Study of the Connecticut Homeowner Insurance Market

And Coastal Affordability and Availability

Katharine L. Wade

Insurance Commissioner

January 12, 2017

Our homes are among our most important investments. The ability to access homeowners

insurance helps us protect that investment from a variety of risks that exist in Connecticut

– from coastal storms to severe winter weather. All homeowners benefit when there is a

competitive insurance market in the state. Competition means more choices with plans that

best suit your needs and your budget.

The Connecticut Insurance Department (CID) has taken the pulse of the market in a data

collection that took place over multi-year period stretching from 2013 through June 2015.

We wanted to make sure that carriers were writing policies in all corners of the state and

that the impacts of recent damaging weather events – Tropical Storm Irene, Superstorm

Sandy and record winters – did not have a detrimental effect on the availability of

coverage, particularly for coastal homeowners.

The CID worked with the National Association of Insurance Commissioners (NAIC) to

compile information from a voluntary data call of 94 homeowner insurance companies in

the traditional Personal Lines Homeowner market. The data included the number of

policies for each carrier and where those policies were issued. We also tracked premium

rates over the last three years. The CID reviews rates proposed by a company to ensure

they are actuarially justified and reports those results annually. CID reviews have helped

save homeowners more than $56 million in premium increases since 2012.

Some highlights of the report include:

• 65% of all new business written in 2014 was in the coastal counties

• Average CT premium for new policies has increased by 6.5% since 2013

• Average CT premium for new coastal policies had decreased by 1.4% between

2013 and mid-2015

• Since 2010, 19 new licensed insurers have begun or expanded their homeowners

business in Connecticut.

Our data show that the homeowners market remains competitive throughout the state and

with new carriers entering the state, there is availability along the coast. The CID will

continue to closely monitor availability, particularly in areas where this report has

identified trends that may affect future availability and affordability issues.

The CID is committed to our mission of protecting the insurance consumer. I encourage

anyone with questions or concerns about their insurance to contact the CID either

online or

by phone at 800-203-3447.

Katharine L. Wade

Insurance Commissioner

Background

A previous CID study on the availability of coastal homeowners insurance was issued

in December 2006. That study focused solely on availability. The report identified three

main factors that contributed to availability concerns for property owners who lived certain

distances from the shoreline. They were:

• More conservative reviews of insurers by rating agencies

• Cost and availability of reinsurance

• Enhanced and more detailed catastrophe models

Based on our more recent study, it is clear that those three factors no longer have the

same impact on narrowing coverage availability as had been the case in 2006. This is due

primarily due to the increased availability and affordability of reinsurance

1

, and the

industry’s development of other risk-transfer innovations which have resulted in greater

capacity in the retail homeowners market.

Although not a new factor in coverage availability, companies still depend on

catastrophe models and continue to fine tune those models. Rating agencies, regulators and

in-house risk managers all conduct financial stress tests on carriers to ensure they are

adequately capitalized to withstand the impacts of significant events.

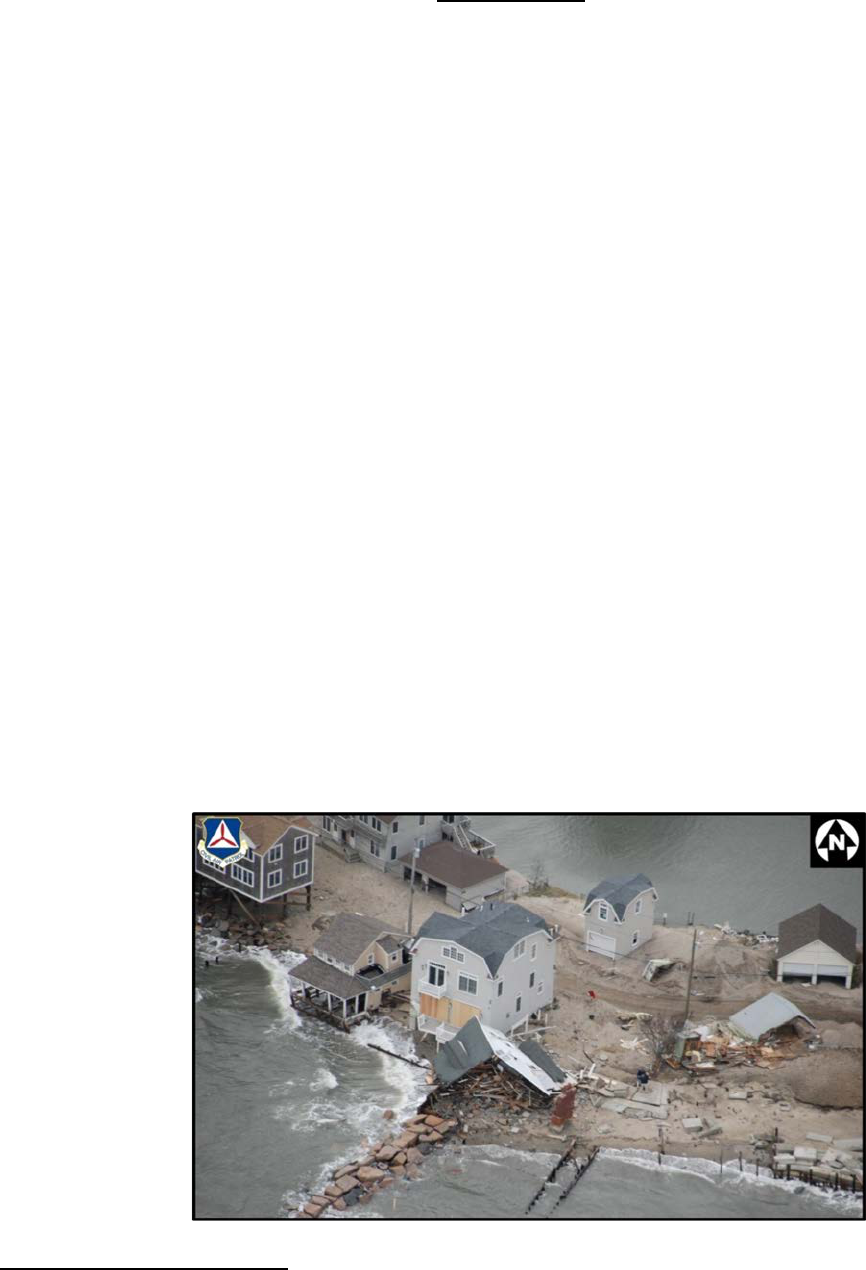

Since that 2006 report, the state has experienced several significant weather events over

a period of several years that caused significant damage in all corners of the state.

1

Reinsurance cost and availability became very difficult following 2004 and 2005 hurricane seasons. Florida, which was hit by

four hurricanes in 2004: Charley, Frances, Ivan, and Jeanne, was impacted again by several more in 2005 including Dennis,

Katrina, Rita, and Wilma.

The events underscored the big risks inherent in this small New England state:

• $675 billion worth of property insured on CT coastline, 6th highest of 18 Atlantic

states

• 64% of all insured property in the state is on the coastline, 3rd behind FL and NY

• Nearly 60% of CT is forested and the state is among the most densely populated

In 2011, Tropical Storm Irene and a powerful October nor’easter struck within two

months of each other. A year later in 2012 Superstorm Sandy, a storm of historic

proportions, slammed Connecticut again. The state also experienced record winter

snowfalls that collapsed roofs and pipe-bursting extreme cold around the same time.

Insurers paid more than $1 billion in claims from those events. Until 2014, carriers in

the state-regulated market could decline new business if a homeowner didn’t have pre-

drilled or cut plywood on the premises for windows to mitigate future losses. State

lawmakers responded with public policy changes in

Public Act No. 14-175 that, in part,

prohibited this practice to ensure homeowners could obtain insurance without the plywood

conditions.

In the wake of the weather events, public policy changes and other factors, the CID felt

it necessary to re-examine the market with a voluntary data call of state-regulated Personal

Lines homeowner carriers in Connecticut.

This study was compiled with the assistance of the NAIC and presents the findings of

that data call and other market trends.

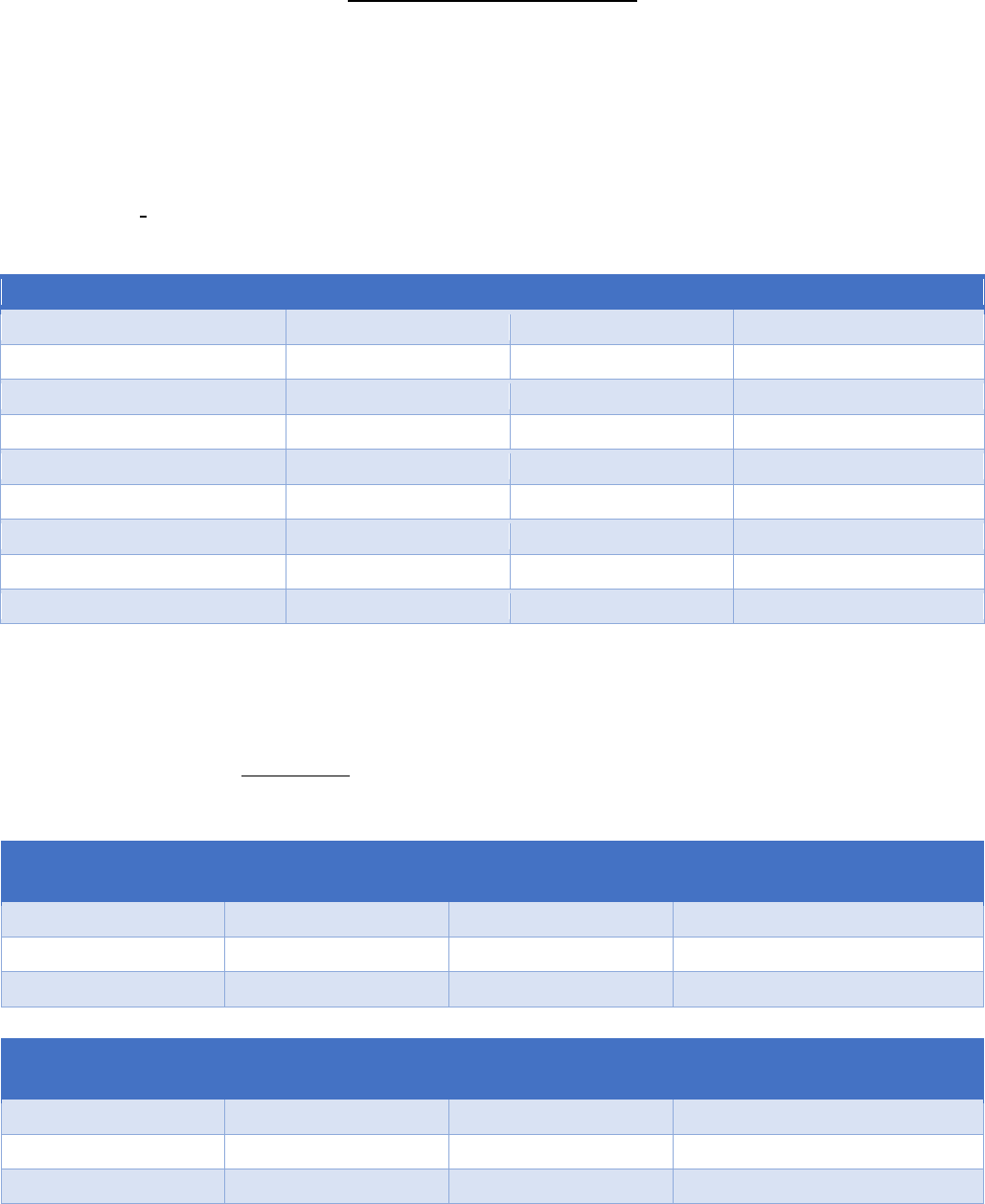

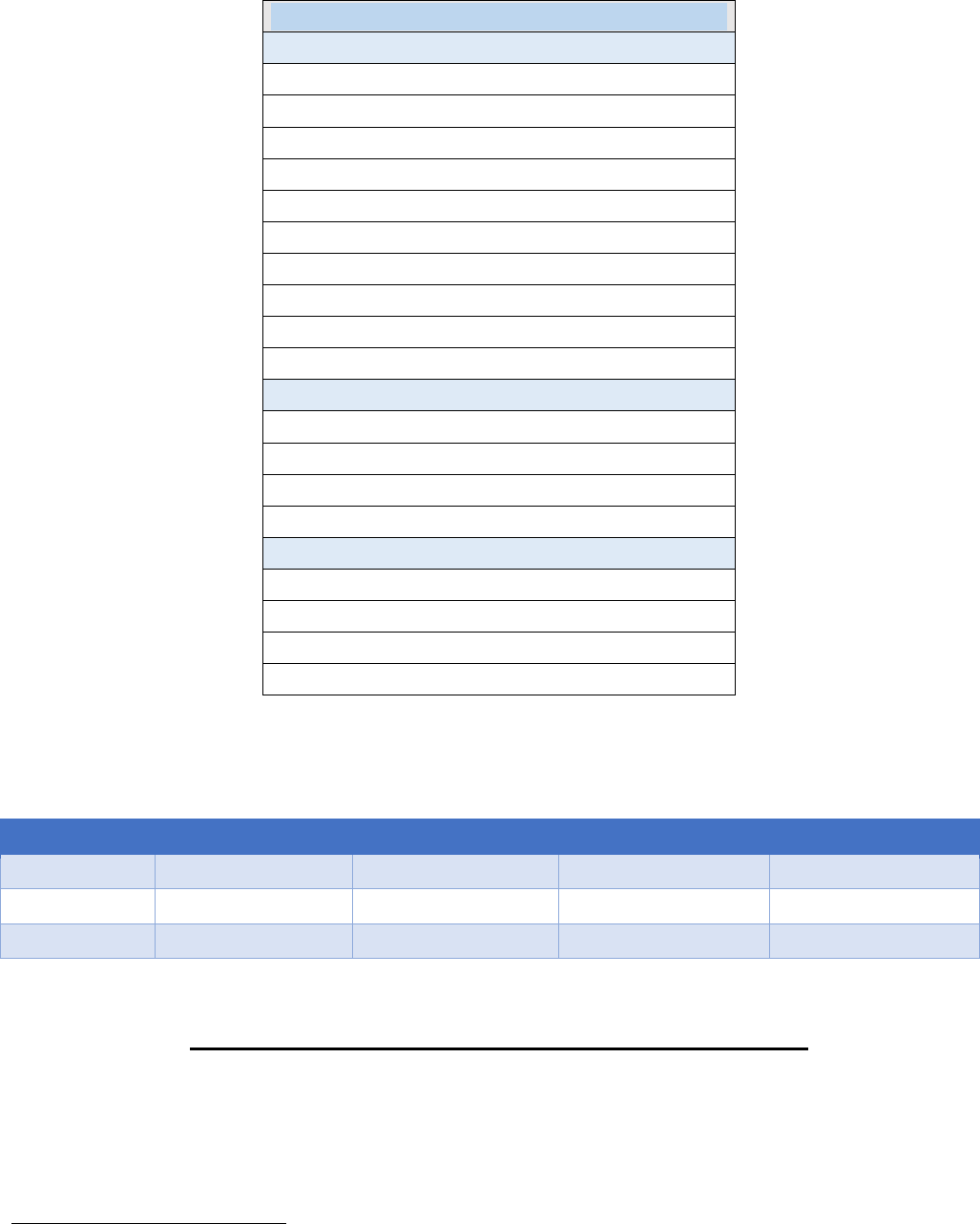

2015 Data Call Summary

The following is a summary of the survey. The full NAIC analysis of the data is

attached as Exhibit 1 of this report.

Companies: Breakdown of the types of companies surveyed. A captive agent is an

insurance agent who works exclusively for one company.

Type of Company

Group

Company

Mutual – Agent/Captive

5

8

Mutual – Agent/Independent

17

22

Mutual – Direct

5

7

Mutual Totals

27

37

Stock – Agent/Captive

3

4

Stock – Agent/Independent

18

44

Stock – Direct

6

9

Stock Totals

27

57

Grand Totals

54

94

Premiums average (2013-2015) The average premium for new policies increased 6.5

percent statewide and decreased

1.4 percent on the coast. The average premium for

renewed policies increased 8.4 percent statewide and 9 percent on the coast.

New Business

2013 Average

Premium

2014 Average

Premium

2015 Average Premium

Coastal

$1,701

$1,716

$1,678

Non-Coastal

$1,070

$1,119

$1,149

Statewide

$1,170

$1,214

$1,246

Renewals

2013 Average

Premium

2014 Average

Premium

2015 Average Premium

Coastal

$2,111

$2,221

$2,301

Non-Coastal

$1,340

$1,399

$1,453

Statewide

$1,485

$1,551

$1,610

New entrants to the CT homeowners market:

New Carriers entering CT Homeowner Market

2012

Universal North American

American Commerce

ACE

Pacific Specialty

Old Dominion

Ohio Mutual

AAA

Fidelity National

PURE

Cincinnati Companies

2015

MapFre

Stillwater

United Property & Casualty

National Specialty

2016

Narragansett

Ironshore

AM Trust

Nationwide

Change in number of companies writing homeowner insurance on the coast:

Fairfield County

Middlesex County

New Haven County

New London County

2013

43

42

43

44

2014

46

42

45

44

2015

42

39

44

44

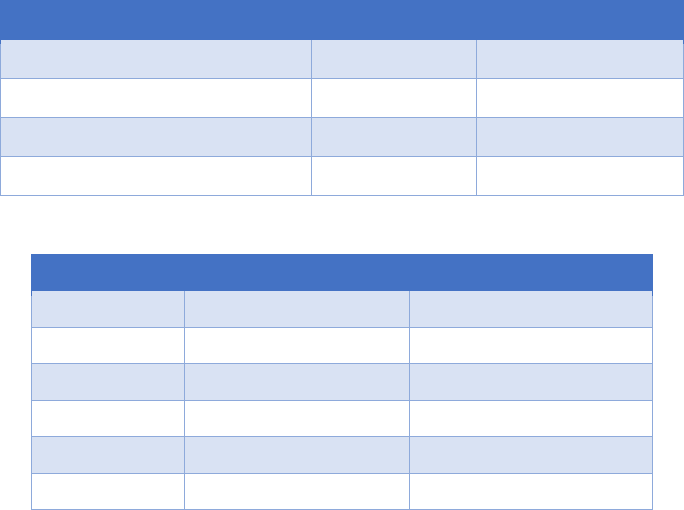

Market Trends – Claims costs, rates and underwriting

Since 2011 Connecticut direct written premium (DWP) has grown from $1.12 billion to

$1.40 billion

2

which represents 25 percent growth. Most of this growth is due to rate

increases following the weather events the state experienced starting in 2010. The charts

2

A.M. Best Market Share report

below show the storm impacts on claims costs and the average rate increase requests that

carriers filed with the CID since 2010.

Storm

Claims

Claims Paid

Sandy (2012)

62,000

$493 million

Irene (2011)

60,000

$235 million

October Nor’easter (2011)

93,000

$247 million

Winter 2010-2011

n/a

$165 million

Year

Requested Increase

Approved Increase

2010

9.1%

8.1%

2011

4.7%

4.3%

2012

12.4%

9.7%

2013

8.5%

7.9%

2014

6.8%

4.8%

2015

4.6%

4.0%

Rate requests – CID rate reviews saved policyholders nearly $57 million

Industry Underwriting and Marketing Trends:

Carriers have filed with the Department various restrictive criteria in an effort to

mitigate exposure. Carriers attempt to back up their requirements by using models that

calculate storm surge potential and the damage that could occur to homes in certain

locations and elevations, called predictive modeling. For example, some sought to mitigate

their losses on damaged roof claims by paying based on the age of the roof or limiting the

settlement to the actual cash value. The CID has disapproved many of these filings

because a homeowner policy in Connecticut is a replacement cost policy. While the CID

understands the need for predictive modeling it is essential that the practice not be

discriminatory nor impede the availability of homeowner insurance.

Insurance agents marketing the policies for the carriers also provided anecdotal

information on availability of coverage on the shoreline. CID staff visited with agents in

each of the four coastal counties and learned that since the implementation of P.A. 14-175

in 2014 placing homeowner business in nearly all counties has been much easier. The CID

continues to monitor the issue and will begin a market conduct investigation if there is any

indication that carriers are directing agents to discourage placing new business on the

coast.

Coverage Through Non-Traditional Markets

The CID also has examined trends in the non-traditional markets such as Excess &

Surplus Lines (E&S), which is not regulated by the CID and the FAIR Plan, the plan of

“last resort.”

The

FAIR Plan does not compete in the voluntary market. It is an insurance association

that provides coverage for property owners who have been unable to obtain it elsewhere.

The policies have generally higher average premiums and provide limited coverage,

significantly lower than that found in the standard market. Since 2007, the number of

policies issued by FAIR Plan has been decreasing:

Year

No. of FAIR Plan Policies

Written Premium

2016

2,345

$3.22M

2015

2,538

$3.47M

2014

2,779

$3.67M

2013

2,829

$3.48M

2012

2,964

$3.29M

2010

3,178

$3.30M

2009

3,436

$3.23M

2008

3,817

$3.51M

2007

4,207

$3.90M

The E&S market is also a market of last resort. The carriers whose policies are placed

through the E&S market are not admitted in Connecticut, meaning the carriers and the

products in this market are not regulated by the CID to the same extent the admitted

personal and commercial markets are. Therefore consumers do not have the same

regulatory protections afforded to policyholders within the traditional or “admitted”

market and may also be offered policies with less coverage than required in the admitted

market. For example, a homeowner with an E&S policy is not protected by the Guaranty

Fund, should the carrier become insolvent. It is important for homeowners to be aware of

the regulatory distinction between the traditional and non-traditional markets. There have

been indications, however, that the E&S homeowners’ market has been growing, and this

is a trend the CID will be closely monitoring. The CID encourages homeowners to talk to

their agents or contact the CID with any questions.

Ensuring Future Availability & Affordability of Coverage

Based upon our findings, the homeowners market is currently competitive throughout

Connecticut, including the coastline. New carriers continue to enter the state and provide

consumers with competitive choices. However, the CID has identified some potential areas

of concern that require regulatory vigilance to ensure the market remains robust. Those

areas are:

Credit Ratings

An insurance company’s access to capital is linked to its credit rating. Additionally,

financial resilience, along with the continued ability to market products, are affected by a

company’s credit rating and its financial strength rating. The higher the credit rating, the

greater flexibility a company has to acquire additional capital when necessary. Access to

new capital can be vital in order for a company to continue to pay claims and remain

solvent after a catastrophic event. The Department will continue to monitor changes to

rating agencies’ standards to gauge how they may affect company ratings.

Excess & Surplus Lines Trend

The passage of Public Act 14-175 was intended to provide more coastal homeowners with

greater access to the admitted (i.e., fully regulated) market by prohibiting carriers from

refusing to issue or renew a homeowners’ policy simply because the homeowner did not

have pre-drilled and cut plywood on the premises or any type of storm shutters installed on

the house. However, the CID has identified some growth in the E&S market as the overall

premium volume has increased. One driver of such growth could be that premiums are

generally lower for the pared down offerings in an E&S homeowner policy. The CID

believes that the pricing dynamic may be inducing many consumers or their brokers to

seek out this “non-admitted” market, despite the reduced coverage and lack of Guaranty

Fund protection. As a result, the CID will include E&S carriers in subsequent data calls for

purposes of assessing availability and affordability of homeowner policies.

The CID will continue to monitor the business practices of agents, reminding them moving

a customer into the E&S market because of lower premium is not an acceptable reason for

leaving the admitted market and ultimately jeopardizes consumer protection.

Coastal Business Practices

The CID will continue to ensure that neither insurance carriers nor their agents are

engaging in business practices that discourage the marketing of policies along the coast.

The CID will remind the industry that this practice is unacceptable and may result in

market conduct investigations and penalties.

Exhibit 1

NAIC Analysis of Connecticut Homeowner Insurance Data Call

Connecticut Homeowner

Market Study

2016

Introduction & Background

The reason for the study is to determine the availability and affordability of homeowners

insurance along the coast of Connecticut.

A total of 94 companies submitted their information for this study. Forty-four companies

classified themselves as Stock-Agent/Independent, 22 Mutual-Agent/Independent, 9 Stock-

Direct, 8 Mutual-Agent/Captive, 7 Mutual-Direct, and 4 Stock-Agent/Captive.

This study will take a look at the total business written across the state as well as and in

comparison to business written in the coastal zip codes, as provided by the Connecticut

Department of Insurance.

The NAIC obtained all information contained in the study from companies who submitted

individual company data in a prescribed format.

The accuracy of the reports included in this publication depends on the accuracy of the

information contained in the company submissions. While the NAIC exercises a great deal of

care in validating and capturing data, as with any statistical project, errors can occur.

Consequently, the NAIC makes no representations or warranties with respect to the accuracy

of the data and statistics in this report.

2

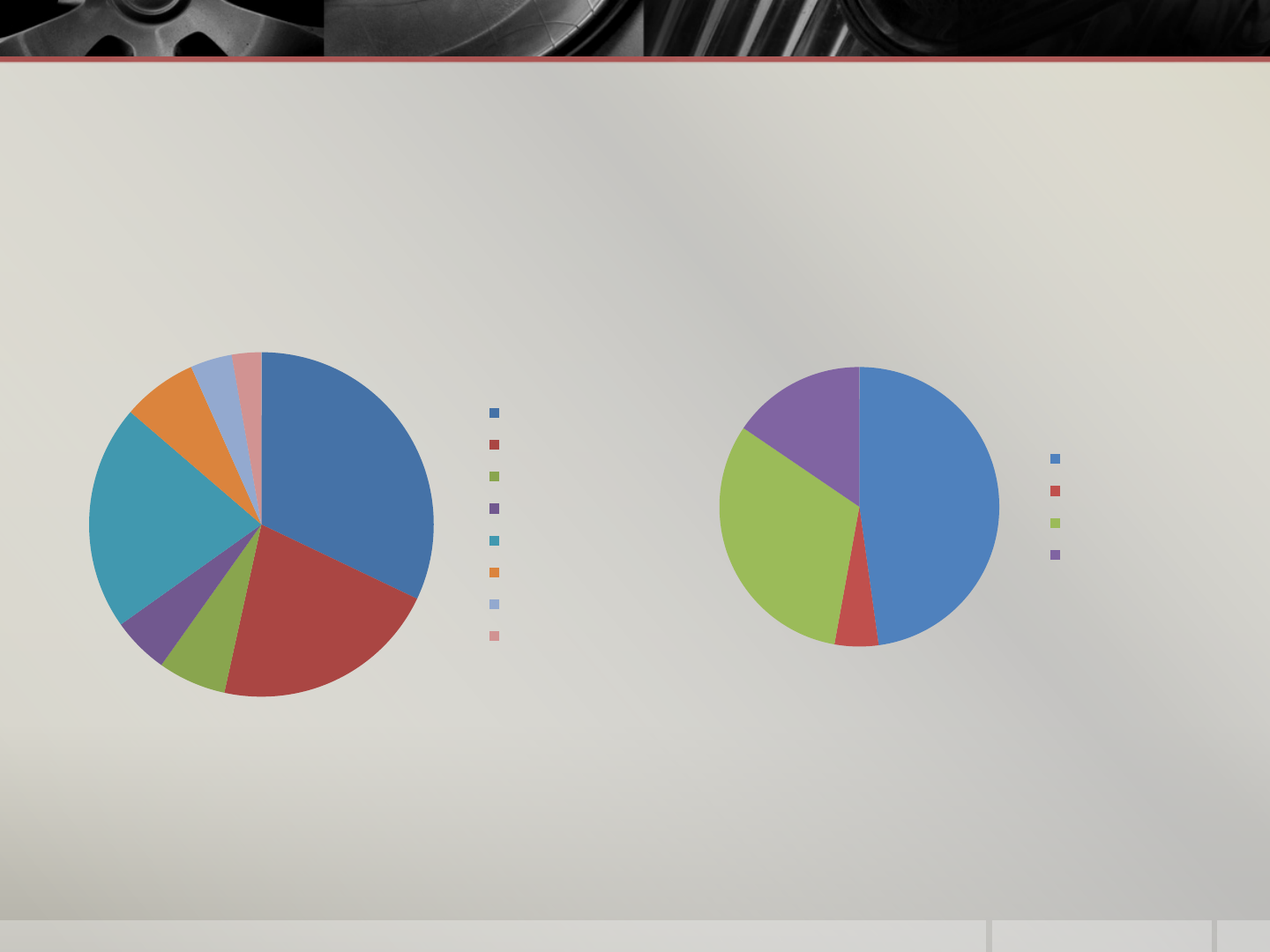

2014 New Business Written

65% of all new business written in 2014

was in the coastal counties.

Approximately 50% of business written in

the coastal zip codes is in Fairfield County.

New 2014 Written Premium

3%

4%

7%

32%

21%

5%

21%

7%

Fairfield County

Hartford County

Litchfield County

Middlesex County

New Haven County

New London County

Tolland County

Windham County

New 2014 Written Premium -

Coastal Zip Codes

15%

48%

32%

5%

Fairfield County

Middlesex County

New Haven County

New London County

3

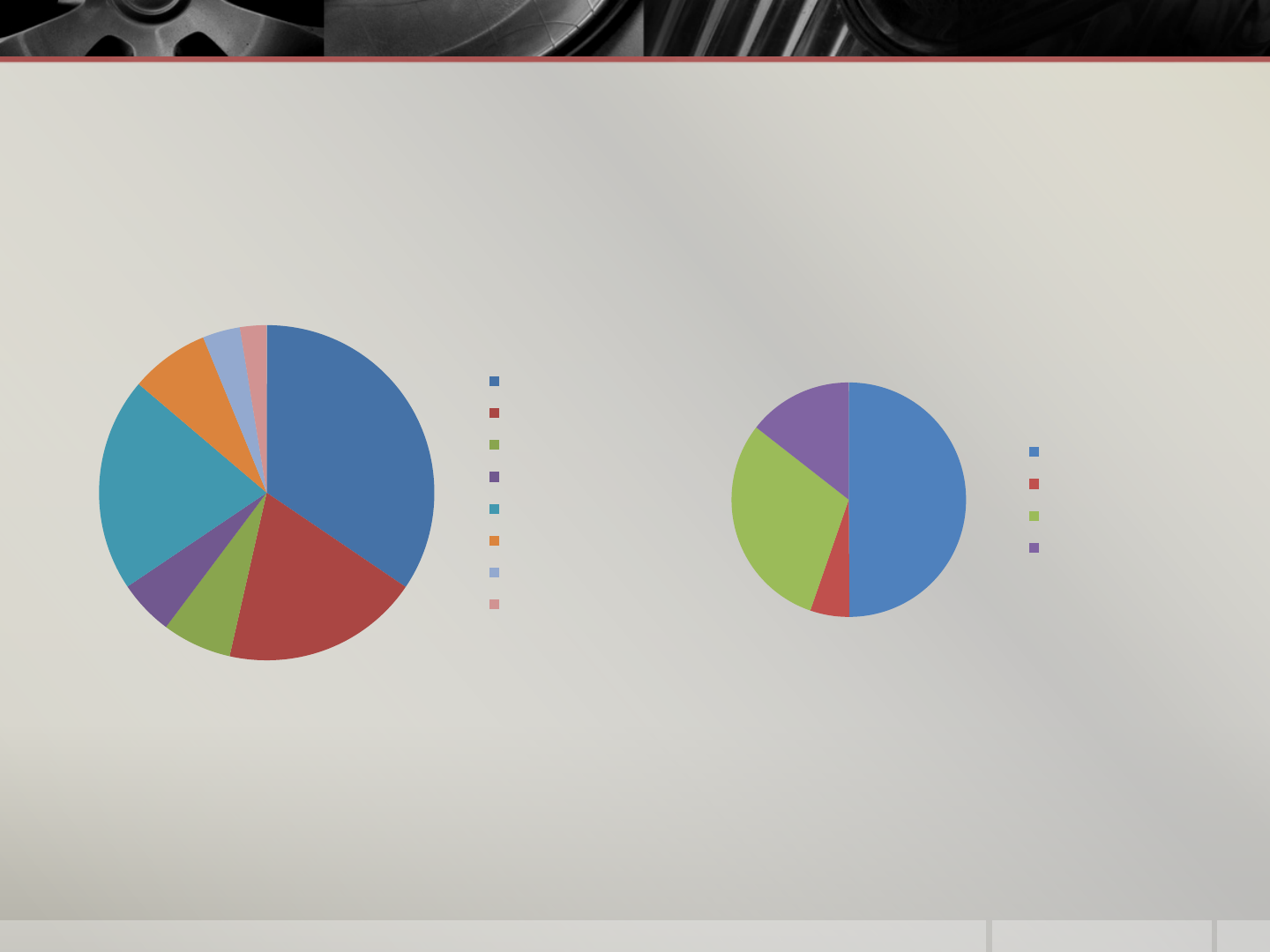

2014 Renewal Business Written

68% of all renewal business written in

2014 was in the coastal counties.

Approximately 50% of business written

in the coastal zip codes is in Fairfield

County.

Renewal 2014 Written

Premium - Coastal Zip Codes

15%

50%

30%

5%

Fairfield County

Middlesex County

New Haven County

New London County

4

2014 Renewal Written Premium

4%

2%

8%

34%

21%

5%

7% 19%

Fairfield County

Hartford County

Litchfield County

Middlesex County

New Haven County

New London County

Tolland County

Windham County

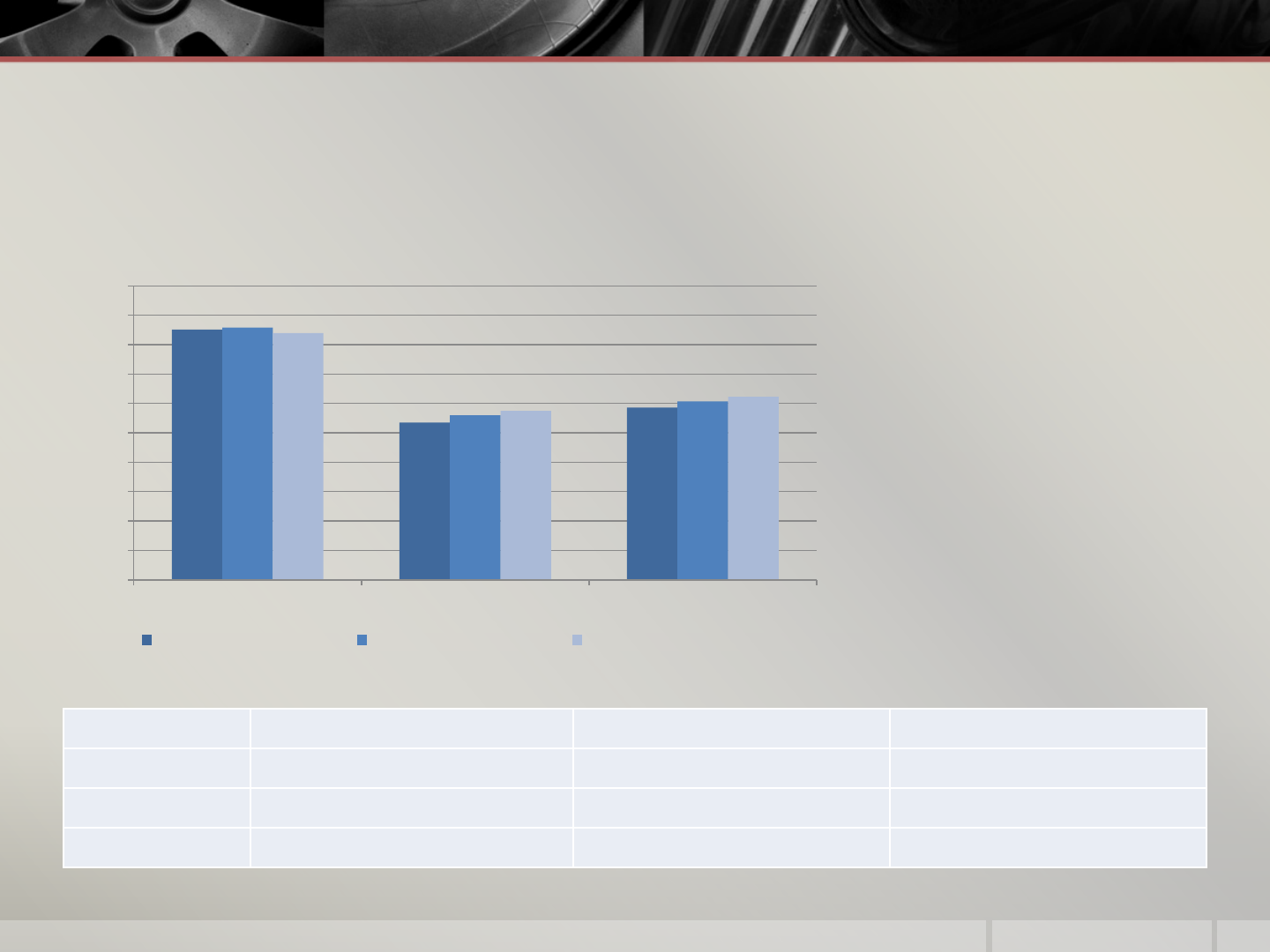

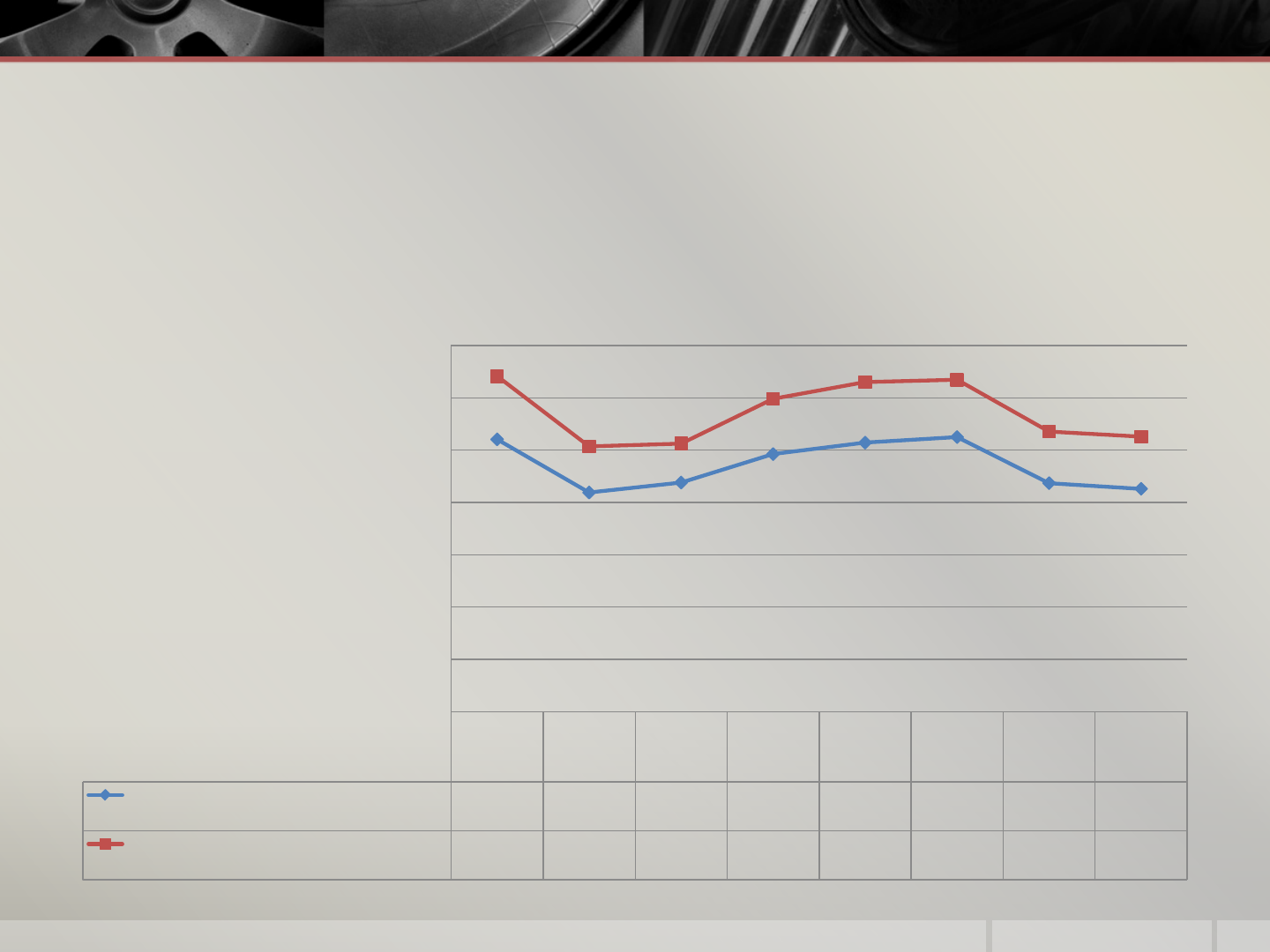

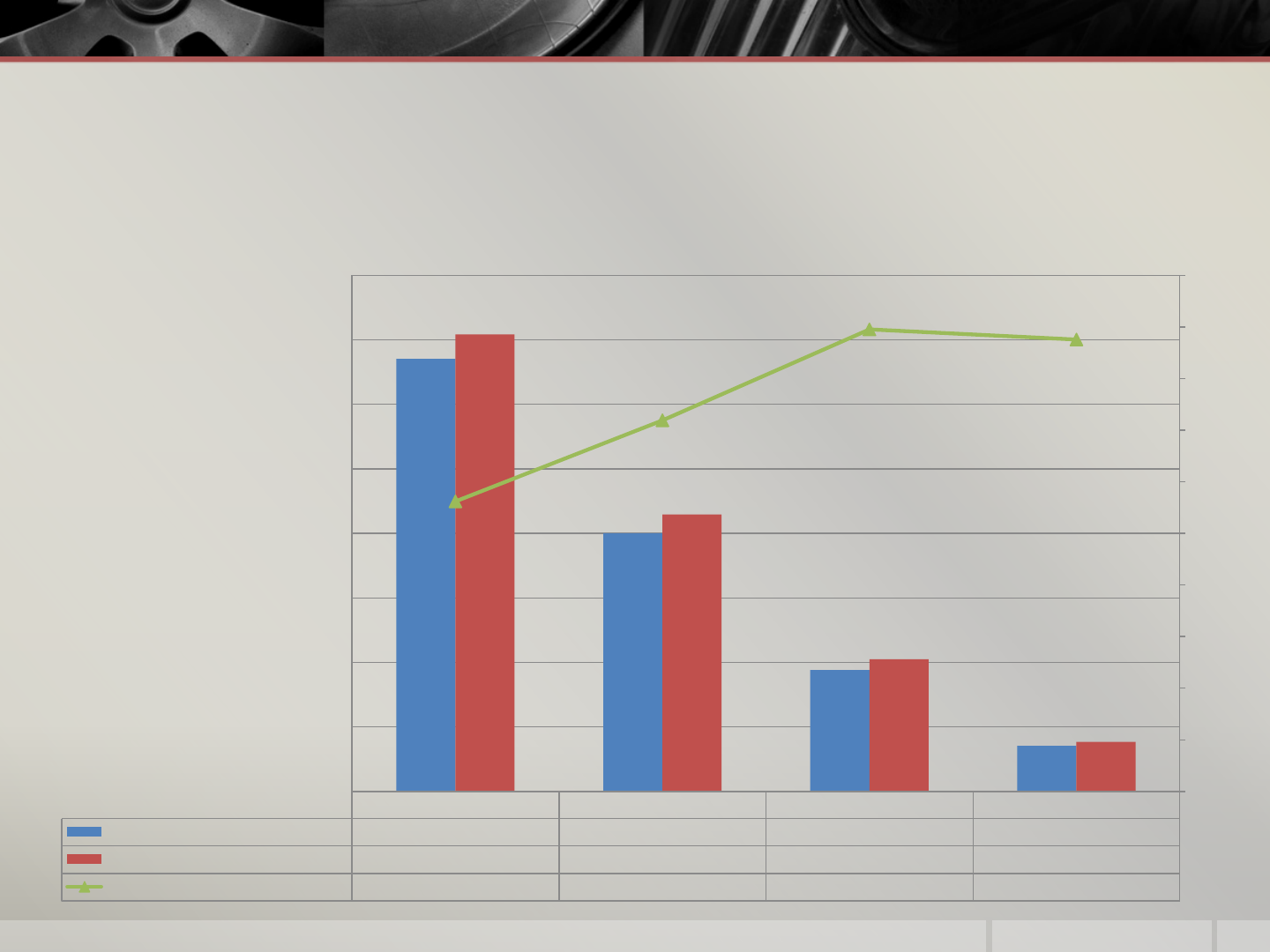

Average Premiums for New Written Premium

Average premium cost has

increased by 6.5% over the

past three years for the state.

Average premium cost in

coastal zip codes has

decreased by 1.4% over the

past three years.

*2015 represents 6 months of

data.

NEW BUSINESS

2013 Average Premium 2014 Average Premium 2015 Average Premium

Coastal

$1,701 $1,716 $1,678

Non

-Coastal

$1,070 $1,119 $1,149

Statewide

$1,170 $1,214 $1,246

5

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

Coastal Non-Coastal Statewide

Average New Premiums

2013 Average Premium 2014 Average Premium 2015 Average Premium

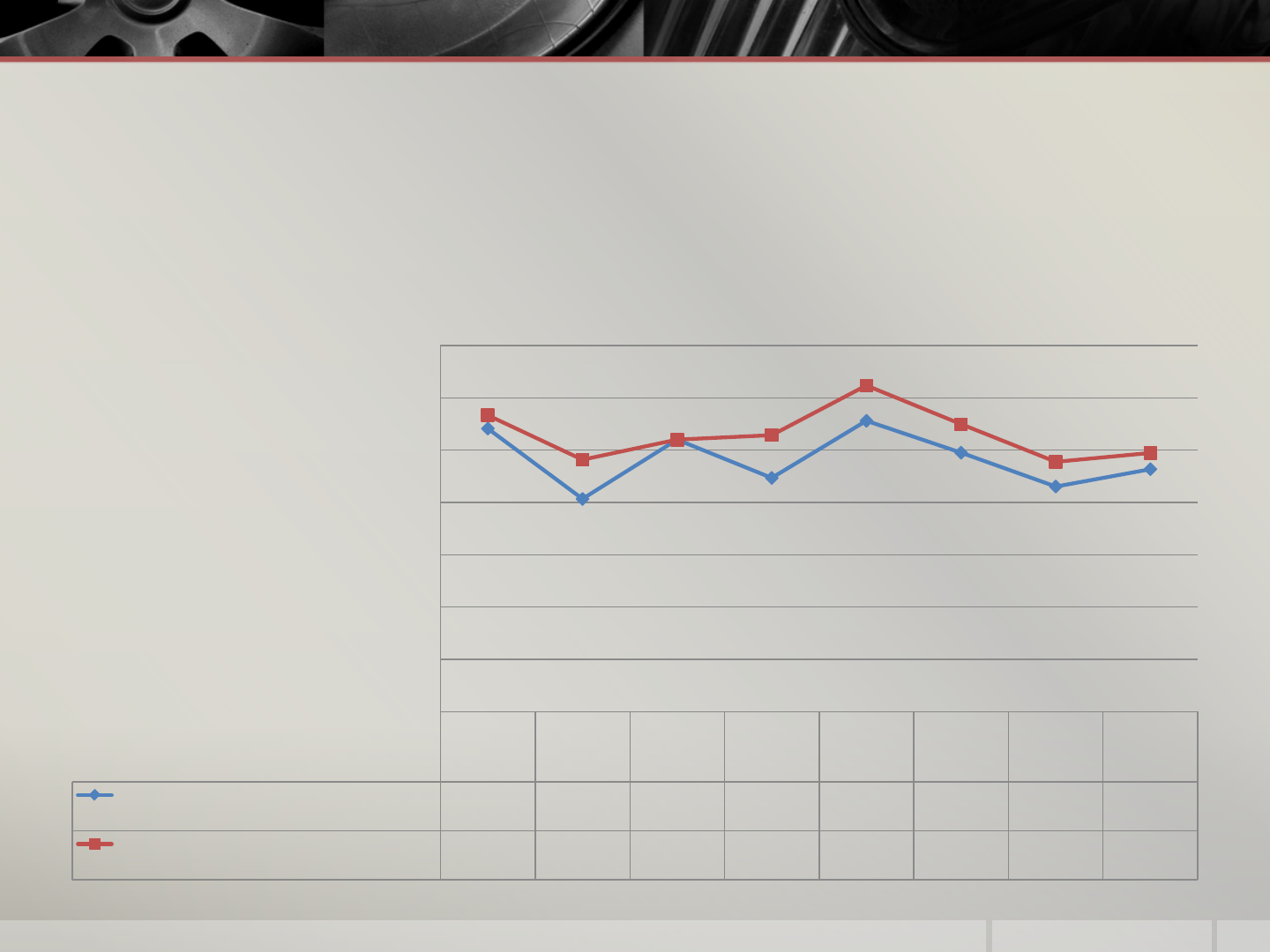

Average Premiums for Renewal Written Premium

Average renewal premiums

has increased by 8.4% over

the past three years for the

state.

Average renewal premiums in

the coastal zip codes

increased by approximately

9% over the past three years.

*2015 represents 6 months of

data.

RENEWALS

2013 Average Premium 2014 Average Premium 2015 Average Premium

Coastal

$2,111 $2,221 $2,301

Non

-Coastal

$1,340 $1,399 $1,453

Statewide

$1,485 $1,551 $1,610

6

$0

$500

$1,000

$1,500

$2,000

$2,500

Coastal Non-Coastal Statewide

Average Renewal Premiums

2013 Average Premium 2014 Average Premium 2015 Average Premium

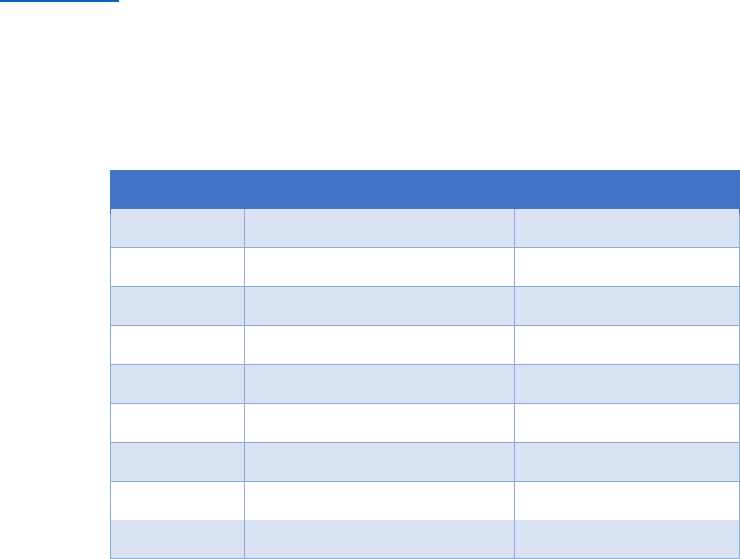

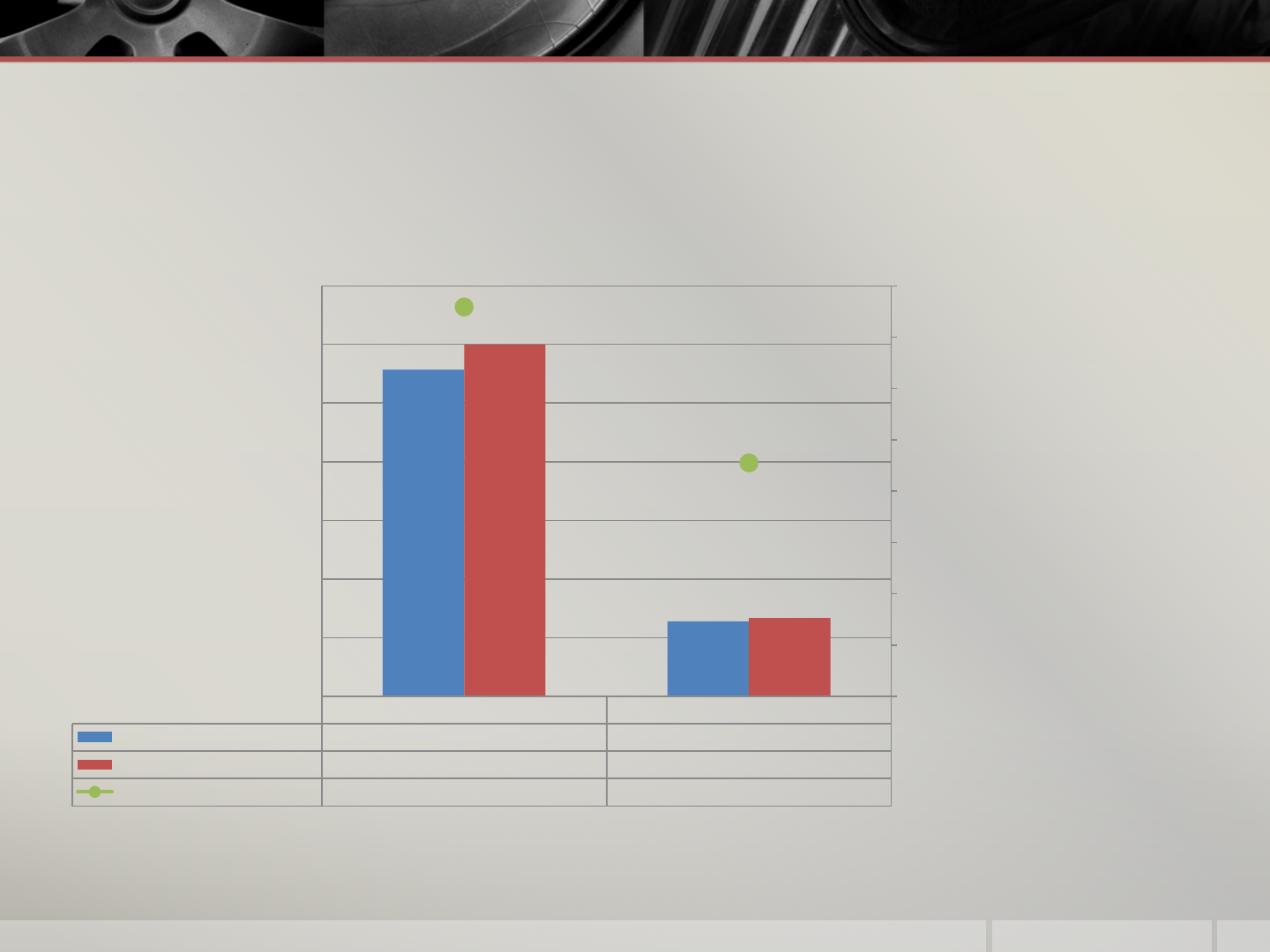

Average 2014 HO3 New and Renewal Premiums by County

$200,000-$399,999 Exposure Range

Fairfield

County

Hartford

County

Litchfield

County

Middlesex

County

New

Haven

County

New

London

County

Tolland

County

Windham

County

2014 New HO3 Average Premium $200,000-

$399,999

$1,041 $838 $876 $985 $1,029 $1,050 $874 $852

2014 Renewal HO3 Average Premium

$200,000-$399,999

$1,283 $1,014 $1,025 $1,196 $1,261 $1,269 $1,071 $1,052

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

2014 Average Premium

2014 HO3 New and Renewal Average Premiums

$200,000-$399,999 Range

7

Average 2014 HO5 New and Renewal Premiums by County

$200,000-$399,999 Exposure Range

Fairfield

County

Hartford

County

Litchfield

County

Middlesex

County

New

Haven

County

New

London

County

Tolland

County

Windham

County

2014 New HO5 Average Premium $200,000-

$399,999

$1,083 $813 $1,040 $894 $1,112 $990 $861 $927

2014 Renewal HO5 Average Premium

$200,000-$399,999

$1,134 $964 $1,040 $1,058 $1,247 $1,099 $956 $989

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

2014 Average Premium

2014 HO5 New and Renewal Average Premiums

$200,000-$399,999 Range

8

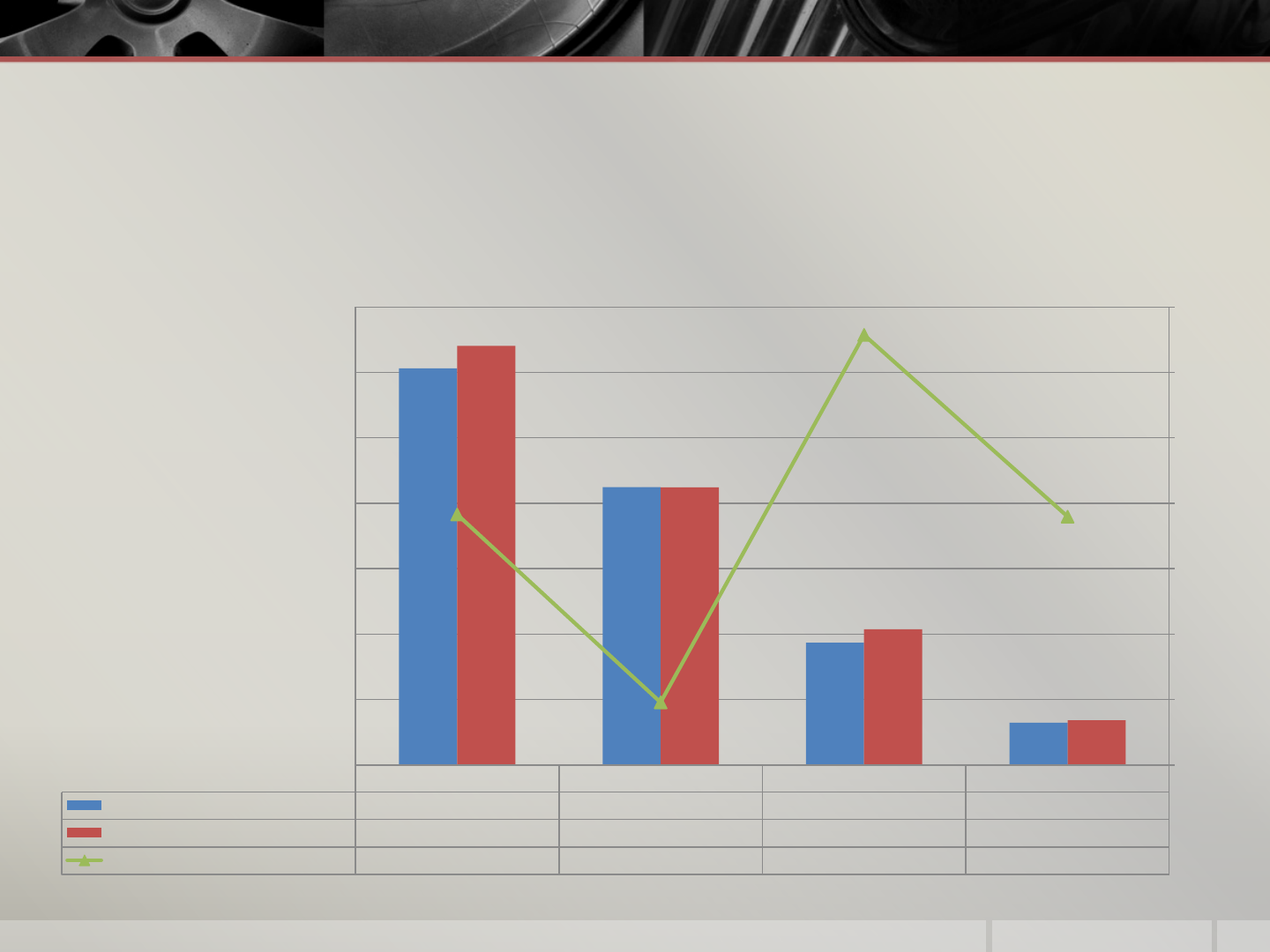

Average Premiums by County - New and Renewal

2013 to 2014

9

Fairfield

County

Hartford

County

Litchfield

County

Middlesex

County

New Haven

County

New London

County

Tolland

County

Windham

County

Total 2013 Total Average Premium

2,076 1,112 1,365 1,322 1,353 1,376 1,104 1,047

Total 2014 Total Average Premium

2,156 1,156 1,433 1,391 1,422 1,451 1,159 1,108

0

500

1,000

1,500

2,000

2,500

Average Premium

Change in Total Average Premium by County

Exposures by County - New and Renewal

2013 to 2014

10

Hartford

County

Fairfield

County

New Haven

County

New London

County

Litchfield

County

Middlesex

County

Tolland

County

Windham

County

2013 Total Exposures

191,335 184,770 170,294 60,375 54,098 43,960 35,400 26,935

2014 Total Exposures

199,011 189,260 173,555 62,051 55,362 45,494 37,460 27,817

-

50,000

100,000

150,000

200,000

250,000

Average Premium

Change in Total Exposures by County

Change in New Written Premium - 2013 to 2014

The increase in

new business

written in the

coastal zip codes

was only 4.55%,

compared to

7.59% statewide.

Statewide Coastal Zip Codes

2013 New Written Premium

$111,452,207 $25,633,736

2014 New Written Premium

$119,908,405 $26,800,257

Percentage Change

7.59% 4.55%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

$-

$20,000,000

$40,000,000

$60,000,000

$80,000,000

$100,000,000

$120,000,000

$140,000,000

New Premium Written

Change in New Written Premium

11

Change in Renewal Written Premium - 2013 to 2014

Statewide Coastal Zip Codes

2013 Renewal Written Premium

$997,719,760 $265,848,654

2014 Renewal Written Premium

$1,071,915,692 $283,735,295

Percentage Change

7.44% 6.73%

6.20%

6.40%

6.60%

6.80%

7.00%

7.20%

7.40%

7.60%

$-

$200,000,000

$400,000,000

$600,000,000

$800,000,000

$1,000,000,000

$1,200,000,000

Premium Written

Change in Renewal Written Premium

Renewal business

written in the

coastal zip codes

increased by

6.73% compared

to 7.44%

statewide.

12

Change in Exposures - 2013 to 2014

Exposures

increased by

1.68% in the

coastal zip

codes in 2014

(the latest year

with a full 12

months of data)

compared to an

increase of

2.98%

statewide .

13

Statewide Coastal Zip Codes

2013 Total Exposures

767,168 140,981

2014 Total Exposures

790,010 143,344

Percentage Change

2.98% 1.68%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

-

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

Exposures

Change in Exposures

Fairfield

County

Hartford

County

New Haven

County

New

London

County

Litchfield

County

Middlesex

County

Tolland

County

Windham

County

New 2013 Written Premium Total

$35,032,581 $23,498,310 $24,558,403 $8,349,751 $7,243,438 $5,663,180 $4,168,255 $2,938,289

New 2014 Written Premium Total

$38,481,354 $25,606,112 $25,365,099 $8,414,752 $7,667,388 $6,365,534 $4,695,030 $3,313,136

Percent Change

10% 9% 3% 1% 6% 12% 13% 13%

0%

2%

4%

6%

8%

10%

12%

14%

$0

$5,000,000

$10,000,000

$15,000,000

$20,000,000

$25,000,000

$30,000,000

$35,000,000

$40,000,000

$45,000,000

New Written Premium

Annual Change in New Written Premium by County

Change in New Written Premium by County - 2013 to 2014

New London County experienced the least growth from 2013 to 2014.

14

Change in New Written Premium by County

2013 to 2014 – Coastal Zip Codes

New London County

experienced most of its growth

in new premium along the

coast.

Fairfield County New Haven County New London County Middlesex County

2013 New Written Premium Total

$12,120,015 $8,487,123 $3,734,565 $1,292,034

2014 New Written Premium Total

$12,805,517 $8,479,752 $4,150,754 $1,364,235

Premium Percentage Change

6% 0% 11% 6%

-2%

0%

2%

4%

6%

8%

10%

12%

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

$14,000,000

New Written Premium

Annual Change in New Written Premium by County - Coastal Zip Codes

15

Change in Renewal Written Premium by County

2013 to 2014

Fairfield

County

New Haven

County

Hartford

County

New

London

County

Litchfield

County

Middlesex

County

Tolland

County

Windham

County

Renewal 2013 Written Premium

$348,592,856 $205,897,905 $189,268,263 $74,728,636 $66,599,350 $52,438,909 $34,917,919 $25,275,922

Renewal 2014 Written Premium

$369,573,625 $221,462,702 $204,486,332 $81,590,873 $71,673,815 $56,912,468 $38,721,239 $27,494,637

Sum of Renewal Premium Change

6% 8% 8% 9% 8% 9% 11% 9%

0%

2%

4%

6%

8%

10%

12%

$0

$50,000,000

$100,000,000

$150,000,000

$200,000,000

$250,000,000

$300,000,000

$350,000,000

$400,000,000

Renewal Premium Written

Annual Change in Renewal Written Premium by County

16

Change in Renewal Written Premium by County

2013 to 2014 – Coastal Zip Codes

17

Fairfield County New Haven County New London County Middlesex County

Renewal 2013 Written Premium

$134,089,551 $80,054,393 $37,619,342 $14,085,367

Renewal 2014 Written Premium

$141,621,727 $85,809,606 $40,985,776 $15,318,186

Sum of Renewal Premium Change

6% 7% 9% 9%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

$0

$20,000,000

$40,000,000

$60,000,000

$80,000,000

$100,000,000

$120,000,000

$140,000,000

$160,000,000

Renewal Business Written

Annual Change in Renewal Written Premium by County

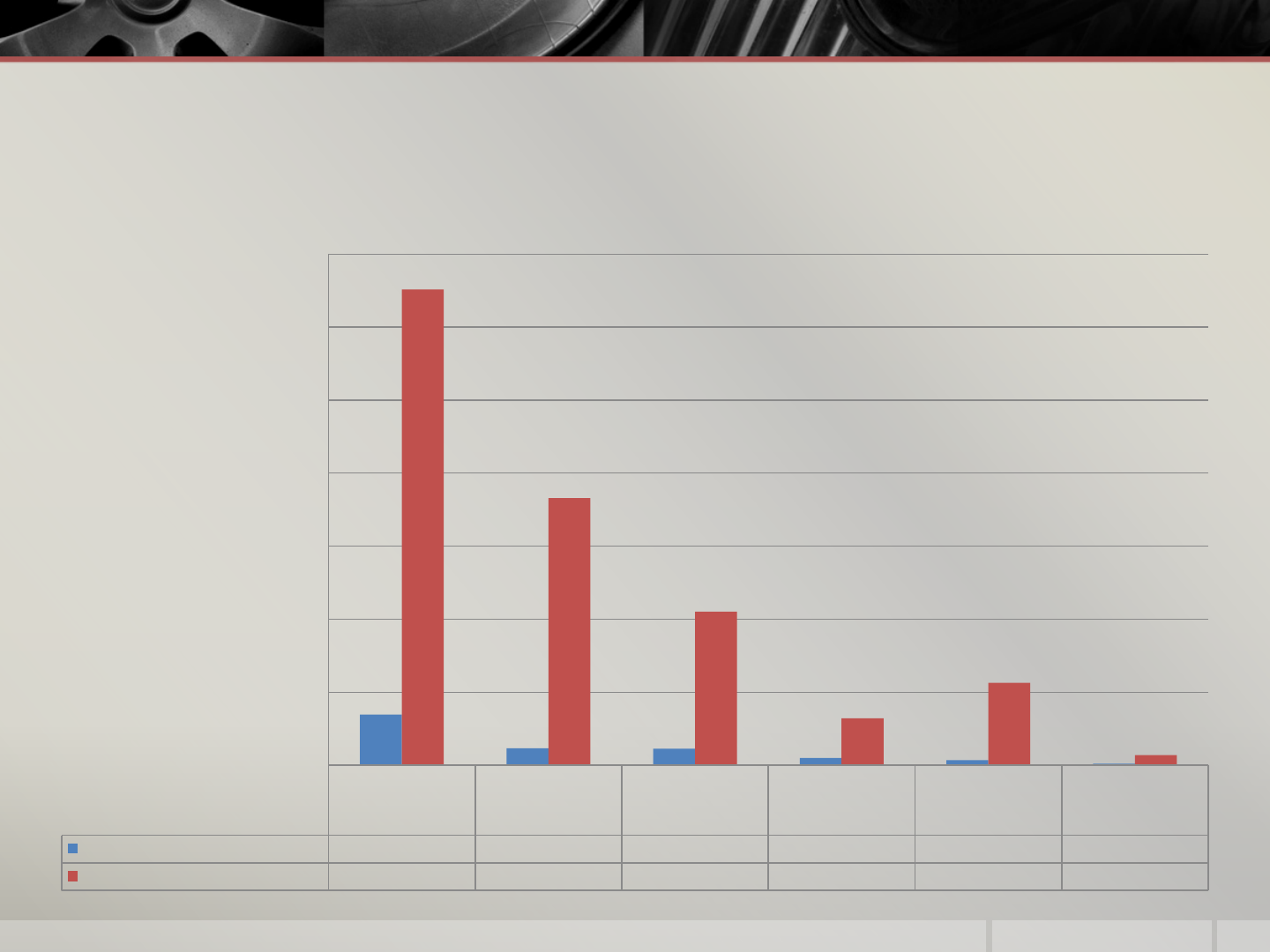

Coastal Business by Company Type

18

Stock-

Agent/Independ

ent

Mutual-

Agent/Independ

ent

Mutual -

Agent/Captive

Stock-Direct Mutual - Direct

Stock -

Agent/Captive

New 2014 Written Premium Total

$13,843,913 $4,617,839 $4,536,773 $1,959,287 $1,424,255 $418,189

Renewal 2014 Written Premium

$130,328,895 $73,134,669 $42,085,014 $12,851,994 $22,536,458 $2,798,266

$0

$20,000,000

$40,000,000

$60,000,000

$80,000,000

$100,000,000

$120,000,000

$140,000,000

2014 Written Premium

2014 Premiums in Coastal Zip Codes by Company Type

List of Companies by Type

Mutual – Agent/Captive

CSAA Fire & Casualty Insurance Company

Liberty Insurance Corporation

Liberty Mutual Fire Insurance Company

Nationwide General Insurance Company

Nationwide Mutual Fire Insurance Company

Nationwide Property & Casualty Insurance

State Farm Fire and Casualty Company

California Casualty Indemnity Exchange

Mutual - Agent/Independent

Allstate Indemnity Company

Allstate Insurance C

ompany

Cambridge Mutual Fire Insurance Company

Casco I

ndemnity Company

Central Mutual Insurance Company

Employers Mutual Casualty C

ompany

General Insurance Company of A

merica

Graphic Arts Mutual Insurance C

ompany

Harleysville Preferred Insurance Company

Harleysville Worcester Insurance C

ompany

Merrimack Mutual Fire Insurance C

ompany

Middlesex M

utual Assurance Company

National Grange M

utual

New England Mutual Insurance Company

New London County Mutual Insurance C

ompany

Patrons Mutual Insurance Company of Connecticut

Providence M

utual Fire Insurance Company

Republic-F

ranklin Insurance Company

Safeco Insurance Company of America

Union M

utual Fire Insurance Company

Utica First Insurance Company

Vermont Mutual Insurance C

ompany

Mutual – Direct

Amica Mutual Insurance Company

Homesite Ins

urance Company

LM Insurance Corporation

United Services Automobile Association

USAA Casualty Insurance Company

USAA General Indemnity Company

21

st

Century Premier Insurance Company

19

List of Companies by Type

Stock – Agent/Independent

AIG Property Casualty Company

American Automobile Insurance

C

ompany

American Commerce Insurance

C

ompany

ASIC Connecticut

Associate Indemnity Corporation

Automobile Insurance Company

of Hartford

Bankers Standard Insurance

C

ompany

Bunker Hill Insurance Company

Chubb National Insurance

C

ompany

Cincinnati Insurance Company

Citizen’s Insurance Company of

A

merica

Economy Premier Assurance

C

ompany

Encompass Indemnity Company

Encompass Insurance Company

o

f America

Federal Insurance Company

Fireman’s Fund Insurance

C

ompanies

General Casualty Company of

W

isconsin

Great Northern Insurance

C

ompany

Hartford Casualty Insurance

C

ompany

Hartford Fire Insurance Company

Hartford Insurance Company of

the Southeast

Hartford Underwriters Insurance

C

ompany

Integon Na

tional Insurance

Company

Kemper Independence Insurance

Company

Mass Bay Insurance Company

Massachusetts Homeland

I

nsurance Company

Merastar I

nsurance Company

Metropolitan Property and

C

asualty Insurance

National Surety Corporation

Pacific Indemnity Company

Praetorian Insurance Company

Priviledge U

nderwriters

Reciprocal Exchange

Sentinel Insurance Company,

L

imited

Standard Fire Insurance

C

ompany

The Hanover American Insurance

C

ompany

The Hanover Insurance Company

Tower Insurance Company of NH

Travelers Home and Marine

I

nsurance Company

Travelers Indemnity Company of

A

merica

Travelers Personal Security

I

nsurance Company

Twin City Fire Insurance

C

ompany

Unitrin Direct Property and

C

asualty Company

Unitrin Preferred Insurance

C

ompany

Universal North America

I

nsurance Company

Vigilant Insurance Company

20

List of Companies by Type

Stock – Direct

Electric Insurance Company

Hartford Accident and indemnity

Co

mpany

IDS Property & Casualty Insurance

Co

mpany

Metropolitan Group Property and

Ca

sualty

Property and Casualty Insurance

Co

mpany

Trumbull Insurance Company

Hartford Insurance Company of the

M

idwest

Pacific Specialty Insurance Company

Stillwater Property and Casualty

I

nsurance

Stock – Agent/Captive

Covenant Insurance Company

Farm Family Casualty Insurance

Co

mpany

Horace Mann Insurance Company

Teachers Insurance Company

21

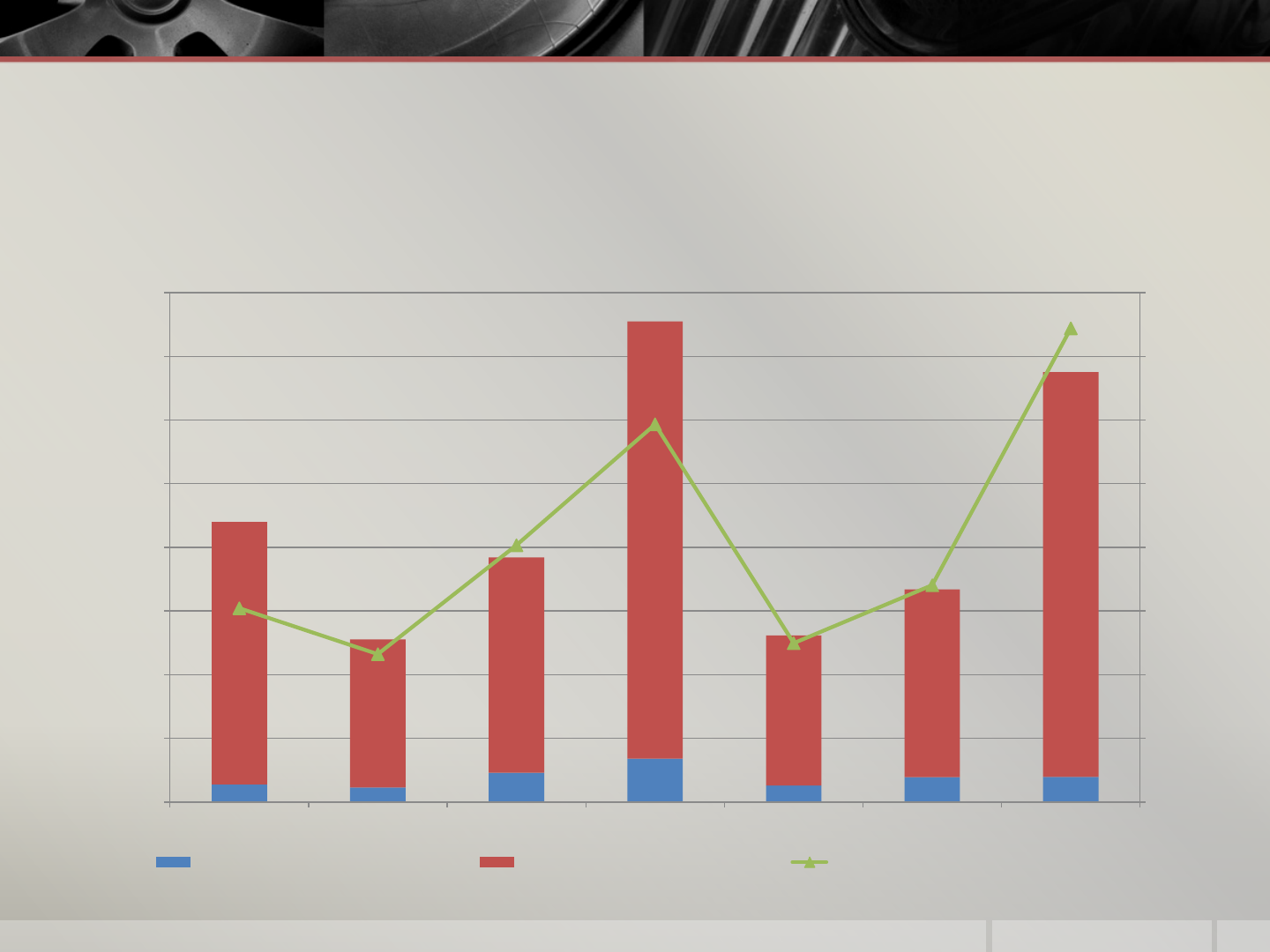

Coastal Business by Distance From Shore

22

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

$0

$10,000,000

$20,000,000

$30,000,000

$40,000,000

$50,000,000

$60,000,000

$70,000,000

$80,000,000

0-1000 Feet 1001-2600 Feet 2601-1Mile 1.1-2 Miles 2.1-3 Miles 3 Miles+ Unknown

2014 Premiums & Exposures by Feet from Shore

Coastal Zip Codes

New 2014 Written Premium Total Renewal 2014 Written Premium Total New and Renewal 2014 Exposures

Average Premiums by Distance from Shore

23

0-1000 Feet 1001-2600 Feet 2601-1Mile 1.1-2 Miles 2.1-3 Miles 3 Miles+ Unknown

New 2014 Average Premium

$2,768 $1,780 $1,479 $1,874 $1,600 $1,781 $1,393

Renewal 2014 Average Premium

$2,900 $2,252 $1,983 $2,638 $2,172 $1,989 $1,850

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

Average Premiums

2014 Average Premiums by Feet from Shore

Coastal Zip Codes

Statewide Market Competition

Herfindahl Hirschman Index and Number of Writers

Herfindahl-Hirschman Index (HHI):

The HHI is calculated by summing the squares of the

market shares (as a percentage) of all groups in the

market. For example, if a market had only one seller, its

market share would be 100% and the HHI would be

10,000. If a market had 10 sellers, each with an equal

10% of the market, the HHI would be 1,000. Although

there is no precise point at which the HHI indicates that a

market or industry is concentrated highly enough to

restrict competition, the U.S. Department of Justice has

developed guidelines with regard to corporate mergers.

Under these guidelines, if a merger of companies in a

given market causes the HHI to rise above 1,800, the

market is considered highly concentrated. If, after the

merger, the HHI is between 1,000 and 1,800, the market

is considered moderately concentrated. An HHI of less

than 1,000 is considered not concentrated. Because

these numbers are guidelines, judgment must be used to

interpret what information the HHIs provide for a

particular market.

24

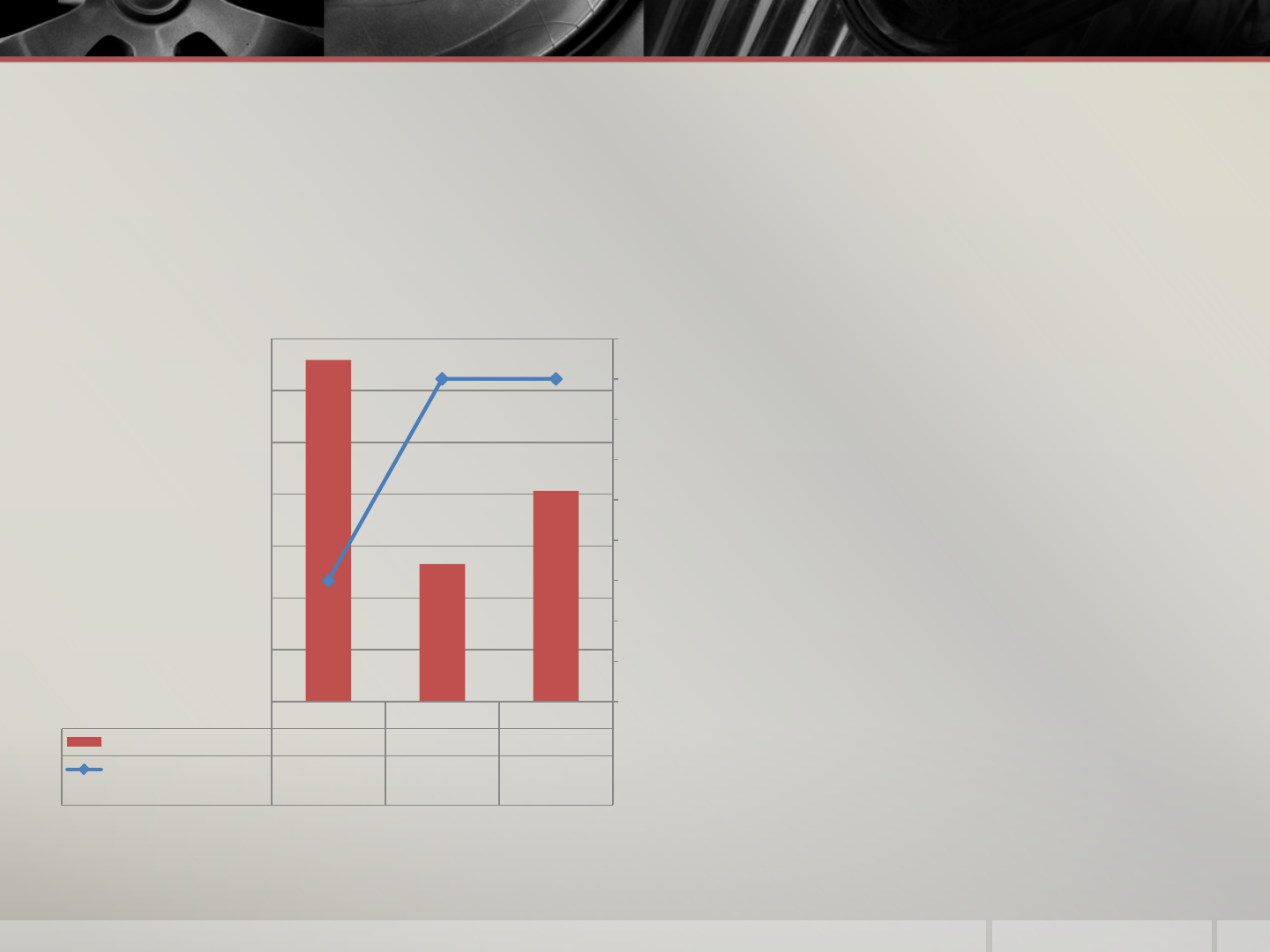

2013 2014 2015

HHI

468 448 455

Number of Writers (By

Group)

45 46 46

44.4

44.6

44.8

45

45.2

45.4

45.6

45.8

46

46.2

435

440

445

450

455

460

465

470

Statewide Market Competition

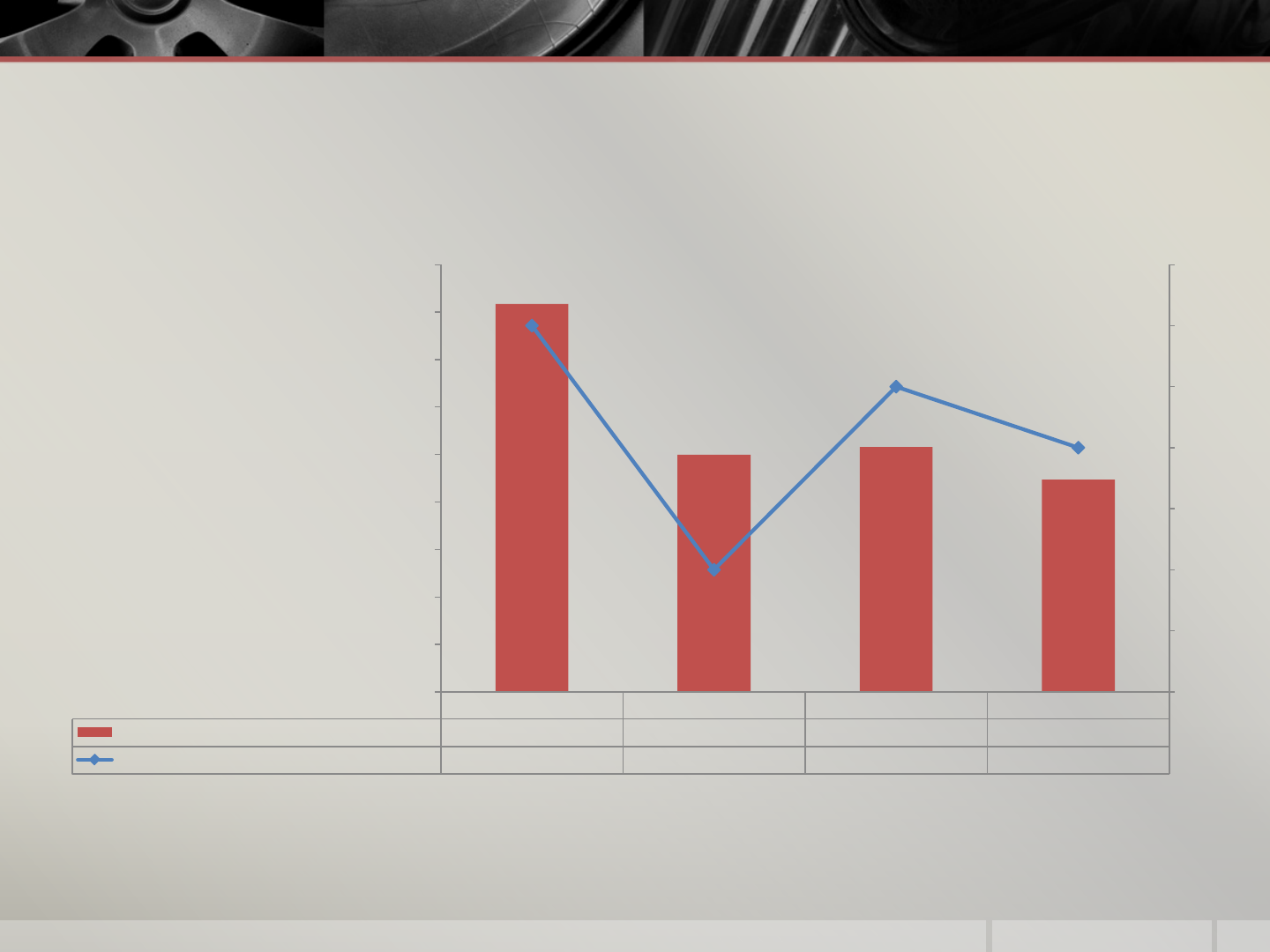

2014 Market Competition – Coastal Zip Codes

The greater the Herfindahl Hirschman Index number, the less competitive the market.

An HHI of less than 1,000 is considered not concentrated.

25

Fairfield County Middlesex County New Haven County New London County

Herfindahl Hirschman Index

817 500 516 447

Number of Companies Writing New Business

46 42 45 44

-

100

200

300

400

500

600

700

800

900

40

41

42

43

44

45

46

47

Market Competition in Coastal Counties

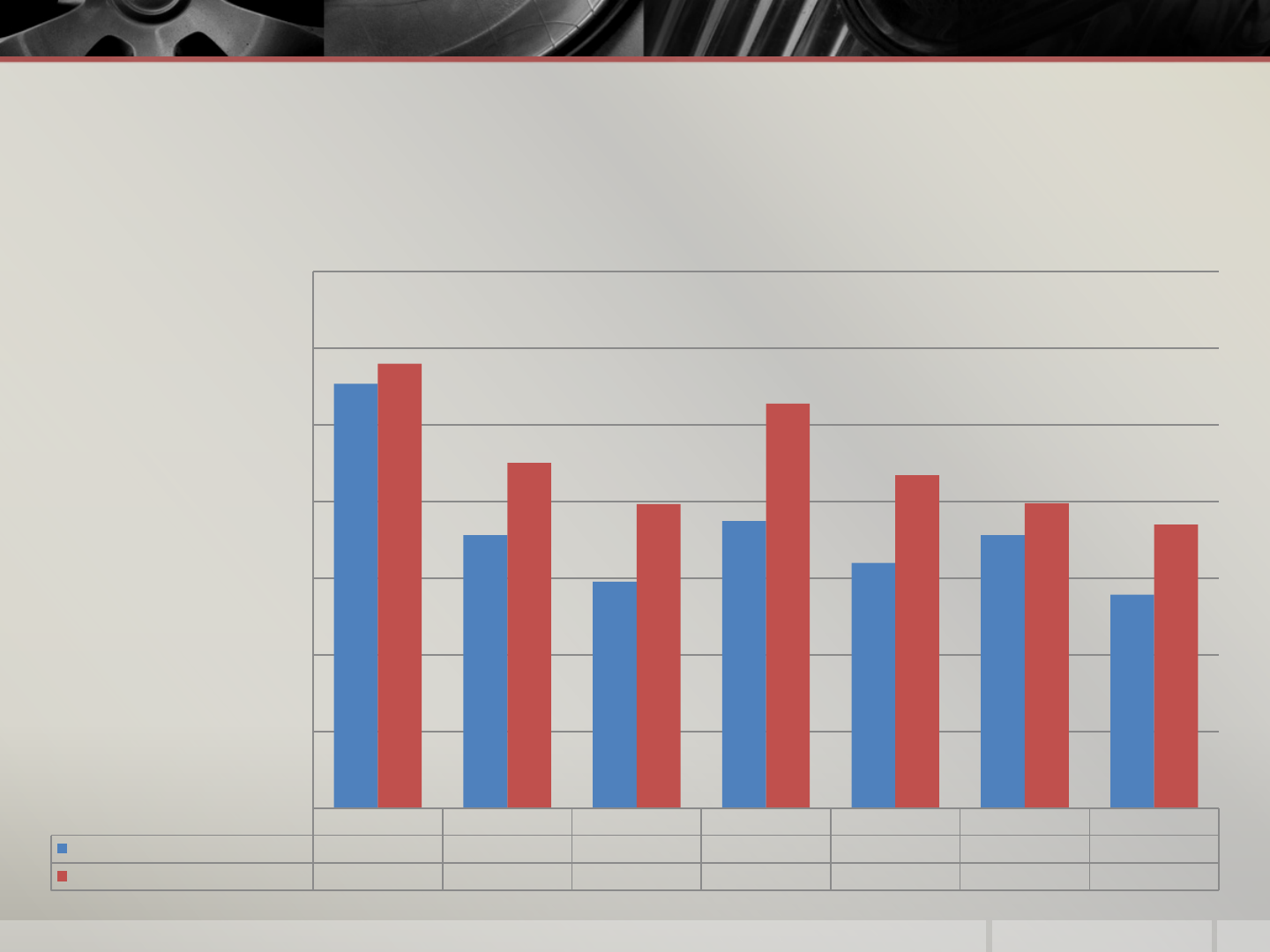

Annual Market Competition – Coastal Zip Codes

26

Fairfield

County

Middlesex

County

New

Haven

County

New

London

County

2013 Herfindahl

Hirschman Index

889 480 611 460

2014 Herfindahl

Hirschman Index

817 500 516 447

2015 Herfindahl

Hirschman Index

639 632 522 536

-

100

200

300

400

500

600

700

800

900

1,000

Herfindahl-Hirschman Index

Change in Market Competition by

County

Fairfield

County

Middlesex

County

New Haven

County

New London

County

2013

43 42 43 44

2014

46 42 45 44

2015

42 39 44 44

34

36

38

40

42

44

46

48

Number of Companies Writing New Business

Change in Number of Groups

Writing New Business by County -

Coastal Zips Only