Los

December 2019 Draft

Acknowledgements

County Council

Sara Scott, Chair

Pete Sheehey, Vice-Chair

David Izraelevitz

Antonio Maggiore

James Robinson

Randal Ryti

Katrina Martin

Los Alamos County Staff

Harry Burgess, City Manager

Steve Lynne, Deputy City Manager

Julie Habiger, Public Relations Administrator

Paul Andrus, Community Development Director

Joanie Ahlers, Economic Development Administrator

Andrew Harnden, Housing and Special Projects Manager

Ryan Foster, Principal Planner

Michael Arellano, Building Safety Manager

Economic Vitality Action Team

Joanie Ahlers, Economic Development

Administrator

Los Alamos County

Paul Andrus, Community Development Director

Los Alamos County

Harry Burgess, County Manager

Los Alamos County

Micheline Devaurs, Former Business Operations

Los Alamos National Laboratory

Los Alamos Resident

Tony Fox, Vice President of Institutional

Advancement & Scholarship - LANL Foundation

White Rock Resident

Doug Hintze, Manager of Environmental

Management

Los Alamos Field Office

U.S. Department of Energy

Paul Johnson, Interim Chief Executive Officer

Zia Credit Union, Los Alamos

Kathy Keith, Executive Office Director

Community Partnerships Office

Los Alamos National Laboratory

Steve Lynne, Deputy County Manager

Los Alamos County

Ian Maes

Realtor - RE/MAX FIRST of Los Alamos

Linda Matteson, Asst. to the Los Alamos County

Manager

Los Alamos County

Charlie Nakhleh, Executive Officer

Weapons Programs

Los Alamos National Laboratory

Antonio Redondo, PhD, Division Leader

Richard P. Feynman Center for Innovation

Los Alamos National Laboratory

Cindy Rooney, Chief Executive Officer

University of New Mexico-Los Alamos

Bret E. Simpkins, Associate Laboratory Director

Facilities & Operations

Los Alamos National Laboratory

Kelly Stewart, Marketing Specialist

Los Alamos County

Patrick Sullivan, Executive Director

Los Alamos Commerce

and Development Corporation

Dave Woodruff, Former President/Chief Executive

Officer

Zia Credit Union, Los Alamos

Focus Group Participants

Steve Buelow, New Mexico Consortium

Connie Clark, Los Alamos Public Schools

Jyl De Haven, Retail Solutions

David Horpedahl, Zia Realty Group

Kathy Keith, LANL

Liddie Martinez, Enterprise Bank

Jim McGonnell, Los Alamos Medical Center

Kelly McReynolds, Guardian Mortgage

Cindy Rooney UNM-Los Alamos

Thank you to 1,000 Los Alamos County citizens and business owners who responded to the Community and

Employer Housing Surveys.

Los Alamos County Housing Market Needs Analysis, 2019 Page i

Table of Contents

Section 1. Executive Summary ............................................................................................ 1

A. Purpose of the Housing Market Needs Analysis ...................................................... 1

B. Policy Framework ...................................................................................................... 1

1. Los Alamos Strategic Leadership Plan, 2019 ........................................................... 1

2. Los Alamos County Comprehensive Plan, 2016 ...................................................... 1

3. Economic Vitality Strategic Plan (ESVP), 2019 ......................................................... 2

4. Los Alamos Affordable Housing Plan, 2010 ............................................................. 2

C. Report Contents ........................................................................................................ 3

D. Methodology ............................................................................................................. 4

1. Data Collection ......................................................................................................... 4

2. Focus Groups ............................................................................................................. 4

3. Surveys ........................................................................................................................ 4

E. Summary of Findings ................................................................................................. 5

1. Recurring Themes ...................................................................................................... 5

2. Housing Preferences .................................................................................................. 8

Section 2. Community and Housing Profile ........................................................................ 9

A. Community Profile ....................................................................................................10

1. Demographic Profile ................................................................................................10

2. Household Characteristics .......................................................................................10

3. Income ......................................................................................................................11

B. Local Economy .........................................................................................................16

1. Economic Impact of Los Alamos National Laboratory .........................................16

2. County Employment and Wages by Industry Classification .................................16

C. Commuting Patterns ................................................................................................17

Section 3. Housing Market Analysis ....................................................................................20

A. Los Alamos County Housing Supply ........................................................................20

1. Housing Characteristics............................................................................................20

2. Occupancy Characteristics ....................................................................................21

3. Housing Problems .....................................................................................................22

B. Indicators of Maintenance and Rehabilitation Needs .........................................23

Los Alamos County Housing Market Needs Analysis, 2019 Page ii

C. Current Market Conditions ......................................................................................23

1. New Construction .....................................................................................................23

2. Housing for Sale ........................................................................................................24

3. Housing for Rent ........................................................................................................25

4. Short-term Housing ...................................................................................................28

5. Current and Proposed/Planned Projects ...............................................................28

D. Housing Sales Trends ................................................................................................30

1. Characteristics of Home Sales .................................................................................30

2. Total Housing Sold by Type ......................................................................................30

3. Sale Price Trends .......................................................................................................31

E. Rental Price Trends since 2010 ................................................................................32

F. Affordable Rental Complexes.................................................................................33

G. Potential Development Sites ...................................................................................34

Section 4. Housing Needs Assessment ...............................................................................40

A. Data Sources ............................................................................................................40

B. Housing Preferences ................................................................................................41

C. Housing Need ...........................................................................................................42

1. Homeownership ........................................................................................................42

2. Rental Housing ..........................................................................................................45

Section 5. Land Use and Policy Recommendations ........................................................49

A. Housing Policy Issues and Recommendations .......................................................49

1. Limited Housing Choice ...........................................................................................49

2. Need for Quality Housing to Meet Demand ..........................................................51

3. Limited Supply of Developable Land .....................................................................52

4. Housing Affordability ................................................................................................55

5. Aging Housing Stock ................................................................................................58

6. Coordinating Housing with Other Planning ............................................................58

B. Implementation Summary Table .............................................................................59

Section 6. Appendices .......................................................................................................64

A. Focus Group Summaries ..........................................................................................65

1. Employer Focus Group Meeting Notes ...................................................................65

2. Real Estate & Lenders Focus Group Meeting Notes ..............................................73

Los Alamos County Housing Market Needs Analysis, 2019 Page iii

3. LANL Focus Group Meeting Notes ..........................................................................79

B. Community and Employer Survey Results ..............................................................82

1. Community Housing Preference Survey .................................................................83

2. Employer Housing Needs Survey .............................................................................95

C. Housing for Sale in September 2019 ..................................................................... 103

Tables

Table 1. Population Trends .....................................................................................................10

Table 2. Household Characteristics and Trends, 2000-2017 ................................................11

Table 3. Household Income Distribution, 2000-2017 .............................................................12

Table 4. Family and Nonfamily Household Incomes ............................................................12

Table 5. Income by Tenure ....................................................................................................13

Table 6. Cost Burdened Households by Tenure and Income Range .................................13

Table 7. Los Alamos County Programs Income Limits ..........................................................14

Table 8. 2019 HUD Income Limits for Los Alamos County ....................................................15

Table 9. 2019 MFA Income and Purchase Price Limits by Program ....................................15

Table 10. Jobs and Wages by Industry Classification ..........................................................17

Table 11. Residence Locations of County Workforce, Journey to Work Data ..................19

Table 12. Residence Locations of County Workforce, OnTheMap Data ...........................19

Table 13. Commuting Time and Distance from Surrounding Areas ...................................19

Table 14. Year Structure Built ..................................................................................................20

Table 15. Housing Type ...........................................................................................................20

Table 16. Number of Bedrooms .............................................................................................20

Table 17. Occupancy Characteristics ..................................................................................21

Table 18. Tenure by Type of Housing .....................................................................................22

Table 19. Indicators of Housing Problems .............................................................................22

Table 20. Age of Housing by Tenure......................................................................................23

Table 21. New Residential Construction 2010 to 2018 .........................................................24

Table 22. Average Housing Prices, Homes for Sale in September 2019 .............................24

Table 23. Rental Complexes in Los Alamos County .............................................................25

Table 24. Rental Units Advertised in August and September 2019 .....................................27

Table 25. Short-Term Rentals Wanted and Available, Summer 2019 ..................................28

Table 26. Housing Projects in the Development Pipeline ....................................................29

Table 27. Housing Sales by Housing Type, 2009-2018 ...........................................................30

Table 28. Median Sales Price by Housing Type, 2009-2019 ..................................................31

Table 29. Affordable Rental Complexes ...............................................................................33

Table 30. Capacity of Potential Development Sites (Units) .................................................35

Table 31. Potential Development Sites in Los Alamos Townsite ..........................................36

Table 32. Potential Development Sites in White Rock .........................................................37

Table 33. Annual Demand for Homeownership ...................................................................44

Los Alamos County Housing Market Needs Analysis, 2019 Page iv

Table 34. Estimated Need for Rental Housing ......................................................................47

Table 35. Implementation Summary Table ...........................................................................60

Figures

Figure 1. Los Alamos County Commuting Pattern ...............................................................18

Figure 2. Building Permits for New Residential Construction ................................................24

Figure 3. Los Alamos County Sales Trend, Total Units Sold per Year, 2009-2018 .................30

Figure 4. Median Sales Price by Type, 2009-2019 .................................................................31

Figure 5. Market Rent Trends November 2010 to August 2019, All Unit Types ....................32

Figure 6. Land with Potential for Residential Development (Acres) and Estimated

Capacity (Units) ......................................................................................................................38

Figure 7. Estimated Development Time Frame for Potential Sites .......................................38

Figure 8. Potential Development and Redevelopment Sites ..............................................39

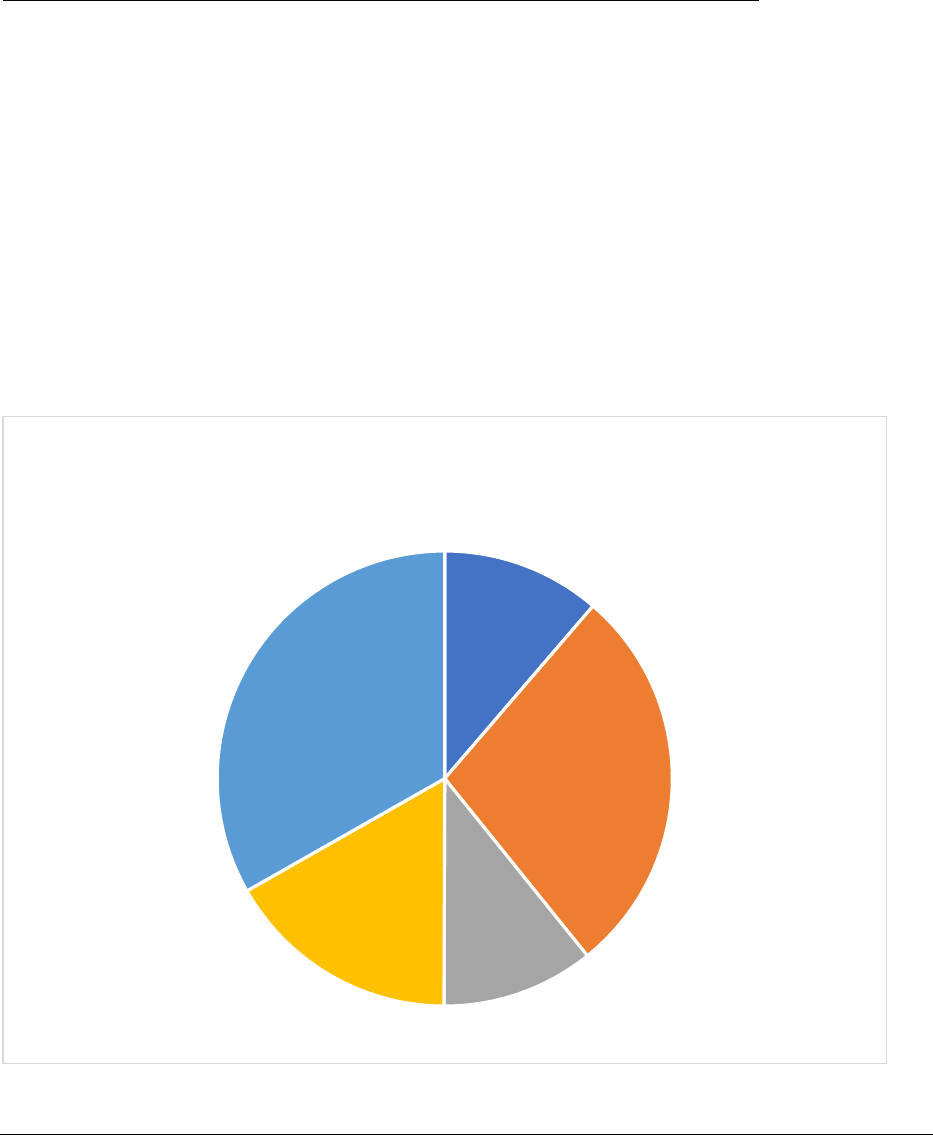

Figure 9. Demand for Homeownership .................................................................................45

Figure 10. Unmet Need for Homeownership by Income Range .........................................45

Figure 11. Rental Housing Demand .......................................................................................48

Figure 12. Unmet Need for Long-Term Rental Housing by Income Range ........................48

Los Alamos County Housing Market Needs Analysis, 2019 Page 1

Section 1. Executive Summary

A. Purpose of the Housing Market Needs Analysis

Los Alamos County is experiencing an acute shortage of housing. The lack of housing

affects the quality of life of people who live and work in the county. It is also a problem

for the local economy, which depends on a skilled labor force. Recognizing that a

lack of housing of all types and in all price ranges exists in the County, Los Alamos

County commissioned this housing market needs assessment that addresses current

and future housing needs and future actions the County can take to meet these

needs. The County’s greatest housing challenge is the limited land available to meet

immediate housing needs. Key strategies include identifying priority sites that can be

developed in the short-term, including development of vacant residential properties,

downtown redevelopment and higher density housing in in some locations.

B. Policy Framework

The Los Alamos County Strategic Leadership Plan, the Los Alamos County

Comprehensive Plan and the Economic Vitality Strategic Plan describe housing issues

and recommendation actions by the County. The County is moving forward on the

recommendations of these plans. An Affordable Housing Plan completed in 2010

provided recommendations to address the need for affordable housing. The issues in

these plans have been identified through extensive public outreach and consideration

by the County Council. Key housing recommendations from these guiding documents

are summarized below.

1. Los Alamos Strategic Leadership Plan, 2019

The Strategic Leadership Plan identifies increasing the amount and types of housing

options as a priority area. This includes “a variety of housing options for all segments of

the community, from affordable, entry level, and live-work housing to new options for

those interested in downsizing or moving closer to central areas of the community.”

The Strategic Leadership Plan focuses on issues identified in adopted plans that have

had significant public involvement, time and expertise. The housing priority area will

implement the housing related recommendations of the 2016 Comprehensive Plan

and the Los Alamos County Economic Vitality Strategic Plan.

2. Los Alamos County Comprehensive Plan, 2016

The Comprehensive Plan recognizes the need for more and different kinds of housing

as well as protecting existing neighborhoods. Housing is important to the economic

health of Los Alamos County. New housing development that expands opportunities

for the local workforce to establish residence in Los Alamos will support population

Los Alamos County Housing Market Needs Analysis, 2019 Page 2

growth, improve housing quality, help normalize housing prices, improve the local retail

market, and keep spending in the local community.

The plan also recognizes the links between housing, economic development and

infrastructure. Housing supports the ability of the County to thrive, and in turn

coordination of planning for housing, infrastructure and economic development is

essential to the quality of development in the County.

The Comprehensive Plan identified an inventory of buildable parcels within the County,

on which a potential of 1,108 dwelling units could be constructed, including vacant

homes, vacant lots, unplatted vacant residentially zoned land, and planned projects

at a range of densities.

Comprehensive Plan Housing Goals

1. Provide a variety of housing types, sizes and densities

2. Promote development of housing stock that would accommodate downsizing

households

3. Promote maintenance and enhancement of housing stock quality

4. Provide programs, regulations, and enforcement to help ensure that all housing

is healthy and safe, and meets basic housing maintenance requirements

5. Promote turning vacant housing back into safe and viable homes

6. Allow and encourage housing for older adults and people with disabilities,

including designs that allow for independent living, various degrees of assisted

living, and/or skilled nursing care

3. Economic Vitality Strategic Plan (ESVP), 2019

An EVSP goal is to “increase the availability of quality housing in the County, both

affordable and market rate.”

The EVSP lists a number of actions and strategies for accomplishing this goal. This

housing market needs analysis defines current housing demand, which is the first action

listed in the 2018 housing goal. Additional actions identified in the EVSP include:

• Identify and assess developable properties

• Produce quality housing to meet demand

• Provide financial assistance for affordable housing

• Reinforce neighborhood beautification, which includes maintaining the existing

affordable housing stock

4. Los Alamos Affordable Housing Plan, 2010

The 2010 Housing Plan focused on affordable housing needs and assessed the local

housing market, including analysis of owner occupied and rental housing, housing for

sale and for rent, special needs housing, land use and policy considerations, and

development costs.

Los Alamos County Housing Market Needs Analysis, 2019 Page 3

The plan recognized the shortage of privately owned, developable land and the best

opportunity for additional developable land through land transfers.

A land use and policy review pointed out the existing low-density housing pattern and

the potential for higher densities. The plan recognized the code incentives that are in

the development code, including accessory dwellings allowed in some residential

districts, high-density mixed-use projects allowed in downtown overlay districts, and

reduced parking requirements for mixed-use projects.

An analysis of the development process and related fees found that Los Alamos

County’s process does not present a barrier to development.

Due to the dramatically changed housing climate in the County and the length of

time since the last Affordable Housing Plan was drafted, it may be time to update that

plan to reflect the different needs pertaining to affordable and workforce housing.

C. Report Contents

The Housing Market Needs Assessment includes the following sections in addition to the

Introduction:

Community Profile. The Community Profile updates key indicators related to

demographics, household characteristics and the local economy in Los Alamos

County.

Housing Market Analysis. The Housing Market Analysis updates information on the

current housing market, including housing conditions and the cost and availability of

housing for sale and for rent.

Housing Needs Assessment. The Housing Needs Assessment identifies needs for

affordable and market rate housing based on demographics, the local economy,

needs expressed by local employers, and the housing preferences of people who live

and work in Los Alamos County.

Land Use and Policy Recommendations. The Land Use and Policy Recommendations

are not a complete update to the 2010 Affordable Housing Plan or a thorough look at

the impact of local regulations and policies affecting housing production. However,

land use and local policy issues were mentioned in focus groups and surveys. The

topics that were mentioned by the public are summarized in this chapter.

Appendices. The appendices include detailed summaries of public outreach results

and detailed characteristics of housing for sale.

Los Alamos County Housing Market Needs Analysis, 2019 Page 4

D. Methodology

1. Data Collection

The community profile and base information about the housing market and housing

needs was collected from third party sources. Data sources include the following:

• Historical information from the 2010 Affordable Housing Plan

• US Census, American Community Survey, Five-Year Estimates, 2013-2017

• A survey of rental properties in Los Alamos County

• MLS housing sales data

• A review of available rental housing through on-line sources, including LANL

student and post-doc housing sites, Craigslist, Zillow and Realtor.com.

2. Focus Groups

Three focus group discussions were held in August 2019. These groups included local

employers, real estate and lending professionals, and Los Alamos National Laboratory.

Each group contributed knowledge of housing needs from the respective employers,

the impact of housing on their organizations, and their perceptions of barriers to

meeting housing needs and potential solutions.

3. Surveys

Two surveys were conducted to get information about housing needs from the

perspective of local businesses and from community residents and the local workforce.

A link to the online Employer Housing Needs Survey was sent to local businesses

through the Los Alamos Commerce and Development Corporation email list and the

Los Alamos County business license contact list. A link to the online Community Housing

Preferences Survey was advertised through local media and sent to local employers to

distribute to their employees. Paper copies of the survey were distributed at the local

farmers market and through senior centers. A total of 46 employer surveys and 951

community surveys were returned. Survey results are summarized in Appendix B.

Many who responded to the survey were people who are dissatisfied with their current

housing and would consider moving and people who are have another interest in

housing. Some local residents are concerned about the amount and scale of new

development, traffic impacts and loss of open spaces. Others are advocates for

housing because of the impact on their employees or coworkers or because family

members need housing.

Commuting data indicates that half of the people who work in the County commute

in from outside of the County, but only 15 percent of the survey respondents commute

in. The commuters who responded to the survey overwhelmingly indicated that they

would consider moving.

Los Alamos County Housing Market Needs Analysis, 2019 Page 5

E. Summary of Findings

The report findings are based on data analysis and analysis of focus group and survey

results. Housing is clearly a major concern for local employers, the local workforce, and

community residents.

Several issues emerged from the analysis. These are described below as common

recurring themes and housing preferences.

1. Recurring Themes

• Limited Housing Choices

o Focus group participants are supportive of higher densities, including housing

types referred to as the “missing middle” that are compatible in scale with

detached single-family homes and help create walkable neighborhoods.

Townhomes, duplexes and small-scale apartment buildings in residential

neighborhoods are examples of this. As promoted in the Comprehensive Plan,

higher densities are desired in the Los Alamos Townsite and White Rock town

centers. Multi-story mixed use buildings that are allowed by the development

code in the MU, DT-NGO, DT-NCO, DT-TCO.

o New housing projects provide some diversity in type. However, most proposed

units are either single family detached or apartments. One development in

process is townhouses, an example of the type of housing that could make

maximum use of the limited land supply at prices affordable for middle income

families.

o First time homebuyers, middle- and low-income households cannot find housing

at a price they can afford. The supply of smaller homes on smaller lots is limited.

o Companies with well-paid professional and technical staff have difficulty

recruiting because prospective hires cannot find housing and the age and

quality of housing available is not what people are expecting for the price.

o Postdocs and students who work at LANL have a difficult time finding any kind

of housing. This was mentioned by focus group participants who are familiar

with the need for short-term housing for lab employees. It was also evident in

web sites that have been set up to connect potential tenants with landlords.

Demand for housing significantly outnumbers supply.

o The extremely tight housing market, coupled with limited choices, means that

residents cannot easily move from one housing type to another as their needs

change.

o New housing projects are either market rate, with home prices starting at about

$400,000, or affordable with federal subsidies and targeted to households with

incomes of about $60,000 or less for a family of four. Housing affordable to

households within income between $60,000 and $100,000 is missing from this mix.

Los Alamos County Housing Market Needs Analysis, 2019 Page 6

• Need for Housing to Meet Demand

o This market analysis identified an immediate need for 1,310 units of rental

housing and 379 units for homeownership. The need is distributed among all

income ranges but is particularly acute for middle- and lower-income

households.

o Annual hiring at LANL will bring new employees to the community every year for

the next three to five years. Some of these employees are replacing retirees and

others are to fill positions created by the growth of LANL’s mission. There were

1,500 positions still left unfilled at the time this document was drafted.

o An increasing number of retirees are choosing to remain into the County after

retirement for a variety of reasons, including proximity to family and the lifestyle

of the community.

o Very few homes were for sale or for rent in September 2019. The turnover in

housing, with a sales volume of a few hundred units a year does not support the

1,000 new positions at LANL or the housing needs of other local employers.

o The County has had recent success in attracting new development, including

homes for sale and housing for rent. These projects, which are evidenced by the

housing developments at Mirador and on DP Road, are in early development

stages.

o Private developments in process include the redevelopment of the Black Hole

property. These projects are relatively small, but they will add housing to the

inventory.

o There is a perceived risk of developing property in a market that is dominated

by a single employer that is dependent on the Federal budget. The mission,

programs, and funding for the lab is cyclical. The impact of the cycles on

housing can be seen in the change in median sales price over time for the

County.

• Limited Land Supply and other Development Challenges

o There is limited land available that is suitable for development, and the size of

parcels is relatively small. Production builders cannot achieve the economies of

scale needed to make development worthwhile.

o New housing has taken time to come to fruition. Focus group participants and

survey responses suggest several reasons for this. Development is expensive in

Los Alamos County because topography and subsurface soil conditions, and

construction labor and materials come from a relatively long distance. New

buildings at LANL create competition for construction crews which drives up

prices. As a result, housing development costs are about 30% higher in the

County than in larger nearby markets. Developers may not be attracted to the

county because of the cost of doing business.

o Both local business leaders and community members recognize that the

County’s vacant and open space properties represent an opportunity to

increase the housing supply in the County.

Los Alamos County Housing Market Needs Analysis, 2019 Page 7

o Most of the properties mentioned as potential housing sites at meetings and in

survey responses as potentially developable sites have been mentioned in prior

studies.

o If the County and LANL determine that a housing crisis currently exists, they

should review all County properties, including those listed in Ordinance 252 and

Ordinance 254, each of which is An Ordinance Establishing a Land Preservation

Status for Certain Developed Public Lands, to prioritize County properties for

housing. The County would follow a public process with a 90-day review period

for public input once an ordinance to change status has been introduced.

• Housing Affordability

o The high median income in Los Alamos County is a result of the highly paid

professional and technical jobs at Los Alamos National Laboratory.

o Other industry classifications, such as workers in education, government, retail

and service industries, have wages that are similar to the state average. As a

result, people with more modest incomes who compete with higher income

households for housing are priced out of the market. This is an issue for

employers who have difficulty recruiting.

o The number of housing units set aside for income eligible households decreased

by 31 units with the foreclosure and sale of Caballo Peak Apartments. Projects

financed with low-income housing tax credits must meet eligibility requirements

for at least 30 years after project completion, and preservation of affordable

housing will become more important as existing tax credit projects age.

o Because of the recognized housing need, Los Alamos County is identified as a

Tier 1 community, which gives it a competitive advantage in the statewide

competition for projects financed in part through tax credits.

• Aging Housing Stock

o Housing prices are very high for the age and quality of housing. This is true for

both housing for sale and housing for rent.

• Coordinating Housing with Planning for Utility Infrastructure, Transportation, Schools

and Other Land Use Planning

o Residents in the Townsite and White Rock are concerned that infill and

increasing densities in Los Alamos and White Rock will have an impact on

existing infrastructure, and traffic congestion in particular.

o Coordination and augmentation of transit service that most efficiently provides

connections between new housing to the laboratory and other strategic

locations within the County.

o The LAPS Facilities Master Plan identifies school needs based in part on

anticipated growth in school age population within school attendance zones.

Planned projects will impact classroom needs. Planning for new housing should

be coordinated with the facility plan. This includes consideration of LAPS-owned

properties as well as development that includes families.

Los Alamos County Housing Market Needs Analysis, 2019 Page 8

o County-owned properties that are included in the special land preservation

status established in Ordinances 252 and 254 can be considered for removal

from this status by ordinance, which would require public input.

• Importance of Housing to Economic Development

o Most employers that participated in focus groups or responded to the employer

survey have unfilled positions, in part because new hires cannot find housing.

o Survey responses from prospective LANL hires indicate that lack of housing is a

major consideration when these highly skilled scientists are weighing job

opportunities.

2. Housing Preferences

• The community input regarding housing preferences is consistent: young singles

and married couples with no children often prefer to locate in Santa Fe

because of the activities there; workers with low to mid-range salaries may

prefer to live in the valley rather than on the hill because there are more

affordable housing choices; families with school age children may prefer to live

in Los Alamos County because of the excellent schools.

• Responses to the community survey indicate a preference for single family

detached housing, similar to what is prevalent in Los Alamos County now.

However, there are people who would consider smaller houses with smaller

yards, townhomes and apartments.

• Three bedrooms, two bathrooms and two garage spaces are the most

common preferred housing characteristics.

• While a majority of people who responded to the community survey would

consider moving, families with adult children who want to live and work in the

County have particularly strong opinions about the need for additional housing.

As one respondent noted, “I do not want my daughter to live with us forever.”

Los Alamos County Housing Market Needs Analysis, 2019 Page 9

Section 2. Community and Housing Profile

The Incorporated County of Los Alamos is located in north central New Mexico,

approximately 35 miles northwest of Santa Fe. The County is the home of Los Alamos

National Laboratories, which is the County’s major employer. The estimated 2017

population in the County is 18,031, and the estimated 2018 population is 19,101.

Population estimates for 2018 are not yet available for the two communities in the

County, but the 2017 estimates were 12,035 for Los Alamos townsite and 5,878 for White

Rock. The County is predominantly public land, including Los Alamos National

Laboratories, a portion of Bandelier National Monument, and the Santa Fe National

Forest.

The community and housing profile describe population, housing and economic

trends in the County that influence the demand for housing.

Data sources include the following:

• US Census, American Community Survey, Five-Year Estimates, 2013-2017

• A survey of rental properties in Los Alamos County

• MLS housing sales data

• A review of available rental housing through on-line sources, including LANL

student and post-doc housing sites, Craigslist, Zillow and Realtor.com

Information regarding population trends, household characteristics, incomes, jobs and

wages shall be used to identify housing needs of the current population and what is

affordable based on typical wages.

There are several demographic and economic trends affecting housing needs:

Growth. While the population of the County has grown at a relatively slow pace,

primarily due to the limited availability and relatively high cost of housing, employment

is increasing. Expansion of the mission of Los Alamos National Laboratory and the

increased emphasis on innovation and transfer of technology have increased job

growth outside of the lab. A commensurate increase of employment in other industry

classifications would be expected to support job growth in professional and technical

services. This is a distinctly different scenario than the decreasing population and

employment in 2010. The demand increase created by a booming job market puts

upward pressure on prices unless the supply of housing can increase to meet demand.

Age. The County’s housing stock is aging, with 3,755 units, which is 44.5 percent of the

existing housing supply, more than 50 years old. There is a need for renovation or

replacement of older properties.

Retirees Aging in Place. Focus group participants reported that more retirees are

choosing to remain in Los Alamos County as multigenerational families have

established roots in the community. This means that fewer homes are sold as fewer

retirees leave the community. The supply of senior housing is limited, which means that

Los Alamos County Housing Market Needs Analysis, 2019 Page 10

as retirees stay in the community, they have limited options for downsizing, if that is

their goal.

Young People Staying. As part of the increase in multigenerational families, young

adults are choosing to find jobs in Los Alamos County and stay in the community. This

phenomenon was mentioned by respondents to the community survey who noted

that their adult children are living at home because they cannot find housing.

Income Disparities. The professional and technical wages prevalent in Los Alamos

County are much higher than the state average. However, other types of jobs pay

approximately the same as the state average. The impact on housing is that higher

wage workers can “outbid” lower wage workers in a market where the supply is not

expanding to meet demand. Increased demand coupled with a stagnant supply is

putting upward pressure on housing prices.

A. Community Profile

1. Demographic Profile

The demographic profile updates key indicators of change over the past ten years.

The demographic profile describes historical and recent population trends,

a) Population Trends

Los Alamos County population has fluctuated slightly between 2000 and 2018. The

population estimate for Los Alamos County for 2018 is at the highest point during the

past 19 years. The Los Alamos County population has increased 4 percent since 2000.

This includes recovery from slight dips in 2010 and from 2013 to 2015.

Table 1. Population Trends

US Census

(as of April 1)

Census Population Estimates (as of July 1)

2000

2010

2011

2012

2013

2014

2015

2016

2017

2018

New

Mexico

1,819,046

2,059,179

2,080,395

2,087,549

2,092,792

2,090,342

2,090,211

2,092,789

2,093,395

2,095,428

Los

Alamos

County

18,343

17,950

18,229

18,238

17,950

17,807

17,830

18,239

18,804

19,101

Source: US Census 2000, US Census Bureau, Population Division, Annual Estimates of the Resident

Population, April 1, 2010 to July 1, 2018 (PEPANNRES)

The population of Los Alamos County has been consistent at roughly 18,000 people for

the past 20 years. Because there is an extremely limited supply of developable land,

economic growth in Los Alamos County has not resulted in population growth. People

who work in the County commute from surrounding communities.

2. Household Characteristics

Since 2000, the number of households in the County has ranged from 7,500 to 7,600

households, according to the Census and Census estimates. During this time,

Los Alamos County Housing Market Needs Analysis, 2019 Page 11

household characteristics have changed somewhat, with the number of family

households decreasing, and the number of nonfamily households increasing. The most

dramatic changes have been in the number of female headed family households and

the number of nonfamily households with a householder who is 65 years old and older.

Family households are 66 percent of all households, down from 71 percent in 2000. The

percentage of all households that are nonfamily households headed by seniors has

increased from 7 percent to 11 percent.

Table 2. Household Characteristics and Trends, 2000-2017

Los Alamos County

2000

2010

2017

% Change

2000-2010

% Change

2010-2017

Total households

7,497

7,663

7,525

2.21%

-1.80%

Family households (families)

5,341

5,199

4,969

-2.66%

-4.42%

Married couple

4,703

4,451

4,300

-5.36%

-3.39%

Male householder

(no wife present)

426

258

215

-39.44%

-16.67%

Female householder

(no husband present)

212

490

454

131.13%

-7.35%

Nonfamily households

2,156

2,464

2,556

14.29%

3.73%

Householder living alone

1,869

2,183

2,292

16.80%

4.99%

65 years and over

504

697

842

38.29%

20.80%

Average household size

2.43

2.33

2.38

-4.12%

2.15%

Average family size

2.92

2.86

2.99

-2.05%

4.55%

Source: US Census, American Community Survey 5-year estimates 2013-2017

3. Income

The median household income has increased steadily since 2000, with a 2017 median

household income of over $110,000 in 2017. HUD has established income limits for

Federal programs, and the state has established Los Alamos County income limits

approved by the New Mexico Mortgage Finance Authority (MFA) for programs that

are funded through the County. The MFA income limits recognize that moderate

income households cannot afford housing in Los Alamos County without assistance.

The following sections describe the income characteristics of County households, and

Federal and state income limits are described at the end of the chapter.

a) Income Distribution

Los Alamos County is more affluent than the rest of the state of New Mexico. While

most household incomes in Los Alamos County are greater than $50,000,

approximately twenty percent of households have lower incomes.

Los Alamos County Housing Market Needs Analysis, 2019 Page 12

Table 3. Household Income Distribution, 2000-2017

2000

2010

2017

Total households

7,495

7,566

7,525

Less than $10,000

262

3.5%

100

1.3%

258

3.4%

$10,000 to $14,999

134

1.8%

40

0.5%

206

2.7%

$15,000 to $24,999

403

5.4%

266

3.5%

217

2.9%

$25,000 to $34,999

429

5.7%

331

4.4%

263

3.5%

$35,000 to $49,999

822

11.0%

675

8.9%

523

7.0%

$50,000 to $74,999

1,479

19.7%

1,141

15.1%

870

11.6%

$75,000 to $99,999

1,409

18.8%

1,029

13.6%

1,149

15.3%

$100,000 to $149,999

1,880

25.1%

1,973

26.1%

1,840

24.5%

$150,000 or more

677

9.0%

2,011

26.6%

2,199

29.2%

Median household income

$78,993

$103,643

$110,190

Source: US Census, American Community Survey 5-year estimates 2013-2017

The median income for Los Alamos ($110,190) is more than double the state median of

$46,718. Over fifty percent of households have a household income of over $100,000

annually.

Family incomes are higher than nonfamily incomes, primarily because nonfamily

households are householders living alone. These include single working age adults and

retirees.

Table 4. Family and Nonfamily Household Incomes

Income Range and Household Type

2010

2017

Families

5,248

4,969

Less than $10,000

66

1.30%

43

0.90%

$10,000 to $14,999

5

0.10%

100

2.00%

$15,000 to $24,999

52

1.00%

59

1.20%

$25,000 to $34,999

92

1.80%

83

1.70%

$35,000 to $49,999

328

6.30%

274

5.50%

$50,000 to $74,999

542

10.30%

487

9.80%

$75,000 to $99,999

802

15.30%

683

13.70%

$100,000 to $149,999

1,570

29.90%

1,251

25.20%

$150,000 or more

1,791

34.13%

1,989

40.03%

Median household income

$118,993

$133,523

Non-Families

2,318

2,556

Less than $10,000

34

1.47%

215

8.41%

$10,000 to $14,999

35

1.51%

106

4.15%

$15,000 to $24,999

214

9.23%

158

6.18%

$25,000 to $34,999

239

10.31%

180

7.04%

$35,000 to $49,999

347

14.97%

249

9.74%

$50,000 to $74,999

599

25.84%

383

14.98%

$75,000 to $99,999

227

9.79%

484

18.94%

$100,000 to $149,999

403

17.39%

624

24.41%

$150,000 or more

220

9.49%

157

6.14%

Median household income

$60,353

$73,700

Source: US Census, American Community Survey 5-year estimates 2013-2017

Los Alamos County Housing Market Needs Analysis, 2019 Page 13

Owner occupied housing represents 74 percent (down from 77 percent in 2010) of

occupied housing units in Los Alamos County, but the number of renters is increasing.

Incomes of homeowners are significantly higher than the incomes of renters.

Table 5. Income by Tenure

Income Range and Tenure

2010

2017

Owner occupied:

5,840

5,543

Less than $10,000

53

0.91%

135

2.44%

$10,000 to $14,999

19

0.33%

79

1.43%

$15,000 to $24,999

68

1.16%

75

1.35%

$25,000 to $34,999

154

2.64%

143

2.58%

$35,000 to $49,999

338

5.79%

274

4.94%

$50,000 to $74,999

745

12.76%

571

10.30%

$75,000 to $99,999

846

14.49%

669

12.07%

$100,000 or more

3617

61.93%

3,597

64.89%

Renter occupied:

1,726

1,982

Less than $10,000

47

2.72%

123

6.21%

$10,000 to $14,999

21

1.22%

127

6.41%

$15,000 to $24,999

198

11.47%

142

7.16%

$25,000 to $34,999

177

10.25%

120

6.05%

$35,000 to $49,999

337

19.52%

249

12.56%

$50,000 to $74,999

396

22.94%

299

15.09%

$75,000 to $99,999

183

10.60%

480

24.22%

$100,000 or more

367

21.26%

442

22.30%

Source: US Census, American Community Survey 5-year estimates 2013-2017

b) Cost Burdened Households

Housing is considered to be affordable when a household pays no more than 30

percent of income on housing and utilities. Households who pay more than 30 percent

of income for housing are considered to be cost burdened.

The table below shows the number of owners and renters by income that experience a

cost burden. Overall, 14 percent of households pay more than 30 percent of income

for rent. This includes 10 percent of owners and 25 percent of renters. Cost burdened

owners and renters typically have incomes below $50,000.

Table 6. Cost Burdened Households by Tenure and Income Range

Households by Income Range and Tenure

Number of

Households

Households Paying

30% or More for

Housing

Percent Cost

Burdened by Income

Total Households:

7,525

1036

14%

Owner-occupied housing units:

5,543

534

10%

Less than $20,000:

201

159

79%

$20,000 to $34,999:

197

72

37%

$35,000 to $49,999:

274

85

31%

$50,000 to $74,999:

571

132

23%

$75,000 or more:

4,266

86

2%

Zero or negative income

34

NA

NA

Los Alamos County Housing Market Needs Analysis, 2019 Page 14

Households by Income Range and Tenure

Number of

Households

Households Paying

30% or More for

Housing

Percent Cost

Burdened by Income

Renter-occupied housing units:

1,982

502

25%

Less than $20,000:

218

218

100%

$20,000 to $34,999:

199

155

78%

$35,000 to $49,999:

249

115

46%

$50,000 to $74,999:

289

14

5%

$75,000 or more:

881

0

0%

Zero or negative income

95

NA

NA

No cash rent

51

NA

NA

Source: US Census, American Community Survey, 5-Year Estimates, 2013-2017

c) Program Income Limits

Eligibility for housing assistance is based on household income. Income limits for various

housing programs vary by type of program and funding source. Programs that are

targeted to home buyers and homeowners offer assistance to low- and moderate-

income buyers. These programs are a significant asset to middle income buyers in Los

Alamos County where professional and technical incomes are very high compared to

incomes in other industries.

Los Alamos County Housing Programs Income Limits

Los Alamos County received permission to use the true 80% Area Median Income limits

for all affordable programs funded through the County, as opposed to being restricted

to the national AMI limit for federally funded programs. These income limits allow the

County to potentially assist a broader number of households, such as those with

incomes of up to $96,640 for a family of four with the homebuyer assistance and home

renewal programs.

Table 7. Los Alamos County Programs Income Limits

Persons in Family

1

2

3

4

5

6

Very Low (50%)

Income

$42,300

$48,350

$54,400

$60,400

$65,250

$70,100

Low (80%) Income

$67,680

$77,360

$87,040

$96,640

$104,400

$112,160

HUD Income Limits

HUD income limits apply to federally funded programs, including Housing Choice

Vouchers. These income limits are separate from the income limits established for

County-funded programs. The 2019 HUD median family income in Los Alamos County is

$135,500. Table 8 shows HUD income limits by household size for 2019.

Los Alamos County Housing Market Needs Analysis, 2019 Page 15

Table 8. 2019 HUD Income Limits for Los Alamos County

Persons in Family

% of AMI

1

2

3

4

5

6

7

8

Extremely Low

(30%) Income

$25,400

$29,000

$32,650

$36,250

$39,150

$42,050

$44,950

$47,850

Very Low (50%)

Income

$42,300

$48,350

$54,400

$60,400

$65,250

$70,100

$74,900

$79,750

Low (80%) Income

$52,850

$60,400

$67,950

$75,500

$81,550

$87,600

$93,650

$99,700

Source: HUD Exchange

MFA Income and Acquisition Cost Limits for Los Alamos County

The MFA sets income limits that are higher than either County or HUD limits for certain

of its programs in targeted areas. These programs can help bridge financing gaps for

moderate income buyers in high cost areas like Los Alamos County. The higher income

limits are appropriate for moderate income homebuyers.

Income and home purchase price limits for 2019 are shown in Table 9.

Table 9. 2019 MFA Income and Purchase Price Limits by Program

MFA Program

1 to 2 Person Household

3 or More Person

Household

Purchase Price Limit

FIRSTHome and FIRSTDown

$135,500

$155,825

$369,501

NEXTHome

$91,000

$91,000

$340,000

HOMENow

Same as HUD

Same as HUD

Existing Home $272,650

New Home $329,446

Source: nmhousing.org

FIRSTHome is a first mortgage loan program for first-time homebuyers who have low

and moderate incomes. A first-time homebuyer is someone who has not owned and

occupied a home as their primary residence in the past three years. The program

works with FHA, VA, USDA and HFA Preferred Conventional mortgage loans through

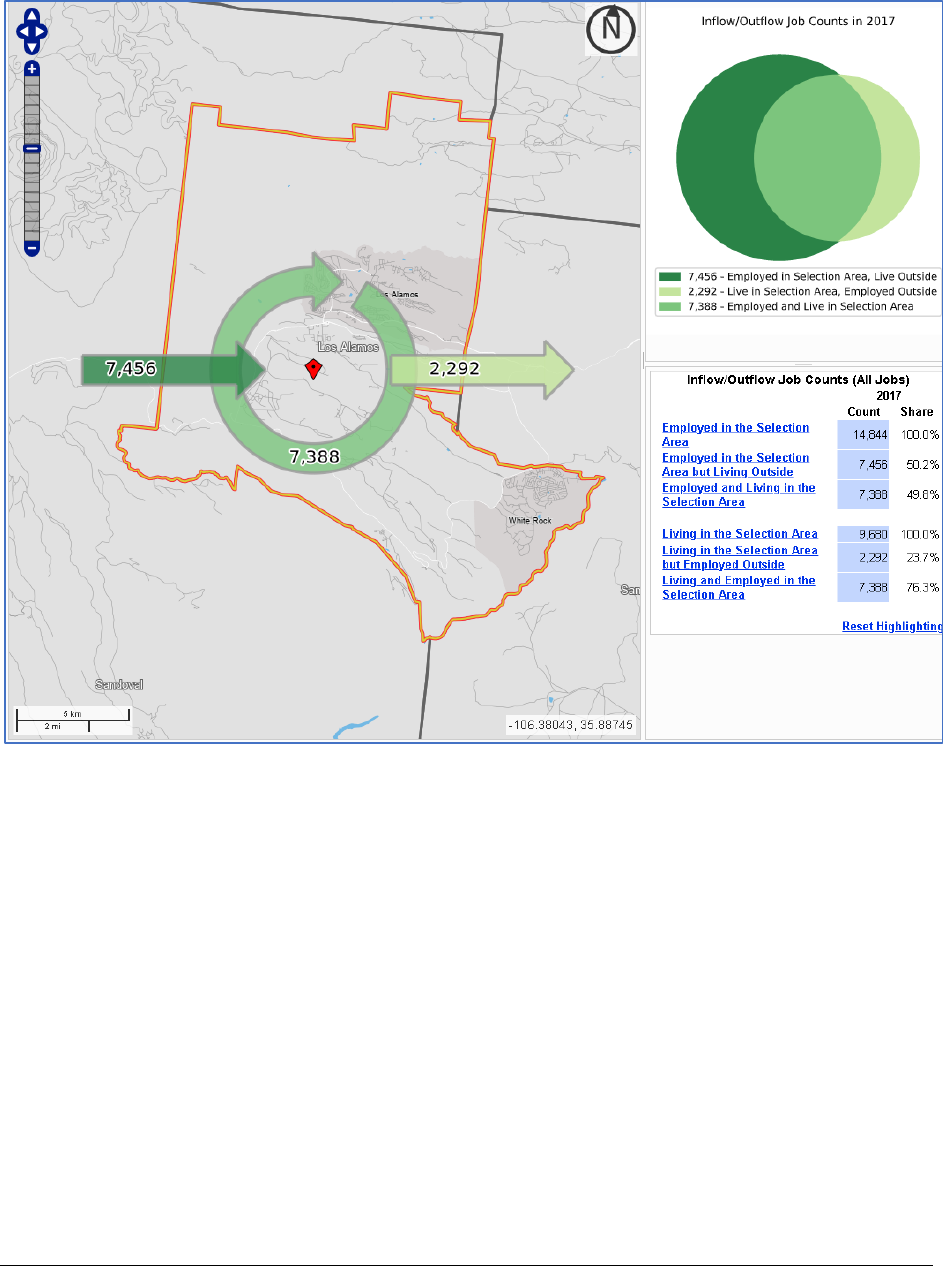

MFA approved participating lenders.

FIRSTDown is a fixed-rate second mortgage loan program that provides up to $8,000 to

assist with down payment and closing cost assistance for first-time homebuyers.

NEXTHome is available to first-time and non-first-time homebuyers who are

purchasing their next home. NEXTHome's first mortgage loan works with FHA, VA,

USDA and HFA Preferred Conventional mortgage loans. The down payment

assistance second mortgage loan is 3 percent of the first mortgage loan amount. It

may be used to finance down payment and closing costs, including pre-paid

items. Borrowers must contribute $500 of their own funds, and the second loan may

be forgiven under certain conditions.

HOMENow is a second mortgage loan that provides down payment and closing

cost assistance for first-time homebuyers with lower incomes. This program provides

the lesser of 8 percent of the sales price of the home or $8,000 to help cover down

payment and closing costs. Borrowers must earn 80 percent or lower of the area

Los Alamos County Housing Market Needs Analysis, 2019 Page 16

median income, must contribute $500 of their own funds, and may qualify for loan

forgiveness after living in the home for ten years.

B. Local Economy

1. Economic Impact of Los Alamos National Laboratory

The economy of Los Alamos County, as well as much of northern New Mexico, is driven

by activity at Los Alamos National Laboratory (LANL). LANL directly employs 14,754

persons, with a total payroll of $1.46 billion. LANL purchases $332.8 million in goods and

services and $45.2 million in construction from New Mexico businesses. Other

expenditures supported by LANL, including expenditures of its employees and vendors,

indirectly create 9,415 jobs with a combined payroll of $353.6 million, Indirect spending

generates $1.21 billion in receipts for New Mexico businesses.

Thus, including both direct and indirect and induced activities, LANL is responsible for

the creation of 24,169 jobs, $1.82 billion in labor income, and total revenues of $3.12

billion to businesses in the state. For context, jobs directly and indirectly supported by

LANL are nearly equal to the total employment in the state’s manufacturing sector

(26,398); wages & salaries exceed those of the manufacturing industry by nearly $400

million

1

.

2. County Employment and Wages by Industry Classification

Jobs in Los Alamos County and the annual average weekly wages for each industry

classification are shown below. Data for industry classifications with few employers is

not reported by classification but is included in the County total. Los Alamos County’s

annual average weekly wage is by far the highest in the state, almost double the state

average. This is substantially due to the prevalence of professional and technical jobs

in Los Alamos County, which is the industry classification with the highest wages in the

state.

However, wages are not equally high across industry classifications in the County. In

2018, the highest wages in the state by industry class were Professional and Technical

Services, a category that is not reported for Los Alamos County. Wages for lower paid

industries are comparable to the state average, and in several industries average

weekly wages are lower than the state average. This wage differential puts people

who are employed in lower wage jobs at a disadvantage when competing for

housing in the County.

1

University of New Mexico, Bureau of Business and Economic Research, The Economic Impact

of Los Alamos National Laboratory, June 2019.

Los Alamos County Housing Market Needs Analysis, 2019 Page 17

Table 10. Jobs and Wages by Industry Classification

Los Alamos County, 2018

New Mexico, 2018

Industry Classification

Average Annual Jobs

Annual Average

Weekly Wages

Annual Average

Weekly Wages

Accommodation and Food Services

459

$375

$366

Administrative and Waste Services

547

$1,362

$703

Arts, Entertainment, and Recreation

74

$246

$514

Construction

187

$1,165

$941

Educational Services

70

$426

$834

Finance & Insurance

192

$1,297

$1,217

Health Care and Social Assistance

860

$964

$857

Information

56

$842

$998

Management of Companies and

Enterprises

*

*

$1,315

Manufacturing

103

$815

$1,022

Other Services, Except Public

Administration

296

$391

$664

Professional and Technical Services

*

*

$1,551

Public Administration

1,753

$976

$1,123

Real Estate and Rental and Leasing

87

$644

$774

Retail Trade

489

$612

$566

Transportation & Warehousing

*

*

$996

Utilities

0

*

$1,358

Wholesale Trade

28

$1,141

$1,064

Total All Industries

16,349

$1,633

$868

* The sum of industries may not add to total due to Non-Disclosure

Source: NM Department of Workforce Solutions, Quarterly Census of Employment and Wages Annual

Report 2018

C. Commuting Patterns

There are two sources of commuting data. The Census American Community Survey

data and the Census OnTheMap data. The totals are slightly different, with the ACS

data reporting higher numbers. OnTheMap data are more current but do not include

some Federal employees. Data from both sources are shown below. The Census

OnTheMap application estimates that a little over half of jobs in Los Alamos County are

filled by people who commute in from outside of the County. An estimated 2,300

people who live in the County are employed outside of the County. These may include

“trailing spouses” of the local workforce who have jobs outside of the County. Half of

the people with jobs in the County live and work there.

Los Alamos County Housing Market Needs Analysis, 2019 Page 18

Figure 1. Los Alamos County Commuting Pattern

Source: US Census, OnTheMap

Los Alamos County Housing Market Needs Analysis, 2019 Page 19

Table 11. Residence Locations of County Workforce, Journey to Work Data

2010

2013

2015

Commute from Santa Fe County

3,903

3,787

3,703

Commute from Rio Arriba County

3,286

2,710

2,605

Commute from Sandoval County

626

659

686

Commute from Bernalillo County

496

555

477

Commute from Taos County

131

202

124

Commute from all other locations

630

559

533

Total Workforce Commuting from

Outside Los Alamos County

9,072

8,472

8,128

Live and Work in Los Alamos County

8,197

8,121

8,278

Total Workers

17,269

16,593

16,406

Source: US Census, Population Division, Journey-to-Work

Table 12. Residence Locations of County Workforce, OnTheMap Data

2010

2013

2015

2017

Commute from Santa Fe County

3,134

3,019

3,119

3,181

Commute from Rio Arriba County

2,655

1,736

1,273

1,237

Commute from Sandoval County

734

703

759

805

Commute from Bernalillo County

875

714

904

1,012

Commute from Taos County

312

1,068

142

131

Commute from all other locations

538

1,022

843

1,090

Total Workforce Commuting from

Outside Los Alamos County

7,699

8,262

7,040

7,456

Live and Work in Los Alamos County

6,979

6,336

7,276

7,388

Total Workers

15,232

14,598

14,277

14,844

Source: US Census, OnTheMap

Previous studies examined the number of people who work in Los Alamos and number

of those who live elsewhere and commute in. Commuters travel from Santa Fe,

Española, Rio Rancho, and other areas to work. The majority of commuters live in

Santa Fe and Rio Arriba Counties. Commuting time from nearby counties vary

depending on location within a neighboring County, but Table 13 shows typical travel

times from the top commuting locations. These range from less than a half hour from

Española to an hour and a half commute from Rio Rancho or Albuquerque.

Table 13. Commuting Time and Distance from Surrounding Areas

Community

Travel Time

Distance

Española

24 min

18 miles

Santa Fe

43 min

34 miles

Rio Rancho

1 hour 30 min

90 miles

Albuquerque

1 hour 38 min

97 miles

Source: Google Maps

Los Alamos County Housing Market Needs Analysis, 2019 Page 20

Section 3. Housing Market Analysis

The housing market analysis describes the characteristics of the County’s housing

supply and current market conditions, including housing available for sale and for rent.

Recent market trends include trends in sales price and rental rates.

A. Los Alamos County Housing Supply

1. Housing Characteristics

Table 14 shows the age of housing by year structure was built. Almost 45 percent of the

housing in the County, or 3,755 units, was built prior to 1970. Homes built before 1970

are 50 years old and prime candidates for rehabilitation. Since 2016, the County has

issued permits for 70 new homes.

Table 14. Year Structure Built

Year Built

Number of Units

Percent of Total

Built 2017 or later

70

0.8%

Built 2014 to 2016

0

0.0%

Built 2010 to 2013

43

0.5%

Built 2000 to 2009

1,006

11.9%

Built 1990 to 1999

734

8.7%

Built 1980 to 1989

941

11.1%

Built 1970 to 1979

1,891

22.4%

Built 1960 to 1969

1,631

19.3%

Built 1950 to 1959

1,389

16.5%

Built 1940 to 1949

711

8.4%

Built 1939 or earlier

24

0.3%

Census Total

8,370

--

Total with County permits 2017 and

later

8,440

100.0%

Source: Census, American Community Survey, 5-year estimates, 2013-2017;

Los Alamos County

Table 15. Housing Type

Housing Type

Number of Units

Percent of Total

1-unit, detached

5,347

63.90%

1-unit, attached

821

9.80%

2 units

406

4.90%

3 or 4 units

407

4.90%

5 to 9 units

377

4.50%

10 to 19 units

412

4.90%

20 or more units

354

4.20%

Mobile home

246

2.90%

Total Units

8,370

Source: Census, American Community Survey, 5-year estimates, 2013-2017

Table 16. Number of Bedrooms

Number of Bedrooms

Number and Percent of Total

Total housing units

8,370

No bedroom

109

1.30%

1 bedroom

578

6.90%

2 bedrooms

1,783

21.30%

3 bedrooms

3,595

43.00%

Los Alamos County Housing Market Needs Analysis, 2019 Page 21

Number of Bedrooms

Number and Percent of Total

4 bedrooms

1,839

22.00%

5 or more bedrooms

466

5.60%

Average household size of Owner-occupied unit

2.48

Average household size of Renter-occupied unit

2.12

Source: Census, American Community Survey, 5-year estimates, 2013-2017

2. Occupancy Characteristics

According to the American Community estimates, nearly three-fourths of housing in

Los Alamos County is owner occupied.

The American Community Survey estimates that ten percent of housing in Los Alamos

County is vacant. Most of these units are not available for rent of for sale. Census

vacancy estimates include housing that is rented or sold but not occupied, housing

that is intended for occasional use, and housing that is vacant for another reason,

such as held in an estate, being renovated or similar situations.

Table 17. Occupancy Characteristics

2017 (est.)

Percent of

Total

2010

2000

Total housing units

8,370

8,354

7,937

Occupied housing units

7,525

89.9%

7,663

7,497

Owner-occupied

5,543

73.7%

5,828

5,894

Renter-occupied

1,982

26.3%

1,835

1,603

Vacant housing units

845

10.1%

691

440

For rent

197

23.3%

198

204

Rented, not occupied

56

6.6%

8

7

For sale only

68

8.0%

74

63

Sold, not occupied

0

0.0%

14

14

For seasonal, recreational, or occasional use

291

34.4%

257

71

Other vacant

233

27.6%

139

66

Homeowner vacancy rate

1.2%

1.3%

1.1%

Rental vacancy rate

8.8%

9.7%

11.3%

Source: US Census, American Community Survey 5-year estimates 2013-2017

The Census vacancy estimate can be flawed because of the difficulty in determining

the reason that a unit is vacant at the time of the Census. The estimates of housing that

is vacant for sale or for rent from the Census are not consistent with either the original

data collected for this analysis or the experience of local residents, local businesses

and employees as expressed in the focus groups and surveys. Local data show that

there are very few homes for sale or rent.

The Census estimates that more than 500 homes in the County are vacant for seasonal

or occasional use or for other reasons. Other reasons include foreclosures; personal

reasons; legal issues; preparing to rent or sell; needing repairs or being renovated,

extended absence for work, military service or other temporary absence; abandoned

or unknown reason. Homes that are vacant but not rented, sold or available for sale or

Los Alamos County Housing Market Needs Analysis, 2019 Page 22

for rent could be monitored for the reason that they are vacant to determine if there

are actions the County could take to encourage year-round occupancy for some of

these units.

Owner occupied housing is primarily single family detached, although more than

twenty percent of owner-occupied housing is in multi-unit buildings. Renter-occupied

housing more evenly distributed among housing types.

Table 18. Tenure by Type of Housing

Tenure and Housing Type

Estimate

Percent of Total

Owner-occupied housing units:

5,543

1, detached

4,360

78.7%

1, attached

550

9.9%

2

140

2.5%

3 or 4

121

2.2%

5 to 9

121

2.2%

10 to 19

32

0.6%

20 to 49

0

0.0%

50 or more

48

0.9%

Mobile home

171

3.1%

Renter-occupied housing units:

1,982

1, detached

479

24.2%

1, attached

248

12.5%

2

218

11.0%

3 or 4

248

12.5%

5 to 9

181

9.1%

10 to 19

316

15.9%

20 to 49

124

6.3%

50 or more

93

4.7%

Mobile home

75

3.8%

Source: US Census, American Community Survey 5-year estimates 2013-2017

3. Housing Problems

Housing problems documented in the Census include a lack of complete plumbing

facilities, a lack of complete kitchen facilities, and overcrowding, which is defined as

more than one person per room. Very little of Los Alamos County’s housing has these

problems.

Table 19. Indicators of Housing Problems

Occupied housing units

7,525

Lacking complete plumbing facilities

0

0.00%

Lacking complete kitchen facilities

45

0.60%

Occupants per room

1.00 or less

7,456

99.10%

1.01 to 1.50

69

0.90%

1.51 or more

0

0.00%

Source: US Census, American Community Survey, 5-year estimates, 2013-2017

Los Alamos County Housing Market Needs Analysis, 2019 Page 23

B. Indicators of Maintenance and Rehabilitation Needs

The 2010 Affordable Housing Plan identified all housing built since 1960 as potentially

needing rehabilitation. Ten years later, housing built prior to 1970 is now fifty years old.

Forty-five percent of the owner-occupied housing in Los Alamos County and 42

percent of renter-occupied housing was built prior to 1970. The age of housing and the

quality of older housing were mentioned in focus groups and the community survey as

a source of dissatisfaction with housing choices, even though some older housing has

been renovated. The Los Alamos County Home Renewal Program assists income-

qualified homeowners to make needed repairs that increase comfort, safety and

livability without increasing monthly expenses. The Home Renewal Program has

assisted 20 homeowners since 2016.

Table 20. Age of Housing by Tenure

Owner Occupied

Renter Occupied

Total Housing Units: 7,525

5,543

1,982

Built 2014 or later

0

0.0%

0

0.0%

Built 2010 to 2013

43

0.8%

0

0.0%

Built 2000 to 2009

626

11.3%

317

16.0%

Built 1990 to 1999

388

7.0%

298

15.0%

Built 1980 to 1989

607

11.0%

178

9.0%

Built 1970 to 1979

1,366

24.6%

349

17.6%

Built 1960 to 1969

1,270

22.9%

159

8.0%

Built 1950 to 1959

785

14.2%

484

24.4%

Built 1940 to 1949

445

8.0%

186

9.4%

Built 1939 or earlier

13

0.20%

11

0.60%

Built BEFORE 1970, Potential Need for

Rehabilitation

2,513

45.30%

840

42.40%

Source: US Census, American Community Survey, 5-year estimates, 2013-2017

C. Current Market Conditions

1. New Construction

A review of building permits for new residential construction shows that very few units

have been built in Los Alamos County, although the number of permits has increased

in 2017 and 2018. Most new construction has been single family homes.

Los Alamos County Housing Market Needs Analysis, 2019 Page 24

Figure 2. Building Permits for New Residential Construction

Source: Energov

Table 21. New Residential Construction 2010 to 2018

2010

2011

2012

2013

2014

2015

2016

2017

2018

Total Permits Issued

2

7

3

4

4

9

4

23

14

Single-Family

2

7

1

4

4

9

4

15

8

Total Multi-Family

0

0

2

0

0

0

0

8

6

2-unit/Duplex

0

0

2

0

0

0

0

0

0

3- and 4-unit Multi-Family

0

0

0

0

0

0

0

8

6

5+ Unit Multi-Family

0

0

0

0

0

0

0

0

0

Source: HUD, State of the Cities Data Systems (SOCDS)

2. Housing for Sale

A total of 21 houses, townhouses and condominiums were listed for sale in the Multiple

Listing Service (MLS) in Los Alamos County in September 2019. Of these, ten had a

listing price of $550,000 or more. The average price was $460,000. There is very little

housing available for sale, and housing for sale is not affordable to a family with

income from a service or retail job. A listing of individual homes for sale is in Appendix

C.

Table 22. Average Housing Prices, Homes for Sale in September 2019

Average Price by Number of Bedrooms

Housing Type

1

2

3

4

Average Price

Condo

$129,000

$315,000

$550,000

$595,000

$380,800

House

$220,000

$455,000

$649,714

$549,000

Quad

$148,500

$148,500

Townhouse

$339,667