ANNUAL COMPREHENSIVE

F

INANCIAL

R

EPORT

F

ISCAL

Y

EAR

E

NDING

:ƵŶĞϯϬ͕ϮϬ21

C

ityof

C

anby

C

anby,

O

regon

AnnualComprehensive

FinancialReport

FiscalYearEnding

June30,2021

Preparedby

CityofCanby,Oregon

FinanceDepartment

ThisPageIntentionallyLeftBlank

CITYOFCANBY,OREGON

TABLEOFCONTENTS

June30,2021

INTRODUCTORYSECTION: Page

LetterofTransmittal i

CertificateofAchievementforExcellenceinFinancialReporting v

OrganizationalChart vi

PrincipalOfficials vii

FINANCIALSECTION:

IndependentAuditor’s Report 2

Management’sDiscussionandAnalysis 5

BASICFINANCIALSTATEMENTS:

Government‐WideFinancialStatements:

StatementofNetPosition 14

StatementofActivities 15

GovernmentalFundsFinancialStatements:

BalanceSheet–GovernmentalFunds 16

ReconciliationoftheBalanceSheettotheStatementofNetPosition 17

StatementofRevenues,Expenditures,andChangesinFundBalance–GovernmentalFunds 18

Reconciliatio

noftheSt

atementofRevenues,Expenditures,and

ChangesinFundBalancetotheStatementofActivities 19

ProprietaryFundsFinancialStatements:

StatementofNetPosition 20

StatementofRevenues,Expenses,andChanges inFundNetPosition 21

StatementofCashFlows 22

NotestotheFinancialSta

t

ements 23

REQUIREDSUPPLEMENTARYINFORMATION:

SchedulesofRevenues,Expenditures,andChangesinFundBalance–BudgetandActual:

GeneralFund 48

StreetFund 49

TransitFund 50

UrbanRenewalAgencyGeneralFund 51

SystemDevelopmentChargesFund 52

SchedulesofOtherPostemploymentBenefitPlans 53

ScheduleofProportionateShareoftheNetPe

nsion(Asset)/Liability‐PERS 54

ScheduleofContributions‐PERS 55

NotestotheRequiredSupplementaryInformation 56

SUPPLEMENTARYINFORMATION:

GovernmentalFunds:

Non‐MajorSpecialRevenueFunds:

CombiningBalanceSheet 58

CombiningScheduleofRevenues,Expenditures,andChangesinFundBalance 59

SchedulesofRevenues,Expenditures,andChangesinFundBalance–BudgetandActual:

TransientRoomTaxFund 60

ForfeitureFund 61

CemeteryPerpetualCareFund 62

CITYOFCANBY,OREGON

TABLEOFCONTENTS(Continued)

June30,2021

SUPPLEMENTARYINFORMATION(Continued):Page

GovernmentalFunds(Continued)

SwimCenterLocalOptionTaxLevyFund63

LibraryFund 64

MajorNon‐SpecialRevenueFunds:

SchedulesofRevenues,Expenditures,andChangesinFundBalance–BudgetandActual:

UrbanRenewalAgencyDebtServiceFund 65

ProprietaryFund:

SchedulesofRevenues,Expenditures,andChangesinFu

ndBalance–BudgetandAc

tual:

SewerCombinedFund 66

InternalServiceFunds:

CombiningBalanceSheet 67

CombiningScheduleofRevenues,Expenditures,andChangesinFundNetPosition68

CombiningScheduleofCashFlows69

SchedulesofRevenues,Expenditures,andChangesinFundBalance–BudgetandAc

tual:

FacilitiesFund70

FleetServicesFund71

TechnicalServicesFund72

STATISTICALSECTION:

IntroductiontoStatisticalSection74

NetPositionbyComponent–LastTenFiscalYears75

ChangesinNetPosition–LastTenFiscalYears76

FundBalanceofGovernmentalFunds–LastTenFiscalYears78

ChangesinFundBalancesofGovernmentalFunds–LastTenFiscalYears79

GovernmentalActivi

tiesTaxReve

nuesbySource–LastTenFiscalYears 80

AssessedValuesandEstimatedActualValueofTaxableProperty–LastTenFiscalYears 81

PropertyTaxRates–LastTenFiscalYears 82

PrincipalPropertyTaxpayers–CurrentYearandNineYearsAgo 83

PropertyTaxLeviesandCo

llections–La

stTenFiscalYears 84

RatiosofOutstandingDebtbyType–LastTenFiscalYears 85

RatiosofGeneralBondedDebtOutstanding–LastTenFiscalYears 86

DirectandOverlappingGovernmentalActivitiesDebt–June30,2021 87

LegalDebtMarginInformation–LastTenFiscalYears 88

Pledged‐RevenueCoverage–LastTenFiscalYears 89

DemographicStatistics–LastTenFiscalYears 90

PrincipalEmployers–CurrentYearandNineYearsAgo 91

Full‐TimeEquivalentCityGovernmentEmployeesbyFunction–LastTenFiscalYears 92

OperatingInd

i

catorsbyFunction–LastTenFiscalYears 93

CapitalAssetStatisticsbyFunction–LastTenFiscalYears 94

COMPLIANCESECTION:

IndependentAuditor’s ReportRequiredbyOregonStateRegulations 96

INTRODUCTORYSECTION

i

LetterofTransmittalfortheFiscalYearEndedJune30,2021

June30,2022

TotheHonorableMayor,CityCouncil,andCitizensoftheCityofCanby,Oregon:

Statelawrequiresthateverygeneralpurposelocalgovernmentpublish,withinsixmonthsofthecloseofeach

fiscalyear,acompletesetofauditedfinancial statements.InJulyof2021thecity experiencedturnoverofkey

FinanceDepartmentstaff,followedbyasubstan

t

ialdelayinreplacingthestaff.Theconsequenceoftheseevents

wereadelayinthecompletionofauditedfinancialstatements.Thisreportispublishedtofulfillthatrequirement

forthefiscalyearendedJune30,2021.

Managementassumesfullresponsibilityforthecompletenessandreliabilityofthei

nformationcontainedinthis

report, based upon a comprehensive framework of internal control that it has establis hed for this purpose.

Becausethecostofinternalcontrolshouldnotexceedanticipatedbenefits,theobjectiveistoprovidereasonable,

ratherthanabsolute,assurancethatthefinancialstatementsarefreeofanymat

e

rialmisstatements.

GroveMueller&Swank,P.C.,Certified PublicAccountants,haveissuedanunmodified(“clean”)opiniononthe

CityofCanby’sfinancialstatementsfortheyearendedJune30,2021.Theindependentauditor’sreportislocated

atthefrontofthefinancialsectionofthisreport.

Managemen

t

’s discussion and analysis (MD&A) immediately follows the independent auditor’s report and

providesanarrativeintroduction,overview,andanalysisofthebasicfinancialstatements.MD&Acomplements

thisletteroftransmittalandshouldbereadinconjunctionwithit.

CanbyProfile

TheCityofCanby,incorporatedin1893,islocatedinthewesternpartofthestate,whichisconsideredtobeone

ofthetopgrowthareasinthestate.Itcurrentlyoccupies4.5squaremilesandservesapopul a tionof17,860.The

City of Canby is empowered to levy a property tax on real pro

perty located within its boundaries. It also is

empoweredbystatestatutetoextenditscorporatelimitsbyannexation.

TheCityofCanbyoperatesunderthemayor‐councilformofgovernmentconsistingofthemayorandsixother

members,allofwhomareelectedatlarge.Councilmem

b

ersservefour‐yearterms,withthreememberselected

everytwoyears.TheMayoriselectedforatwo‐yearterm.TheMayor,withCouncilapproval,appointstheCity

ofCanbyAdministrator,whointurnappointsitsdepartmentheads.Policy‐makingandlegislativeauthorityare

vestedinthegoverningcouncil(Council

)

The City of C

anby provides a full range of services consisting of public safety, municipal court, waste water

treatment,stormwatermanagement,streetmaintenance,planningandzoning,economicdevelopment,parkand

recreation, swim center, library, transit, cemetery maintenance, and general administrative services.Water

City of Canby

ii

distribution services are provided through Canby Utility Board (CUB), a legally separate component unit. CUB

provides water services to the City of Canby residents and is reported separately within the City of Canby’s

financial statements. The City of Canby also is financially accountable for an urban renewal agency which is

includedasapartoftheCityofCanby’sfinancialstatements.Additionali

nformationonCUBcanbefoundinthe

notestothefinancial statements.

TheCouncilisrequiredtoadoptabudgetforthefiscalyearnolaterthanJune30precedingthebeginningofthe

fiscalyearonJuly1.This a

nnualb

udgetservesas thefoundationfortheCityofCanby’s financialplanningand

control. The budget is prepared by fund, and department. Department heads may transfer resources within a

departmentastheyseefit.Transfersbetweendepartments,however,needspecialapprovalfromthegoverning

council.

CanbyEconomy

LocaldevelopmentisactivelypromotedbytheCity’seconomicdevelopmentdepartment.Majoreventsinclude

theCanbyFarmersMarket, Clackamas County Fair, Independence Day Celebration, andCanby’s Big Night Out.

ThecommunityislocatedontheMolallaRiverandHighway99E,just4milesfromI‐5.

The City of Canby is a s

uburb of the Portland Metro area with a commu

nity of residences, schools, and

approximately680businesses.Majorindustriesincluderetail,medical,professionalservices,financialinstitutions,

insurancecompanies,wholesale,lightindustrial,m anufacturing,andagriculture.Thesurroundingareacontains

someoftherichestfarmlandinOregon.Localnurseriesproduceawidevarietyofplants,bulbsandseeds.The

schooldistri

ctandCityofCanbyalsohaveasignificanteconomicpresence,employingintotalapproximately600

people.

Thedowntownbusinessdistrictishometocommercialbusinesses,governmentbuildings,financialinstitutions,

medical offices, an eight‐screen movie theater with adjacent public parking, and a variety of shops and

restaurants.Establishedcommercialareashavebee

n

improvedwiththehelpoffundingfromtheCanbyUrban

Renewal Agency.Façade and streetscape improvements, gateway sign projects, business recruitment and

retention and strategic planning for the business districts have all been funded by urban renewal. Industrial

growthhasbeenspurred bythedevel

o

pmentoftwoindustrialparks:LoggingRoadIndustrial ParkandCanby

Pioneer In dustrial Park. The development of these parks has resulted from the combined efforts of local

landownersandtheCityofCanby,CanbyUrbanRenewal,andstatesources.Plansareunderwaytoaddadditional

accesstoindustrialproper

tieswithintheCanbyPioneerIndustrial Parktoalleviatetrafficpressureoncommuter

roads.

Becauseofitslocationinaregionwithavariedeconomicbase,unemploymentrateshavedeclinedoverthepast

ten years, the unemployment rate in 2010 was 10.6% and has dropped annually to a low of 3.6% in 2018

.

Une

mploymentforClackamasCountywas5.6%asofJune30,2021.

Median household incomes within the City of Canby are significantly higher than for the state as a whole.

Accordingtothe2017censusestimates,thegovernment’smedianfamilyincomewas$66,220,thecounty’swas

$72,408,whileth

e state’s

was $45,623.Canby’s population has seena steady increase since the 2010 census,

currentestimatesare17,860asofJune30,2020.Attheendofthesecondquarterof2020,themedianpriceofa

singlefamilyhomeintheCityofCanbywas$326,900.

Moody’sInvestorsServiceupgradetheCityofCanby’slong‐termissuerratinginearly2019fromA1toAa3.The

ratingactionaffectsapproximately$22.1millioninrat

edfullfaithandcreditdebtoutstanding.Theupgradeto

Aa3reflectsthecity’srecoveredtaxbaseandimprovedfinancialpositionthroughconsecutiveyearsofstructurally

iii

balancedoperations.Totaldebtliabilitiesofthecityarebelowaveragerelativetosimilarlyratedpeersandwill

continuetoamortizegivennoadditionalnear‐termdebtfinancingplans.

Long‐termFinancialPlanningandMajorInitiatives

TheCity of Canby, likeother political subdivisions inthe Stateof Oregoncontinuestoface increasing financial

challengesinlightofvoterapprovedpropertytaxlimi tationsandtheon‐going,naturalincreasesincostofservice

delivery.Expectationsarenowformodestrevenuegrowth.

Unrestrictedfundbalance(thetotalofthecommitted,assigned,an

dunassignedcomponentsoffundbalance)in

the generalfund atyear end was 43% of totalgeneral fundrevenues.Thisamount was in line with the policy

guidelinessetbytheCouncilforbudgetaryandplanningpurposes(30‐40%ofgeneralfundoperatingrevenues).

Upcomingmajorinitiativesinclude:

Aroadconne

ctionfrom PioneerI

ndustrialParktoHighway99E.Thisis amulti‐yearprojectwith many

facetsincluding,right‐of‐wayacquisition,design,geotechnicalreview,constructi on andcoordinationwith

ClackamasCountyandtheOregonDepartmentofTransportation(ODOT).

TheconstructionofagatewayarchonGrantSt.thatwillwelco

m

evisitorsandcitizenstothedowntown

area.

ImplementationofarailroadquietzonebetweenIvyStandElmSt.Thisprojectis amulti‐yearinitiative

thatinvolvescoordinationwithODOT,theCityandPacificRailroad.Therewillbesafetyimprovementsat

theIvy St, Gr

antSt,and El

mSt intersectionsthat willallowthetrainsto travelthrough thedowntown

areawithouthavingtoblowtheirhornsdisruptingcitizenslivinginthedowntowncore.

NLocust,NE4thtoNE10thAvenueimprovementsincludethefollowing:Curbs,sidewalk,sanitarysewer,

stormwaterandlightingimprovements.

Improveme

ntswill be madetoS. Ivy Street between OR99‐E andLee Elementary School. Projectwork

includesthe following:Constructionofsidewalksandabike lane,ConstructADAimprovements,Install

signal at the intersection of S. Ivy Street and Township Road Address residential driveway within the

intersectionare

a.

BeginconstructionofthenewTransitOffice.

Replacementoftheplayground equipmentandLocustStPark.

PavingprojectsonSRedwood,SW13thSBergParkwayandNE2ndAvestreets.

UpgradetothesewersystemonSIvyfrom99Eto13

th

.

SafewaypumpstationconversionpermitstheabandoningoftheSa feway SanitarySewerPumpingSta tion

and instead use an 8” gravity line extending from Safeway Shopping Center to the existing sewer

dischargingtothe3

rd

andBakerPumpStation.

The City of Canby maintains a five‐year Capital Improvement Plan which serves as a guide to ensure that its

infrastructureisconstructedinamannerthatfitswith thegrowthoftheCity.ThisprocessgivestheCityofCanby

theabilitytoplanforitscapitalneedsandalloca

teshortandlong‐

termresourcesappropriately.Aspartofthis

process,thegovernmen t identifiesandquantifiestheoperationalcosts associatedwithitscapitalprojectsand

budgets resources accordingly. In addition, the Fleet Department monitors the condition ofall equipment and

vehiclesandmakesrecommendationsontheirrepairandreplacement.

FactorsAffectingtheCity’sFinancialCo ndition

Thevolumeofinquiriesandapplicationssubmittedtoourplanningdepartm entindicatesresidential,commercial,

iv

andindustrialgrowth.

TaxBase—Propertyissubjecttoamaximum3%increaseinassessedvalueperyear.Withtheannual3%increase

andboomingdevelopmenttheCityhasseenasteadyincreaseinpropertytaxrevenuesoverthepastfewyears.

Generalfundpropertytaxreceiptsforthecurrentyearwere5.9%greaterthanthepreviousyear.

InNovember2008,th

evotersofClackamasCountyapproveda county‐widelibrarydistrict.TheCity’sshareof

revenuesfromthelibrarydistrictinFY20was$1,012,388.

Special Tax Levy—Voters approved a renewal of a five‐year (2018‐2022) local option levy for Swim Center

operations.Thelevyisbasedona fixedrateof$0.49

per$1,000ofassessedpropertyvalue.The propertytax

revenuefromthelocaloptionlevyisusedtofundcurrentSwimCenterservices,lifeguards,andprovideforpool

maintenance.Thelevyisbasedona5‐yearoperatingplan crea

tedbytheBudgetCommittee,CityCounciland

City staff. Th

e Swim Center is fully fundedthrough a combination of levy dollars and user fees.Fees paid for

approximately5%ofoperatingcosts,adramaticdownturnduetoCovidrestrictions.

AwardsandAcknowledgements

Wegreatlyappreciatetheprofessionalism,commitment,andeffortsetforthbytheMayor,CityCouncil,Budget

Committee,CityAdministratorandDepartmentDirectorswhoseleadershipisintegraltothehealthandvitality

ofCanby.

Respectfullysubmitted,

EricKytola

FinanceDirector

v

vi

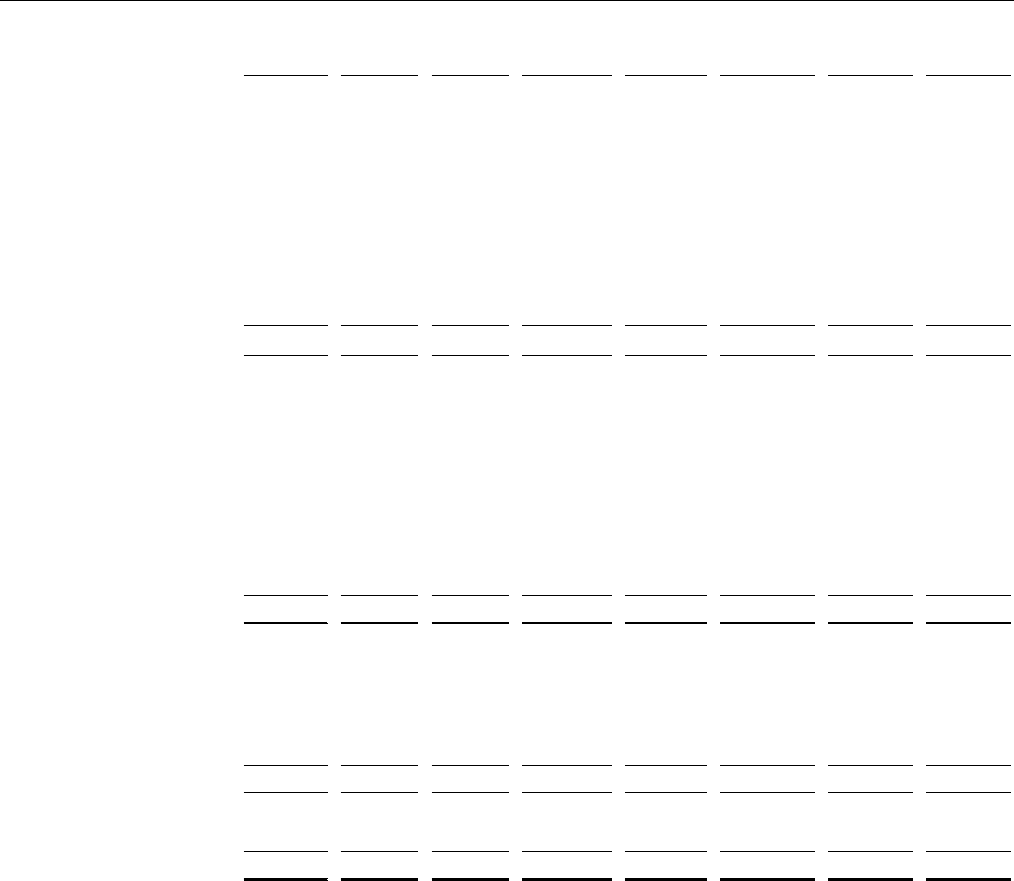

CITYOFCANBYORGANIZTIONALCHART–20202021

MAYOR&COUNCIL

Munici palJudge

CityAdministrator

CityAttorney

Enterprise

Fund

Sewer

InternalService

Funds

WasteWater

Treatment

Plant

Department

Sewer

Col lections

Department

TransitFund

FacilitiesFund

Police

Department

Cemetery

Department

FleetFu nd

LibraryFund

Special

RevenueFund s

Economic

Development

Department

SwimCenter

Fund

GeneralFund

Administration

Dep artment

Finance

Dep artment

Court

Dep artment

Planning

Dep artment

Building

Dep artment

StreetFun d

TechSer vices

Fund

Stormwater

Department

Cemetery

PerpetualCare

Fund

Forfeiture

Fund

System

Development

Cha rgesFund

Transient

RoomTaxFund

CITYOFCANBY,OREGON

PRINCIPALOFFICIALS

June30,2021

vii

CityOfficialsTermExpires

BrianHodson,MayorDecember31,2022

Canby,Oregon97013

CouncilMembers

TraciHensley,PresidentDecember31,2024

Canby,Oregon97013

ChristopherBangsDecember31,2024

Canby,Oregon97013

GregParkerDecember31,2022

Canby,Oregon97013

SarahSpoonDecember31,2024

Canby,Oregon97013

JordanTibbalsDecember31,2022

Canby,Oregon97013

ShawnVarwigDecember31,2022

Canby,Orego

n97013

CityAdministration

ScottArcher CityAdministrator

EricKytolaFinanceDirector

CouncilmembersreceivemailattheCity’saddress:

CityHall

222NE2

nd

Avenue

POBox930

Canby,Oregon97013

1

FINANCIALSECTION

2

INDEPENDENT AUDITOR’S REPORT

Honorable Mayor and Council Members

City of Canby

222 NE 2

nd

Avenue

Canby, Oregon 97013

Report on the Financial Statements

We have audited the accompanying financial statements of the governmental activities, the business-type activities,

each major fund, and the aggregate remaining fund information of the City of Canby, Oregon (the City) as of and for

the year ended June 30, 2021, and the related notes to the financial statements, which collectively comprise the City’s

basic financial statements as listed in the table of contents.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with

accounting principles generally accepted in the United States of America; this includes the design, implementation,

and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are

free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express opinions on these financial statements based on our audit. We did not audit the

financial statements of the discretely presented component unit (Canby Utility Board), which represent 32 percent,

35 percent, and 39 percent, respectively of the assets, net position, and revenue of the City. Those financial statements

were audited by other auditors whose report thereon has been furnished to us, and in our opinion, insofar as it relates

to the amounts included for the discretely presented component unit, is based solely on the report of the other auditors.

We conducted our audit in accordance with auditing standards generally accepted in the United States of America

and the standards applicable to financial audits contained in Government Auditing Standards issued by the

Comptroller General of the United States. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial

statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of

material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments,

the auditor considers internal control relevant to the City’s preparation and fair presentation of the financial statements

in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the City’s internal control. Accordingly, we express no such opinion. An audit also

includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting

estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit

opinions.

3

Opinions

In our opinion, based on our audit and the report of other auditors, the financial statements referred to above present

fairly, in all material respects, the respective financial position of the governmental activities, the business-type

activities, the discretely presented component unit, each major fund, and the aggregate remaining fund information

of the City of Canby, Oregon, as of June 30, 2021, and the respective changes in financial position and, where

applicable, cash flows thereof for the year then ended in accordance with accounting principles generally accepted in

the United States of America.

Other Matters

Required Supplementary Information

Accounting principles generally accepted in the United States of America require that the management’s discussion

and analysis (MD&A) and the schedules of revenues, expenditures and changes in fund balance – budget and actual

for the General, Street, Transit, Urban Renewal – General Fund and System Development Charges funds (“the

budgetary schedules”), the City’s PERS schedules and the City's OPEB schedules be presented to supplement the

basic financial statements. Such information, although not a part of the basic financial statements, is required by the

Governmental Accounting Standards Board, who considers it to be an essential part of financial reporting for placing

the basic financial statements in an appropriate operational, economic, or historical context. We have applied certain

limited procedures to management’s discussion and analysis, PERS schedules and OPEB schedules described in the

preceding paragraph in accordance with auditing standards generally accepted in the United States of America, which

consisted of inquiries of management about the methods of preparing the information and comparing the information

for consistency with management’s responses to our inquiries, the basic financial statements, and other knowledge

we obtained during our audit of the basic financial statements. We do not express an opinion or provide any assurance

on the information because the limited procedures do not provide us with sufficient evidence to express an opinion

or provide any assurance.

The budgetary schedules described above is the responsibility of management and were derived from and relate

directly to the underlying accounting and other records used to prepare the basic financial statements. The budgetary

schedules have been subjected to the auditing procedures applied in the audit of the basic financial statements and

certain additional procedures, including comparing and reconciling such information directly to the underlying

accounting and other records used to prepare the basic financial statements or to the basic financial statements

themselves, and other additional procedures in accordance with auditing standards generally accepted in the United

States of America. In our opinion, the budgetary schedules are fairly stated, in all material respects, in relation to the

basic financial statements as a whole.

Supplementary Information

Our audit was conducted for the purpose of forming opinions on the financial statements that collectively comprise

the City’s basic financial statements. The supplementary information is presented for purposes of additional analysis

and is not a required part of the basic financial statements.

The supplementary information is the responsibility of management and was derived from and relates directly to the

underlying accounting and other records used to prepare the basic financial statements. Such information has been

subjected to the auditing procedures applied in the audit of the basic financial statements and certain additional

procedures, including comparing and reconciling such information directly to the underlying accounting and other

records used to prepare the basic financial statements or to the basic financial statements themselves, and other

additional procedures in accordance with auditing standards generally accepted in the United States of America. In

our opinion, the supplementary information is fairly stated, in all material respects, in relation to the basic financial

statements as a whole.

4

Other Information

The introductory and statistical sections have not been subjected to the auditing procedures applied in the audit of the

basic financial statements and, accordingly, we do not express an opinion or provide any assurance on them.

Reporting Required by Legal and Regulatory Requirements

Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated June 30, 2022 on our

consideration of the City’s internal control over financial reporting and on our tests of its compliance with certain

provisions of laws, regulations, contracts and grant agreements, and other matters. The purpose of that report is solely

to describe the scope of our testing of internal control over financial reporting and compliance and the results of that

testing, and not to provide an opinion on the effectiveness of internal control over financial reporting or on

compliance. That report is an integral part of an audit performed in accordance with Government Auditing Standards

in considering the City’s internal control over financial reporting and compliance.

Reporting Required by Oregon Minimum Standards

In accordance with Minimum Standards for Audits of Oregon Municipal Corporations, we have issued our report

dated June 30, 2022, on our consideration of the City’s compliance with certain provisions of laws and regulations,

including the provisions of Oregon Revised Statutes as specified in Oregon Administrative Rules. The purpose of

that report is to describe the scope of our testing of compliance and results of that testing and not to provide an opinion

on compliance.

GROVE, MUELLER & SWANK, P.C.

CERTIFIED PUBLIC ACCOUNTANTS

By: ______________________________

Ryan T. Pasquarella, A Shareholder

June 30, 2022

CITYOFCANBY,OREGON

MANAGEMENT’SDISCUSSION&ANALYSIS

June30,2021

5

ThissectionoftheCityofCanby’sAnnualComprehensiveFinancialReportforthefiscalyearendedJune30,2021

presentsthehighlightsoffinancialactivitiesandillustratesthefinancialpositionoftheCityofCanby,Oregon(the

City) and the Canby Utility Board (CUB),a discretely presented componen t unit of the City, for the fiscal year

endedJune30,2021(FY2021).

Thishasbeenpreparedbymanagementandshouldbereadinconjunction with

thefinancialstatementsandnotes.

FINANCIALHIGHLIGHTS

Government‐Wide

TheCity’scombinednetpositionwas$123.7millionatJune30,2021.Ofthisamount,$10.1millionmay

be used to meet the City’s ongoing obligations to its citizens and credi

tors (unrestricted net position).

Totalnetpositionincreased$7.0million(6.0%)fromtheprioryear.

Canby’stotalassetsincreasedby$7.6millionduringFY21.Totalassetsconsist ofcurrentandnoncurrent

assets.Current assets were $39.3 million atthe end of FY21. Of thatamount, $35.7 millio

n(91.0%) of

currentassetswerein

cashandcashequivalents.Capitalandlong‐termassets(netofdepreciation)were

$118millionattheendofFY21.Capitalandlong‐termassetsincreasedby$1.0million (0.8%)duringFY21.

Theprimaryreasonfortheincrease isduetoth

edelayofworkonmajor

capitalprojectsandtheARPA

fundsreceivedbythecity.

Amounts related to pensions and OPEB have increased. In FY20 the City had a net pension and OPEB

liabilityof$11.4millionandattheendofFY21thisincreasedto$

14.8million,a9.9%changetothetotal

noncurrentliabilitiesoftheCity.

FundLevel

TheCity’sGeneralFundreportedanendingfundbalanceof$3.9million,anincreaseof$551thousand

(16.6%)fromtheprioryear;mainlyduetoARPAfundsandlesscapitaloutlaythanbu

dgeted.

ThetotalGovernmentalfunds’endingfundbalancewas$28.0million,anincreaseof26.1%inFY21.

Intheaggregate,theEnterpriseandInternalServicefunds’endingfundbalanceequivalent,netposition,

was$24.4million,anincreaseof$2.4million(10.7%)fortheyear.

TotalFY21PropertyTa

x

revenuewas$10.6million,anincreaseof8.0%fromFY20levels.

OVERVIEWOFTHEFINANCIALSTATEMENTS

ThisdiscussionandanalysisservesasanintroductionandsummaryoftheCity’sbasicfinancialstatements.Itis

followedbythebasicfinancialsta tementsthemselves,whicharecomprisedofthreeelements;Government‐Wide

FinancialStatements,FundFinancialStat

ements,andNotestotheFinancialStatements.Thisreportalsocontains

requiredandothersupplementaryinformationinadditiontothebasicfinancialstatements.

Government‐WideFinancialStatements

ThegovernmentwidefinancialstatementsaredesignedtoprovidereaderswithabroadoverviewoftheCity’s

finances,inamannersimilartoaprivate‐sectorbusi

n

ess.

Oneway toevaluate theCity’sfinancialpositionis bymeasuring theCity’snet positionsandhow theychange

over time. Both of these government‐wide financial statements distinguish functions of the City that are

principally supported by taxesand intergovernmental revenues (governmental activities) fr

om other functions

thatareintendedtorecoverallorasignificantportionoftheir coststhroughuserfeesandcharges(business‐type

activities).

CITYOFCANBY,OREGON

MANAGEMENT’SDISCUSSION&ANALYSIS

June30,2021

6

TheStatementofNetPositionincludestheCity’sassets,deferredoutflowsofresources,liab ilities, anddeferred

inflows of resources with the difference reported as net position. Over time, increases and decrease s in net

positionmayserveasausefulindicator ofimprovem ents ordeteriorationoftheCity’sfinancialposition.

The City’s net position tot

aled $123.7 million as of June 30, 2021. The City’s net investme nt in capital assets

accounts for the majority of the City’s net position. The City has invested $97.9 million in land, buildings,

equipment,andinfrastructure(netofdepreciationandoutstandingdebtusedtoacquire thoseassets).TheCity

usestheseas

setstoprovideservices toitscitizenssotheyarenotassetsthatareavailableforfuturespending.

Restrictednetposition($15.7million)relatestoamountsthatarelegallyrestrictedforspecificfutureobligations.

Unrestrictednetposition($10.1million)isavailabletomeettheCity’son‐goingobligations.

2021 2020 2021 2020 2021 2020 Change

Assets

Currentandotherassets 30,859,621$ 24,274,667$ 8,419,661$ 8,403,676$ 39,279,282$ 32,678,343$ 20.2%

Capitalassets 100,300,176 101,957,800 17,673,977 15 ,037,734 117,974,153 116,995,534 0.8%

Totalassets 131,159,797 126,232,467 26,093,638 23 ,441,410 157,253,435 149,673,877 5.1%

TotalDeferredOutflows 4,527,92

0

3,759,036 486,335 401,430 5,014,255 4,160,466 20.5%

Liabilities

Long‐termliabilities 29,457,505 31,637,059 1,467,017 1,124,841 30,924,522 32,761,900 ‐5.6%

Otherliabilities 6,783,805 2,901,493 328,944 370,740 7,112,749 3,272,233 117.4%

Totalliabilities 36,241,310 34,538,552 1,795,961 1,495,581 38,037,271 36,034,133 5.6%

TotalDeferredInflows 501,023 1,044,155 51,530 111,506 552,553 1,155,661 ‐52.2%

NetPosition

Netinvestmentincapital

assets 80,195,011 79,788,252 17,673,977 15,037,734 97,868,988 94,825,986 3.2%

R

e

stricted 15,681,220 13,334,765 ‐ ‐ 15,681,220 13,334,765 17.6%

Unrestricted 3,069,153 1,285,779 7,058,505 7,198,019 10,127,658 8,483,798 19.4%

Totalnetposition 98,945,384$ 94,408,796$ 24,732,482$ 22,235,753$ 123,677,866$ 116,644,549$ 6.0%

GovernmentalAct ivities Business‐TypeActivities Tota l

CITYOFCANBY,OREGON

MANAGEMENT’SDISCUSSION&ANALYSIS

June30,2021

7

TheStatementofActivitiespresentsthechangesinnetpositionbydetailingthe revenuesandexpensesforthe

FiscalYears2021and2020.ThisinformationisbrokenintoGovernmentalandBusiness‐typeActivities.Revenues

andexpensesaresegregatedbygeneralcategories(revenues)andprograms(expenses).

StatementofActivities

Governmentalactivities

Governmentalactivitiesnetpositionincreasedby$4

.5million(4.8%),thisismai

nlyduetoanincreaseinrevenue.

Totalrevenueincreasedby$2.3million(9.2%)mainlyduetoanincreaseinpropertytaxesandtheARPAgrant

funds.Totalexpensesdecreased$1.6million(6.8%),this decreaseismainlyduetoadecreas ein

capitaloutlayin

streetandroadconstructionprojects.

Thegovernmental activitiesof theCityincludesixmajorfunds:generalfund, streetfund, transitfund,system

developmentchargefund, urbanrenewalgeneralfundandtheur ban renewaldebtservice fund.Informationis

2021 2020 2021 2020 2021 2020

Revenues

Progra mrevenues

Chargesfors ervi ces 4,737,591$ 4,528,429$ 4,460,413$ 4,322,371$ 9,198,004$ 8,850,800$

Oper a tinggrantsandcontri buti ons 3,955,933 4,190,555 ‐ ‐ 3,955,933 4,190,555

Capitalgrantsandcontri butions 3,397,960 2,261,717 ‐ 74,634 3,397,960 2,336,351

Generalrevenues

Propertytaxes 10,625,478 9,835,249 ‐ ‐ 10,625,478 9,835,249

Transi tta xes 1,790,583 1,569,157 ‐ ‐ 1,790,583 1,569,157

Transi entRoomTaxes 21,000 21,132 ‐ ‐ 21,000 21,132

Franchis e 1,672,933 1,

6

35,603 ‐ ‐ 1,672,933 1,635,603

Unrestrictedintergovernmenta l 1,045,263 599,236 ‐ ‐ 1,045,263 599,236

Interes tandinvestmentincome 195,651 481,307 59,584 146,204 255,235 627,511

Otherrevenues 205,712 198,290 9,025 18,180 214,737 216,470

Totalre venue s 27,648,104 25,320,675 4,529,022 4,561,389 32,177,126 29,882,064

ProgramExpenses

Generalgovernment 5,700,556 4,907,284 ‐ ‐ 5,700,556 4,907,284

Public s a fety 6,008,163 6,313,592 ‐ ‐ 6,008,163 6,313,592

Highwaysands treets 4,497,361 6,

2

00,318 ‐ ‐ 4,497,361 6,200,318

Tra nsportation 1,839,235 1,970,063 ‐ ‐ 1,839,235 1,970,063

Cultur eandr ecreation 2,483,163 2,673,890 ‐ ‐ 2,483,163 2,673,890

Communi tydevel opment 878,645 893,524 ‐ ‐ 878,645 893,524

Interestonlong‐termexpens e 905,915 972,294 ‐ ‐ 905,915 972,294

Seweroper ations ‐ ‐ 2,830,771 2,586,158 2,830,771 2,586,158

Totalexpenses 22,313,038 23,930,965 2,830,771 2,586,158 25,143,809 26,517,123

Changeinnetpositionbeforetr

ansfers

5,

335,066 1,389,710 1,698,251 1,975,231 7,033,317 3,364,941

Trans fersin(out) (798,478) 40,044 798,478 (40,044) ‐ ‐

Changeinnetposi ti on 4,536,588 1,429,754 2,496,729 1,935,187 7,033,317 3,364,941

Netposition‐be ginningofyear 94,408,796 92,979,042 22,235,753 20,300,566 116,644,549 113,279,608

Netposition,endofyear 98,945,384$ 94,408,796$ 24,732,482$ 22,235,753$ 123,677,866$ 116,644,549$

Governmenta lActivit ies Business‐TypeActivities Total

CITYOFCANBY,OREGON

MANAGEMENT’SDISCUSSION&ANALYSIS

June30,2021

8

presentedseparatelyinthegovernmentalfundbalancesheetandinthegovernmentalstatementofrevenues,

expendituresandchangesinfundbalanceforeachofthesemajorfunds.Datafromtheremaininggovernmental

fundsarecombinedintoasingle,aggregatedpresentation.

Individual fund data for each of the non‐major governmental funds is provided in the form of combinin

g

statementselsewhereinthereport.

The City also has one blended component unit, the Urban RenewalAgency (URA).Blendedcomponent units,

althoughlegallyseparateentitiesare,insubstance,partofthegovernment’soperationsandsodatafromthese

unitsarecombinedwithdataoftheprimarygovern

ment.TheactivitiesoftheURAarereportedwithinacapital

projectsfundandadebtservicefundfortheCity.CompletefinancialstatementsfortheURAfortheyearended

June30,2021,maybeobtainedatCanbyCityHall,222NE2

nd

Ave.,Canby,Oregon97013.

Business‐typeactivities

Thebusiness‐typeactivityoftheCityencompassesthesewertreatment,collectionandstormwateroperations.

Business‐typeactivitiesnetpositionincreasedby$2.5million(11.2%),thisincreaseismainlyduetoanincrease

incapitalassetsandcashreserves.Totalrevenuedecreasedby$32thousan

d(0.7%)mainlydu

etoan decreasein

interestandotherrevenue.Totalexpensesincreased$245thousand(9.5%)mainlyduepersonnelcostsallocated

totheSewerFund.

TheCanbyUtilityBoard(CUB)isresponsibleforprovidingwaterandelectricservicestoresidentialandcommercial

customers within the city limitsof Canby.CUB is a l

e

gally separate entity from the City, governed by a board

appointed by the Mayor of the City and confirmed by the majority of the City Council.CUB is reported as a

discretely presented component unit, consistent with GASB Sta tement No. 61.Completefinancial statements

maybeobtainedatCUB’sadministrativ

eoffice,1265SE3

rd

Avenue,Canby,Oregon97013.

FundFinancialStatements

Afundisagroupingofrelatedaccountsthatisusedtomaintaincontrol overresourcesthathavebeensegregated

for specific activities or objectives.The City, like other state and local governments, uses fund accounting to

ensureanddemonstratecompliancewithfinancerelatedlegalre

quireme

nts.AllofthefundsoftheCitycanbe

dividedintothefollowingtwocategories:GovernmentalFundsandProprietaryFunds.

GovernmentalFunds

Governmentalfundsareusedtoa ccountforessentiallythesamefunctionsreportedasgovernmentalactivitiesin

the government‐wide financial statements.However, unlike the government‐wide financial statements,

governmentalfundfinancialstatementsfocusonnear‐

terminflowsandoutflowsofspendableresourcesaswell

asonbalancesofspendableresourcesavailableattheendofthefiscalyear.Suchinformationmaybeusefulin

determiningwhatfinancialresourcesareavailableinthenearfuturetofinancetheCity’sprograms.

Becausethefoc

u

sofgovernmentalfundsisnarrowerthanthatofthegovernment‐widefina ncialstatements,it

isusefultocomparethe informationpresentedfor governmentalfundswithsimilar informationpresentedfor

governmentalactivitiesinthegovernment‐widefinancialstatements.Bydoingso,readersmaybetterunderstand

thelong ‐ter

mimpa

ctofthegovernment’snear‐termfinancingdecisions.Reconciliationsareprovidedforboth

the governmental fund balance sheet and the governmental fund statement of revenues, expenditures, and

changesinfundbalancestofacilitatethiscomparisonbetweengovernmentalfunds andgovernmentalactivities.

CITYOFCANBY,OREGON

MANAGEMENT’SDISCUSSION&ANALYSIS

June30,2021

9

Attheendofthefiscalyear,theCity’sgovernmentalfundsreportedacombinedending fundbalancesof$28.0

million,anincrease$5.8million(26.1%).Changesinfundbalanceformajorfundsconsistedofthefollowing:

GeneralFund‐Fundbalanceincreased$0.6million(16.6%)mainlyduetotheARPAgrantfunds.

StreetFund–Fundbalanceincreased$2.1million(101.1%)duetoreductionincapitaloutlayexpenditures.

TransitFund–Fundbalanceincreased$0.7million(29.6%)duetoreductionincapitaloutlayexpenditures.

SDCFund–Fund balanceincreased$1.4million(14.0%) duetocontinuedincreasesindevelopmentactivity

coupledwiththered

uctionincapitaloutlayexpenditures.

UrbanRenewalDebtServiceFund–Fund balanceincreased$0.7million (29.2%)duetothereductionin

capitaloutlayexpenditures .

ProprietaryFunds

ProprietaryFundsaregenerallyusedtoaccountforservicesforwhichtheCitychargescustomers.Proprietary

Fundsprovidethesamety

peofinformationasshowninthegovernment‐widefinancialstatements,onlyinmore

detail.TheCitymaintainsfourproprietaryfunds.TheSewerCombinedFundisanenterprisefund(Business‐Type

Activities) which accounts for the operations of the sewer treatment plant, sewer collect ion system, and the

stormwatersy

s

tem.ThefundistreatedasamajorfundoftheCity.TheCityalsomaintainsthreeinternalservices

funds for Facilities, Technical Services and Fleet; these are proprietary funds as they operate on a charge for

service basis but as their primary client base is other City departments/programs these fu

nds are reported as

GovernmentalActivitiesintheStatementofNetPositionandStatementofActivities.

GeneralFundStreetFundTransi tFund

System

Development

ChargeFund

Urba n

Rene wal

GeneralFund

Urban

RenewalDeb t

Serv iceFund

Other

Governmental

FundsTotal

BalancesJune30,2 020

3,3 24,431$ 2,110 ,399$ 2,418,761$ 9,907 ,514$ ‐$ 2,23 2,524$ 2,185,147$ 22,178,776$

ChangeinFundBalance

551,114 2,133 ,450 716,454 1,390 ,500 ‐ 651,1 65 351,204 5,793,887

Fu

ndBalancesat

June30,2021

3,8 75,545$ 4,243 ,849$ 3,135,215$ 11,298,014$ ‐$ 2,883,6 89$ 2,536,351$ 27,972,663$

OnaModifiedAccrualBasis

FiscalYear20 21

GovernmentalFunds:ChangesinFundBalance

CITYOFCANBY,OREGON

MANAGEMENT’SDISCUSSION&ANALYSIS

June30,2021

10

NotestotheFinancialStatements

Thenotestothefinancialstatementsprovideadditionalinformationthatisessentialtoafullunderstandingof

thedataprovidedinthego vernment‐wideandfundfinancialstatements.

RequiredSupplementaryInformation

In addition to the basic financial statements and accompanying notes, this report presents cert

ain required

supplem

entaryinformation(RSI) concerning theCity.The RSI(exclu dingthe MD&A)is presentedimmediately

followingthenotestothefinancialstatements.

GENERALFUNDBUDGETHIGHLIGHTS

TheGeneralFundbudgetaryscheduleintheRSIsectionshowsthattheoriginalappropriations werealteredwith

a supplemental budget and an appropriation transfer resulting in an in

c

rease to overall expenditure

appropriations.

FinalBudgetComparedtoActualResults–GeneralFund

Expenditures of $10.9 million were originally budgeted in the General Fund including a 1.8% operating

contingency.General Fund budget changes approved by the City Council increased appropriations by about

$448,000.Theincreaseismainlydu

etotheonetim

ePERSUALsideaccountcontributiontotakeadvantageofa

SewerFund

Facilities

FundFl eetFund

Tech

Services

FundTotal

NetPositionatJune30,2020 22,235,753$ (50,234)$ (131,374)$ 13,20 8$ 22,067,353$

Chan geinNetPos i ti on 2,496,729 (22,834) (74,267) (44,137) 2,355,491

NetPositionatJune30,2021 24,732,482$ (73,068)$ (205,641)$ (30,929)$ 24,422,844$

InternalServiceFunds

OnanAccrualBasis

FiscalYe

ar20

21

Proprieta r yandInternal ServiceFunds:Ch angesinNetPosition

CITYOFCANBY,OREGON

MANAGEMENT’SDISCUSSION&ANALYSIS

June30,2021

11

25%matchinfundingbytheStateof Oregon.Theyear‐endgeneralfundbalancewas$0.9million higherthan

budgetedwithmajorvariancesasfollows:

Beginningfundbalancewas$15thousandhigherthanbudgetedduetosavingsintheprioryear.

Expenditurescamein$361thousandlowerthanbudgeted.

o $111thousan

d–delayofParksMasterPlanupdateandcapitalprojects

o $185thousand‐vacancysavingsandlower insurancecosts

o $65thousand–theremainingreducedexpendituresarespreadthroughou ttheentirefundand

arenotrelatedtoanyspecificitem.

CAPITALASSETS

Astheschedulebelowdis

plays,infrastructureintangiblesandla

ndarethelargestcompone ntsofgovernmental

activities’ capital assets which include streets improvements and land for buildings, park s and roadways. The

largest component for business‐type activities is the wastewater treatment plant and sewer collections

infrastructure.

Capitalassetsusedingovernmentalactivitiesintotaldecreasedapproximately$1.7million(1.6%)whichwasthe

net result of additions, dis posals and depreciation. Capital assets used in business ‐type activities increased by

approximately$2.6million(17.5%)whichwasthenetresultofadditions,disposalsanddepreciation.Additional

informationabouttheCity’scapitalassetsandde

preci

ationcanbefoundintheNotestotheFinancialStatements

onpages29‐30.

DEBTADMINISTRATION

Atyear‐end,theCityhad$20,906,465inlong‐termobligationsoutstandingcomparedto$23,031,624intheprior

year.OftheobligationsoutstandingatJune30,2021,$4,785,088isduewithinoneyear.Th

eCityre

fundedits

outstandingbondsinthecurrentyeartoreducetheinterestrateandhaveanetpresentvaluesavingsinfuture

payments of approximately $5.6 million. Additional information can be found in the Notes to the Financial

Statementsonpages32‐33.

2021 2020 2021 2020 2021 2020

Land 13,279,710$ 13,279,710$ 1,155,911$ 1,155,911$ 14,435,621$ 14,435,621$

Intangibl es 36,724,734 36,724,734 5,500 5,500 36,730,234 36,730,234

Cons tructi oninProgres s 1,347,529 1,763,778 1,800,226 648,720 3,147,7 55 2,412,498

Infras tructure 27,950,264 29,825,268 5,470,393 3,670,529 33,420,657 33,495,797

Buildingsandi mprovements 18,772,383 18,698,902 8,893,410 9,143,802 27,665,793 27,842,704

Machineryandequipment 318,886 307,050 122,095 137,589 440,981 444,639

Vehi cl es 1,906,670 1,358,358 226,442 275,683 2,13 3,1 12 1,

634,041

Total CapitalAs s ets $100,300,176 $101,957,800 $17,673,977 $15,037,734 $117,974,153 $116,995,534

CapitalAssetsatFiscalYearEnd

NetofDepreciation

GovernmentalActivities

Business‐TypeActivities Total

CITYOFCANBY,OREGON

MANAGEMENT’SDISCUSSION&ANALYSIS

June30,2021

12

UnderOregonRevised Statutes,generalobligation debtissuesarelimitedto3%ofthe realmarketvalueofall

taxablepropertywithintheCity’sboundaries.TheCityiswellwithinthelimitation.

ECONOMICFACTORSANDNEXTYEAR’SBUDGET

Oregon’sannualaverageunemploymentratewas5.4%inJune2021,downfrom11.6%theprioryear.

Themain

reasonforthedecreaseistheState’srecoveryfromthepandemic.Theultimateeffectsofthepandemicarestill

unfolding,duetotheunusualnatureofthesituationitisnotpossibletoaccuratelypredictunemploymentlevels

forthecomingyear.

The General Fund is the on

e f

und in the City that is the narrowest in its ability to grow in terms of increased

revenues(duetopropertytaxlimitations)yetitsupportsawiderangeofcriticalgovernmentalfunctionssuchas

publicsafety,municipalcourtservices,parksandcommunitydevelopment.TheCityestimatedthatpropertyta

x

revenueswo

uldincreaseapproximately3.0%overtheprioryearinnextyear’sbudget.

REQUESTSFORINFORMATION

Ifyouhavequestionsaboutthereportorneedadditionalfinancialinformation,pleasecontacttheCity’sFinance

Departmentat222NE2

nd

Ave.,POBox930,Canby,Oregon97013.

2021 2020 2021 2020 2021 2020

Bonds 20,105,165$ 21,061,577$‐$ ‐$ 20,105,165$ 21,061,577$

Loa ns ‐ 1,107,971 ‐ ‐ ‐ 1,107,971

CompensatedAbsens es 686,581 766,994 114,719 95,082 801,300 862,076

Total Obliga tions $20,791,746 $22,936,542 $114,719 $95,082 $20,906,465 $23,031,624

OutstandingObligationsatFiscalYear‐End

GovernmentalActivit ie s

Business‐TypeActivities Total

13

BASICFINANCIALSTATEMENTS

CITYOFCANBY,OREGON

STATEMENTOFNETPOSITION

June30,2021

Theaccompanyingnotesareanintegralpartofthebasicfinancialstatements.

14

Comp onentUni t

Governme ntal Business‐Type Canby

Acti vi ties Activi ti es Total Util i tyBoard

ASSETS

Currentassets:

Cashandca s hequival ents 28,013,338$ 7,729,112$ 35,742,450$ 14,201,586$

Duefromothergovernments 38,876 245 39,121 ‐

Acc ountsreceivable,net 2,517,619 690,304 3,207,923 1 ,807,228

Propertytaxesreceiva bl e 289,788 ‐ 289,788 ‐

Prepaids ‐ ‐ ‐ 24,551

Materialsandsupplies ‐ ‐ ‐ 1,523,485

Restrictedca sh ‐ ‐ ‐ 709,292

Totalcurrenta ssets 30,859,621 8,419,661 39,

279,282 18,266,142

Noncurr entassets:

Cap italassets:

Nondepreci a bl e 51,351,973 2,961,63 7 54,313,610 8,846,211

Depr ecia ble,net 48,948,203 14,712,340 63,660,543 45,550,797

Total noncur renta s s ets 100,300 ,176 17,673,977 117,974,153 54,397,008

Total a s s ets 131,159 ,797 26,093,638 157,253,435 72,663,150

DEFERREDOUTFL OWSOFRESOURCES

Deferredoutfl owsrelatedtoOPEB 144,543 15,815 160,358 25,482

Deferredoutfl owsrelatedtopensions 4,383,377 470,520 4,853,897 1 ,440,389

Totaldeferredoutflo wsofresources 4,527,920

486,

335 5,014,255 1,465,871

LIABILITIES

Currentliabilities:

Acc ountspa yabl e 2,020,126 242,905 2,263,031 1 ,676,955

Accruedex pens es ‐ ‐ ‐ 275,737

Interes tpaya ble 64,710 ‐ 64,710 ‐

Customer depos its ‐ ‐ ‐ 315,392

Currentporti onoflong‐termobli gati ons 4,698,969 86,039 4,785,008 399,000

Total currentl iabi li ties 6,783,805 328,944 7,112,749 2 ,667,084

Noncurr entliabilities:

NetOPEBliabi li ty 524,358 56,487 580,84 5 91,728

Noncurr entporti onoflong‐te rmo

bliga ti ons 16,092,776 28,68 0 16,121,456 1,827,000

Netpensionl i a bi li ty 12,840,371 1,381,850 14,222,221 4,190,578

Totalnoncur rentl iabi li ties 29,457,505 1,467,017 30,924,522 6,109,306

Total l iabi li ties 36,241,310 1,795,961 38,037,271 8,776,390

DEFERREDINFLOWSOFRESOURCES

Deferredinflowsrel atedtoOPEB 130,6 76 13,837 144,513 32,823

Deferredinflowsrel atedtopensions 370,347 37,693 408,040 153,247

Totaldeferredi nflows 501,023 51,530 552,55 3 186,070

NETPOSITION

Netin

vestmentinca

pital assets 80,195,011 17,673,977 97,868,988 52,171,008

Restrictedfor:

Drugenforcementandequipment 13,050 ‐ 13,050 ‐

Cap italprojects 11,298,014 ‐ 11,298,014 ‐

Urbanrenewa l debtservic e 2,883,689 ‐ 2,883,689 ‐

Buildings ervi c es 74,785 ‐ 74,785 ‐

Librarys ervi ces 70,771 ‐ 70,771 ‐

Swimcenter 1,291,724 ‐ 1,291,724 ‐

PEGfees 49,187 ‐ 49,187 ‐

Watersystem ‐ ‐ ‐ 381,781

Unrestricted 3,069,153 7,058,505 10,127,658 12 ,613,772

Tota

lnetpositi on 98,945,384$ 2 4,732,482$ 123,677,866$ 65,166,561$

CITYOFCANBY,OREGON

STATEMENTOFACTIVITIES

FortheYearEndedJune30,2021

Theaccompanyingnotesareanintegralpartofthebasicfinancialstatements.

15

Operati ng Capital Business ComponentUni t

Chargesfor Grantsand Grantsa nd Governmental Type Canby

Functi ons/Programs

Ex pens es Services Contributions Contr ibutions Acti vities Activities Total UtilityBoard

Primarygovernment:

Governmentalactivi ties:

Generalgovernment 5,700,556$ 2,333,091$ 2,008$ ‐$ (3,365,457)$ ‐$ (3,365,457)$ ‐$

Publics a fety 6,008,163 36,327 58,755 ‐ (5,913,081) ‐ (5,913,081) ‐

Highwaysands treets 4,497,361 1,444,201 1,978,627 202,467 (872,066) ‐ (872,066) ‐

Tra nsporta ti on 1,839,235 300 892,423 611,894 (334,618) ‐ (334,618) ‐

Cultur eandrecr eati on 2,483,163 500,901 1,024,120 ‐ (958,142) ‐ (958,142) ‐

Communi tydevelopment 878,645 422,771 ‐

2,583,599 2,127,725 ‐ 2,127,725 ‐

Interes texpense 905,915 ‐ ‐ ‐ (905,915) ‐ (905,915) ‐

Total governmentalac ti vi ties 22,313,038 4,737,591 3,955,933 3,397,960 (10,221,554) ‐ (10,221,554) ‐

Businesstypeactivi ties:

Seweropera ti ons 2,830,771 4,460,413 ‐ ‐ ‐ 1,629,642 1,629,642 ‐

Total prima rygovernment 25,143,809$ 9,198,004$ 3,955,933$ 3,397,960$ (10,221,554) 1,629,642 (8,591,912) ‐

Component Unit:

Electricsystem 12,153,358 13,365,760 ‐ 740,288 1,952,690

Watersys tem 3,508,545 3,900,314

‐

959,218 1,350,987

Total componentuni t 15,661,903$ 17,266,074$‐$ 1,699,506$ 3,303,677

Generalrevenues:

Taxes :

Propertyta xes 10,625,478 ‐ 10,625,478 ‐

Transi tta xes 1,790,583 ‐ 1,790,583 ‐

Transi entroomtaxes 21,000 ‐ 21,000 ‐

Fra nchise 1,672,933 ‐ 1,672,933 ‐

Unrestrictedi ntergovernmentalrevenues 1,045,263 ‐ 1,045,263 ‐

Interes tandinvestmentea rni ngs 195,651 59,584 255,235 120,133

Otherrevenues 205,712 9,025 214,737 1,467,797

Transfersin(out) (798,478) 798,478 ‐ ‐

Total ge

neralr

evenues,tra ns fers 14,758,142 867,087 15,625,229 1,587,930

Changeinnetposi ti on 4,536,588 2,496,729 7,033,317 4,891,607

Netposition ‐begi nning 94,408,796 22,235,753 116,644,549 60,274,954

Netposition ‐endi ng 98,945,384$ 24,732,482$ 123,677,866$ 65,166,561$

Net(Expense)Revenueand

Chan geinNetPos itionProgramRevenues

CITYOFCANBY,OREGON

BALANCESHEET–GOVERNMENTALFUNDS

June30,2021

Theaccompanyingnotesareanintegralpartofthebasicfinancialstatements.

16

General

FundStr eetFundTransitFund

System

Development

ChargeFund

Urban

Renewal

GeneralFund

UrbanRenewal

DebtService

Fund

Other

Governmental

Funds

Total

Governmental

Cashandcas hequi valents 4,172,508$ 3,828,482$ 2,912,988$ 11,273,309$ 164,768$ 2,837,979$ 2,606,572$ 27,796,606$

Duefromothergovernments 20,407 ‐ ‐ ‐ ‐ 15,262 3,207 38,876

A

cco

unts receivable,net 795,059 516,686 1,1 29,036 24,705 ‐ 39,992 11,706 2,517,184

Propertytaxesrecei vabl e 153,256 ‐ ‐ ‐ ‐ 112,446 24,086 289,788

Tota lass ets 5,141,230$ 4,345,168$ 4,042,0 24$ 11,298,014$ 164,768$ 3,005,679$ 2,645 ,571$ 30,642,454$

LIABILITIES:

Accounts paya bleandothercurrentli abi li ties 714,563$ 65,723$ 88 3,956$ ‐$ 164,768$ ‐$ 86,758$ 1,915,768$

DEFERREDINFLOWS:

Unavail ablerevenue 551,122

35,596 22,853 ‐ ‐ 121,990 22,462 754,023

Tota lliabilitiesanddeferredi nfl ows 1,265,685 101,319 906,8 09 ‐ 164,768 121,990 109,220 2,669,791

FUNDBALANCES:

Re stricte dfor:

Drugenforcementandequipment ‐ ‐ ‐ ‐ ‐ ‐ 13,050 13,050

Capitalprojec ts ‐ ‐ ‐ 11,298,014 ‐ ‐ ‐ 11,298,014

Urbanrenewaldebtservice ‐ ‐ ‐ ‐ ‐ 2,883,689 ‐ 2,883,689

Buildingservi ces 74,785 ‐ ‐ ‐ ‐ ‐

‐ 74,785

Libraryservices ‐ ‐ ‐ ‐ ‐ ‐ 70,771 70,771

Swimcenter ‐ ‐ ‐ ‐ ‐ ‐ 1,291,724 1,291,724

PEG 49,187 ‐ ‐ ‐ ‐ ‐ ‐ 49,187

Committed for:

Transportationservices ‐ ‐ 3,135,215 ‐ ‐ ‐ ‐ 3,135,215

Streetpr ojects ‐ 4,243,849 ‐ ‐ ‐ ‐ ‐ 4,243,849

Workers compretropl a n 121,863 ‐ ‐ ‐ ‐ ‐ ‐ 121,863

Pa rkma intena nce 192,509 ‐ ‐ ‐ ‐ ‐ ‐ 192,509

To

u

rismpromotionandenha ncement ‐ ‐ ‐ ‐ ‐ ‐ 40 ,041 40,041

Cemeteryca re ‐ ‐ ‐ ‐ ‐ ‐ 1,120,765 1,120,765

3,437,201 ‐ ‐ ‐ ‐ ‐ ‐ 3,437,201

Tota lfundbala nce 3,875,545 4,24 3,849 3,135,215 11,298,014 ‐ 2,883,689 2,536,351 27,972,663

Tota lliabilities,deferr edinflowsandfundbalance 5,141,230$ 4,345,168$ 4,042,0 24$ 11,298,014$ 164,768$ 3,005,679$ 2,645 ,571$ 30,642,454$

Unassigned:

ASSETS

L

I

ABILITIES,DEFERREDINFLOWSANDFUNDBALANCES

CITYOFCANBY,OREGON

GOVERNMENTALFUNDS

RECONCILIATIONOFTHEBALANCESHEETTOTHESTATEMENTOFNETPOSITION

June30,2021

Theaccompanyingnotesareanintegralpartofthebasicfinancialstatements.

17

TOTALFUNDBALANCE 27,972,663$

Capitalassetsarenotfinancial resourcesforbudgetary purposesand

thereforearenotreportedinthegovernmentalfunds.

Cost $ 215,725,638

Accumul ate ddepreciation (115,425,462) 100,300,176

AportionoftheCity'sreceivablesarecollectedafteryear‐endbuttheyare

notcollectedsoonenoughtobe availableasfinancialresourcesforthe

cur

rentyear.Therevenuesrelatedtothesereceivablesareunavai labl eand

notreportedinthegovernmentalfunds. 754,023

DeferredInflows‐Pension (354,721)

DeferredOutflow s‐Pension 4,198,409

DeferredInflows‐OPEB (124,271)

DeferredOutflow s‐OPEB 141,644

Compensated absencesnotpayableinthecurrentyearar enotrecordedas

governmentalfundliabil ities. (662,262)

Inte rnalservi ce fundsreportedasgovernmentalac t

ivities

(309,638)

Long‐termasse ts,arenotreportedasgovernmentalfundassetsand

liabilitiesnotpayableinthecurrentyeararenotreportedasgovernmental

fund liabil ities.Interestonlong‐termde btisnotaccruedinthe

governmentalfunds,butratherisrecognizedasanexpensewhenitisdue.

Theselo

ng‐te

rmassetsandliabilitiesconsistof:

Long‐termdebt (20,105,162)$

NetOPEBliability (502,232)

Netpensionliability (12,298,534)

Accrue dinterestpayable (64,710) (32,970,638)

TOTALNETPOSITION 98,945,384$

Totalnetposi tionshownintheStatementofNetPositi onisdifferentbe cause:

CITYOFCANBY,OREGON

GENERALFUND

SCHEDULEOFREVENUES,EXPENDITURES,ANDCHANGESINFUNDBALANCE

BUDGETANDACTUAL

FortheFiscalYearEndedJune30,2021

Theaccompanyingnotesareanintegralpartofthebasicfinancialstatements.

18

GeneralFundStreetFu ndTransitFund

System

Development

ChargeFund

Urban

Rene wal

GeneralFund

UrbanRenewal

DebtService

Fund

Other

Governmental

Funds

Total

Governmental

REVENUES:

Propert ytaxes 5,518,863$ ‐$ ‐$ ‐$ ‐$ 4,215,618$ 863,271$ 10,597,752$

Intergovernmental 1,01 4,827 2,186,330 ‐ ‐ ‐ ‐ 1,01 2,388 4,2 13,545

Chargesforservices 1,238,550 723,772 300 ‐ ‐

‐ 70,868 2,033,490

Franchise 1,672,933 ‐ ‐ ‐ ‐ ‐ ‐ 1,6 72,933

Licenses,fees,permits 184,664 ‐ ‐ ‐ ‐ ‐ ‐ 1 84,664

Finesandforfeitures 493,684 ‐ ‐ ‐ ‐ ‐ 3,639 497,323

Specialassessments ‐ ‐ ‐ ‐ ‐ 18,644 ‐ 18,644

Grantsanddonations 72,075 ‐ 1,504,317 ‐ 2,000 ‐ 11,732 1,590,124

Interest 27,295 19,690 18,784 85,961 876 21,6 48 18,752 193,006

Miscellaneous 137,365 718,223 1,525 ‐ 52,283 67

,

398 553 977,347

Systemdevelopmentcharges ‐ ‐ ‐ 2,586,859 ‐ ‐ ‐ 2,586,859

Transientoccupancytax ‐ ‐ ‐ ‐ ‐ ‐ 21,000 21,000

Transittaxes ‐ ‐ 1,805,992 ‐ ‐ ‐ ‐ 1,805,992

Totalrevenues 10,360,256 3,648,015 3,330,918 2,672,820 55,159 4,323,3 08 2,002,203 26 ,392,679

EXPENDITURES:

Current:

Generalgovernment 3,021,394 ‐ ‐ ‐ 20,236 ‐ ‐ 3,041,630

Publicsafety 5,792,537 ‐ ‐ ‐ ‐ ‐ 541 5,793,078

Highwaysandstr

eets ‐

1,082,854 ‐ ‐ ‐ ‐ ‐ 1,082,854

Transportation ‐ ‐ 2 ,029,451 ‐ ‐ ‐ ‐ 2,0 29,451

Cultureandrecreation 871,442 ‐ ‐ ‐ ‐ ‐ 1,496,617 2,368,059

Communitydevelopment 857,306 ‐ ‐ ‐ ‐ ‐ ‐ 857,306

Capitaloutlay 451,307 3 48,878 402,285 ‐ 4 67,448 ‐ 34,397 1 ,704,31 5

Debtservice:

Principal ‐ ‐ ‐ ‐ ‐ 1,984,387 ‐ 1,984,387

Interest ‐ ‐ ‐ ‐ ‐ 939,232 ‐ 939,232

Bondissuancecosts ‐

‐ ‐ ‐ ‐ 145,763 ‐ 145,763

Totalexpenditures 10,993,986 1,431,732 2,431,736 ‐ 487,684 3,069,3 82 1,531,555 19 ,946,075

Revenuesover(under)expenditures (633,730) 2,216,283 8 99,182 2,672,82 0 (432,525 ) 1,253,9 26 470,648 6,446,604

OTHERFINANCINGSOURCES(USES):

Proceedsfromsaleofbonds ‐ ‐ ‐ ‐ ‐ 18,435 ,000 ‐ 18,435,000

Bondpremiums ‐ ‐ ‐ ‐ ‐ 995,165 ‐ 995,165

Bondrefundingescrow ‐ ‐ ‐

‐ ‐ (19,284,402) ‐ (19,284,402)

Transfersin 1,385,558 47,777 ‐ ‐ 748,523 ‐ 1,14 2,687 3,3 24,545

Transfersout (200,714) (130,610) (182,728) (1,282,320) (315,998) (748,524) (1,262,131) (4 ,123,025)

Totalotherfinancingsources(uses) 1,184,844 (82,833) (182,728) (1,282,320) 432,525 (602,761) (119,444) (652,717)

Netchangesinfundbalances 551,114 2,133,450 716,454 1,390,500 ‐ 651,165 351,204 5,793,887

3,324,431 2,110,399 2 ,418,761 9,907,514 ‐ 2,232 ,524 2,185,147

22

,178,776

FUND BALANCE,ENDING 3,875,545$ 4,243,849$ 3,135,215$ 11 ,298,014$ ‐$ 2,883,6 89$ 2,536,351$ 27,972,663$

FUND BALANCE,BEGINNING

CITYOFCANBY,OREGON

GOVERNMENTALFUNDS

RECONCILIATIONOFTHESTATEMENTOFREVENUES,EXPENDITURES,ANDCHANGESINFUND

BALANCETOTHESTATEMENTOFACTIVITIES

FortheFiscalYearEndedJune30,2021

Theaccompanyingnotesareanintegralpartofthebasicfinancialstatements.

19

AmountsreportedforgovernmentalactivitiesintheStatementofActivitiesaredifferentbecause:

Netchangeinfundbalances‐totalgovernmentalfunds 5,793,887$

Thestatementofrevenues,expenditures,andchangesinfundbalancesreportcapital

outlaysasexpenditures.However,in theStatementofActivitiesthecostofthose

assetsisallocatedovertheirestimatedus

efullivesandreportedasdepreciation

Currentyeardepr eciation (3,684,670)$

Capitalacquisitions 2,027,046 (1,657,624)

Changeinunavailablerevenue,netofallowancefo rdoubtfulaccounts 26,387

Changeinaccruedinterestonlon g‐termliabilities 33,317

Theissuanceoflong‐termdebt(e.g.,bonds,leases)providescurrentfinancialresources

Debtserviceprincipalpayments 2,064,384

Changeinco

mpensateda

bsences 103,367 2,167,751

Internalservicefundreportedasgovernmentalactivities (141,238)

OPEBexpense 6,089

Pensionexpense (1,691,984)

Changeinnetpositionofgovernmentalac tivities 4,536,588$

CITYOFCANBY,OREGON

PROPRIETARYFUNDS

STATEMENTOFNETPOSITION

June30,2021

Theaccompanyingnotesareanintegralpartofthebasicfinancialstatements.

20

SewerCombine d

Fund

Internal

Serv iceFunds

ASSET S ANDDEFERREDOUTFLOWS

ASSETS:

CurrentAssets:

Cashandcashequivalents 7,729,112$ 216,732$

Accountsreceiv able,net 690,549 434

Totalcurrentassets 8,419,661 217,166

NoncurrentAssets:

Capitalassets,net 17,673,977 ‐

Totalassets 26,093,638 217,166

DEFERREDOUTFLOWSOFRESOURCES:

Deferredoutflowsrelatedtopensions 470,520 184,968

DeferredoutflowsrelatedtoOPEB 15,815 2,899

Totaldeferredoutflowsofre

sources 486,335 187,867

Totalassetsanddeferredoutflows 26,579,973$ 405,033$

LIABILITIES,DEFERREDINFLOWSANDNETPOSITION

LIABILITIES:

CurrentLiabilities:

Accountspayable 242,905$ 104,358$

Long‐termdebt‐withinoneyear 86,039 18,240

Totalcurrentliabilities 328,944 122,598

NoncurrentLiabilities:

Long‐termobligations‐non‐currentportion 28,680 6,079

Netpensionliability 1,381,850 541,837

NetOPEBliability 56,487 2 2,126

Totalnoncurrentl

i

abilities 1,467,017 570,042

Totalliabilities 1,795,961 692,640

DEFERREDINFLOWSOFRESOURCES:

Deferredinflowsrelated topensions 37,693 1 5,626

Deferredinflowsrelated toOPEB 13,837 6,405

Totaldeferredinflowsofresources 51,530 22,031

Totalliabilities anddeferredinflows 1,847,491 714,671

NETPOSITION:

Netinvestmentincapitalassets 17,673,977 ‐

Unrestricted 7,058,505 (309,638)

Totalnetposition 24,732,482 (3 09,638)

Totalliabilities,deferredinflowsan

dnetposition 26,579,973$ 405,033$

CITYOFCANBY,OREGON

PROPRIETARYFUNDS

STATEMENTOFREVENUES,EXPENSES,ANDCHANGESINFUNDNETPOSITION

FortheFiscalYearEndedJune30,2021

Theaccompanyingnotesareanintegralpartofthebasicfinancialstatements.

21

Sewer

CombinedFund

InternalServ ice

Funds

OPERATINGREVENUES:

Chargesforservices 4,460,413$ 1,225,032$

Miscellaneous 9,025 1,223

Totaloperatingrevenues 4,469,438 1,226,255

OPERATINGEXPENSES:

Personnelservices 1,435,087 547,686

Materialsandservices 952,738 821,867

Depreciationandamortization 442,946 ‐

Totaloperatingexpenses 2,830,771 1,369,553

Operatingincome(loss) 1,638,667 (143,298)

NON‐OPERATINGINCOME(EXPENSE):

Interestincome 59,584 2,060

TRANSFERSANDCAPITALCONTRIBUTIONS:

Transfersin 1,052,264 ‐

Transfersout (253,786)

‐

Changeinnetposition 2,496,729 (141,238)

FUNDNETPOSITION,BEGINNING 22,235,753 (168,400)

FUNDNETPOSITION,ENDING 24,732,482$ (309,638)$

CITYOFCANBY,OREGON

PROPRIETARYFUNDS

STATEMENTOFCASHFLOWS

FortheFiscalYearEndedJune30,2021

Theaccompanyingnotesareanintegralpartofthebasicfinancialstatements.

22

Sewer

Combin edFund

Internal

ServiceFunds

CASHFLOWSFROMOPERATIN GACTIVITIES:

Cashrecei vedfromoutsidecus tomers 4,410,238$ 4,947$

Cashrecei vedfrominternalcustomers ‐ 1,221,8 07

Cashpaidtoemployeesforsalariesandbenefits (1,223,065) (469,178)

Cashpaidtosupplier sandother s (1,009,261) (774,697)

Netcas hfromoper atinga ctiviti es 2,17 7,912 (17,1 21)

CASHFLOWSFROM

NON‐CAPITALFINANCINGAC

T

IVITIES:

Transfersin 1,052,264 ‐

Transferout (253,786) ‐

Netcas hfromnon‐ca pi ta l financinga cti vi ties 798,478 ‐

CASHFLOWSFROMCAPITALAND

RELATEDFINANCINGACTIVITIES:

Purc ha seofcapita la s s ets (3,079,189) ‐

CASHFLOWSFROMINVESTINGACTIVITIES:

Interestrecei ved 59,584 2,060

Netincrease(decr ease)inca shandca s hequivalents (43 ,21 5 ) (15,0 61)

CASHAN DCASHEQUIVALENTS,BEGINNING 7,772,327 231,793

CASHAN

DCAS

HEQUIVALENTS,ENDING 7,729,112$ 216,732$

RECONCI LIATIONOFOPERATINGINCOME(LOSS)TO

NETCASHPROVIDEDBYOPERATIN GACTIVITIES:

Opera tingincome(l os s ) 1,638,667$ (143,298)$

Adjustments:

Deprec i a ti on 442,946 ‐

Los sondisposalofassets ‐ ‐

Decrease(increase)in:

Accounts receivabl e (59,200) 499

Increase(decrease)in:

Accounts payableandaccruedexpens es (56,523) 47,170

OPEBobl i ga tion (229) 4,003

Accruedco

mpens atedabsences 19,637 893

Pens ionobl i gations 192,614 73,612

Netcas hfromoper atinga ctiviti es 2,17 7,912$ (17,121)$

23

NOTESTOTHEFINANCIALSTATEMENTS

CITYOFCANBY,OREGON

NOTESTOTHEFINANCIALSTATEMENTS

FortheYearEndedJune30,2021

24

1) SUMMARYOFSIGNIFICANTACCOUNTINGPOLICIES

A. DescriptionofReportingEntity

TheCityofCanby,Oregon,(theCity)islocatedinClackamasCounty21milessouthofPortland,Oregon,and35miles

northofSalem,Oregon.TheCitywasincorporated asamunicipalcorporationin1893andoperatesunderacouncil‐

administratorformofgovernment.

TheCityCouncilconsistsofamayorelectedforatwo‐yearterm,andsixmembers

eachelectedtofour‐yearterms.TheCityCouncilappointstheCityAdministrator,whoisresponsiblefortheday‐to‐

daymanagementoftheCity.

The accompanying financial statements present the City and its comp

onent units, entities for which the City is

consideredfinanciallyresponsible.TheCityistheprimarygovernment.Aprimarygovernmentisafinancialreporting

entity,whichhasaseparatelyelectedgoverningbody,islegallyseparate,andisfiscallyindependentofotherstateand

localgovernments.Asrequiredbyaccou

ntingprinciples

generallyacceptedintheUnitedStatesofAmerica(GAAP),

these financial statements present the City and its component units.Blended component units, although legally

separateentitiesare,insubstance, partofthegovernment’soperationsandso data from theseunitsarecombined

withdata of theprimary government.Di

scretelypresented component units, onthe other

hand, are reported in a

separatecolumninthecombinedfinancialstatementtoemphasizeitislegallyseparatefromtheCity.

BlendedComponentUnit

TheCityhasoneblendedcomponentunit,theUrbanRenewalAgency(theAgency).TheAgencywasformedtoplan,

direct, andmana

ge certainprojects within the City. Pursuant to ORS457.055, theCity Council has been appointed

governing body of the Agency, which is the same governing board as the primary government. In accordance with

GASB61theAgencymeetsthecriteriaofablendedcomponentunitbecausethegoverningbodyisthesame,thereis

a financial benefit/burden relationship between the e

ntities in relation to debt burden, asset contributions, and

managementof

theprimarygovernmenthasoperationalresponsibilityforthecomponentunit.TheUrbanRenewal

District General Fund and Urban Renewal Debt Service Fund are reported as governmental fund types. Co

mplete

financialstatementsfortheUrban

RenewalAgencyfortheyearendedJune30,2021,maybeobtainedatCanbyCity

Hall,locatedat222NE2

nd

Ave.,Canby,Oregon97013.

DiscretelyPresentedComponentUnit

TheCanbyUtilityBoard(CUB)isresponsibleforprovidingwaterandelectricityservicestoresidentialandcommercial

customerswithinthecitylimitsofCanby.CUBisa legallyseparateentityfromtheCity,whichiscurrentlygovernedby

aboard appointedbythemembersof

theCityCouncil.Afinancialbenefitexists.Completefinancialstatementsfor

CUBfortheyearendedJune30,2021maybeobtainedatCUB’sadministrativeofficelocatedat1265SE3

rd

Avenue,

Canby,Oregon97013.

B. BasicFinancialStatements

Basic financial statements are presented at both the government‐wide and fund financial level.Both levels of

statementscategorizeprimaryactivitiesaseithergovernmentalorbusiness‐type.Governmentalactivities,whichare

normallysupportedbytaxesandintergovernmentalrevenues,arereportedseparatelyfrombusiness‐typeactivities,

which rely significantly on fees and charges for support.

Separate fund financial statements are provided for

governmentalfundsandproprietaryfunds.

CITYOFCANBY,OREGON

NOTESTOTHEFINANCIALSTATEMENTS

FortheYearEndedJune30,2021

25

1) SUMMARYOFSIGNIFICANTACCOUNTINGPOLICIES(Continued)

B. BasicFinancialStatements(Continued)

Government‐widefinancialstatements

Government‐widefinancialstatementsdisplayinformationabouttheCityasawhole.Thesestatementsfocusonthe

sustainabilityoftheCityasanentityandthechange inaggregatefinancialpositionresultingfromtheactivitiesofthe

fiscalperiod.TheseaggregatedstatementsconsistoftheStatementofNetPositionandtheStatementof

Activities.

Eliminationshavebeenmadetominimizethedouble‐countingofinternalactivities.

TheStatementofActivitiespresentsacomparisonbetweendirectexpensesandprogramrevenuesforeachfunction

oftheCity’sactivities.Directexpensesarethosethatarespecificallyassociatedandthereforeclearlyidentifiablewith

a program or function.

Indirectexpense allocationsthat have beenmade inthe fundshave beeneliminated in the

StatementofActivities.Programrevenuesinclude(a)fees,fines,andchargespaidbytherecipientsofgoodsorservices

offered by th

e programs, and (b) grants and contributions that are restricted to meeting the operational or capital

requirements of a particular program.Taxes and other items not properly included among program revenues are

reportedinsteadasgeneralrevenues.

Fundfinancialstatements

Thesestatementsdisplayinformationattheindividualfundlevel.Eac

hfundisconsi

deredtobeaseparateaccounting

entity.Fundsareclassifiedandsummarizedasgovernmentalorproprietary.Majorindividualfundsarereportedas

separatecolumnsinthefundfinancialstatements.Non‐majorfundsareconsolidatedintoasinglecolumnwithineach

fundtypeinthefinancialsectionoftheba

sicfinancialstatementsan

daredetailedinthesupplementaryinformation.

The financial transactions of the City are recorded in individual funds.Each fund is accounted for by providing a

separate set of self‐balancing accounts that comprises its assets, liabilities, reserves, fund equity, revenues and

expenditures/expenses.Thevariousfundsarereportedbygenericclassificationwithinthefinancia

lstatements.

TheCityreportsthefollowingmajorgovernmentalfunds:

GeneralFund‐ThisistheCity’sprimaryoperatingfund.ItaccountsforthefinancialresourcesoftheCitythat

arenotaccountedforinanyotherfund.Principalsourcesofrevenuearepropertytaxes,intergovernmental

proceeds from the State of Oregon and Clackamas County, licenses and permits, and fines.Primary

expendituresareforgeneraladministrati

on,publicsafety,andcultu

reandrecreation.

StreetFund‐ThisfundaccountsforrevenuesfromgastaxapportionmentsreceivedfromtheStateofOregon

andthelocalstreetmaintenancefeeandexpendituresformaintenanceofpublicstreets.

TransitFund‐Thisfundaccountsforpayrolltaxescollectedfromthelocalbusinesscommunityaswellasgrants

receivedandusedtofundtheCity’smasstransitprogram.

UrbanRenewal–GeneralFund‐Thisfund is usedtoaccount fortheoperationsandconstructionofcapital

projects.ThemainsourceoffundingisatransferfromtheURADebtServiceFund.

System Development Charge Fund‐This fund accounts for the collection and use of system development

chargesforcapitalprojectfunding.

UrbanRenewal‐DebtServiceFund‐Thisfundisusedtoaccountforthepaymentofprincipalandintereston

bondsandloansissuedtofundprojectsasplannedandexecutedthroughtheUrbanRenewalAgency–General

Fund.Theprimarysourceoffundsispropertytaxincrementrevenue.

CITYOFCANBY,OREGON

NOTESTOTHEFINANCIALSTATEMENTS

FortheYearEndedJune30,2021

26

1) SUMMARYOFSIGNIFICANTACCOUNTINGPOLICIES(Continued)

B. BasicFinancialStatements(Continued)

AdditionallytheCityreportsnon‐majorfundswithinthegovernmentalfundtype.

Special RevenueFunds‐These funds are used to account for proceeds of specific revenuesources that are

earmarkedforspecific purposes includingcemeteryoperations, transient roomtax,swim center operations

andlibraryoperations.Principalresourcesincludeprop

ertytaxes,intergovernmentalrevenues,roomtaxes,

andchargesforservices.

TheCityreportsthefollowingmajorenterprisefund:

Sewer Combined Fund‐The fund accounts for business type activities of the City that receive a significant

portionoffundingthroughuserchargeswiththeintenttofullyrecoverthecostofservice.Thefundaccounts

for the day‐to‐day operation of the City’s sanitary se

w

er collection and treatment processes as well as

stormwateroperations.

TheCityreportsthefollowinginternalservicefunds:

FacilitiesFund‐ThefacilitiesfundaccountsforutilitiesandmaintenanceforallCityoperatinglocationswith

the intent of then recovering the cost by charging all operating units based on their applicable portion,

attributedbasedonapercentageofsquarefootage.

FleetServicesFund‐Thefacilitiesfundaccountsforoperationandmaintenanceofthevehiclefleetand

other

equipmentwiththeintentofthenrecoveringthecostbychargingfortheservicesprovided.

TechnicalServicesFund‐Thetechnicalservicesfund accounts foroperationandmaintenanceofcomputers

andthephonesystemwiththeintentofrecoveringthecostbychargingoperatingunitsbasedonthenumber

ofcomputersinuse.

C. MeasurementFocusand

BasisofAccounting

Measurementfocusisatermusedtodescribewhichtransactionsarerecordedwithinthevariousfinancialstatements.

Basisofaccountingreferstowhentransactionsarerecorded.

The government‐wide financial statements and the pr

oprietary funds financial statements are presented using

the

economicresourcesmeasurementfocusandtheaccrualbasisofaccounting.Aneconomicresourcefocusconcentrates

onanentityorfund’snetposition.Alltransactionsandeventsthataffectthetotaleconomicresources(netposition)

duringtheperiodarereported.Aneconomicresourcesmeasurementfocusisinextricablyconnectedwithfullaccrual

accounting.U

nderthefullaccrual

basisofaccounting,revenuesarerecordedwhenearnedandexpensesarerecorded

whenaliabilityisincurred,regardlessofthetimingofrelatedcashflows.

Governmentalfundfinancialstatementsarereportedusingthecurrentfinancialresourcesmeasurementfocusandthe

modified accr

ual basis of a

ccounting.This measurement focus concentrates on the fund’s resources available for

spendingcurrentlyorinthenearfuture.Onlytransactionsandeventsaffectingthefund’scurrentfinancialresources

duringtheperiodarereported.Similartotheconnectionbetweenaneconomicresourcemeasurementfocusandfull

accrualaccou

nting,acurre

ntfinancialresourcemeasurementfocusisinseparablefromthemodifiedaccrualbasisof

accounting.Under modified accrual accounting, revenues are recognizedas soon asthey are both measurable and

available.

CITYOFCANBY,OREGON

NOTESTOTHEFINANCIALSTATEMENTS

FortheYearEndedJune30,2021

27

1) SUMMARYOFSIGNIFICANTACCOUNTINGPOLICIES(Continued)

C. MeasurementFocusandBasisofAccounting(Continued)

Revenuesareconsideredtobeavailablewhentheyarecollectiblewithinthecurrentperiodorsoonenoughthereafter

topayliabilitiesofthecurrentperiod.Forthispurpose,theCityconsidersrevenuestobeavailableiftheyarecollected

within60day

softheendofthecurrentfiscalperiod.Expendituresgenerallyarerecordedwhenaliabilityisincurred,

asunderaccrualaccounting.However,long‐termcompensatedabsencesarerecordedonlywhenpaymentisdue.

Propertytaxes,franchisetaxes,licenses,andinterestassociatedwiththecurrentfiscalperiodareallconsideredtobe

susceptibletoaccrualandsohavebeenre

cognized

asrevenuesofthecurrentfiscalperiod.Onlytheportionofspecial

assessmentsreceivableduewithinthecurrentfiscalperiodisconsideredtobesusceptibletoaccrualasrevenueofthe

currentperiod.Allotherrevenueitemsareconsideredtobemeasurableandav

ailable

onlywhencashisreceivedby

theCity.

In accordance with GASB 65 unavailable revenue which occurs on the modified accrual basis of accounting when