1

What is ‘affordable housing’? - Frequently asked questions

What is meant by the term ‘affordable housing’?

The term ‘affordable housing’ has a number of definitions, and has been confused by

the government’s introduction of ‘Affordable Rent’ homes which can be set at up to

80% of local market rents.

In London, where private rent levels are very high, rents at or near 80% are not

affordable to many local residents.

This is why the Council prefers to use the alternative term ‘genuinely affordable

housing’ to refer to homes which are affordable to residents on low and

medium incomes, whether for rent or sale.

What is meant by ‘genuinely affordable housing’?

One way of defining genuinely affordable is based on the proportion of a household’s income

spent on housing costs. A common measure is that a household should not spend more

than one third of their income on housing costs. The London Mayor has formally

adopted this approach in calculating the rent levels he expects to see set for new

London Living Rent homes.

Affordable housing is intended to be for households on low and medium incomes and is

often divided into social housing and ‘intermediate’ housing.

Social housing:

● ‘Social Rent’ is considered the most affordable form of social housing. These

properties make up the largest proportion of rented social housing properties. The

rent paid is based in a formula set by government (more information provided within

the glossary below).

● ‘London Affordable Rent’ are usually genuinely affordable to those on low incomes

(though the benefit cap has begun to affect housing affordability for some larger

households). Weekly rents were calculated and published by the GLA for each house

type (i.e 1 bed flat, 2 bed flat etc), between 2017/18 until 2022/23. Similar to Social

Rent, households must be on the housing waiting list and be nominated by a Local

Authority to be eligible.

● homes let at ‘Affordable Rent’ are unlikely to be genuinely affordable to those on low

incomes if rents are set at or near 80% of local market rents.

2

Intermediate housing (for sale or rent):

● Shared Ownership has enabled many people on medium incomes to take a first step

on the housing ladder. The share of the home purchased can be as little as 25%,

with a subsidised rent paid on the remaining share. This is often an affordable option

for those not prioritised for social housing but unable to afford to buy outright, though

ensuring the affordability of shared ownership is becoming more challenging in areas

of the borough with especially high house prices.

● London Living Rent is considered as an intermediate product. Rents are set at one

third of average local incomes. The idea is the money saved can be saved towards a

deposit to allow a middle income household to purchase a property within around 10

years.

● there are a range of other housing products that are intended to make house

purchase cheaper, such as Equity Share, Equity Loans, Starter Homes and First

Homes. However, because of very high house prices, in many cases these would still

not reduce the price enough to be genuinely affordable or would not result in any

eligible households due to the household income required to afford the house prices

of these products exceeding the income caps set out in national planning policy.

● Loosely defined ‘sub-market rents’ can be set at any level between social rent and

market rent though, in practice, they are usually closer to market rent and so are

unlikely to be genuinely affordable.

Who decides what types of ‘affordable housing’ is provided?

The government and the Mayor of London set the broad framework for affordable housing,

through the National Planning Policy Framework, London Plan and relevant guidance. Local

Planning Authorities then set more specific policy requirements for what type of affordable

housing is required including the housing mix (such as the amount of 1 bed, 2 bed, 3 bed

homes) within planning applications, however, the requirements must conform to National

Planning Policy and the London Plan. These polices are informed by background evidence

including studies like the Local Housing Needs Assessment which provides information on

what types of overall housing and affordable housing are needed the most, using information

from sources such as the recent census.

By law, the Council’s planning policies for new housing have to comply with national and

London-wide planning guidance. The definition of affordable housing is incorporated in

national planning guidance, and includes social housing let at up to 80% of local market rent

(Affordable Rent) and a range of below market level ‘intermediate’ housing for sale and rent.

Affordable housing providers, whether Councils or housing associations, have their own rent

setting policies for both new and existing homes, though these must be set within the rules

laid down by the government and the regulator of social housing.

3

Is private housing affordable?

Much private housing, both for rent and sale, is unaffordable to residents on low to medium

incomes. House prices in Richmond borough are amongst the highest in the country, and

private rents are also very high. Another useful measure of the affordability of housing is

assessing the lowest earnings against the lowest house prices within a Council area and

comparing this to what would be accepted for a mortgage. Generally, to be accepted for a

mortgage a household can borrow up to 4.5 times their household income. Within Richmond

the ratio is 18.85, the third highest in England, exceeded only by Westminster (19.59) and

Kensington and Chelsea (31.16). This means for lower income households, even the lower

end of houses on the market are on average 18.85 times their income. Which when

considering this ratio against the mortgage limit of 4.5 times a households income, this

shows how unaffordable most private housing is.

The lack of affordable housing to buy means that many low and medium income households

have to rent in the private sector. But the private rented sector is also very expensive. This

means that one of the few housing options available to many residents on low and medium

incomes is to live in shared housing in the private rented sector.

What about those receiving benefits?

The government’s welfare reforms have had a serious impact on the ability of many

households receiving benefits to afford housing costs in the borough. The benefit paid to

private tenants – the Local Housing Allowance (LHA) – has been capped and frozen.

4

Affordable Housing: Glossary of terms

Under the Government’s definition, “affordable housing includes social rented, affordable

rented and intermediate housing, provided to specified eligible households whose needs are

not met by the market.”

1

In more detailed planning terms, ‘affordable housing’ is defined by the Government in the

National Planning Policy Framework (NPPF) as:

● “housing for sale or rent, for those whose needs are not met by the market (including

housing that provides a subsidised route to home ownership and/or is for essential

local workers)”, and,

● “it includes provisions to remain at an affordable price for future eligible households,

or for the subsidy to be recycled for alternative affordable housing provision.

A full definition from the NPPF is provided below the table.

The Mayor of London is committed to delivering genuinely affordable housing. Within the

broad NPPF definition of affordable housing, the Mayor’s preferred affordable housing

tenures are:

● Homes based on social rent levels, including Social Rent

● London Affordable Rent is still accepted, however it is no longer eligible for grant

funding. (New emerging guidance from the London Mayor is adding support to Social

Rent housing and lessening support for London Affordable Rent due to Social Rent

being more affordable for more Londoners).

● London Living Rent

● London Shared Ownership.

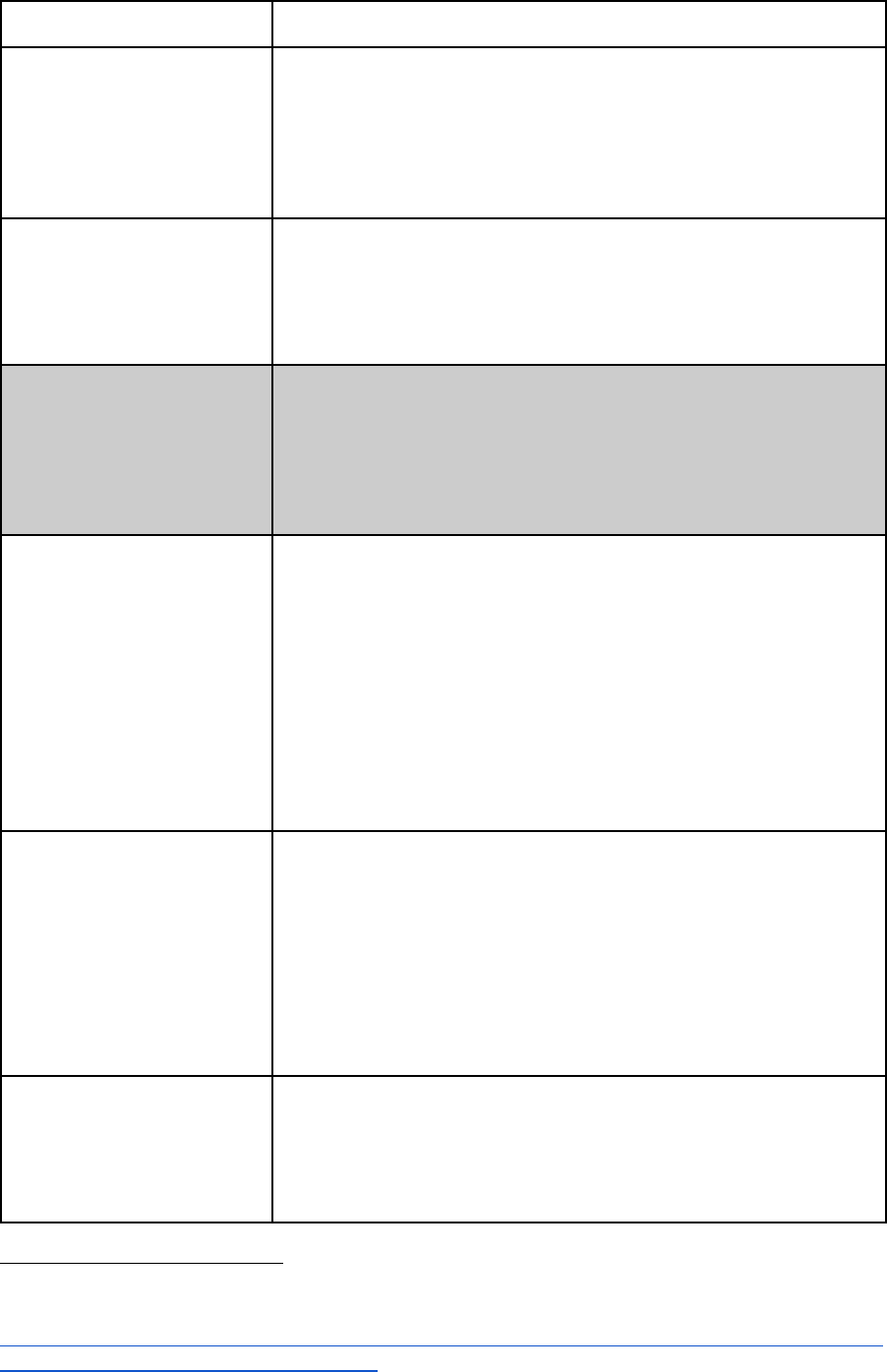

These are described in more detail in the table below.

Affordable housing should be genuinely affordable to households on low and medium

incomes, i.e. as a general rule, that housing costs should not exceed one third of gross

household income or that, for households in receipt of housing benefit, that housing costs

should not exceed the level of benefit received.

Social housing

The overall term for rented housing that is intended for

allocation to households on low incomes who are usually

registered on a Council’s Housing Register. Social housing

can be let on secure or fixed term tenancies.

Social Rent

Genuinely affordable rented housing, mainly owned and

managed by local authorities and housing associations, with

rent levels that are calculated using a nationally-set formula.

The formula is based on the value of the property, relative

property values in the area, the number of bedrooms, and the

1

https://www.gov.uk/government/collections/affordable-housing-supply

5

average earnings in the area.

2

Affordable Rent

A rent level introduced and promoted by the Government

from 2011, where new homes are let at up to 80% of the

average local market rent. Given the high level of market

rents in London, Affordable Rent is not genuinely affordable

to households on low incomes in the borough. This type of

social housing is not supported by the Council.

London Affordable Rent

A genuinely affordable rent level introduced by the Mayor of

London in November 2016, with benchmarks for weekly rent

based on bedroom size. These benchmarks reflect the above

formula rent cap figures for Social Rent and are uprated and

published by the GLA each April.

Intermediate housing

A catch-all term for low cost rental or home ownership

products that are intended to meet the housing needs of

households on medium incomes - those who are unable to

afford open market costs but are not a priority for social

housing. Housing costs are lower than open market levels,

but higher than Social Rent or London Affordable Rent.

Shared Ownership

Shared Ownership is an intermediate ownership product

which allows households who would struggle to buy on the

open market, to purchase a share in a new home and pay a

low rent on the remaining, unsold share (often described as

part rent / part buy). Applicants must normally purchase

between 25-75% of the value of the home, and pay a

subsidised rent to the housing provider for the remainder. If

they can afford to, shared owners can subsequently

‘staircase’ up to 100% ownership over time. Shared

ownership opportunities are available to households with an

annual household income of up to £90,000.

London Living Rent

(LLR)

Introduced by the Mayor of London in 2016, with rent levels

set at one third of average local ward household income.

Existing private or social renters with annual household

incomes of up to £60,000 will be able to apply. LLR is a Rent

to Buy product, with sub-market rents on time-limited

tenancies, which will help households on medium income

levels to save for a deposit. Tenants will be expected to

purchase their homes on shared ownership terms within 10

years.

Intermediate or

Discounted Rent

These are usually homes let at a discount to market rent

levels, often 80% of local market rents. Housing providers

should be able to demonstrate that the homes are affordable

to residents on median household incomes or to households

with an income of not more than £60,000 per annum (the

2

The full technical definition of Social Rent and Affordable Rent is included in the Regulator

of Social Housing’s Rent Standard:

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_da

ta/file/725825/Rent_Standard_2015.pdf

6

income threshold for LLR).

Discounted market sale

and First Homes

Homes sold at a discount on average local market house

prices of normally 20%. Eligibility is determined with regard to

local incomes and local house prices.

First Homes are defined by the Government as affordable

homes sold to first-time buyers at a discount. Key aspects of

the national planning policy for First Homes are:

• 25 per cent of affordable homes in each scheme

should be First Homes.

• In London First Homes will be sold to first-time buyers

earning no more than £90,000 per year, and the

maximum price after discount will be £420,000.

• The discount will be passed on at each subsequent

sale.

Given house price values in London First Homes do not

represent a genuinely affordable form of affordable housing

that would help first time buyers in the Borough