LB&I Concept Unit

Unit Name

Introduction to Dollar Value LIFO

Primary UIL Code

00472.08-00 Dollar Value Method

Library Level Title

Knowledge Base

Corporate/Business Issues & Credits

Shelf

Inventory and IRC 263A

Book

Inventory LIFO

Chapter

Dollar Value Method

Document Control Number (DCN)

COR-C-015

Date of Last Update

06/10/20

Note: This document is not an official pronouncement of law, and cannot be used, cited or relied upon as such. Further, this document may not contain a

comprehensive discussion of all pertinent issues or law or the IRS's interpretation of current law.

DRAFT

3

General Overview

Introduction to Dollar Value LIFO

Any taxpayer may elect to determine the cost of Last In-First Out (LIFO) inventories under the “dollar-value” LIFO method, provided

the taxpayer uses the method consistently and it clearly reflects income in accordance with the rules of Treas. Reg. 1.472–8 Dollar-

value method of pricing LIFO inventories.

The dollar-value method of valuing LIFO inventories is a method of determining cost by using “base-year” costs expressed in total

dollars rather than the quantity and price of specific goods as the unit of measurement. Under this method, the taxpayer groups goods

contained in the inventory into a pool(s). The method groups related inventory and uses an overall price index, under one of three

approaches, to approximate changes in inventory cost. Rather than tracking individual units, taxpayers measure value based on the

total value of the pool.

The term “base-year cost” is the aggregate of the cost of all items in a pool determined as of the base date. The base date is the

beginning of the taxable year for which the taxpayer first adopts the LIFO method. The taxable year for which the taxpayer first adopts

the LIFO method for any item in the pool is the “base year” for that pool.

Liquidations (decrements) and increments of items contained in the pool are reflected only in terms of a net liquidation or net

increment for the pool. Fluctuations may occur in quantities of various items within the pool, new items that properly fall within the pool

may be added, and old items may disappear from the pool, all without necessarily changing the dollar value of the pool.

An increment in the LIFO inventory occurs when the end of the year inventory for any pool expressed in terms of base-year cost is

more than the beginning of the year inventory for that pool expressed in terms of base-year cost. Pool liquidation occurs when the

year’s ending inventory is less than beginning inventory after correcting for inflation. Because liquidations and increments are reflected

only on a net basis, the dollar-value LIFO method minimizes liquidation in most cases.

In determining the inventory value for a pool, the taxpayer adjusts the increment, if any, for changing unit costs or values by reference

to a percentage, relative to base-year-cost, determined for the pool.

Back to Table of Contents

DRAFT

4

Detailed Explanation of the Concept

Introduction to Dollar Value LIFO

Analysis Resources

IRC 472(b)(2) states that if the taxpayer uses the LIFO inventory method, it must value the

inventory at cost regardless of market value. Lower of cost or market write-downs are not

allowed.

Treas. Reg. 1.472-8 covers the dollar-value method of pricing LIFO Inventories. This method

measures inventory based on dollars and not particular units. The taxpayer groups the

inventory into a pool or pools.

There are various methods the taxpayer can choose for computing the LIFO value:

Double-extension Method

Link-chain Method

Inventory Price Index Computation (IPIC)

Retail Inventory Method (RIM)

The following two sections first describe various LIFO methods then provide examples.

IRC 472(b)(2)

Treas. Reg. 1.472-8(b)

Back to Table of Contents

DRAFT

5

Detailed Explanation of the Concept (cont’d)

Introduction to Dollar Value LIFO

Analysis Resources

Double-extension Method

The Double-extension method is described in Treas. Reg. 1.472-8(e)(2) and is the preferred

method per the regulations.

Used in industries where the composition of pools does not change much.

Measures cumulative inflation in one step, from the base year (first LIFO year) to the current

year.

Extends quantity of each pool item at both base-year unit cost and current-year unit cost,

then totals the respective extensions at the two costs.

Compares items in ending inventory at current-year cost to the same items at base-year

cost to derive an inflation index (LIFO Index).

The cumulative inflation is calculated as follows:

Treas. Reg. 1.472-8(e)(2)

Treas. Reg. 1.472-8(e)(2)(ii)

The total current-year cost of items making up a pool may be determined:

1. by reference to the actual cost of the goods most recently purchased or produced using

the earliest acquisition method, or

2. by the average unit cost, equal to the aggregate cost of all of the goods purchased or

produced throughout the taxable year divided by the total number of units purchased or

produced, or

3. any other method which, in the opinion of the Commissioner, clearly reflects income.

Back to Table of Contents

DRAFT

6

Detailed Explanation of the Concept (cont’d)

Introduction to Dollar Value LIFO

Analysis Resources

Link-chain Method

The Link-chain method is described in Treas. Reg. 1.472-8(e)(1) & Treas. Reg. 1.472-

8(e)(3)(iii)(D)(iii).

The taxpayer can use this method if the taxpayer can demonstrate the Double-extension

method is impractical or unsuitable.

Measures the cumulative inflation in two steps:

- For the period between the current year and the year immediately prior to the current year

(current-year index),

- From the base year (LIFO year #1) to the year prior to the current year (prior-year

cumulative index).

To find the current-year index, compare items in ending inventory at current-year unit cost to

the same items at prior-year unit cost.

The annual inflation is calculated as follows:

- [End of year quantity multiplied by (current-year cost divided by end of year quantity)] then

multiplied by prior-year cost.

Multiply the current-year index by the prior-year cumulative index to calculate the current-

year cumulative index.

Divide the current-year cost by the current-year cumulative index to calculate the base-year

cost (See “General Overview”).

Treas. Reg. 1.472-8(e)(1)

Treas. Reg. 1.472-8(e)(3)(iii)(D)(iii)

Back to Table of Contents

DRAFT

7

Detailed Explanation of the Concept (cont’d)

Introduction to Dollar Value LIFO

Analysis Resources

Inventory Price Index Computation (IPIC) Method

The IPIC method is described in Treas. Reg. 1.472-8(e)(3).

The IPIC method values inventories under LIFO. This method uses an external index found in

the Bureau of Labor Statistics (BLS). The index is used to value the items in inventory. The

taxpayer must assign every item to the most detailed BLS category for the selected BLS table

that contains that item.

When using the IPIC method, the taxpayer may compute the inflationary index using either:

Double-extension method, or

Link-chain method

Under the IPIC method the taxpayer may use:

IPIC method pooling

Regular LIFO pooling

When using the IPIC method pooling:

Manufacturers pool items by the Producer Price Index (PPI) 2-digit commodity code (Treas.

Reg. 1.472-8(b)(4)).

Retailers/Wholesalers pool by the PPI 2-digit commodity code. Retailers only may pool by

Consumer Price Index (CPI) major groups (Treas. Reg. 1.472-8(c)(2)).

Treas. Reg. 1.472-8(e)(3)

Treas. Reg. 1.472-8(b)(4)

Treas. Reg. 1.472-8(c)(2)

Back to Table of Contents

DRAFT

8

Detailed Explanation of the Concept (cont’d)

Introduction to Dollar Value LIFO

Analysis Resources

Inventory Price Index Computation (IPIC) Method (cont’d)

5% Rules with IPIC Method Pooling (Treas. Reg. 1.472-8(b)(4) and (c)(2)): If a major

category of inventory (an IPIC Pool) is less than 5% of the total current-year costs, then the

taxpayer may combine the less than 5% category with the largest major category of inventory

(an IPIC Pool). This eliminates small pools and increases the size of the largest pool.

To use this method a taxpayer:

Must make an election to use the 5% Rule.

Must sort inventory into BLS categories.

May combine major categories with less than 5% of total current-year costs into a single

miscellaneous IPIC pool.

May combine the miscellaneous pool with largest IPIC pool when a miscellaneous IPIC pool

is less than 5%.

Must retest the pools every three years (high non-compliance area)

Other IPIC Method Pooling Audit Issues

Taxpayers may value some items in a single major category on First In-First Out (FIFO) and

value other items on LIFO.

Major categories with less than 5% may grow beyond 5% and taxpayers may not be

retesting them every three years.

Treas. Reg. 1.472-8(b)(4)

Treas. Reg. 1.472-8(c)(2)

Back to Table of Contents

DRAFT

9

Detailed Explanation of the Concept (cont’d)

Introduction to Dollar Value LIFO

Analysis Resources

Retail LIFO Method

The Retail LIFO method is described in Treas. Regs. 1.472–1(k) and 1.472-8.

The Retail LIFO method is a dollar-value LIFO method which uses retail sales values to

calculate increments and decrements to the LIFO layers.

The taxpayer converts the retail value of the closing inventory to cost by applying a cost

complement. The cost complement reflects the relationship of the retail values to the cost.

Compute the cost complement as follows, per Treas. Reg. 1.471-8:

The numerator is the value of beginning inventory plus the cost of goods purchased during

the taxable year.

The denominator is the retail selling prices of beginning inventory plus the retail selling

prices of goods purchased during the year adjusted for all permanent markups and

markdowns, including markup and markdown cancellations and corrections. The

denominator is not adjusted for temporary markups or markdowns.

A retailer may determine its annual-inflation index under a traditional dollar-value technique

(Double-extension or Link-chain) or by using indexes the government publishes.

Treas. Reg. 1.471-8

Treas. Reg. 1.472–1(k)

Treas. Reg. 1.472–8

Back to Table of Contents

DRAFT

10

Examples of the Concept

Introduction to Dollar Value LIFO

Examples

Double-extension Method

Establish the extended base-year cost (BYC) for the first year when LIFO was elected by multiplying the quantities on hand at the

beginning of the base year by the unit costs for each item on hand at the beginning of the base year.

Back to Table of Contents

DRAFT

11

Examples of the Concept (cont’d)

Introduction to Dollar Value LIFO

Examples

Double-extension Method (cont’d)

Calculate current-year costs (CYC) for the first tax year. Calculate the end of year (EOY) extended cost for each item by multiplying

the end of year (EOY) quantity for each item on hand by the end of year unit cost for each item. The sum of the EOY extended costs is

the total current-year cost (CYC).

Back to Table of Contents

DRAFT

12

Examples of the Concept (cont’d)

Introduction to Dollar Value LIFO

Examples

Double-extension Method (cont’d)

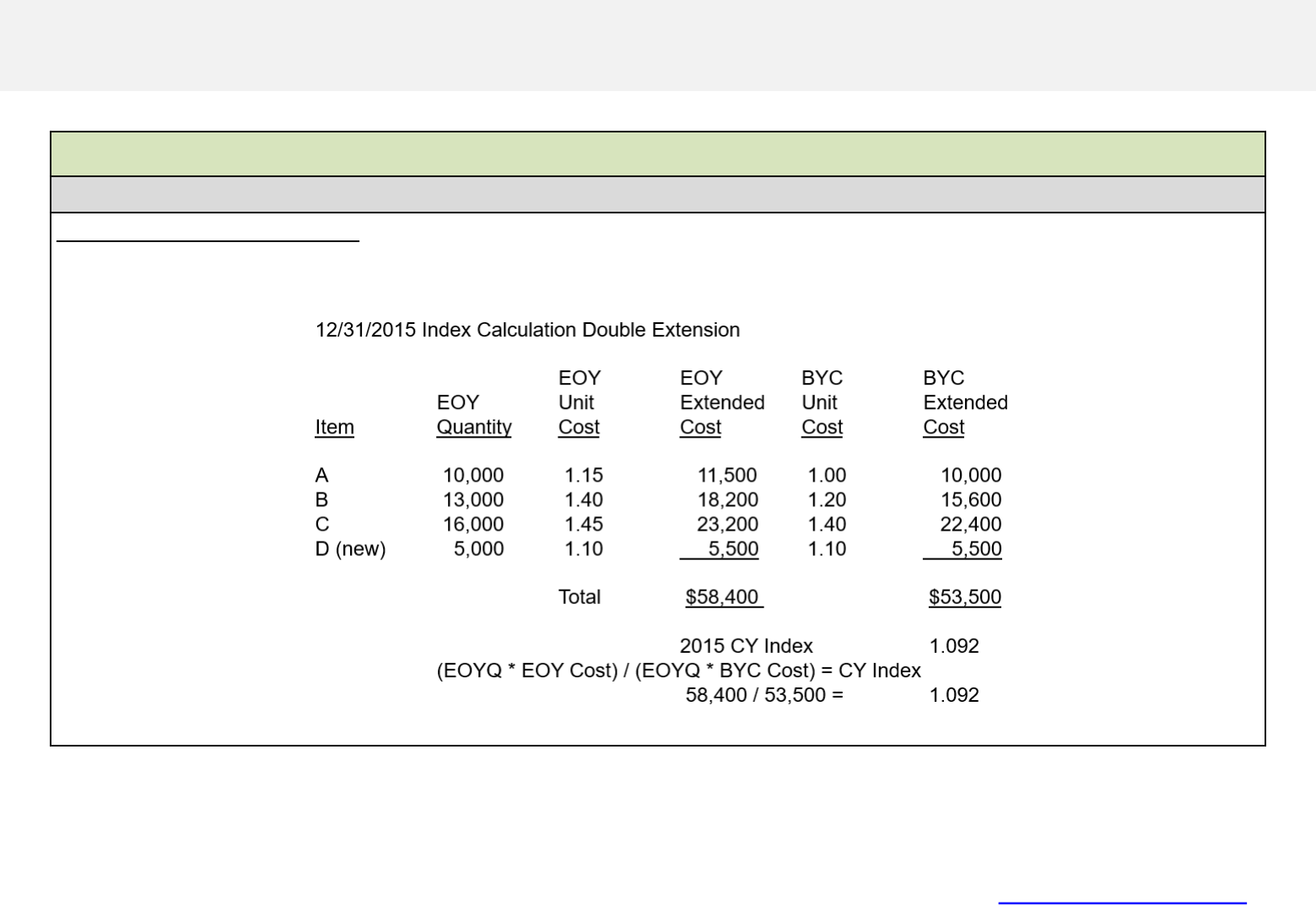

Compute the current year Inflation index for the base year by (1) multiplying the end of year quantities (EOYQ) by end of year (EOY)

unit costs to determine EOY extended cost, then (2). multiply base-year (BYC) unit cost by EOY quantity to determine BYC extended

cost, then, (3) divide the EOY extended cost by BYC extended cost.

Back to Table of Contents

DRAFT

13

Examples of the Concept (cont’d)

Introduction to Dollar Value LIFO

Examples

Double-extension Method (cont’d)

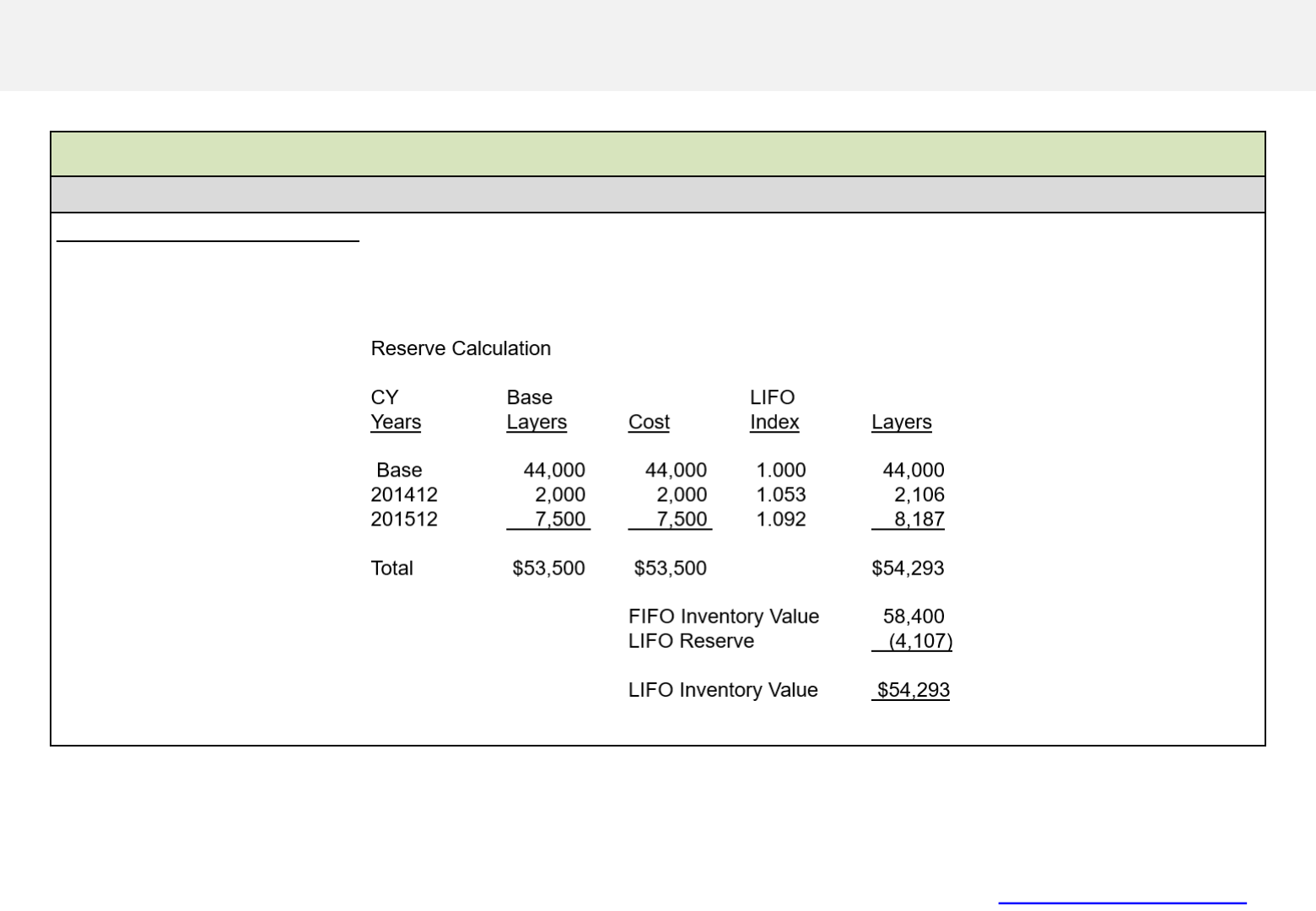

Deflate the current-year cost to base-year cost by dividing current-year cost by the current-year index. When the ending inventory is

deflated to base-year cost, determine if a new base year layer is created. If a new base year layer is created, the layer is inflated to

current cost to create a new LIFO layer. Add the LIFO layers together to calculate the LIFO inventory value. Calculate the LIFO

reserve by subtracting the LIFO inventory from the FIFO inventory value. The FIFO inventory value is the EOY Extended Cost for all

items at the end of the most recent year.

Back to Table of Contents

DRAFT

14

Examples of the Concept (cont’d)

Introduction to Dollar Value LIFO

Examples

Double-extension Method (cont’d)

Calculate current-year cost (CYC) for the second tax year. Calculate the end of year (EOY) extended cost for each item by multiplying

the end of year (EOY) quantity for each item on hand by the end of year unit cost for each item. The sum of the EOY extended costs is

the total current-year cost (CYC).

Back to Table of Contents

DRAFT

19

Examples of the Concept (cont’d)

Introduction to Dollar Value LIFO

Examples

Double-extension Method (cont’d)

Determine if a new base year layer is created. If not, then reduce the layers and re-calculate LIFO for the remaining base layers.

Calculate the LIFO inventory value and LIFO reserve.

Back to Table of Contents

DRAFT

25

Examples of the Concept (cont’d)

Introduction to Dollar Value LIFO

Examples

Link-chain Method (cont’d)

Compute the current year index by multiplying the end of year quantities (EOYQ) by end of year (EOY) costs and divide that amount

by the end of year quantities by beginning of year costs. Then compute the current year cumulative index by multiplying the current

year’s index by the base-year cost index of 1.000 in the year of election.

Back to Table of Contents

DRAFT

26

Examples of the Concept (cont’d)

Introduction to Dollar Value LIFO

Examples

Link-chain Method (cont’d)

Deflate the current-year cost to base-year cost by dividing the current-year cost by the current year’s cumulative index. When the

ending inventory is deflated to base-year cost, determine if a new base year layer is created. If a new base year layer is created, the

layer is inflated to current cost to create a new LIFO layer. Add the LIFO layers together and calculate the LIFO inventory value.

Calculate the LIFO reserve by subtracting the LIFO inventory from the current costs (FIFO) inventory cost.

Back to Table of Contents

DRAFT

29

Examples of the Concept (cont’d)

Introduction to Dollar Value LIFO

Examples

Link-chain Method (cont’d)

Deflate the current-year cost to base-year cost and determine if a new base year layer is created. If a new base year layer is created,

the layer is inflated to current cost to create a new LIFO layer. Add the LIFO layers and calculate the LIFO inventory value. Calculate

the LIFO reserve by subtracting the LIFO inventory from the current costs (FIFO) inventory cost.

Back to Table of Contents

DRAFT

32

Examples of the Concept (cont’d)

Introduction to Dollar Value LIFO

Examples

Link-chain Method (cont’d)

Determine if a new base year layer is created. If not, then reduce the layers and recalculate LIFO for the remaining base layers.

Calculate the LIFO inventory value and LIFO reserve.

Back to Table of Contents

DRAFT

35

Examples of the Concept (cont’d)

Introduction to Dollar Value LIFO

Examples

Link-chain Method (cont’d)

Deflate the current-year cost to base-year cost and determine if a new base year layer is created. If a new base year layer is created,

then the layer is inflated to current cost to create a new LIFO layer. Add the LIFO layers together and calculate the LIFO inventory

value. Calculate the LIFO reserve by subtracting the LIFO inventory from the current costs (FIFO) inventory cost.

Back to Table of Contents

DRAFT

36

Examples of the Concept (cont’d)

Introduction to Dollar Value LIFO

Examples

Calculating IPIC LIFO Using 7 Steps

Step 1 - Compute current cost

Step 2 - Compute inflation

Select a BLS Table and appropriate month

Assign all inventory item in the pool to BLS categories

Compute the category inflation index

Computation of the IPI

Step 3 - Reduce current cost to base

Step 4 - Determine current year base layer

Step 5 - Value current year base layer at current year cost

Step 6 - Total all LIFO Layers

Step 7 - Compute LIFO reserve

Back to Table of Contents

40

Index of Referenced Resources

Introduction to Dollar Value LIFO

IRC 472

Treas. Reg. 1.446-1(e)

Treas. Reg. 1.471-1

Treas. Reg. 1.471-8

Treas. Reg. 1.472-8(b)

Treas. Reg. 1.472-8(c)

Treas. Reg. 1.472-8(e)

Treas. Reg. 1.472-8(g)

FAA 20080401F

TAM 9129004

Form 3115 - Application for Change in Accounting Method

Back to Table of Contents

DRAFT

41

Training and Additional Resources

Introduction to Dollar Value LIFO

Type of Resource Description(s)

White Papers/Guidance White Paper Analysis - Manufacturer Natural Business Unit Pooling Goods Purchased for

Resale

White Paper Analysis - Establishing LIFO Pools

Issue Toolkits Issue Snapshot - LIFO IPIC Pools for Manufactured Goods and Goods Purchased for

Resale

Issue Snapshot - LIFO Pooling Under Dollar Value Method

Issue Snapshot - Establishing Pools Under the Dollar Value LIFO Method

Issue Snapshot - Representative Sample Allowed to Compute a LIFO Index

Other Training Materials

Basic LIFO Inventory PPT - 2012-03

IPIC LIFO PPT - 2012-03

Overview of IPIC method and BLS Reports PPT - 2015-04

Databases / Research Tools United States Bureau of Labor Statistics (BLS) - Producer Price Indexes and Percent

Changes for Commodity Groupings and Individual Items, Not Seasonally Adjusted

Back to Table of Contents

DRAFT

42

Glossary of Terms and Acronyms

Term/Acronym Definition

BLS United States Bureau of Labor Statistics

BOY Beginning of the Year

BYC Base Year Cost

CY Current-year

CYC Current-year Cost

EOY End of the Year

EOYQ End of the Year Quantities

IPIC Inventory Price Index Computation

IRC Internal Revenue Code

FIFO First In-First Out

LIFO Last In-First Out

PPI Producer Price Index

PY Prior year

RIM Retail Inventory Method

Treas. Reg. Treasury Regulation

Back to Table of Contents