Investor Presentation

February 2024

05/05/2022

Introduction

1

3

Vestiaire Collective brings concrete solutions to the

acute challenges of the fashion industry

Challenges of the fashion industry

35% of all oceans’

microplastics

2

10% of greenhouse

gases emissions

1

20% of all global

wastewater

1

Sources:

1

United Nations Environment Programme and the Ellen MacArthur Foundation;

2

Report sent by five NGOs (A Plastic Planet, Matter, PlanetCare, Xeros, and 5 Gyres) to the European Commission (2023);

3

Vestiaire Collective’s impact

report (2023)

Secondhand, first choice:

82% of the items purchased on Vestiaire Collective

prevent a first-hand purchase

3

Much smaller environmental cost:

90% of the environmental cost of a fashion item is saved

by shopping on Vestiaire Collective

3

The upscale effect:

85% of Vestiaire Collective’s users are willing to buy fewer

and better quality items

3

Vestiaire Collective’s positive impact

The fashion industry has become one of the most

polluting industry in the world, representing today…

VC is a climate positive company: the GHG emissions it allows

to avoid amount to c.3x the GHG emissions it actually produces

3

4

Vestiaire Collective has defined a 3-pillar strategy to deliver

on its ambitious vision

Building a scalable platform

Growing our fashion community

Bolstering the sustainability ecosystem

Our Vision

Our Strategy

“ We’re on a mission to

transform the fashion

industry for a more

sustainable future by

empowering our community

to drive the change ”

Tech first & asset light Attractive unit economics

Global & uniquely engaged Trust as a core value

BCorp & Climate positive Resale as a Service

5

Vestiaire Collective has become a leading online luxury

fashion resale platform with global operations

Notes:

1

Data for Vestiaire Collective platform. Annualized GMV representing the monthly GMV multiplied by 12.

Business model repositioning with renewed focus on technology (app-first,

e-commerce best practices) and operational excellence

Introduction of complementary Direct Shipping model (in 2019) resulting

increased engagement and reach and significant reduction in costs per order

Strong tailwinds from growing awareness towards sustainability and the role

of the circular economy

Accelerated international expansion across Europe, the US (acquisition of US

competitor Tradesy in 2022) and Asia

Passionate founding team including complementary fashion and technology

backgrounds

Seamless experience with fashion and trust positioned as key pillars of the

business model (all transactions physically authenticated)

Brand building and new customer acquisition mainly achieved organically,

through social networks, influencers and public relations

Progressive international roll-out in Europe (UK in 2012), the US (in 2014)

and Asia (in 2017)

2009 2018 2019

Annual GMV (€m)

1

CEO Change

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

<1

3

11

18

30

52

89

130

171

197

Annualized GMV (€m)

1

Jan-19 Jan-20 Jan-21 Jan-22 Jan-23

33% p.a. growth

Dec-23

192

285

485

685

817

957

857

6

Vestiaire Collective at a glance: a leading global marketplace

for pre-loved luxury fashion

640

Full-time employees

2024

Aims at reaching breakeven

towards the end of 2024. Already

profitable (gross margin) across

every price range

€824m

Gross Merchandise Value

achieved in 2023

33%

Through-the-cycle Gross

Merchandise Value CAGR (5-year)

70+

Countries of presence

4.8m

Available items across all

fashion categories

7

Strong operational team dedicated to deliver long-term

profitable growth

Fanny Moizant

Co-Founder & President

Founded Vestiaire Collective in 2009

Maximilian Bittner

Chief Executive Officer

Joined Vestiaire Collective in 2018

Charles Bellois

Chief Experience &

Logistics Officer

Joined VC in 2018

Chief Financial Officer

Joined VC in 2021

Bernard Osta

Chief Operating Officer

Joined VC in 2021

Klemen Drole

Chief Strategy Officer

Joined VC in 2019

Thomas Hezard

CEO North America

Joined VC in 2023

Samina Virk

Chief Impact Officer

Joined VC in 2020

Dounia Wone

Chief Technology Officer

Joined VC in 2022

Olaf Zschiedrich

Sophie Hersan

Co-founder & Fashion

Director

Founded VC in 2009

Chief Marketing Officer

Joined VC in 2023

Marie-Christin Oebel

Chief Product Officer

Joined VC in 2023

Adam Kwiecinski

8

Management

Vestiaire Collective is backed by high profile long-term

shareholders perfectly matching its global ambitions

Luxury Sustainability

Europe Growth US Growth APAC Growth

Founders, managers and other Condé Nast

Kering

1

Generation IM

2

Eurazeo

Vitruvian

Bpifrance

Luxury Tech Fund

Ventech

Balderton

Other funds

Tiger Global Management

1

John Doerr

3

Other funds

3

SoftBank

2

Korelya

4

22.5%

9.6%

5.8%

2.5%

2.2%

1.8%

1.1%

3.8%

3.6%

0.8%

6.0%

2.8%

2.8%6.9%

4.5%

23.2%

Notes: Shareholding as of Dec 31, 2023, on a fully-diluted basis.

1

Co-led the €178m fundraising announced in March 2021;

2

Co-led the €178m fundraising announced in September 2021;

3

Former shareholders of Tradesy;

4

Paris-based

investment group funded by Korea-based technology company Naver

2

Market overview

10

€76bn

€220bn

€290bn

€345bn

€550bn

1998 2002 20182000 2021 2030E20031996 1997 20201999 2001 2004 2005 2006 2007 2008 2009 2010 2011 2012 20172013 20192014 2015 2016 2022

A large, resilient and growing personal luxury goods market

Notes:

1

Bain/Altagamma personal luxury goods report (June 2023 update)

• The personal luxury goods market amounted to €345bn in 2022

• The industry has grown at a CAGR of 6% in the past 25 years and is expected to maintain the same pace until 2030

Global personal luxury goods market

1

+6% p.a.

+6% p.a.

11

The breakthrough of online luxury fashion resale

Notes:

1

BCG report: “What an Accelerating Secondhand Market Means for Fashion Brands and Retailers” (October 2022);

2

Source: ThredUp resale report (2023 edition)

• The broad fashion resale market is expected to deliver annual growth of 15% over 2022-2027E

• … and a sustained 21% annual growth for the online fashion resale market in which Vestiaire Collective operates

177

211

248

288

324

351

2024E2022 20272025E2023E 2026E

Global fashion resale marketsize

2

(in $bn)

+15% CAGR

Key drivers of secondhand

purchase in luxury fashion

1

1

2

3

4

Affordability and value

Variety of choice

Sustainability

Thrill of the hunt

50%

40%

40%

35%

(% approval rate among interviewed shoppers)

12

Vestiaire Collective has secured an attractive positioning in the

fashion marketplace ecosystem

High End: €350+ AOV

Mass: €50- AOV

Consignment and

purchase models

Asset-light

marketplaces

Presence in: Europe US Asia

Attractive unit economics

thanks to:

✓High average order value

✓Low costs per order

3

Brand positioning

14

Vestiaire Collective’s commitment to luxury fashion

translates into attractive catalog and GMV mix

Scope: Based on 2023 data

• Vestiaire Collective is primarily exposed to timeless brands from leading luxury houses (c.75% of its GMV) and therefore

insulated from risks associated to (i) mono-brand businesses or (ii) less-established fashion brands

40% New-ins

75% GMV

14% New-ins

13% GMV

17% New-ins

7% GMV

17% New-ins

3% GMV

Luxury houses

Designers

Premium

Middle Brands

Other

12% New-ins

2% GMV

15

Vestiaire Collective delivers impactful and innovative branding

campaigns, effectively leveraging its brand pillars

Puppets campaign

March to May 2022: Branding

campaign run in France & Italy

+7pp aided brand awareness

+11pp aided brand awareness

Stylist campaign

September and October

2023: Branding campaign run

in the US, France, Germany,

Italy leveraging our

community to build trust &

fashion authority

Burberry x Vestiaire Collective

October 2023: Announcing our

Resale as a Service partnership with

Burberry, positioning VC as the

trusted resale partner for luxury

brands

Think First, Buy Second(Hand)

November 2023: Wave II of Vestiaire

Collective’s fast fashion ban

212M+ PR clippings reach

18M+ Organic social videos views

4

Business model

17

A business model reflecting the four pillars of Vestiaire

Collective’s mission

Asset-light dual business model dedicated to promote trust with consumers

Supply-driven model confirming the high desirability of the luxury fashion category

Global platform dedicated to grow the share of more sustainable local-to-local transactions

Technology-led to offer a superior customer experience to our community of users

1

2

3

4

18

Vestiaire Collective has developed an innovative, asset-light

and scalable dual business model

Notes:

1

Based on 2023 data

Direct

Shipping

Advanced

Authentication

Product

online &

sold

Item

deposit

Item

shipped to

buyer

Item

shipped to

buyer

Digital

authen-

tication

VC-led process

Seller-led process

Reach a larger share of customers’

wardrobe and drive engagement

• Option for buyers to opt-out of physical control for

selected transactions

• Offer reduced shipping time and greater

affordability as well as more sustainable shopping

Create strong brand DNA building

on customer trust

• Self-listing and selling, with physical control by

Vestiaire Collective once the sale is initiated

• 4 authentication centers located in France, the

UK, the US and HK

~2/3 of

GMV

~1/3 of

items sold

~1/3 of

GMV

~2/3 of

items sold

Physical

control

Sources of supply

1

C2C: 81%

B2C: 18%

VIP / RaaS: 1%

1

19

Vestiaire Collective operates a supply-driven business

highlighting the high desirability of its underlying market

• The high correlation between new listings and items sold is reinforcing the high relevance of our asset-light peer-to-peer

business model generating no inventory (i.e., supply drives growth but not inventory)

• Since Q4 2023, we have secured on average c.30k new-in items per day (that represents 9x more than the average

observed in 2018 of c.3.5k new-in items per day)

Jan-

18

Jan-

19

Jan-

20

Jan-

21

Jan-

22

Jan-

23

Dec-

23

Items sold

New-in items

One-off: migration

of Tradesy catalog

2

20

Vestiaire Collective has built a true global marketplace,

dedicated to grow its share of local-to-local transactions

Notes: Data for Vestiaire Collective from January to December 2023. DAT stands for Germany and Austria, ROE for the Rest of Europe and ROW for Rest of the World

• Vestiaire Collective has become a true global player with customers (buyers and sellers) located on three continents

• Local-to-local transactions (i.e., regional within Europe, the Americas and APAC) represent close to 80% of our GMV

• With the acquisition of Tradesy, the share of local-to-local transactions in the Americas has significantly increased. Still,

the highly attractive supply from Europe remains a key differentiating factor to win in this strategic market

GMV %

FRANCE DAT UK ITALY ROE AMERICAS APAC ROW

Total

FRANCE

4,9% 3,6% 0,6% 2,1% 5,9% 1,8% 0,7% 0,3% 19,8%

DAT

1,7% 2,0% 0,2% 0,7% 2,8% 0,9% 0,3% 0,1% 8,7%

UK

0,4% 0,3% 7,0% 0,2% 0,8% 1,8% 0,6% 0,2% 11,3%

ITALY

3,3% 3,4% 0,6% 3,2% 5,8% 2,2% 0,7% 0,3% 19,5%

ROE

4,3% 4,1% 0,7% 2,2% 7,9% 2,5% 0,9% 0,4% 23,0%

AMERICAS

0,3% 0,2% 0,3% 0,1% 0,5% 7,3% 0,6% 0,3% 9,7%

APAC

0,2% 0,2% 0,3% 0,1% 0,4% 1,4% 2,4% 0,3% 5,3%

ROW

0,2% 0,2% 0,2% 0,1% 0,4% 1,1% 0,4% 0,1% 2,7%

Total

15,3% 14,0% 9,8% 8,6% 24,6% 18,9% 6,6% 2,1% 100%

… To (Buyer Country)

From… (Seller Country)

3

21

Jan-

19

Jan-

20

Jan-

21

Jan-

22

Jan-

23

Dec-

23

104

151

264

345

359

415

55%

91%

Monthly average 2018 Monthly average 2023

+36pp

4x since January 2019

Logged Daily Average User [in k]Share of logged daily traffic through app

With technology unlocking consumer engagement, Vestiaire

Collective is building a unique community of fashion lovers

• The app first strategy initiated in 2019 has driven strong growth in traffic data

• Product features introduced in recent years are allowing consumers to engage with the platform in many ways, at any

time and from anywhere

4

5

Business performance

23

214

192

285

485

685

820

957

857

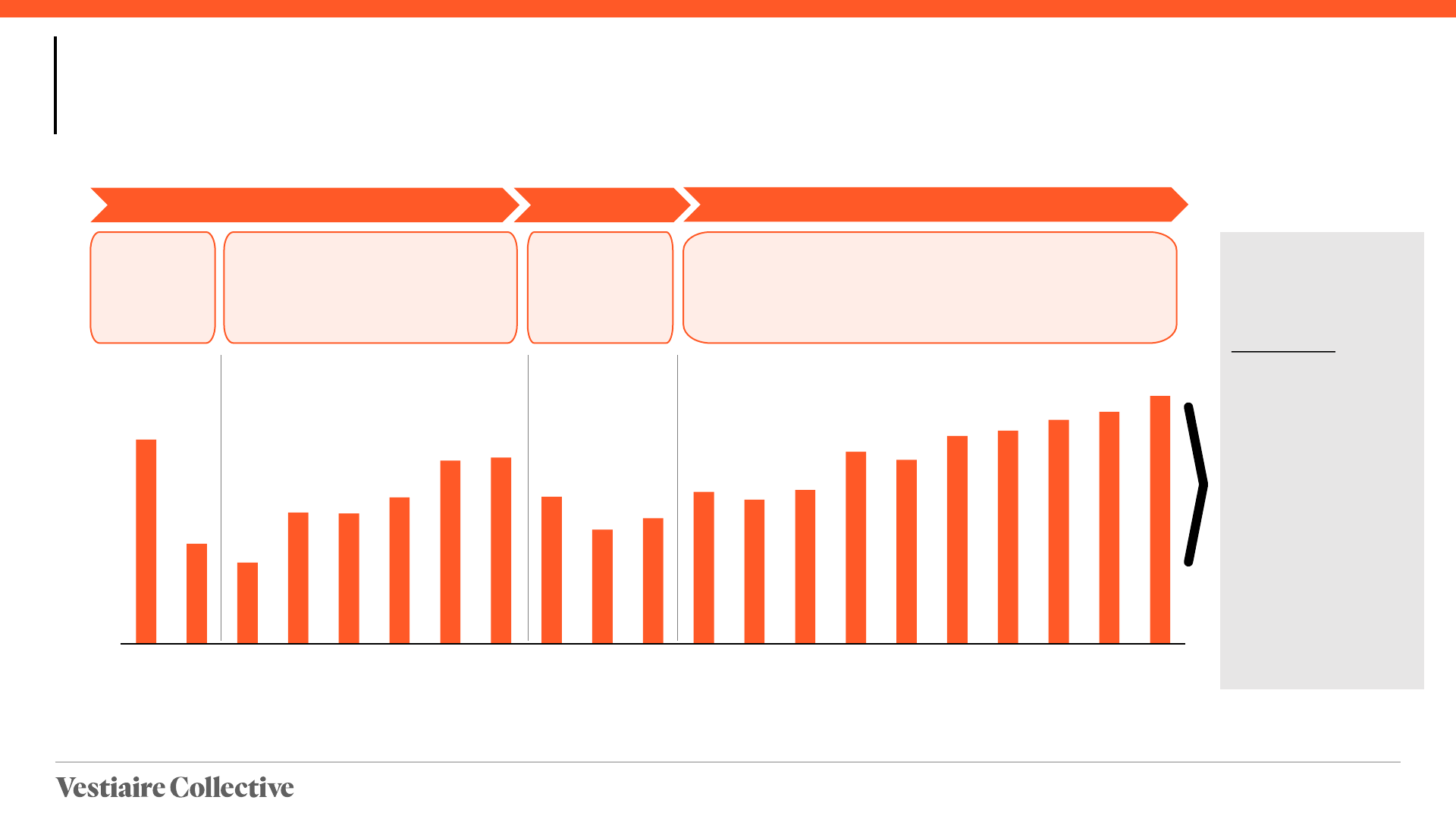

Sustainable growth since 2019 driven by increased focus on

technology and well-executed strategic initiatives

Annualized GMV for

Vestiaire Collective

platform only (€m)

Max Bittner

appointed CEO

• New vision & team

• App-first strategy

• Launch of Direct

Shipping

• Rollout of Direct Shipping

• US and APAC expansion

• Technology

improvements

• US and APAC

consolidation

• Development of local-

to-local strategy

• New commission

structure

Jan-18

Jan-20

Jan-21 Jan-22

Jan-19

Jan-23

• Acquisition of Tradesy

• Brand relaunch

• Progressive increase in

commissions

• US-first strategy

• Personalization

• RaaS acceleration

Dec-23

2019

2020

2021

2022

2023

24

19

30

52

102

168

173

156

121

167

256

348

386

464

417

Each of our three main regions are delivering sustained GMV

growth

International

AmericasCore Europe (FR, UK, DAT, IT)

53

89

177

236

266

320

284

Jan-20 Jan-21 Jan-22Jan-19 Jan-23 Dec-23 Jan-20 Jan-21 Jan-22Jan-19 Jan-23 Dec-23 Jan-20 Jan-21 Jan-22Jan-19 Jan-23 Dec-23

c.30% p.a. growth c.55% p.a. growth c.40% p.a. growth

Annualized GMV (€m)

25

Vestiaire Collective has been primarily managed for growth until

Q4 2021. Significant profitability gains recorded since then

Q2

19

Q3

19

Q4

19

Q1

20

Q2

20

Q3

20

Q4

20

Q1

21

Q2

21

Q3

21

Q4

21

Q1

22

Q2

22

Q3

22

Q4

22

Q1

23

Q2

23

Q3

23

Q4

23

7.7%

3.8%

3.1%

4.9%

4.9%

5.5%

6.9%

7.0%

5.5%

4.3%

4.7%

5.7%

Q1

19

5.8%

7.2%

6.9%

7.8%

5.4%

8.4%

8.7%

Jan

24

9.3%

8.0%

PC2

margin

(% of

NMV)

Reduction in

commissions

to drive growth

Significant reduction in costs per order

mainly coming from the introduction of

the Direct Shipping model

More challenging

e-commerce

environment

2024 Target: > 10%

Main drivers:

• Continue focusing

on monetization

• Continue reducing

cancellation rate

• Continue reducing

costs per order as

Vestiaire Collective

scales up

• Continue increasing

contribution from

higher AOV region

(Americas)

Significant profitability gains from more dynamic management of

commissions, growing focus on reducing cancellation rate and

progressive reduction in transportation costs

Business Reset Post-Covid

Continuous Improvement

26

Financial performance, 2018A-2024E Revenue build-up

Consolidated P&L Observations

• Orders have been multiplied by 5 over the past 5

years (38% CAGR) to reach 2.3m in 2023

• We operate with a high AOV of c.€350 reflecting our

luxury positioning

• GMV has been multiplied by 4 since 2018 (33%

CAGR) to reach €824m in 2023 (and a run rate of

€957m in Nov-2023)

• We have reduced our cancelled transaction value

(CTV) rate over the past two years taking it from 21.0-

21.5% over 2019-2021 to 20.6% in 2022 and 19.5%

in 2023

• Revenue reached €157m in 2023, up by 24% YoY on

VC platform. It reflects a take rate of 24%

• In 2024, we expect to grow our GMV and NMV by

18% and our Revenue by 24%. Considering our

historical track record, we are confident in our ability to

achieve those objectives

18A-23A 18A-24E

FYE 31-12, €m

FY18A FY19A FY20A FY21A FY22A FY23A FY24E CAGR CAGR

Orders 472 078 634 733 1 296 456 1 823 131 2 236 586 2 337 670 2 762 614 38% 34%

% YoY Growth 8,5% 34,5% 104,3% 40,6% 22,7% 4,5% 18,2%

Orders VC Platform only 472 078 634 733 1 296 456 1 823 131 2 089 576 2 337 670 2 762 614 38% 34%

% YoY Growth 8,5% 34,5% 104,3% 40,6% 14,6% 11,9% 18,2%

AOV (€) 417 380 297 289 356 352 353

GMV 197 241 385 526 796 824 975 33% 31%

% YoY Growth 14,7% 22,3% 59,6% 36,8% 51,2% 3,5% 18,4%

GMV VC Platform only 197 241 385 526 720 824 975 33% 31%

% YoY Growth 14,7% 22,3% 59,6% 36,8% 36,9% 14,4% 18,4%

NMV 157 190 302 414 626 663 785 33% 31%

% CTV 20,3% 21,2% 21,4% 21,3% 21,4% 19,5% 19,5%

% YoY Growth 13,5% 20,8% 59,1% 37,0% 51,1% 6,1% 18,4%

NMV VC Platform only 157 190 302 414 572 663 785 33% 31%

% CTV 20,3% 21,2% 21,4% 21,3% 20,6% 19,5% 19,5%

% YoY Growth 13,5% 20,8% 59,1% 37,0% 38,1% 16,0% 18,4%

Revenue 43 48 71 94 135 157 194 30% 29%

% of NMV 27,2% 25,3% 23,5% 22,6% 21,6% 23,6% 24,7%

% YoY Growth 17,8% 12,4% 47,4% 32,0% 44,6% 15,9% 23,8%

Revenue VC Platform only 43 48 71 94 125 157 194 30% 29%

% YoY Growth 17,8% 12,4% 47,4% 32,0% 34,0% 25,0% 23,8%

27

Financial performance, 2018A-2024E P&L statement

Consolidated P&L Observations

• Revenue reached €157m in 2023, up by 24% YoY on

VC platform. It reflects a take rate of 24%

• PC2 (Gross Profit) reached €55m in 2023, up by 38%

vs. 2022. It reflects a PC2/NMV margin of 8.3% and a

PC2/Revenue margin (i.e., gross margin) of 35.0%

• PC3 (contribution before central costs) reached €13m

in 2023, from negative results in 2021 and 2022,

notably reflecting increased marketing efficiency

• Opex (operational expense) decreased from €114m in

2022 to €89m in 2023, reflecting notably the

successful integration of Tradesy (the company we

acquired in the US in April 2022)

• Our EBITDA burn decreased significantly in 2023,

from -€117m in 2022 to -€76 in 2023. In particular, our

monthly EBITDA burn in Dec-2023 stood at -€4m

• Through continuous improvement (growth and

improvement of our unit economics), we aim at

reducing our EBITDA burn to -€31m in 2024. In

particular, our monthly EBITDA burn in Dec-2024 is

expected to be lower than -€1m

18A-23A 18A-24E

FYE 31-12, €m

FY18A FY19A FY20A FY21A FY22A FY23A FY24E CAGR CAGR

Revenue 43 48 71 94 135 157 194 30% 29%

% of NMV 27,2% 25,3% 23,5% 22,6% 21,6% 23,6% 24,7%

% YoY Growth 17,8% 12,4% 47,4% 32,0% 44,6% 15,9% 23,8%

Revenue VC Platform only 43 48 71 94 125 157 194 30% 29%

% YoY Growth 17,8% 12,4% 47,4% 32,0% 34,0% 25,0% 23,8%

Retail COGS -3 -3 -4 -5 -10 -13 -11

PC1 40 45 67 88 126 144 183 29% 29%

% of NMV 25,6% 23,8% 22,1% 21,3% 20,1% 21,6% 23,3%

Marketplace COGS -26 -36 -48 -67 -86 -89 -101

CPO COGS (€) -55,1 -57,3 -37,1 -36,8 -38,3 -38,0 -36,7

PC2 (Gross Profit) 14 9 19 21 40 55 82 31% 34%

% of NMV 9,1% 4,7% 6,2% 5,1% 6,4% 8,3% 10,4%

% of Revenue 33,3% 18,4% 26,5% 22,6% 29,4% 35,0% 42,0%

Marketing -11 -7 -10 -29 -43 -42 -36

CAC (€) -102 -49 -43 -85 -90 -87 -66

% of NMV -6,9% -3,5% -3,5% -7,0% -6,8% -6,3% -4,6%

PC3 3 2 8 -8 -3 13 45 31% 54%

% of NMV 2,1% 1,2% 2,7% -1,9% -0,5% 2,0% 5,8%

Opex -25 -36 -45 -63 -114 -89 -77

% of NMV -15,9% -18,9% -14,8% -15,3% -18,2% -13,4% -9,8%

EBITDA -22 -34 -36 -71 -117 -76 -31 -- --

% of NMV -13,7% -17,8% -12,0% -17,2% -18,7% -11,4% -4,0%

% of Revenue -50,5% -70,2% -51,2% -75,9% -86,3% -48,3% -16,2%

28

Glossary

• AOV Average order value

• CAC Customer acquisition cost

• CPO Costs per order

• CTV Cancelled transaction value

• GMV Gross merchandise value

• NMV Net merchandise value

• PC1 Profit contribution 1 (= revenues less retail COGS)

• PC2 Profit contribution 2 (= revenues less retail & marketplace COGS = gross profit)

• PC3 Profit contribution 3 (= gross profit less marketing = EBITDA before opex)

• RaaS Resale as a Service