Annual Report

2019

Contents

Strategic report

Our business model 01

Chairman’s statement 03

CEO’s statement 04

Financial performance 06

Our long-term priorities 09

Our culture 10

Key performance indicators 11

Industry trends 12

Stakeholder engagement 15

Pharmaceuticals 17

Vaccines 23

Consumer Healthcare 27

Trust 30

Risk management 43

Group financial review 49

Corporate Governance

Chairman’s Governance statement 76

Our Board 78

Our Corporate Executive Team 82

Responsible leadership 84

Division of responsibilities 90

Composition, succession

and evaluation 92

Nominations Committee report 92

Audit, risk and internal control 96

Audit & Risk Committee report 96

Science Committee report 107

Corporate Responsibility

Committee report 109

Section 172 statement 111

Directors' report 113

Remuneration report

Chairman’s annual statement 116

Annual report on remuneration 119

2020 Remuneration policy summary 140

2020 Remuneration policy report 141

Financial statements

Directors’ statement of

responsibilities 152

Independent Auditor’s report 154

Financial statements 166

Notes to the financial statements 170

Financial statements of

GlaxoSmithKline plc prepared

under UK GAAP 252

Investor information

Quarterly trend 258

Five-year record 263

Product development pipeline 269

Products, competition and

intellectual property 272

Principal risks and uncertainties 275

Share capital and share price 288

Dividends 290

Financial calendar 291

Annual General Meeting 2020 291

Tax information for shareholders 292

Shareholder services and contacts 294

US law and regulation 296

Group companies 299

Glossary of terms 311

Cautionary statement

See the inside back cover of this document for the cautionary statement regarding

forward-looking statements.

Non-IFRS measures

We use a number of adjusted, non-IFRS, measures to report the performance of our business.

Total reported results represent the Group's overall performance under IFRS. Adjusted results,

pro-forma growth rates and other non-IFRS measures may be considered in addition to, but not

as a substitute for or superior to, information presented in accordance with IFRS. Adjusted results

and other non-IFRS measures are defined on pages 50 to 52 and reconciliations to the nearest

IFRS measures are on pages 62 and 65.

We believe that Adjusted results, when considered together with Total results, provide investors,

analysts and other stakeholders with helpful complementary information to understand better

the financial performance and position of the Group from period to period, and allow the Group's

performance to be more easily compared against the majority of its peer companies. These

measures are also used by management for planning and reporting purposes. They may not

be directly comparable with similarly described measures used by other companies.

Our purpose

To improve the quality of human life by helping people do more, feel better,

live longer.

Our goal

To become one of the world’s most innovative, best-performing and trusted

healthcare companies.

Our strategy

To bring differentiated, high-quality and needed healthcare products

to as many people as possible, with our three global businesses, scientific

and technical know-how and talented people.

Our long-term priorities

Our priorities are underpinned by our ambition to build a more performance-

focused culture, aligned to our values and expectations.

Innovation

We invest in scientific and technical excellence to develop and launch

a pipeline of new products that meet the needs of patients, payers

and consumers.

Performance

We deliver growth-based performance by investing effectively in our

business, developing our people and executing competitively.

Trust

We are a responsible company and commit to use our science and

technology to address health needs, make our products affordable

and available and to be a modern employer.

Our values and expectations

Our values – patient focus, transparency, respect and integrity.

Our expectations – courage, accountability, development and teamwork.

We are a science-led

global healthcare company

Investor information

Financial statements

Strategic report

Governance and remuneration

GSK Annual Report 2019

01

Our business model

We have three global businesses that discover, develop and

manufacture innovative medicines, vaccines and consumer healthcare

products. Every day, we help improve the health of millions of people

around the world.

Pharmaceuticals

Our Pharmaceuticals business has

a broad portfolio of innovative and

established medicines in respiratory,

HIV, immuno-inflammation and oncology.

We are strengthening our R&D pipeline

through a focus on immunology, human

genetics and advanced technologies

to help us identify transformational

new medicines for patients.

Read more on page 17

Vaccines

We are the world’s largest vaccines

company by revenue, delivering vaccines

that protect people at all stages of life.

Our R&D focuses on developing

vaccines against infectious diseases

that combine high medical need and

strong market potential.

Read more on page 23

Consumer Healthcare

Our world-leading Consumer Healthcare

business combines science and

consumer insights to create innovative

everyday healthcare brands that

consumers trust and experts recommend.

In 2019, we finalised an agreement with

Pfizer to combine our two consumer

healthcare businesses.

Read more on page 27

Our operations span the value chain from identifying,

researching, developing and testing ground-breaking

discoveries, to regulatory approval, manufacturing and

commercialisation.

We have over 99,000 employees across 95 countries

with outstanding scientific and technical know-how and

deep expertise in regulation, intellectual property and

commercialisation. We also work with world-leading

experts and form strategic partnerships to complement

our existing capabilities.

Innovation is critical to how we improve health and create

financial value. As a research-based healthcare company

we rely on intellectual property protection to help ensure

a reasonable return on our investments so we can

continue to research and develop new and innovative

medicines. In 2019 we invested £4.6 billion in R&D.

In Pharmaceuticals and Vaccines we focus on science

related to the immune system, human genetics and

advanced technology. In Consumer Healthcare we

leverage our scientific expertise and deep consumer

insights to create healthcare products that meet

consumer demands.

Our ability to launch new products successfully and

grow sales from our existing portfolio is key to our

commercial success. For patients and consumers

we deliver transformational medicines, vaccines and

consumer healthcare products. In 2019 that included

2.3 billion packs of medicines, 701 million vaccine

doses and 4.2 billion consumer healthcare products.

As part of our capital allocation framework we invest

in our three businesses and provide returns to

shareholders in the form of dividends and share value

growth. In 2019 we paid a dividend of 80p per share

and delivered £5.1 billion of free cash flow.

We make a positive contribution to the communities

in which we operate by creating employment, working

with suppliers and paying tax. We offer a broad range

of employee benefits, including preventative healthcare

services, so that we are able to attract and retain the

best people. By delivering on our purpose, the greatest

contribution we make is to improve the health of people

around the world with our medicines, vaccines and

consumer healthcare products.

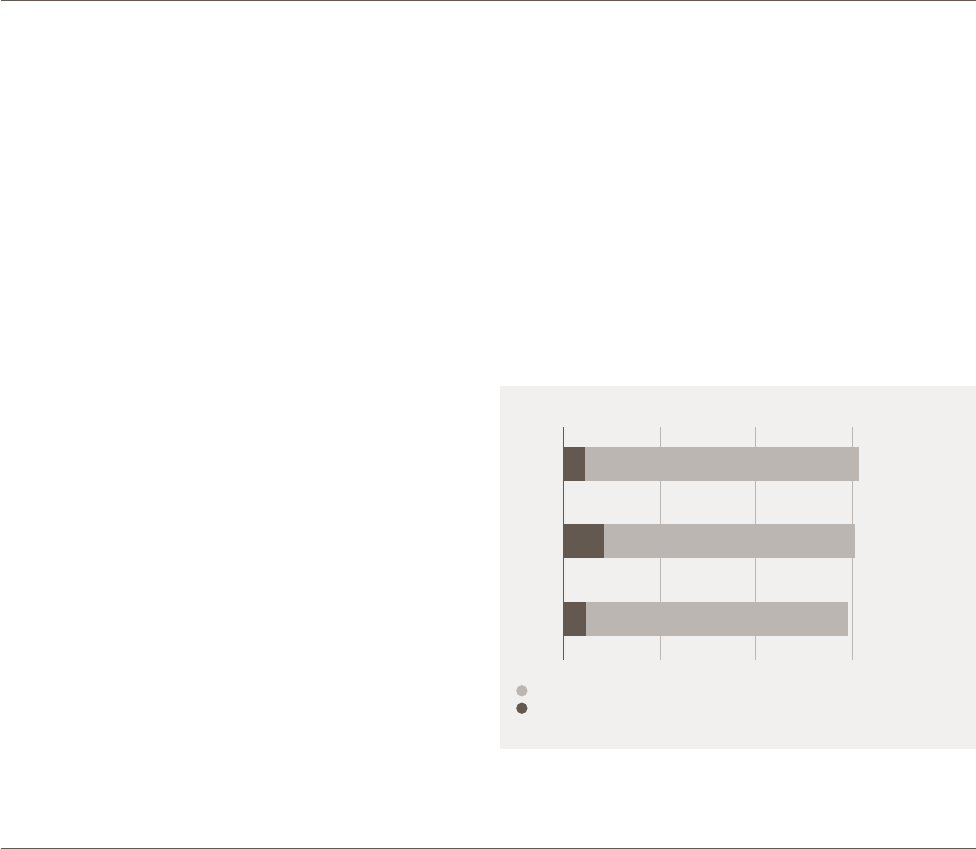

Turnover £m

Respiratory

3,081

HIV

4,854

Immuno-inflammation

613

Oncology

230

Established Pharmaceuticals

8,776

Total

17,554

Turnover £m

Meningitis

1,018

Shingles

1,810

Influenza

541

Established Vaccines

3,788

Total

7, 15 7

Turnover £m

Wellness

4,526

Oral health

2,673

Nutrition

1,176

Skin health

620

Total

8,995

02

GSK Annual Report 2019

Investing in R&D and new products

In order to be successful, we are increasing investment in R&D

and new products to deliver future growth. Since announcing

our new approach to R&D in 2018, we have made significant

progress to strengthen our pipeline, particularly in oncology.

We now have 39 medicines and 15 vaccines in the pipeline,

and in 2019 we had three major approvals, eight regulatory

submissions, six positive read-outs from pivotal studies and

we progressed four new assets into pivotal studies.

During 2019 we also completed transactions with Tesaro

and with Merck KGaA, further strengthening our position

in oncology, and initiated alliances to build out our platform

technologies, in genomics with the University of California,

and in cell therapy with Lyell Immunopharma.

The positive clinical data we are generating and the progress

we have made to strengthen the pipeline underpins our decision

to further increase investment in R&D over the next two years.

Creating two new companies

In early 2020, consistent with our strategic priorities and

previous announcements, we started a two-year programme

to prepare GSK for separation into two new leading companies:

New GSK, a biopharma company, with an R&D approach

focused on science related to the immune system, use of

genetics and new technologies; and a new Consumer

Healthcare company with category-leading power brands

and innovation based on science and consumer insights.

Our intention remains to separate around three years from the

close of the transaction that resulted in the formation of our new

Consumer Healthcare Joint Venture, which was in July 2019.

The new programme will use the unique catalyst of separation

to reset the capabilities and cost base for both companies,

and help support delivery of the significant value creation

opportunities we see in both New GSK and new Consumer

Healthcare.

For New GSK, we see a clear opportunity to drive a common

approach to R&D as science related to the immune system

converges across both pharmaceuticals and vaccines. This

will enable us to be even more effective in how we allocate

our budget, share technical and scientific expertise and deliver

our pipeline, regardless of modality.

Under the programme, we will also seek to improve our

capabilities and create efficiencies in our global support

functions; continue to simplify and focus our manufacturing

network, ensuring our supply chain is ready to launch our

new speciality medicines, and rationalise our portfolio

through divestments.

For the new Consumer Healthcare company, this programme

will support the building of key technology infrastructure and

the expertise necessary to operate as a standalone company.

We believe that increased investment in our pipeline and new

products, together with effective implementation of our new

two-year programme, will set each new company up with

strong foundations for future performance. The financial

benefits, costs and reporting associated with the programme

are set out on pages 63 and 64.

Capital allocation

Capital allocation framework

Improved

cash

generation

Invest in the business

– R&D pipeline (including business

development)

– Vaccines capacity

– New products

Shareholder returns

Other M&A

– Dividends

– Target 1.25x to 1.5x cover before

returning dividend to growth

– Strict discipline on returns

Key priorities for capital

Innovation

Performance

Trust

Our business model continued

Preparing for the future

Investor information

Financial statements

Strategic report

Governance and remuneration

GSK Annual Report 2019

03

While GSK has a proud history of innovation, it was the

exciting future ahead that made joining GSK irresistible.

Not only do we have the opportunity to create the world’s

leading Consumer Health business but also to create a

biopharma business, founded on today’s leading scientific

platforms. The Board and an outstanding management team

led by Emma are determined to achieve this.

GSK delivered good operating performance in 2019 with

growth in sales and earnings and good cash generation.

Emma and her team are sucessfully focused on strengthening

the pipeline and delivering strong commercial execution.

This is evident in the contribution to growth from new

products in these results.

Innovation

2019 saw good progress on the Group’s priority to strengthen

its pharmaceuticals pipeline, particularly in oncology, with eight

filings and four assets moved into pivotal trials. The Board was

particularly pleased to see positive data came from assets

acquired through the Tesaro transaction.

The distinctive new approach to R&D, to focus on the

immune system, the use of genetics and advanced analytical

technologies, is also advancing with the formation of

partnerships including with the University of California,

23andMe and Lyell and the attraction of new talent into

the organisation. Over the longer term, this new approach

promises to deliver a more productive R&D organisation

delivering a higher number of differentiated medicines.

This is an area the Board Science Committee is working

closely with management on.

In my first few months, I have had many conversations with

shareholders. I am pleased to report strong support for the

strategic direction of the company and for the intention to

separate into two new companies. To successfully deliver

this the Group has initiated a new programme to help prepare

for separation. Consequently, we have established a new

Board committee, to work closely with management and

provide support and oversight over the next two years.

Capital allocation

The Board supports management’s clear framework for capital

allocation which prioritises investment in the pharmaceuticals

pipeline and building vaccine supply capacity. Disciplined

support of business development opportunities is also part

of the framework. Of course, the Board are also mindful of

returns to shareholders and we returned 80p per share in

2019 as expected. Total shareholder return in 2019 was 25%.

Chairman’s statement

I am delighted to introduce my first GSK Annual Report as Chairman.

I am passionate about life sciences having worked in the industry for

many years. It is a sector that I know can make a meaningful difference

to patients and people around the world.

Environment, social and governance (ESG)

With 2019 the first year of required compliance with the

revised UK Corporate Governance Code, and with the

increased emphasis on the value of ESG factors to overall

performance, I have been pleased to find GSK’s purpose,

strategy and priorities well placed to deliver long-term value

for society and shareholders. That we will need to do more

and give greater prominence to what we are doing, is clear,

but we start from a good place.

GSK has a strong foundation in global health innovation and

this continues to play an important role. Promising data on our

candidate TB vaccine and recognition for GSK’s leadership

in antimicrobial resistance, a major global health threat is good

demonstration of this. Access and affordability of medicines

is a critical issue for the industry and society, and the company

continues to be focused on making its products affordable and

available through responsible pricing and strategic access

programmes and partnerships.

Tackling climate change will require action from everyone and

GSK is committed to playing its part. The company is delivering

well on reducing its carbon footprint in line with the Paris

Agreement, and is assessing the opportunities and risks

that the transition to a low carbon economy presents.

Board changes

We have made progress on searching for Judy Lewent’s

successor as Chair of the Audit & Risk Committee.

I am delighted that Judy has agreed to stay for a further year

to facilitate a transition before stepping down from the Board

at the 2021 AGM. Whilst I am mindful that the 2018 UK Corporate

Governance Code indicates that Non-Executive Directors should

not serve for more than nine years, I firmly believe that a smooth

transition is in the best interests of the company and shareholders.

As is set out in more detail in the section on Board governance,

we have re-evaluated our priorities and the Board committee

architecture to be able to support and oversee the creation

of two outstanding new organisations.

During the year Sir Philip Hampton stood down from the Board

as anticipated in last year’s Annual Report, and Iain Mackay

became our Chief Financial Officer, replacing Simon Dingemans.

I’d like to take this opportunity to thank Philip and Simon for their

service to GSK.

Finally, my thanks go to all of GSK’s employees, partners,

shareholders and customers for their support and warm welcome.

Sir Jonathan Symonds

Chairman

04

GSK Annual Report 2019

Growth in 2019 sales and earnings

Group sales grew 10% at actual exchange rates and 8%

at constant exchange rates to £33.8 billion. This is a good

performance, particularly when considering that 2019 was

the first year of a generic version of Advair in the US.

New products drove the increase in sales, reflecting their

innovation and our focus on commercial execution. Shingrix,

our shingles vaccine, had a remarkable year with sales of

£1.8 billion and is now the most successful biopharma launch

of the last 10 years. The product also received the prestigious

Prix Galien award for innovation. In Respiratory, we saw strong

growth from Trelegy and Nucala, and in HIV, new two-drug

regimens, Dovato and Juluca, contributed sales of £422 million.

The Total Group operating margin increased 2.8 percentage

points but the Adjusted operating margin decreased 2.1

percentage points (CER) reflecting our decision to invest

in these new products and our priority pipeline programmes.

Total earnings per share were 93.9p, up 27% at actual

exchange rates, 23% CER and Adjusted earnings per share

grew 4% at actual exchange rates, 1% CER to 123.9p.

We achieved strong cash generation, with free cash flow

of £5.1 billion. As expected, we announced a dividend of

80p in 2019 and we expect to do so again in 2020.

Landmark year for R&D

When I became CEO, I made strengthening our R&D pipeline

our first priority. In 2019 we made significant progress. Under

the leadership of Dr Hal Barron, our Chief Scientific Officer,

we delivered three major approvals, eight regulatory filings

for new medicines, six positive readouts from assets in pivotal

studies and progressed four new assets into pivotal studies,

three of which are biologics.

This progress reflects successful prioritisation and development

of the pipeline in core areas such as HIV and Respiratory,

and in fast emerging areas such as Oncology. Here, we were

particularly pleased to see pivotal data for Zejula, for ovarian

cancer, and belantamab mafodotin for multiple myeloma.

We believe both these assets have the potential to transform

how patients are treated for these underserved cancer types.

In all, we have 39 medicines and 15 vaccines currently in

clinical development, and in 2020 we expect at least six

potential product approvals. We also expect a substantial

amount of proof-of-concept data including combination

studies for various immuno-oncology agents and for innovative

vaccines; for respiratory syncytial virus (RSV) and for chronic

obstructive pulmonary disease (COPD).

We continue to build our capabilities in new platform

technologies, notably with a pioneering new partnership

with the University of California, to establish a state-of-the-art

laboratory for CRISPR gene-editing technologies; and with the

biotech company, Lyell, for development of new cell therapies.

I am also pleased that our partnership with 23andMe is

progressing well. We have now identified eight new targets

to work on together in immunology, oncology, neurology and

cardiovascular disease.

Preparing for the future

Delivering innovation is our first priority, and our recent

data readouts, together with the progress we have made

to strengthen the pipeline, underpin our decision to further

increase investment in R&D and our new products for

long-term growth.

At the same time, we continue to focus on operational

execution, including delivering a successful integration

in Consumer Healthcare following completion of the

transaction with Pfizer on 31 July 2019.

We are also now preparing for separation of the Group.

As previously stated, our intention is to separate around

three years from closing the transaction. We have therefore

initiated a two-year programme to prepare two new companies:

New GSK, a Biopharma company with an R&D approach

focused on science related to the immune system, the use

of genetics and advanced technologies; and a new Consumer

Healthcare company with a world-leading portfolio of brands

and scale.

Our new programme aims to use the unique catalyst we have

of separation to set competitive capabilities and a cost base

for both companies, and help to deliver the significant value

creation for patients, consumers and shareholders.

Building Trust

GSK has consistently, and will continue to take action to

make a broader contribution to society in addition to delivery

of financial returns. In 2019 we made good progress across

all of our Trust commitments, and we are well placed to respond

to increasing investor interest in environmental, social and

governance (ESG) performance. We were pleased to be ranked

the top pharma company in the Dow Jones Sustainability Index

for our sector.

CEO’s statement

I am pleased with the progress we made in 2019 on our three long-term

priorities of Innovation, Performance and Trust. We have strengthened our

pipeline, improved operational execution and further reshaped the Group.

Investor information

Financial statements

Strategic report

Governance and remuneration

GSK Annual Report 2019

05

Most notable have been several recent initiatives related to

global health and health security. Following the publication

of excellent data for our candidate TB vaccine, in early 2020

we secured a ground-breaking agreement with the new

Gates Medical Research Institute, to develop the vaccine

for use in low-income countries. This new alliance reflects

our aim to take a sustainable approach to global health,

focusing our efforts and expertise on science and research,

while partnering with others to ensure development and

delivery. We also filed regulatory submissions for a new

formulation of our latest HIV medicine, which will expand

access for use by children in resource poor settings.

We were also pleased to see our science and research

recognised through GSK’s leadership of the Access to

Medicine Foundation’s 2020 antimicrobial resistance

benchmark.

In February 2020, to support the global response to the

outbreak caused by coronavirus (SARS-CoV-2), we formed

collaborations with CEPI (Coalition for Epidemic Preparedness

Innovations) and other institutions and companies to make our

vaccine adjuvant technology available for the development of

an effective vaccine against the virus.

In another area of our Trust agenda, we are working hard to

reduce our environmental impact. Underpinned by five public

targets, our goal is to reduce our impact by one quarter by

2030. In this report we also set out our approach to climate

change risk, including our first voluntary disclosure using

recommendations of the Taskforce for Climate-related

Financial Disclosure (TCFD).

Our people and culture

We continue to work to develop a more performance-focused

culture, with a strong emphasis on ethics and values. Building

trust internally remains a key priority. Our regular employee

survey helps us review our levels of employee engagement

and we were pleased to achieve excellent engagement scores

at all levels of the organisation over the course of last year.

We are also pursuing a broad agenda to promote inclusion and

diversity. In 2019, female representation across the organisation

increased, particularly at senior management level, and GSK

was recognised in the Stonewall LGBT+ rights group, as a top

global employer.

The significant progress we made in 2019 is due to the effort,

talent and dedication of GSK people and all those we work

with. I want to thank them for their enormous contribution and

we count on them again in 2020.

Emma Walmsley

Chief Executive Officer

CEO's statement continued

06

GSK Annual Report 2019

Financial performance

Total results

2019 2018 Growth

% of % of

£m turnover £m turnover £% CER%

Turnover 33,754 100 30,821 100 10 8

Cost of sales (11,863) (35.1) (10,241) (33.2) 16 16

Gross profit 21,891 64.9 20,580 66.8 6 4

Selling, general and administration (11,402) (33.8) (9,915) (32.2) 15 13

Research and development (4,568) (13.5) (3,893) (12.6) 17 15

Royalty income 351 1.1 299 1.0 17 17

Other operating income/(expense) 689 1.9 (1,588) (5.2)

Operating profit 6,961 20.6 5,483 17. 8 27 23

Net finance costs (814) (717)

Profit on disposal of interest in associates – 3

Share of after-tax profits of associates and joint ventures 74 31

Profit before taxation 6,221 4,800 30 25

Taxation (953) (754)

Tax rate 15.3% 15.7%

Profit after taxation 5,268 4,046 30 26

Profit attributable to non-controlling interests 623 423

Profit attributable to shareholders 4,645 3,623

Earnings per share 93.9p 73.7p 27 23

How we performed

Cost of sales

Total cost of sales as a percentage of turnover was 35.1%,

1.9 percentage points higher at AER and 2.4 percentage points

higher in CER terms. This primarily reflected an increase in

the costs of Major restructuring programmes, the unwind of

the fair value uplift on inventory arising on completion of the

Consumer Healthcare Joint Venture with Pfizer and continued

adverse pricing pressure in Pharmaceuticals, partly offset by

a more favourable product mix in Vaccines.

Selling, general and administration

Total SG&A costs as a percentage of turnover were 33.8%,

1.6 percentage points higher at AER and 1.6 percentage points

higher at CER. This included increased significant legal charges

arising from the settlement of existing matters and provisions

for ongoing litigation, increased investment resulting from the

acquisition of Tesaro and greater promotional product support,

particularly for new launches.

Research and development

Total R&D expenditure was £4,568 million (13.5% of turnover),

up 17% AER, 15% CER. This reflected a significant increase

in study and clinical trial material investment in Oncology and

increased spending on the progression of key non-Oncology

assets, partly offset by savings from the early phase portfolio

reprioritisation in late 2018.

Other operating income/(expense)

Net other operating income primarily reflected the profit on

disposal of rabies and tick-borne encephalitis vaccines and

a number of other asset disposals together with an increase

in value of the shares in Hindustan Unilever Limited to be

received on the disposal of Horlicks and other Consumer

Healthcare brands.

Operating profit

Total operating profit was £6,961 million in 2019 compared

with £5,483 million in 2018. Reduced remeasurement charges

on the contingent consideration liabilities, no Consumer

Healthcare put option charge, increased profits on disposals

and an increase in value of the shares in Hindustan Unilever

Limited to be received on the disposal of Horlicks and other

Consumer Healthcare brands were partly offset by increased

charges for Major restructuring and significant legal matters.

Tax

The charge of £953 million represented an effective tax rate

on Total results of 15.3% (2018 – 15.7%) and reflected the

different tax effects of the various Adjusting items.

Non-controlling interests

The allocation of Total earnings to non-controlling interests

amounted to £623 million (2018 – £423 million). The increase

was primarily due to an increased allocation of ViiV Healthcare

profits.

Earnings per share

Total earnings per share was 93.9p, compared with 73.7p

in 2018. The increase in earnings per share primarily reflected

reduced remeasurement charges on the contingent

consideration liabilities and put options, an increase in the

value of the shares in Hindustan Unilever Limited to be received

on the disposal of Horlicks and other Consumer Healthcare

brands, a reduced effective tax rate and an increased share

of after-tax profits of associates as a result of a non-recurring

income tax benefit in Innoviva.

Investor information

Financial statements

Strategic report

Governance and remuneration

GSK Annual Report 2019

07

Total and Adjusted results

Intangible asset amortisation and impairment

Amortisation and impairment of intangible assets and goodwill

excludes computer software.

Major restructuring

Major restructuring costs, which include impairments of tangible

assets and computer software (under specific Board-approved

programmes that are structural, of a significant scale and where

the costs of individual or related projects exceed £25 million),

including integration costs following material acquisitions.

Transaction-related

Transaction-related accounting or other adjustments related

to significant acquisitions.

Divestments, significant legal and other items

Proceeds and costs of disposals of associates, products

and businesses; significant legal charges (net of insurance

recoveries) and expenses on the settlement of litigation and

government investigations; other operating income other than

royalty income, and other items.

Total reported results represent the Group’s overall performance.

GSK uses a number of Adjusted, non-IFRS, measures to

report the performance of its business. Adjusted results and

other non-IFRS measures may be considered in addition to,

but not as a substitute for or superior to, information presented

in accordance with IFRS. See page 50 for a fuller definition.

GSK believes that Adjusted results, when considered together

with Total results, provide investors, analysts and other

stakeholders with helpful complementary information to

understand better the financial performance and position

of the Group from period to period, and allow the Group’s

performance to be more easily compared against the majority

of its peer companies. These measures are also used by

management for planning and reporting purposes. They may

not be directly comparable with similarly described measures

used by other companies.

GSK encourages investors and analysts not to rely on any

single financial measure but to review GSK’s Annual Reports,

including the financial statements and notes, in their entirety.

GSK is undertaking a number of Board-approved Major

restructuring programmes in response to significant changes

in the Group’s trading environment or overall strategy, or

following material acquisitions. Costs, both cash and non-cash,

of these programmes are provided for as individual elements

are approved and meet the accounting recognition criteria.

As a result, charges may be incurred over a number of years

following the initiation of a Major restructuring programme.

The Group has also initiated a two-year Separation Preparation

programme to prepare GSK for separation into two new leading

companies in biopharma and consumer healthcare.

GSK is committed to continuously improving its financial

reporting, in line with evolving regulatory requirements and

best practice.

GSK's reported results include five months of results of the

former Pfizer consumer healthcare business from 1 August

2019. Pro-forma growth rates at CER have been calculated

for 2019 including the equivalent five months of results of the

former Pfizer consumer healthcare business in the comparative

period, as more fully described on page 52.

Adjusting items

Total

results

£m

Intangible

asset

amortisation

£m

Intangible

asset

impairment

£m

Major

restructuring

£m

Transaction-

related

£m

Divestments,

significant

legal and

other items

£m

Adjusted

results

£m

Turnover 33,754 33,754

Cost of sales (11,863) 713 30 658 383 – (10,079)

Gross profit 21,891 713 30 658 383 – 23,675

Selling, general and administration (11,402) 4 332 104 247 (10,715)

Research and development (4,568) 64 49 114 2 (4,339)

Royalty income 351 351

Other operating income/(expense) 689 1 (142) (548) –

Operating profit 6,961 777 83 1,105 345 (299) 8,972

Net finance costs (814) 5 (1) (810)

Share of after-tax profits of associates and joint ventures 74 74

Profit before taxation 6,221 777 83 1,110 345 (300) 8,236

Taxation (953) (156) (17) (208) (124) 140 (1,318)

Tax rate 15.3% 16.0%

Profit after taxation 5,268 621 66 902 221 (160) 6,918

Profit attributable to non-controlling interests 623 164 787

Profit attributable to shareholders 4,645 621 66 902 57 (160) 6,131

Earnings per share 93.9p 12.6p 1.3p 18.2p 1.2p (3.3)p 123.9p

Financial performance continued

08

GSK Annual Report 2019

Financial performance continued

Adjusted results

2019 2018 Growth

% of % of

£m turnover £m turnover £% CER%

Turnover 33,754 100 30,821 100 10 8

Cost of sales (10,079) (29.9) (9,178) (29.8) 10 10

Gross profit 23,675 70.1 21,643 70.2 9 7

Selling, general and administration (10,715) (31.7) (9,462) (30.7) 13 12

Research and development (4,339) (12.9) (3,735) (12.1) 16 14

Royalty income 351 1.1 299 1.0 17 17

Operating profit 8,972 26.6 8,745 28.4 3 –

Net finance costs (810) (698)

Share of after-tax profits of associates and joint ventures 74 31

Profit before taxation 8,236 8,078 2 (1)

Taxation (1,318) (1,535)

Tax rate 16.0% 19.0%

Profit after taxation 6,918 6,543 6 3

Profit attributable to non-controlling interests 787 674

Profit attributable to shareholders 6,131 5,869

Earnings per share 123.9p 119.4p 4 1

How we performed

Cost of sales

Adjusted cost of sales as a percentage of turnover was 29.9%,

0.1 percentage points higher at AER and 0.5 percentage points

higher at CER. On a pro-forma basis, Adjusted cost of sales

as a percentage of turnover was 29.9%, 0.3 percentage points

higher at CER. This primarily reflected continued adverse

pricing pressure in Pharmaceuticals, partly offset by a more

favourable product mix in Vaccines, largely due to the growth

of Shingrix in the US.

Selling, general and administration

Adjusted SG&A costs as a percentage of turnover were 31.7%,

1.0 percentage point higher at AER and 1.0 percentage point

higher on a CER basis. On a pro-forma basis, Adjusted SG&A

costs as a percentage of turnover were 31.7%, 0.8 percentage

points higher at CER, compared with 2018. This primarily

reflected increased investment resulting from the acquisition

of Tesaro and in promotional product support, particularly for

new launches in Vaccines, Respiratory and HIV, partly offset

by the continuing benefit of restructuring in Pharmaceuticals

and the tight control of ongoing costs.

Research and development

Adjusted R&D expenditure was £4,339 million (12.9% of

turnover), 16% higher at AER, 14% higher at CER than in 2018.

On a pro-forma basis, Adjusted R&D expenditure grew 13%.

This reflected a significant increase in study and clinical trial

material investment in Oncology and increased spending

on the progression of key non-Oncology assets, partly offset

by savings from the early phase portfolio reprioritisation in

late 2018.

Operating profit

Adjusted operating profit was £8,972 million, 3% higher

at AER but flat at CER on a turnover increase of 8% CER.

The Adjusted operating margin of 26.6% was 1.8 percentage

points lower at AER, and 2.1 percentage points lower on

a CER basis than in 2018. On a pro-forma basis, Adjusted

operating profit was 3% lower at CER on a turnover increase

of 4% CER. The Adjusted pro-forma operating margin of 26.6%

was 1.9 percentage points lower on a CER basis than in 2018.

The reduction in pro-forma Adjusted operating profit primarily

reflected continuing price pressure and investments in R&D and

promotional product support, partly offset by the benefit from

sales growth, particularly in Vaccines, a more favourable mix in

Vaccines and Consumer Healthcare and the continued benefit

of restructuring.

Tax

Tax on Adjusted profit amounted to £1,318 million and

represented an effective Adjusted tax rate of 16.0%

(2018 – 19.0%), reflecting the impact of the settlement

of a number of open issues with tax authorities.

Non-controlling interests

The allocation of Adjusted earnings to non-controlling interests

amounted to £787 million (2018 – £674 million). The increase

primarily reflected an increased allocation of Consumer

Healthcare profits.

Earnings per share

Adjusted EPS of 123.9p compared with 119.4p in 2018,

up 4% AER, 1% CER, with Adjusted operating profit flat

at CER. The improvement primarily resulted from a reduced

effective tax rate and an increased share of after-tax profits

of associates, partly offset by increased net finance costs

and a higher non-controlling interest allocation of Consumer

Healthcare profits.

Investor information

Financial statements

Strategic report

Governance and remuneration

GSK Annual Report 2019

09

Our long-term priorities

Innovation

We invest in scientific and

technical excellence to develop

and launch a pipeline of new

products that meet the needs of

patients, payers and consumers.

Performance

We deliver growth by investing

effectively in our business,

developing our people and

executing competitively.

Trust

We are a responsible company.

We commit to use our science

and technology to address health

needs, make our products

affordable and available and

be a modern employer.

Our long-term priorities are designed to create lasting value for patients,

consumers and shareholders. 2019 was an important year of execution

and we made good progress in delivering on our objectives.

2019 objectives

– Deliver continued strong sales of Trelegy

Ellipta, Nucala, HIV two-drug regimen

and Shingrix

– Continue to strengthen pipeline through

execution of new R&D approach,

accelerating priority assets and optimising

recent strategic business development

transactions

2019 progress

– Delivered strong sales of all key launches,

notably Shingrix with sales of £1.8 billion

– Strengthened pipeline with eight filings,

six positive pivotal trial results, and four

priority assets accelerating to phase II/III

– Accelerated oncology pipeline with

regulatory submissions for Zejula in first-line

maintenance ovarian cancer, belantamab

mafodotin in relapsed/refractory multiple

myeloma, and dostarlimab in endometrial

cancer

– Developed advanced technology capability

with significant hires and partnerships with

world-leading scientists

2020 priority objectives

– Deliver Innovation sales with excellent

commercial, R&D and supply chain

execution

– Further accelerate and strengthen pipeline

with six potential approvals expected

2019 objectives

– Continue to drive sales growth and

operational performance

– Successful integration of Tesaro

– Deliver restructuring benefits

– Develop plan for integration of Pfizer’s

consumer healthcare business

– Accelerate capability building in priority

areas including digital, data and analytics

2019 progress

– Group sales £33.8 billion, up 10% AER,

8% CER, pro-forma +4%

– Free cash flow £5.1 billion

– Total earnings per share 93.9p (up 27%

AER, 23% CER), Adjusted earnings per

share 123.9p (up 4% AER, 1% CER)

– Successful integration of Tesaro and built

capability in priority areas, notably specialty

therapies, including oncology

– Continued delivery on restructuring benefits

to support investment in innovation and new

launches

– Completed Consumer Healthcare JV with

Pfizer and on track to deliver synergies

– Invested in new talent to build capability

2020 priority objectives

– Prioritise spending to deliver growth and

return on investment

– Successful Consumer Healthcare JV

integration, including driving growth and

delivering synergies

– Deliver further capability building in

specialty Pharmaceuticals

– Deliver two-year programme to prepare

GSK for separation into two new companies

2019 objectives

– Focus on supply service levels, execute

portfolio and network simplification

– Deliver progress on Trust commitments

– Progress global health research in TB

and HIV

– Deliver modern employer programmes

to empower employees to be themselves,

feel good and keep growing at GSK

2019 progress

– Filed FDA and EU regulatory submissions

for paediatric dolutegravir

– Released positive final phase II results

for our candidate TB vaccine and built a

collaboration with the Bill & Melinda Gates

Medical Research Institute for the

continued development of the asset for

developing countries – which was finalised

and announced in January 2020

– Continued to embed modern employer

programmes with progress in engagement,

diversity and inclusion, employee health

and wellbeing, and development

– Ranked top in Dow Jones Sustainability

Index for the pharmaceuticals industry

2020 priority objectives

– Continue to deliver on-time in-full supply

of our products

– Build reputation with a focus on Innovation

– Deliver progress on Trust commitments

Culture

We are committed to developing the right culture to drive and maximise performance. We are empowering and enabling everyone at GSK

to live our values and expectations, and changing the way we work to accelerate delivery of our long-term priorities.

Principal risks

Our principal risks are: patient safety; product quality; financial controls and reporting; anti-bribery and corruption; commercial practices;

privacy; research practices; third party oversight; environment, health and safety, and sustainability; information security; and supply continuity.

Our risk management framework is designed to support our long-term priorities. See pages 43 to 46 and 275 to 287.

10

GSK Annual Report 2019

GSK has a well-established purpose – to help people

do more, feel better, live longer – together with strong

values of patient focus, respect, transparency and integrity.

We are extremely proud of how our purpose and values lead

us as a company. However, our operating environment is

changing rapidly and our stakeholders have increasing

expectations of us.

We recognise that our culture must have a greater focus on

performance and growth, while remaining firmly purpose-led

and values-based. This necessary shift in culture is key to

delivering our goal of becoming one of the world’s most

innovative, best performing and trusted healthcare companies.

Our expectations – courage, accountability, development

and teamwork – sit alongside our values to help us develop

the behaviours we need in our desired culture:

Courage: having high ambitions, setting an accelerated pace,

smart risk taking where appropriate, making the right decisions

assertively even when it is difficult, and speaking up when

we see opportunities to improve or have a concern.

Accountability: taking ownership, having single point

of accountability decision making, prioritising work that

supports our strategy and delivering what we promise.

Development: prioritising people's development and

encouraging them to ask for and give open and honest

feedback, so we continually grow as individuals, teams

and as an organisation.

Teamwork: ensuring our people work better together on

aligned objectives and understand how they contribute to

our long-term priorities, encouraging diversity of thought

and inspiring each other; holding each other to account.

Enabling culture change

Culture change is a long-term commitment and requires

focus at every level of the company:

– We have made company-wide changes to our incentive

schemes, governance and ways of working, including

implementing key performance indicators and standardised

performance reviews.

– We continue to strengthen how our values and expectations

are embedded into our recruitment processes, leadership

development, employee training and performance evaluation.

– Across the whole company there are two broad themes

we are focusing on: clearer accountability and better

decision-making to drive pace and performance, and an

open, honest and straight-talking culture where our people

trust their leaders and feel confident to share their views.

Each of the businesses have set clear objectives to drive

the culture shift needed in their area.

– Our leaders and managers should be role models of our

desired culture. This starts with having the right people, and

we have made significant changes to our top 125 leaders,

with 29% new appointments (internal movement and external

hires) in the last year. We have invested significantly in

building High Performing Teams (HPT), including our

Corporate Executive Team, taking part in ongoing HPT

development programmes.

Tracking progress

We track our cultural change with a range of indicators and

the Board receives regular updates. In addition to specific lead

indicators by business area, we measure employee feedback

across the company through our global employee survey.

This focuses on (a) our progress on embedding a culture that

prioritises Innovation, (b) our discipline, competitive edge,

speed and agility to deliver growth orientated Performance,

(c) employee Trust, including pride in our purpose and progress

on our Modern Employer priorities and (d) how well the values

and expectations are embedded into our ways of working.

We also measure progress on key drivers of culture:

(1) strength of talent and succession plans for key roles and

(2) effectiveness of our global people manager population

through our global One80 survey (see page 36). We use our

employee engagement scores as an additional indicator of our

progress in embedding a culture in which our employees are

inspired by our purpose and are working together in the best

way so that we meet our long-term priorities, bring competitive

returns to shareholders, and help more patients and consumers.

We are building a more performance-focused culture, aligned to our

values and expectations, that will help us achieve our purpose and

power our long-term priorities.

Our culture

Investor information

Financial statements

Strategic report

Governance and remuneration

GSK Annual Report 2019

11

We track progress against our long-term priorities with ten operating key

performance indicators. These measure our performance at a Group level

and across our three businesses.

Key performance indicators

Innovation

2019 2018 2017

Innovation sales

R

Pharmaceuticals and Vaccines – sales of products launched in the last five years £3.8bn £1.7bn

a

£0.4bn

a

Consumer Healthcare – sales from products which are new to a market in the last

three years as a % of total sales

12% 11% 13%

Pipeline value and progress – the value of products in our pipeline and R&D

milestones achieved n/r n/r n/r

Performance 2019 2018 2017

Group turnover

R

– up 10% AER, 8% CER £33.8bn £30.8bn £30.2bn

Profit

R

Total operating profit – up 27% AER, 23% CER

£7.0bn £5.5bn £4.1bn

Adjusted operating profit – up 3% AER, flat CER

£9.0bn £8.7bn £8.6bn

Total operating margin

20.6% 17.8% 13.5%

Adjusted operating margin

26.6% 28.4% 28.4%

Free cash flow

R

– down 11% £5.1bn £5.7bn £3.5bn

b

Market share – our market share in relation to our competitors n/r n/r n/r

Top talent and succession plans for key roles – our most talented employees

in key roles with succession plans in place n/r n/r n/r

Trust 2019 2018 2017

Employee feedback – employee engagement scores from our global employee survey 78% 78% 79%

Supply service level – percentage of orders delivered on-time and in-full n/r n/r n/r

Corporate reputation – reputation index among stakeholders and informed public

measured globally and in top 13 markets n/r n/r n/r

R

Linked to Executive LTI awards and bonus, see pages 117, 123 and 125.

a Comparative information reflects sales of those products that meet the definition for 2019.

b Revised to include proceeds from the sale of intangible assets.

n/r Not reported externally.

Our operating key performance indicators (KPIs) are reviewed

regularly by our Corporate Executive Team and the Board.

Our employees are updated on our progress against them every

quarter. Our performance system aligns employees’ bonuses

with a relevant subset of our ten indicators and the remuneration

policy used to reward the performance of our executives also

includes measures linked to our KPIs (see pages 117, 123

and 125).

We track all of our operating KPIs internally, and below we

provide performance data for those that we report externally.

Due to commercial sensitivities we do not publish data for all

operating KPIs (indicated as n/r). We use a number of adjusted,

non-International Financial Reporting Standards (IFRS)

measures to report our business performance, as described

on pages 50 to 52. These include Adjusted results, free cash

flow and CER growth rates. Non-IFRS measures may be

considered in addition to, but not as a substitute for or superior

to, information presented in line with IFRS.

12

GSK Annual Report 2019

We are operating in a dynamic environment, shaped by fast-

changing and interdependent global trends. We continue to

be responsive to this changing environment through monitoring

industry trends and engaging with key stakeholder groups

(see pages 15 to 16).

The global healthcare industry

Global growth is projected to rise from an estimated 2.9% in

2019 to 3.3% in 2020, a downward revision of 0.1% from the

previous World Economic Outlook. Rising geopolitical tensions

have increased uncertainty about the future of the global trading

system and international cooperation, taking a toll on business

confidence and investment decisions.

1

The global healthcare market continues to grow, with

worldwide pharmaceutical sales totalling £801 billion from

September 2018-2019, up 6.4%. North America remains

the largest pharmaceutical market with a 48% share of global

sales, with Europe representing 21%. China is the second

largest individual country for pharmaceutical sales, representing

8.5% of global sales.

2

Global vaccine sales rose to

approximately £23.8 billion in 2019, up around 15% from

2018.

3

The global consumer healthcare market is estimated

to be approximately £140 billion.

3

The healthcare sector remains intensely competitive, with

companies increasingly pursuing mergers, acquisitions and

partnerships to strengthen pipelines and portfolios. 2019

saw significant M&A activity in oncology and speciality care,

together with several company mergers, most notably with

Bristol-Myers Squibb acquiring Celgene and AbbVie

acquiring Allergan.

Intellectual property (IP) protection is important to continue

to incentivise innovation. This helps research-based healthcare

companies ensure a reasonable return on their investments

and allows them to continue to conduct research and develop

new and innovative medicines. Once IP protection expires,

or if challenges to a patent are upheld, generic competitors

can rapidly capture a large share of the market. Vaccines

and other biologics do not face such exposure to generic

competition through these ‘patent cliffs’. They require high

capital investment due to the highly technical manufacturing

processes, and complex regulatory and quality requirements.

Global trends: opportunities and challenges

Changing demographics

Demographic change is increasing demand for both preventive

and therapeutic healthcare products.

The world’s population continues to grow. From an estimated

7.7 billion people worldwide in 2019, the global population is

predicted to grow to 8.5 billion by 2030.

4

Virtually all countries

are experiencing population ageing, with the proportion of the

world’s population over 60 projected to nearly double between

2015 and 2050.

5

More people are living in cities and affluence

is growing, with the size of the global middle class projected to

be approximately 4.9 billion people by 2030, up from 1.8 billion

in 2009.

6

Our response

These factors are all contributing to rising demand for healthcare,

including in areas where we are focused such as oncology

and respiratory, as well as pressuring healthcare systems

to restrain spending growth. As part of our Innovation priority

we are investing in developing and launching a pipeline of new

products that meet the changing needs of patients, payers

and consumers (see pages 17 to 21 and 23 to 25). We ensure

our products serve a broad demographic through our global

health and pricing strategies (see pages 30 to 34).

Industry trends

1 IMF World Economic Outlook Update

2 IQVIA data

3 Internal data

4 https://population.un.org/wpp/Publications/Files/WPP2019_

Highlights.pdf

5 https://www.who.int/news-room/fact-sheets/detail/ageing-and-health

6 http://oecdobserver.org/news/fullstory.php/aid/3681/An_emerging_

middle_class.html

The healthcare industry operates in a rapidly changing environment with

strong growth potential. Our strategy is designed to respond to this context

by maximising opportunities and mitigating risks.

Investor information

Financial statements

Strategic report

Governance and remuneration

GSK Annual Report 2019

13

Advances in science and technology

Rapid advances in innovative science and technology are

transforming the sector. Cell therapy technologies, where

cells become living medicines, are changing the definition

and profile of medicine. New advances in functional genomics,

such as CRISPR, are changing what is possible in drug

discovery and will enable researchers to pinpoint novel targets

with a higher probability of success. The scale of data from

genetic libraries and genomics requires artificial intelligence (AI)

to interpret, and machine learning helps to predict possible new

pathways to a medicine. The growth in data is also improving

the healthcare ecosystem and helping to build a virtuous

cycle of data, technology and R&D. Regulators and purchasers

can use these technologies to track product effectiveness,

while consumers relying on digital tools to manage their

health and understand their genetic profiles are helping

research efforts by building a better understanding of

genetics and disease.

Our response

The application of advanced technologies is central to our R&D

approach, as part of our Innovation priority. We are developing

core capabilities in AI, machine learning, functional genomics

and cell therapy to accelerate the pace at which we identify

and develop novel targets and medicines, including creating

the Laboratory for Genomics Research, a state-of-the-art lab

to apply CRISPR gene editing technologies to drug discovery.

We have made significant investments to help us realise the

potential of these cutting-edge technologies and, ultimately,

strengthen our pipeline. We are also attracting the best

scientific minds to work for us and with us, by entering into

ambitious and creative collaborations, such as our partnership

with Lyell Immunopharma, to enhance our cell and gene therapy

programme and with 23andMe, with which we have eight

ongoing joint programmes (see page 21).

Pricing and access

The pricing of healthcare products and the increasing pressure

to fund high-cost, innovative therapies continues to attract

significant attention from governments and the public, with

calls for better transparency on how prices are set and a

greater emphasis on value and health outcome-based pricing.

Government and payer budgets remain subject to increasing

review as demand for healthcare grows and the healthcare

policy environment remains fluid, with payers introducing

increasingly restrictive cost-control mechanisms.

In the US, the government has proposed several drug pricing

initiatives, including a new ‘international pricing index’, in order

to reduce healthcare costs for patients and the government.

While there are still significant potential obstacles to the

implementation of national drug pricing proposals, multiple

states have also passed legislation or regulation that increases

oversight, transparency and/or control of pharmaceutical prices.

Organisations that assess the value of pharmaceutical products

relative to price and health outcomes, such as the Institute for

Clinical and Economic Review, are also rising in prominence

in the US.

In Europe, while the majority of markets have established price

control processes in place, national healthcare authorities are

continually looking to sharpen these tools in response to

changing market dynamics. Disparity in both access and supply

availability across EU markets has been a topic of recurrent

debate in recent years. Member states have repeatedly raised

serious concerns over the problem of medicines shortages.

They call for transparency of prices, R&D costs and public

subsidies, pushing to roll back existing flexibilities with EU

legislation and/or create additional hurdles for market access.

In Europe and many Emerging Markets, international reference

pricing (IRP) continues to gain traction, with over 70 markets

now using this as a primary lever for pricing control.

Increasingly, countries are also cooperating on health

technology assessments (HTAs) – the new EU HTA regulation

proposal would centralise the clinical assessments of new

medicines and medical devices.

Beyond Europe many countries are implementing various

forms of HTA. In China several policies have been proposed

to boost the quality, efficiency and value of healthcare delivery

and HTA implementation is among the key initiatives proposed.

Products with high clinical value, particularly those seeking

a premium price, will likely be prioritised for HTA review,

especially in oncology and other critical disease areas.

While accelerating access to innovation, China is also

implementing cost containment measures to balance its

healthcare budget. Saudi Arabia is establishing a new,

independent and evidence-based HTA entity to help it

maximise health gains through efficient use of resources.

Finally, in Japan the pharmaceutical industry remains

concerned about the proposed use of HTA for pricing

control rather than value assessment.

Our response

We aim to improve the health of millions of people each year

by making our products available at responsible prices that are

sustainable for our business. Getting this right is fundamental

to both our Performance and Trust priorities. When setting

the price of our medicines in developed markets, we apply

a value-based approach to balance reward for innovation with

access and affordability (see page 33). We aim to bring truly

differentiated, innovative products that bring highly effective

health outcomes for patients and payers, so that even those

products with a high cost will bring value to patients and

healthcare systems. By investing in genetics, genomics,

big data and AI we are accelerating the pace at which we

develop transformational medicines, prioritising those molecules

with a higher probability of success – we know that genetically

validated drug candidates are twice as likely to become

registered medicines, improving the productivity of our

R&D investment.

Industry trends continued

14

GSK Annual Report 2019

Regulatory environment

Healthcare is a highly regulated industry, reflecting public

expectations that products comply to stringent levels of quality,

safety and efficacy.

Governments continue to introduce and develop regulatory

approaches to support the accelerated development and

introduction of new medicines and to encourage pharmaceutical

innovation. Regulatory authorities are exploring how to progress

or adapt regulatory science to address new and potentially

disruptive technologies, such as digital healthcare, cell and

gene therapies, big data and real-world evidence. Work on

cross-border harmonisation of pharmaceutical regulation is

increasing through supranational bodies, such as the

International Council for Harmonisation, the geographic scope

of which continues to expand, including to emerging markets.

This work is supporting the introduction and development of

initiatives in which regulators from different jurisdictions share

or co-operate in the assessment of regulatory submissions,

for example the US Food and Drug Administration (FDA) is

providing a framework for concurrent submission and review

of oncology products with international partners.

Our response

GSK closely monitors and, where relevant and appropriate,

engages in how we can improve regulation, particularly in the

UK, Europe and the US. For example, as scientific innovation

moves beyond the scope of current regulation and standards,

we are working with the sector to engage with governments

to explore new policies, processes and incentives that would

support the discovery and delivery of medicines developed

through emerging technologies and techniques (see page 16).

Societal expectations

Expectations of business are changing. As well as delivering

financial returns, companies are expected to create value

for a range of stakeholders through taking action on social

and environmental issues. Some are calling for the purpose

of business to be redefined, with groups like Business

Roundtable, a leading business group in the US, saying

a corporation exists to benefit all stakeholders, moving away

from the long-standing endorsement of shareholder primacy.

In order to attract and retain the best talent companies need

to rise to the expectations of a workforce that is motivated

by delivering on a greater purpose. Employees who work

for a company with a strong sense of purpose, and who feel

connected to it, are three times more likely to thrive in what

they do.

1

At the same time, investors are increasingly asking companies

to articulate how they are managing a range of environmental,

social and governance (ESG) risks and opportunities. Major

institutional investors are publicly stating that they believe that

ESG factors impact a company’s long-term success and so

are important to their investment decisions.

Companies are expected to contribute to the UN Sustainable

Development Goals (SDGs), especially as we move into the

final decade for their delivery by 2030. There is growing public

demand for companies to play a role in managing climate

change and mitigating climate risk, as well as address other

environmental issues such as plastics, air pollution and water

management. Companies are also under increasing pressure

to address social issues such as human rights, inclusion and

diversity and fair pay, both in direct operations and throughout

the supply chain.

The pharmaceutical sector in particular has a trust deficit and

remains under sustained scrutiny around sales and marketing

practices and ethics and compliance. It is also facing additional

reputational challenges related to issues like the opioid crisis

in the US, as well as the growing momentum of the anti-vaccine

movement in some regions.

Our response

Our Trust priority is designed to respond to multi-stakeholder

expectations and prioritise the areas where we are positioned

to have significant and sustainable impact. We set 13 public

commitments to support our Trust priority in 2018 and are

making good progress against them (see pages 30 to 42). We

recognise that expectations are moving quickly and that we

need to respond accordingly (see pages 15 to 16).

Industry trends continued

1 Mercer 2018 Global Talent Trends Study. Input: 800 executives, 1,800 HR

leaders, 5000+ employees, 21 industries, 44 countries

Investor information

Financial statements

Strategic report

Governance and remuneration

GSK Annual Report 2019

15

Stakeholder engagement

Engaging and building trust with the broad range of stakeholders that interact

with, or are impacted by, our business is key to delivering our strategy and

ensuring our success over the long term.

Section 172 statement

We have various mechanisms that enable management and the Board to understand and consider stakeholder views as part

of their oversight and decision making. This is explained in our section 172 statement, which is set out in full on page 111, and

is incorporated by reference into this Strategic report. On this page we summarise our key stakeholder groups, how we engage

with them, the issues that matter most to them and what we are doing in response.

Patients and

consumers

Insights from patients and consumers enable us

to develop products that better meet their needs.

How we engage

– Advisory boards, disease-specific patient panels

and Patient Advocacy Leaders Summits to provide

patient insights

– Engagement and support for patient groups (disclosed

on gsk.com), and initiatives that empower patients

to get involved in medicine development

– Market research and consumer sensory labs help

to uncover consumer insights

What matters

– The pricing of healthcare products, particularly out-of-pocket

expenses

– Differentiated product innovation based on patient and

consumer needs

– Access to a reliable supply of high-quality, safe products

What we are doing

– We take a values-based approach to pricing to balance

reward for innovation with access and affordability

– Strengthening our pipeline to bring innovative products

to patients and ensure we maintain high standards for

product quality and safety

Investors

We maintain regular and constructive dialogue with

investors to communicate our strategy and performance

in order to promote investor confidence and ensure

our continued access to capital.

How we engage

– Ongoing communications including the AGM, quarterly

results calls and detailed company information online

– One-to-one meetings between Board members, senior

executives and institutional investors including introduction

roadshows for our new Chairman and CFO

– Biannual investors and analysts perception study and, for

the first time in 2019, we conducted a specific ESG study

What matters

– Financial performance and commercial success

– Understanding how our R&D strategy is successfully

developing our pipeline

– Management of key environment, social and governance

(ESG) issues to mitigate risk and create opportunity

What we are doing

– Continuing to report in line with best practice disclosure

on progress towards our financial targets and strategic goals

– Specific business and R&D updates and events e.g. ViiV meet

the management, Vaccines Investor Day, Oncology roundtables

– We are increasing engagement on ESG matters

Healthcare

professionals

and medical

experts

We work with healthcare professionals (HCPs)

and medical experts to understand patient needs

and to ensure our products are being administered

in the right way.

How we engage

– Scientific dialogue to increase understanding

of disease management and patient experience

– Providing high-quality, balanced information about

our medicines and vaccines

– Collaboration on clinical trials and research

What matters

– Access to product and scientific information

– Responsible sales and marketing practices

– Safety, efficacy and differentiated innovation

What we are doing

– Increasing the use of digital channels to deliver a more

personalised and effective sharing of information to HCPs

– Updating our salesforce incentive policy to attract and

retain the best talent while upholding ethical standards

– Using HCP insights on disease management and patient

experience to inform the development of our medicines

R&D partners

and academia

We partner with scientific institutions, national health

systems, business partners and academia to help

ensure we develop differentiated healthcare products.

How we engage

– Collaboration with outstanding scientists from organisations

across the globe

– Establishing joint ventures to strengthen innovation

and efficiency

– Working with academic institutions to accelerate

discovery and development of new medicines

What matters

– Finding the right partner to accelerate a potential medicine

or vaccine to approval to reach patients

– Pushing the science as far as it can go to advance human

health

– Dissemination and advancement of scientific knowledge

What we are doing

– Working with world leading experts at biotechs, universities

and other scientific institutions to improve drug discovery

and increase the productivity of our R&D pipeline

– Collaborating with partners such as Open Targets, FinnGen,

and the UK Biobank that are focused on identifying

disease-relevant genes to validate high-potential targets

16

GSK Annual Report 2019

Governments

and regulators

We work with governments and regulators to advocate

for policies that encourage innovation, promote

efficient management of healthcare spending

and give patients the support they need.

How we engage

– Meeting with regulatory bodies throughout the

development process to ensure high quality

and safe new products

– Engaging with government health agencies

to demonstrate the value of our products

– Working with governments to build a strong

operating environment for life sciences

What matters

– Environments which value innovation and drive investment

in life sciences

– Scientific funding and collaboration

– Medicines pricing and reimbursement

– Public health threats

What we are doing

– Working with policymakers to support an operating environment

that remains competitive for R&D investment, enables mobility

of scientific talent and accelerates the uptake of innovative

medicines, including the UK Life Sciences Industrial Strategy

– Actively engaging on government proposals for healthcare

reform, including in the US where we successfully ensured

patient access to full treatment regimes for HIV and cancer

was maintained

– Partnering with authorities in China to ensure support

for global innovation, including swift regulatory approval

of Shingrix and Benlysta

NGOs and

multilateral

organisations

We work with partners to improve access to healthcare

services and our products, and to advocate for the

policy environment in which we can be successful.

How we engage

– Working with non-governmental organisations (NGOs)

and partners to research and develop products to

address global health challenges

– Collaborating with NGOs and generic manufacturers to

sustainably supply our products to developing countries

– Partnerships to strengthen health systems in developing

countries and drive progress on global health priorities

What matters

– Access to medicines and vaccines

– Achieving the UN SDGs and WHO targets for specific

disease areas

– Universal Health Coverage (UHC) and the future

of health systems

– Sustainable financing for global health

What we are doing

– Focusing on our unique value-add as a global health partner

to develop products where we have scientific expertise

– Partnering with organisations that have complementary