ManipalCigna ProHealth Prime | Protect Plan and Advantage Plan | Terms & Conditions | UIN: MCIHLIP22224V012122 | April 2022

A. Preamble

This is a legal contract between You and Us subject to the receipt of full

premium, Disclosure to Information Norm including the information

provided by You in the Proposal Form and the terms, conditions and

exclusions of this Policy.

If any Claim arising as a result of a Disease/Illness or Injury that

occurred during the Policy Period becomes payable, then We shall

paythebenetsinaccordancewithterms,conditionsandexclusions

of the Policy subject to availability of Sum Insured and Cumulative

Bonus (if any). All limits mentioned in the Policy Schedule are

applicable for each Policy Year of coverage.

B Denitions

B.I StandardDenitions

1. Accidentmeans a sudden, unforeseen and involuntary event caused

by external, visible and violent means.

2. AnyoneIllness means continuous Period of illness and it includes

relapse within 45 days from the date of last consultation with the

Hospital/Nursing Home where the treatment was taken.

3. AYUSH Hospital is a healthcare facility wherein medical/ surgical/

para-surgical treatment procedures and interventions are carried out

by AYUSH Medical Practitioner(s) comprising any of the following:

1. Central or State Government AYUSH Hospital; or

2. Teaching hospitals attached to AYUSH College recognized by the

Central Government / Central Council of Indian Medicine / Central

Council for Homeopathy; or

3. AYUSH Hospital, standalone or co-located with In-patient

healthcare facility of any recognized system of medicine, registered

with the local authorities, wherever applicable, and is under the

supervisionofaqualiedregistered AYUSH Medical Practitioner

and must comply with all the following criterion:

i) HavingatleastveIn-patientbeds;

ii) HavingqualiedAYUSHMedicalPractitionerinchargeroundthe

clock;

iii) Having dedicated AYUSH therapy sections as required and/or

has equipped operation theatre where surgical procedures are

to be carried out;

iv) Maintaining daily record of the patients and making them

accessible to the insurance company’s authorized

representative.

4. Cashless Facility means a facility extended by the insurer to the

insured where the payments, of the costs of treatment undergone by

the insured in accordance with the Policy terms and conditions, are

directly made to the network provider by the insurer to the extent pre-

authorization approved.

5. Co-payment means a cost-sharing requirement under a health

insurance policy that provides that the policyholder/insured will bear a

specied percentage of the admissible claim amount. A co-payment

does not reduce the Sum Insured.

6. ConditionPrecedent means a policy term or condition upon which the

Insurer’s Liability under the Policy is conditional upon.

7. CongenitalAnomaly refers to a condition(s) which is present since

birth, and which is abnormal with reference to form, structure or

position.

a. Internal Congenital Anomaly - which is not in the visible and

accessible parts of the body is called Internal Congenital Anomaly

b. ExternalCongenitalAnomaly- Congenital Anomaly which is in the

visible and accessible parts of the body.

8. CriticalIllnessmeans the following:

a) CancerofSpeciedSeverity

A malignant tumor characterized by the uncontrolled growth &

spread of malignant cells with invasion & destruction of normal

tissues. This diagnosis must be supported by histological evidence

of malignancy. The term cancer includes leukemia, lymphoma and

sarcoma.

The following are excluded –

i. All tumors which are histologically described as carcinoma in

situ, benign, pre-malignant, borderline malignant, low malignant

potential, neoplasm of unknown behavior, or non-invasive,

including but not limited to: Carcinoma in situ of breasts, Cervical

dysplasia CIN-1, CIN -2 and CIN-3.

ii. Any non-melanoma skin carcinoma unless there is evidence of

metastases to lymph nodes or beyond;

iii. Malignant melanoma that has not caused invasion beyond the

epidermis;

iv. Alltumorsoftheprostateunlesshistologicallyclassiedashaving

a Gleason score greater than 6 or having progressed to at least

clinicalTNMclassicationT2N0M0

v. All Thyroid cancers histologically classied as T1N0M0 (TNM

Classication)orbelow;

vi. Chronic lymphocytic leukemia less than RAI stage 3

vii. Non-invasive papillary cancer of the bladder histologically

describedasTaN0M0orofalesserclassication,

viii.All Gastro-Intestinal Stromal Tumors histologically classied as

T1N0M0 (TNM Classication) or below and with mitotic count of

lessthanorequalto5/50HPFs;

ix. All tumors in the presence of HIV infection.

b) MyocardialInfarction(FirstHeartAttackofSpecicSeverity)

I Therstoccurrenceofheartattackormyocardialinfarction,which

means the death of a portion of the heart muscle as a result of

inadequate blood supply to the relevant area. The diagnosis for

this will be evidenced by all of the following criteria:

i. a history of typical clinical symptoms consistent with the diagnosis

of Acute Myocardial Infarction (for e.g. typical chest pain)

ii. new characteristic electrocardiogram changes

iii. elevation of infarction specic enzymes, Troponins or other

specicbiochemicalmarkers.

II The following are excluded:

i. Other acute Coronary Syndromes

ii. Any type of angina pectoris.

iii. A rise in cardiac biomarkers or Troponin T or I in absence

of overt ischemic heart disease OR following an intra-arterial

cardiac procedure.

c) OpenChestCABG

I The actual undergoing of heart surgery to correct blockage or

narrowing in one or more coronary artery (s), by coronary artery

bypass grafting done via a sternotomy (cutting through the breast

bone) or minimally invasive keyhole coronary artery bypass

procedures. The diagnosis must be supported by a coronary

angiographyandtherealizationofsurgeryhastobeconrmedby

a cardiologist.

II The following are excluded:

a. Angioplasty and/or any other intra-arterial procedures

d) OpenHeartReplacementorRepairofHeartValves

The actual undergoing of open-heart valve surgery is to replace or repair

one or more heart valves, as a consequence of defects in,

abnormalities of, or disease-affected cardiac valve(s). The diagnosis

of the valve abnormality must be supported by an echocardiography

and the realization of surgery has to be conrmed by a specialist

medical practitioner. Catheter based techniques including but not

PolicyContract

Plans:Protect|Advantage

MANIPALCIGNAPROHEALTHPRIME

ManipalCigna ProHealth Prime | Protect Plan and Advantage Plan | Terms & Conditions | UIN: MCIHLIP22224V012122 | April 2022

limited to, balloon valvotomy/ valvuloplasty are excluded.

e) ComaofSpeciedSeverity

1. A state of unconsciousness with no reaction or response to

external stimuli or internal needs.

This diagnosis must be supported by evidence of all of the following:

i. no response to external stimuli continuously for at least 96 hours;

ii. life support measures are necessary to sustain life; and

iii. permanentneurologicaldecitwhichmustbeassessedatleast30

days after the onset of the coma.

2. The condition has to be conrmed by a specialist medical

practitioner. Coma resulting directly from alcohol or drug abuse is

excluded.

f) KidneyFailureRequiringRegularDialysis

End stage renal disease presenting as chronic irreversible failure

of both kidneys to function, as a result of which either regular

renal dialysis (hemodialysis or peritoneal dialysis) is instituted or

renaltransplantationiscarriedout.Diagnosishastobeconrmed

by a specialist medical practitioner.

g) StrokeResultinginPermanentSymptoms

Any cerebrovascular incident producing permanent neurological

sequelae. This includes infarction of brain tissue, thrombosis in

an intracranial vessel, hemorrhage and embolization from an

extracranialsource.Diagnosishastobeconrmedbyaspecialist

medical practitioner and evidenced by typical clinical symptoms

aswellastypicalndingsinCTscanorMRIofthebrain.Evidence

ofpermanentneurologicaldecitlastingforatleast3monthshas

to be produced.

The following are excluded:

1. Transient ischemic attacks (TIA)

2. Traumatic injury of the brain

3. Vascular disease affecting only the eye or optic nerve or

vestibular functions.

h) MajorOrgan/BoneMarrowTransplant

The actual undergoing of a transplant of:

1. One of the following human organs: heart, lung, liver, kidney,

pancreas, that resulted from irreversible end-stage failure of the

relevant organ, or

2. Human bone marrow using hematopoietic stem cells. The

undergoing of a transplant has to be conrmed by a specialist

medical practitioner.

The following are excluded:

i. Other stem-cell transplants

ii. Where only islets of langerhans are transplanted

i) PermanentParalysisofLimbs

Total and irreversible loss of use of two or more limbs as a result of

injury or disease of the brain or spinal cord. A specialist medical

practitioner must be of the opinion that the paralysis will be permanent

with no hope of recovery and must be present for more than 3 months.

j) MotorNeuronDiseasewithPermanentSymptoms

Motor neuron disease diagnosed by a specialist medical practitioner

as spinal muscular atrophy, progressive bulbar palsy, amyotrophic

lateral sclerosis or primary lateral sclerosis. There must be progressive

degeneration of corticospinal tracts and anterior horn cells or bulbar

efferent neurons. There must be current signicant and permanent

functional neurological impairment with objective evidence of motor

dysfunction that has persisted for a continuous period of at least 3

months.

k)MultipleSclerosiswithPersistingSymptoms

I. TheunequivocaldiagnosisofDeniteMultipleSclerosisconrmed

and evidenced by all of the following:

i. investigationsincludingtypicalMRIndingswhichunequivocally

conrmthediagnosistobemultiplesclerosisand

ii. there must be current clinical impairment of motor or sensory

function, which must have persisted for a continuous period of

at least 6 months.

II. Other causes of neurological damage such as SLE and HIV are

excluded.

9. CumulativeBonus

Cumulative Bonus means any increase in the Sum Insured granted by

the insurer without an associated increase in premium.

10. DayCareCentre - A day care centre means any institution established

for day care treatment of illness and / or injuries or a medical set -up

within a hospital and which has been registered with the local authorities,

wherever applicable, and is under the supervision of a registered and

qualied medical practitioner AND must comply with all minimum

criteria as under:-

a. hasqualiednursingstaffunderitsemployment

b. hasqualiedmedicalpractitioner(s)incharge

c. has a fully equipped operation theatre of its own where surgical

procedures are carried out

d. maintains daily records of patients and will make these accessible

to the Insurance Company’s authorized personnel.

11. Day Care Treatment means medical treatment, and/or surgical

procedure which is:

i) Undertaken under General or Local Anesthesia in a hospital/day

care centre in less than 24 hours because of technological

advancement, and

ii) Which would have otherwise required a Hospitalization of more

than 24 hours.

Treatment normally taken on an out-patient basis is not included in the

scopeofthisdenition.

12. Deductible means a cost-sharing requirement under a health

insurance policy that provides that the Insurer will not be liable for a

specied rupee amount in case of indemnity policies and for a

speciednumberofdays/hoursincaseofhospitalcashpolicies,which

willapplybeforeanybenetsarepayablebytheinsurer.Adeductible

does not reduce the sum insured.

13. Dental Treatment - Dental treatment means a treatment related to

teeth or structures supporting teeth including examinations, llings

(where appropriate), crowns, extractions and surgery excluding any

form of cosmetic surgery/implants.

14. DisclosuretoInformationNorm means the Policy shall be void and

all premium paid hereon shall be forfeited to the Company, in the event

of misrepresentation, mis-description or non-disclosure of any material

fact.

15. DomiciliaryHospitalization means medical treatment for an illness/

disease/injury which in the normal course would require care and

treatment at a hospital but is actually taken while conned at home

under any of the following circumstances:

a) the condition of the patient is such that he/she is not in a condition

to be removed to a hospital, or

b) the patient takes treatment at home on account of non-availability

of room in a hospital.

16. Emergency Care means management for a severe illness or injury

which results in symptoms which occur suddenly and unexpectedly,

and requires immediate care by a medical practitioner to prevent death

or serious long term impairment of the insured person’s health

17. GracePeriodmeansthespeciedperiodoftimeimmediatelyfollowing

the premium due date during which a payment can be made to renew

or continue a policy in force without loss of continuity benets such

as waiting periods and coverage of pre-existing diseases. Coverage is

not available for the period for which no premium is received.

18. Hospitalmeans any institution established for In-patient care and day

care treatment of illness and/or injuries and which has been registered

as a hospital with the local authorities, under the Clinical Establishments

(Registration and Regulation) Act, 2010 or under the enactments

specied under the Schedule of Section 56 (1) of the said Act OR

ManipalCigna ProHealth Prime | Protect Plan and Advantage Plan | Terms & Conditions | UIN: MCIHLIP22224V012122 | April 2022

complies with all minimum criteria as under:

i. hasqualiednursingstaffunderitsemploymentroundtheclock;

ii. has at least 10 In-patient beds, in towns having a population of

less than 10,00,000 and at least 15 In-patient beds in all other

places;

iii. hasqualiedmedicalpractitioner(s)inchargeroundtheclock;

iv. has a fully equipped operation theatre of its own where surgical

procedures are carried out

v. maintains daily records of patients and makes these accessible to

the Insurance company’s authorized personnel.

19. Hospitalization or Hospitalized means admission in a hospital for

a minimum period of 24 consecutive In-patient Care hours except for

speciedprocedures/treatments,wheresuchadmissioncouldbefora

period of less than 24 consecutive hours.

20. Illness means a sickness or disease or pathological condition leading

to the impairment of normal physiological function and requires medical

treatment.

a) Acutecondition- Acute condition is a disease, illness or injury that

is likely to respond quickly to treatment which aims to return the

person to his or her state of health immediately before suffering

the disease/illness/injury which leads to full recovery

b) Chroniccondition-Achronic condition isdenedasa disease,

illness, or injury that has one or more of the following characteristics:

1. it needs ongoing or long-term monitoring through consultations,

examinations, check-ups, and /or tests

2. it needs ongoing or long-term control or relief of symptoms

3. it requires rehabilitation for the patient or for the patient to be

specially trained to cope with it

4. itcontinuesindenitely

5. it recurs or is likely to recur

21. Injury means accidental physical bodily harm excluding illness or

disease solely and directly caused by external, violent and visible and

evidentmeanswhichisveriedandcertiedbyaMedicalPractitioner.

22. In-patientCare means treatment for which the Insured Person has to

stay in a hospital for more than 24 hours for a covered event.

23. IntensiveCare Unit means an identied section, ward or wing of a

Hospital which is under the constant supervision of a dedicated

medical practitioner (s), and which is specially equipped for the

continuous monitoring and treatment of patients who are in a critical

condition, or require life support facilities and where the level of care

and supervision is considerably more sophisticated and intensive than

in the ordinary and other wards.

24. Maternityexpenses means:

i. Medical treatment expenses traceable to childbirth (including

complicated deliveries and caesarean sections incurred during

Hospitalization);

ii. Expenses towards lawful medical termination of pregnancy during

the Policy Period

25. Medical Advice means any consultation or advice from a Medical

Practitioner including the issue of any prescription or follow-up

prescription.

26. Medical Expenses means those expenses that an Insured Person

has necessarily and actually incurred for medical treatment on account

of Illness or Accident on the advice of a Medical Practitioner, as long as

these are no more than would have been payable if the Insured Person

had not been insured and no more than other hospitals or doctors in

the same locality would have charged for the same medical treatment.

27. Medically Necessary Treatment means any treatment, tests,

medication, or stay in Hospital or part of a stay in Hospital which

i. Is required for the medical management of the Illness or injury

suffered by the Insured;

ii. Must not exceed the level of care necessary to provide safe,

adequate and appropriate medical care in scope, duration or

intensity.

iii. Must have been prescribed by a Medical Practitioner.

iv. Must conform to the professional standards widely accepted in

international medical practice or by the medical community in

India.

28. Medical Practitioner A Medical practitioner means a person who

holds a valid registration from the medical council of any state or

Medical Council of India or Council for Indian Medicine or for

Homeopathy set up by Government of India or a State Government

and is and is thereby entitled to practice medicine within its jurisdiction;

and is acting within the scope and jurisdiction of license.

29. NewBornBaby means baby born during the Policy Period and is Aged

upto90days

30. NetworkProvider means hospitals or health care provider enlisted by

an insurer, TPA or jointly by an insurer and TPA to provide medical

services to an insured by a cashless facility.

31. Non-NetworkProviderAny hospital, day care centre or other provider

that is not part of the network.

32. Notication of Claim Notication of claim means the process of

intimating a claim to the insurer or TPA through any of the recognized

modes of communication.

33. Migration means, the right accorded to health insurance policyholders

(including all members under family cover and members of group

Health insurance policy), to transfer the credit gained for pre-existing

conditions and time bound exclusions, with the same insurer.

34. OPDTreatment is one in which the Insured visits a clinic / hospital

or associated facility like a consultation room for diagnosis and

treatment based on the advice of a Medical Practitioner. The Insured is

not admitted as a day care or In-patient.

35. Pre-existingDisease means any condition, ailment, injury or disease

a. That is/are diagnosed by a physician within 48 months prior to the

effective date of the policy issued by the insurer or

b. For which medical advice or treatment was recommended by, or

received from, a physician within 48 months prior to the effective

date of the policy issued by the insurer or its reinstatement.

36. Pre-hospitalizationMedicalExpenses

Pre-hospitalization Medical Expenses means medical expenses

incurredduringpredenednumberofdaysprecedingtheHospitalization

of the Insured Person, provided that:

- Such Medical Expenses are incurred for the same condition for

which the Insured Person’s Hospitalization was required, and

- The In-patient Hospitalization claim for such Hospitalization is

admissible by the Insurance Company.

37. Post-hospitalizationMedicalExpenses

Post-hospitalization Medical Expenses means medical expenses

incurred during predened number of days immediately after the

insured person is discharged from the hospital provided that:

i. Such Medical Expenses are for the same condition for which the

insured person’s Hospitalization was required, and

ii. The In-patient Hospitalization claim for such Hospitalization is

admissible by the insurance company.

38. Portability means the right accorded to an individual health insurance

policyholder (including all members under family cover), to transfer the

credit gained for pre-existing conditions and time bound exclusions,

from one insurer to another insurer.

39. QualiedNurse means a person who holds a valid registration from

the Nursing Council of India or the Nursing Council of any state in

India.

ManipalCigna ProHealth Prime | Protect Plan and Advantage Plan | Terms & Conditions | UIN: MCIHLIP22224V012122 | April 2022

40. ReasonableandCustomaryChargesmeans the charges for services

orsupplies,whicharethestandardchargesforthespecic provider

and consistent with the prevailing charges in the geographical area for

identical or similar services, taking into account the nature of the illness

/ injury involved.

41. Renewal means the terms on which the contract of insurance can be

renewed on mutual consent with a provision of grace period for treating

the renewal continuous for the purpose of gaining credit for pre-existing

diseases, time-bound exclusions and for all waiting periods.

42. Room Rent - Room Rent means the amount charged by a Hospital

towards Room and Boarding expenses and shall include the associated

medical expenses.

43. Surgery or Surgical Procedure means manual and / or operative

procedure (s) required for treatment of an illness or injury, correction

of deformities and defects, diagnosis and cure of diseases, relief from

suffering and prolongation of life, performed in a hospital or day care

centre by a medical practitioner

44. Unproven/Experimental treatment means the treatment including

drug experimental therapy which is not based on established medical

practice in India, is treatment experimental or unproven.

B.II SpecicDenitions

1. Age or Aged is the age at last birthday, and which means completed

years as at the date of Inception of the Policy.

2. Ambulance means a road vehicle operated by a licensed/authorized

service provider and equipped for the transport and paramedical

treatment of the person requiring medical attention.

3. Annexure means a document attached and marked as Annexure to

this Policy

4. Associated Medical Expenses. shall include Room Rent, nursing

charges, operation theatre charges, fees of Medical Practitioner/

surgeon/ anesthetist/ Specialist, excluding cost of pharmacy and

consumables, cost of implants and medical devices, cost of diagnostics

conducted within the same Hospital where the Insured Person has

been admitted. It shall not be applicable for Hospitalization in ICU.

Associated Medical Expenses shall be applicable for covered

expenses, incurred in Hospitals which follow differential billing based

on the room category.

5. AYUSH treatment refers to the medical and /or hospitalization

treatments given under Ayurveda, Yoga and Naturopathy, Unani,

Siddha and Homeopathy Systems.

6. InceptionDatemeanstheInceptiondateofthisPolicyasspeciedin

the Policy Schedule

7. CosmeticSurgerymeansSurgeryorMedicalTreatmentthatmodies,

improves, restores or maintains normal appearance of a physical

feature, irregularity, or defect.

8. CoveredRelationshipsshallinclude spouse, children, brother and

sister of the Policyholder who are children of same parents, father,

mother, grandparents, grandchildren, parent in laws, son in law,

daughter in law, uncle, aunt, niece and nephew.

9. DependentChild A dependent child refers to a child (natural or legally

adopted),whoisnanciallydependentonthePolicyHolder,doesnot

have his / her independent source of income, is up to the age of 25

years.

10. Emergency shall mean a serious medical condition or symptom

resulting from injury or sickness which arises suddenly and

unexpectedly, and requires immediate care and treatment by a medical

practitioner, generally received within 24 hours of onset to avoid

jeopardy to life or serious long term impairment of the insured person’s

health, until stabilization at which time this medical condition or

symptom is not considered an emergency anymore.

11. Family Floater means a Policy described as such in the Policy

Schedule where under You and Your Dependents named in the Policy

Schedule are insured under this Policy as at the Inception Date. The

Sum Insured for a Family Floater means the sum shown in the Policy

Schedule which represents Our maximum liability for any and all claims

made by You and/or all of Your Dependents during each Policy Period.

12. HighDependencyUnit/ward is a specially staffed and equipped area

of a hospital that provides a level of care intermediate between

intensive care and the general ward care

13. Indian Resident - An individual will be considered to be resident of

India, if he is in India for a period or periods amounting in all to one

hundred and eighty-two days or more, in the immediate preceding 365

days.

14. In-patientmeans an Insured Person who is admitted to hospital and

stays for at least 24 consecutive hours for the sole purpose of receiving

treatment.

15. InsuredPerson means the person(s) named in the Policy Schedule,

who is / are covered under this Policy, for whom the insurance is

proposed and the appropriate premium paid.

16. IUI - Intrauterine insemination (IUI) is a fertility treatment where sperm

are placed directly into a woman’s uterus

17. IVF - In vitro fertilization (IVF) is a type of assistive reproductive

technology (ART). It involves retrieving eggs from a woman’s ovaries

and fertilizing them with sperm.

18. MaternitySumInsuredmeansthesumspeciedinthePolicySchedule

againstthebenet

19. Policymeans this Terms & Conditions document, the Proposal Form,

PolicySchedule,Add-OnBenetDetails(ifapplicable)andAnnexures

which form part of the Policy contract including endorsements, as

amended from time to time which form part of the Policy Contract and

shall be read together.

20. PolicyPeriod means the period between the inception date and the

expirydateofthepolicyasspeciedinthePolicyScheduleorthedate

of cancellation of this policy, whichever is earlier.

21. PolicyYear means a period of 12 consecutive months within the Policy

Period commencing from the Policy Anniversary/Commencement

Date.

22. PolicySchedule means Schedule attached to and forming part of this

Policy mentioning the details of the Policy Holder, Insured Persons, the

Sum Insured, the period and the limits to which benets under

the Policy are subject to, Premium Paid (including taxes), including any

annexures and/or endorsements, made to or on it from time to time,

and if more than one, then the latest in time.

23. Restored Sum Insured means the amount restored in accordance

with Section D.I.8 of this Policy

24. SinglePrivateRoommeans a single Hospital room with any rating

and of most economical category available at the time of hospitalization

with/without air-conditioning facility where a single patient is

accommodated and which has an attached toilet (lavatory and bath).

The room should have the provision for accommodating an attendant.

This excludes a suite or higher category.

25. Sum Insured means, subject to terms, conditions and exclusions of

this Policy, the amount representing Our maximum liability for any or all

claimsduringthePolicyPeriodspeciedinthePolicySchedule

separately in respect of that Insured Person.

i. In case where the Policy Period is 2/3 years, the Sum Insured

speciedonthePolicyisthelimitfortherstPolicyYear.These

ManipalCigna ProHealth Prime | Protect Plan and Advantage Plan | Terms & Conditions | UIN: MCIHLIP22224V012122 | April 2022

limitswilllapseattheendoftherstyearandthefreshlimitsupto

the full Sum Insured as opted will be available for the second/third

year.

ii. In the event of a claim being admitted under this Policy, the Sum

Insured for the remaining Policy Period shall stand correspondingly

reduced by the amount of claim paid (including ’taxes’) or admitted

and shall be reckoned accordingly.

26. ThirdPartyAdministrator(TPA) means a company registered with

the Authority, and engaged by Us, for a fee or, by whatever name called

and as may be mentioned in the health services agreement, for

providing health services as mentioned under TPA Regulations.

27. We/Our/Us/Insurer means ManipalCigna Health Insurance Company

Limited

28. You/Your/Policy Holder means the person named in the Policy

Schedule as the policyholder and who has concluded this Policy with

Us.

C Benetscoveredunderthepolicy

C.I Basiccovers

C.I.1 In-patientHospitalization

We will cover Medical Expenses of an Insured Person in case of

Medically Necessary Hospitalization arising from a Disease/ Illness

or Injury provided such Medically Necessary Hospitalization is for

more than 24 consecutive hours provided that the admission date of

the Hospitalization due to Disease/ Illness or Injury is within the Policy

Year. We will pay Medical Expenses as shown in the Policy Schedule

for:

a. Reasonable and Customary Charges for Room Rent for

accommodation in Hospital room up to Category as specied in

the Policy Schedule.

b. Intensive Care Unit charges for accommodation in ICU ,

c. Operation theatre charges,

d. Fees of Medical Practitioner/ Surgeon ,

e. Anesthetist,

f. QualiedNurses,

g. Specialists,

h. Cost of diagnostic tests,

i. Medicines,

j. Drugs and consumables, blood, oxygen, surgical appliances and

prosthetic devices recommended by the attending Medical

Practitioner and that are used intra operatively during a Surgical

Procedure.

Room category coverage under each plan will be covered up to

SinglePrivateACRoomorasspeciedinthePolicySchedule,subject

to maximum of Sum Insured Opted. For ICU accommodation, we will

coveruptoSumInsuredoptedorasspeciedinthePolicySchedule.

If the Insured Person is admitted in a room category that is higher

than the one that is specied in the Policy Schedule, then the

Policyholder/Insured Person shall bear a ratable proportion of the total

Associated Medical Expenses (including surcharge or taxes thereon)

in the proportion of the difference between the room rent of the entitled

room category to the room rent actually incurred.

Under In-patient Hospitalization expenses, when availed under In-

patient care, we will cover the expenses towards articial life

maintenance, including life support machine use, even where such

treatment will not result in recovery or restoration of the previous state

of health under any circumstances unless in a vegetative state, as

certiedbythetreatingMedicalPractitioner.

The following procedures will be covered (wherever medically

indicated) either as In-patient or as part of Day Care Treatment in

a hospital up to the limit as per the plan and sum insured opted and as

speciedinthePolicyScheduleinaPolicyYear.:

a. Uterine Artery Embolization and HIFU (High intensity focused

ultrasound)

b. Balloon Sinuplasty

c. Deep Brain stimulation

d. Oral chemotherapy

e. Immunotherapy - Monoclonal Antibody to be given as injection

f. Intra vitreal injections

g. Robotic surgeries

h. Stereotactic radio surgeries

i. Bronchial Thermoplasty

j. Vaporization of the prostrate (Green laser treatment or holmium

laser treatment)

k. IONM - (Intra Operative Neuro Monitoring)

l. Stem cell therapy: Hematopoietic stem cells for bone marrow

transplant for hematological conditions to be covered.

Medical Expenses incurred towards Medically Necessary Treatment of

the Insured Person for In-patient Hospitalization due to a condition

caused by or associated with Human Immunodeciency Virus (HIV)

or HIV related Illnesses, including Acquired Immune Deciency

Syndrome (AIDS) or AIDS Related Complex (ARC) and/or any mutant

derivative or variations thereof, sexually transmitted diseases (STD), in

respect of an Insured Person, will be covered up to the Sum Insured

optedandasspecied in thePolicySchedulein a PolicyYear.The

necessity of the Hospitalization is to be certied by an authorized

Medical Practitioner.

Medical Expenses incurred towards Medically Necessary treatment

taken during In-patient Hospitalization of the Insured Person, arising

out of a condition caused by or associated to a Mental illness, or a

medical condition impacting mental health will be covered up to the

suminsuredoptedandasspeciedinthePolicyScheduleinaPolicy

Year. For the below mentioned ICD Codes, the Insured Person should

have been continuously covered under this Policy for at least 24

monthsbeforeavailingthisbenet.

ICD 10

CODES

DISEASES

F05 Delirium due to known physiological condition

F06 Other mental disorders due to known physiological

condition

F07 Personality and behavioural disorders due to known

physiological condition

F10 Alcohol related disorders

F20 Schizophrenia

F23 Brief psychotic disorders

F25 Schizoaffective disorders

F29 Unspeciedpsychosisnotduetoasubstanceorknown

physiological condition

F31 Bipolar disorder

F32 Depressive episode

F39 Unspeciedmood[affective]disorder

F40 Phobic Anxiety disorders

F41 Other Anxiety disorders

F42 Obsessive-compulsive disorder

F44 Dissociative and conversion disorders

F45 Somatoform disorders

F48 Other nonpsychotic mental disorders

F60 Specicpersonalitydisorders

F84 Pervasive developmental disorders

F90 Attention-decithyperactivitydisorders

F99 Mentaldisorder,nototherwisespecied

AllClaimsunderthisbenetcanbemadeasper theprocessdenedunder

Section G.I.4 and G.I.5.

C.I.2 Pre-hospitalization

We will, on a reimbursement basis cover Medical Expenses of an

Insured Person which are incurred due to a Disease/ Illness or Injury

ManipalCigna ProHealth Prime | Protect Plan and Advantage Plan | Terms & Conditions | UIN: MCIHLIP22224V012122 | April 2022

that occurs during the Policy Year immediately prior to the Insured

Person’s date of Hospitalization up to the limits as specied in the

Policy Schedule, provided that a Claim has been admitted under

In-patientbenetunderSectionD.I.1andisrelatedtothesameillness/

condition.

AllClaimsunderthisbenetcanbemadeaspertheprocessdened

under Section G.I.5 and G.I.9.

C.I.3 Post-hospitalization

We will, on a reimbursement basis cover Medical Expenses of an

Insured Person which are incurred due to a Disease/ Illness or Injury

that occurs during the Policy Year immediately post discharge of the

InsuredPersonfromthe Hospital uptothelimits as speciedinthe

Policy Schedule, provided that a Claim has been admitted under

In-patientbenetunderSectionD.I.1andisrelatedtothesameillness/

condition.

AllClaimsunderthisbenetcanbemadeaspertheprocessdened

under Section G.I.5 and G.I.9.

C.I.4 DayCareTreatment

We will cover payment of Medical Expenses of an Insured Person in

case of Medically Necessary Day Care Treatment or Surgery that

requires less than 24 hours of Hospitalization due to advancement in

technology and which is undertaken in a Hospital/ Nursing Home/ Day

Care Centre on the recommendation of a Medical Practitioner, up to

theSumInsuredasspeciedinthePolicySchedule,providedthat:

a. The Day Care Treatment is Medically Necessary and follows the

written advice of a Medical Practitioner.

b. The Medical Expenses incurred are Reasonable and Customary

Charges for any procedure where such procedure is undertaken

by an Insured Person as Day Care Treatment.

c. We will not cover any OPD Treatment and Diagnostic Service

underthisbenet.

Coverage will also include pre-post hospitalization expenses as per the

limitsapplicableandspeciedunderthePlanopted.

AllClaimsunderthisbenetcanbemadeaspertheprocessdened

under Section G.I.4 & G.I.5.

C.I.5 DomiciliaryHospitalization

We will cover Medical Expenses of an Insured Person, up to limits

speciedaspertheoptedplan,whicharetowardsaDisease/Illnessor

Injury which in the normal course would otherwise have been covered

for Hospitalization under the policy but is taken at home on the advice

of the attending Medical Practitioner, under the following circumstances:

i. The condition of the Insured Person does not allow a Hospital

transfer; or

ii. A Hospital bed was unavailable;

Provided that, the treatment of the Insured Person continues for at

least 3 days, in which case the reasonable cost of any Medically

Necessary treatment for the entire period shall be payable.

a) We will pay for Pre-hospitalization, Post-hospitalization Medical

Expensesupto30dayseach.

b) Restoration of Sum Insured shall not be available under this

benet

c) We shall not be liable under this Policy for any Claim in connection

with or in respect of the following:

i. Asthma, COPD, bronchitis, tonsillitis and upper and lower

respiratory tract infection including laryngitis and pharyngitis,

coughandcold,inuenza,

ii. Arthritis, gout and rheumatism including the rheumatism of

bones, joints and also rheumatic heart disease,

iii. Chronic nephritis and nephritic syndrome,

iv. All types of Diarrhea and dysenteries, including gastroenteritis,

v. Diabetes mellitus and Diabetes Insipidus,

vi. Epilepsy / Seizure disorder,

vii. Hypertension,

viii. Pyrexia of unknown origin.

AllClaimsunderthisbenetcanbemadeaspertheprocessdened

under Section G.I.5.

C.I.6 RoadAmbulance

We will provide for reimbursement of Reasonable and Customary

expenses up to Sum Insured as specied in the Policy Schedule

that are incurred towards road transportation of an Insured Person by a

registered Healthcare or Ambulance Service Provider to a nearest

Hospital for treatment of an Illness or Injury covered under the Policy in

case of an Emergency, necessitating the Insured Person’s admission

to the nearest Hospital. The necessity of use of an Ambulance must be

certiedbythetreatingMedicalPractitioner.

a. Reasonable and Customary expenses shall include:

(i) Costs towards transferring the Insured Person from one

Hospital to another Hospital or diagnostic centre for advanced

diagnostic treatment where such facility is not available at the

existing Hospital; or

(ii) When the Insured Person requires to be moved to a better

Hospital facility due to lack of super specialty treatment in the

existing Hospital.

b. Payment under this cover is subject to a claim being admissible

under Section D.I.1 ‘In-patient Hospitalization’, for the same

Illness/Injury;

AllClaimsunderthisbenetcanbemadeaspertheprocessdened

under Section G.I.5.

C.I.7 DonorExpenses

We will cover In-patient Hospitalization Medical Expenses towards the

donorforharvestingtheorganuptotheSumInsuredasspeciedin

the Policy Schedule, subject to the below mentioned conditions:

a. The organ donor is any person in accordance with the

Transplantation of Human Organs Act 1994 (amended) and other

applicable laws and rules, provided that –

i. The organ donated is for the use of the Insured Person who

has been asked to undergo an organ transplant on Medical

Advice.

b. We have admitted a claim under Section D.I.1 – towards In-patient

Hospitalization

c. We will not cover expenses towards the Donor in respect of:

i. Any Pre or Post-hospitalization Medical Expenses,

ii. Cost towards donor screening,

iii. Cost associated to the acquisition of the organ,

iv. Any other medical treatment or complication in respect of the

donor, consequent to harvesting.

AllClaimsunderthisbenetcanbemadeaspertheprocessdened

under Section G.I.4 & G.I.5.

C.I.8 RestorationofSumInsured

We will provide for a 100% restoration of the Sum Insured for any

number of times in a Policy Year whether the illness/condition is

unrelated or same, provided that:

a. The Sum Insured inclusive of earned Cumulative Bonus (if any) or

CumulativeBonusBooster(ifopted&earned)isinsufcientasa

result of previous claims in that Policy Year.

b. The Restored Sum Insured will be available only for claims made

by Insured Persons in respect of future claims that become

payable under Section D of the Policy and shall not apply to the

rstclaiminthePolicyYear.RestorationoftheSumInsuredwillonly

be provided for coverage under Section D.I.1 ‘In-patient

Hospitalization’, Section D.I.2 ‘Pre-Hospitalization’, Section D.I.3

‘Post-Hospitalization’, Section D.I.4 ‘Day Care Treatment’, Section

D.I.6 ‘Road Ambulance’, Section D.I.7 ‘Donor Expenses’, Section

D.I.9 ‘AYUSH Treatment (In-patient Hospitalization)’ Section D.IV.1

‘Non-Medical Items’.

c. The Restored Sum Insured will not be considered while calculating

the Cumulative Bonus/ Cumulative Bonus Booster.

d. Such restoration of Sum Insured will be available for any number

of times, during a Policy Year to each insured in case of an

Individual Policy and can be utilized by Insured Persons who stand

covered under the Policy before the Sum Insured was exhausted.

e. IfthePolicyisissuedonaoaterbasis,theRestoredSumInsured

willalsobeavailableonaoaterbasis.

f. If the Restored Sum Insured is not utilized in a Policy Year, it shall

not be carried forward to subsequent Policy Year.

g. For any single claim during a Policy Year the maximum Claim

amount payable shall be sum of:

ManipalCigna ProHealth Prime | Protect Plan and Advantage Plan | Terms & Conditions | UIN: MCIHLIP22224V012122 | April 2022

i. The Sum Insured

ii. Cumulative Bonus (if earned) or Cumulative Bonus Booster (if

opted & earned)

iii. Restored Sum Insured

AllClaimsunderthisbenetcanbemadeaspertheprocessdened

under Section G.I.4 & G.I.5.

C.I.9 AYUSHTreatment(In-patientHospitalization)

We will pay the Medical Expenses incurred during the Policy Year,

up to the Sum Insured as specied in the Policy Schedule, of an

Insured Person in case of Medically Necessary Treatment taken during

In-patient Hospitalization for AYUSH Treatment for an Illness or Injury

that occurs during the Policy Year, provided that:

The Insured Person has undergone treatment in an AYUSH Hospital

where AYUSH Hospital is a healthcare facility wherein medical/

surgical/ para-surgical treatment procedures and interventions

are carried out by AYUSH Medical Practitioner(s) comprising any of the

following:

i) Central or State Government AYUSH Hospital; or

ii) Teaching hospitals attached to AYUSH College recognized by

Central Government / Central Council of Indian Medicine and

Central Council of Homeopathy; or

iii) AYUSH Hospital, standalone or co-located with In-patient

healthcare facility of any recognized system of medicine, registered

with the local authorities, wherever applicable, and is under the

supervisionofaqualiedregistered AYUSH Medical Practitioner

and must comply with all the following criterion:

a. HavingatleastveIn-patientbeds;

b. HavingqualiedAYUSHMedicalPractitionerinchargeround

the clock;

c. Having dedicated AYUSH therapy sections as required and/or

has equipped operation theatre where surgical procedures are

to be carried out;

d. Maintaining daily record of the patients and making them

accessible to the insurance company’s authorized

representative.

The following exclusions will be applicable in addition to the other

Policy exclusions:

Facilities and services availed for pleasure or rejuvenation or as

a preventive aid, like beauty treatments, Panchakarma, purication,

detoxicationandrejuvenation.

Allclaimsunderthisbenetcanbemadeaspertheprocessdened

under Section G.I.4 & G.I.5.

C.I.10 AirAmbulanceCover

We will reimburse the Reasonable and Customary expenses

incurred towards transportation of an Insured Person, to the

nearest Hospital or to move the Insured Person to and from

healthcare facilities within India, by an Air Ambulance, provided

that:

i. Air Ambulance is used in case of an Emergency life threatening

health condition of the Insured Person which requires immediate

and rapid ambulance transportation to the hospital or a medical

centre which ground transportation cannot provide;

ii. The Illness/ Injury, causing Emergency, is covered under the

Section D.I.1 In-patient Hospitalization;

iii. The transportation should be provided by medically equipped

aircraft which can provide medical care in ight and should

have medical equipment to monitor vitals and treat the Insured

Person suffering from an Illness/Injury such as but not limited

to ventilators, ECG’s, monitoring units, CPR equipment and

stretchers;

iv. Restoration of Sum Insured shall not be available under this

benet.

v. Air Ambulance service is offered by a Registered Ambulance

service provider;

vi. ThetreatingMedicalPractitionercertiesinwritingthattheseverity

and nature of the Insured Person’s Illness/Injury warrants the

Insured Person’s requirement for Air Ambulance;

vii. Payment under this cover is subject to a claim being admissible

under Section D.I.1 ‘In-patient Hospitalization’ or under Section

D.I.4 ‘Day Care Treatment’, for the same Illness/Injury;

Benet under this cover is payable Up to the limits as specied in

the Policy Schedule subject to maximum up to `10 Lacs in a

policy year and this is over and above the Sum Insured.

What is not covered: Expenses incurred in return transportation to

Insured Person’s home by air ambulance is excluded.

All Claims under this benet can be made as per the process

denedunderSectionG.I.5.

C.I.11 BariatricSurgeryCover

We will cover the Medical Expenses incurred towards Medically

Necessary Hospitalization of the Insured Person for Bariatric

Surgery and its complications, up to Sum Insured and as specied

in Policy Schedule subject to maximum of `5 Lacs.

The cover is available subject to below conditions:

i. SurgeryisMedically Necessary andiscertiedby anauthorized

Medical Practitioner;

ii. Hospitalization is within the Policy Year.

iii. TheInsuredPersonsatisesfollowingcriteriaasdevisedbyNIH

(National Institute of Health):

a. The BMI should be greater than 37.5 without any co-morbidity;

or greater than 32 with co-morbidity and

b. Is unable to lose weight through traditional methods like diet

and exercise.

iv. This cover is available after a Waiting Period of 36 months from the

inception of this Policy with Us, with respect to the Insured Person.

v. Restoration of Sum Insured shall not be available under this

benet

vi. ExclusionE.I.6shallnotapplyuptotheextentofthisbenet

AllClaimsunderthisbenetcanbemadeaspertheprocessdened

under Section G.I.4 & G.I.5

C.I.12 OutpatientExpenses

We will cover the Reasonable and Customary Charges for below

mentioned expenses incurred by the Insured Person as an Outpatient

when treatment is taken from a Network Medical Practitioner to the

extentoftheOutpatientSumInsuredoptedandasspeciedinPolicy

Scheduleforthisbenet.

i. Consultation and Diagnostic tests including Dental and Vision

consultations and diagnostics, wherever prescribed by the Network

MedicalPractitioner,uptotheOutpatientSumInsuredasspecied

in the Policy Schedule.

ii. Expenses incurred on drugs and medicines prescribed by the

Network Medical Practitioner up to 20% of the Outpatient Sum

InsuredandasspeciedinthePolicySchedule.

Overall payout in a Policy Year should not exceed 100% of the

applicable Outpatient Sum Insured.

Any medical aids such as spectacles and contact lenses, hearing aids,

crutches, wheel chair, walker, walking stick, lumbo-sacral belt shall not

becoveredunderthisbenet.Weshallnotcoveranytreatmentand/or

procedureunderthisbenetrelatedtoDentalandVision

Any unutilized amount under this benet shall not be carried

forward to subsequent Policy Year.

This benet shall be available only on Cashless basis from the

MCHI Network. All Diagnostics and Pharmacy requirements would

need to be prescribed by the Network Medical Practitioner in order

tomakethemeligibleunderthisbenet.

Restoration of Sum Insured shall not be available under this

benet.

AllClaimsunderthisbenetcanbemadeaspertheprocessdened

under Section G.I.4. and G.I.12

C.I.13 DailyCashforSharedAccommodation

WewillpayadailycashamountasspeciedinthePolicySchedule

for the Insured Person for each continuous and completed period

of 24 hours of Hospitalization provided that,

a. We have accepted claim under Section D.I.1 In-patient

Hospitalization during the Policy Year

b. The Insured Person has occupied a shared room accommodation

during such Hospitalization

c. The Insured Person has been admitted in a Hospital for a minimum

period of 48 hours continuously.

What is not covered:

ManipalCigna ProHealth Prime | Protect Plan and Advantage Plan | Terms & Conditions | UIN: MCIHLIP22224V012122 | April 2022

This benet will not be payable if the Insured Person stays in an

Intensive Care Unit or High Dependency Units / wards.

AllClaimsunderthisbenetcanbemadeaspertheprocessdened

under Section G.I.5

C.II Valueaddedcovers

C.II.1 HealthCheckUp

(a) If the Insured Person, covered as adult (excluding dependent

children in oater Policy) and has completed 18 years of age,

the Insured Person may avail a comprehensive health check-up

with Our Network Provider as per the eligibility details mentioned in

the table below.

(b) In case of individual policy where more than 1 member are covered

under the same Individual Policy, upon attainment of 18 years of

age, the Insured member shall be eligible for health check-up with

Our Network Provider as per the eligibility details mentioned in the

table below.

(c) Health Check Ups will be arranged by Us and conducted at Our

Network Providers. Alternatively, the Insured member may choose

to undergo Health Check Ups as per Insured member’s choice on

Cashless basis with Our Network Provider, subject to the maximum

limitsasspeciedagainsttheapplicableSumInsured.

(d) This benet is available once in a policy year including the rst

policy year. And all the tests must have been done on the same

date.

(e) Original Copies of all reports will be provided to You.

(f) We shall cover Health Check Up only on cashless basis.

(g) All eligible Insured members under the Policy shall either follow

“Basis A” or “Basis B” while availing Health Check Up cover, within

MCHI Network.

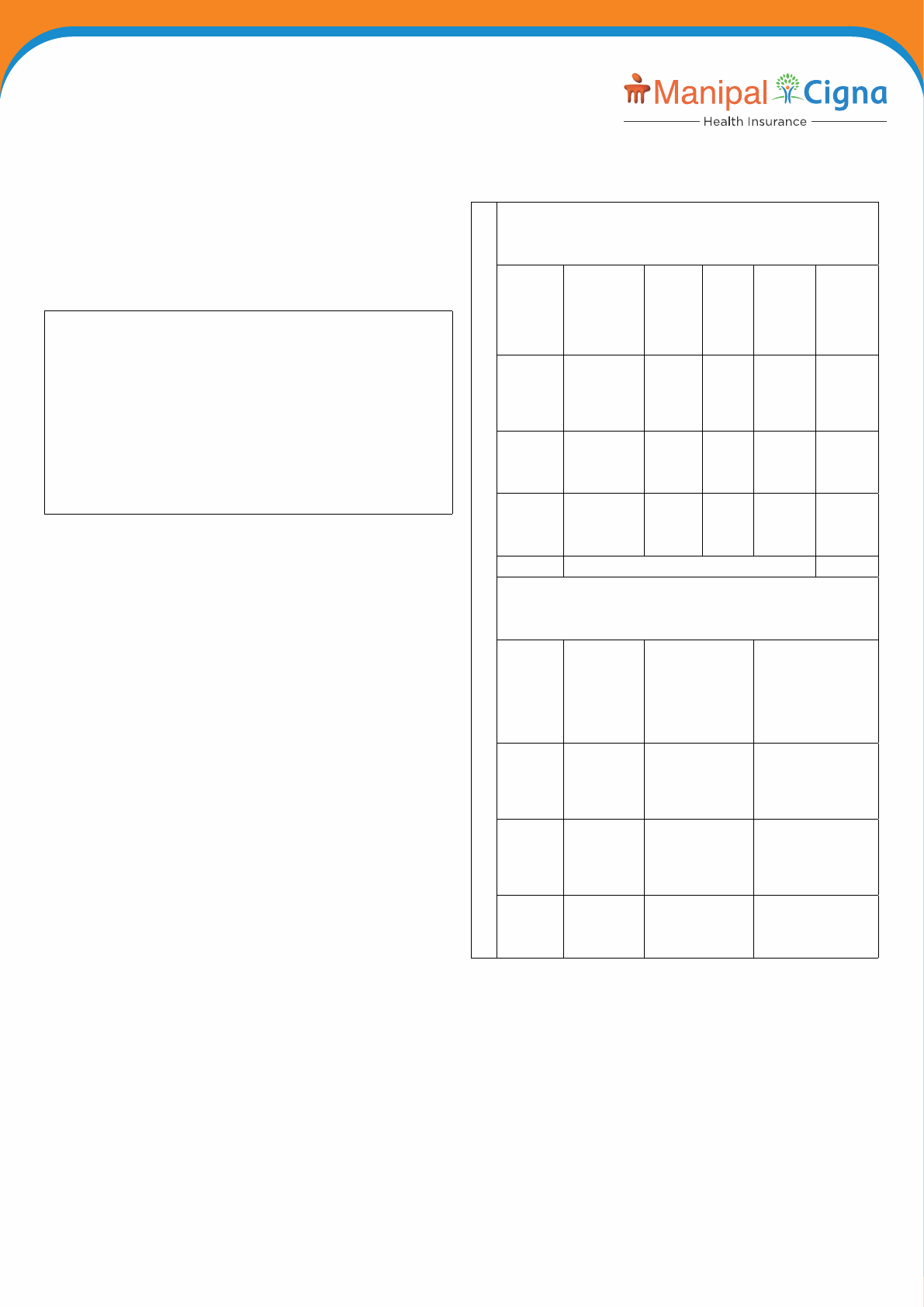

HealthCheckUp

Package

Sum

Insured

Age

group

Basis–A Basis-B

Listoftests–Cashless

Limitsfor

testsof

Insured

member’s

choiceon

Cashless

basis

Compulsory

Tests

Optional

Tests

(Anyone)

1

`3

Lacs,

`4

Lacs,

`5 Lacs

Up

to40

Years

CBC-ESR,

FBS, Lipid

Prole,Sr.

Creatinine

B1 - Heart

monitoring

– ECG or

B2 - Liver

screening

- SGOT

and SGPT

`1,000

per adult

Insured

member

Above

40

years

CBC-ESR,

FBS, Lipid

Prole,Sr.

Creatinine

B1 - Heart

monitoring

– ECG or

B2 - Liver

screening

- SGOT

and SGPT

or

B3 -

Thyroid

Screening

- Thyroid

prole

B4 -

Diabetes

screening

- HbA1c

2

`7.5

Lacs,

`10

Lacs,

Up

to40

Years

ECG,FBS,LipidProle,

Sr. Creatinine, CBC-ESR,

SGOT, SGPT, GGT, TSH,

USG - Abdomen & pelvis

`2,500

per adult

Insured

member

Above

40

years

ECG,FBS,LipidProle,

Sr. Creatinine, CBC-ESR,

SGOT, SGPT, GGT, TSH,

HbA1c, USG Abdomen &

Pelvis, PSA (for Males),

Mammogram/ PAP Smear

(for females)

3

> `10

Lacs

Up

to40

Years

FBS,KidneyProle,ECG,

CBC-ESR,LipidProle,

LiverProle,Thyroid

Prole,2D-Echo,USGAb-

domen & Pelvis, Vitamin

D3, Vitamin B12

`5,000

per adult

Insured

member

Above

40

years

FBS, ECG, HbA1C,

KidneyProle,CBC-ESR,

LipidProle,LiverProle,

ThyroidProle,2D-Echo,

PSA (for Males)/ Mam-

mogram/ PAP Smear (for

females), USG Abdomen

& Pelvis, Vitamin D3,

Vitamin B12,

Full explanation of Tests is provided here: FBS – Fasting Blood

Sugar, ECG – Electrocardiogram, CBC-ESR – Complete Blood Count-

Erythrocyte Sedimentation Rate, Sr. Creatinine – Serum Creatinine,

HbA1c – Glycosylated Hemoglobin, SGOT – Serum Glutamate

oxaloacetate transaminase, SGPT – Serum Glutamate Pyruvate

Transaminase, GGT – Gamma Glutamyl Transferase, TMT – Tread

Mill Test, PSA – Prostate Specic Antigen, USG – Ultrasound

Sonography, TSH – Thyroid Stimulating Hormone, CBC – Complete

Blood Count

(h) This cover is available up to the limits as per Sum Insured opted

andasspeciedinthePolicySchedule.

(i) ThisbenetshallbeoverandabovetheSumInsured.

(j) Restoration of Sum Insured shall not be available under this

benet

(k) All Claims under this benet can be made as per the process

denedunderSectionG.I.14&G.I.5

C.II.2 DomesticSecondOpinion

You may choose to secure a second opinion from Our Network of

Medical Practitioners in India, if an Insured Person is diagnosed

with/ advised a treatment listed and dened under Critical Illness

during the Policy Year. The expert opinion would be directly sent to the

Insured Person.

You understand and agree that You can exercise the option to secure

an expert opinion, provided:

(a) We have received a request from You to exercise this option.

(b) That the expert opinion will be based only on the information and

documentation provided by the Insured Person that will be shared

with the Medical Practitioner

(c) This benet is only a value added service provided by Us and

does not deem to substitute the Insured Person’s visit or

consultation to an independent Medical Practitioner.

(d) The Insured Person is free to choose whether or not to obtain the

expert opinion, and if obtained then whether or not to act on it.

(e) We shall not, in any event be responsible for any actual or alleged

errors or representations made by any Medical Practitioner or in

any expert opinion or for any consequence of actions taken or not

taken in reliance thereon.

(f) The expert opinion under this Policy shall be limited to covered

Critical Illnesses and not be valid for any medico legal purposes.

(g) We do not assume any liability towards any loss or damage arising

out of or in relation to any opinion, advice, prescription, actual

or alleged errors, omissions and representations made by the

Medical Practitioner.

(h) This benet can be availed by each Insured Person only once

during a Policy Year for one Critical Illness. However, one can avail

thisbenetformultiplecriticalillnessesinayear.

ManipalCigna ProHealth Prime | Protect Plan and Advantage Plan | Terms & Conditions | UIN: MCIHLIP22224V012122 | April 2022

(i) AnyclaimunderthisbenetwillnotimpacttheSumInsuredand/or

Cumulative Bonus or Cumulative Bonus Booster.

(j) For the purpose of this benet covered Critical Illnesses shall

include –

1. CancerofSpeciedSeverity

A malignant tumor characterized by the uncontrolled growth & spread

of malignant cells with invasion & destruction of normal tissues. This

diagnosis must be supported by histological evidence of malignancy.

The term cancer includes leukemia, lymphoma and sarcoma.

The following are excluded –

i. All tumors which are histologically described as carcinoma in

situ, benign, pre-malignant, borderline malignant, low malignant

potential, neoplasm of unknown behavior, or non-invasive,

including but not limited to: Carcinoma in situ of breasts, Cervical

dysplasia CIN-1, CIN -2 and CIN-3.

ii. Any non-melanoma skin carcinoma unless there is evidence of

metastases to lymph nodes or beyond;

iii. Malignant melanoma that has not caused invasion beyond the

epidermis;

iv. All tumors of the prostate unless histologically classied as

having a Gleason score greater than 6 or having progressed to at least

clinicalTNMclassicationT2N0M0

v. All Thyroid cancers histologically classied as T1N0M0 (TNM

Classication)orbelow;

vi. Chronic lymphocytic leukemia less than RAI stage 3

vii. Non-invasive papillary cancer of the bladder histologically

describedasTaN0M0orofalesserclassication,

viii.All Gastro-Intestinal Stromal Tumors histologically classied as

T1N0M0 (TNM Classication) or below and with mitotic count of

lessthanorequalto5/50HPFs;

ix. All tumors in the presence of HIV infection.

2. MyocardialInfarction(FirstHeartAttackofSpecicSeverity)

I The rst occurrence of heart attack or myocardial infarction, which

means the death of a portion of the heart muscle as a result of

inadequate blood supply to the relevant area. The diagnosis for this will

be evidenced by all of the following criteria:

i. a history of typical clinical symptoms consistent with the diagnosis

of Acute Myocardial Infarction (for e.g. typical chest pain)

ii. new characteristic electrocardiogram changes

iii. elevationofinfarctionspecicenzymes,Troponinsorotherspecic

biochemical markers.

II The following are excluded:

1. Other acute Coronary Syndromes

2. Any type of angina pectoris.

3. A rise in cardiac biomarkers or Troponin T or I in absence of overt

ischemic heart disease OR following an intra-arterial cardiac

procedure.

3. OpenChestCABG

I The actual undergoing of heart surgery to correct blockage or

narrowing in one or more coronary artery(s), by coronary artery bypass

grafting done via a sternotomy (cutting through the breast bone) or

minimally invasive keyhole coronary artery bypass procedures. The

diagnosis must be supported by a coronary angiography and the

realizationofsurgeryhastobeconrmedbyacardiologist.

II The following are excluded:

a. Angioplasty and/or any other intra-arterial procedures

4. OpenHeartReplacementorRepairofHeartValves

The actual undergoing of open-heart valve surgery is to replace or

repair one or more heart valves, as a consequence of defects in,

abnormalities of, or disease-affected cardiac valve (s). The diagnosis

of the valve abnormality must be supported by an echocardiography

and the realization of surgery has to be conrmed by a specialist

medical practitioner. Catheter based techniques including but not

limited to, balloon valvotomy/valvuloplasty are excluded.

5. ComaofSpeciedSeverity

1. A state of unconsciousness with no reaction or response to external

stimuli or internal needs.

This diagnosis must be supported by evidence of all of the following:

i. no response to external stimuli continuously for at least 96 hours;

ii. life support measures are necessary to sustain life; and

iii. permanentneurologicaldecitwhichmustbeassessedatleast30

days after the onset of the coma.

2. The condition has to be conrmed by a specialist medical

practitioner. Coma resulting directly from alcohol or drug abuse is

excluded.

6. KidneyFailureRequiringRegularDialysis

End stage renal disease presenting as chronic irreversible failure of

both kidneys to function, as a result of which either regular renal dialysis

(hemodialysis or peritoneal dialysis) is instituted or renal transplantation

iscarriedout.Diagnosishastobeconrmedbyaspecialistmedical

practitioner.

7. StrokeResultinginPermanentSymptoms

Any cerebrovascular incident producing permanent neurological

sequelae. This includes infarction of brain tissue, thrombosis in an

intracranial vessel, hemorrhage and embolization from an extra cranial

source. Diagnosis has to be conrmed by a specialist medical

practitioner and evidenced by typical clinical symptoms as well as

typicalndingsinCTscanorMRIofthebrain.Evidenceofpermanent

neurologicaldecitlastingforatleast3monthshastobeproduced.

The following are excluded:

1. Transient ischemic attacks (TIA)

2. Traumatic injury of the brain

3. Vascular disease affecting only the eye or optic nerve or vestibular

functions.

8. MajorOrgan/BoneMarrowTransplant

The actual undergoing of a transplant of:

1. One of the following human organs: heart, lung, liver, kidney,

pancreas, that resulted from irreversible end-stage failure of the

relevant organ, or

2. Human bone marrow using hematopoietic stem cells. The

undergoing of a transplant has to be conrmed by a specialist

medical practitioner.

The following are excluded:

i. Other stem-cell transplants

ii. Where only islets of langerhans are transplanted

9. PermanentParalysisofLimbs

Total and irreversible loss of use of two or more limbs as a result of

injury or disease of the brain or spinal cord. A specialist medical

practitioner must be of the opinion that the paralysis will be permanent

with no hope of recovery and must be present for more than 3 months.

10. MotorNeuronDiseasewithPermanentSymptoms

Motor neuron disease diagnosed by a specialist medical practitioner

as spinal muscular atrophy, progressive bulbar palsy, amyotrophic

lateral sclerosis or primary lateral sclerosis. There must be progressive

degeneration of corticospinal tracts and anterior horn cells or bulbar

efferent neurons. There must be current signicant and permanent

functional neurological impairment with objective evidence of motor

dysfunction that has persisted for a continuous period of at least 3

months.

11. MultipleSclerosiswithPersistingSymptoms

I. TheunequivocaldiagnosisofDeniteMultipleSclerosisconrmedand

evidenced by all of the following:

i. investigationsincluding typicalMRIndings,which unequivocally

conrmthediagnosistobemultiplesclerosis;

ii. there must be current clinical impairment of motor or sensory

function, which must have persisted for a continuous period of at

least 6 months, and

II. Other causes of neurological damage such as SLE and HIV are

excluded.

ManipalCigna ProHealth Prime | Protect Plan and Advantage Plan | Terms & Conditions | UIN: MCIHLIP22224V012122 | April 2022

12. Primary(Idiopathic)PulmonaryHypertension

I. An unequivocal diagnosis of Primary (Idiopathic) Pulmonary

Hypertension by a Cardiologist or specialist in respiratory medicine

with evidence of right ventricular enlargement and the pulmonary

arterypressureabove30mmofHgonCardiacCauterization.

There must be permanent irreversible physical impairment to the

degree of at least Class IV of the New York Heart Association

Classicationofcardiacimpairment.

II. TheNYHAClassicationofCardiacImpairmentareasfollows:

i. Class III: Marked limitation of physical activity. Comfortable at rest,

but less than ordinary activity causes symptoms.

ii. Class IV: Unable to engage in any physical activity without

discomfort. Symptoms may be present even at rest.

III. Pulmonary hypertension associated with lung disease, chronic

hypoventilation, pulmonary thromboembolic disease, drugs and toxins,

diseases of the left side of the heart, congenital heart disease and any

secondarycausearespecicallyexcluded.

13. AortaGraftSurgery

The actual undergoing of major Surgery to repair or correct aneurysm,

narrowing, obstruction or dissection of the Aorta through surgical

opening of the chest or abdomen.

Forthepurposeofthisbenet,Aortameansthethoracicandabdominal

aorta but not its branches.

You understand and agree that We will not cover:

a. Surgery performed using only minimally invasive or intra-arterial

techniques.

b. Angioplasty and all other intra-arterial, catheter based techniques,

"keyhole" or laser procedures.

c. Congenital narrowing of the aorta and traumatic injury of the aorta

arespecicallyexcluded.

14. Deafness

Total and irreversible Loss of hearing in both ears as a result of Illness

or accident.

This diagnosis must be supported by pure tone audiogram test and

certiedbyanEar,NoseandThroat(ENT)specialist.Totalmeans“the

lossofhearingtotheextentthatthelossisgreaterthan90decibels

across all frequencies of hearing” in both ears.

15. Blindness

I. Total, permanent and irreversible loss of all vision in both eyes as a

result of illness or accident.

II. The Blindness is evidenced by:

i. correctedvisualacuitybeing3/60orlessinbotheyesor;

ii. theeldofvisionbeinglessthan10degreesinbotheyes.

III. The diagnosis of blindness must be conrmed and must not be

correctable by aids or surgical procedure.

16. AplasticAnemia

Chronic persistent bone marrow failure which results in anemia,

neutropenia and thrombocytopenia requiring treatment with at least

one of the following:

a. Blood product transfusion;

b. Marrow stimulating agents;

c. Immunosuppressive agents; or

d. Bone marrow transplantation.

The diagnosis must be conrmed by a hematologist Medical

Practitioner using relevant laboratory investigations including Bone

MarrowBiopsyresultinginbone marrowcellularityoflessthan 25%

which is evidenced by any two of the following:

a. Absoluteneutrophilcountoflessthan500/mm³orless;

b. Plateletscountlessthan20,000/mm³orless;

c. Reticulocytecountoflessthan20,000/mm³orless.

We will not cover temporary or reversible Aplastic Anemia under this

Section.

17. CoronaryArteryDisease

Therstevidenceofnarrowingofthelumenofatleastonecoronary

arterybyaminimumof75%andoftwoothersbyaminimumof60%,

regardless of whether or not any form of coronary artery Surgery

has been performed. Coronary arteries herein refer to left main stem,

leftanteriordescendingcircumexandrightcoronaryarteryandnotits

branches which is evidenced by the following

a. evidence of ischemia on Stress ECG (NYHA Class III symptoms)

b. coronary arteriography (Hearth Cath)

18. EndStageLungFailure

End Stage Lung Disease, causing chronic respiratory failure, as

conrmedandevidencedbyallofthefollowing:

i. FEV1 test results consistently less than 1 liter measured on 3

occasions 3 months apart; and

ii. Requiring continuous and permanent supplementary oxygen

therapy for hypoxemia; and

iii. Arterial blood gas analysis with partial oxygen pressure of 55mmHg

or less (PaO2 < 55 mm Hg); and

iv. Dyspnea at rest.

19. EndStageLiverFailure

Permanent and irreversible failure of liver function that has resulted in

all three of the following:

a. Permanent jaundice;

b. Ascites; and

c. Hepatic Encephalopathy.

Liver failure secondary to drug or alcohol abuse is excluded.

20. ThirdDegreeBurns

There must be third-degree burns with scarring that cover at least

20%ofthebody’ssurfacearea.Thediagnosismustconrmthetotal

area involved using standardized, clinically accepted, body surface

areachartscovering20%ofthebodysurfacearea.

21. FulminantHepatitis

A sub-massive to massive necrosis of the liver by the Hepatitis virus,

leading precipitously to liver failure. This diagnosis must be supported

by all of the following:

a. Rapid decreasing of liver size;

b. Necrosis involving entire lobules, leaving only a collapsed reticular

framework;

c. Rapid deterioration of liver function tests;

d. Deepening jaundice; and

e. Hepatic encephalopathy.

Acute Hepatitis infection or carrier status alone does not meet the

diagnostic criteria.

22. Alzheimer’sDisease

Alzheimer’s disease is a progressive degenerative Illness of the

brain, characterized by diffuse atrophy throughout the cerebral cortex

with distinctive histopathological changes. Deterioration or loss of

intellectualcapacity,asconrmedbyclinicalevaluationandimaging

tests, arising from Alzheimer’s disease, resulting in progressive

signicant reduction in mental and social functioning, requiring the

continuous supervision of the Insured Person. The diagnosis must be

supported by the clinical conrmation of a Neurologist Medical

Practitioner and supported by Our appointed Medical Practitioner.

The following conditions are however not covered:

a. non-organic diseases;

b. alcohol related brain damage; and

c. any other type of irreversible organic disorder/dementia.

23. BacterialMeningitis

Bacterialinfectionresultinginsevereinammationofthemembranes

of the brain or spinal cord resulting in signicant, irreversible and

permanentneurologicaldecit.Theneurologicaldecitmustpersistfor

atleast6weeks.Thisdiagnosismustbeconrmedby:

a. Thepresenceofbacterialinfectionincerebrospinaluidbylumbar

puncture; and

b. A consultant neurologist Medical Practitioner.

We will not cover Bacterial Meningitis in the presence of HIV infection

ManipalCigna ProHealth Prime | Protect Plan and Advantage Plan | Terms & Conditions | UIN: MCIHLIP22224V012122 | April 2022

under this Section.

24. BenignBrainTumor

a. Benignbraintumorisdenedasalifethreatening,non-cancerous

tumor in the brain, cranial nerves or meninges within the skull. The

presenceoftheunderlyingtumormustbeconrmedbyimaging

studies such as CT scan or MRI.

b. This brain tumor must result in at least one of the following and

mustbeconrmedbytherelevantmedicalspecialist.

i. Permanent Neurological decit with persisting clinical

symptoms for a continuous period of at least 90consecutive

days or

ii. Undergone surgical resection or radiation therapy to treat the

brain tumor.

The following conditions are however not covered by Us:

a. cysts;

b. granulomas;

c. malformations in the arteries or veins of the brain;

d. hematoma;

e. Abscesses

f. Pituitary Tumors

g. tumors of skull bones and

h. tumors of the spinal cord

25. ApallicSyndrome

Universal necrosis of the brain cortex with the brainstem remaining

intact. The diagnosis must be conrmed by a Neurologist Medical

Practitioner acceptable to Us and the condition must be documented

by such Medical Practitioner for at least one month.

26. Parkinson’sDisease

The unequivocal diagnosis of progressive, degenerative idiopathic

Parkinson’s disease by a Neurologist Medical Practitioner acceptable

to Us.

The diagnosis must be supported by all of the following conditions:

a. the disease cannot be controlled with medication;

b. signs of progressive impairment; and

c. inability of the Insured Person to perform at least 3 of the 6

activities of daily living as listed below (either with or without the use

of mechanical equipment, special devices or other aids and

adaptations in use for disabled persons) for a continuous period of

at least 6 months:

Activities of daily living:

i. Washing: the ability to wash in the bath or shower (including getting

into and out of the shower) or wash satisfactorily by other means

and maintain an adequate level of cleanliness and personal

hygiene;

ii. Dressing: the ability to put on, take off, secure and unfasten all

garmentsand,asappropriate,anybraces,articiallimbsorother

surgical appliances;

iii. Transferring: The ability to move from a lying position in a bed to a

sitting position in an upright chair or wheel chair and vice versa;

iv. Toileting: the ability to use the lavatory or otherwise manage bowel

and bladder functions so as to maintain a satisfactory level of

personal hygiene;

v. Feeding: the ability to feed oneself, food from a plate or bowl to the

mouth once food has been prepared and made available.

vi. Mobility: The ability to move indoors from room to room on level

surfaces at the normal place of residence.

We will not cover Parkinson’s disease secondary to drug and/or alcohol

abuse under this Section.

27. MedullaryCysticDisease

A progressive hereditary disease of the kidneys characterised by the

presence of cysts in the medulla, tubular atrophy and interstitial

brosiswiththeclinicalmanifestationsofanaemia,polyuriaandrenal

loss of sodium, progressing to chronic renal failure. The diagnosis

must be supported by renal biopsy.

28. MuscularDystrophy

A group of hereditary degenerative diseases of muscle characterized

by progressive and permanent weakness and atrophy of certain

muscle groups. The diagnosis of muscular dystrophy must be

unequivocal and made by a Neurologist Medical Practitioner acceptable

toUs,withconrmationofatleast3ofthefollowing4conditions:

a. Family history of muscular dystrophy;

b. Clinical presentation including absence of sensory disturbance,

normalcerebrospinaluidandmildtendonreexreduction;

c. Characteristic electromyogram;

d. Clinicalsuspicionconrmedbymusclebiopsy.

The condition must result in the inability of the Insured Person to

perform at least 3 of the 6 activities of daily living as listed below (either

with or without the use of mechanical equipment, special devices or

other aids and adaptations in use for disabled persons) for a continuous

period of at least 6 months:

Activities of daily living:

i. Washing: the ability to wash in the bath or shower (including getting

into and out of the shower) or wash satisfactorily by other means

and maintain an adequate level of cleanliness and personal

hygiene;

ii. Dressing: the ability to put on, take off, secure and unfasten all

garmentsand,asappropriate,anybraces,articiallimbsorother

surgical appliances;

iii. Transferring: The ability to move from a lying position in a bed to a

sitting position in an upright chair or wheel chair and vice versa;