UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 28, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 1-33338

AMERICAN EAGLE OUTFITTERS, INC.

(Exact name of registrant as specified in its charter)

Delaware 13-2721761

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

77 Hot Metal Street, Pittsburgh, PA 15203-2329

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (412) 432-3300

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol(s) Name of each exchange on which registered

Common Stock, $0.01 par value AEO New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☒ NO ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Sections 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for at the past 90

days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange

Act.

Large accelerated filer

☒

Accelerated filer

☐

Non-accelerated filer

☐

Smaller reporting company

☐

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the

correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☒

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of July 30, 2022 was $2,067,276,031.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 195,556,065 Common Shares were

outstanding at March 8, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement for the 2023 Annual Meeting of Stockholders are incorporated into Part III herein.

AMERICAN EAGLE OUTFITTERS, INC.

TABLE OF CONTENTS

Page

Number

PART I

Item 1. Business 4

Item 1A. Risk Factors 13

Item 1B. Unresolved Staff Comments 26

Item 2. Properties 26

Item 3. Legal Proceedings 27

Item 4. Mine Safety Disclosures 27

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities 28

Item 6. Reserved 30

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations 31

Item 7A. Quantitative and Qualitative Disclosures About Market Risk 41

Item 8. Financial Statements and Supplementary Data 42

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 74

Item 9A. Controls and Procedures 74

Item 9B. Other Information 76

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections 76

PART III

Item 10. Directors, Executive Officers and Corporate Governance 77

Item 11. Executive Compensation 77

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 77

Item 13. Certain Relationships and Related Transactions, and Director Independence 77

Item 14. Principal Accounting Fees and Services 77

PART IV

Item 15. Exhibits, Financial Statement Schedules 78

Item 16. Form 10-K Summary 81

2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K ("Annual Report") contains “forward‑looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended (the Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act”) that are

based on the views and beliefs of management, as well as assumptions and estimates made by management. Actual results could differ

materially from such forward‑looking statements as a result of various risk factors, including those that may not be in the control of management.

All statements other than statements of historical facts contained in this Annual Report are forward-looking statements. Words such as “estimate,”

“project,” “plan,” “believe,” “expect,” “anticipate,” “intend,” “potential,” and similar expressions may identify forward-looking statements. Our

forward-looking statements include, but are not limited to, statements about:

• the planned opening of approximately 5 to 15 American Eagle stores and approximately 20 to 30 Aerie locations, including approximately

15 OFFLINE™ stores, which will be a mix of stand-alone and Aerie side-by-sides, during Fiscal 2023;

• the anticipated selection of approximately 15 to 30 American Eagle and Aerie stores in the United States and Canada for remodeling

during Fiscal 2023;

• the potential closure of approximately 20 to 40 American Eagle stores at the expiration of their lease term, primarily in North America,

during Fiscal 2023;

• the success of our core American Eagle and Aerie brands through our omni-channel and licensed outlets within North America and

internationally;

• our plans for Quiet Platforms;

• our acquisitions' ability to achieve expected results;

• the success of our business priorities and strategies;

• the continued validity of our trademarks;

• our performance during the back-to-school and holiday selling seasons;

• the reduction of operating expenses and capital expenditures;

• the accuracy of the estimates and assumptions we make pursuant to our critical accounting policies and estimates;

• the payment of a dividend in future periods;

• our ability to fund our current and long-term cash requirements through current cash holdings and available liquidity, including under our

revolving credit facility;

• the possibility that product costs are adversely affected by foreign trade issues (including import tariffs and other trade restrictions with

China and other countries), currency exchange rate fluctuations, increasing prices for raw materials, supply chain issues, political instability

or other reasons;

• the possibility of changes in global economic and financial conditions, and resulting impacts on consumer confidence and consumer

spending, as well as other changes in consumer discretionary spending habits;

• the effect of inflation on our business;

• the possibility that we may be required to take additional impairment or other restructuring charges;

• the ongoing impact of the COVID-19 pandemic on global economic conditions; and

• the ability of our distribution centers and stores to maintain adequate staffing to meet increased customer demand.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ

materially from those in the forward-looking statements. Potential risk factors include the risk factors discussed under the heading “Risk Factors”

under Part I, Item 1A of this Annual Report. Any forward-looking statement speaks only as of the date on which such statement is made, and we

do not intend to correct or update any forward-looking statement, whether as a result of new information, future events, or otherwise, except as

required by law.

3

PART I

Item 1. Business.

Company Overview

American Eagle Outfitters, Inc. (the “Company,” "AEO," “we,”, "us," and “our”) is a leading global specialty retailer. We operate and license over

1,400 retail stores worldwide and are online at www.ae.com and www.aerie.com in the United States and internationally. Our brands are

connected under the core tenet of REAL, which is inclusive, optimistic, and empowering and celebrates self-expression. Our purpose is to show

the world that there's REAL power in the optimism of youth.

We offer a broad assortment of high-quality, on-trend apparel, accessories, and personal care products at affordable prices for men and women

under the American Eagle brand, and intimates, apparel, active wear, and swim collections under the Aerie brand. We sell directly to consumers

through our retail channel, which includes our stores and concession-based shop-within-shops. We operate stores in the United States, Canada,

Mexico, Hong Kong, and Japan. We also have license agreements with third parties to operate American Eagle and Aerie stores and online

marketplace businesses throughout Asia, Europe, India, Latin America, and the Middle East.

We also operate Todd Snyder New York (“Todd Snyder”), a premium menswear brand, and Unsubscribed, which focuses on consciously made,

slow fashion.

In Fiscal 2021, we acquired AirTerra, Inc. ("AirTerra") and Quiet Logistics, Inc. ("Quiet Logistics"), creating a new supply chain platform ("Quiet

Platforms”). Quiet Logistics is a logistics company that operates a network of in-market fulfillment centers, locating products closer to need,

creating inventory efficiencies, cost benefits and affordable same-day and next-day delivery options for customers and stores. AirTerra is a

logistics service and platform that solves e-commerce fulfillment and shipping challenges in a unique and innovative way for retailers and brands

of all sizes. Both acquisitions represent an important step in building our supply chain platform, as part of our ongoing supply chain

transformation strategy of leveraging scale and innovation to help us manage costs and improve service.

Operating Segments

The Company has identified two operating segments (American Eagle brand and Aerie brand) that also represent our reportable segments and

reflect the Chief Operating Decision Maker’s (defined as our CEO) internal view of analyzing results and allocating resources. Additionally, our

Todd Snyder and Unsubscribed brands and Quiet Platforms have been identified as separate operating segments; however, as they do not meet

the quantitative thresholds for separate disclosure they have been included in the Corporate and Other category. See Note 16. “Segment

Reporting,” of the Notes to the Consolidated Financial Statements included herein for additional information.

Fiscal Year

Our fiscal year is a 52- or 53-week year that ends on the Saturday nearest to January 31. As used herein, "Fiscal 2023" refers to the 53-week

period that will end on February 3, 2024. “Fiscal 2022” refers to the 52-week period ended January 28, 2023, “Fiscal 2021” refers to the 52-week

period ended January 29, 2022, and “Fiscal 2020” refers to the 52-week period ended January 30, 2021.

Brands

American Eagle

American Eagle is a leading American jeans and apparel brand, the go-to destination for casual style, embraced by generations of youth since

1977. We are rooted in authenticity, powered by positivity and inspired by our community. Our collections are designed to inspire self-expression

and empower our customers to celebrate their own uniqueness. We have broadened our leadership by producing innovative, sustainable fabrics.

As of January 28, 2023, we operated 865 AE stores. We offer American Eagle products online at www.ae.com.

4

Aerie and OFFLINE™ by Aerie

Built on a platform of power, positivity and no photo retouching - inspiring people to love their real selves. Aerie is a fast-growing lifestyle brand

offering intimates, apparel, activewear, and swim collections. With the #AerieREAL™ movement, we celebrate our community by advocating for

body positivity and the empowerment of all women. As part of our Real Good promise, we create swimsuits, bras, and underwear with materials

made from recycled polyester, recycled nylon fabric or sustainably sourced cotton.

OFFLINE™ by Aerie offers a complete collection of activewear and accessories made for real movement and real comfort. Built on the success

of Aerie's leggings and sports bras, OFFLINE™'s unique take on an active lifestyle celebrates real life - when some days you feel like you can

take on the world and other days you need that extra push to get off the couch. Our Real Good promise extends to the OFFLINE™ collections

with some of our best-selling fleece, leggings and tees made with the planet in mind.

As of January 28, 2023, we operated 295 Aerie brand stand-alone stores, inclusive of 34 OFFLINE™ stand-alone stores and 28 OFFLINE™

side-by-side stores connected to an Aerie brand location. We also operated 186 Aerie side-by-side stores connected to an AE brand location, four

locations with an AE brand location, Aerie brand location and OFFLINE™ connected as one store, and two OFFLINE™ side-by-side stores

connected to an AE brand location. In addition, Aerie brand merchandise is sold online at www.aerie.com and certain items are sold in AE brand

stores.

Todd Snyder New York

A premium menswear brand informed by heritage, yet updated for today, with an emphasis on versatility and comfort. Todd Snyder offers

signature essentials, statement pieces, custom suiting and iconic accessories reflective of quintessential American style. From bespoke tailoring

to innovative capsule collections - good style can be attainable and playful.

As of January 28, 2023, we operated 10 Todd Snyder stores. We offer Todd Snyder products online at www.ToddSnyder.com.

Unsubscribed

A truly unique brand offering consciously-made, slow fashion with timeless clothing and accessories, Unsubscribed offers one-of-a-kind vintage

pieces that represent socially conscious and ethically produced practices. Each store is a unique experience that respects and highlights the

heritage of the space and the surrounding community. We are making wise choices through plant-first practices, emphasizing local makers,

natural fibers, and a desire to produce pieces that stand the test of time in both style and quality.

As of January 28, 2023, we operated five Unsubscribed stores. We offer Unsubscribed products online at www.unsubscribed.com.

Key Business Priorities & Strategy

We are focused on our “Real Power. Real Growth.” value creation. AEO has the following strategic priorities:

o Fueling Aerie to $2 billion in revenue; and

o Driving sustained profitable growth for American Eagle.

The Company will leverage customer-focused capabilities and continue to strengthen its return on investment ("ROI") discipline, while building on

the power of AEO’s people, culture and purpose.

Real Estate

We ended Fiscal 2022 with 1,175 Company-owned stores and 269 licensed store locations. Our AE brand stores average approximately 6,400

gross square feet and our Aerie brand stand-alone stores, inclusive of OFFLINE™ stand-alone stores, average approximately 5,800 gross

square feet. The gross square footage of our Company-owned stores increased by 5.6% to 7.3 million during Fiscal 2022.

5

COVID-19

Impacts related to the ongoing COVID-19 pandemic have had a significant impact on the retail industry, our Company, our customers, and our

associates.

The impacts of the COVID-19 pandemic on our business are discussed in further detail throughout this Business section, Part I, Item 1A Risk

Factors, and Part II Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report.

Company-Owned Stores

Our Company-owned retail stores are located in shopping malls, lifestyle centers, and street locations in the United States, Canada, Mexico,

Hong Kong and Japan.

Refer to Note 17. “Impairment, Restructuring and COVID-19 Related Charges,” to the Consolidated Financial Statements included in this Annual

Report for additional information regarding impairment charges related to our Company-owned stores.

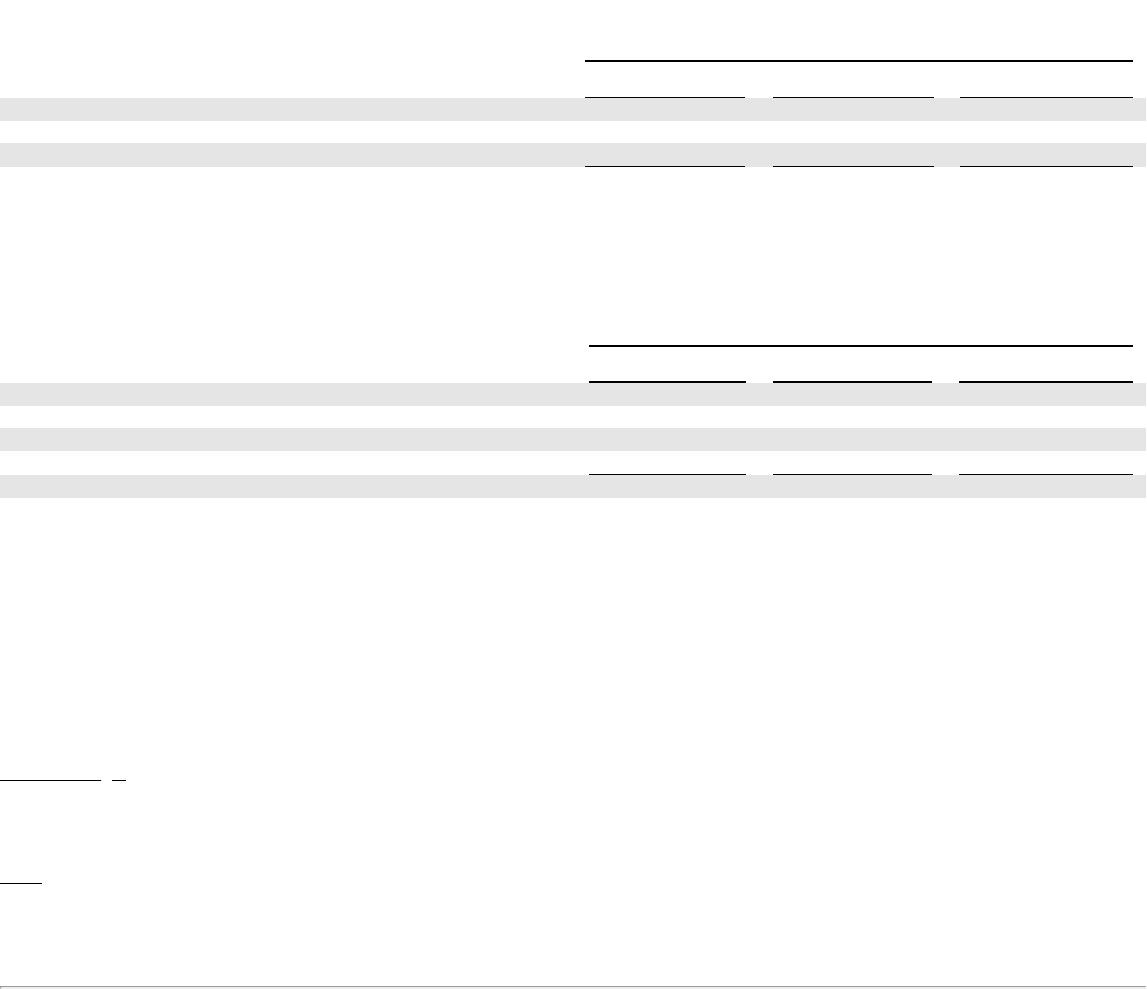

The following table provides the number of our Company-owned stores in operation as of January 28, 2023 and January 29, 2022.

January 28, January 29,

2023

2022

AE Brand:

United States 715 741

Canada 75 78

Mexico 56 48

Hong Kong 16 13

Japan

3

—

Total AE Brand 865 880

Aerie Brand:

United States 248 206

Canada 29 22

Mexico 16 14

Hong Kong

2

2

Total Aerie Brand 295 244

Todd Snyder 10 5

Unsubscribed

5

4

Total Consolidated

1,175

1,133

(1) Includes 186 Aerie side-by-side stores connected to an AE brand location, four locations with AE brand, Aerie brand and OFFLINE™

connected as one store, and two OFFLINE™ side-by-side stores connected to an AE brand location.

(2) Includes 34 OFFLINE™ stand-alone stores and 28 OFFLINE™ side-by-side stores connected to an Aerie brand location.

The following table provides the changes in the number of our Company-owned stores for the past five fiscal years:

Fiscal Year Beginning of Year Opened Closed End of Year

2022 1,133 87 (45 ) 1,175

2021 1,078 103 (48 ) 1,133

2020 1,095 40 (57 ) 1,078

2019 1,055 66 (26 ) 1,095

2018 1,047 29 (21 ) 1,055

Licensed Operations

Our international licensing partners acquire the right to sell, promote, market, and/or distribute various categories of our products in a given

geographic area and to source products from us. International licensees' rights include the right to own and operate retail stores and may include

rights to sell in wholesale markets and shop-in-shop concessions and operate online marketplace businesses. As of January 28, 2023, our

international licensing partners operated in 269 licensed retail

6

(1)

(2)

stores and concessions, as well as wholesale markets, online brand sites, and online marketplaces in approximately 30 countries.

We plan to continue to increase the number of locations under license agreements or similar arrangements as part of our disciplined approach to

global expansion.

AEO Direct

We sell merchandise through our digital channels, www.ae.com, www.aerie.com, www.toddsnyder.com, www.unsubscribed.com, and our AEO

apps, both domestically and internationally in approximately 80 countries. We also sell merchandise on various international online marketplaces.

The digital channels reinforce each particular brand platform and are designed to complement the in-store experience.

Over the past several years, we have invested in building our technologies and digital capabilities. We focused our investments in three key

areas: making significant advances in mobile technology, investing in digital marketing and improving the digital customer experience.

Omni-Channel

In addition to our investments in technology, we have invested in building omni-channel capabilities to better serve customers and gain

operational efficiencies. These upgraded technologies provide a single view of inventory across channels, connecting physical stores directly to

our digital store and providing our customers with a more convenient and improved shopping experience. Our United States and Canadian

distribution centers and our Quiet Logistics regional distribution centers are fully omni-channel and service both stores and digital businesses. We

offer the ability for customers to return products seamlessly via any channel regardless of where the products were originally purchased. We also

offer a variety of channels to fulfill customer orders. These include “ship to home,” which can be fulfilled either through our distribution center or

our store sites (buy online, ship from stores) when purchased online or through our app; “store pick-up,” which consists of online orders being

fulfilled either in store or curbside, and “store-to-door” where customers order within our store, and the goods are shipped directly to their home.

Customer Loyalty Program

Real Rewards by American Eagle and Aerie™ (the “Program”) is a highly digitized loyalty program that launched in June 2020. The Program

features a variety of benefits for loyalty members and credit card members.

Real Rewards by American Eagle and Aerie™ highlights include:

• Faster earn rates, which equal more rewards;

• Exclusive access to member promotions, discounts, and experiences;

• Free shipping perks; and

• Special cardmember discounts and tier benefits.

Under the Program, members accumulate points based on purchase activity and earn rewards by reaching certain point thresholds. Members

earn dollar rewards in the form of discount savings certificates. Rewards earned are valid through the stated expiration date, which is 60 days

from the issuance date of the reward. Rewards not redeemed during the 60-day redemption period are forfeited.

Merchandise Suppliers

We design our merchandise, which is manufactured by third-party factories. During Fiscal 2022, we purchased substantially all of our

merchandise from non North American suppliers. We sourced merchandise through approximately 330 vendors located throughout the world,

primarily in Asia, and did not source more than 10% of our merchandise from any single factory or supplier. Although we purchase a significant

portion of our merchandise through a single international buying agent, we do not maintain any exclusive commitments to purchase from any one

vendor.

We maintain quality control departments at our distribution centers to inspect incoming merchandise shipments for overall quality of

manufacturing. Inspections are also made by our employees and agents at manufacturing facilities to identify quality issues prior to shipment of

merchandise.

7

We uphold an extensive factory inspection program to monitor compliance with our Supplier Code of Conduct. New garment factories must pass

an initial inspection in order to do business with us and we continue to review their performance against our guidelines regarding working

conditions, employment practices, and compliance with local laws through internal audits by our compliance team and the use of third-party

monitors. We strive to partner with suppliers who respect local laws and share our dedication to utilize best practices in human rights, labor rights,

environmental practices, and workplace safety. We are a certified, validated member of the Customs-Trade Partnership Against Terrorism

program (“CTPAT”), a designation we have held since 2004. CTPAT is a voluntary program offered by United States Customs and Border

Protection (“CBP”) in which an importer agrees to work with CBP to strengthen overall supply chain security. In 2016, we were accepted into the

Apparel, Footwear, and Textiles Center, one of CBP’s Centers of Excellence and Expertise (“CEE”). The CEEs were created to ensure uniformity,

create efficiencies, reduce redundancies, enhance industry expertise, and facilitate trade, all with a final goal of reduced costs at the border and

allowing CBP to focus on high-risk shipments.

Inventory and Distribution

Merchandise is shipped directly from our vendors, and deconsolidated through trans loaders to our Company-owned distribution centers in

Hazleton, Pennsylvania and Ottawa, Kansas, our Quiet Logistics regional distribution centers strategically located throughout the United States,

or our Canadian distribution center in Mississauga, Ontario. Additionally, some products are shipped directly to stores, which reduces transit

times and lowers operating costs. We contract with third-party distribution centers in Mexico, Hong Kong and Japan to service our Company-

owned stores and e-commerce operations in those regions.

Regulation

We and our products are subject to regulation by various federal, state, local, and foreign regulatory authorities. Substantially all of our products

are manufactured by foreign suppliers and imported by us, and we are subject to a variety of trade laws, customs regulations, and international

trade agreements. Apparel and other products sold by us are under the jurisdiction of multiple governmental agencies and regulations, including,

in the United States, the Federal Trade Commission and the Consumer Products Safety Commission. These regulations relate principally to

product labeling, marketing, licensing requirements, and consumer product safety requirements and regulatory testing. We are also subject to

regulations governing our employees both globally and in the United States, and by disclosure and reporting requirements for publicly traded

companies established under existing or new federal or state laws, including the rules and regulations of the Securities and Exchange

Commission (“SEC”) and New York Stock Exchange (“NYSE”).

Our licensing partners, buying/sourcing agents, and the vendors and factories with which we contract for the manufacture and distribution of our

products are also subject to regulation. Our agreements require our licensing partners, buying/sourcing agents, vendors, and factories to operate

in compliance with all applicable laws and regulations, and we are not aware of any violations that could reasonably be expected to have a

material adverse effect on our consolidated business or operating results.

Human Capital Management

Our people come first. As of January 28, 2023, we employed approximately 40,000 associates throughout the world, of whom approximately

32,000 were part-time or seasonal associates. We employed 32,800 associates in the United States, of whom approximately 26,400 were part-

time or seasonal associates.

Our values of People, Innovation, Passion, Integrity, and Teamwork are the backbone of our Company and are at the center of every

decision, every product and every interaction - they represent the foundation of our REAL culture. We all have a vital role to play in

creating an environment where everyone feels respected and empowered while we continue to grow as a community that promotes individuality

and difference. We celebrate the diversity of one through the inclusion of many.

To evaluate our REAL culture, we look holistically at all the beliefs, values and behaviors that reflect how our best work is done. We aim to ensure

there is alignment between what is espoused and what is practiced. Our consistently strong internal employee satisfaction scores, corporate exit

survey data, and external Glassdoor ratings demonstrate the achievement of this goal.

8

Our culture model is composed of Listening, Observing, Supporting, and Informing:

• Listening to our associates, customers and candidates through reviews of culture surveys, exit surveys, Glassdoor reporting,

LinkedIn responses, and hotline reporting; we also conduct open-door engagement, Company-wide town halls, and roundtables on

a periodic basis.

• Observing who we are and what our associates are doing by regularly reviewing our demographic data and retention rates.

• Supporting a positive Company culture through programs and processes for eligible associates that promote our strong values and

address leadership development opportunities, work-life integration, well-being initiatives, fair pay initiatives, family support, and

inclusion and diversity programs.

• Informing and clearly communicating our values, modeling the behaviors we expect, and providing training and feedback.

Our Board of Directors (our “Board”) plays an important role in the oversight of our talent and culture and devotes time each quarter to receiving

updates from senior management on employee engagement, turnover and retention rates, inclusion and diversity, talent development,

leadership, and succession planning initiatives.

During Fiscal 2022, we prioritized growth through developing our people, our brands, and our operations. Our growth of people focused on

supporting the health and well-being of our associates, customers and communities while also reimagining connection and collaboration and

remaining diligent in the execution of our corporate social responsibility objectives.

TALENT MANAGEMENT PROGRAMS

We utilize an integrated set of talent management tools and programs, rooted in our values, that thread through the entire talent life cycle.

Consistent talent reviews, performance evaluations, equitable pay practices and succession planning have contributed to a full-time voluntary

and mutual turnover rate, including our store associates, of approximately 28% for Fiscal 2022, which is consistent with our retail peer group and

compares to a 27% five-year Company average. Associate development is supported through numerous programs, including AEO Academy, an

online training platform that provides eligible associates with continuous learning opportunities. AEO Academy has nearly 2,900 modules, which

aggregate were completed over one million times during Fiscal 2022, with a total of 14.9 million views on the platform since it was launched in

late Fiscal 2019. Our focus on associate development led to a full-time promotion rate of approximately 26% for Fiscal 2022 as compared to a

24% five-year Company average.

INCLUSION, DIVERSITY, EQUITY & ACCESS

At AEO, we believe that our success is the result of our focus on being an inclusive, diverse, equitable and accessible Company. It is about more

than simply bringing together people who are different; it is about celebrating what makes us REAL.

We believe in embedding Inclusion, Diversity, Equity & Access (“IDEA”) into everything we do. Our mission is to achieve sustainable progress

in the pillars of hiring, community, and development through strategic, data-supported, and people-centric action. Our values are at the center of

every decision, product, and interaction. This means making sure that all people are respected and feel that being their authentic selves will not

be a barrier to personal or professional fulfillment and growth.

We are a global company with people from many different backgrounds. In the United States alone, as of January 28, 2023, approximately 44%

of our associates self-identified as people of color (“POC”). Specifically, our United States population is approximately 55% White, 25% Hispanic,

10% Black, 4% Asian, 1% American Indian or Native Hawaiian, 4% two or more races or other, and 1% not reported. Globally, 79% of our

associates self-identified as women.

These numbers reflect a year-over-year increase of 1% in the representation of POC across the organization. These gains were achieved

through increased rates of POC hiring in each of the Company’s business units (Corporate, Stores and Distribution Centers), with increases of

1% in all three business units.

We have three IDEA Pillars. Hiring, Community and Development.

Hiring. AEO believes that a diverse workforce makes us stronger as an organization. We are focused on increasing candidate diversity in our

recruiting process through implementation and execution of policies, processes, practices and strategies focused on inclusion, equity, and

accessibility.

9

Community. Our associates have the freedom to be themselves, uniquely helping to create a vibrant community. We believe that AEO is a place

where our people are excited to come to work, believe in the work that they do, feel valued, and are appreciated for their contributions. At AEO

we also know we not only have the power to touch lives within our Company but also can make a lasting impact in the communities in which we

operate. We know that living our values of People, Innovation, Passion, Integrity and Teamwork will allow us to enrich our internal and external

communities and sustain our inclusive culture.

Development. We believe in the power of equipping our leaders and our associates with the necessary resources to create and maintain an

inclusive workplace, while aiming to advance the careers of associates from historically marginalized groups.

During Fiscal 2022, in addition to increasing the representation of POC throughout the organization, we believe that we made significant progress

on our IDEA initiatives at AEO, including:

• The announcement of our second class of 15 recipients of the Steven Davis Scholarship for Social Justice (renamed in honor of the

late Steven Davis, a Director of the AEO Board who passed away in 2022). The scholarship program is supported by an investment

of $5 million, providing annual full scholarships to 15 associates who are actively driving anti-racism, equality and social justice

initiatives;

• Continuing our commitment to using both qualitative and quantitative data to inform our strategies and priorities, we released an

expanded IDEA survey capturing our entire — population and leveraged information gathered through mandatory inclusive

workplace training programs developed by our training partner Emtrain. These efforts provide us with important data-points to

measure future progress.

• Launching the Structured Hiring process which revamps candidate evaluation for corporate positions to provide a more thoughtful

and standardized approach to hiring, leading to a more equitable, accessible and inclusive process.

• Investing in relationships with both Historically Black Colleges and Universities and underrepresented group student organizations

at Predominantly White Institutions resulting in increased diversity within our Internship and Teammate programs.

• Becoming an original signatory to the Open to All Charter to Mitigate Racial Bias, meant to address the different experiences of

BIPOC customers in retail establishments and the role bias or the perception of bias has on their shopping experiences and

choices.

• Expanding Close Knit, our internal co-mentoring program and PREP, our mentoring and retail enrichment program aimed at

educating college students from historically marginalized groups about opportunities in retail, generally, and AEO specifically.

• The introduction of a LGBTQAI+ associate guide and Transition support resources for transgender associates, developed by

members of The Real Pride Network (AEO’s LGBTQAI+ employee resource group), IDEA Department and AEO Human Resources.

TOTAL REWARDS

Our compensation programs are designed to attract and retain highly skilled, performance-oriented associates who live our brands and embody

the spirit of authenticity and innovation we cultivate. We focus on delivering simple, straightforward compensation programs that our associates

can easily understand. Ensuring that our teams are rewarded for delivering results is a key priority.

We strive to make compensation decisions that are fair and equitable, consistently evaluating compensation through both an internal and

external lens. We focus on internal pay equity and conduct regular benchmarking to ensure competitiveness to the external market.

Our compensation programs are composed of three key elements:

• Competitive base pay rates, which are aligned to specific roles and skills, local market rates, and relevant experience;

10

• Incentive bonuses for full-time associates, which are structured to deliver financial rewards for the delivery of monthly, quarterly, or

annual results; and

• Annual stock awards for over 450 leaders and key individual contributors throughout areas of the business, including the senior

management team, which provide a commonality of interest between our leaders and shareholders.

We recognize that benefits are highly personal, and we offer a broad suite of inclusive plans and programs to our workforce, understanding that

their needs and priorities vary. Starting on their hire, re-hire, or promotion date, our full-time associates have access to a variety of medical,

dental and vision plan offerings. In the United States, our largest market, we also offer the following benefits to our workforce:

• All associates are eligible for the following benefits: comprehensive health and holistic well-being programs, supporting the physical,

emotional, social and financial needs of our associates. Benefit programs include: robust well-being programs and incentives

promoting an active and healthy lifestyle; mental health and meditation benefits; innovative student loan debt benefits; financial well-

being tools and guidance; a gym/online fitness discount program; discounts on AEO merchandise; and a voluntary benefit and

discount platform, offering competitive rates for auto insurance, home/renters insurance, legal services, identity theft services, pet

insurance and more. Upon eligibility, associates can participate in AEO’s Employee Stock Purchase Plan and 401(k) plans.

• Associates that are eligible for AEO’s medical insurance programs: Full-time associates, or part-time associates with an average of

30 hours or more (per ACA’s required initial or standard measurement period), are eligible to enroll in medical insurance on their hire

or rehire date. Associate’s dependents are also eligible to enroll in AEO’s medical insurance programs including dependent

child(ren), and same or opposite-sex spouses or domestic partners. Enhanced benefits offered with medical insurance include:

primary care, behavioral and specialist visits via telehealth to ensure consistent access to convenient, high-quality, low-cost care; a

wide selection of behavioral health programs to support mental health; generous fertility management benefits, adoption and

surrogacy reimbursement for our associates who are focused on expanding their families; digital management programs for chronic

conditions, smoking cessation and digital physical therapy; prescription drug savings programs; access to care navigators and

claims advocacy; gender affirmation support programs; free to low-cost primary and specialist visits at four onsite health care

centers; and

• For all full-time associates: Up to 10 free, confidential in-person or telephonic sessions per issue through the Employee Assistance

Program; paid time off; life insurance, short-term and long-term disability insurance; access to health coaches and lifestyle programs

to assist with managing chronic conditions, nutrition, smoking cessation and weight loss; flexible spending accounts; benefits to

support parents of children with disabilities; neurodiversity inclusion training and resources; mobile apps for fertility, menopause,

maternity, and parenting; support for nursing mothers on business travel; paid parental and caregiver leave; and additional caregiver

programs.

We recognize the importance of supporting AEO’s new parents and caregivers. During Fiscal 2022, AEO made significant enhancements to

parental and caregiver benefits. Full-time associates, after only 30 days of employment, are eligible for up to eight weeks of paid parental leave

upon becoming a new parent. In addition, AEO automatically enrolls full-time associates into employer-paid short-term disability benefits upon

being hired, rehired or promoted into a full-time status. Full-time associates that qualify for benefits under the Family and Medical Leave Act are

also provided with four weeks of paid caregiver leave, to take care of a child, spouse, domestic partner or parent dealing with a serious medical

condition.

As securing child care and backup care in the United States remains challenging, we made the decision to continue child care benefits that offer

support to those working at home, on a waiting list for child care, or those needing backup care. These programs were also expanded to offer

tutoring for grades K-12 and expanded resources to caregivers.

HEALTH AND SAFETY

The health and safety of our workforce and customers are critical to our culture and business. We continue to put our people first in our health

and safety programs for our associates, customers, and partners. AEO's Health and Safety Management Program focuses on accident

prevention, training, and response. Safety is a team effort; all levels of management have responsibilities and are held accountable to the

standards set by the Company.

11

Our efforts are focused on reporting leading indicators, which allow us to be proactive in predicting and preventing accidents from occurring. We

identify leading indicators by conducting observations of our associates working and correcting unsafe behaviors, through coaching, before an

injury can occur. Our efforts are benchmarked and audited annually. The results of the audits are shared with the executive management team,

and appropriate corrective measures are taken to correct any identified deficiencies.

Creating a safe and secure environment allows our associates, customers, and partners to perform efficiently and confidently. We deploy state-

of-the-art technology in screening personnel, vehicles, and the surrounding grounds. Some technology applications use artificial intelligence (AI)

and advanced analytics to enhance awareness and provide early detection of security anomalies that deserve appropriate attention. Our layered

approach to security, coupled with technology, training, and vigilance, ensures AEO, Inc. maintains an environment that is the safest place to

work and shop.

Throughout Fiscal 2022, we have maintained the comprehensive global store playbook to protect our associates and guests from the new

variants of COVID-19 as we evolved to a less restrictive set of protocols to stay in step with the CDC guideline. With the need for sanitizers and

disposable masks being reduced in our stores, distribution centers, and offices, we found other organizations that could benefit and made

donations of 15 million disposable masks to our communities.

Competition

The global retail apparel industry is highly competitive both in stores and online. We compete with various local, national, and global apparel

retailers, as well as the casual apparel and footwear departments of department stores and discount retailers, primarily on the basis of quality,

fashion, service, selection, and price.

Trademarks and Service Marks

We have registered AMERICAN EAGLE OUTFITTERS®, AMERICAN EAGLE®, AE®, AEO®, LIVE YOUR LIFE®, AERIE®, OFFLINE BY

AERIE® and various eagle designs with the United States Patent and Trademark Office. We also have registered or have applied to register

substantially all of these trademarks with the registries of the foreign countries in which our stores, e-commerce sites, and/or manufacturers are

located and/or where our product is shipped.

We have registered AMERICAN EAGLE OUTFITTERS®, AMERICAN EAGLE®, AEO®, LIVE YOUR LIFE®, AERIE®, and various eagle designs

with the Canadian Intellectual Property Office. In addition, we have acquired rights in AE™ for clothing products and registered AE® in

connection with certain non-clothing products.

In the United States and in other countries around the world, we also have registered, or have applied to register, a number of other marks used

in our business, including TODD SNYDER®, TAILGATE®, UNSUBSCRIBED®, AE77®, AIRTERRA™, QUIET LOGISTICS®, and our pocket

stitch designs.

Our registered trademarks are renewable indefinitely, and their registrations are properly maintained in accordance with the laws of the country in

which they are registered. We intend to use, renew, and enforce our trademarks in accordance with our business plans.

Seasonality

Historically, our operations have been seasonal, with a large portion of total net revenue and operating income occurring in the third and fourth

fiscal quarters, reflecting increased demand during the back-to-school and year-end holiday selling seasons, respectively. Our quarterly results of

operations also may fluctuate based upon such factors as the timing of certain holiday seasons, the number and timing of new store openings,

the acceptability of seasonal merchandise offerings, the timing and level of markdowns, store closings and remodels, competitive factors,

weather and general economic and political conditions.

Information About our Executive Officers

Marisa A. Baldwin, age 52, has served as our Chief Human Resources Officer since September 2021. Prior to joining us, Ms. Baldwin served as

Chief Human Resources Officer at Ascena Retail Group/ANN Inc. from November 2019 to May 2021; as Senior Vice President, Human

Resources & Corporate Communications (ANN INC.) from 2015 to 2019; and as Vice President, Human Resources, ANN INC. from 2011 to

2015. Prior thereto, Ms. Baldwin served in human resources leadership roles focused on the growth and expansion of Starbucks Corporation and

building a culture of inclusion at Diageo North America Inc.

12

Jennifer M. Foyle, age 56, has served as our President, Executive Creative Officer – AE and Aerie since June 2021 and as Chief Creative

Officer, AEO Inc. and Global Brand President – Aerie from September 2020 to June 2021. Prior thereto she served as our Global Brand President

- Aerie since 2015. Ms. Foyle served as Executive Vice President, Chief Merchandising Officer - Aerie from February 2014 to January 2015 and

Senior Vice President, Chief Merchandising Officer – Aerie from August 2010 to February 2014. Prior to joining us, Ms. Foyle was President of

Calypso St. Barth from 2009 to 2010. In addition, she was the Chief Merchandising Officer at J. Crew Group, Inc., from 2003 to 2009. Early in her

career, Ms. Foyle was the Women’s Divisional Merchandise Manager for Gap Inc. from 1999 to 2003 and held various roles at Bloomingdales

from 1988 to 1999.

Michael A. Mathias, age 48, has served as our Executive Vice President and Chief Financial Officer since April 2020. Prior thereto, he served

as Senior Vice President, Financial Planning & Analysis from October 2017 to April 2020, and in various key financial and operational roles since

joining us in 1998 through 2014. From 2016 to 2017, Mr. Mathias served as Vice President, Financial Planning and Strategy at General Nutrition

Centers, Inc. From 2014 to 2016, he served as President and Managing Partner of SY Ventures.

Michael R. Rempell, age 49, has served as our Executive Vice President and Chief Operations Officer since June 2012. His current

responsibilities include oversight of our Commercial, Technology, end-to-end Supply Chain, Production and Sourcing, Corporate Strategy, and

Todd Snyder Business. Prior thereto, he served as our Executive Vice President and Chief Operating Officer, New York Design Center, from April

2009 to June 2012, as Senior Vice President and Chief Supply Chain Officer from May 2006 to April 2009, and in various other positions since

joining us in February 2000.

Jay L. Schottenstein, age 68, has served as our Executive Chairman, Chief Executive Officer since December 2015. Prior thereto, Mr.

Schottenstein served as our Executive Chairman, Interim Chief Executive Officer from January 2014 to December 2015. He has also served as

the Chairman of the Company and its predecessors since March 1992. He served as our Chief Executive Officer from March 1992 until

December 2002 and prior to that time, he served as a Vice President and Director of our predecessors since 1980. He has also served as

Chairman of the Board and Chief Executive Officer of Schottenstein Stores Corporation (“SSC”) since March 1992 and as President since 2001.

Prior thereto, Mr. Schottenstein served as Vice Chairman of SSC from 1986 to 1992. He has been a Director of SSC since 1982. Mr.

Schottenstein also has served since March 2005 as Executive Chairman of the Board of Designer Brands Inc. (f/k/a DSW Inc.) (NYSE: DBI) and

formerly served as that company’s Chief Executive Officer from March 2005 to April 2009. He has also served as a member of the Board of

Directors for Albertsons Companies, Inc. (NYSE: ACI) since 2006 to 2022. He has also served as an officer and director of various other entities

owned or controlled by members of his family since 1976.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, as well as

other information that we file with or furnish to the SEC, are available under the Investor Relations section of our website at www.aeo-inc.com.

These reports are available as soon as reasonably practicable, free of charge, after such material is electronically filed with or furnished to the

SEC. Alternatively, you may access these reports at the SEC’s website at www.sec.gov.

Our corporate governance materials, including our corporate governance guidelines: the charters of our audit, compensation, and nominating and

corporate governance committees; and our code of ethics may also be found under the Investor Relations section of our website at www.aeo-

inc.com. A copy of the corporate governance materials is also available upon written request.

Additionally, our investor presentations are available under the Investor Relations section of our website at www.aeo-inc.com. These materials

are available no later than the time they are presented at investor conferences. We have included our website addresses throughout this report

as inactive textual references only. The information on our website or any other websites is not incorporated by reference in this Annual Report

and should not be considered part of this Annual Report.

Item 1A. Risk Factors

Macroeconomic and Industry Risks

Global economic conditions and the effect of economic pressures and other business factors on discretionary consumer

spending and changes in consumer preferences have had and could continue to have a material adverse effect on our

business, results of operations and financial condition.

The uncertain state of the global economy continues to impact businesses around the world, including ours. Inflation and other macroeconomic

pressures in the United States and the global economy such as rising interest rates, energy prices

13

and recession fears are creating a complex and challenging retail environment for us and our customers, and consumers may further reduce

discretionary spending.

If global economic and financial market conditions deteriorate, the following factors could have a material adverse effect on our business,

operating results and financial condition:

• The success of our operations is highly dependent on consumer spending, which can be negatively impacted by economic

conditions as well as factors affecting disposable consumer income such as income taxes, payroll taxes, employment, consumer

debt, interest rates, increases in energy costs and consumer confidence. During Fiscal 2022 interest rates and energy costs

increased, and consumer confidence reached an all time low. Additionally, there are fears of a potential recession during Fiscal

2023. Any of these factors could lead to a decrease in consumer spending. Declines in consumer spending have and, in the future,

may result in decreased demand for our products, increased inventories, lower revenues, higher discounts, pricing pressure and

lower gross margins.

• We may be negatively impacted by changes in consumer preferences and discretionary spending habits such as consumer

behavior reallocating to non-retail discretionary consumer spending.

• We may be unable to access financing in the credit and capital markets at reasonable rates.

• We conduct transactions in various currencies, which creates exposure to fluctuations in foreign currency exchange rates relative to

the United States dollar, in particular the Mexican peso and Canadian dollar. Continued volatility in the markets and exchange rates

for foreign currencies could have a significant impact on our reported operating results and financial condition.

• Continued volatility in the availability and prices for commodities and raw materials we use in our products and in our supply chain

(such as cotton) and related inflationary pressures could have a material adverse effect on our costs, gross margins and profitability.

• If our suppliers or other participants in our supply chain experience difficulty obtaining financing needed for their operations in the

capital and credit markets, it may result in delays or non-delivery of our products.

In uncertain economic environments, we cannot predict whether or when such circumstances may improve or worsen, or what impact, if any,

such circumstances could have on our business, results of operations, cash flows and financial position.

Our inability to anticipate and respond to changing consumer preferences and fashion trends and fluctuations in

consumer demand in a timely manner could adversely impact our business and results of operations.

The specialty retail apparel business fluctuates according to changes in the economy and consumer preferences and trends, which are dictated

by fashion trends and season and may shift quickly. These fluctuations can materially impact our sales and gross margins and are exacerbated

by the fact that merchandise is typically ordered well in advance of a selling season. While we work to identify trends and consumer preferences

on an ongoing basis and offer inventory and shopping experiences that meet such trends and preferences, we may not do so effectively and/or

on a timely basis. As a result, we are vulnerable to changes in consumer demand, pricing shifts and the timing and selection of merchandise

purchases.

Our future success depends, in part, upon our ability to identify and respond to fashion trends and changing consumer preferences in a timely

manner. Lead times for many of our design and purchasing decisions may make it more difficult for us to respond rapidly to new or changing

apparel trends or consumer acceptance of our products. Our failure to enter into agreements for the manufacture and purchase of merchandise

in a timely manner could, among other things, lead to a shortage of inventory and lower sales. Changes in fashion trends, if unsuccessfully

identified, forecasted or responded to markdowns or write-offs, could negatively impact our ability to achieve or maintain profitability and have a

material adverse effect on our business, particularly unanticipated changes such as those that resulted from the COVID-19 pandemic, could also

negatively impact our brand image with our customers and result in diminished brand loyalty.

Seasonality may cause sales to fluctuate and negatively impact our results of operations.

Historically, our operations have been seasonal, with a large portion of total net revenue and operating income occurring in the third and fourth

fiscal quarters, reflecting increased demand during the back-to-school and year-end holiday selling seasons, respectively. Because of this

seasonality, factors negatively affecting us during the third and fourth fiscal quarters of any year, including adverse weather or unfavorable

economic conditions, could have a material adverse effect on our financial condition and results of operations for the entire year. As a result, we

may not be able to accurately predict our

14

quarterly sales. Accordingly, our results of operations are likely to fluctuate significantly from period to period. Our quarterly results of operations

also may fluctuate based upon such factors as the timing of certain holiday seasons, the number and timing of new store openings, the

acceptability of seasonal merchandise offerings, the timing and level of markdowns, store closings and remodels, competitive factors, weather,

and general economic and political conditions.

This seasonality, along with other factors that are beyond our control, including public health events, social or political unrest, general economic

conditions, changes in consumer preferences, weather conditions, including the effects of climate change, the availability of import quotas,

transportation disruptions and foreign currency exchange rate fluctuations, could adversely affect our business and cause our results of

operations to fluctuate.

We operate in a highly competitive industry, and we face significant pricing pressures from existing and new competitors.

The sale of apparel, accessories, intimates, and personal care products is a highly competitive business with numerous participants, including

individual and chain specialty apparel retailers, local, regional, national, and international department stores; discount stores and online

businesses. Changing consumer preferences has resulted and may continue to result in new competition for our products. The substantial sales

growth in the digital channel within the last several years has increased competition due to new entrants in the market and has resulted in pricing

pressures from new entrants and established competitors. Some of these competitors have robust digital consumer experiences and highly

efficient delivery systems. Furthermore, the decrease in mall traffic is putting a greater reliance on the digital channel and thus increasing the

competitive threat.

We face a variety of competitive challenges, including:

• Anticipating and quickly responding to changing consumer demands or preferences better than our competitors;

• Maintaining favorable brand recognition and effective marketing of our products to consumers in several demographic markets;

• Sourcing merchandise efficiently;

• Developing innovative, high-quality merchandise in styles that appeal to our customers and in ways that favorably distinguish us

from our competitors;

• Countering the aggressive pricing and promotional activities of many of our competitors; and

• Anticipating and quickly responding to changing consumer shopping preferences and practices, including the increasing shift to

digital brand engagement, social media communication, and online shopping.

In light of the competitive challenges we face, we may not be able to compete successfully in the future, which may result in lower market share.

Additionally, increases in the number of our competitors could reduce our sales, which in turn could have a material adverse effect on our results

of operations and financial condition.

Our results could be adversely affected by events beyond our control, such as natural disasters, public health crises,

political crises, negative global climate patterns, or other catastrophic events.

Our operations, those of our licensees, our suppliers, or our customers, could be negatively impacted by various events beyond our control,

including, without limitation, natural disasters, such as hurricanes, tornadoes, floods, earthquakes, extreme cold events and other adverse

weather conditions; public health crises, such as pandemics and epidemics (including, without limitation, the ongoing COVID-19 pandemic);

political crises, such as terrorist attacks, war, labor unrest, and other political instability (including, without limitation, the ongoing conflict between

Russia and Ukraine); negative global climate patterns, especially in water-stressed regions; or other catastrophic events, such as fires or other

disasters occurring at our distribution centers or our vendors' manufacturing facilities, whether occurring in the United States or internationally. In

particular, these types of events could impact our supply chain from or to the impacted region and could impact our ability or the ability of our

licensees or other third parties to operate our stores or websites, or could impact our business as a whole if the impacted region includes our

corporate offices. In addition, these types of events could negatively impact consumer spending in the impacted regions or, depending upon the

severity, globally. Disasters occurring at our vendors’ manufacturing facilities could impact our reputation and consumers’ perception of our

brands. To the extent that any of these events occur, our operations and financial results could be adversely affected. In addition, the impacts of

climate change could result in changes in regulations or consumer preferences, which could in turn affect our business, operating results, and

financial condition.

15

Impairment to goodwill, intangible assets, and other long-lived assets could adversely impact our profitability.

Significant negative industry or general economic trends, changes in customer demand for our product, disruptions to our business, and

unexpected significant changes or planned changes in our operating results or use of long-lived assets may result in impairments to goodwill,

intangible assets, and other long-lived assets.

The ongoing COVID-19 pandemic has had, and may in the future have, an adverse effect on our business and results of

operations.

The COVID-19 pandemic has negatively impacted the global economy, disrupted consumer spending and global supply chains, created

significant volatility and disruption of financial markets, and has had an adverse impact on our business and financial performance. The COVID-

19 pandemic also has impacted and may in the future interrupt and further increase costs for our supply chain and could require additional

changes to our operations.

Transportation shortages, labor shortages and port congestion globally have in the past delayed and could in the future delay inventory orders

and, in turn, deliveries to our customers and availability in our company-operated stores and e-commerce sites. These supply chain and logistics

disruptions have impacted our inventory levels and net revenues in prior periods and could impact our financial results in future periods.

The COVID-19 pandemic also directly threatens the health of our associates and consumers. The operation of all of our stores is critically

dependent on our associates who staff these locations. In the event that an associate tests positive for COVID-19, we have had to, and may in

the future have to, temporarily close one or more stores, offices or distribution centers for cleaning and/or quarantine one or more associates, or

due to the unavailability of impacted associates, which could negatively impact our financial results.

The extent of the impact of the COVID-19 pandemic on our business will depend on future developments, which remain highly uncertain and

difficult to predict, including the duration, severity and sustained geographic spread of the pandemic; additional waves of increased infections; the

virulence and spread of different strains of the virus; and the extent to which associated prevention, containment, remediation and treatment

efforts, including global vaccination programs and vaccine acceptance, are successful.

Strategic Risks

Our inability to grow our digital channels and leverage omni-channel capabilities could adversely impact our business.

We have made and expect to continue to make significant investments in building our technologies and digital capabilities in three key areas:

mobile technology, digital marketing, and the digital customer experience. We have made significant capital investments in these areas but there

is no assurance that we will realize expected returns on those investments or be successful in growing our digital channels.

As omni-channel retailing continues to evolve, our customers are increasingly more likely to shop across multiple channels that work in tandem to

meet their needs. In addition, our competitors are also investing in omni-channel initiatives, some of which may be more successful than our

initiatives. Our inability to respond to changes in consumer behavior and our competitive environment, or to successfully maintain and expand our

omni-channel business may have an adverse impact on our results of operations. See “— Operational Risks — Our failure to manage growth in

our omni-channel operations and the resulting impact on our distribution and fulfillment networks may have an adverse effect on our results of

operations.”

Failure to define, launch and communicate a brand-relevant customer experience could have a negative impact on our

growth and profitability.

We strive to build strong emotional connections with our customers and to enrich the customer experience. If our marketing and customer

experience programs, including our loyalty program, are unsuccessful, or if our competitors are more effective with their programs than we are,

our growth and profitability may be negatively affected.

16

Our efforts to execute on our key business priorities could have a negative impact on our growth and profitability.

Our success depends on our ability to execute on our key priorities. Achieving these key business priorities depends on us executing our

strategies successfully, and the initiatives that we implement in connection with these goals may not resonate with our customers, or be

successful in achieving their intended goals. It may take longer than anticipated to generate the expected benefits of our initiatives, and there can

be no guarantee that pursuing these key priorities will result in improved operating results or achievement of a given priority. Misalignment and

competing initiatives could result in inefficiencies, erroneously prioritized efforts, and resource dilution. Failure to implement our key business

priorities successfully could have a negative impact on our growth and profitability.

Our current international operations and efforts to further expand internationally expose us to risks inherent in operating

in other countries.

We are actively pursuing additional international expansion initiatives, which include Company-owned stores and stores operated by third parties

through licensing arrangements in select international markets. The effect of international expansion arrangements on our business and results of

operations is uncertain and will depend upon various factors, including the demand for our products in new markets internationally. Furthermore,

although we provide store operation training, literature and support, to the extent that a licensee does not operate its stores in a manner

consistent with our requirements regarding our brand and customer experience standards, our business results and the value of our brand could

be negatively impacted.

As we pursue our international expansion initiatives, we are subject to certain laws, including the Foreign Corrupt Practices Act, as well as the

laws of the foreign countries in which we operate, which may impose new or changing regulatory restrictions and requirements, including in the

areas of data privacy, sustainability and responses to climate change. Violations of these laws could subject us to sanctions or other penalties

that could have an adverse effect on our reputation, operating results and financial condition.

A failure to implement our expansion initiatives properly, or the adverse impact of political or economic risks in our current or new international

markets, could have a material adverse effect on our results of operations and financial condition. In certain international markets we have

limited prior experience operating our Company-owned stores, and in all international markets we face established local and international

competitors. In many of these locations, the real estate, labor and employment, transportation and logistics and other operating requirements

differ dramatically from those in the locations where we have more experience. Consumer demand and behavior, as well as tastes and

purchasing trends, may differ substantially, and, as a result, sales of our products may not be successful, or the margins on those sales may not

be in line with those we currently anticipate. Our potential inability to anticipate and address differences that we encounter as we expand

internationally may divert financial, operational, and managerial resources from our existing operations, which could adversely impact our

financial condition and results of operations. In addition, we are increasingly exposed to foreign currency exchange rate risk with respect to our

revenue, profits, assets, and liabilities denominated in currencies other than the United States dollar. The instruments we may use to hedge

certain foreign currency risks in the future may not succeed in offsetting all of the negative impact of foreign currency rate movements on our

business and results of operations.

Operational Risks

Our failure to protect our reputation could have a material adverse effect on our brands.

Our business depends on the value and reputation of our brands and our ability to anticipate, identify, and respond to consumer demands and

preferences, and to fashion trends. In addition, the increasing use of social media platforms allows for rapid communication and any negative

publicity related to the aforementioned concerns may reduce demand for our merchandise. Public perception about our products or our stores,

whether justified or not, could impair our reputation, involve us in litigation, damage our brands and may adversely impact our business, results of

operations, and financial condition.

The appeal of our brands may also depend on the success of our environmental, social and governance ("ESG") initiatives, which require

company-wide coordination and alignment. We are working to manage risks and costs to us, our licensees and our supply chain that are exposed

to the effects of climate change as well as diminishing fossil fuel and water resources. These risks include any increased public focus, including

by governmental and non-governmental organizations, on climate change and other environmental sustainability matters, including packaging

and waste, animal welfare, and land use. We may receive increased pressure to expand our disclosures in these areas, make commitments, set

targets or establish additional goals and take actions to meet them, which could expose us to market, operational and execution costs or risks.

The metrics we disclose in our ESG report, such as emissions and water usage, whether they be based on the standards

17

we set for ourselves or those set by others, may influence our reputation and the value of our brand. Our failure to achieve progress on our

metrics on a timely basis, or at all, could adversely affect our business, financial performance, and growth. By electing to publicly set and share

these metrics and expand upon our disclosures, we may also face increased scrutiny related to ESG activities. As a result, we could experience

damage to our reputation and the value of our brands if we fail to act responsibly in the areas in which we report. Any such harm to our reputation

or any failure or perceived failure by us to adequately address ESG-related activities, including setting of metrics or enhancing disclosures, could

adversely affect our business, financial performance, and growth.

Our failure to manage growth in our omni-channel operations and the resulting impact on our distribution and fulfillment

networks may have an adverse effect on our results of operations.

Increasingly, consumers are using mobile-based devices and applications to shop online with us and with our competitors, and to do comparison

shopping, as well as to engage with us and our competitors through digital services and experiences that are offered on mobile platforms. In

Fiscal 2022, digital sales represented 36% of our total revenue. In order to grow and remain competitive, we will need to continue to adapt to

future changes in technology to address the changing demands of consumers. Any failure on our part to provide attractive, effective, reliable,

secure, user-friendly digital commerce platforms that offer a wide assortment of merchandise with rapid delivery options and that continually meet

the changing expectations of online shoppers or any failure to provide attractive digital experiences to our customers could place us at a

competitive disadvantage, result in the loss of digital commerce and other sales, harm our reputation with consumers, have a material adverse

impact on the growth of our digital commerce business globally and have a material adverse impact on our business and results of operations.

Our omni-channel operations are subject to numerous risks that could have a material adverse effect on our results. Risks include, but are not

limited to, the difficulty in recreating the in-store experience; our ability to anticipate and implement innovations in technology and logistics in

order to appeal to existing and potential consumers who increasingly rely on multiple channels to meet their shopping needs; and the failure of

and risks related to the systems that operate our web infrastructure, websites and the related support systems, including computer viruses, theft

of consumer information, privacy concerns, telecommunication failures and electronic break-ins and similar disruptions.

Our failure to maintain efficient and uninterrupted fulfillment operations could also have a material adverse effect on our results. The satisfaction

of consumers who shop online depends on their timely receipt of merchandise. If we encounter difficulties with our distribution facilities, or if the

facilities were to shut down for any reason, including as a result of fire, natural disaster or work stoppage, we could face shortages of inventory,

incur significantly higher costs and longer lead times associated with distributing our products to consumers, and cause consumer dissatisfaction.

Any of these issues could have a material adverse effect on our operations, financial condition and cash flows.

Our inability to implement and sustain adequate information technology systems could adversely impact our profitability

and the loss of disruption of information technology systems could have a material adverse effect on our business.

Our information technology systems are an integral part of our strategies in efficiently operating our business, in managing operations and

protecting against security risks related to our electronic processing and transmitting of confidential consumer and associate data. The

requirements to keep our information technology systems operating at peak performance may be higher than anticipated and could strain our

capital resources, management of any system upgrades, implementation of new systems and the related change management processes

required with new systems and our ability to prevent any future information security breaches. We regularly evaluate our information technology

systems and are currently implementing modifications and/or upgrades to the information technology systems that support our business.

Modifications include replacing legacy systems with successor systems, making changes to legacy systems, or acquiring new systems with new