The Print Security Landscape, 2023 May 2023

© Quocirca 2023 1

The Print Security Landscape, 2023

Securing the print infrastructure amidst a growing threat

landscape

Print security trends in the US and Europe

Excerpt report: Xerox

May 2023

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 2

Executive summary

Quocirca’s Global Print Security Landscape 2023 report reveals that organisations face ongoing challenges in

securing print infrastructure. Home printing continues to cause security concerns, with employee shadow

purchasing making it harder to control document security. Print-related data breaches remain prevalent, with

61% of respondents reporting at least one data loss in the last 12 months, rising to 67% amongst midmarket

organisations. This is leading to lower confidence, particularly among SMBs, in the security of print

infrastructure.

Notably, the research reveals a strong disconnect between the perceptions and attitudes to print security

amongst chief information officers (CIOs) and chief information security officers (CISOs). Expectations for

security spend growth in the coming 12 months are similar, with 84% of CIOs and 81% of CISOs expecting their

print security spend to increase. Only 28% of CISOs believe it has become harder to keep up with print security

challenges, compared to 50% of CIOs. Similarly, only 45% of CISOs are very or somewhat concerned about the

risks of unsecured printers, compared to 72% of CIOs. This chasm between CIOs and CISOs means the two

individuals responsible for the overall technical security of the print environment when serving the business are

not seeing things in the same light – and this has ramifications for the business itself.

Fortunately, print security leaders are mitigating risks. As shown by Quocirca’s Print Security Maturity Index,

organisations classed as leaders, which have implemented a range of technology and policy measures, are seeing

lower levels of data loss and have higher confidence in the security of their print infrastructure. For print

manufacturers, MPS providers, and the rest of the print channel, bridging this gap between the two security

camps is a must. However, this cannot be done simply – it will require a two-pronged approach to bring the two

parties closer together, as well as ensuring the business itself is more aware of the security issues around print.

Therefore, print manufacturers and channel partners must strengthen their security propositions for

organisations of all sizes to help customers mitigate risk in the new era of hybrid work. Becoming a trusted

advisor and provider of print security solutions that fit with an organisation’s existing security environment is

key. Ensuring data and information flow, along with device and output security, will create new revenue

capabilities for the print channel.

The Global Print Security Landscape 2023 study is based on the views of 507 IT decision-makers (ITDMs) in the

US and Europe. Respondents include 20% from the UK, 20% from France, 20% from Germany, and 40% from the

US. In terms of organisation size, 24% represent small and medium-sized businesses (SMBs) (250 to 499

employees), 26% are from mid-size organisations (500 to 999 employees), and 50% are from large enterprises

(1,000+ employees). Respondents are drawn from a range of verticals, including business and professional

services, finance, industrials, public sector, and retail.

The study also includes the print security vendor landscape, which features Quocirca’s assessment of service

offerings from major print manufacturers.

The following vendors participated in this study: Brother, Canon, Epson, HP, Kyocera, Konica Minolta, Lexmark,

Ricoh, and Xerox.

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 3

Key findings

• Cybersecurity incidents continue to rise. Overall, 42% of organisations report an IT security breach in

the past year, rising to 55% among mid-market organisations and dropping to 36% amongst large

enterprises, along with 51% in the finance sector, dropping to 32% in the public sector. The highest

incidence across all organisations is malware, with phishing highest in the mid-market. Security

breaches increased for 61% of organisations in the past year, rising to 70% in the US and 66% in business

and professional services. On average, 27% of IT security incidents were related to paper documents.

• Reliance on printing creates a need for effective print security. Despite rapid digitisation over the

course of the pandemic, 70% remain dependent on print today, rising to 72% in large organisations. A

majority (80%) have changed the composition of their printer fleet over the last two years, rising to

88% in the mid-market. Overall, 79% expect to increase their print security spend in the next year, rising

to 86% in the US and 85% in business and professional services and retail.

• Print security is lower on the security agenda than other elements of IT infrastructure. Cloud or hybrid

application platforms, email, public networks, and traditional end points are seen as top security risks.

Employer-owned home printers come in as the seventh top security risk (21%), ahead of the office print

environment (20%). Notably, there is a disparity between CIOs and CISOs. Just 18% of CIOs consider

office printing a key security risk compared to 30% of CISOs.

• Organisations are taking different approaches to managing the security of their print infrastructure.

While 31% indicate they use an MPS provider, over half (54%) indicate that they use a managed security

services provider (MSSP) to manage both print and IT security. This rises to 58% amongst smaller

organisations (249–499 employees).

• Organisations are finding it harder to keep up with print security demands. Overall, 39% say it is

becoming harder, rising to 50% in the midmarket (500–999 employees). The top challenge is keeping

print management software up to date (35%), protecting sensitive and confidential documents from

being printed (34%), and securing printing in the remote/home environment (31%). Hardware security

is a key concern for SMBs (29%), and highest in the finance and industrial sectors (31%) and for CISO

respondents (38%).

• Organisations using MPS or that are classified as print security leaders are more confident in the

security of their print infrastructure. The visibility and control provided by an MPS appears to ease the

security burden for users. While overall, only 19% of respondents are completely confident in the

security of their print infrastructure, this rises to 26% amongst organisations using MPS. Overall, a

further 50% say they are mostly confident. This reflects the growing complexity and challenges

associated with securing both devices and documents across a hybrid workplace.

• In the past 12 months, 61% of organisations have experienced data losses due to unsecure printing

practices. This is a fall from 68% in our 2022 study. Mid-market organisations are more likely to report

one or more data losses (67%) than large organisations (57%) and the public sector (49%). On average,

the cost of a print-related data breach is £743K. Beyond the financial loss, the top impact of a data

breach is the lost time in addressing the breach and the impact on business continuity (30%).

Vulnerabilities around home printing, such as home workers not disposing of confidential information

securely, was cited as a top factor contributing to data losses.

• Quocirca’s Print Security Maturity Index reveals that only 27% of the organisations studied can be

classed as Print Security Leaders, meaning they have implemented six or more security measures. The

number of leaders rises to 31% in the US and falls to 18% in Germany, which also has the highest

number of laggards (29%). Print Security Leaders are likely to spend more on print security, experience

fewer data losses, and report higher levels of confidence in the security of their print environment.

When compared by vertical, business and professional services have the largest percentage of leaders

(37%), with the public sector having the least (18%).

• Less than one-third (32%) are very satisfied with their print supplier’s security capabilities. This rises

to 50% amongst US organisations and drops to 17% in Germany. Those using an MPS have far higher

satisfaction levels (39% are very satisfied) than those not currently using an MPS or with no plans to

use one (23%). Print security leaders – those that have adopted a range of measures, including security

assessments, pull printing, and formal print security policies, are most likely to report higher

satisfaction levels – 53% of leaders are very satisfied, compared to 27% of followers and only 15% of

laggards.

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 4

Table of Contents

Executive summary ..........................................................................................................................................2

Key findings ........................................................................................................................................................ 3

Introduction .....................................................................................................................................................5

Hybrid work and cloud adoption are shaping print security challenges ...........................................................6

Print security remains low on the IT security agenda .......................................................................................7

Print security challenges are harder to keep up with .......................................................................................8

Taking measures to address print security ..................................................................................................... 10

Print security spend is increasing ................................................................................................................... 11

Print security leaders are most confident in the security of the print infrastructure ....................................... 12

Print-related data loss, cost, and impact ........................................................................................................ 14

The majority report print-related data losses, particularly in smaller organisations ...................................... 14

The cost of a print-related data breach ........................................................................................................... 15

The broad consequences of a data breach ...................................................................................................... 16

Organisations using MPS are most satisfied with print security ..................................................................... 17

Recommendations ......................................................................................................................................... 18

Supplier recommendations .............................................................................................................................. 18

Buyer recommendations ................................................................................................................................. 18

Vendor landscape .......................................................................................................................................... 20

Vendor profile: Xerox .................................................................................................................................... 21

About Quocirca .............................................................................................................................................. 24

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 5

Introduction

As organisations adjust to managing remote and hybrid teams, supporting digital transformation, and navigating

an uncertain and volatile global economy, they face an ever-expanding landscape of vulnerabilities and

increasing risk. Quocirca’s research reveals that 42% of organisations have experienced a cybersecurity incident

in the past year, rising to 51% in the finance sector and 55% amongst midmarket organisations. The volume of

security incidents has increased in the past year for 61% of organisations.

Supply chain disruption and geopolitical situations such as the Russia-Ukraine war have further intensified the

threat landscape. The increased prevalence of ransomware, ransomware denial of service (RDoS), distributed

denial of service (DDoS), social engineering, and supply chain attacks is driving increased concerns around

cybersecurity and the resilience of business-critical functions.

This is further compounded by a raft of technological challenges. As organisations migrate more applications

and services to the cloud to support digital transformation initiatives, new security challenges emerge. The

growing amount of business-critical data hosted in the cloud becomes vulnerable to attack and compromise.

This risk is heightened due to remote workers accessing data from potentially unsecure home networks. Security

threats include misconfigured access points, weak passwords, lack of identity and access management (IAM),

and failure to use multifactor authentication. A fragmented approach to threat detection and monitoring means

security teams are struggling to keep up.

The print infrastructure is not immune to security risks – on average, paper documents represent 27% of IT

security incidents. Today’s intelligent multi-function printers (MFPs) not only pose a risk of paper output falling

into the wrong hands – whether accidentally or maliciously – but also can be exposed as gateways into the rest

of an organisation’s environment. Home printers pose an additional risk, particularly those that were purchased

by employees. This shadow purchasing means home printers may not meet corporate security standards or be

monitored through centralised security tools.

Although print remains low on the IT security agenda, organisations continue to report print-related data losses.

In our 2023 study, 61% of respondents report a print-related data breach, with an estimated average cost of

£743K for one data breach. With both the reputational and financial impact of any security incident far reaching

and substantial, organisations cannot afford to be complacent.

These risks can be mitigated through adopting a never trust, always verify zero-trust security approach.

Implementing data and network encryption, security monitoring, and remediation, along with micro-

segmentation, can help reduce the attack surface, improve threat containment, and strengthen regulatory

compliance.

This report highlights the risks and challenges associated with securing the print infrastructure for the hybrid

workplace. It discusses security confidence levels, print security measures adoption, and the disconnect

between CIOs and CISOs that must be overcome. The report also includes an analysis of the security products,

services, and solutions from the major print manufacturers in the market.

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 6

Hybrid work and cloud adoption are shaping print security challenges

Despite the ongoing shift to digitisation, organisations remain reliant on print. Quocirca’s study shows that the

majority (70%) believe print will remain very important or critical to their organisation in the next 12 months.

Meanwhile, hybrid work is here to stay. On average, 25% of workforces are fully remote, 33% are hybrid, and

42% are fully in the office. A higher proportion of SMB workforces are fully in the office (49%) than of those at

large enterprises (39%). This creates challenges for managing and securing print in the hybrid work setting.

With the return to the office now well underway, print volumes are beginning to recover. Overall, 68% expect

to see growth in office print volumes in the next 12 months, with 64% expecting growth in home printing of

business documents. Overall, 80% have changed the composition of their printer fleet over the last two years,

rising to 88% in the mid-market. In addition, 69% operate a multivendor fleet, rising to 73% and 71% in finance

and business and professional services, respectively.

In terms of MPS usage, 57% use a managed print service (MPS) and 53% some form of cloud printing, rising to

60% in large organisations. Although currently only 4% operate their print infrastructure fully in the cloud, this

is set to rise to 18% by 2025. Today the majority are taking a hybrid approach (29% operate a mix of cloud and

on-premise print management).

The need to implement more effective security for print infrastructure means addressing not only the office

print environment, but also employee-owned printers and MFPs, because of data traversing public networks.

Without effective security controls, this reliance on printing amidst an expanding threat landscape exposes

organisations to security risks.

A multivendor fleet may not have consistent security controls across a mixed fleet of devices, home printers

may not be authorised or monitored, and a fragmented approach to cloud printing may create further security

risks around access and authentication. Although previous Quocirca research has shown that organisations tend

to regard cloud platforms as more secure than on-premise systems, nothing should be taken for granted as the

threat surface increases and novel threats continue to emerge.

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 7

Print security remains low on the IT security agenda

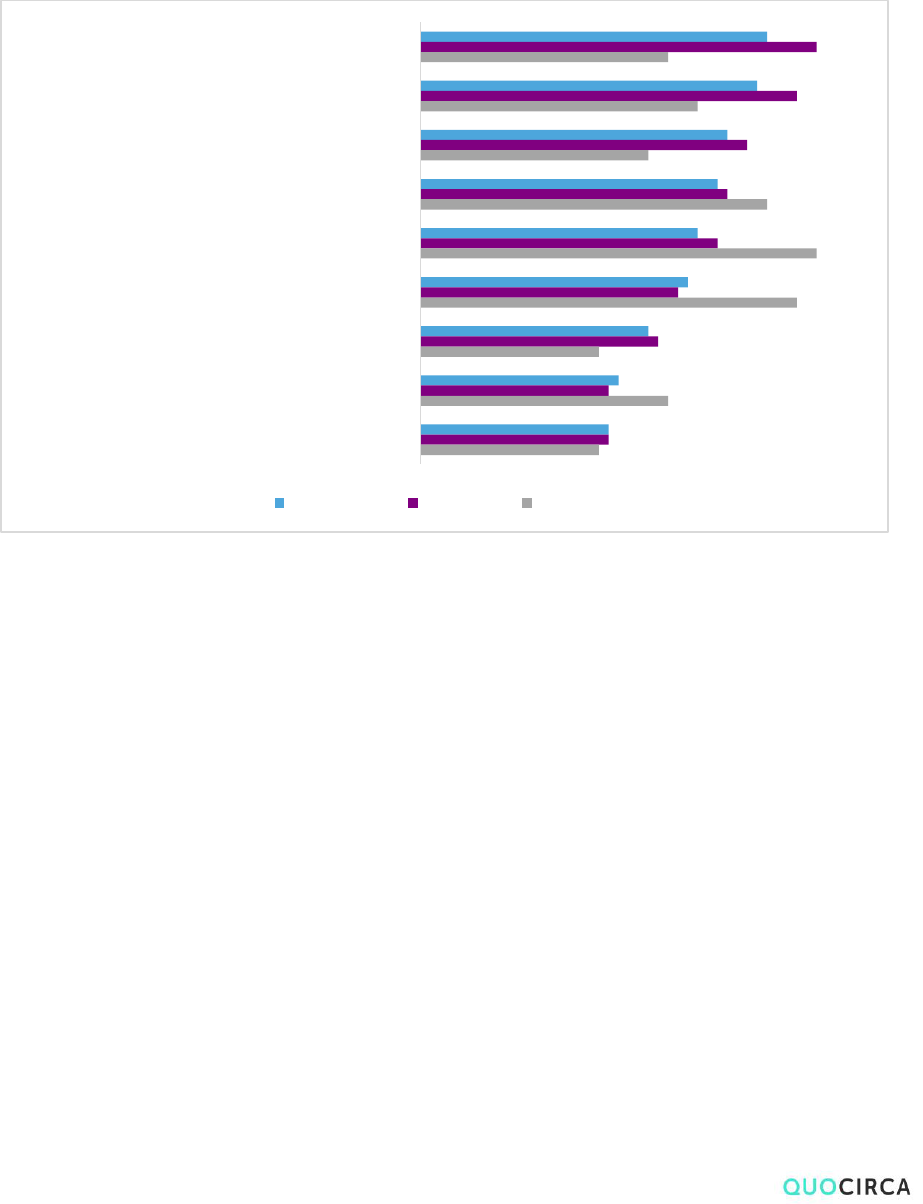

Perhaps unsurprisingly, given the broader IT security threat landscape, printers are ranked lower than other

areas of IT when it comes to security risks (Figure 1). This varies distinctly by region. US and UK organisations

are most likely to rank office printing as a top risk (25% and 26%, respectively), with US organisations most likely

to consider home printing a risk – 25%, compared to just 14% of UK organisations.

Notably, CISOs are more likely to consider office printing a security risk (30%), compared to just 18% of CIOs.

This disconnect reflects the potential challenges around priorities that organisations are placing on print

security. If these stakeholders can work more closely to understand the print security risk, organisations can

gain stronger resilience around their print infrastructure.

Figure 1. Which areas are considered to pose the greatest security breach risk? (Top 10 shown)

25%

25%

25%

19%

23%

26%

30%

17%

28%

34%

14%

17%

13%

18%

18%

15%

17%

35%

26%

22%

16%

15%

13%

28%

18%

21%

18%

26%

21%

23%

18%

14%

26%

21%

24%

17%

23%

36%

31%

32%

0% 5% 10% 15% 20% 25% 30% 35% 40%

Connection from corporate network to external services

Employees-owned home printers

Office Print infrastructure

Public cloud services

Traditional user end points (PCs notebooks etc.)

Employer-provisioned home printers

Other devices attached to a home network (e.g. cameras, voice

assistants, etc)

Email

Public networks

A cloud or hybrid application platform

UK France Germany US

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 8

Print security challenges are harder to keep up with

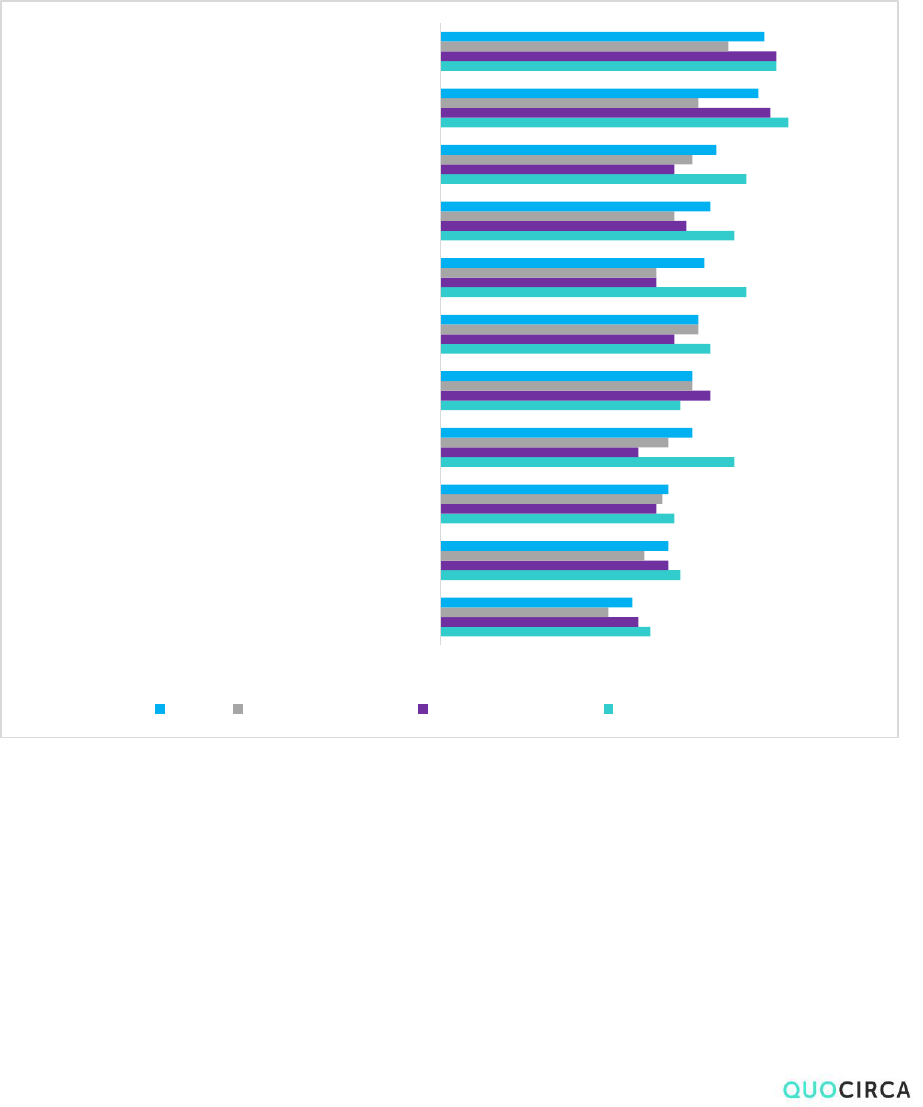

When asked to identify their top three challenges around print security, 35% of respondents chose maintaining

printer management software at a suitable level of security capabilities, with 34% choosing protecting sensitive

or confidential documents from being printed, and 31% choosing securing printing in a remote/home

environment (Figure 2). The level of disconnect between CIOs and CISOs stands out. CIOs rank their top three

challenges as maintaining security levels of print management software, document security, and remote/home

printing. In contrast, CISOs’ top challenges are related to data and hardware security. This may point to differing

levels of understanding of the print infrastructure risks seen earlier.

Figure 2. Which of the following do you consider to be the biggest print security challenges?

Consequently, keeping up with print security challenges remains problematic for many organisations (Figure 3),

with 39% overall stating that it is either considerably or somewhat harder. This is, however, down from 2022,

when over half stated that it was somewhat or considerably harder. The US has the largest number of

respondents stating that it has become considerably harder (13%), but also the highest proportion stating that

it has become somewhat or a lot easier (39%). Mid-market organisations are struggling the most, with 50%

stating that they find it either somewhat or very difficult to keep pace with print security challenges.

CIOs are finding it far harder (50% considerably or somewhat harder) than CISOs (28%) to keep pace. This should

not be a surprise: CIOs have a far broader range of issues to keep pace with, while CISOs should be more focused

purely on security issues.

35%

34%

31%

30%

28%

27%

23%

20%

19%

40%

38%

33%

31%

30%

26%

24%

19%

19%

25%

28%

23%

35%

40%

38%

18%

25%

18%

Maintaining security levels of print management software

Protecting printing of sensitive/confidential documents

Securing printing in a remote/home environment

Tracking and monitoring print activity

Knowing what data is stored across the print environment

Maintaining printers at a suitable level of hardware security

Understanding the evolving print security landscape

Zero-day attacks using the print infrastructure as a means of

attack

Reporting on print activity

Total (n=507) CIO (n=88) CISO (n=40)

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 9

Figure 3. How do you feel about keeping up with print security challenges and demands?

9%

9%

4%

8%

13%

14%

3%

30%

33%

34%

34%

24%

36%

25%

35%

39%

47%

44%

23%

32%

53%

18%

15%

10%

10%

27%

11%

18%

7%

4%

3%

5%

12%

7%

3%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Total UK France Germany US CIO CISO

It has become considerably harder It is somewhat harder

It is neither harder nor easier It is somewhat easier

It is a lot easier

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 10

Taking measures to address print security

Organisations are taking different approaches to managing the security of their print infrastructure (Figure 4).

While 31% indicate they use an MPS provider, over half (54%) indicate that they use a managed security services

provider (MSSP) to manage both print and IT security. This rises to 58% amongst smaller organisations (249–499

employees).

This potentially has a bearing on their concerns and confidence in managing print security.

Figure 4. How do you currently manage print security?

31%

23%

34%

33%

54%

58%

52%

53%

16%

20%

14%

15%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Total 250-499 employees 500-999 employees 1,000+ employees

We manage print security internally

We use a managed security services provider that manages the IT and print environment

We use a third-party managed print services provider

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 11

Print security spend is increasing

Print security spend continues to rise. Overall, 79% of respondents expect their security spend to increase in the

coming 12 months, rising to 86% in the US and dropping to 72% in Germany.

Organisations are using their allocated security budgets to invest in a variety of print security products and

services (Figure 5). Adoption of print security varies by organisation size – larger organisations are more likely

to be implementing formal print security assessments (56%) and data loss prevention (DLP) tools (58%). They

are also more likely to be undertaking security audits of cloud and MPS providers (51%).

Overall, 38% have adopted a zero-trust approach to print security, with a further 39% indicating that they plan

to adopt this in the next 12 months.

Figure 5. Has your organisation implemented any of the following print security measures?

35%

40%

39%

49%

40%

45%

51%

49%

51%

58%

56%

33%

38%

36%

33%

45%

39%

36%

41%

39%

55%

56%

28%

34%

37%

38%

42%

43%

36%

39%

42%

43%

48%

32%

38%

38%

42%

42%

43%

44%

45%

46%

53%

54%

0% 10% 20% 30% 40% 50% 60% 70%

SIEM integration (implementing print security tools that

integrate SIEM platforms)

Contactless printing (pull printing)

Adopting a zero-trust security architecture which treats

all endpoints, including printers, as hostile

Revised company’s security/BYOD policies to include

printers purchased by employees for home use

Reporting and analytics e.g. monitor home and office

print usage

Providing authorised printers to home workers that

adhere to company security policies

Formal assessments and security audits of cloud and

MPS providers

Secure cloud print job submission e.g. from remote

locations to printers/MFPs located in the office

Having a formal process to respond to print security

incidents, including remediation

Content security solutions such as data leak prevention

(DLP)

Formal print security and risk assessments

Total 250-499 employees 500-999 employees 1,000+ employees

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 12

Print security leaders are most confident in the security of the print

infrastructure

To understand and compare the extent to which organisations are adopting these measures, Quocirca has

created a Print Security Maturity Index based on the number of measures implemented by our research sample,

dividing them into leaders, followers, and laggards.

• Leaders have implemented six or more of the measures (i.e., more than 50% of the measures indicated

in Figure 5).

• Followers have implemented between two and five measures.

• Laggards have implemented one or none of the measures.

Overall, 27% are classed as print security leaders (up from 18% in 2022), rising to 31% in the US (Figure 6).

Germany has the largest proportion of laggards (29%). Large organisations have the highest proportion of

leaders (30%), with mid-market and SMBs having 23% each. Company size and being a laggard have correlation,

however – 21% of SMBs are laggards, compared to 17% of the midmarket and 11% of large organisations.

Business and professional services organisations have the largest proportion of leaders (37%), followed by retail

(32%). The public sector has the lowest proportion of leaders at 18%. The number of laggards is similar across

all verticals, ranging from 13–17%.

Overall, 76% of print security leaders use MPS, compared with only 52% of those in the follower segment and

42% of laggards. Of leaders, 33% expect their overall security spend to increase by more than 26% over the next

12 months, compared to 20% of followers and 13% of laggards.

Figure 6. Quocirca’s Print Security Maturity Index by country

27%

27%

26%

18%

31%

23%

23%

30%

59%

59%

52%

52%

65%

57%

60%

58%

15%

14%

22%

29%

4%

21%

17%

11%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Total UK France Germany US 250-499

employees

500-999

employees

>1,000

employees

Leader Follower Laggard

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 13

Overall, only 19% of respondents are completely confident that their print infrastructure is secure, compared to

23% in 2022 (Figure 7). A further 50% are mostly confident, compared to 34% in 2022.

However, overall levels of confidence are growing, with 69% being mostly or completely confident in their

environment now, compared to 60% in 2022. US respondents are the most confident, with 28% reporting they

are completely confident, compared to just 8% in France, 16% in Germany, and 17% in the UK. Mid-market

organisations report the highest confidence (27%), compared to 19% of large organisations and 11% of SMBs.

Business and professional services are the most confident at 28%, with industrials the least confident at 12%.

CIOs, at 24%, are far more confident than CISOs at 15%.

Print security leaders (33% completely confident) are ahead of followers (16%) and laggards (8%). Notably,

organisations using MPS have the most confidence in their print security. While just 10% of organisations not

using MPS are confident in the security of their print infrastructure, this rises to 26% amongst organisations

using MPS.

Figure 7. How confident are you that your organisation's print infrastructure (office and remote workplace)

is protected from security breaches and data loss?

19%

17%

8%

16%

28%

11%

27%

19%

50%

49%

50%

47%

51%

50%

43%

53%

27%

30%

34%

35%

18%

34%

25%

25%

3% 3%

7%

1%

2%

4% 4%

2%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Total UK France Germany US 250-499

employees

500-999

employees

1,000+

employees

Completely confident Mostly confident Moderately confident

Not that confident Not at all confident Do not know

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 14

Print-related data loss, cost, and impact

The majority report print-related data losses, particularly in smaller organisations

The research shows that 61% of organisations have reported at least one print-related data loss over the past

12 months (Figure 8), rising to 63% in the UK and 67% in organisations with 500–999 employees, and dropping

to 57% amongst large organisations. These figures are in line with the 2022 findings, showing that little has

changed in enhancing the security of a print data environment. Retail organisations are most likely to have

experienced a data loss during the period (67%), while the public sector reported the lowest volume of data

breaches (48%). No data losses were reported by 32% of CIOs, against 25% of CISOs. Here, it seems that CISOs

are not keeping the CIOs up to speed with what is happening – this is dangerous both in overall management

and because of the possibility for any data leak to have reputational and/or legal ramifications.

As in 2022, midmarket organisations state the highest confidence levels in the security of their print platforms,

yet also disclose the highest number of data breaches. This shows an obvious disconnect between perception

and reality. The channel should help provide solid security audits, backed up with advice that will enable an

organisation to better understand its security risks. The organisation can then make better decisions on what it

implements as adequate security measures, aided by the channel partner.

Reported data losses for those operating a mixed fleet of printers (63%) are considerably higher than those with

a standardised fleet (56%). For MPS providers this opens up major opportunities to move customers to a

managed, single-vendor fleet in order to better control data security – focusing on the message that data

breaches result in material business and reputational costs to an organisation.

MPS users report a lower level of security breaches (59% reporting at least one print-related security breach)

than those with no MPS or plans to implement one (66%).

The level of data loss and print security maturity also have correlation. Overall, 47% of print security leaders

report one data loss or more, compared to 65% of followers and 68% of laggards. Although this shows that being

a security leader does help, it is still worrying that nearly half of leaders have experienced one data leak or more.

This demonstrates the need for robust security measures regardless of MPS usage, as well as for help from

external partners to ensure the security measures have been implemented and are being operated effectively.

Figure 8. Level of data losses through printers/MFPs due to unsecure printing practices (in the past 12 months)

When asked to consider the reasons behind the print-related data losses they had suffered, 56% cited

vulnerabilities around home printers, such as homeworkers not disposing of confidential information securely.

Of these respondents, 44% indicated that confidential data had been intercepted in transit, 32% cited unsecure

handling of printed output in the office, and 30% reported insecure disposal of printed output. This should focus

organisations on the home-printing security issue, but it has not been the case to date. MPS providers can help

61%

63%

58%

62%

60%

63%

67%

57%

52%

54%

56%

58%

60%

62%

64%

66%

68%

Total UK France Germany US 250-499

employees

500-999

employees

1,000+

employees

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 15

by bringing this dichotomy to the table and showing how a suitable MPS can help manage the flow and output

of information across the whole hybrid workplace.

The cost of a print-related data breach

The average cost of a data breach is over £743,000 per breach, rising to approximately £1,338,000 in France and

falling to a little over £492,000 in the UK (Figure 9). The sizes of organisations show correlation: large

organisations see losses averaging £1,103,000 per breach, with SMBs seeing losses of £400,000. Business and

professional services see the highest cost of a breach (£1,219,000), with the public sector experiencing the

lowest cost (£419,000). The security index also shows correlation: security leaders see average losses of

£713,500, compared to followers with £992,700 and laggards with £1,240,800. This provides a solid platform for

the channel to show how lack of suitable controls can lead to major financial losses – and the probability of

reputational ones piling on top of this.

Figure 9. Estimated average cost of a data breach (n=308 that reported a data breach)

£743,086

£492,254

£1,338,015

£1,114,343

£822,965

£400,258

£455,028

£1,103,497

£0

£200,000

£400,000

£600,000

£800,000

£1,000,000

£1,200,000

£1,400,000

£1,600,000

Total UK France Germany US 250-499

employees

500-999

employees

1,000+

employees

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 16

The broad consequences of a data breach

Beyond the simple direct costs of a data breach, organisations also report a range of other impacts (Figure 10).

The highest impacts overall are on the amount of time it takes the IT team to respond to and manage the issue

(30%), along with the negative impact on business capability (30%). Negative impact on business capability has

much greater effect on large organisations (35%), compared to 23% of the midmarket and 28% of SMBs.

Similarly, for 33% of large organisations, time lost to waiting for IT to respond to a breach is a major issue,

compared to 26% of the midmarket and 28% of SMBs. SMBs and the midmarket find that breaches of internal

personal information are of greater impact than large organisations, as well as lost revenue.

Figure 10. What were the major impacts of these data losses? Select all that apply

28%

28%

19%

23%

19%

27%

16%

16%

11%

26%

14%

12%

3%

23%

26%

18%

25%

19%

25%

16%

15%

18%

20%

15%

17%

3%

35%

33%

29%

28%

26%

23%

23%

18%

18%

17%

16%

14%

2%

Negative impact on business capability

Lost IT time to respond/manage issue

Loss of staff (either due to resignations or sackings in relation to

data breach)

Data breach of customer info

Business disruption

Data breach of internal personal information

Reputational damage

Fine via government data commissioner

Lost intellectual property

Lost revenue

Lost customers

Fine via other body (e.g. trade body)

No major impact

250-499 employees 500-999 employees 1,000+ employees

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 17

Organisations using MPS are most satisfied with print security

US respondents have the largest percentage (50%) that are very satisfied with their print supplier’s security

capabilities (Figure 12), with German respondents least satisfied (17% very satisfied). Just 27% of industrial

organisations are very satisfied, along with 28% of public sector organisations, compared to 38% of business and

professional services organisations. Suppliers have an opportunity here to drive up satisfaction rates by

extending their security offerings and working with customers to increase confidence in print security.

Overall, 39% of those using an MPS are very satisfied with their current print supplier, compared to 23% that

are not using MPS. This shows how the services that fall under an MPS offering can lead to better relationships

with customers and longer ongoing loyalty. However, whereas 42% of CIOs state that they are satisfied with

their print supplier’s security capabilities, only 23% of CISOs are – yet again demonstrating a major disconnect

between these two closely related roles.

Figure 12. How satisfied are you with your print supplier’s capabilities when it comes to securing your print

infrastructure?

32%

22%

23%

17%

50%

39%

23%

58%

65%

67%

67%

45%

53%

64%

9%

13%

8%

15%

5%

7%

11%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Total UK France Germany US MPS user Non-MPS user

Very satisfied Quite satisfied Neither satisfied nor unsatisfied Quite unsatisfied Very unsatisfied

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 18

Recommendations

Print security spend is expected to continue to grow over the next 12 months, creating ongoing opportunities

for print manufacturers, managed print service providers, and channel partners. It is clear that organisations

using MPS and those that have adopted a range of print security measures are ahead of the curve.

Demonstrating how MPS can improve the security resilience of the print infrastructure will enable suppliers to

shape their propositions across both the office and home printing environments.

Supplier recommendations

Quocirca recommends that suppliers address the following areas:

• Bridge the CIO and CISO divide. In larger organisations, the responsibility for print security may often

be fragmented across different IT and business stakeholders. While CIOs have a strategic focus across

the IT infrastructure, CISOs are fully focused on security. Given the awareness gap across these

decision-makers, suppliers should elevate positioning and messaging of print security to a strategic

level. This can support the alignment of print security priorities as CIOs and CISOs develop a more

collaborative relationship.

• Deliver consistent security across the hybrid environment. Many home printers that are purchased by

employees will not conform to the security requirements of the business. Ensure that security-led MPS

offerings help address this shadow purchasing through either centralised remote monitoring or

provision of authorised devices for home use. While standardised environments generally have a higher

level of hardware security compared to a mixed-fleet environment, many organisations operate a mix

of device brands across office and home environments. This creates a need for integrated third-party

print management platforms that can manage document security consistently across a heterogenous

fleet. Nevertheless, this presents an opportunity for MPS providers to transition customers to a

standardised environment to gain tighter security across their print infrastructure.

• Create clarity around zero trust-led offerings. There is no one-size-fits all to zero trust. Be clear on how

this works with legacy devices and avoid the misuse of the term zero trust – or ‘zero trust-washing’ –

to create the perception of robust security. Zero trust in the print landscape can be best achieved

through micro-segmentation and integration with multifactor authentication and identity and access

management (IAM) platforms. Demonstrate credentials and expertise in this area through focusing on

strategic principles and partnerships. This will also build trust with customers that need a secure move

to a cloud-based print infrastructure.

• Harness MPS as an enabler for enhanced security. Organisations using MPS and a range of security

measures – from formal security assessments, audits, and solutions – are ahead of the print security

curve – in terms of both confidence and lower data loss. Scalable and flexible security services and

solutions will appeal to smaller organisations that are not immune to security risks yet do not have the

budget to implement advanced print security measures. Offering regular security reviews as business

needs change will also be key to improving satisfaction levels around print security.

Buyer recommendations

The print security threat landscape has expanded to include a variety of home and office devices to support new

hybrid ways of working. As intelligent networked devices, MFPs present a weak link in IT security. This can be

mitigated with a range of measures based on an organisation’s security posture.

Buyers should consider the following actions:

• Treat print security as a strategic priority. Print and IT security must be integrated and considered a

higher priority. Elevate the importance of securing the print infrastructure to both CIO and CISO

stakeholders so that they are aligned on understanding the risks, and the measures that can be

implemented to mitigate risks, of unsecured printing.

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 19

• Conduct in-depth print security and risk assessments. Organisations should look to providers that can

offer in-depth assessments of the print environment. Security audits can uncover potential security

vulnerabilities across device and document security. For organisations operating a mixed fleet, this may

help in understanding the opportunities for device optimisation using a single fleet with consistent

hardware security features.

• Ensure remote and home workers can print securely. Ensure printers conform to corporate security

standards, and in cases where employees have purchased their own printers, develop security

guidelines on whether and how these printers can be used. Evaluate print management platforms for

support and security monitoring of home printing.

• Build a cohesive print security architecture. Piecemeal security solutions rarely deliver consistent and

robust security, particularly across a hybrid work environment. Consider an integrated security platform

that can support capabilities such as pull printing, remote monitoring, and reporting across the full

fleet. Extend print security to content and workflow through the use of content security and data loss

prevention (DLP) tools at the application level. Carefully evaluate vendor zero-trust claims and ensure

integration with multi-factor authentication platforms already used in the organisation. Evaluate

whether secure print management solutions can operate in a microsegmented network.

• Formalise processes to respond to print security incidents. Organisations must ensure that they are

prepared for this and have the right processes in place in order to deal with the technical, legal, and

reputational fallout from such a breach. This requires the organisation working together to create an

embracing set of policies.

• Continuously monitor, analyse, and report. Ensure that data from existing security devices, such as

security information and event management (SIEM) devices, is collected and analysed to show what

has been happening, what is happening now, and what may happen in the future. Ensure that such

systems cover as much of the overall platform as possible, and use the insights gained to work on

plugging holes in your organisation’s security.

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 20

Vendor landscape

Quocirca has created a snapshot of the positioning of vendors in the Global Print Security market (Figure 14).

Please note, because of varying service offerings for each vendor and regional differences, this is intended for

guidance only.

The graphic represents Quocirca’s view of the competitive landscape for vendors based on the following

categories:

1. Leaders: Vendors with a strong strategic vision and a comprehensive print security product and

service offering. Leaders have made significant investments in their hardware, solutions and services

portfolio, and infrastructure, and also demonstrate a strong vision for future strategy.

2. Major players: Vendors that have established and proven offerings and are continuing to develop

their solutions service portfolio. These vendors are most likely to be strongly focused on the SMB

market with a hardware-centric approach.

Figure 13. Quocirca Print Security Vendor Landscape, 2023

The Quocirca Vendor Landscape is a graphical representation of Quocirca’s opinion of the market and is based on Quocirca’s scorecard

methodology. This information is provided as a visual representation only and should be combined with other sources to determine the

suitability of any vendor. Quocirca does not endorse any vendor, product, or service. Information is based on best available resources

and opinions reflect judgment at the time. All opinions are subject to change.

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 21

Vendor profile: Xerox

Quocirca opinion

Xerox has advanced its leadership position in Quocirca’s assessment of the print security market in 2023. Xerox

has refined its security strategy, deepened investment in its service portfolio, and enhanced its go-to-market

enablement. Its security-centric hardware portfolio is complemented by a broad range of flexible and scalable

security services and solutions that it delivers to both SMBs and large multiregional and global customers with

stringent security needs. Xerox particularly stands out for its strong legacy in the managed print services (MPS)

sector and expertise in delivering comprehensive security assessments. Its depth of experience and capability in

securing and optimising document workflow processes is among the strongest in the industry.

Over the past year, it has amplified its global security messaging and adopted a multi-layered security portfolio

that conforms to a set of zero-trust principles. In particular, Xerox has deepened its capabilities across device

security, fleet management and content security. Notable advancements have been made in areas such as

certificate management, firmware management, vulnerability management, security monitoring, and

automated remediation.

Xerox products conform to a broad range of industry certifications, including ISO 27001, ISO 22301, SOC2, SOC3,

and FedRAMP. Most recently it introduced a private bug bounty programme in partnership with HackerOne to

proactively identify and remediate potential vulnerabilities in the Xerox AltaLink 8100 Series printers. Robust

security extends to Xerox cloud services such as Workplace Cloud, which enables secure print management and

fleet management, and is also FedRAMP authorised.

By virtue of strong capabilities across print, capture, and workflow, Xerox is a good strategic choice for

organisations that are strongly reliant on printing and looking to mitigate security risks across their document

processes.

Vendor highlights

Xerox’s products and services portfolio includes a range of solutions and services that include Managed Print

Solutions (MPS), Capture & Content Services (CCS), Customer Engagement Services (CES), and IT Services. As a

result of continued R&D investment, Xerox has filed in excess of 600 security-related patents. All Xerox-

developed products comply with the Xerox Product Security Standard (XPSS) modelled on NIST SP 900-53.

Vulnerability scans, penetration testing, and ethical hacking are performed throughout the product lifecycle to

uncover, fix, and validate vulnerabilities.

Security-centric hardware portfolio

Xerox ConnectKey Technology-enabled devices are certified to Common Criteria (ISO/ IEC 15408) and FIPS 140-

2/140-3, and include a range of capabilities to prevent malicious attacks, malware, and unauthorised attacks.

This includes intrusion prevention, digital signed system software, user authentication, firmware verification

(either at start-up on selected devices or upon user activation), Trellix whitelisting technology, and integration

with Cisco’s Identity Services Engine, which can be used for security policy and compliance. Xerox also offers

cloud Identity Provider (IdP) integration with Okta, Ping Identity, and Microsoft Azure as standard, and provides

multi-factor authentication. In addition, further device and document security functionality, such as encrypted

PDF, hardware disk and memory overwrite, and audit logs, are supported.

Its compliance programme provides independent assurance over its security policies and controls, and it has

achieved certifications including ISO 27001, SOC2, FedRAMP, PCI DSS, and more. Xerox was also the first to

receive security authorisation from FedRAMP for cloud-based managed print services.

Robust security framework across hardware, solutions, and services

The Xerox security framework is based on four key elements: secure device management, fleet management,

print management, and secure content management. At a device level, this includes a range of capabilities to

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 22

prevent malicious attacks, malware, and unauthorised attacks. This includes intrusion prevention, digital signed

system software, user authentication, firmware verification (either at start-up on selected devices or upon user

activation), Trellix whitelisting technology, and integration with Cisco’s Identity Services Engine.

Secure fleet management provides fleet-wide policy enforcement and automated remediation for compliance

with security policies aligned to device firmware, passwords, security settings, and device certificates. Xerox also

provides proactive security monitoring. Xerox Printer Security Audit Services use a centralised policy mechanism

and device grouping to streamline fleet management.

Secure data and content management is enabled through the content security feature of Xerox Workplace Cloud

and Workplace Suite solution. This provides a capability to detect predefined sensitive content and generate

alerts and reports based on how that data is used. In addition, the Xerox Workplace Cloud solution encrypts

content in transit and at rest. Content stored in the cloud at Xerox can be encrypted using a client’s own

encryption key.

Expanded software integration and vulnerability management

Integration with security solutions including Security Information and Event Management (SIEM) solutions from

Trellix (formerly McAfee Enterprise), LogRhythm, and Splunk simplify reporting and management of security

events. Of note are Xerox’s Printer Security Audit Service (on-premise or via a private hosted cloud) and

advanced fleet monitoring, which includes security monitoring and SIEM integration.

Recent developments include Device Certificate Management, which provides remote configuration,

monitoring, and automated remediation for digital certificate policies, and the launch of its Bug Bounty

programme in partnership with HackerOne in December 2022.

Deep content and capture security capabilities

Beyond its security feature-rich ConnectKey hardware portfolio, Xerox particularly stands out for its extensive

content and capture solutions, which include advanced content and data loss prevention functionality. Xerox

excels in the area of analytics and reporting, providing in-depth assessments and continuously monitoring the

risk profile of its customers’ print environments.

Vendor strengths and opportunities

Strengths

• Strong commitment to enhancing product portfolio to most stringent security certifications. Broad

spectrum of certifications, including ISO 27001, SOC2, FedRAMP, and PCI DSS. Heavy investment in

R&D, more than 600 security-related patents filed.

• A clear approach to zero trust. Xerox has developed a clear proposition around zero trust that

encompasses authentication, monitoring, remediation, and automation. It now offers advanced

hardware-security features, such as Trusted Boot on selected products, with plans to expand it to more

of the portfolio, as well as firmware and BIOS protection all AltaLink and VersaLink products. These

position Xerox devices strongly in the market.

• Comprehensive assessment and analytics capabilities. Xerox has proven expertise in the MPS market

and deep capabilities when it comes to security assessments. This enables it to offer valuable insight

into the security vulnerabilities of existing multivendor environments, and equally demonstrate how a

standardised Xerox fleet supported by its security services and solutions can mitigate risk.

• Globally consistent sales enablement platform. Over the past year Xerox has invested in training and

resources to support its direct and indirect channels. It has executed an effective marketing campaign

that helps demystify the complexity of security, which strengthens its position not only with end users,

but also channel members that need to build or enhance their security service offering.

Opportunities

• Further expand IT services offerings to the SMB market. Xerox has made strong inroads into the IT

services space and can further leverage partnerships to build packaged security services offerings for

channel partners in both IT and the traditional print sector.

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 23

• Enhance use of ML/AI to support anomaly detection. This advancement could extend Xerox’s

capabilities beyond breach protection to further detect and remediate against new and advanced

threats.

• Build MSSP relationships. Whilst Xerox is more than capable of delivering Managed Print Security in its

own right, many customers will seek to work with a Managed Security Services Provider for all aspects

of their security, including print. Xerox needs to ensure it has the right relationships with the leading

providers in this space.

The Print Security Landscape, 2023 May 2023

© Quocirca 2023 24

About Quocirca

Quocirca is a global market insight and research firm specialising in the convergence of print and digital

technologies in the future workplace.

Since 2006, Quocirca has played an influential role in advising clients on major shifts in the market. Our

consulting and research are at the forefront of the rapidly evolving print services and solutions market, trusted

by clients seeking new strategies to address disruptive technologies.

Quocirca has pioneered research in many emerging market areas. More than 10 years ago we were the first to

analyse the competitive global market landscape for managed print services (MPS), followed by the first global

competitive review of the print security market. More recently Quocirca reinforced its leading and unique

approach in the market, publishing the first study looking at the smart, connected future of print in the digital

workplace. The Global Print 2025 study provides unparalleled insight into the impact of digital disruption, from

both an industry executive and end-user perspective.

For more information, visit www.quocirca.com.

Usage rights

Permission is required for quoting any information in this report. Please see Quocirca’s Citation Policy for further

details.

Disclaimer:

© Copyright 2023, Quocirca. All rights reserved. No part of this document may be reproduced, distributed in any form, stored

in a retrieval system, transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or

otherwise, without express written permission from Quocirca. The information contained in this report is for general

guidance on matters of interest only. Please note, due to rounding, numbers presented throughout this report may not add

up precisely to the totals provided and percentages may not precisely reflect the absolute figures. The information in this

report is provided with the understanding that the authors and publishers are not engaged in rendering legal or other

professional advice and services. Quocirca is not responsible for any errors, omissions or inaccuracies, or for the results

obtained from the use of this report. All information in this report is provided ‘as is’, with no guarantee of completeness,

accuracy, timeliness or of the results obtained from the use of this report, and without warranty of any kind, express or

implied. In no event will Quocirca, its related partnerships or corporations, or its partners, agents or employees be liable to

you or anyone else for any decision made or action taken in reliance on this report or for any consequential, special or similar

damages, even if advised of the possibility of such damages. Your access and use of this publication are governed by our

terms and conditions. Permission is required for quoting any information in this report. Please see our Citation Policy for

further details.