ISSN: 1962-5361

Disclaimer: This Philadelphia Fed working paper represents preliminary research that is being circulated for discussion purposes. The views

expressed in these papers are solely those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of

Philadelphia or the Federal Reserve System. Any errors or omissions are the responsibility of the authors. Philadelphia Fed working papers

are free to download at: https://philadelphiafed.org/research-and-data/publications/working-papers.

Working Papers

From Incurred Loss to Current

Expected Credit Loss (CECL):

A Forensic Analysis of the Allowance

for Loan Losses in Unconditionally

Cancelable Credit Card Portfolios

José J. Canals-Cerdá

Federal Reserve Bank of Philadelphia Supervision, Regulation, and Credit Department

WP 20-09

February 2020

https://doi.org/10.21799/frbp.wp.2020.09

1

From Incurred Loss to Current Expected Credit Loss (CECL):

A Forensic Analysis of the Allowance for Loan Losses in

Unconditionally Cancelable Credit Card Portfolios

José J. Canals-Cerdá

1

February 2020

Abstract

The Current Expected Credit Loss (CECL) framework represents a new approach for calculating the allowance

for credit losses. Credit cards are the most common form of revolving consumer credit and are likely to present

conceptual and modeling challenges during CECL implementation. We look back at nine years of account-level

credit card data, starting with 2008, over a time period encompassing the bulk of the Great Recession as well

as several years of economic recovery. We analyze the performance of the CECL framework under plausible

assumptions about allocations of future payments to existing credit card loans, a key implementation element.

Our analysis focuses on three major themes: defaults, balances, and credit loss. Our analysis indicates that

allowances are significantly impacted by specific payment allocation assumptions as well as downturn

economic conditions. We also compare projected allowances with realized credit losses and observe a

significant divergence resulting from the revolving nature of credit card portfolios. We extend our analysis

across segments of the portfolio with different risk profiles. Interestingly, less risky segments of the portfolio

are proportionally more impacted by specific payment assumptions and downturn economic conditions. We

also analyze the impact of macroeconomic forecast error and find that it can be substantial and can be impacted

by CECL implementation design features. Overall, our findings suggest that the effect of the new allowance

framework on a specific credit card portfolio will depend critically on its risk profile. Thus, our findings should

be interpreted qualitatively, rather than quantitatively. Finally, the goal is to gain a better understanding of the

sensitivity of allowances to plausible variations in assumptions about the allocation of future payments to

present credit card loans. Thus, we do not offer specific best practice guidance.

Keywords: expected credit losses, allowances, unconditionally cancellable, revolving credit, credit loss

JEL Classification Codes: G21, G28, M41

1

Corresponding author: José J. Canals-Cerdá, Federal Reserve Bank of Philadelphia, Ten Independence Mall,

Philadelphia, PA 19106; 215-574-4127, Fax: 215-574-4146, email: jose.canals-cerda@phil.frb.org

. Special thanks to

Onesime Epouhe and Piu Banerjee for their contributions at an early stage of this research project. The paper has benefited

from conversations with Tom C. Stark about the Survey of Professional Forecasters and from comments received from

Fang Du (Board of Governors of the Federal Reserve System), Chris Henderson (Philadelphia Fed), Arthur Fliegelman

(Office of Financial Research) and two anonymous referees. Any errors or omissions are the author’s.

This paper supersedes “From Incurred Loss to Current Expected Credit Loss (CECL): A Forensic Analysis of the

Allowance for Loan Losses in Unconditionally Cancelable Credit Card Portfolios” by José J. Canals-Cerdá, Federal

Reserve Bank of Philadelphia Working Paper 19-08, January 2019.

Disclaimer: This Philadelphia Fed working paper represents preliminary research that is being circulated for discussion

purposes. The views expressed in these papers are solely those of the authors and do not necessarily reflect the views of

the Federal Reserve Bank of Philadelphia or the Federal Reserve System. Any errors or omissions are the responsibility of

the authors. No statements here should be treated as legal advice. Philadelphia Fed working papers are free to download at

https://philadelphiafed.org/research-and-data/publications/working-papers.

2

Contents

I. Introduction ..................................................................................................................................................................... 3

II. Data and Descriptive Analysis .................................................................................................................................. 7

Data Source ............................................................................................................................................................................ 7

Data Segmentation ............................................................................................................................................................. 8

Historical Charge-Off Performance of Credit Cards ................................................................................................ 9

III. Credit Cards as Unconditionally Cancelable Accounts Under CECL ....................................................... 10

Treatment of Unconditionally Cancelable Accounts Under FASB ASU 2016-13 ........................................ 11

Methodological Challenges: Defining Life of the Loan, Default, and Exposure at Default Under CECL

.................................................................................................................................................................................................. 12

Tracking Credit Card Accounts Performance, Some Stylized Examples ........................................................ 14

IV. Tracking Default, Balance, Exposure at Default, and Loss .......................................................................... 16

Tracking the Evolution of Defaults over Time and Across Cohorts ................................................................. 17

Tracking the Evolution of Balances over Time and Across Cohorts ................................................................ 20

Tracking Loan Loss and the Coverage Ratio over Time and Across Cohorts ............................................... 22

Assessing the Potential Impact of Macroeconomic Forecast Error…………………………………………………23

V. Conclusions..................................................................................................................................................................... 27

VI. Tables and Figures ...................................................................................................................................................... 30

VII. References ....................................................................................................................................................................... 46

3

I. Introduction

The current allowance for loan and lease losses (ALLL) under U.S. generally accepted accounting

principles is an “incurred loss” accounting methodology. Under this methodology, the allowance is a

valuation reserve established and maintained to cover losses that are probable and estimable as of

the reserve calculation date. The methodology has been in place for about 40 years. During the 2008

global financial crisis, however, the existing reserving methodology delayed the recognition of credit

losses on loans and resulted in loan loss reserves that were not adequate. Postcrisis, the Financial

Accounting Standards Board (FASB) considered enhancing standards on valuation and loan loss

provisioning. In June 2016, the accounting standard-setters issued an accounting standards update

(ASU 2016-13) — and the Current Expected Credit Loss Framework (CECL) was born. The new

accounting standard is slated to become effective in 2020, with early adoption permissible in 2019.

2

CECL represents an alternative framework for calculating the allowance for credit losses.

Conceptually, CECL differs from the existing incurred-loss methodology in many respects. CECL is

built on the notion of forward-looking estimated “expected losses.” The measurement of expected

credit losses is based on relevant information about past events, including historical experience,

current conditions, and reasonable and supportable forecasts that affect the collectability of loans.

Also embedded in CECL is the “life of loan” concept. Institutions are expected to reserve for lifetime

losses on loans at the time the loans are originated. The accounting standards update does not

prescribe a specific modeling approach.

Credit cards are revolving accounts for which the user is not required to pay the entire

balance at the end of the cycle. The cardholder can carry a revolving balance, which accrues interest

at the end of each cycle. Credit card portfolios represent a significant contributor to the balance sheet

of many large banks, with some banks specializing primarily in credit card lending. During the 2019

stress test, the Federal Reserve projected overall losses of $410 billion for the 18 participant firms

under the severely adverse scenario. Credit card losses contributed $107 billion, or 26%, to overall

losses, and first mortgage portfolios contributed $14 billion, or 3.4%, to overall losses. The unsecured

and revolving nature of credit card lending are significant factors behind the disproportionate

contribution of credit card losses to overall stress losses.

3

2

Banking regulators have issued Implementation and transition guidance. See the Board of Governors of the

Federal Reserve System (BOG), May 2018, BOG, June 2016, and BOG “Frequently Asked Questions on the New

Accounting Standard on Financial Instruments – Credit Losses.”

3

BOG, June 2019.

4

ASU 2016-13 explicitly addresses the application of CECL to unconditionally cancelable loan

commitments, credit cards in particular.

4

Specifically, ASU 2016-13 indicates that reserves on credit

card portfolios need to be established over the remaining lives of the funded credit card loans (i.e., for

balance on books); reserves need not be established for any additional draws on credit line over the

life of a loan.

The new standard represents a significant departure from current practices under the

existing standards. Implementing the “life of loan” concept underlying CECL may be a significant

challenge for revolving retail products such as credit cards.

Our analysis is descriptive in nature and takes advantage of a rich data set of credit card

accounts that contains relevant information on account characteristics, performance, and payment

behavior. The data set was constructed from individual monthly data submissions to regulatory

agencies from the largest U.S. banks with sizable credit card portfolios. The data set tracks more than

nine years of credit card data, starting with the first quarter of 2008 and continuing up to the second

quarter of 2017. The data set is not meant to represent a specific credit card portfolio of a particular

bank or group of banks.

CECL specifies that reserves need to be established over the remaining lives of the funded

credit card loans, which will depend critically on the stream of future monthly payments. Thus, a

critical component of the analysis of allowances for unconditionally cancelable credit card accounts

under CECL is the specification of payment allocation rules on the remainder of the account balance

at measurement date, or month 0, for as long as the balance remains positive, or until the time of

account default. Payments could be allocated, for example, to incurred finance costs, account balance

at month 0, or debt incurred on any given month as a result of the revolving nature of credit card

lending.

In this paper, we analyze two payment allocation rules that could be interpreted as limit

examples of payment allocation rules, with alternative payment allocation rules likely falling within

these two options. The first payment rule considered allocates all future monthly payments, after

finance charges, to the remainder of the initial reference month 0 balance. We call this the first-in-

first-out (FIFO) allocation rule. A second payment allocation rule, which we call last-in-first-out, or

LIFO, assumes that all future payments, net of finance charges and any incurred expenses, will be

applied to the remainder of month 0 balance for as long as it remains positive or until the time of

4

ASU 2016-13, example 10 states: “Bank M estimates the expected credit losses over the remaining lives of the

funded credit card loans … Bank M does not record an allowance for unfunded commitments on the unfunded

credit cards because it has the ability to unconditionally cancel the available lines of credit.”

5

account default. Thus, in contrast with FIFO, in this second case we are also netting any additional

incurred expenses after month 0 out of monthly payments before applying the remaining payment

to the remainder of month 0 balance.

The non-prescriptive nature of the CECL framework allows for a variety of quantification

methodologies.

5

FIFO and LIFO may be interpretable as boundary payment allocation strategies

under CECL, with LIFO generating higher or equal life of the loan and projected loss estimates.

Lifetime loss on a credit card account will be at least as large as the loan loss projected under CECL

because loss from a defaulted account is likely to include loss resulting from additional draws on its

credit line over the life of the account. Recent industry discussion on the empirical application of the

CECL framework to credit cards has placed some emphasis on the potential implications of the Credit

Card Accountability Responsibility and Disclosure (Credit Card) Act for the allocation of payments

under CECL. Specifically, Section 104 of the Credit Card Act requires that firms allocate any payment

above the minimum periodic payment to the balance with the highest annual percentage rate (APR).

The data available to us for this study are not sufficiently granular to allow for a deep dive into this

question.

The relationship between the payment allocation under the Credit Card Act and the FIFO or

LIFO payment allocation strategies is likely to be complex and endogenous. For example, payment

allocations under the Credit Card Act for a credit card loan subject to a 0 percent promotional interest

rate will be similar to LIFO over the duration of the promotional offer because other payments will

take precedent and a loan subject to this promotional rate will be paid last. Promotional rates are

intertwined with borrowers’ behavior and lenders’ decisions regarding portfolio growth, risk

appetite, and past, current, and expected future economic conditions, among other factors that may

play a role. Different APRs may also be applied to purchases, balance transfers, or cash advances, for

5

This topic has been addressed in recent memos of the Financial Accounting Standards Board (FASB)’s Transition

Resource Group (TRG) for Credit Losses, a task force within the FASB tasked with the job of “solicit, analyze, and

discuss stakeholder issues arising from implementation of the new guidance.” Specifically, Memo No. 5:

“Determining the Estimated Life of a Credit Card Receivable”; Memo No. 5A: “Determining the Estimated Life of a

Credit Card Receivable — Appendix A”; Memo No. 6: June 2017 “Meeting — Summary of Issues Discussed and

Next Steps”; Memo No. 6B: “Addendum to Memo No. 6 — Determining the Estimated Life of a Credit Card

Receivable.” In particular, Memo No. 6B indicates “entities are not limited to the payment determination and

allocation methodologies discussed in the June 12, 2017 TRG meeting and October 4, 2017 Board meeting if other

appropriate means of estimating the expected life of a credit card receivable are available.”

https://www.fasb.org/jsp/FASB/Page/SectionPage&cid=1176168064117.

6

example. Incidentally, a penalty APR usually applies to delinquent accounts. Thus, the Credit Card Act

if applied to CECL may increase implementation costs.

6

It is not our objective to highlight any specific payment allocation proposals currently being

discussed among interested parties. Also, given the principle-based nature of the CECL framework, it

is also not our objective to offer specific best practice guidance. Instead, we believe that there is value

in conducting an analysis of the impact of explicit and transparent payment allocation rules looking

back at historical data across relevant risk segments of a portfolio, which is our primary objective.

Thus, our analysis should not be regarded as endorsement of any specific payment allocation rule.

Our analysis relies on the construction of a synthetic portfolio of credit card accounts. The

primary data in our analysis consist of monthly submissions of detailed account level credit card data

from large banks collected by regulatory agencies. We analyze the performance of allowances at the

overall aggregated portfolio level as well as across segments of the portfolio properly differentiated

by their level of credit risk. We analyze the behavior of different measures of allowances across

cohorts, starting with the first quarter of 2008 and up to the second quarter of 2017. We track the

performance of each account in our sample for at least five years (and up to nine years) from each

reference month, or up to the time of account’s closure or default. Our period of analysis encompasses

a variety of economic conditions, including the bulk of the Great Recession and the subsequent

recovery.

We focus our analysis, both at the portfolio level and across risk segments, on three major

themes: defaults, balances, and credit loss. The specification of a payment allocation rule under CECL

plays a significant role in the definition of loan default. In general, risk profile is the primary

determinant of default at the segment level, but the impact of the specific payment allocation rule

considered is also significant. The divergence in cumulative default curves across payment allocation

rules considered is relatively small over the initial projection months and increases significantly after

that. Differences across payment allocation rules are, proportionally, more pronounced for less risky

segments. Thus, a portfolio’s risk composition is likely to play a significant role on the final CECL

impact of any specific payment allocation rule. Across payment allocation rules, projected default

rates increased significantly during the downturn and then experienced a significant decrease as

economic conditions improved.

6

TRG staff raised some concerns with the level of complexity introduced by the Credit Card Act (referred as View B

in the memo). Specifically (Memo No. 6B), “The staff notes that while this may be an operable method to apply

View B, it would be a new concept of the estimate of credit losses that credit card issuers would need to develop,

which may increase implementation costs.” “The staff also notes that if View B were to be required it may affect

flexibility and scalability for smaller institutions that may not currently have the resources to apply the approach

under View B.”

7

We also observe significant differences in the evolution of the remainder of month 0 balances

across payment allocation rules and in relation to the evolution of account balances. The observed

differences in the evolution of balances across different payment allocation rules have important

implications for the evolution of loan default and loan loss at default.

Projected allowances are significantly higher during the period of the economic downturn.

Perhaps contrary to intuition, our analysis suggests that low-risk segments, and portfolios, are

proportionally likely to be most sensitive to specific assumptions about payment allocation rules, and

differences across payment allocation rules increase during the downturn. These findings also

suggest that portfolios with different levels of credit risk are likely to experience dissimilar impacts.

Thus, our findings should be interpreted from a qualitative, rather than quantitative, perspective.

Last, we highlight how projected allowances differ significantly from realized credit loss. This is

primarily because of the focus of CECL on the concept of credit card loans at observation time, which

contrasts with the revolving nature of credit card lending. In our empirical analysis, we also address

the issue of sensitivity of CECL projections to macroeconomic forecasting error and observe that the

impact can be significant.

In the next section, we present the data and conduct a descriptive statistical analysis. In

Section III, we analyze in detail the treatment of unconditionally cancelable accounts under FASB ASU

2016-13. In Section IV, we present relevant empirical findings. In Section V, we present conclusions.

Tables and figures are presented in a separate section at the end of the paper.

II. Data and Descriptive Analysis

Data Source

Our analysis employs a sample of credit card accounts from a data set that combines credit card

portfolios from some of the largest U.S. banks with significant credit card exposures. The original data

comprise monthly account characteristics and performance information from the first quarter of

2008 and up to the second quarter of 2017, or up to the time the account is closed or charged off. The

data contain more than 100 variables that provide monthly observations of the credit card

8

characteristics; credit attributes of the cardholders such as credit score, payment, and usage

behavior; and delinquency status for each individual account.

7

The data were primarily collected with the objective of conducting supervisory work,

including the annual stress test exercise. Because of the confidentiality of the data, all the information

provided in this paper is reported at a highly aggregated level. Our sample is neither meant to be

representative of the overall credit card lending market nor representative of the credit card

portfolio of any particular bank or group of banks. However, our analysis is meant to offer helpful

qualitative insights about the loss performance of credit card portfolios across risk segments under

different economic conditions.

Data Segmentation

Our analysis is primarily descriptive and conducted at the segment level for a group of segments

derived from account-level information on credit score, historical payment, and usage behavior as

well as delinquency status.

Table 1 describes the segmentation variables considered and the different segments

generated by combining these variables. Specifically, we consider nine different segments of

accounts: dormant accounts, transactor accounts with a 0 balance, transactor accounts with positive

balance, three segments of revolver accounts by risk score ranges, and three segments of delinquent

accounts by severity of delinquency. From our interpretation of ASU 2016-13, dormant accounts and

transactor accounts with a 0 balance at observation time will not require an allowance.

8

Thus, our

primary focus will be on these seven segments that will require an allowance under CECL.

Table 2 provides a very preliminary view of the risk across different segments considered by

reporting average sample default rates over different time horizons. The table reports significant

differences in risk profile across segments even in our simple segmentation framework. Dormant and

transactor accounts exhibit very low default risk even over a five-year time horizon. In contrast,

revolver accounts are significantly more risky, and we can further differentiate risk by combining

7

These submissions are commonly known as FR Y-14M reports and consist of Domestic First Lien Closed-End 1-4

Family Residential Loan, Domestic Home Equity Loan, and Domestic Credit Card data collections. A link to available

public information about the data is included in the References section.

8

ASU 2016-13 indicates that reserves on credit card portfolios need to be established over the remaining lives of

the funded credit card loans.

9

revolver status with credit scores. Not surprisingly, delinquent accounts have the highest risk of

default. In future sections, we provide additional analysis of risk across segments.

Historical Charge-Off Performance of Credit Cards

Figure 1 provides additional intuition about the level of risk embedded in the credit card portfolios.

The figure provides strong evidence of the relationship between credit card charge-off rates and

economic conditions. Furthermore, the severity and duration of elevated charge-off rates seem to

track well the severity and duration of recessions and increases in unemployment rate.

9

Figure 2 presents median recovery rates across banks and over the time period of our

analysis. Recovery rates measure the percentage of gross charge-off that is recovered. The figure also

includes median 12- and 24-month net charge-off rates for the same group of banks defined as the

sum of 12 months and 24 months net charge-offs as a percentage of portfolio balance. The net charge-

off rates presented in this figure are broadly consistent with those presented in Figure 1, which are

representative of a larger sample of banks. The figure also indicates that recovery rates, as a

percentage of charge-offs, were at their lowest point around the same time as charge-off rates were

at their highest.

Figures 1 and 2 highlight the significant increase in net charge-offs over the economic

downturn, as a result of an increase gross charge-offs and a decrease in recovery rates. Thus, a focus

on the dynamics of gross charge-offs primarily will not provide a sufficiently stressed view of the

impact of economic downturns on net portfolio loss. On the other hand, an analysis of net charge-offs

requires potentially judgmental assumptions about the timing and allocation of recoveries from

defaulted accounts, which are not usually tracked at the account level in credit card portfolios.

With the wisdom of hindsight, Figure 3 provides a window into the performance of the

existing allowance framework during the recent financial crisis. These results are derived from bank-

specific information that we don’t report for confidentiality reasons. The figure displays median

portfolio allowances and 12-month cumulative charge-offs, as a percentage of assets, as well as the

median coverage rate defined as the number of months of forward-looking net charge-off losses that

can be sustained by contemporaneous allowance levels.

The 12-month forward-looking, cumulative median charge-off rate picked around 2009 in

our portfolio and remained elevated well into 2011. The allowance rate increased significantly from

9

Canals-Cerdá and Kerr (2015) conduct a comprehensive study of the relationship between unemployment and

the risk of credit card portfolios. See also Banerjee and Canals-Cerdá (2013).

10

2008 to 2010 and decreased after that in conjunction with a significant, and continued, decrease in

charge-off rates that began around 2010. Thus, the pick up in allowances lagged behind the pick up

in forward-looking cumulative charge-off rates by about a year, or longer. The median coverage rate

was significantly below average in 2008, experienced a steep and continued increase between 2008

and 2010, and extended its increase into 2011, after which it began a continued decline, stabilizing

at around the nine to 11 months median coverage rate range. The behavior displayed by the

allowance rate and coverage rate in Figure 3 is in line with the common view that the “incurred loss”

accounting methodology, employed by bank holding companies over the past 40 years, delayed the

recognition of credit losses during the 2008 global financial crisis and resulted in loan loss reserves

that were not adequate for the level of stress during the downturn.

III. Credit Cards as Unconditionally Cancelable Accounts Under CECL

The special treatment of credit card portfolios under ASU 2016-13 requires us to revisit the

traditional framework of analysis of expected loss and credit risk in revolving accounts. The ASU

2016-13 update describes unconditionally cancelable accounts as those in which the unfunded

portion of a line of credit may be unconditionally canceled at any time. In most cases, credit card

accounts will fall into this category.

It is standard industry practice to analyze expected credit card loss as a function of three

components: the probability of default, the exposure at default, and the loss given default, with

expected loss defined as the product of these three factors. For revolving accounts in particular, the

analysis is not constrained by the amount of the debt carried at observation time. However, the

account balance at observation time is usually regarded as an important driver of default and future

expected loss in the case of default. Generally, the expectation is that a borrower at risk of default is

likely to increase her level of borrowing prior to default. Thus, the standard quantitative analysis of

exposure at default is not bounded by the account balance at observation time.

In this section, we look closely at the treatment of credit card accounts under ASU 2016-13.

First, we review the concept of an unconditionally cancelable account under CECL; second, we

consider conceptual and methodological challenges brought about by this framework, such as life of

loan or the concept of default and exposure at default under CECL; and finally, we consider the

implications of different assumptions about the treatment of future payments and illustrate these

concepts with highly stylized numerical examples.

11

Treatment of Unconditionally Cancelable Accounts Under FASB ASU 2016-13

For unconditionally cancelable accounts, ASU 2016-13 stipulates that banks would “estimate the

expected credit losses over the remaining lives of the funded credit card loans.” It also specifies that

“even though Bank M has had a past practice of extending credit on credit cards before it has detected

a borrower’s default event, it does not have a present contractual obligation to extend credit.” Based

on that reasoning, it also indicates that “an allowance for unfunded commitments should not be

established because credit risk on commitments that are unconditionally cancellable by the issuer

are not considered to be a liability.”

10

The FASB statements referred to in the previous paragraph have significant implications for

the analysis of allowances. For starters, they specify that there should not be an allowance for

unfunded commitments.

Typical credit card segments of accounts that entirely fall in this category of unfunded

commitments are dormant accounts (i.e., accounts with no balance and no financial activity), and

transactor accounts that don’t carry a balance in a particular month.

11

Thus, dormant accounts and

transactor accounts that don’t carry a balance in a particular month will not necessitate an allowance

under CECL. These segments of accounts represent a large percentage of accounts in the typical cards

portfolio.

Similarly, unfunded commitments of credit card accounts with positive utilization are also

not considered a liability under CECL. Thus, an account’s exposure at default under the CECL

framework will not be larger than its present funded commitment. This represents a key distinction

with respect to traditional risk quantification frameworks, such as the Basel advanced approaches

framework, typical stress-testing frameworks, and similar standard approaches for quantifying

credit risk. Generally, the expectation is that a borrower at risk of default will likely continue to draw

from an available line of credit prior to default, and risk models are designed to account for this

empirical regularity.

10

See FASB, ASU 2016-13, p. 138.

11

Transactor accounts are usually referred to as accounts that carry no debt from month to month and incur no

finance charges.

`

12

Methodological Challenges: Defining Life of the Loan, Default, and Exposure at Default Under CECL

A recently publicly circulated FASB memo offers additional information about the analysis of

allowances for unconditionally cancelable accounts under CECL.

12

The memo didn’t reach any firm

conclusion, but it provided a window into the conceptual and methodological challenges firms may

face in the process of implementing CECL and perspectives into the type of preliminary analysis being

conducted by stakeholders in this area. The memo focuses specifically on the estimation of the life of

a credit card receivable. The memo points out “estimating the remaining life of a credit card

receivable balance is dependent on estimating the amount and timing of the payments expected to

be collected on it.” In contrast with closed-end loans, estimating the life of a credit card receivable

balance “is significantly more complex because in addition to future expected payments there also

will be new borrowing activity over the remaining life of the measurement date balance.”

It is not our objective to analyze specific proposals currently being discussed in the industry.

Instead, we believe there is value in conducting an analysis of the impact of different plausible

payment allocation rules looking back at historical data at different points in time and across risk

segments of a portfolio.

In our data, we observe a rich set of account characteristics and historical account

performance. We also observe monthly account balances, payments, and overall finance charges at

the account level.

13

With this information in hand, we can analyze how different types of plausible

assumptions about allocations of the future stream of payments impact the forecast of balance, life

of the loan, the risk of loan default, and loss at the time of loan default, and ultimately, how they

impact current expected credit loss on the funded credit card loans at the portfolio, or segment, level.

Specifically, in the next paragraphs, we analyze two possible stylized ways of accounting for future

payments, or payment rules. In our view, these two payment allocation rules could be interpreted as

limit examples of payment allocation rules, with alternative plausible payment allocation rules likely

falling within these two options.

A first approach, which we call first-in-first-out, or FIFO, assumes that all future payments,

net of finance charges, will be applied to the remainder of the balance existing at the measurement

date, or month 0, for as long as the balance remains positive or until the time of account default. The

12

See FASB Memo No. 5, June 2017.

13

Banks have access to all individual card transactions and detailed information on payments, promotions, interest

rates, and finance charges; our data are not as granular in this regard.

13

minimum number of months until the remainder of month 0 balance equals zero or default occurs

will represent the life of the loan in this case.

A second approach, which we call last-in-first-out, or LIFO, assumes that all future payments,

net of finance charges and any incurred expenses, will be applied to the remainder of month 0 balance

for as long as it remains positive or until the time of account default. The minimum number of months

until one of these events occur will represent the life of the loan in this case. Under LIFO, a payment

to the remainder of the balance will not occur before all incurred finance charges and incurred

expenses have been paid off. Thus, the remainder of month 0 balance will be reduced in a future

month only if the actual monthly revolving balance falls below the rolling remainder of month 0

balance (i.e., the last incurred finance charges and incurred expenses will be paid off first). Thus, at

any future time t, the remainder balance will be the minimum of the remainder of month 0 balance

and the stream of revolving monthly balances up to that point. In the next paragraphs, we provide

additional detail about FIFO and LIFO, and in the next subsection, we analyze some examples,

including actual examples of account behavior observed in our data as well as stylized numerical

examples.

The main difference between FIFO and LIFO is that, in the case of LIFO, in addition to finance

charges registered at the time of the monthly payment, we also deduct from monthly payments any

incurred expenses registered at the time the payment is due, before subtracting the residual payment

from the remainder of the balance at month 0.

The FIFO and LIFO concepts can be expressed analytically after introducing some necessary

notation. Denote by

0

the account’s balance existing at month 0 and more generally denote by

the account’s balance existing at month t; denote the payment in month t, net of finance charges, as

and denote the remainder of month 0 balance t months into the future as

0

(

)

.

Under the FIFO assumption, the remainder of month 0 balance at time t = 1 can be computed

as,

0

(

= 1

)

=

(

0

−

1

, 0

)

,

and the remainder of month 0 balance at any future time t+1 can be computed as,

0

(

+ 1

)

=

(

0

(

)

−

+1

, 0

)

.

Under the LIFO assumption, the remainder of month 0 balance at time t = 1 can be computed

as,

14

0

(

= 1

)

=

(

0

,

1

)

,

with

1

representing the account’s balance one month after the reference month 0. Similarly, the

remainder of month 0 balance at month t +1 after the reference month 0 can be computed as,

0

(

+ 1

)

=

(

0

(

)

,

+1

)

,

with

representing the account’s balance t months after the reference month 0.

Observe that under LIFO, the remainder of the month 0 balance at month t+1 equals the

minimum balance attained by the account during the period [0,t+1] (i.e., the remainder of the month

0 balance will equal the revolving balance in a particular month when the revolving balance falls

below the remainder of month 0 balance until that point). The remainder of the month 0 balance will

be equal to 0 when the revolving balance in a particular month becomes 0 for the first time, at which

point it is assumed that the loan will have been repaid.

Under both concepts, the remainder of the month 0 balance will be fully paid at month when

the remainder of the month 0 balance reaches a value of 0 balance,

0

(

)

= 0 <

0

(

− 1

)

,

with representing the life of the credit card loan in this case.

A credit card account is at risk of default as long as it remains open, but a loan incurred in

month 0 is at risk of default only while it is being repaid (i.e., during the length of the life of the loan).

If an account defaults at time t before the remaining balance reaches value 0 (i.e., before the

end of the life of the loan), then we consider that the loan is in default in an amount equal to the

remainder of month 0 balance, i.e.,

0

(

)

.

Tracking Credit Card Accounts Performance, Some Stylized Examples

Table 3 presents three stylized examples that illustrate the concepts described previously. For

simplicity, we don’t explicitly consider finance charges. The first example presents the case of a credit

card loan in which the account receives monthly payments and there are no additional charges after

month 0. In this case, the FIFO and LIFO concepts produce exactly the same outcomes. This is

generally the case when the account incurs no additional charges after month 0.

15

In our second example, the account incurs new monthly charges and receives monthly

payments that are not large enough to compensate for monthly charges (i.e., the account balance

continues to grow after month 0). In this case, the LIFO life of the loan will go beyond the 12 months

that are being tracked in this table, and the LIFO remainder balance will stay constant over the entire

tracking period. In contrast, the FIFO life of the loan will be equal to 10 months, and the path of the

remainder balance will be remarkably different from the LIFO case.

In the last example, the account charges and payments over the next 12 months will generate

different paths for the remainder of the balance and the life of loan under LIFO and FIFO. But in both

cases, the remainder balance will be 0 before the end of the tracking period, while the actual account

balance will drop to 0 at month 7 but will end up growing significantly by the end of the tracking

period.

Each of the previous three examples considers the case in which the account does not default

over the period of analysis. If instead we assume that the account defaults in month 6, for example,

then the FIFO remainder loan exposure at default will be equal to 40, 40 and 0, for examples 1 to 3,

in the case of FIFO (i.e., no loan default in the last case), while the remainder loan exposure at default

will be equal to 40, 100 and 40, for examples 1 to 3, under LIFO.

In Figure 4, we track the evolution of a few selected accounts in our data starting at a fixed

initial date, or month 0, and with reported amounts normalized with respect to the account’s balance

at that initial date. We track balances and payments as well as three different measures of remainder

balances after month 0. The selected examples provide insights about the impact of different

payment allocation rules.

In Figure 4.a, the different payment allocation rules considered result in an almost identical

path across the remainder of month 0 balances, until month 24, at which point the remainder of the

month 0 balance is completely paid off. Thus, the life of the loan is 24 months in this case under both

FIFO and LIFO. After month 25, the tracked revolving account balance increases because of an

increase in monthly borrowing with respect to monthly payments. In Figure 4.b, we observe a

divergence between the two measures of the remainder of the month 0 balance. Under FIFO, the life

of the loan is 15 months, while under LIFO, the life of the loan is 32 months. Between months 15 and

32, the remainder of the month 0 balance exposed under LIFO is about 40% of the balance at time 0.

Figure 4.c depicts an account for which balances increase significantly after month 0, while monthly

payments are comparatively low. In this instance, under FIFO, the life of the loan is equal to 25

16

months, while under LIFO, the remainder of the month 0 balance remains constant at 100% of the

initial balance at the month 0 over the tracked 37-month period.

Figures 4.d to 4.f represent examples of accounts for which the final outcome prior to month

37 was account default, but not in all cases did this account default result in loan default. In all three

cases, the final default balance was significantly larger than the initial balance at month 0, something

that is not atypical when a credit card defaults. The main difference among these three examples is

in the remainder of the month 0 balance at the time of the account default. In example 4.f, the

remainder of the month 0 balance becomes 0 at month 5, while the account does not default until

month 33 (i.e., this case will not be categorized as a loan default even though the account eventually

ends up defaulting). In the case of Figure 4.e, the remainder of the month 0 balance will be positive

at the time of account default, under both payment allocation rules considered (i.e., we will record a

loan default in this case). In this case, the loan exposure at default will be close to 100% of the balance

in the case of LIFO, while it will be close to 30% of the balance under FIFO. In Figure 4.d, the

remainder of the month 0 balance at the time of account default will be positive under LIFO, while it

will be 0 under FIFO. In this case, we will be recording a loan default under LIFO and recording a loan

paid off under FIFO. In all cases considered in which the final outcome is account default over the

tracking period, the remainder balance at default under FIFO and LIFO is either 0 or significantly

lower than the observed account balance at default.

IV. Tracking Default, Balance, Exposure at Default, and Loss

A key aspect of the CECL implementation for credit cards is the allocation of future payments to the

remainder balances after month 0. The adoption of a specific payment allocation rule will determine

the life of the loan at the account level, the evolution of remainder balances after month 0, and the

default and loss experienced after month 0 for CECL purposes. More important, the specific payment

allocation rule implemented will determine, along with the historical experience, the projection of

portfolio allowances under CECL for any specified economic forecast.

In the next paragraphs, we analyze, at the portfolio level and for specific segments, the

evolution of default, balances, and loss, from an initial predetermined starting point in time or “month

0.” The FIFO and LIFO payment allocation rules defined in the previous section will be applied at the

account level and, after aggregation at the portfolio or segment of accounts, will determine default

rates, balance rates, and loss rates that can be projected forward from a predetermined starting point

in time, or month 0.

17

The portfolio employed in our analysis was not constructed to be representative of the overall

credit card industry. Even an industry representative portfolio cannot be expected to provide precise

guidance on the impact of CECL at any specific institution given the heterogeneity of portfolios and

strategies prevalent across credit card lenders. Thus, instead of focusing on a specific representative

portfolio, we present descriptive information across the characteristic risk segments defined in Table

1. Our analysis of segments of revolver accounts with different levels of risk as well as our analysis

of segments of delinquent accounts by severity will provide relevant insights on the performance of

credit card portfolios with different risk distributions.

We focus our attention on a few selected segments by risk profile; considering all segments

would overcomplicate our exposition. Pure dormant and transactors with a 0 balance don’t require

an allowance under CECL because they don’t carry a balance as of month 0. Furthermore, transactor

accounts with a positive balance have a very low probability of default over the short and medium

term, as evident in Table 2, and will carry a small allowance irrespective of the payment rule that

emerges as common industry practice and should be generally marginally sensitive to the choice of

payment allocation rule. Thus, we focus our attention primarily on the revolver and delinquent

segments. For revolvers, we focus on the low-risk and high-risk segments, with the elevated risk

segment in our experience behaving in an intermediate way between these other two segments

considered. For the delinquent case, using our own judgment, we will present at times results

aggregated for the overall delinquency segment; at other times, we will present separate results for

low-delinquency, elevated-delinquency, and high-delinquency segments.

Tracking the Evolution of Defaults over Time and Across Cohorts

This subsection documents the differences between cumulative default curves across payment

allocation rules and with respect to traditional cumulative default curves at the account level. A credit

card account is at risk of default as long as it remains open, but a credit card loan at reference month

0 is at risk of default only while it is being repaid (i.e., during the life of the loan). Differences in

cumulative default curves across payment allocation rules are driven by differences in the life of the

loan associated with differences in the evolution of the remainder of the month 0 balances, as

illustrated in the previous section. For the same reason, we can anticipate differences in the evolution

of balances and losses across payment allocation rules; these will be discussed in the subsequent

subsections.

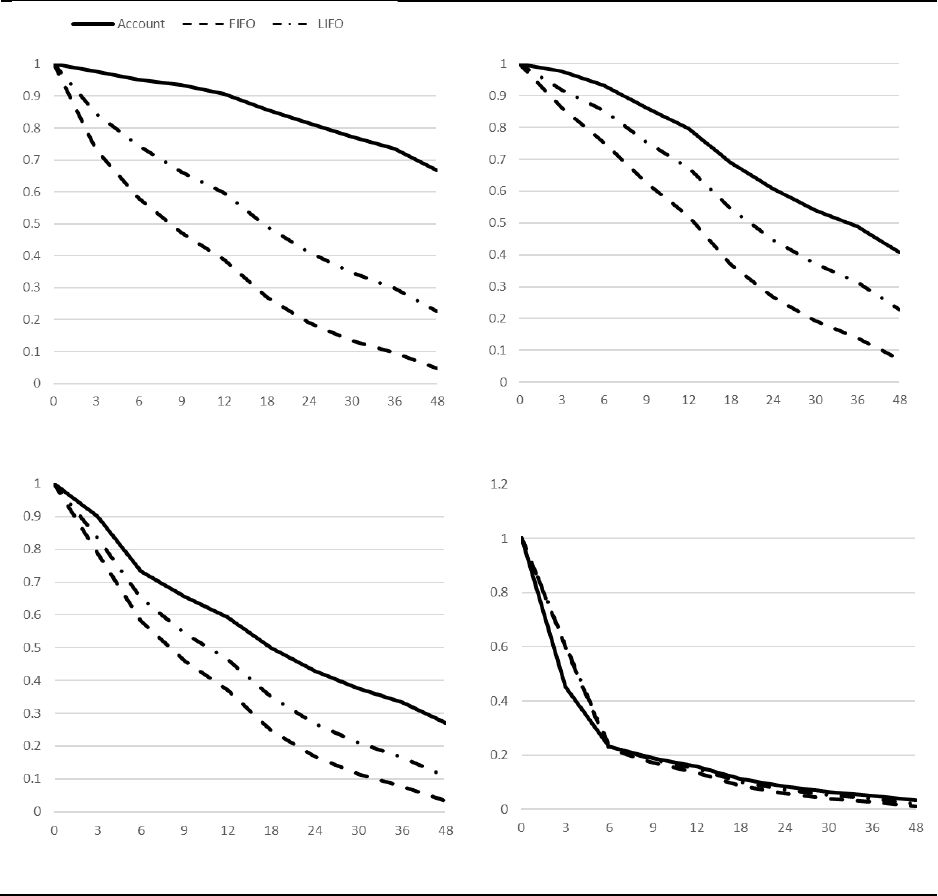

Figure 5 presents Kaplan-Meier (K-M) cumulative default curves derived from the

implementation of the FIFO and LIFO payment allocation rules (i.e., tracking loan defaults), along

18

with the more traditional cumulative default curves at the account level. The Kaplan-Meier estimator

represents a standard nonparametric technique for estimating the probability of survival, or in our

case, the cumulative default probability, across time for a time-related event, like default.

14

We

present results at the portfolio level and for three different segments: the low- and high-risk revolver

segments and the segment of delinquent accounts. We present results aggregated across cohorts

because the patterns observed in the data are similar for different cohorts, but with the expected

variations in severity among the cohorts more directly impacted by the downturn.

Figure 5.a presents results at the portfolio level. The figure reveals three main patterns in the

data. First, the choice of payment allocation rule plays a significant role in the definition of default.

We observe a substantial divergence between the FIFO and LIFO K-M cumulative default curves, with

a significant divergence starting around month 20. Second, perhaps not surprisingly, the divergence

in cumulative default curves is relatively small over the initial 10 months and intensifies after that.

The FIFO K-M curve is the first one to reach a plateau around month 40, while the LIFO curve seems

to reach a plateau around month 80. There is no apparent plateau in the default curve at the account

level, although the slope of the curve decreases over time. Third, there is a clear divergence between

the cumulative default curve at the account level and any of the cumulative loan default curves

considered. This is consistent with our intuition since the life of the account is expected to exceed the

life of the loan in most cases.

Figure 5.b provides additional insights about the evolution of defaults. The figure presents

cumulative default curves for three segments of accounts: the low-risk revolver segment, the high-

risk revolver segment, and the delinquent segment. There is a clear differentiation in cumulative

default curves across segments, which indicates that risk profile is an important determinant of

default and outweighs the importance of the payment allocation rule, at least for the highly

differentiated risk segments considered.

As expected, the more risky segments are associated with steeper cumulative default curves.

For the delinquent segment, most of the defaults occur within the first 10 months and there are no

significant differences across payment allocation rules over this time frame. Significant differences

across payment allocation rules in the delinquent segment emerge after 30 months, but even then,

these differences are proportionally small when compared with other segments. The high-risk

revolver segment follows a similar pattern, but the cumulative default curves are comparatively less

steep and the bulk of defaults are not realized until the 40th month. In this case, there is no apparent

plateau in the cumulative default curves for the account and LIFO curves, while a plateau occurs for

14

See Kaplan and Meier (1958) or Kalbfleisch and Prentice (2002).

19

the FIFO curve around 40 months. Finally, the low-risk revolver segment follows a similar pattern;

however, most defaults occur by the 30th month for the FIFO curve, while defaults continue to

increase after that for the LIFO and account curves.

The insights gained from our analysis of Figure 5.b also contribute to a better understanding

of the portfolio-level dynamics observed in Figure 5.a. Delinquent accounts, as well as accounts in

high-risk segments contribute a high proportion of defaults during the first 20 months, adding to a

steeper portfolio default curve initially. The less risky segments of accounts increase their

contribution to overall portfolio defaults after the initial months, contributing to a softening in the

slope of the default curve.

Perhaps the most relevant finding from Figure 5.b is the observation that differences across

payment allocation rules are, proportionally, more pronounced for less risky segments. They have a

comparatively lower impact for the high-risk segments, with the lowest impact associated with the

segment of delinquent accounts. In particular, for the low-risk segment, at month 80, the value of the

LIFO curve is about 50% higher than that of the FIFO curve, and the value of the account default curve

is about 100% higher. The differences are proportionally less pronounced for higher-risk segments.

Finally, our findings from Figure 5.b also have important implications for the analysis of the

potential impact of CECL across portfolios with different risk profiles. Specifically, they suggest that

differences in payment allocation rules can have significant impact on the overall cumulative default

curves under CECL. Furthermore, the impact will be dissimilar across segments with different risk

profiles and may be proportionally largest in lower-risk profile segments. Thus, a portfolio’s risk

composition is likely to play a significant role on the final CECL impact of any specific payment

allocation rules.

Figure 6 considers the evolution of default rates over a time frame with a mix of economic

conditions. The figure tracks five-year cumulative default rates across different cohorts. Specifically,

we define the initial reference “month 0” to take values at each quarter between the first quarter of

2008 and the first quarter of 2012; after the initial reference month is fixed, we analyze each cohort’s

default rate over a five-year window and report that five-year default rate in the graph for each

quarterly cohort. From Table 5, we already know that most defaults will occur within the initial 60-

month window, so our focus on the five-year default rate does not represent a significant restriction.

In principle, when computing default rates over a five-year period, we would consider it

reasonable to expect a certain level of default averaging across a five-year window with a mixture of

economic conditions. On the other hand, under the treatment of credit cards as unconditionally

cancelable accounts, the bulk of defaults realized under CECL are likely to occur within the first two

20

years after month 0, as Figure 5 indicates. Furthermore, for credit cards, the difference between the

charge-off in good times versus the charge-off in a downturn can be very significant, as Figure 1

indicates.

15

Figure 6 shows that, with the perfect foresight assumption implicit in our analysis, long-term

default rates experienced an increase in severity between the first quarter of 2008, the first

observation period, and the second quarter of 2009. Default rates were elevated during the overall

downturn period and experienced a significant decline as economic conditions improved. Looking at

Figures 6.b to 6.e, we also observe differences in performance across segments. The more risky

segments are more severely impacted by downturns in absolute value, but it is worthwhile to point

out that the more risky segments are also proportionally (i.e., in terms of percentage change) less

affected by economic fluctuations.

16

Specifically for FIFO, we observe fluctuations in default rate from

bad to good times between 0.06 and 0.03 in the low-risk segment (i.e., a 100% increase), between

0.28 and 0.16 in the high-risk segment (i.e., a 75% increase), and between 0.58 and 0.4 in the

delinquent segment (i.e., a 45% increase).

Default constitutes the critical trigger of credit risk, but another significant contributor to

credit risk is loan exposure at default, particularly for the case of revolving accounts. The next

subsection looks at the evolution of the remainder of the month 0 balance at the portfolio level, across

segments, and under different payment allocation rules. In the final subsection, we combine the

concept of default and the remainder loan exposure at default after month 0 and look closely at the

concept of portfolio credit loss.

Tracking the Evolution of Balances over Time and Across Cohorts

Figures 7 and 8 look at the evolution of portfolio balances across cohorts, across segments, at the

account level, and for different payment allocation rules. Figure 7.a depicts the evolution of balances

across cohorts at the portfolio level and for the segments of transactor, revolver, and delinquent

accounts. Perhaps not surprisingly, revolver accounts consistently carry the largest balances, and

transactor accounts (excluding these with a 0 balance), the smallest. Some readers may find it

surprising that balances for delinquent accounts are generally lower than those of revolver accounts.

This may be the result of the specific composition of our portfolio. More likely, accounts that become

delinquent are primarily associated with lower credit scores and lower credit lines, and thus have

15

Figure 1 also indicates that the downturn was followed by a long period of low credit card charge-off rates.

16

This is consistent with prior research by Canals-Cerdá and Kerr (2015).

21

limited ability to borrow. Finally, we also observe that balances associated with delinquent accounts

seem to be more sensitive to fluctuations in economic conditions. One possible explanation of this

phenomenon is that worse macroeconomic conditions increase the proportion of delinquent

accounts with higher initial credit score, higher credit limits, and higher ability to borrow. Further

study of these issues is warranted but is beyond the scope of our analysis.

Figure 7.b draws the evolution of account balance and the remainder of the month 0 loan

balance for different payment allocation rules. We observe significant differences between the

evolution of account balances and the evolution of the remainder of the month 0 loan balance under

different payment allocation rules. Specifically, 40 months after month 0, only about 10% of the

original balance at month 0 remains under FIFO, while about 20% of the balance remains under LIFO.

In contrast, the revolving portfolio balance after 40 months is about 60% of the original balance. The

attrition in the revolving portfolio balance may be due to account closure, charge-off, account

transitions to transactor or dormant, or the availability of other sources of credit for accounts with

improved credit scores.

Figure 8 looks at the evolution of the remainder of the month 0 balance across segments up

to 48 months into the future at the account level and for different payment allocation rules. We

observe the largest differences in the remainder of the month 0 balance curves for the low-risk

segment of accounts and the smallest differences in the delinquent segments. This indicates that

differences in payment allocation rules are likely to have the largest impact in the low-risk segments.

Low-risk borrowers are likely to contribute higher payments to the remainder of the month 0

balance, thus differences in payment allocation rules are likely to have a larger impact in this

segment, which may help to explain the significant differences. On the other hand, delinquent

borrowers are likely to contribute low or 0 payments to the remainder of the month 0 balance, and

the reduction in segment balance over time are likely the result of defaults. Thus, it should not be

surprising that delinquent segments display the smallest differences across payment allocation rules.

The insights provided by Figure 8 don’t change for specific cohorts; for this reason, we include here

only the results aggregated across cohorts.

The difference in the evolution of balances among payment allocation rules across risk

segments undoubtedly plays a significant role in the evolution of loan default and loss at default

across risk segments and cohorts. In the next subsection, we focus our attention on the analysis of

portfolio credit loss, which combines the effect of different payment allocation rules on default and

the remainder of the month 0 balance at default.

22

Tracking Loan Loss and the Coverage Ratio over Time and Across Cohorts

In this subsection, we analyze current expected credit loss curves after month 0, for specific payment

rules, as well as standard portfolio or segment loss curves, with all the results normalized by the

portfolio or segment balance at month 0. From the perspective of account default and loss, we

consider the account as being at risk of default as long as it remains open. Also, loss at default at the

account level is defined as the account balance at the time of default. The trigger of default is when

the account reaches 150 days past due or the account is charged off for other reasons.

17

Under CECL,

default and loss are measured at the loan level. Specifically, a loan will be at risk of default as long as

it stays open (i.e., as long as the remainder of the month 0 balance is positive). The trigger of default

of an open loan is the same as the trigger of account default. Thus, for our purposes, loan default and

account default occur simultaneously while the loan stays open. When a loan defaults, we define the

gross loan loss as the remainder of the month 0 balance at the time of default. The focus here is on

gross loss; we don’t deal with the problem of allocation of recoveries and net loss.

Figures 9 and 10 analyze the variation in loss curves across cohorts, portfolio segments, and

payment allocation rules. Figures 11 and 12 focus on the analysis of loss coverage under different

payment allocation rules.

Figure 9 looks at the evolution after month 0 of cumulative loss curves across cohorts and for

different payment allocation rules. First, we observe that the cohorts that were more directly

impacted by the last financial crisis exhibit significantly more severe loss curves. The 2008Q1 cohort,

with March 2018 as the associated month 0, exhibits the largest portfolio losses in the long run, but

rank ordering across loss curves is not maintained across payment allocation rules. FIFO, and to a

lesser extent LIFO, curves are highly sensitive to losses over the short and medium term (i.e., losses

occurring over the initial 24-month period), while overall account portfolio losses are more affected

by long-run losses. Figure 9.c reports differences over time in loss curves across payment allocation

rules. The figure shows large differences in loss rates across payment allocation rules, and these

differences are magnified in cohorts more heavily impacted by the economic downturn.

Figure 10 looks at the evolution from month 0 of loss curves for different payment allocation

rules across risk segments: low-risk revolver, high-risk revolver, and delinquent. Consistent with

previous findings, we observe that, proportionally (i.e., in terms of percentage change), the largest

differences across payment allocation rules are associated with the lowest-risk segments.

17

Most banks will freeze or close an account after 90 days past due, while the Basel II framework assumes that

default occurs at 180 days past due. We choose 150 days as the trigger of default to minimize potential problems

of missing data reported by the banks that may arise if a bank moves an account to a collections system.

23

Specifically, for the low-risk revolver segment projected portfolio losses after five years are about

350% of loss under FIFO and about 200% of loss under LIFO. For the high-risk revolver segment

projected portfolio losses after five years are about 200% of loss under FIFO and about 150% of loss

under LIFO. For the delinquent segment losses under FIFO and LIFO after five years are similar and

only about 8% lower than portfolio loss. These observations are relevant for the analysis of specific

payment rules across portfolios with different risk profile distributions.

Figures 11 and 12 focus on the analysis of loss coverage across cohorts, portfolio segments,

and payment allocation rules. The figures include portfolio/segment loss curves across cohorts for

different time spells: 15 months into the future, 18 months, and so on. The figures also depict loss

curves under FIFO/LIFO. The intersection of portfolio/segment loss curves with FIFO/LIFO loss

curves represents the coverage rate under FIFO/LIFO allowances (i.e., a measure of how many future

months of actual portfolio loss are covered by the corresponding allowance). However, it is important

to note that our analysis tracks losses under the assumption of no new accounts originations after

month 0. In practice, losses from new credit cards originated after month 0 are likely to contribute

significantly to a bank credit card portfolio, especially after the initial six months and during the

initial two years after origination. For this reason, the analysis in this section is not directly

comparable with information reported in Figure 3.

Figure 11 reports significant differences in portfolio loss coverage under FIFO and LIFO. In

good times (i.e., the 2012Q3 cohort), the portfolio coverage ratio under LIFO is close to 30 months,

while under FIFO, it is close to 21 months. In bad times (i.e., the 2009Q1 cohort), the portfolio

coverage ratio under LIFO is close to 27 months, while under FIFO, it is close to 18 months. Also, as

we have already reported in other parts of this paper, projected CECL allowances under either choice

of payment rule are significantly larger during the period of a downturn in economic conditions as

depicted in this figure. As stated previously, our analysis is being conducted under the implicit

assumption of perfect foresight of future economic conditions. Consistent with the findings of larger

projected allowances under the downturn in economic conditions, it is to be expected that the

coverage ratio will drop significantly if allowances are not increased at the onset of the downturn,

which could be the case under significant forecasting uncertainty about the timing and severity of

the downturn.

Figure 12 depicts loss curves across cohorts for relevant segments of the portfolio. Consistent

with findings reported early in this paper, the largest differences across payment rules emerge in the

low-risk segments. Intuitively, losses are likely to be realized early in the more risky segments of the

portfolio, while the differences among FIFO, LIFO, and portfolio losses will be comparatively small

24

early in the projection period. Also consistent with previous findings, losses in low-risk segments

seem more sensitive to the downturn in economic conditions, proportionally. As we have previously

pointed out, these findings indicate that the portfolio risk profile distribution will play a significant

role in the final impact of different payment allocation rules, sensitivity of allowances to downturns,

and more generally the overall impact of implementing CECL. Perhaps contrary to intuition, our

analysis suggests that low-risk portfolios are likely to be most sensitive to specific assumptions about

payment allocation rules under CECL as well as the potential effects of downturn economic

conditions, at least proportionally.

Assessing the Potential Impact of Macroeconomic Forecast Error

The analysis until this point has relied on the convenient assumption of perfect foresight to focus our

attention on the important topic of the impact of payment allocation assumptions on CECL

allowances. However, several studies in the growing CECL quantification literature put special

emphasis on the potential sensitivity of CECL projections to macroeconomic forecast error (Chae et

al., 2018; Covas and Nelson, 2018; DeRitis and Zandi, 2018; Loudis and Ranish, 2019). In this

subsection, we directly address the topic of the sensitivity of CECL loss projections to macroeconomic

forecast error of the kind experienced during the last recession.

18

Credit risk in credit card portfolios

is sensitive to macroeconomic conditions. Thus, perhaps not surprisingly, we observe a significant

CECL loss forecasting error in line with the observed macroeconomic forecasting error during the

time of the last Great Recession.

First, we briefly analyze the evidence of macroeconomic forecasting error during the last

recession. Second, we analyze model-based CECL loss projections under a perfect foresight

assumption as well as an alternative assumption that considers the macroeconomic forecast

available at projection time. Third, we compare the results of CECL loss projections under the two

alternative macroeconomic scenarios at the portfolio level and across segments of the portfolio. Our

contemporaneous macroeconomic forecasts come from the Philadelphia Survey of Professional

Forecasters.

The existing literature points to unemployment as the primary macroeconomic driver of

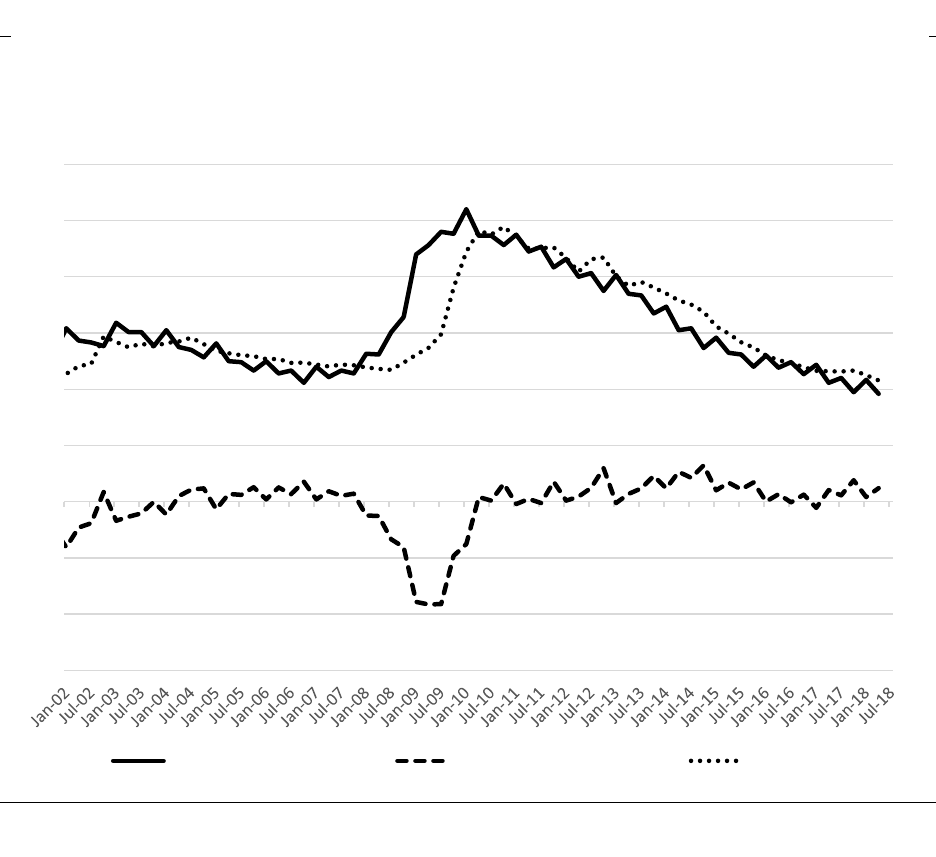

credit risk in credit card portfolios (Agarwal and Liu, 2003; Canals-Cerda and Kerr, 2015). Figure 13

compares the realized unemployment rate with a four quarter ahead forecast from the Philadelphia

Survey of Professional Forecasters. We observe the largest divergence between realized

18

This subsection was not part of an early draft of the paper; it was added later at the suggestion of a referee.

25

unemployment and the four quarters ahead forecast during the 2008–2009 period. The average

forecasting error during that period is -2.1% in absolute terms, and the largest observed forecasting

error is close to -4%, with a four quarters ahead forecast that was about 40% lower than the realized

unemployment rate at that point in time. These findings are consistent with existing studies that also

highlight the inability of forecasters and forecasting models to accurately anticipate economic

turning points.

To analyze the impact of errors in a macroeconomic forecast on FIFO loss projections, we

built a model of credit card loss with unemployment and three months’ change in unemployment as

the relevant macroeconomic drivers of credit card loss. Even though credit card portfolios are

expected to have significantly higher credit loss than other consumer credit portfolios (mortgages or

autos), it is still the case that credit card loss is a relatively infrequent event, and we can expect credit

loss to be equal to 0 for most credit card loans. Taking this into account, we model credit card loss

using simple hurdle models.

19

The hurdle model combines a model of the probability of default with

a model of credit loss in the case of default. The hurdle model offers a simple and convenient

approach to modeling loss when 0 loss is the most likely event (li et al. 2016).

We restrict the analysis to the segments of revolver and delinquent accounts, where most of

the credit risk is concentrated. We estimate separate models across segments of the portfolio

consistent with the segmentation scheme described in Table 2.

20

Finally, our model specification

allows for the impact of risk drivers to vary quarterly within the first forecasting year and annually

for the second forecasting year. Aside from these design features, the modeling framework is

relatively simple and includes only account age in years and macroeconomic variables as risk drivers.

The final model specification is relatively simple within segments, with only account age and two

measures of unemployment as risk drivers, but it is also flexible because of the level of segmentation

considered. To avoid excessive econometric modeling, we conduct our analysis for the FIFO payment

allocation approach only.

The models are used to estimate FIFO loss rates over a five-year forecasting period, which

should cover the life of a credit card loan in most cases. Our model projections of credit card FIFO

loss are conditional on macroeconomic variables over the initial two-year forecast period and

consider a long-run average FIFO loss for the remaining three years. Thus, we implicitly select the

19

See https://www.stata.com/manuals/rchurdle.pdf.

20

We consider separate segments for low-risk, medium-risk, and high-risk revolver accounts, and for delinquent

(30+ days past due) and seriously delinquent (60+ days past due) accounts.

26

initial two years of forecast as a “reasonable and supportable forecast” period. The choice of

reasonable and supportable forecast period as well as other model specification choices should not

have a determinant impact on our qualitative conclusions, but it may have some impact on the loss

projection fit to realized-loss over the five-year loss projection period. Our two-year loss projections

based on a perfect macroeconomic foresight have a tendency to underpredict two-year loss rates

during downturns (by about 6% in relative terms) and overpredict during benign periods.

21

Furthermore, because our model projections assume a long-run average loss rate after the initial

two-year forecasting period, our five-year FIFO loss projection forecast will have a tendency to

underpredict (or overpredict) the five-year realized FIFO loss in downturn (or benign) economic

environments.

Figure 14 presents a graphical depiction of FIFO realized five-year loss along with model

projected five-year FIFO loss under a perfect foresight assumption and an alternative projection

using the macroeconomic forecast information available at the time of forecast. As discussed before,

model forecasts underpredict five-year realized FIFO losses during the period of downturn and

overpredict losses during recent years. However, the gap between projected and realized loss is

significantly increased when we employ contemporaneous macroeconomic forecasts rather than

perfect macroeconomic foresight.

In Figure 15, we present a more granular analysis of the impact of macro forecast error on

FIFO loss forecast at the segment level. Taking the model forecast with perfect foresight as the “ideal”

baseline, the figure reports the perceptual deviation from this baseline as a result of employing

instead the contemporaneous macroeconomic forecast from the Philadelphia Survey of Professional