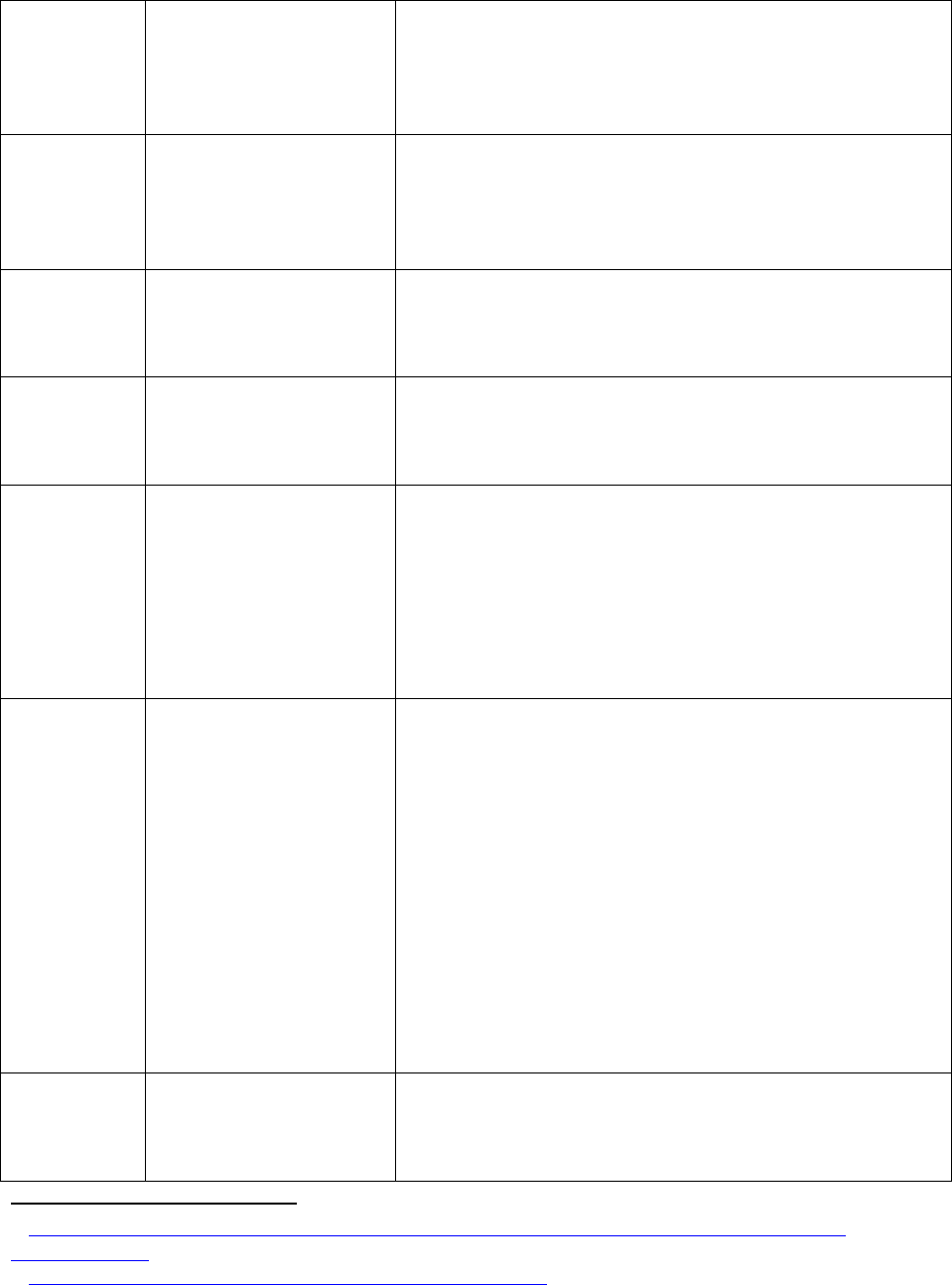

Affordable Mortgage Products from NYMC Lenders

Bank

Product

Description

Astoria,

1

HSBC BANK

USA, N.A.,

2

M&T

3

First Home Club

Up to $7,500 towards down payment and closing costs

Savings program matches $4 for every $1 you save, up to

$1,875

Savings plan runs 10-24 consecutive months

First time buyers

For 1-4 family homes, condos, co-ops, and manufactured

homes.

Total household income of up to 80% of Area Median

Income.

Must complete homebuyer education course, minimum 6

hours.

Must be mortgage ready in 24 months.

Astoria,

HSBC BANK

USA, N.A.,

M&T

4

, Valley

National

SONYMA

1-4 family, condos, and co-ops

3% down payment, 5% for co-ops

1% minimum buyer contribution, 3% for co-ops and 3-4

families

20, 25, and 30-year fixed rate terms

100 day lock required

Exempt from Qualified Mortgage/Ability to Repay rules

45% max DTI

Low mortgage insurance premiums

Down payment assistance loan available – 0% interest,

greater of $3000 or 3% of purchase price

Must meet 100% of AMI and purchase price limits

97% LTV for 1-2 family, 95% LTV for co-ops, 90% LTV for 3-4

family

Homebuyer counseling required

First-time homebuyer, except eligible military veterans or

property in Federally Designated Target Area

Astoria

5

Affordable Housing

Program

30 year fixed rate or 5/1 year ARM

Income limits.

First time buyers.

Bank of

America

6

HPD HomeFirst Down

Payment Assistance

Program

Up to $15,000 toward down payment or closing costs

Must be a first-time homebuyer

Must complete a homebuyer education course

Must have own savings to contribute to the down payment

or closing costs

1

http://www.fhlbny.com/members/faqs/first-home-club.aspx

2

http://www.us.HSBC Bank USA, N.A..com/1/2/home/personal-banking/mortgages/home-buying/first-time-

home-buyers

3

https://www.mtb.com/aboutus/community/Pages/FirstHomeClub.aspx

4

http://www.us.HSBC Bank USA, N.A..com/1/2/home/personal-banking/mortgages/faq

5

https://www.astoriabank.com/mortgage-rates/

6

http://www.nyc.gov/html/hpd/html/buyers/downpayment.shtml

Meet program income eligibility requirements, varying

based on family size.

Must purchase a 1-4 family home, a condominium, or a

cooperative for owner-occupancy in one of the five

boroughs of New York City

Home purchased must pass Housing Quality Standards

(HQS) inspection before Purchase

Must live in the home purchased for at least 10 years

Bank of

America,

CapitalOne,

Chase, Citi,

M&T,

Municipal

Credit Union

FHA and VA Mortgages

Minimal down payment requirements

More flexible guidelines than conventional loans

No maximum income limits

Bank of

America

America’s Home Grant

Up to $5,000 closing cost assistance

Can be layered with other down payment assistance

programs

Must be owner-occupied

Available with conforming conventional, FHA and VA loans

Homebuyer education required for first-time homebuyers

Income limit: $54,400 or $200,000 in LMI census tract

First mortgage must be conforming conventional, FHA or VA

Bank United

Portfolio Product

First-time homebuyers only

Student loan debt not counted in payment if deferred for

more than 12 months

No PMI

Can use 100% alternative credit references

Minimum 640 credit score, with exceptions

Minimum borrower contribution 1%

Seller contribution of up to 6%

2nd mortgage at same rate/term as first up to 95% CLTV

Up to 105% CLTV when local subsidies are being used

Compatible with local subsidy and down payment

assistance programs

Recent Graduate Home Loan Program option:

Can close with offer letter prior to starting employment

minimum 5% down from borrowers own funds, 10% total

No PMI

Fixed rate and RM

CapitalOne

7

Community Homebuyers’

Program

97% financing with minimum 620 credit score

No PMI

30 and 40 year fixed rate, no points

Down payment 3% borrower contribution

1-4 unit properties, co-ops and condos

Closing cost grants available up to $3000/$6000

7

http://www.capitalone.com/media/doc/about/capitalone-sustainability-report.pdf PG 11

Some down payment assistance programs allowed

No pre-payment penalty

Must have 2 years established credit (no mix of

traditional/non traditional)

Homebuyer and landlord education required

Can be used for refinancing but no CCA

Allow for deed restrictions

Portfolio mortgage product

Chase

8

DreaMaker

Credit Flexibility and closing cost assistance.

Minimum 620 credit score

Up to 105% CLTV

Fixed-rate mortgages up to 30 year terms.

Used to purchase a 1 to 4 unit primary residence.

Down payment minimum of 5% - 3% required from

borrower’s own funds.

For borrowers up to 100% AMI

Mortgage insurance required for under 20% down payment

Non-traditional credit available for first time homebuyer

Chase

Homebuyer Grant

9

Up to $1,500 to lower interested rate or closing cost

assistance

Income and location restrictions apply

Citi

Conventional Community

Lending Programs

10

1-2 family residence, condos, PUDs, or rate & term

refinance

Down paments as low as 3%-5%

Low or no cash reserves required

Income and/or geographic restrictions may apply

Low down payment programs

Alternative credit evaluation allowed for borrowers with

limited or no credit history

Flexibility on ratios

Citi

HomeRun

Up to 97% LTV

No mortgage insurance

Down payment as low as 1% borrower contribution, 2%

gift/assistance. 5% minimum for 2-unit properties

Available only in Citibank assessment areas, income up to

80% AMI or specific census tracts.

10, 15, 20, 25, and 30 year terms

Minimum credit score of 640. Alternative credit evaluations

allowed.

First-time and repeat homebuyers may qualify

8 hours homeownership education and counseling

required.

Single-family homes, condos, co-ops, PUDs, 2-unit

8

https://www.chase.com/mortgage/home-loans/types-of-mortgages#!drop3:fhal,dmm,jm,val

http://oregonon.org/files/2014/07/23013C_DreaMaker_ProspKit-Flyer_0515.pdf

9

https://www.chase.com/snippets/mortgage/modular/homebuyer-grant-modal

10

http://www.citibank.com/citimortgage/mymortgage/branchlo/programs/comprog.htm

properties (NYC only)

Enhancements:

Non Warrantable Condo Feature

No Counseling Feature

Student Loan Policy

Citi

Closing Cost Assistance

Up to $1500 credit towards closing costs for borrowers in a

low or moderate income census tract.

Up to $1500 credit towards closing costs if borrower

income is less than 80% AMI.

Buyers may be entitled to both grants.

Citi

Bond Programs

Typically offer below market interest rates to first time

homebuyers

Income, purchase price and geographic restrictions may

apply

Citi

Community Assistance

Programs

Funds to assist with down payment and/or closing costs

Provided by federal, state, or local government agency or

non-profit organization

Repayment may be required or forgiven over time

HSBC BANK

USA, N.A.

11

CommunityWorks

30 year fixed term

97% LTV.

1 to 4 family, condos, co-ops and PUDs

Down payment minimum 3%

Flexible underwriting guidelines

Closing cost assistance available up to $7,000

Accommodation of eligible assistance such as grants and

subsidies

M&T Bank

12

Get Started Mortgage

97% financing

No income limits in LMI areas or over 50% Minority Census

Tract (otherwise 80% of AMI)

FICO score minimum 680 (2 unit), 700 (3-4 unit)

Down payment minimum borrower contribution 1% (FICO

700) or 5% (condo/co-op/2 unit)

30 year fixed rate

Homeownership and landlord education required

Maximum DTI is 41%, 43% with QM

Only 1% needs to be the borrowers own funds

All other funds required may be included in an Unsecured

Installment loan from M&T

M&T offers a $2,000 grant for closing cost or discounted

interest rate for qualified borrowers

M&T Bank

SONYMA Mortgage

Borrower only needs to have 1% of their own funds

invested

Down payment assistance of $3,000 or 3% of the loan

amount (whichever is greater)

11

http://www.us.HSBC Bank USA, N.A..com/1/2/home/personal-banking/mortgages/special-mortgage-

programs/details

12

https://services.mtb.com/personal/mortgage/buyingahome.asp

Veterans do not have to be a First Time Homebuyer

M&T offers a $2,000 grant for closing cost for properties

located in a LMI Census Tract

M&T Bank

13

SONYMA Remodel New

York

30 year fixed rate

No Points

Down payment minimum 3%, with 1% borrower

contribution

No prepayment penalties

First-time homebuyers (except veterans or Federally

designated target areas)

Income requirements apply.

Existing 1-2 family homes, and condos.

Eligible renovations include repair or replacement of

plumbing, electrical, and heating systems, structural

repairs, additions, modernization of kitchens and

bathrooms, new siding and windows, etc.

Renovation cost must be at minimum the lower of $5000 or

5% of the property’s appraised value after repairs, at

maximum 40% of the property’s appraised value after

repairs.

Municipal

Credit Union,

Valley

National

My Community Fixed

Rate (Fannie Mae)

Fixed rate

1-2 family

MI at 95%

No minimum borrower contribution for single family

2 family requires 3%

Homebuyer must meet FNMA county income limits

Santander

Affordable Mortgage

Program

15 or 30 year fixed rate

Minimum 620 credit score

1 unit 97% LTV/CLTV

2 unit 95% LTV/CLTV

3-4 unit 80% LTV/CLTV

Cash out refinance 80% LTV/CLTV on 1-2 unit

Co-op properties eligible

45% max DTI, 41% for loans with PMI

No income restriction for properties in LMI census tract.

Income restriction of 120% AMI for all other properties.

Minimum 680 credit score for 120% AMI.

Homebuyer education required for first-time homebuyers.

Eligible with closing cost assistance and grants from

approved non-profit Affordable Second/Community Second

sources.

Borrowers cannot own any other real estate at time of

closing

Valley

National

Community Home

Ownership

First-time homebuyers only

97% LTV max.

PMI not required up to 90% LTV.

13

http://www.nyshcr.org/Topics/Home/Buyers/SONYMA/RemodelNewYorkTermSheet.htm

43% max DTI / 38% max DTI with non-traditional credit

verification

1-2 family, condo, and co-ops.

Income limit $55,051 for NYC, $83,975 for Long Island.

No limit for specific census tracts

Minimum 640 FICO

Homebuyer counseling required

Rental income can be up to 75% for 2-family

Valley

National

Home Possible Fixed Rate

(Freddie Mac)

Fixed rate

1-4 family

MI at 95%

No miniumum borrower contribution for single family

2-4 family requires 3%

Homebuyer must meet FHLMC county income limits

Valley

National

SONYMA Achieving the

Dream

20, 25, and 30 year fixed rate

First time homebuyer, requirement waived for eligible

military veterans or property in Federally Designated Target

Area.

Up to 80% of SONYMA AMI and purchase price limits

Homebuyer counseling required

Owner occupied 1-2 family homes. Condos and co-ops must

be SONYMA eligible.

Down payment assistance loan is higher of $3000 or 3% of

purchase price ($15,000 max). Cannot exceed actual down

payment and closing costs. Loan forgiven after 10 years if

financing and residence is maintained.

PMI required over 80% LTV.

97% LTV for 1-2 family, 95% LTV for co-op

45% max DTI

1% minimum cash contribution, 3% for co-ops

Updated December 23, 2015