information

- Non-Real Estate

Microenterprise

- Climate-Centered

Finance

- Other

27

BI-FP03

If “Other” was selected for Financial Product

Purpose describe the purpose.

Provide description.

BI-FP04

If “Other similar financing” was selected as a

Financial Product transaction type:

Has the “Other similar financing” been pre-

approved as an eligible new Financial Product

category by the CDFI Fund?

Yes or No.

If No, the Applicant cannot include

the financing as an eligible

Financial Product.

If Yes:

BI-FP04.1

Provide the name of the new

Financial Product category

exactly as it appears in the

approval letter from the CDFI

Fund.

Enter name.

BI-FP04.2

Attach approval letter

evidencing the CDFI Fund’s

approval of the “other similar

financing” product.

Attach documentation.

BI-FP05

Are the listed Financial Products offered

directly by the Applicant?

Yes or No.

If No, only a DIHC Applicant may

include the Financial Products as

eligible Financial Products.

BI-FP06

Are the listed Financial Products on-balance

sheet for the Applicant?

Yes or No.

If No, only a DIHC Applicant may

include the Financial Products as

eligible Financial Products.

BI-FP07

Are the listed Financial Product(s) offered by

the Applicant at arm’s-length?

Yes or No.

If No, the Applicant cannot include

the Financial Products as eligible

Financial Products.

BI-FP08

What is the earliest date that the Applicant can

demonstrate that it closed an arm’s-length, on-

balance sheet transaction with its Financial

Product?

Enter date.

BASIC INFORMATION – FINANCIAL SERVICES INFORMATION – APPLICANT

Section

Question or purpose of data field

Response

BI-FS01

Does the Applicant offer Financial Services?

Yes or No.

BI-FS02

If the Applicant is a DIHC, does it directly offer

any Financial Services?

Yes or No.

28

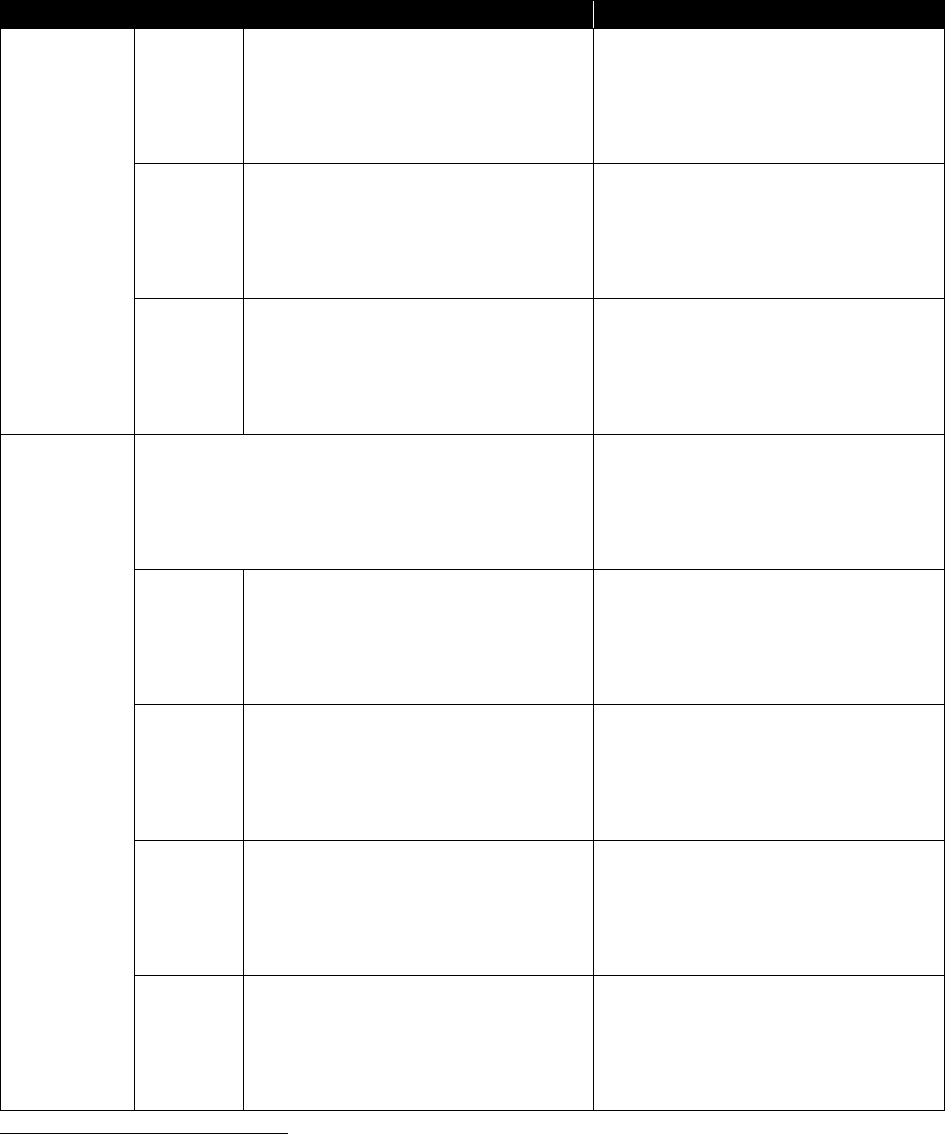

If the Applicant engages in the direct provision of Financial Services Complete “Basic Information –

Financial Services Information – Table 1” with information on all of the listed Financial Services offered

directly by the Applicant:

(Simulated Table – Actual display may differ)

Basic Information Table 2: Financial Services Information

Financial Services

Category (Select

all that apply)

Financial Services Names

-Savings and

Share Accounts

-Checking

Accounts

-Certificates of

Deposit

-Money Market

Accounts

-Check Cashing

BI-FS03

Are the selected Financial Service categories

ones that the Applicant offers directly?

Yes or No.

BI-FS04

Provide the earliest date a Financial Services

transaction was completed.

Enter date.

BASIC FINANCIAL PRODUCT INFORMATION – AFFILIATE

The Applicant must enter Financial Product information for any Affiliate subject to review in connection

with any of the CDFI Certification requirements.

Note: AMIS may allow Affiliates that are Certified CDFIs, certified CDEs or have the sole activity of

offering other federal financial products, to omit certain Basic Financial Product Information for

Affiliates questions.

BASIC FINANCIAL SERVICES INFORMATION – AFFILIATE

The Applicant must enter Financial Services information for any Affiliate that is subject to review in

connection with any of the CDFI Certification requirements.

Note: AMIS may allow Affiliates that are Certified CDFIs, certified CDEs or have the sole activity of

offering other federal financial products, to omit certain Basic Financial Services Information for

Affiliates questions.

29

LEGAL ENTITY

To be a Certified CDFI, the Applicant must be duly organized and validly exist under the laws of the

State or jurisdiction in which it is incorporated or established as of the date the Application is submitted.

The Applicant must also have a valid EIN.

To complete the Legal Entity section of the Application, Applicants will:

- Review and confirm the information included in the auto-populated Legal Entity fields is correct.

If information is missing or inaccurate, submit all updates and make corrections on the

Organization Detail Page in AMIS. For assistance with technical issues, submit a Service Request

in AMIS.

- Provide information, as requested, in any of the Legal Entity fields that are not auto-populated.

- Attach original copies of all required Legal Entity documents, including any amendments.

- Include evidence that the Legal Entity documentation was filed and approved by the appropriate

government agency and of the date the documentation was filed or approved. A letter from a

government agency that is signed and dated by the appropriate official stipulating when the

Applicant’s legal documents were filed and signed, or a stamped document from the

government agency containing the date the documents were filed and initialed by the

appropriate government official may be submitted to meet this requirement.

The Applicant and/or Affiliate names should match those listed in the Basic Information section or, if

sufficient documentation or explanation cannot be provided, the Application may be rejected.

A regulated financial institution that does not have a charter issued by the appropriate Federal

Banking Agency or State Agency cannot apply for CDFI Certification. Regulated credit unions and

banks/thrifts or bank/thrift holding companies must include a copy of their charter.

Section

Question or purpose of data field

Response

LE1

Applicant EIN.

[Auto-populated].

LE2

Applicant EIN documentation

Indicate the type of documentation the

Applicant is providing as evidence of its EIN.

Select all that apply:

- Official letter from IRS

providing EIN.

- Confirmation fax from local

IRS office with the

organization’s name and

EIN.

- A printout of completed

and submitted online SS-4

(with organization’s EIN in

upper right hand corner)

from IRS website,

accompanied by a printout

30

Section

Question or purpose of data field

Response

of the online confirmation

of receipt of EIN from IRS

website.

LE3

Applicant’s EIN documentation

Attach a copy of each EIN documentation

selected in question LE02.

Attach documentation.

LE4

Date of

Incorporation/Organization/Establishment

[Auto-populated].

LE5

Applicant Institution Type.

[Auto-populated ].

LE6

Applicant Federal Regulator.

[Auto-populated ].

LE7

Applicant Charter Number.

[Auto-populated ].

LE8

Applicant FDIC Insurance Certificate Number.

[Auto-populated ].

LE9

Applicant RSSID Number.

[Auto-populated].

LE10

Applicant State or Other Regulator.

[Auto-populated].

LE11

If the Applicant is a depository institution,

identify the Applicant’s insurer.

- FDIC

- NCUA

- State Regulator

- Other

- None

- N/A

Applicants other than those

insured by the FDIC, NCUA or a

State Regulator must complete the

Financing Entity section of the

Application.

LE12

Applicant Legal Entity document(s).

Select all that apply:

- Articles of Incorporation

- Articles of Organization

- Certificate of Incorporation

- Organization Certificate

- Certificate of Formation

- Certificate of Existence

- Other Legal Entity

documentation (please

describe)

LE13

Applicant Legal Entity documentation:

Attach documentation selected in question LE12

that evidences the Applicant’s Legal Entity

status.

Attach documentation.

LE14

Applicant Legal Entity documentation:

Indicate how governing or managing

board/owner-approval of the Applicant’s Legal

Entity documentation and the date of approval

Select one:

- Legal Entity documentation

indicating date approved

by the governing or

managing board or the

31

Section

Question or purpose of data field

Response

is evidenced in the related documentation

attached to the Application.

owner, and signed by an

officer(s) of the

governing/managing

board, owner, or

authorized representative.

- A statement attached to

the Legal Entity

documentation indicating

date document(s) was

approved by the governing

or managing board or

owner and signed by an

officer(s) of the

governing/managing

board, owner, or

authorized representative.

- Official

governing/managing board

meeting minutes signed by

an officer(s) of the

governing/managing board

show the date of the

governing/managing board

meeting at which the Legal

Entity document(s) was

approved and clearly

indicate

governing/managing board

approval of the

document(s) at that

meeting.

- Other.

LE14.1

If “Other,” explain.

Provide explanation.

LE15

If governing or managing board or owner-

approval and/or the date of approval of the

Applicant’s Legal Entity documentation is not

evidenced within the relevant document itself:

Attach additional documentation that evidences

approval of the Applicant’s Legal Entity

documentation by the Applicant’s

governing/managing board or owner and the

date approved that is signed by an officer(s) of

the governing/managing board, a

Attach documentation.

32

Section

Question or purpose of data field

Response

managing/general partner, or a managing

member (or an authorized representative of a

general partner or managing member).

LE16

Have there been any amendments to the

Applicant’s Legal Entity documentation?

Yes or No.

LE16.1

If yes, attach all amendments.

Attach amendments.

LE17

If the Applicant seeks to use the CDFI

Certification provision for BG Program

participation, solely to participate in the CDFI BG

Program:

Attach the operating agreement between the

Applicant and a Controlling Certified CDFI that

includes management and ownership provisions.

The operating agreement will be evaluated to

ensure it is in a form and substance acceptable

to the CDFI Fund per 12 CFR 1805.201(b)(2)(C)(ii-

iii).

Attach operating agreement.

33

PRIMARY MISSION

A Certified CDFI shall have a primary mission of promoting community development.

In determining whether an entity has a primary mission of promoting community development, the CDFI

Fund will consider whether the activities of the Applicant (and of certain Affiliates) are purposefully

directed toward improving the social and/or economic conditions of underserved people

9

and/or

residents of economically distressed communities. As part of its assessment, the CDFI Fund will consider

whether the entity has a reasonable community development strategy and whether the entity meets

the CDFI Fund’s standards for responsible financing practices.

All Applicants with Affiliates must meet the Primary Mission requirements based on a review of their

own status and that of certain members in their family of affiliated entities.

DIHCs, Affiliates of DIHCs, and Subsidiaries of IDIs

An Applicant that is a DIHC, an Affiliate of a DIHC, or a Subsidiary of an IDI, including Subsidiaries

of a Tribal Government, is required by statute to meet the CDFI Certification requirements

based on a collective review of its family of entities. Such entities must demonstrate that any

Affiliate in its family of entities that meets any of the following criteria each individually meets

the Primary Mission requirements:

- The Affiliate is a DIHC or an IDI that Controls the Applicant;

- The Affiliate is Controlled by the Applicant and the Applicant is a DIHC; or

- The Applicant and the Affiliate are mutually Controlled by a DIHC or an IDI and the

Affiliate directly engages in the provision of Financial Products and/or Financial

Services.

Applicants other than DIHCs, Affiliates of DIHCs, and Subsidiaries of IDIs

Applicants (except a DIHC, Affiliate of a DIHC, or Subsidiary of an IDI) must demonstrate that any

Affiliate in its family of entities that meets any of the following criteria each individually meet

the Primary Mission requirements:

- The Affiliate Controls the Applicant, except if the Controlling entity is a Tribal

Government; or

- The Affiliate engages in the provision of Financial Products and/or in Financial

Services.

Affiliates listed in the Basic Information section that are separately-Certified CDFIs or

Community Development Entities (CDEs), as well as entities whose sole activity is the

9

Includes Low-Income persons and/or, as approved by the CDFI Fund, other persons who lack adequate access to

capital and/or Financial Services.

34

participation in other federal financing programs, are presumed to meet the CDFI Certification

Primary Mission requirements and are exempt from completing this section of the Application.

Spinoffs

Any Applicant that seeks to use the CDFI Certification provision for Spinoff entities must

demonstrate that the Applicant and/or original entity has had an acceptable primary mission of

community development in place for at least the full six months completed immediately prior to

submission of the CDFI Certification Application. Spinoffs also must demonstrate that all

relevant Affiliates each individually meets all of the Primary Mission criteria.

DOCUMENTING MISSION

The Applicant must be able to demonstrate that it has had an acceptable primary mission of community

development in place for at least the six full completed months immediately prior to submission of the

Application. Applicants also must demonstrate that any relevant Affiliate has a mission currently in place

that supports and/or is consistent with that of the Applicant’s.

To demonstrate that it has an acceptable primary mission, an entity must present documentation

specified by the CDFI Fund that clearly articulates that the entity’s primary purpose is to promote

community development and that demonstrates board or owner approval of that mission. Examples of

promoting community development include the provision of Financial Products/Services or other efforts

to promote affordable or Low-Income housing, public facilities, infrastructure or economic development

and/or the provision of community services such as childcare, education, healthcare, social services,

workforce development, etc.

COMMUNITY DEVELOPMENT STRATEGY

The Applicant must be able to demonstrate that it has an acceptable community development strategy

such that the Financial Products and/or Financial Services it offers support a community development

objective(s) for underserved populations and/or residents of economically distressed communities. To

demonstrate that it has an acceptable community development strategy, the Applicant must submit a

board -approved (or, for institutions without a board of directors, owner-approved) strategic plan that

shows evidence of such a community development strategy. (Affiliates are not required to demonstrate

a community development strategy, but must describe how their activities support and/or are

consistent with the community development mission of the Applicant.)

RESPONSIBLE FINANCING PRACTICES

To meet the CDFI Certification requirements for responsible financing practices, an entity should provide

Financial Products and Financial Services in a way that does not harm consumers. Financial Products

should be affordable and based upon a borrower’s ability to repay. CDFIs should practice transparency,

fair collections, and be in compliance with federal, state, and local laws.

To measure compliance with these principles, the Application asks a series of questions related to the

Applicant’s Financial Products and Financial Services, some of which may be disqualifying, while others

may be used holistically, to evaluate the Applicant’s practices as a whole.

35

Any Applicant that engages in the following practices is ineligible for CDFI Certification:

Originates or otherwise offers loans that exceed the interest limits that apply to non-depository

institutions in the state where the borrower resides;