A guide to accounting for debt

and equity instruments in

financing transactions

Fifth Edition

A guide to accounting for debt and

equity instruments in financing

transactions

Fifth Edition

March 2022

A guide to accounting for debt

and equity instruments in

financing transactions

Prepared by:

Faye Miller, Partner, National Professional Standards Group, RSM US LLP

fay[email protected], +1 410 246 9194

Ginger Buechler, Partner, National Professional Standards Group, RSM US LLP

ging[email protected]om, + 1 612 455 9411

Monique Cole, Principal, National Professional Standards Group, RSM US LLP

monique.c[email protected]om, +1 617 241 1461

March 2022

e FASB material is copyrighted by the Financial Accounting Foundation, 401 Merritt 7, Norwalk,

CT 06856, and is used with permission.

MARCH 2022

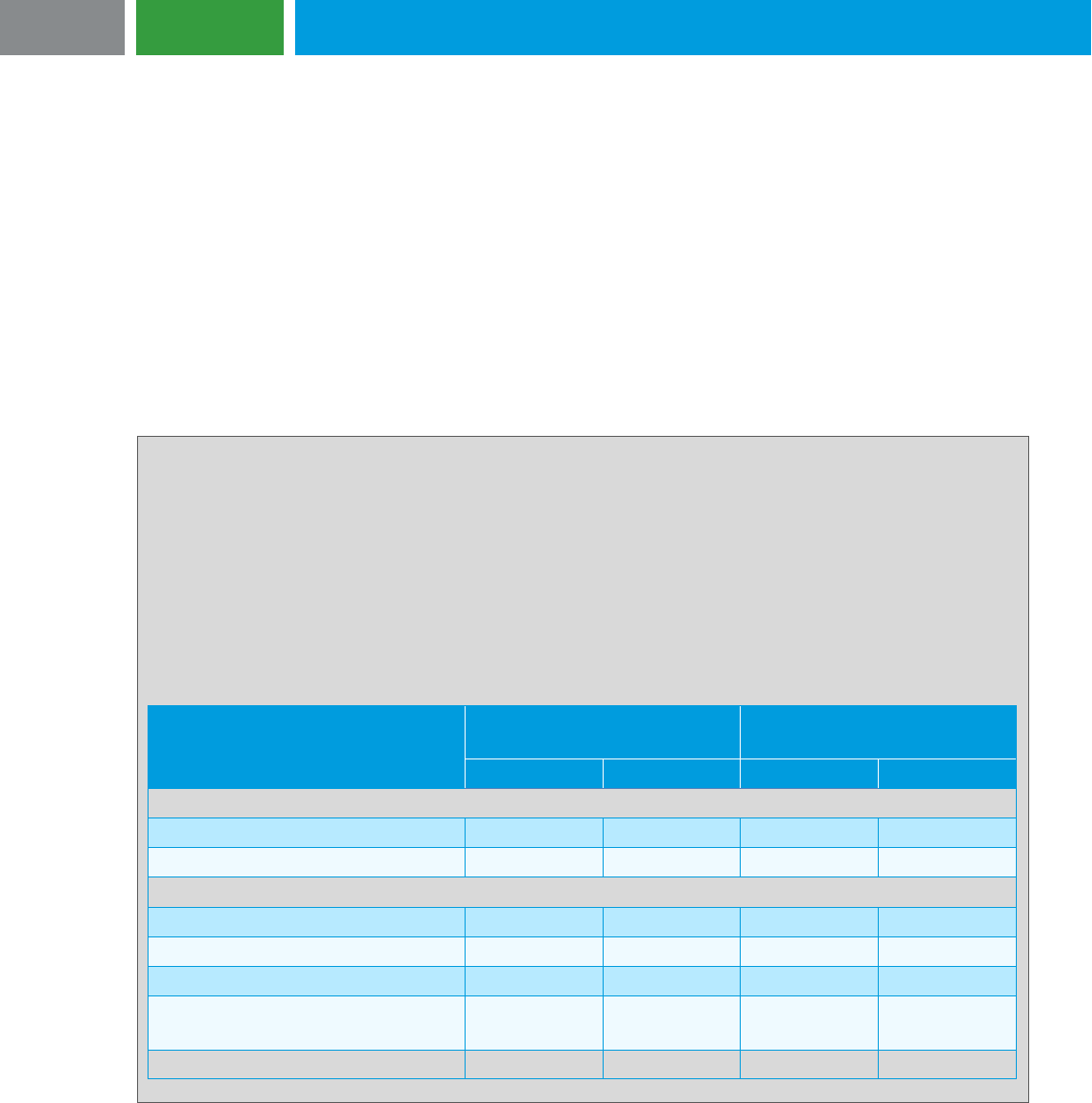

TABLE OF CONTENTS

Foreword… .................................................................................................................................................. 1

Important information about the scope of the guide ........................................................................ 1

Content overview .................................................................................................................................. 2

Chapter 1: Accounting for the issuance of multiple instruments or embedded features ................ 2

Chapter 2: Accounting for debt with conversion and other embedded features – After the

adoption of ASU 2020-06 ..................................................................................................... 2

Chapter 3: Accounting for debt with conversion and other embedded features – Before the

adoption of ASU 2020-06 ..................................................................................................... 2

Chapter 4: Accounting for preferred and similar stock ................................................................... 2

Chapter 5: Accounting for warrants and other equity-linked instruments ....................................... 3

Other RSM technical accounting guidance ....................................................................................... 3

Chapter 1: Accounting for the issuance of multiple instruments or embedded features .................. 4

1.1 Overview ........................................................................................................................................ 4

1.2 Identify the freestanding financial instruments ......................................................................... 5

1.3 Allocate the proceeds to each freestanding financial instrument ........................................... 6

1.4 Allocate the proceeds to embedded features – After adoption of ASU 2020-06 .................... 8

1.5 Allocate the proceeds to embedded features – Prior to adoption of ASU 2020-06 ............... 9

1.6 Registration payment arrangements ........................................................................................ 10

1.6.1 Definition and scope ........................................................................................................... 10

1.6.2 Recognition and measurement .......................................................................................... 11

Chapter 2: Accounting for debt with conversion options and other embedded features – After

adoption of ASU 2020-06 ...................................................................................................... 12

2.1 Introduction ................................................................................................................................. 12

2.2 ASC 480 considerations – After adoption of ASU 2020-06 .................................................... 12

2.3 Derivative analysis of embedded features – After adoption of ASU 2020-06 ....................... 14

2.3.1 Overview ............................................................................................................................. 14

2.3.2 Application of the embedded derivatives guidance to common features in debt

instruments – After adoption of ASU 2020-06.................................................................... 15

2.3.3 Accounting treatment if derivative recognition is required – After adoption of ASU

2020-06 .............................................................................................................................. 21

2.3.4 Accounting treatment if derivative recognition is not required – After adoption of ASU

2020-06 .............................................................................................................................. 21

2.3.5 Ongoing need for reassessment of derivative conclusions ................................................ 21

2.4 ASC 470-20 considerations when the debt instrument is convertible – After adoption

of ASU 2020-06 ............................................................................................................................ 22

2.4.1 Convertible debt instruments issued at a substantial premium – After adoption of

ASU 2020-06 ...................................................................................................................... 22

2.4.2 Interest Forfeiture – After adoption of ASU 2020-06 .......................................................... 23

2.5 Derecognition – After adoption of ASU 2020-06...................................................................... 23

2.5.1 Conversion pursuant to the contractual terms when conversion option was not

separately accounted for as a derivative – After adoption of ASU 2020-06 ...................... 24

2.5.2 Conversion, modification or extinguishment of the debt instrument for which a

conversion option was recognized as a derivative – After adoption of ASU 2020-06 ....... 24

2.5.3 Induced conversion – After adoption of ASU 2020-06 ....................................................... 26

2.5.4 Conversion due to the issuer’s exercise of a call option – After adoption of ASU

2020-06 .............................................................................................................................. 27

MARCH 2022

2.5.5 Conversion not pursuant to contractual terms – After adoption of ASU 2020-06 .............. 27

2.5.6 Modifications or extinguishments – After adoption of ASU 2020-06 .................................. 27

2.6 Amortizing discounts on debt or redeemable preferred stock – After adoption of ASU

2020-06 ......................................................................................................................................... 28

Chapter 3: Accounting for debt with conversion options and other embedded features –

Before adoption of ASU 2020-06 .......................................................................................... 31

3.1 Introduction ................................................................................................................................. 31

3.2 ASC 480 considerations – Before adoption of ASU 2020-06 ................................................. 31

3.3 Derivative analysis of embedded features – Before adoption of ASU 2020-06 .................... 33

3.3.1 Overview ............................................................................................................................. 33

3.3.2 Application of the embedded derivatives guidance to common features in debt

instruments – Before adoption of ASU 2020-06................................................................. 34

3.3.3 Accounting treatment if derivative recognition is required – Before adoption of ASU

2020-06 .............................................................................................................................. 40

3.3.4 Accounting treatment if derivative recognition is not required – Before adoption of

ASU 2020-06 ...................................................................................................................... 42

3.3.5 Ongoing need for reassessment of derivative conclusions – Before adoption of ASU

2020-06 .............................................................................................................................. 42

3.4 ASC 470-20 considerations if the debt instrument is convertible – Before adoption of

ASU 2020-06 ................................................................................................................................ 43

3.4.1 Cash Conversion subsections of ASC 470-20 – Before adoption of ASU 2020-06 ........... 43

3.4.2 Beneficial conversion features provisions of ASC 470-20 – Before adoption of ASU

2020-06 .............................................................................................................................. 48

3.4.3 Convertible debt instruments issued at a substantial premium – Before adoption of

ASU 2020-06 ...................................................................................................................... 59

3.4.4 Accounting treatment if no separate recognition is necessary for conversion feature –

Before adoption of ASU 2020-06 ....................................................................................... 59

3.5 Amortizing discounts on debt or redeemable preferred stock – Before adoption of

ASU 2020-06 ................................................................................................................................ 60

Exhibit: High-level overview of the accounting for a convertible instrument .............................. 63

Chapter 4: Accounting for preferred and similar stock ........................................................................ 65

4.1 Introduction ................................................................................................................................. 65

4.2 Balance sheet classification and subsequent measurement ................................................ 65

4.2.1 Mandatorily redeemable stock ........................................................................................... 66

4.2.2 Obligations to issue a variable number of shares .............................................................. 68

4.2.3 Temporary equity presentation of redeemable stock ......................................................... 70

4.3 Derivative analysis of embedded features ............................................................................... 73

4.3.1 Overview ............................................................................................................................. 73

4.3.2 Criterion 1 of embedded derivative analysis ...................................................................... 74

4.3.3 Criterion 2 of embedded derivative analysis ...................................................................... 78

4.3.4 Criterion 3 of embedded derivative analysis ...................................................................... 78

4.3.5 Accounting treatment if derivative recognition is required ................................................. 80

4.3.6 Ongoing need for reassessment of derivative conclusions ................................................ 81

4.4 ASC 470-20 considerations if the preferred stock is convertible – Before adoption of

ASU 2020-06 ................................................................................................................................ 81

4.5 Subsequent accounting considerations for preferred and similar stock ............................. 82

4.5.1 Accounting upon triggering a down round feature – Upon adoption of ASU 2020-06 ....... 82

4.5.2 Conversion of preferred stock in accordance with its contractual terms ............................ 83

MARCH 2022

4.5.3 Induced conversions of preferred stock ............................................................................. 83

4.5.4 Modification, extinguishment and redemption of preferred stock instruments

(including conversion of instruments for which the conversion feature was bifurcated

as a derivative) ................................................................................................................... 84

4.6 Delayed issuance of preferred or other stock ......................................................................... 85

4.6.1 Overview ............................................................................................................................. 85

4.6.2 Determining if the future tranche right is freestanding or embedded ................................. 86

4.6.3 Accounting analysis for freestanding future tranche rights ................................................ 86

4.6.4 Accounting analysis for embedded future tranche rights ................................................... 87

4.7 Preferred stock dividends .......................................................................................................... 87

4.7.1 Overview ............................................................................................................................. 87

Exhibit: High-level overview of the accounting for convertible preferred stock ......................... 91

Chapter 5: Accounting for warrants and other equity-linked instruments ........................................ 93

5.1 Overview ...................................................................................................................................... 93

5.2 Determining the balance sheet classification and ongoing measurement .......................... 93

5.2.1 ASC 480 considerations ..................................................................................................... 96

5.2.2 ASC 815 considerations ................................................................................................... 103

5.2.3 Additional consideration for warrants to purchase convertible instruments – Prior to

adoption of ASU 2020-06 ................................................................................................. 126

5.3 Accelerated share repurchase program ................................................................................. 128

Appendix A: Acronyms and literature references ............................................................................... 129

A.1 Acronym legend ........................................................................................................................ 129

A.2 Literature listing ........................................................................................................................ 129

Appendix B: Definitions ......................................................................................................................... 132

Appendix C: High Level Overview of ASU 2020-06 ............................................................................. 137

C.1 Convertible instruments .......................................................................................................... 137

C.1.1 Simplified accounting models ........................................................................................... 137

C.1.2 Disclosures ....................................................................................................................... 137

C.2 Derivatives scope exception for contracts in an entity’s own equity ................................. 138

C.3 Earnings per share (EPS) ......................................................................................................... 139

C.4 Effective date and transition .................................................................................................... 140

Appendix D: Ramifications of ASU 2017-11 ......................................................................................... 143

D.1 Overview .................................................................................................................................... 143

D.2 Accounting upon triggering a down round feature ............................................................... 144

D.3 Effective date and transition .................................................................................................... 144

D.4 Important implementation considerations ............................................................................. 145

D.4.1 Ramifications associated with reclassifying a freestanding instrument from liability to

equity ................................................................................................................................ 145

D.4.2 Ramifications when a conversion option no longer requires derivative treatment ........... 146

1

MARCH 2022

Foreword

The accounting for debt and equity instruments issued in financing transactions can be quite complicated

due in part to the complexity inherent in certain instruments, the sheer volume of transaction documents

that may need to be considered in performing the accounting analysis and the myriad of accounting

guidance that may be relevant. In many cases, an accounting outcome can be significantly affected by

the existence or absence of one sentence in the relevant documents. Consideration needs to be given to

not only the appropriate balance sheet classification of instruments such as preferred stock and warrants,

which may have both debt and equity characteristics, but also the subsequent measurement. Additionally

instruments such as debt or preferred stock oftentimes have embedded features that may need to be

given separate accounting recognition. The accounting analysis is further complicated if multiple

instruments are issued as part of the same transaction as that typically necessitates an allocation of

proceeds to the various instruments or features.

This guide is intended to be a resource in understanding and analyzing some of the accounting guidance

that may be relevant when analyzing debt and equity instruments issued in financing transactions and

should be read in conjunction with the authoritative guidance. Given the complexity of instruments issued

in financing transactions and the relevant accounting guidance, management may also want to consider

seeking external expertise to assist in the accounting analysis. Appropriate upfront consideration to the

accounting ramifications can help to minimize the risk of unanticipated and undesirable accounting

consequences. Additionally, while valuation is beyond the scope of this guide, management should be

mindful of the potential need to seek external expertise in developing the fair value estimates that may be

necessary in appropriately accounting for certain instruments (or embedded features) issued in financing

transactions.

For ease of use, definitions for acronyms and titles for ASC topics and subtopics and other literature

referred to in this guide are included in Appendix A. In addition, several terms with specific meaning are

used throughout this guide. Those terms and the corresponding definition are provided in Appendix B.

Important information about the scope of the guide

This guide is not intended to be a comprehensive manual as its content is limited to the accounting

complexities associated with certain common instruments issued in financing transactions. The

accounting analysis is from the issuer’s perspective and differs significantly from an analysis that would

be performed from the holder’s perspective. This guide does not apply to share-based payments issued

in exchange for goods and services within the scope of ASC 718.

Most recent updates to the guide

This guide has been updated to incorporate ASU 2020-06 and ASU 2021-04, as well as to address

practice issues related to special-purpose acquisition companies (refer to Section 4.2.3.3.1, Section

5.2.2.1.3 and Section 5.2.2.2) and provide additional illustrations of the guidance relevant to determining

whether an instrument (or embedded feature) is considered indexed to an entity’s own stock (refer to

Section 5.2.2.1.3).

The FASB issued ASU 2020-06, Debt—Debt with Conversion and Other Options (Subtopic 470-20) and

Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible

Instruments and Contracts in an Entity’s Own Equity, to reduce complexities associated with the

accounting for convertible instruments and the derivatives scope exception for contracts in an entity’s own

equity, the latter of which is the focus of Section 5.2.2 of this guide.

ASU 2020-06 is effective for public business entities that meet the definition of an SEC filer, excluding

entities eligible to be smaller reporting companies as defined by the SEC and based on their most recent

determination as of August 5, 2020, for fiscal years beginning after December 15, 2021, including interim

periods within those fiscal years. For all other entities, the ASU is effective for fiscal years beginning after

December 15, 2023, including interim periods within those fiscal years. Early adoption is permitted, but no

2

MARCH 2022

earlier than fiscal years beginning after December 15, 2020, including interim periods within those fiscal

years. The changes to the accounting for convertible instruments and contracts in an entity’s own equity

as a result of ASU 2020-06 have been highlighted throughout this guide. Refer to Appendix C for

additional information.

The FASB issued ASU 2021-04, Earnings Per Share (Topic 260), Debt—Modifications and

Extinguishments (Subtopic 470-50), Compensation—Stock Compensation (Topic 718), and Derivatives

and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Issuer’s Accounting for Certain

Modifications or Exchanges of Freestanding Equity-Classified Written Call Options (a consensus of the

FASB Emerging Issues Task Force), to address the accounting for modifications or exchanges of equity-

classified written call options that are freestanding and remain equity-classified. This guidance has been

incorporated in Section 5.2.2.5 of this guide.

ASU 2021-04 is effective for all entities for fiscal years beginning after December 15, 2021, including

interim periods within those fiscal years. Early adoption is permitted for all entities, including adoption in

an interim period, with the guidance applied as of the beginning of the fiscal year that includes that interim

period.

Content overview

Chapter 1: Accounting for the issuance of multiple instruments or embedded features

This chapter should be considered if multiple instruments are issued contemporaneously to the same

counterparty or if certain features within a debt or preferred stock instrument require separate recognition.

It addresses how to identify freestanding instruments from embedded features and how to allocate the

proceeds to the various instruments or features. This chapter concludes with a section on registration

rights agreements.

Chapter 2: Accounting for debt with conversion and other embedded features – After the adoption

of ASU 2020-06

The focus of this chapter is the accounting for embedded features within debt instruments, including

conversion, put and call options. Chapter 2 assumes the provisions of ASU 2020-06, which eliminates

both the cash conversion model and the beneficial conversion feature model previously contained within

ASC 470-20, have been adopted. This chapter also includes an illustration of interest expense recognition

(including discount amortization) using the interest method. For guidance related to debt modifications

and restructurings (which are beyond the scope of this guide), refer to our publication, A guide to

accounting for debt modifications and restructurings (our debt modifications and restructurings guide).

Chapter 3: Accounting for debt with conversion and other embedded features – Before the

adoption of ASU 2020-06

The focus of this chapter is the accounting for embedded features within debt instruments, including

conversion, put and call options. Chapter 3 reflects the guidance applicable prior to the adoption of ASU

2020-06. This chapter also includes an illustration of interest expense recognition (including discount

amortization) using the interest method. An exhibit at the end of this chapter provides a high-level

overview of the accounting for a convertible debt instrument when (a) the conversion feature is required

to be separately recognized as either (i) a derivative in accordance with ASC 815, (ii) a cash conversion

feature in accordance with ASC 470-20 or (iii) a beneficial conversion feature in accordance with ASC

470-20, and (b) the conversion feature is not required to be separately recognized. For guidance related

to debt modifications and restructurings (which are beyond the scope of this guide), refer to our debt

modifications and restructurings guide.

Chapter 4: Accounting for preferred and similar stock

The focus of this chapter is preferred stock and similar instruments issued in the form of a share. The

chapter addresses: (a) balance sheet classification and subsequent measurement, (b) the accounting for

3

MARCH 2022

common embedded features and (c) the accounting for conversions, modifications and redemptions. This

chapter also addresses the accounting for delayed issuances of preferred or other stock and dividends on

preferred stock. An exhibit at the end of this chapter provides a high-level overview of the accounting for

convertible preferred stock when the conversion feature is required to be separately recognized as either

a derivative in accordance with ASC 815 or, prior to adoption of ASU 2020-06, as a beneficial conversion

feature in accordance with ASC 470-20, as well as when the conversion feature is not required to be

separately recognized.

Chapter 5: Accounting for warrants and other equity-linked instruments

The focus of this chapter is determining the appropriate accounting treatment for freestanding instruments

that are not in the form of shares, but are linked to shares. Examples may include warrants or forward

contracts to purchase shares or freestanding options to redeem shares. This chapter also contains

guidance on accelerated share repurchases.

Other RSM technical accounting guidance

As previously mentioned, guidance on the accounting for debt modifications and restructurings can be

found in our debt modifications and restructurings guide. In addition, guidance on debt classification can

be found in our publication, Fundamentals of debt classification. For a complete listing of our technical

accounting guides and access to all of our financial reporting thought leadership, click here.

4

MARCH 2022

Chapter 1: Accounting for the issuance of multiple instruments or embedded

features

1.1 Overview

It is common for stock offerings and debt issuances to involve multiple financial instruments

contemporaneously issued to the same counterparty. This would be the case, for example, if warrants are

issued to investors or lenders in conjunction with an equity or debt issuance. When multiple financial

instruments are issued together, this generally necessitates allocating the proceeds received to each

instrument to establish its initial carrying amount. The allocation will, in many cases, necessitate

independent issuance-date estimates of fair value for each of the instruments issued in a bundled

transaction. We believe this is typically the case even if specific proceeds were received for each

instrument because any arbitrarily assigned prices for specific instruments may not be reflective of fair

value. Not only is this allocation critical in establishing the initial carrying amount of each instrument, but it

also has ongoing income statement repercussions resulting from factors such as the amortization or

accretion of discounts or premiums created on debt, as well as the differing accounting treatment of costs

incurred in a financing transaction.

Additionally, it is sometimes necessary to allocate proceeds and give separate recognition to embedded

features within debt and equity instruments as elaborated on in Chapter 2, Chapter 3 and Chapter 4. A

key first step in performing the accounting analysis and allocating proceeds is to identify what instruments

are freestanding given that this determination impacts what accounting guidance is relevant and the

instruments to which proceeds should be allocated. For example, a freestanding put option on an entity’s

shares would be analyzed in accordance with the chapter on equity-linked instruments and required to be

accounted for as a liability under ASC 480-10-25-8, while a put option that is embedded in the underlying

shares would be analyzed in the context of the chapter on preferred stock and is not subject to ASC 480-

10-25-8. Similarly, when analyzing potential features under ASC 815 to determine if derivative recognition

is required, there are additional considerations in ASC 815-15 that are relevant to embedded, but not

freestanding, derivatives. To further complicate the analysis, the manner in which proceeds are allocated

to each instrument is dependent on the required subsequent measurement for the instrument. Lastly, the

determination of whether and to what extent separate recognition must be given to an embedded feature

that is not freestanding can be impacted by the amount of proceeds allocated to the freestanding

instrument.

1

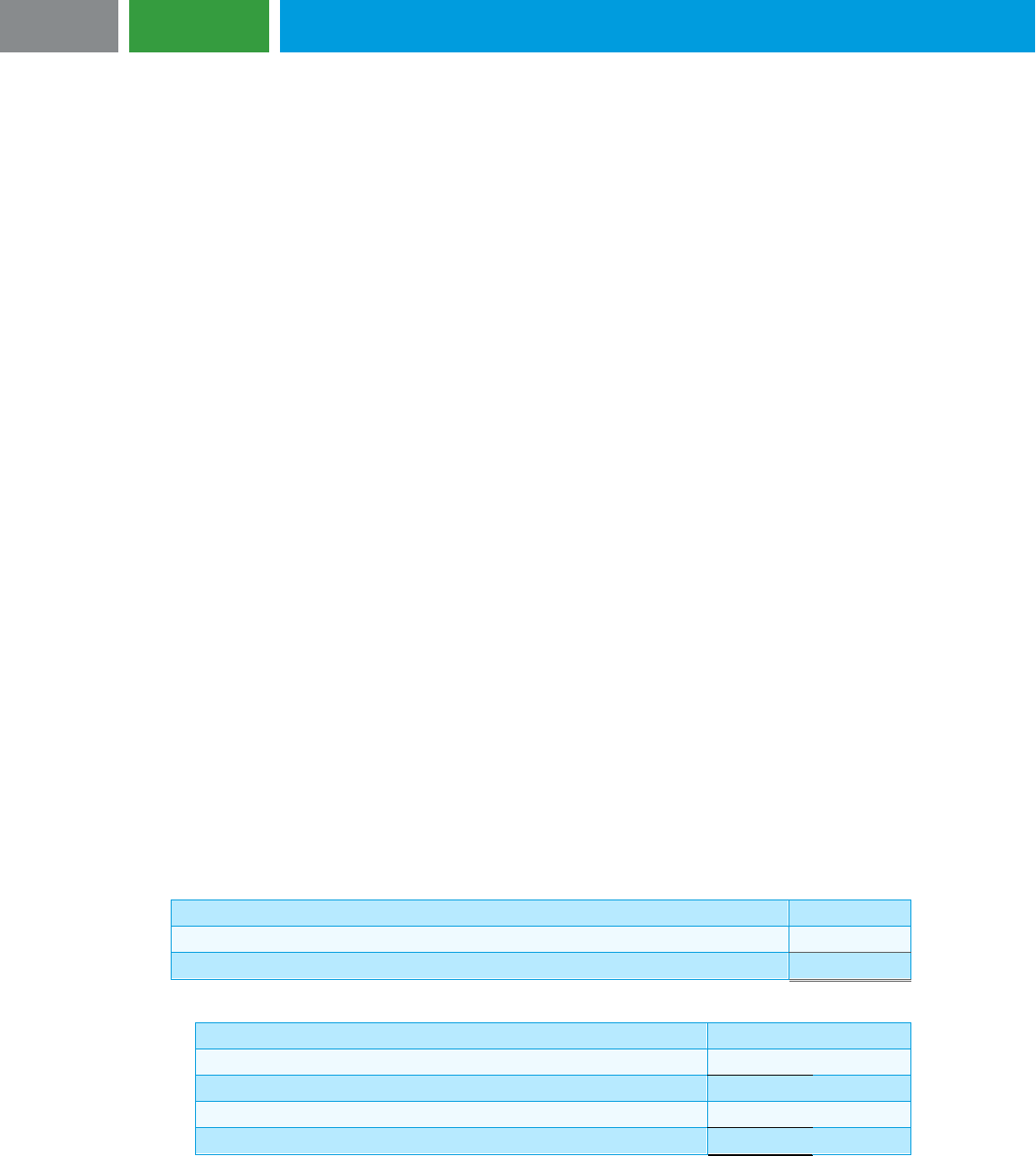

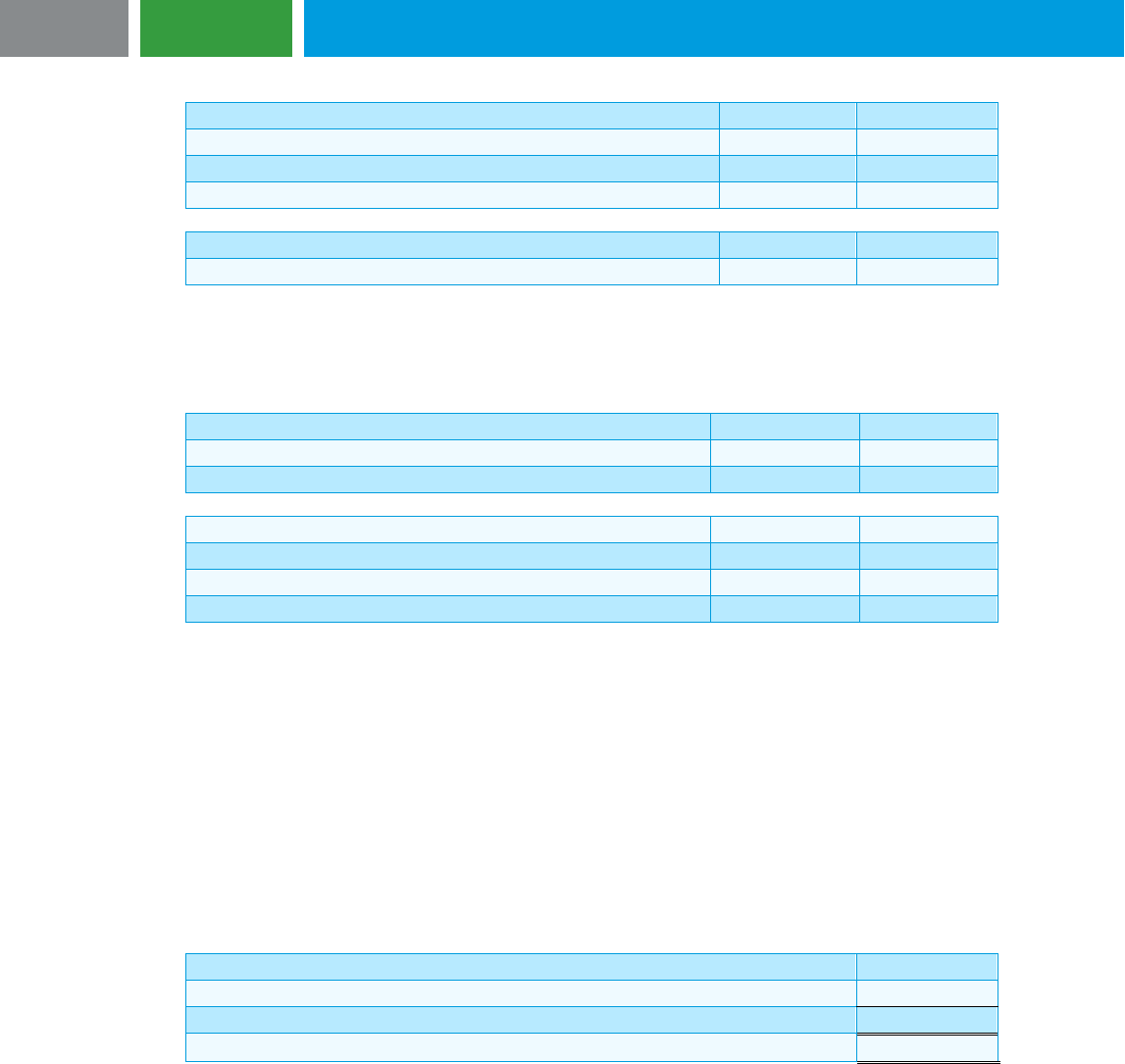

The following steps, which are elaborated on in part in the table that follows and in part in

other sections of this guide, are provided as a tool for structuring the accounting analysis when multiple

financial instruments or embedded features are involved in a transaction.

Step Relevant section in this guide

Identify the freestanding financial instruments Section 1.2

Determine the accounting treatment for each

freestanding financial instrument

Refer to the relevant chapters

Allocate the proceeds to each freestanding

financial instrument

Section 1.3

1

For example, prior to adoption of ASU 2020-06, the amount of proceeds allocated to a convertible instrument will

impact if and to what extent a beneficial conversion feature exists under ASC 470-20 (see Section 3.4.2.1.2).

Additionally, the amount of proceeds allocated to a debt host contract can impact whether an embedded put or call

option requires separate recognition as a derivative (see Section 2.3.2.1 or Section 3.3.2.1, as applicable).

5

MARCH 2022

Step Relevant section in this guide

Determine if any embedded features within each

freestanding instrument require separate

recognition

Section 2.3 for features that are embedded in a

debt instrument, subsequent to adoption of ASU

2020-06

Section 3.3 for features that are embedded in a

debt instrument, prior to adoption of ASU 2020-06

Section 4.3 for features that are embedded in

preferred and similar stock

Allocate the proceeds to embedded features Section 1.4 or Section 1.5, as applicable

1.2 Identify the freestanding financial instruments

The determination of what is freestanding versus embedded is sometimes straightforward and, in other

circumstances, complex. Generally, if a financial instrument is not freestanding, it is embedded.

Understanding the terminology

The Master Glossary of the ASC defines a freestanding financial instrument as “A financial instrument

that is either:

• Entered into separately and apart from any of the entity's other financial instruments or equity

transactions, or

• Entered into in conjunction with some other transaction and is legally detachable and separately

exercisable.”

The Master Glossary defines an embedded derivative as “Implicit or explicit terms that affect some or

all of the cash flows or the value of other exchanges required by a contract in a manner similar to a

derivative instrument.”

The following examples illustrate how common instruments or features are typically viewed; however, if

facts and circumstances differ from those included in the examples, a different conclusion may be

warranted.

Stock purchase warrants

Warrants are generally considered to be freestanding even if

issued with another financial instrument, such as debt or stock,

because typically warrants are separately exercisable (i.e., the

exercise of the warrants would not result in the termination of the

debt or stock the warrants may have been issued with). If, on the

other hand, the warrants are not detachable from another

instrument, such as debt that must be surrendered to exercise the

warrants, as noted at ASC 470-20-25-3, the warrants would be

considered embedded in the convertible instrument and the

following discussion on conversion options applies.

Conversion options in debt or

preferred stock

Conversion options are typically viewed as embedded in the

convertible debt or preferred stock instruments given that the

conversion option generally cannot be detached and separately

exercised (i.e., the exercise of the conversion option would result in

the termination of the debt or preferred stock that is converted).

Put and call options related to

debt and equity instruments

Put and call options are most commonly considered to be

embedded because: (a) the options are typically entered into in

6

MARCH 2022

conjunction with the issuance of the debt or equity instrument, (b)

the options cannot be transferred separately from the underlying

debt or equity instrument, and (c) the exercise of the option will

result in the termination or redemption of the underlying debt or

equity instrument.

1.3 Allocate the proceeds to each freestanding financial instrument

The appropriate method to use in allocating proceeds to each freestanding financial instrument depends

on whether any of the instruments will be subsequently measured at fair value (through a fair value

election or requirement). Instruments such as liability warrants that will be subsequently measured at fair

value are generally allocated proceeds equal to their issuance-date fair value. Any remaining proceeds

are then allocated to instruments that are not subsequently measured at fair value based on each

instrument’s proportionate fair value to the total fair value of instruments not subsequently measured at

fair value. An example follows.

Example: Allocating proceeds to debt and warrants

Debt and warrants are issued as part of the same transaction for total proceeds of $1 million. The

allocation of proceeds under two different scenarios follows. For each of these scenarios, assume that

the fair value of the debt is $1 million and that the fair value of the warrants is $200,000. Assume also

that the debt will not subsequently be measured at fair value (through an election or otherwise).

Scenario 1: Warrants meet the requirements to be classified as equity and therefore will not be

subsequently measured at fair value

Fair value

Allocated proceeds and initial

carrying amount

Debt $1,000,000 $833,333 (a)

Warrants 200,000 166,667

Total $1,200,000 $1,000,000

(a) Represents the net amount. Assuming the face amount is $1 million, this would be recorded as $1 million of

debt with a discount of $166,667.

In this scenario, because ongoing fair value measurement is not required for any instrument, the

proceeds are allocated to each financial instrument based on the respective instrument’s proportionate

fair value (allocated proceeds = instrument fair value ÷ total fair value x total proceeds) in accordance

with ASC 470-20-25-2.

Scenario 2: Warrants are classified as a liability and are subsequently measured at fair value

Fair value

Allocated proceeds and

initial carrying amount

Debt $1,000,000 $800,000 (a)

Warrants 200,000 200,000

Total $1,200,000 $1,000,000

(a) Represents the net amount. Assuming the face amount is $1 million, this would be recorded as $1 million of

debt with a discount of $200,000.

In this scenario, because ongoing fair value measurement is required for the warrants, the proceeds

are allocated to the warrants in an amount equal to their fair value. The remaining proceeds would then

be allocated to the instruments that are not accounted for at fair value based on their relative fair

values. In this example, the debt is the only other freestanding instrument. It should be noted that any

7

MARCH 2022

discounts (such as the $200,000 in Scenario 2) or premiums on debt (and mandatorily redeemable

stock that is accounted for as a liability) that are created through an allocation of the proceeds (or

otherwise) are amortized or accreted into interest expense using the interest method described in ASC

835-30 (refer to the illustration at Section 2.6 or Section 3.5, as applicable). Similarly, discounts on

redeemable preferred stock are accreted as dividends (assuming the preferred stock is not classified

as a liability) as elaborated on in Section 4.2.3.3.

In addition to allocating proceeds, we believe it is also appropriate to allocate issuance costs that are not

specifically associated with one of the financial instruments to each of the freestanding financial

instruments. There is no specific guidance that addresses how such issuance costs should be allocated.

Methods employed in practice include allocating costs to each instrument in the same proportion as how

the proceeds are allocated to each instrument or allocating the costs to each instrument based on the

relative proportion of costs that would be incurred in issuing each instrument separately. Depending on

the facts and circumstances, a different approach may be justifiable. For example, in a transaction

involving only debt and warrants, if the warrants are issued solely as an incentive to obtain debt financing,

it may be appropriate to treat all issuance costs as debt issuance costs. An appropriate allocation of costs

is important as the accounting treatment for the costs differs significantly depending on the accounting

treatment for the instrument, in that:

• Costs associated with debt (including mandatorily redeemable stock classified as a liability) are

amortized over the life of the debt using the interest method.

• Costs associated with temporary-equity-classified preferred stock are netted against the proceeds

and can impact the amount of dividend recognized as the preferred stock is accreted to its

redemption amount.

• Costs associated with equity instruments (including warrants that qualify for equity treatment) are

netted against the proceeds received in equity.

• Costs associated with warrants that are required to be accounted for as liabilities at fair value are

expensed as incurred.

For this reason, it is important to use an approach that is rational in the circumstances and consistently

applied.

When using the relative fair value approach to allocate proceeds, there will be no effect on the income

statement on the issuance date. However, if the aggregate fair value of instruments that will be

subsequently measured at fair value exceeds the total proceeds received, it is possible that there could

be a loss (or, in rare cases, a dividend) recorded on the date of the transaction. This is because the

amount assigned to the remaining instruments that are not recorded at fair value (the debt in the earlier

examples) generally cannot be less than zero. Refer to Remarks by Hillary H. Salo, Professional

Accounting Fellow, Office of the Chief Accountant, at the AICPA National Conference on Current SEC

and PCAOB Developments – 2014 for a more in-depth discussion of this matter. When fact patterns like

this are present, it is particularly important to understand the underlying economics of the transaction,

challenge the valuation of the individual financial instruments (given the counterintuitive results), and also

consider if there are additional rights or obligations requiring separate accounting. We expect this

situation to be rare.

The earlier examples should serve to illustrate why it is necessary to identify the freestanding financial

instruments and determine their appropriate balance sheet classification and subsequent measurement

before allocating the proceeds. It should also be evident from these examples that it may be necessary

for management to develop or obtain fair value estimates for certain, or all, of the multiple freestanding

financial instruments issued as part of the same transaction to appropriately allocate the proceeds.

8

MARCH 2022

1.4 Allocate the proceeds to embedded features – After adoption of ASU 2020-06

In addition to allocating the proceeds to each freestanding financial instrument when multiple financial

instruments are issued together, it is sometimes necessary to allocate a portion of the proceeds

attributable to a freestanding financial instrument to certain embedded features that require separate

recognition as discussed in Chapter 2 for debt and Chapter 4 for preferred and similar stock. Common

examples of embedded features that may require separate recognition as derivatives include conversion

options and puts and calls.

Derivatives requiring separate recognition are reported on the balance sheet as an asset or a liability, and

initially and subsequently are measured at fair value. Generally, the initial carrying amount is established

through an allocation of proceeds, and subsequent changes in fair value are recognized through

earnings.

Once the amount of proceeds to be allocated to features requiring separate recognition is known, any

remaining proceeds that were received or attributed to the debt or equity instrument as a whole establish

the initial carrying amount of the remaining debt or equity instrument. An illustration follows.

Example: Allocating proceeds to embedded features and freestanding instruments

Assume the debt in Scenario 2 of the example presented earlier contains a conversion option with a

fair value of $200,000 that requires separate recognition as a derivative. In this situation, $200,000 of

the $800,000 allocated to the debt would be allocated to the conversion option derivative liability. The

net-of-discount carrying amount of the debt would be the remaining $600,000. The entry to record this

transaction would be:

Debit

Credit

Cash

$1,000,000

Discount on debt

400,000

Derivative liability

$200,000

Debt

1,000,000

Warrant liability

200,000

As previously mentioned, discounts (such as the one in this example) or premiums on debt or certain

redeemable preferred stock that are created through an allocation of the proceeds (or otherwise) are

amortized or accreted into interest expense or dividends using the interest method illustrated in Section

2.6.

With respect to embedded derivatives that require separate recognition, the following additional

considerations should be kept in mind:

• When determining the fair value of an embedded derivative that requires separate recognition, the

objective is to estimate its fair value separately from the fair value of the nonderivative portions of the

instrument in which it is embedded.

• If more than one derivative embedded in an instrument requires separate recognition, those

derivatives should be bundled together and treated as one derivative.

• If an embedded non-option derivative, such as a mandatory conversion feature, requires separate

recognition, the terms for that non-option derivative should be calibrated to result in a fair value of

zero at the issuance date in accordance with ASC 815-15-30-4. Conversely, as noted in ASC 815-15-

30-6, the terms should not be adjusted for an option-based derivative, regardless of whether the

option is in or out of the money at the issuance date.

9

MARCH 2022

• While embedded derivatives that are bifurcated require separate measurement at fair value and are

subject to the derivative disclosure requirements, in practice, the recorded balance is typically

reported in the same financial statement line item as the host contract if the host contract is an asset

or liability. (It would not be appropriate to combine a derivative asset or liability with a host contract

that is classified in equity.)

• As an alternative to separately recognizing embedded derivatives that require bifurcation at fair value,

an entity may be able to make an election as outlined beginning at ASC 815-15-25-4 to account for

the entire instrument at fair value.

1.5 Allocate the proceeds to embedded features – Prior to adoption of ASU 2020-06

In addition to allocating the proceeds to each freestanding financial instrument when multiple financial

instruments are issued together, it is sometimes necessary to allocate a portion of the proceeds

attributable to a freestanding financial instrument to certain embedded features that require separate

recognition as elaborated on in Chapter 3 for debt and Chapter 4 for preferred and similar stock.

Examples of common embedded features that may require separate recognition are summarized in the

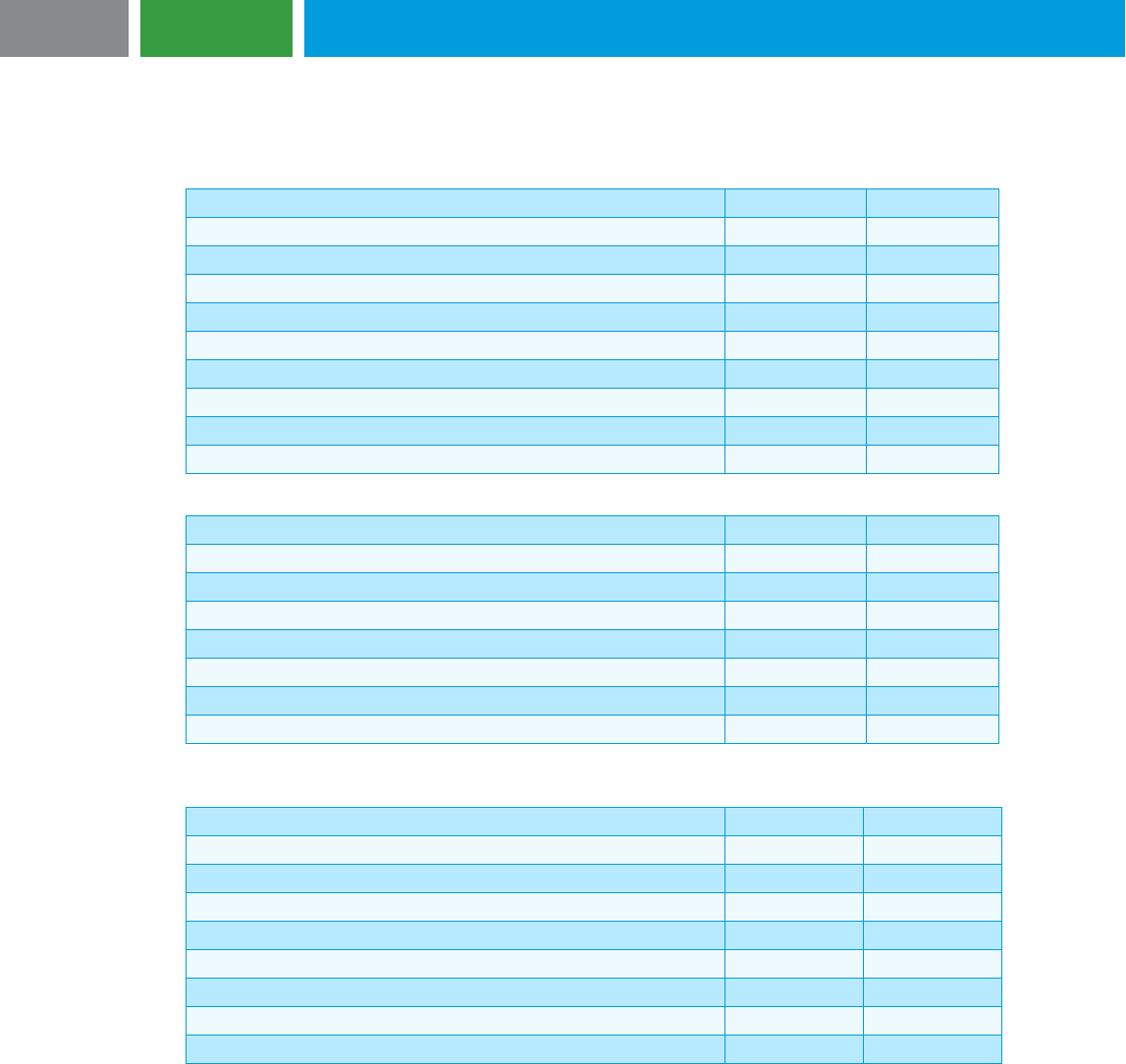

table that follows along with the balance sheet classification and measurement provisions.

Feature

Balance sheet

classification Measurement

Beneficial conversion

feature

Equity Generally, commitment date intrinsic value

without subsequent remeasurement (refer to

Section 3.4.2).

Cash conversion feature Equity The excess of the proceeds ascribed to the

convertible debt instrument as a whole over

the fair value of a similar liability that does

not have an equity component. This amount

is generally not subsequently remeasured

(refer to Section 3.4.1).

Derivatives, including

conversion options, puts

and calls

Asset or liability Initial and subsequent measurement is fair

value. Generally, the initial carrying amount

is established through an allocation of

proceeds, and subsequent changes in fair

value are recognized through earnings.

Once the amount of proceeds to be allocated to features, such as those summarized in the preceding

table is known, any remaining proceeds that were received or attributed to the debt or equity instrument

as a whole establish the initial carrying amount of the remaining debt or equity instrument. An illustration

follows.

Example: Allocating proceeds to embedded features and freestanding instruments

Assume the debt in Scenario 2 of the example presented earlier contains a conversion option with a

fair value of $200,000 that requires separate recognition as a derivative. In this situation, $200,000 of

the $800,000 allocated to the debt would be allocated to the conversion option derivative liability. The

net of discount carrying amount of the debt would be the remaining $600,000. The entry to record this

transaction would be:

10

MARCH 2022

Debit

Credit

Cash

$1,000,000

Discount on debt

400,000

Derivative liability

$200,000

Debt

1,000,000

Warrant liability

200,000

As previously mentioned, discounts (such as the one in this example) or premiums on debt or certain

redeemable preferred stock that are created through an allocation of the proceeds (or otherwise) are

amortized or accreted into interest expense or dividends using the interest method illustrated at Section

3.5.

The following additional considerations should be kept in mind as it relates to embedded derivatives that

require separate recognition:

• The objective when determining the fair value of an embedded derivative that requires separate

recognition is to estimate its fair value separately from the fair value of the nonderivative portions of

the instrument in which it is embedded.

• If more than one derivative embedded in an instrument requires separate recognition, those

derivatives should be bundled together and treated as one derivative.

• If an embedded non-option derivative, such as a mandatory conversion feature, requires separate

recognition, the terms for that non-option derivative should be calibrated to result in a fair value of

zero at the issuance date in accordance with ASC 815-15-30-4. Conversely, as noted at ASC 815-15-

30-6, the terms should not be adjusted for an option-based derivative, regardless of whether the

option is in or out of the money at the issuance date.

• While embedded derivatives that are bifurcated require separate measurement at fair value and are

subject to the derivative disclosure requirements, in practice, the recorded balance is typically

reported on the same financial statement line item as the host contract if the host contract is an asset

or liability. (It would not be appropriate to combine a derivative asset or liability with a host contract

that is classified in equity.)

• As an alternative to separately recognizing embedded derivatives that require bifurcation at fair value,

an entity may be able to make an election as outlined beginning at ASC 815-15-25-4 to account for

the entire instrument at fair value.

1.6 Registration payment arrangements

1.6.1 Definition and scope

It is not uncommon for companies to extend registration rights to their shareholders or potential

shareholders in conjunction with an equity offering or the issuance of warrants or convertible debt. ASC

825-20 provides guidance on how to account for those arrangements that meet the definition of a

registration payment arrangement, which would be the case if both of the following characteristics exist:

• The arrangement specifies that the issuer will either endeavor to: (a) file a registration statement for

the resale of specified financial instruments and (or) the resale of equity shares that are issuable

upon exercise or conversion of specified financial instruments, and for that registration statement to

be declared effective by the SEC (or other applicable securities regulator if the registration statement

will be filed in a foreign jurisdiction) within a specified grace period, and (or) (b) maintain the

effectiveness of the registration statement for a specified period of time (or in perpetuity).

11

MARCH 2022

• The arrangement requires the issuer to transfer consideration to the counterparty if the registration

statement is not declared effective or if effectiveness of the registration statement is not maintained.

The form of the consideration and timing of payment can vary. For example, the consideration may

be in the form of cash, equity instruments or adjustments to the terms of the financial instrument or

instruments that are subject to the registration payment arrangement (such as an increased interest

rate on a debt instrument).

This guidance applies to a registration payment arrangement regardless of whether it is issued as a

separate agreement or included as a provision of a financial instrument or other agreement. Additionally,

an arrangement that requires the issuer to obtain and (or) maintain a listing on a stock exchange (instead

of, or in addition to, obtaining or maintaining an effective registration statement) is also within the scope of

ASC 825-20 if the earlier definition is met.

As outlined at ASC 825-20-15-4, this guidance does not apply to any of the following:

• Arrangements that require registration or listing of convertible debt instruments or convertible

preferred stock if the form of consideration that would be transferred to the counterparty is an

adjustment to the conversion ratio

• Arrangements in which the amount of consideration transferred is determined by reference to either

an observable market (other than the market for the issuer’s stock) or an observable index

• Arrangements in which the financial instrument or instruments subject to the arrangement are settled

when the consideration is transferred (e.g., a warrant that is contingently puttable if an effective

registration statement for the resale of the equity shares that are issuable upon exercise of the

warrant is not declared effective by the SEC within a specified grace period)

Additionally, as noted at ASC 825-20-15-5, this guidance should not be applied by analogy to the

accounting for contracts that are not registration payment arrangements as defined earlier.

1.6.2 Recognition and measurement

In accordance with ASC 825-20-25, registration payment arrangements within the scope of ASC 825-20

should be recognized as a separate unit of account from the financial instrument or instruments that are

subject to the arrangement. Additionally, the financial instruments that are subject to the arrangement

should be recognized in accordance with relevant U.S. GAAP without regard to any contingent obligation

to transfer consideration under the registration payment arrangement. ASC 450-20 should be followed in

determining the appropriate recognition and measurement for the contingent obligation. As a result, if at

the inception of the arrangement, the transfer of consideration is probable and can be reasonably

estimated, a liability for this obligation would be established in accordance with ASC 450-20, and any

remaining proceeds from the related financing transaction would be allocated to the financial instrument

or instruments issued in conjunction with the registration payment arrangement in accordance with the

provisions of this chapter. ASC 825-20-30-5 provides that for arrangements that require payment in

shares, if the transfer of consideration is probable and the number of shares to be delivered can be

reasonably estimated, the share price at the reporting date should be used in measuring the contingent

liability.

If after the inception of the arrangement, the transfer of consideration becomes probable and can be

reasonably estimated such that a liability needs to be newly recognized, this liability would be recognized

as an expense. Similarly, any adjustments to the carrying amount are also recognized in earnings.

Examples are included in ASC 825-20-55 that illustrate the application of this guidance.

12

MARCH 2022

Chapter 2: Accounting for debt with conversion options and other embedded

features – After adoption of ASU 2020-06

2.1 Introduction

This chapter assumes ASU 2020-06 has been adopted. Chapter 3 addresses the accounting for debt with

conversion options prior to the adoption of ASU 2020-06. Refer to Appendix C for additional information

on ASU 2020-06.

The accounting for debt with conversion options and other embedded features, such as put and call

options, necessitates giving consideration to: (a) ASC 480 to determine if the debt is within its scope, (b)

ASC 815 to determine whether any of the features embedded in the debt agreement need to be

separately recognized as a derivative, and (c) ASC 470-20 for convertible debt issued at a substantial

premium for which the conversion feature does not require derivative accounting to determine whether

the premium needs to be recognized as a separate component of equity.

Sections 2.2 through 2.4 of this chapter summarize the accounting analysis necessary to make these

determinations and the resulting ramifications. Section 2.5 addresses derecognition of convertible debt in

various scenarios, and Section 2.6 includes an illustration of interest expense recognition, including

discount amortization, using the interest method. Guidance related to debt modifications and

restructurings can be found in our debt modifications and restructurings guide.

2.2 ASC 480 considerations – After adoption of ASU 2020-06

While a debt instrument should be classified as a liability regardless of whether ASC 480 applies, if a debt

instrument may be settled in shares, consideration should be given to ASC 480-10-25-14, because, if

applicable, this could impact the measurement of the instrument and the relevant disclosure

requirements. Specifically, a debt instrument that embodies a conditional or unconditional obligation that

the issuer must or may settle by issuing a variable number of its equity shares would be subject to ASC

480 if, at inception, the monetary value of the obligation is based solely or predominantly on any one of

the following criteria (referred to for the remainder of this section as the three criteria):

If the debt can be settled in

shares, determine whether

ASC 480 is applicable

(Section 2.2)

Perform derivative analysis

of embedded features

under ASC 815 (Section

2.3)

If convertible, and

conversion feature is not

required to be recognized

as a derivative, determine if

separate equity recognition

is required for a portion of

the instrument under ASC

470-20 (Section 2.4)

13

MARCH 2022

1. A fixed monetary amount known at inception (e.g., a payable settled with the number of issuer's

equity shares required to equate to a fixed amount of value)

2. Variations in something other than the fair value of the issuer's equity shares (e.g., a financial

instrument indexed to the Standard & Poor’s 500 index and settled with a variable number of the

issuer's equity shares)

3. Variations inversely related to changes in the fair value of the issuer's equity shares (e.g., a written

put option that could be net share settled)

Understanding the terminology

The following are key terms used in ASC 480-10, along with their definitions from the Master Glossary

of the ASC:

• Monetary value: “What the fair value of the cash, shares, or other instruments that a financial

instrument obligates the issuer to convey to the holder would be at the settlement date under

specified market conditions.”

• Obligation: “A conditional or unconditional duty or responsibility to transfer assets or to issue

equity shares.”

Generally, instruments that are convertible to shares at the holder’s option are not subject to ASC 480.

However, a debt instrument that must or may be settled in a variable number of the issuer’s equity shares

(through conversion or otherwise) may be subject to ASC 480 if it meets any of the three criteria. An

example of an instrument that may meet the first criterion is a debt instrument that will be settled in a

variable number of shares, with that number to be determined based on 80 percent of the conversion

date fair value of a share (i.e., a 20 percent discount). In this case, the holder receives the same value

regardless of the share price at the time of the conversion. For example, if the face amount of the debt

was $1 million and the share price was $6 at the time of conversion, the holder would receive 208,333

shares ($1 million face amount divided by 80 percent of the $6 share price) worth $6 each for an

extended value of $1.25 million. If the share price was $7 at the time of conversion, the holder would

receive 178,571 shares ($1 million face amount divided by 80 percent of the $7 share price) worth $7

each for the same extended value of $1.25 million.

2

An instrument that meets criterion one would generally be accounted for as stock-settled debt (which

entails accreting the carrying amount up to the $1.25 million settlement amount in the preceding example

through the settlement date in accordance with the interest method illustrated at Section 2.6) if the

monetary value of the obligation is based solely or predominantly on a fixed settlement amount. Other

instruments that fall within the scope of ASC 480 by

meeting the second or third criterion may necessitate

subsequent measurement at fair value

under ASC 480-10-35-5 unless another subtopic of U.S. GAAP

specifies a different measurement attribute.

The analysis of whether a debt instrument is within the scope of ASC 480 becomes more complex when

the monetary value is in part, but not solely, based on one of the three criteria. Subjectivity comes into

play in determining if the monetary value is based predominantly on one of these criteria as

predominantly is not defined in ASC 480. We are aware of divergent views in practice as to whether

2

As noted in the footnote to the section that follows, some bridge notes are settled in a variable number of shares

upon the occurrence of a qualified financing event, with the number of shares determined based on the price at which

shares are issued in the financing event. These instruments are generally not viewed as subject to ASC 480-10-25-

14 unless an obligation exists at the issuance date to conduct a qualified financing event, and settlement in a manner

that meets the first criterion is deemed to be predominant at the issuance date.

14

MARCH 2022

predominant should be interpreted as more likely than not or a higher threshold, such as 90 percent as

suggested by the use of the words “in small part” in ASC 480-10-55-22. Other examples in ASC 480-10-

55 may also be useful in making this determination. In the context of the example in the preceding

paragraph, if the number of shares to be issued is determined based on an average share fair value over

a stated period of time (e.g., 30 days before settlement) rather than the fair value of the shares on the

conversion date, based on the example at ASC 480-10-55-22, a conclusion would be reached that while

the monetary value is in small part based on variations in the fair value of the shares that can occur

during the 30 day period, the monetary value is predominantly fixed such that the first criterion would be

met.

In circumstances involving multiple potential settlement outcomes, the analysis becomes even more

complex as it is necessary to assess as of the issuance date which outcome is predominant. In the

preceding example, the debt will settle in shares at a discount to the conversion date fair value (a

situation that may meet the first of the three criteria). If the debt in that example was also convertible at

the holder’s option into a fixed number of shares or could be settled in cash upon its maturity (two

alternatives that would not meet any of the three criteria), the reporting entity would need to determine if

an outcome that meets one of the criteria is predominant. In making this determination, consideration

should be given to all pertinent information, such as the current stock price and volatility, the strike price

of the instrument and any other relevant factors to determine if, for example, it would be more

advantageous for the holder to elect to convert to the fixed number of shares. If settlement in a manner

that meets one of the three criteria is determined to be predominant, the instrument is accounted for in

accordance with ASC 480. If not, the feature that could result in the issuance of a variable number of

shares is evaluated to determine if it should be separately recognized as a derivative as discussed in the

next section.

2.3 Derivative analysis of embedded features – After adoption of ASU 2020-06

2.3.1 Overview

It is common for debt instruments to have embedded features that may require separate recognition as

derivatives, including conversion options, early redemption features (such as put and call options),

additional payments if a contingent event such as a change in control occurs, and interest that is indexed

to something other than interest rates. While the focus of this section is on the features we have most

commonly observed in practice, there may be other features within a debt instrument that necessitate

similar consideration of the guidance that follows. The focus should be on features that can alter the

amount or timing of cash flows or the value of other exchanges (e.g., conversion shares).

Distinguishing between conversion and redemption options

Standard conversion options allow for conversion of the debt into a fixed or substantially fixed number

of shares. Standard redemption features, such as put and call options, give the holder the right to put

the debt to the issuer (or the issuer the right to call the debt from the holder) at a stated amount to be

paid in cash or shares. Some instruments provide for conversion into a variable number of shares, with

the number of shares determined at the time of conversion based on the fair value of the shares at the

conversion date. Such a feature is designed to ensure that the holder receives a predetermined

amount of value paid in whatever number of shares it takes to arrive at that value.

3

In other words, the

3

We have observed several variations of debt instruments in practice (typically bridge financing notes) that

contractually convert into the class of shares issued in the next qualified financing event (as defined in the

agreement) at the price at which shares are issued in the financing event, or a percentage of that price (e.g., 80% of

the qualified financing price). Generally, such features are evaluated as a redemption option rather than a conversion

option, assuming that the qualified financing event is defined in a manner that one would expect the shares to be

issued at a price reflective of fair value, such that the feature is designed to give the debt holders a fixed amount of

15

MARCH 2022

value that the holder is expected to receive upon conversion is not expected to vary based on changes

in the value of the underlying shares. Assuming that this feature does not result in classification as

stock-settled debt as discussed at Section 2.2, we believe it would be appropriate to analyze this

feature as a redemption option rather than a conversion option in the analysis that follows to determine

when certain embedded features must be separately recognized as derivatives.

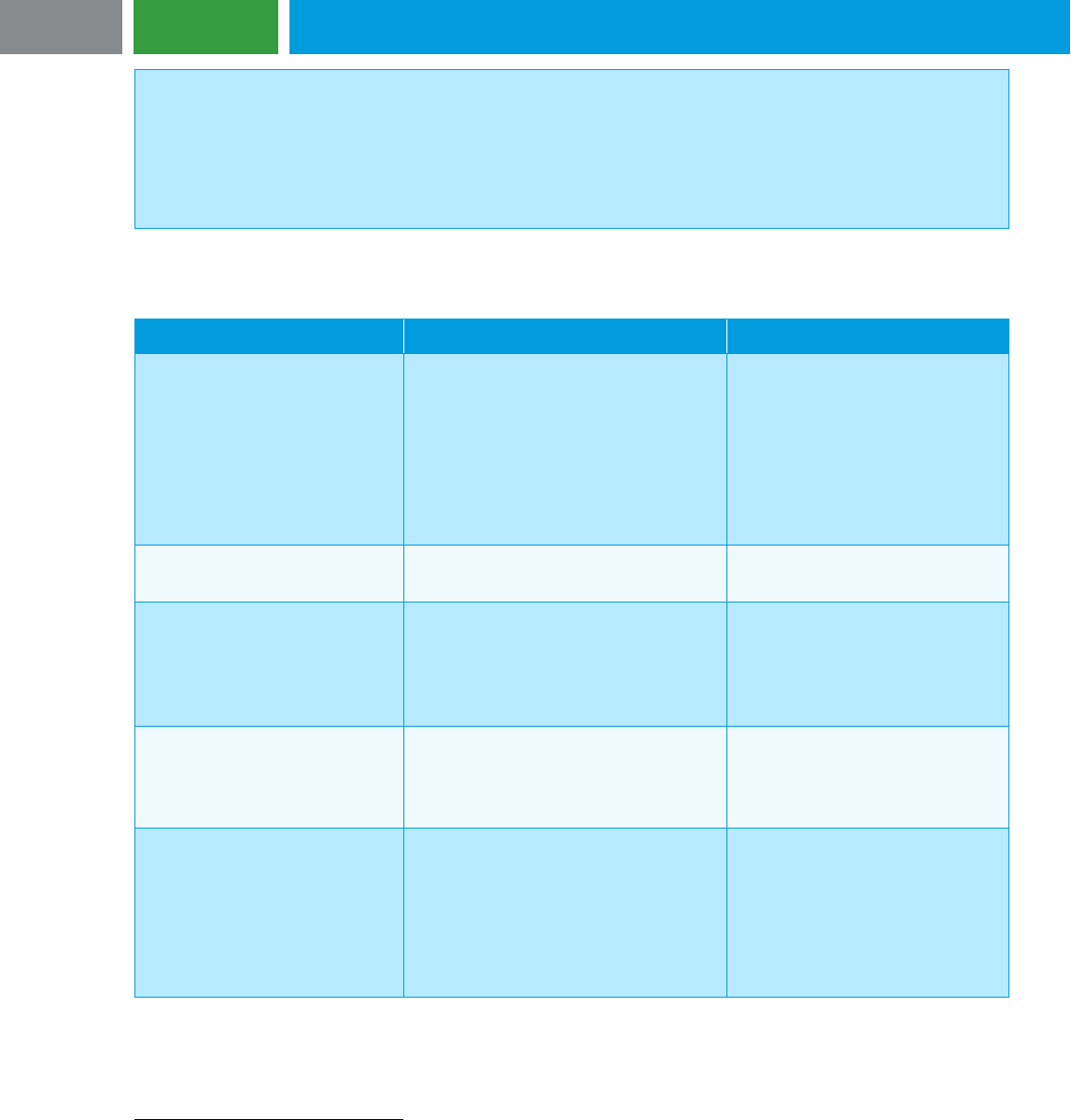

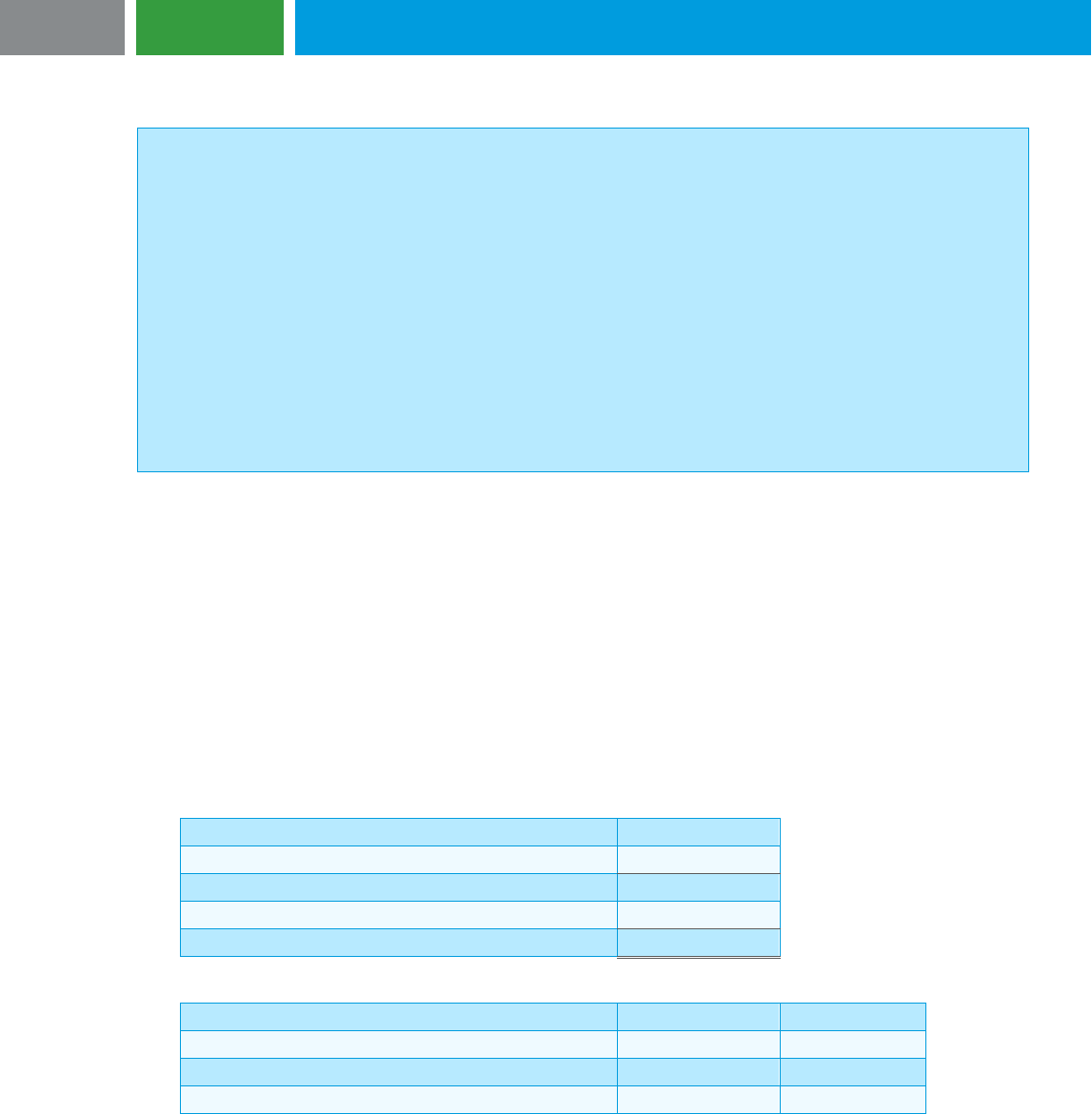

The determination of which, if any, embedded features must be separately recognized as derivatives is

complex. Specifically, ASC 815-15-25-1 requires derivative recognition for embedded features if all of the

following three criteria are met:

1. The economic characteristics and risks of the embedded derivative are not clearly and closely related

to the economic characteristics and risks of the host contract.

2. The hybrid instrument is not remeasured at fair value under otherwise applicable U.S. GAAP.

3. A separate instrument with the same terms as the embedded derivative would be a derivative

instrument subject to the requirements of ASC 815 (i.e., it meets the definition of a derivative and

does not qualify for one of the scope exceptions outlined at ASC 815-10-15-13).

2.3.2 Application of the embedded derivatives guidance to common features in debt

instruments – After adoption of ASU 2020-06

Criteria 1 and 3 are discussed in more depth in the sections that follow. Regarding Criterion 2, if the debt

instrument qualifies, and the reporting entity elects to account for it at fair value or the instrument is

required to be accounted for at fair value on an ongoing basis, no embedded derivatives would require

separate recognition, and the embedded derivative analysis is not relevant

.

2.3.2.1 Criterion 1

The first criterion to consider in the embedded derivative analysis is whether the economic characteristics

and risks of the embedded derivative are clearly and closely related to the economic characteristics and

risks of the host contract. Instruments issued in financing transactions are analyzed to determine whether

the host contract is more debt-like or equity-like. This analysis is based on all stated and implied

substantive terms and features, with each term and feature evaluated and weighted to determine if a

specific instrument is more debt-like or equity-like. Instruments issued in the legal form of debt, as well as

certain preferred or other stock that have strong debt-like characteristics, are generally considered to

have a debt host contract (refer to Section 4.3.2.1 for the determination of the nature of the host contract

for preferred stock and similar instruments issued in the form of a share). The primary economic

value paid in a variable number of shares. (That may not be the case if the financing event is defined to be

substantially based on the exercise or conversion of preexisting warrants or convertible instruments at preestablished

contractual strike prices). In some cases, there may be multiple conversion features or optionality in the conversion

price (i.e., the debt will convert at the lower of a predefined price or a predefined percentage of the qualified financing

price), in which case, the instrument may contain both a conversion option and a redemption option.

Economic

characteristics

and risks of

embedded

derivative are not

clearly and

closely related to

the host contract

The hybrid

instrument is not

remeasured at fair

value under

otherwise

applicable U.S.

GAAP

A separate

instrument with

the same terms

as the embedded

derivative would

be a derivate

instrument subject

to ASC 815's

requirements

Recognize feature

as derivative

16

MARCH 2022

characteristics and risks associated with a debt host are interest rates, inflation and credit risk. As pointed

out at ASC 815-15-25-51, equity conversion options are not clearly and closely related to a debt host

contract because their underlying value is dependent upon the value of an equity interest. As it relates to

redemption features within debt instruments that can accelerate repayment (whether in cash or shares),

such as put and call options, additional analysis is necessary to determine if a particular feature is clearly

and closely related to the debt host contract. Specific guidance relevant to this determination is primarily

found in ASC 815-15-25-26 and ASC 815-15-25-42.

The guidance in ASC 815-15-25-26 does not apply if there is an underlying related to the put or call

option other than interest rates or an interest rate index. If, for example, a put or call option can only be

exercised upon the occurrence of a contingent event, which is another underlying, this guidance is not

relevant.

The guidance on put and call options at ASC 815-15-25-42 outlines a four-step decision sequence that

should be followed in determining whether options that can accelerate the settlement of debt instruments

are clearly and closely related to the debt host contract. This decision sequence results in a conclusion

that put and call options are not clearly and closely related under any of the following circumstances:

• Rather than being the repayment of principal at par, the payoff amount is indexed to something other

than interest rates or credit risk.

• The debt involves a substantial premium or discount and the option is contingently exercisable.

• One of the two conditions outlined later in this section from ASC 815-15-25-26 are met, if applicable.

The four-step decision sequence in ASC 815-15-25-42 follows on the next page.

17

MARCH 2022

Step 2: Is the payoff

indexed to an underlying

other than interest rates or

credit risk?

?

Step 3: Does the debt

involve a substantial

premium or discount?

?

Step

1: Is the amount paid

upon settlement

(i.e.,

payoff) adjusted based on

changes in an index?

?

Embedded feature is not

clearly and closely related to

the debt host contract.

Yes

Yes

No

Yes

Step 4: Does a contingently

exercisable call (put) option

accelerate the repayment of

the contractual principal

amount?

?

Call (put) option is not clearly and

closely related to the debt

instrument.

No

No

Yes

Further analyze the contract

under ASC 815-15-25-26, if

applicable.

No

An example of the type of put or call option that we have observed most frequently in practice that is not

clearly and closely related to the debt host contract is a feature that will result in payment of the debt at a

significant premium upon the occurrence of a contingent event, such as a change in control. When

considering Steps 1 and 2 of the decision sequence, we believe repayments that are based on either a

fixed premium to par or a premium that changes due to the passage of time would not be considered

indexed to something other than interest rates or credit risk. In evaluating the significance of a premium or

discount in Step 3, in practice, premiums or discounts of 10 percent or more are generally viewed as

substantial; however, consideration should be given to the specific facts and circumstances. Additionally,

we believe that when determining if the debt involves a substantial premium or discount, consideration

should be given to not only the relationship of the par amount to the issuance proceeds attributable to the

debt, but also to the relationship of the payoff amount to the issuance proceeds attributable to the debt.

As such, even when debt is issued at par, but a portion of the proceeds is allocated to other freestanding

instruments (such as warrants) in accordance with Chapter 1, the debt could be deemed to involve a

18

MARCH 2022

substantial discount. Generally, it would not be appropriate to consider discounts created by separately

recognizing a conversion option associated with the debt, given that typically the holder would not benefit

from the conversion option if the instrument is redeemed. However, it may be necessary to consider

premiums or discounts created from bifurcating other embedded derivatives from the debt that could

result in payments that are incremental to the redemption feature and can be triggered prior to or on the

redemption date. Additionally, while fees paid to the creditor can create a discount that would be

considered in this analysis, discounts related to issuance costs paid to third parties would be ignored in

this analysis.

The guidance in ASC 815-15-25-26 is relevant to the analysis of noncontingent puts and calls and other

features in a debt instrument that can alter the interest payments if the only underlying in the potential

derivative is an interest rate or interest rate index. (As mentioned earlier, keep in mind that if exercise of

the option is contingent on the occurrence of a certain event, such as a change in control, this would

constitute a non-interest rate underlying and, as such, ASC 815-15-25-26 would not be relevant to the

analysis for that option.) When applicable, a conclusion would be reached under ASC 815-15-25-26 that

an embedded feature is clearly and closely related to a debt host contract unless one of the following two

conditions exists:

• There is a possible situation in which the creditor could be forced by the terms of the debt instrument

to accept settlement in such a way that it would not recover substantially all of its initial recorded

investment. (In practice, substantially all has generally been interpreted to mean at least 90 percent.)

An example of when this condition would exist includes a situation whereby debt is issued at a

premium greater than 10 percent and gives the debtor the option of prepaying at par.

• There is a possible future interest rate scenario under which the embedded derivative would at least

double the creditor’s initial rate of return on the debt instrument and result in a rate of return that

would be at least twice the then-current market rate of return for a debt instrument with the same

terms involving a debtor with similar credit quality at the inception of the debt. This condition does not