FEDERAL RESERVE BANK OF SAN FRANCISCO

WORKING PAPER SERIES

The Long-Run Effects of Monetary Policy

Òscar Jordà

Federal Reserve Bank of San Francisco

University of California, Davis

Sanjay R. Singh

Federal Reserve Bank of San Francisco

University of California, Davis

Alan M. Taylor

Columbia University

NBER and CEPR

May 2023

Working Paper 2020-01

https://www.frbsf.org/economic-research/publications/working-papers/2020/01/

Suggested citation:

Jordà, Òscar, Sanjay R. Singh, Alan M. Taylor. 2023. “The long-run effects of monetary

policy

,” Federal Reserve Bank of San Francisco Working Paper 2020-01.

https://doi.org/10.24148/wp2020-01

The views in this paper are solely the responsibility of the authors and should not be interpreted

as reflecting the views of the Federal Reserve Bank of San Francisco or the Board of Governors

of the Federal Reserve System.

The long-run effects of monetary policy

⋆

`

Oscar Jord`a

†

Sanjay R. Singh

§

Alan M. Taylor

‡

May 2023

Abstract

We document that the real effects of monetary shocks last for over a decade. Our approach

relies on (1) identification of exogenous and non-systematic monetary shocks using the

trilemma of international finance; (2) merged data from two new international historical

cross-country databases; and (3) econometric methods robust to long-horizon inconsistent

estimates. Notably, the capital stock and total factor productivity (TFP) exhibit greater

hysteresis than labor. When we allow for asymmetry, we find these effects with tightening

shocks, but not with loosening shocks. When extending the horizon of the responses

reported in several recent studies that use alternative monetary shocks, we find similarly

persistent real effects, thus supporting our main findings.

JEL classification codes: E01, E30, E32, E44, E47, E51, F33, F42, F44.

Keywords: monetary policy, money neutrality, hysteresis, trilemma, instrumental variables,

local projections.

⋆

We are thankful to Sushant Acharya, George-Marios Angeletos, Gadi Barlevy, Susanto Basu, Saki Bigio,

Edouard Challe, Lawrence Christiano, James Cloyne, Julian di Giovanni, St´ephane Dupraz, Martin Eichenbaum,

Charles Engel, Gauti Eggertsson, Antonio Fat´as, John Fernald, Luca Fornaro, Jordi Gal´ı, Georgios Georgiadis,

Yuriy Gorodnichenko, Pierre-Olivier Gourinchas, James Hamilton, Oleg Itskhoki, Jean-Paul L’Huillier, Silvia

Miranda-Agrippino, Dmitry Mukhin, Juan Pablo Nicolini, Pascal Paul, Albert Queralto, Valerie Ramey, Ina

Simonovska, J´on Steinsson, Andrea Tambalotti, Silvana Tenreyro, Mart´ın Uribe, Johannes Wieland, who

provided very helpful comments and suggestions, as did many seminar and conference participants at the

Barcelona Summer Forum, the NBER Summer Institute IFM and EFCE Program Meetings, the Econometric

Society World Congress, the SED Annual Meeting, the ASSA Meetings, Bank of England, the Federal Reserve

Banks of Richmond, San Francisco, St. Louis, and Board of Governors, CEPR MEF Seminar Series, the Midwest

Macro Conference, Northwestern University, Delhi School of Economics, ISI Delhi, IGIDR Mumbai, Salento

Macro, Claremont McKenna College, the Swiss National Bank, the Bank of Spain, the Norges Bank, the Bank

of Finland, Danmarks Nationalbank, Columbia SIPA, UC Berkeley, UC Davis, UC Irvine, UCLA, UC San

Diego, University of Wisconsin–Madison, Universit¨at Z¨urich, Vanderbilt University, Asian School of Business,

and Trinity College, Dublin. Antonin Bergeaud graciously shared detailed data from the long-term productivity

database created with Gilbert Cette and R´emy Lecat at the Banque de France. All errors are ours. The views

expressed herein are solely those of the authors and do not necessarily represent the views of the Federal Reserve

Bank of San Francisco or the Federal Reserve System.

†

Federal Reserve Bank of San Francisco and Department of Economics, University of California, Davis

§

Federal Reserve Bank of San Francisco and Department of Economics, University of California, Davis

(sanjay[email protected]; [email protected]).

‡

Columbia University; NBER; and CEPR (amt2314@columbia.edu).

Are there circumstances in which changes in aggregate demand can have an appreciable,

persistent effect on aggregate supply?

— Yellen (2016)

1. Introduction

What is the effect of monetary policy on the long-run productive capacity of the economy?

Since at least Hume (1752), macroeconomics has largely operated under the assumption that

money is neutral in the long-run, and a vast literature spanning centuries has gradually built

the case (see, for example, King and Watson, 1997, for a review). Contrary to this monetary

canon, we find evidence rejecting long-run neutrality.

Our investigation of monetary neutrality rests on three pillars. First, it is essential to

identify exogenous movements in interest rates to obtain a reliable measure of monetary effects

and avoid confounding. Second, because we focus on long-run outcomes, we rely on a panel

of countries observed over as long a period as we can to maximize data span and, hence, the

statistical power of our conclusions. Third, as we show below, the empirical method used can

make a big difference: common approaches are designed to maximize short-horizon fit, but we

need methods that are consistent over longer spans of time. We discuss how we build on each

of these three pillars next.

On identification, the first pillar, in section 2 we exploit the trilemma of international finance

(see, for example, Obstfeld, Shambaugh, and Taylor, 2004, 2005; Shambaugh, 2004). The

key idea is that when a country pegs its currency to some base currency with free movement

of capital across borders, it loses control—at least to some degree—over its interest rate: a

correlation in home and base interest rates is thus induced, which is exact when the peg is

hard and arbitrage frictionless, but is generally less than one otherwise. Insofar as base rates

are determined by base country conditions alone, they provide a potential source of exogenous

variation in home rates. We theoretically ground this identification strategy in a canonical New

Keynesian small open economy model (Schmitt-Groh´e and Uribe, 2016; Fornaro and Romei,

2019; Bianchi and Lorenzoni, 2022). Specifically, we derive analytical results to show formally,

for the first time, how a trilemma-based identification approach recovers the monetary policy

impulse response function of interest. Moreover, we exploit the model to provide bounds on

failures of the exclusion restriction due to spillover effects.

1

Second, moving on to the data pillar, in section 3 we rely on two recent macro-history

databases spanning 125 years and 17 advanced economies. First, we use the data in Jord`a,

1

We leverage the insights of open-economy literature to show how theory maps rigorously into our trilemma

identification scheme and guides an econometric approach that builds on earlier work in this vein (di Giovanni,

McCrary, and Von Wachter, 2009; Jord`a, Schularick, and Taylor, 2020).

1

Schularick, and Taylor (2017), available at

www.macrohistory.net/database

. This “JST

Database” contains key macroeconomic series, such as output, interest rates, as well as inflation,

credit, and many other potentially useful control variables for our analysis. Second, to allow

for a Solow decomposition of output into its components, we merge and incorporate data from

Bergeaud, Cette, and Lecat (2016), available at

http://www.longtermproductivity.com

.

2

Their data series include observations on investment in machines and buildings, number of

employees, and hours worked. With these variables, we construct measures of total factor

productivity (TFP), including with utilization adjustment, and then decompose impulse

responses for output into TFP, capital input, and labor input, to explore the channels of the

hysteresis that we have uncovered.

The third and final pillar of our analysis in section 4 has to do with the econometric approach.

We use local projections (Jord`a, 2005) in order to get more accurate estimates of the impulse

response function (IRF) at longer horizons. As we show formally, as long as the truncation

lag in local projections is chosen to grow with the sample size (at a particular rate that we

make specific below), local projections (LPs) estimate the impulse response consistently at any

horizon. In fact, as recently shown by Xu (2023), local projections are semi-parametrically

efficient in settings were the lag order may be infinite and the truncation lag is allowed to grow

with the sample. Other procedures commonly used to estimate impulse responses do not have

this property (see, for example, Lewis and Reinsel, 1985; Kuersteiner, 2005), and this—among

several other reasons—may explain the failure of some of the prior literature to discern the

highly persistent effects that we document here. See also, Plagborg-Møller and Wolf (2021);

Li, Plagborg-Møller, and Wolf (2022) for related results on comparison of LPs with vector

autoregressions (VARs).

Supported by these three pillars in section 5 we show that, surprisingly, monetary policy

affects the productive capacity of the economy for a very long time. In response to an exogenous

monetary shock, output declines and does not return to its pre-shock trend even twelve years

thereafter. Next, we investigate the source of this hysteresis and find that capital and TFP

experience similar trajectories to output. In contrast, total hours worked (both hours per

worker and number of workers) return more quickly to the original trend. Hence, our new

findings are distinct from the usual labor hysteresis mechanism previously emphasized in the

literature (see, for example, Blanchard and Summers, 1986; Gal´ı, 2015a; Blanchard, 2018; Gal´ı,

2020).

After a series of robustness checks, in section 6 we show that the responses display a key

asymmetry, or nonlinearity, with hysteresis forces much stronger after tightening shocks than

2

We are particularly thankful to Antonin Bergeaud for sharing some of the disaggregated series from their

database that we use to construct our own series of adjusted TFP.

2

loosening shocks, consistent with prior research on shorter-horizon response asymmetries (for

example, Tenreyro and Thwaites, 2016; Angrist, Jord`a, and Kuersteiner, 2018). Tight monetary

policy has long lasting effects, but loose monetary policy does not stimulate growth. The

asymmetries that we find echo results from models with downward nominal wage rigidity

(DNWR), though other mechanisms are possible.

3

How do our findings stack up against the state of knowledge? A voluminous literature

based on post-WW2 U.S. data has examined the causal effects of monetary policy (see, for

example, Christiano, Eichenbaum, and Evans, 1999; Ramey, 2016; Nakamura and Steinsson,

2018, provide a detailed review), but the evidence on long-run neutrality is, at best, mixed

(King and Watson, 1997). An important exception is the work of Bernanke and Mihov (1998),

which fails to reject long-run neutrality, but finds that the point estimates of GDP response to

monetary innovations do not revert to zero even after ten years. Mankiw (2001) interprets this

non-reversal as potential evidence of long-run non-neutrality.

4

In section 7, we relate our work to recent studies that employ different methods to identify

monetary shocks for the U.S. and the U.K. economies. Using their replication codes, we extend

the original estimates from published studies to eight-year horizons and, in fact, find similar

evidence of long-run non-neutral effects of monetary shocks. Miranda-Agrippino and Ricco

(2021) estimate a Bayesian VAR(12) for the U.S. economy with high-frequency market-based

monetary surprises around Federal Open Market Committee announcements (G¨urkaynak,

Sack, and Swanson, 2005) and Federal Reserve’s Greenbook forecasts. Brunnermeier, Palia,

Sastry, and Sims (2021) estimate a large-scale Bayesian SVAR model, for the U.S. economy,

with identification based on heteroskedasticity. Cesa-Bianchi, Thwaites, and Vicondoa (2020)

estimate a proxy structural VAR, for the U.K. economy, with their constructed high-frequency

monetary surprises measured around monetary policy announcements of the Bank of England.

Finally, our paper has been followed by a more recent literature that examines long-run

effects of transitory shocks. Antolin-Diaz and Surico (2022) document persistent effects of

transitory government spending shocks. Cloyne, Mart´ınez, Mumtaz, and Surico (2022) find

evidence for long-run effects of transitory corporate tax shocks. Furlanetto, Lepetit, Robstad,

Rubio-Ram´ırez, and Ulvedal (2021) also find that demand shocks have hysteresis effects for

3

On DNWR see, for example, Akerlof, Dickens, and Perry (1996), Benigno and Ricci (2011), Schmitt-Groh´e

and Uribe (2016), Barnichon, Debortoli, and Matthes (2021), Bianchi, Ottonello, and Presno (Forthcoming),

Born, D’Ascanio, M¨uller, and Pfeifer (2022).

4

Mankiw notes (emphasis added): “Bernanke and Mihov estimate a structural vector autoregression and

present the impulse response functions for real GDP in response to a monetary policy shock. (See their Figure

III.) Their estimated impulse response function does not die out toward zero, as is required by long-run neutrality.

Instead, the point estimates imply a large impact of monetary policy on GDP even after ten years. Bernanke

and Mihov don’t emphasize this fact because the standard errors rise with the time horizon. Thus, if we look

out far enough, the estimated impact becomes statistically insignificant. But if one does not approach the data

with a prior view favoring long- run neutrality, one would not leave the data with that posterior. The data’s best

guess is that monetary shocks leave permanent scars on the economy.” See also Gal´ı (1998).

3

the U.S. economy using a structural VAR model identified with short-run sign and long-run

zero restrictions. A theoretical literature at the intersection of endogenous productivity growth

and business cycles following the seminal work by Stadler (1990) provides micro-foundations

for hysteresis effects of transitory shocks. Cerra, Fat´as, and Saxena (2023) provide a recent

review of literature on hysteresis and business cycles. Complementary to our paper, theoretical

analyses by Benigno and Fornaro (2018) and Fornaro and Wolf (2022) link low nominal interest

rates to the rate of growth of productivity.

5

Going beyond our paper, hysteresis matters for

how we build models of monetary economies and what optimal monetary policy is in those

models: the welfare implications could be substantial (Benigno and Benigno, 2003; Benigno

and Woodford, 2012; Garga and Singh, 2021).

6

2. Identification via the trilemma

The trilemma of international finance gives a theoretically justified source of exogenous variation

in interest rates (Jord`a, Schularick, and Taylor, 2020). The logic is straightforward: under

a hard peg with perfect capital mobility, returns on similarly risky assets will be arbitraged

between the pegging (home) and pegged to (base) economies. In ideal frictionless settings,

strict interest parity would imply that rates are exactly correlated.

In reality this correlation is less than perfect, of course. But even under soft pegs (or dirty

floats), with frictions or imperfect arbitrage, a non-zero interest rate correlation between a home

economy and the base economy to which it pegs its exchange rate is enough for identification

using instrumental variables. In this section we present an open economy model to make formal

the conditions for identification, even in the presence of spillovers via non–interest rate channels

(or in the parlance of instrumental variables, violations of the exclusion restriction). This level

of detail allows us to construct econometric estimation procedures via propositions derived

from the model.

2.1. The identification problem in a nutshell

In measuring the effect of exogenous changes in domestic interest rates on output, consider

the simplest possible setup. For reasons that will become clear momentarily, we express all

variables in deviations from steady state (denoted with hats) so as to follow the same notation

5

See, among others, Fat´as (2000); Barlevy (2004); Anzoategui, Com´ın, Gertler, and Mart´ınez (2019); Bianchi,

Kung, and Morales (2019); Guerron-Quintana and Jinnai (2019); Queralto (2020); Schm¨oller and Spitzer (2021);

Vinci and Licandro (2021).

6

Our paper is also tangentially related to literature on productivity research. Baqaee and Farhi (2019)

construct a general framework where monetary shocks may affect allocative efficiency. Meier and Reinelt

(Forthcoming) provide evidence of increased misallocation following contractionary monetary policy shocks.

4

of the economic model that will follow. Hence, let

ˆ

Y

t

denote output;

ˆ

R

n

t

the home interest rate;

and

ˆ

R

∗

t

as base-country interest rates to which the home economy pegs its exchange rate. The

idea is to estimate β in the following regression:

ˆ

Y

t

=

ˆ

R

n

t

β + v

t

(1)

using

ˆ

R

∗

t

as an instrument (di Giovanni, McCrary, and Von Wachter, 2009; Jord`a, Schularick,

and Taylor, 2020). Base country interest rates seem likely to be determined by base country

economic conditions alone. Hence variation might be assumed to be essentially exogenous with

respect to the home economy considered.

However, does the exclusion restriction hold? What if, aside from the interest rates, there

are spillover channels from the base to the home country? That is, is there a direct channel by

which

ˆ

R

∗

t

affects

ˆ

Y

t

? If that is the case, then the regression really should be:

ˆ

Y

t

=

ˆ

R

n

t

β +

ˆ

R

∗

t

θ + u

t

(2)

It is easy to show that the IV estimator in Equation 1 would have a bias given by:

ˆ

β → β +

E(

ˆ

R

∗2

t

) θ

E(

ˆ

R

∗

t

ˆ

R

n

t

)

(3)

which will be non-zero as long as

θ ̸

= 0. However, if

θ

were known, then Equation 1 could be

estimated by instrumental variables by redefining the left-hand side as:

(

ˆ

Y

t

−

ˆ

R

∗

t

θ) =

ˆ

R

n

t

β + u

t

(4)

This observation was made, for example, by Conley, Hansen, and Rossi (2012).

In what follows, we derive an economic model that allows us to carefully work out the

exogeneity conditions of

ˆ

R

∗

t

and then determine the appropriate adjustments for potential

spillovers (the θ that results in the violation of the exclusion restriction).

2.2. Theory to guide identification

We build on a standard open economy setup widely used today as in Schmitt-Groh´e and Uribe

(2016), Fornaro and Romei (2019), and Bianchi and Lorenzoni (2022).

7

Our aim is not a new

model, but how theory maps rigorously into our trilemma identification scheme and guides our

econometric approach to identification. As the model is standard, many details are relegated

7

Elements of this framework appear in Benigno, Fornaro, and Wolf (2020), Farhi and Werning (2017), and

Fornaro (2015), among others. A textbook treatment is Schmitt-Groh´e, Uribe, and Woodford (2022, Ch. 13).

5

to the Appendix. In Appendix H, we obtain similar results in a Mundell-Fleming-Dornbusch

model with additional financial channels, as in Gourinchas (2018).

We assume that there is perfect foresight. The environment features incomplete international

markets with nominal rigidities. We focus on two countries: a large economy that we label the

base and a small open economy, the home country. We begin by describing a benchmark small

open economy. We want to recover the impulse response of output to a monetary shock in this

benchmark economy using trilemma identification.

2.3. Benchmark economy

Households. There is a continuum of measure one of identical households. Each household

receives an endowment of tradables

Y

T t

every period. The household preferences are given by

lifetime utility function

max

{C

t

,l

t

,B

t+1

}

E

0

∞

X

t=0

ζ

t

log(C

t

) − φ

l

1+ν

t

1 + ν

.

where

ζ

denotes the discount factor,

ν

is the (inverse) Frisch elasticity of labor supply,

φ

is a

scaling parameter to normalize

l

= 1 in the steady state, and

E

0

[·]

is the expectation operator

conditional on information available until date 0. The composite good

C

t

is a Cobb-Douglas

aggregate

C

t

=

C

T t

ω

ω

C

Nt

1−ω

1−ω

of a tradable good

C

T t

and a non-tradable good

C

Nt

, where

ω ∈ (0, 1) is the tradable share.

Households can trade in one-period riskless real and nominal bonds. Real bonds are

denominated in units of the tradable consumption good and pay gross interest rate

R

t

, taken

as given (i.e., a world real interest rate). Nominal bonds issued by the domestic central bank

are denominated in units of domestic currency, and pay gross nominal interest rate

R

n

t

. The

households’ budget constraint in units of domestic currency is then

P

T t

C

T t

+ P

Nt

C

Nt

+ P

T t

d

t

+ B

t

= W

t

l

t

+ P

T t

Y

T t

+ P

T t

d

t+1

R

t

+

B

t+1

R

n

t

+ T

t

+ Z

t

.

where

P

T t

and

P

Nt

are the prices of tradable and non-tradable goods in local currency;

d

t

is

the level of real debt in units of tradable good assumed in period

t −

1 and due in period

t

;

B

t

is the level of nominal debt in units of local currency assumed in period

t −

1 and due in period

t

;

W

t

is the nominal wage per unit of labor employed;

T

t

are nominal lump-sum transfers from

the government; and Z

t

nominal profits from domestic firms owned by households.

8

The household chooses a sequence of

{C

T t

, C

Nt

, l

t

, d

t+1

, B

t+1

}

to maximize lifetime utility

8

For ease of exposition, we consider a cashless economy.

6

subject to the budget constraint, taking initial bond holdings as given. Labor is immobile

across countries, so the wage level is local to each small open economy.

The first-order conditions for the household’s optimization problem are

1

C

T t

=

ζ

C

T t+1

R

t

, (5)

1

C

T t

=

ζ

C

T t+1

R

n

t

P

T t

P

T t+1

, (6)

p

t

≡

P

Nt

P

T t

=

(1 − ω)C

T t

ωC

Nt

, (7)

φl

ν

t

C

T t

ω

=

W

t

P

T t

. (8)

Tradable goods and bonds. We assume that law of one price holds for the tradable good.

Let

E

t

be the nominal exchange rate for home relative to the base, and let

P

∗

t

be the base price

of the tradable good denominated in base currency.

9

Then, we have that

P

T t

=

E

t

P

∗

t

. From

Equation 5 and Equation 6 we can then derive the interest rate parity condition,

R

n

t

= R

t

P

T t+1

P

T t

= R

t

E

t+1

E

t

P

∗

t+1

P

∗

t

. (9)

The world real interest rate is taken as given, so there can be dependence on initial conditions.

The home real interest rate on tradable bonds is equal to the world real interest in tradable

bonds:

10

R

t

= R

∗

t

. (10)

Production and nominal rigidity. The non-tradable consumption good is a Dixit-Stiglitz

aggregate over a continuum of products

C

Nt

(

i

) produced by monopolistically competitive

producers indexed by

i

, with

C

Nt

≡

(

R

1

0

C

Nt

(

i

)

(ϵ

p

− 1)

/ϵ

p

di

)

ϵ

p

/(ϵ

p

− 1)

. Each firm

i

in the home

economy produces a homogenous good with technology given by

Y

Nt

(

i

) =

L

Nt

(

i

), taking the

demand for its product as given by

C

Nt

(

i

) =

(

P

Nt

(i)

/P

Nt

)

−ϵ

p

C

Nt

, where we use the price index

of the non-tradable good composite,

P

Nt

= (

R

1

0

P

Nt

(

i

)

1−ϵ

p

di

)

1

/(1 − ϵ

p

)

. We assume the presence

of relevant production subsidies to offset monopoly distortions.

We consider an analytical tractable form of nominal rigidity commonly used in open-

economy literature following Obstfeld and Rogoff (1995a). We assume that prices for all firms

are pre-fixed in the first period. Second period onwards, prices are fully flexible.

11

9

It is common in the small open economy literature to treat price level in the base economy

P

∗

t

as synonymous

for price level of tradable goods in the base economy P

∗

T t

.

10

In Appendix E, we introduce a debt-elastic interest rate premium following Schmitt-Groh´e and Uribe

(2003) and Uribe and Schmitt-Groh´e (2017) along with staggered price setting to show robustness of our results.

11

Appendix E shows the robustness of our results using Calvo (1983) price setting in a stationary model.

7

Monetary and fiscal policy. The policy rate is the home nominal interest rate on one-period

domestic currency bonds. We want to derive the impulse response of domestic output to a

domestic monetary policy shock, i.e., the usual reference object of interest. We assume that

the home nominal interest rate follows an exogenous path subject to policy shocks ε

t

,

R

n

t

=

¯

R

n

e

ε

t

. (11)

Since we are simulating responses to one-time shocks, we interpret this policy rule assumption

as equivalent to that of temporary interest rate peg made in the zero lower bound (ZLB)

literature (Eggertsson and Woodford, 2003; Werning, 2011). Once the shock abates, a policy

rule that maintains local determinacy (Blanchard and Kahn, 1980) is expected to hold in those

environments with temporary interest rates at the zero lower bound. We will be invoking a

similar equilibrium selection device whereby the economy returns back to the same deterministic

steady state.

12

The portfolio allocation between the real and nominal bonds is not determinate in this type

of model. To ensure determinacy, and since all agents at home are identical, we now assume

that home domestic nominal bonds are in net zero supply, i.e.,

B

n

t+1

= 0. We also assume that

the home fiscal authority follows a balanced budget every period.

13

Market clearing. We impose that the non-tradable goods market has to clear at home,

implying that production of non-tradable goods must equal the consumption demand for

non-tradable goods. Therefore, we have that

l

t

= L

Nt

= Y

Nt

= C

Nt

. (12)

Finally, the external budget constraint of the economy must be satisfied every period, so

C

T t

+ d

t

= Y

T t

+

d

t+1

R

t

. (13)

Construction of small open economy GDP. Our key outcome variable of interest is the

real GDP in the small economy. To make the connection with our empirical counterparts, and

to keep our baseline discussion focused, for now we construct this real GDP variable using

constant aggregation weights implied by the Cobb-Douglas aggregator.

12

Similar solution methods to do counterfactual policy simulations have been developed for economies away

from the ZLB (Las´een and Svensson, 2011; Guerrieri and Iacoviello, 2015; Christiano, 2015). Embedding

an endogenous policy transmission through inflation targeting, while the shock is on, does not change our

theoretical results since we are identifying responses to non-systematic components of monetary policy.

13

We assume appropriate government subsidies financed by lumpsum taxes to eliminate monopoly rents in

the intermediate goods sector.

8

Clearly, variation in aggregation weights can cause changes in real GDP in a multiple sector

economy, and this definition abstracts from such potential index number problems. That

said, we present analytical results in an environment with time-varying aggregation weights in

Appendix C.

The large economy. The small country takes the path of prices

P

∗

t

and real interest rates

R

∗

t

in the large (base) economy as given. Without loss of generality, we therefore assume rigid

prices in the base economy, with P

∗

t

= 1.

Equilibrium. We analyze the economy starting at steady state at date 0. We set the initial

external debt of the economy to zero,

d

1

= 0. There is a one-time unanticipated shock at date

1 to a domestic monetary policy rule. We assume that the world real interest rate is equal to

the inverse of the domestic discount factor

R

∗

t

=

...

=

ζ

−1

at all dates. Essentially, this is a

two-period economy with the first period as the short-run, and subsequent time as the long-run.

We present the equilibrium conditions in Appendix A. For some analytical results, we will

log-linearize the economy around initial steady state and denote the corresponding variables

with hats.

Object of interest: response of GDP to a domestic monetary shock. We are interested

in the response of GDP to a domestic monetary shock. We denote this coefficient as β.

2.4. Fixed exchange rate economy exposed to base rate shocks

We consider an identical small open economy to the one just described, but with a different

policy configuration. We assume that this economy’s nominal exchange rate is fixed to the

currency of a large economy, termed as base. We then use the changes in the base economy

interest rate as instruments for domestic monetary shocks. We wish to study conditions under

which this instrument can recover the coefficient β.

To begin, we consider the setup of a hard peg (we will shortly discuss the case of dirty

float or soft peg): A hard peg fixes the nominal exchange rate at a given level. Without loss of

generality, we assume the rule

E

t

= 1 . (14)

By Equation 10, there is perfect passthrough from base economy interest rate changes into

home nominal interest rates, hence

R

n

t

−

¯

R

n

=

R

∗

t

−

¯

R

∗

, where

¯

R

n

and

¯

R

∗

denote the steady

state levels of nominal interest rates in the home and base economies, respectively.

Our identification strategy does not require that we isolate exogenous changes in base

country interest rates as long as they are determined by domestic conditions alone. For small

9

economies, this seems like a plausible assumption. However, in our empirical specifications, we

go one step further. Rather than using raw base country interest rates, we use the component

of these rates that cannot be predicted using base macroeconomic controls. That is, we buy

double insurance by using these residuals as the source of truly exogenous movements in home

economy interest rates. We refer the reader to the empirical methodology section below for

more details.

Based on this alternative regime, the question now is to determine the conditions under

which, using base interest rate shocks as instruments, one can recover exactly the same impulse

response as that generated by a standard domestic monetary policy shock in the benchmark

economy. Our focus is then the impulse response of small open economy output—under peg

—following a shock in

R

∗

1

, and how it compares to

β

, the impulse response of output in the

benchmark economy following a domestic policy shock.

In the peg configuration, there is a one-time unanticipated shock to the foreign interest

rate

R

∗

1

. In order to denote subsequent dates 2, 3, 4, ..., as representing the long-run, we

assume that the world interest rate is equal to the inverse of the domestic discount factor

R

∗

2

=

R

∗

3

=

...

=

ζ

−1

at all future dates. This assumption essentially reduces the fixed-exchange

rate economy to a two-period model as in the textbook treatment of Schmitt-Groh´e, Uribe,

and Woodford (2022, Ch. 13).

2.5. Identification via the trilemma

We now present the core theoretical results of our paper as a series of propositions. All of the

proofs in this section have been relegated to Appendix B.

We begin by noting that tradable goods consumption, as well as real debt choice, are

independent of the monetary policy regime.

14

A well-known result, this simplifies the analysis:

Proposition 1. The responses to a base interest rate shock of tradable consumption and the

domestic real interest rate (on bonds denominated in tradable goods) do not depend on whether

the home economy pegs or floats.

The upshot of this result is that we can now separate the determination of all remaining

variables from {C

T t

, R

t

, d

t+1

}.

15

14

This result is well noted in the literature at least since Obstfeld and Rogoff (1995a, Appendix) in the

case with fixed base economy interest rates. Uribe and Schmitt-Groh´e (2017, Section 9.5) present the general

result in settings where the inter-temporal elasticity of substitution is equal to the intra-temporal elasticity of

substitution between tradable and non-tradable goods.

15

The key difference between a peg and a float comes from whether the nominal exchange rate is used

to counter the passthrough of foreign rates into domestic policy rates. There is an extant literature in open

economy macroeconomics that has emphasized this insight, most recently articulated by Farhi and Werning

(2012), Fornaro (2015), as well as Schmitt-Groh´e and Uribe (2016) upon which we build.

10

Hence consider the equilibrium of a small open economy under a (hard) peg and the

equilibrium of the benchmark economy with a domestic policy shock. Assume real GDP is

constructed with constant and identical aggregation weights in the two economies. Then the

following proposition holds:

Proposition 2 (impulse response equivalence: hard pegs). The response of real GDP to a base

interest rate shock in a peg is identical to the response of real GDP to a domestic policy shock

of the same magnitude in a benchmark economy.

2.6. Departures from the baseline model

We now extend the baseline model in three ways. In all cases, to sharpen the results, we keep

the benchmark economy fixed to the baseline described above, and only vary the economy

configuration in the peg economy. First, we allow for imperfect interest rate pass-through from

the base rate into the home economy. This can happen when the home economy is in a soft peg

or in dirty float regime. Given this setting, we then show that one can still use base country

rates to recover

β

. Second, we allow for endogenous production of tradable goods in the peg

economy. We show that tradable good production increases in response to a base interest rate

shock through a labor reallocation mechanism. Consequently, the response of GDP to base

interest rate shocks is downward biased. Third, we consider other channels through which base

interest rate shocks can spill over into the home economy. In this case we show how one can

adjust the response to base country rates and how this correction still produces the equivalent

benchmark economy response to a monetary shock.

2.6.1 Soft pegs and dirty floats

We define imperfect pass-through (whether for a soft peg, or a dirty float) of base rates to

home rates using a pass-through coefficient 0

< λ ≤

1 such that:

R

n

t

−

¯

R

n

=

λ

(

R

∗

t

−

¯

R

∗

). Then:

Proposition 3 (impulse response equivalence: imperfect pass-through). Consider the equilib-

rium of a small open economy with imperfect pass-through and the equilibrium of the benchmark

economy with a domestic policy shock (subsection 2.3). Assume real GDP is constructed with

constant and identical aggregation weights in the two economies. To a first-order approximation,

the response of real GDP with imperfect pass-through to a base economy interest rate shock is a

fraction λ of the response of real GDP in a benchmark economy to a domestic policy shock of

same magnitude.

Presence of imperfect pass-through implies that domestic interest rate needs to be appropri-

ately scaled to allow interpretation. For this reason, we will later estimate the linear impulse

11

response function of output to a unit increase in domestic interest rate, instrumented with the

change in base economy interest rate. This normalization provides the appropriate scaling to

recover β.

2.6.2 Endogenous tradable good

We extend the baseline model in the peg economy (subsection 2.4) by allowing tradable output

to be produced with labor using a constant returns to scale technology. Prices are set flexibly

in the tradable-good sector. Labor is fully mobile, within the economy, across the tradable and

the non-tradable sector. Economy-wide real wages (in units of tradable goods) are constant

W

t

/P

T t

= 1 ∀t ≥ 0 .

Because the total labor supplied in the economy is divided between tradable and non-tradable

good sector, the labor market clearing condition is now modified as:

l

t

= L

T t

+ L

Nt

= Y

T t

+ L

Nt

Substituting this market clearing condition in the intra-temporal labor supply condition of

the household, we get:

φ (L

T t

+ L

Nt

)

ν

C

T t

ω

=

W

t

P

T t

= 1

where

L

T

/L

is fraction of total labor force allocated to the tradable goods sector in the steady

state. The rest of the equilibrium equations are same as in the baseline peg economy model

(subsection 2.4). We obtain the following result:

Proposition 4 (endogenous tradable goods). Consider the equilibrium of a hard peg economy

extended with endogenous production of tradable goods described above. And consider the

benchmark small open economy with domestic policy shock described in subsection 2.3. Assume

real GDP is constructed with constant and identical aggregation weights in the two economies.

The response of real GDP to a base economy interest rate shock is an upward biased estimate

of the response of real GDP in a benchmark economy to a domestic policy shock of the same

magnitude.

While the impulse response of non-tradable output is identical across the peg and the

benchmark economy, the total output response is biased upwards (i.e., towards zero, or smaller

absolute size) in the peg economy relative the benchmark economy. This upward bias emerges

due to labor reallocation to the tradable goods sector. We next formalize the empirically

relevant scenario when the exclusion restriction may fail.

12

2.6.3 Spillovers

If there are other channels through which base interest rates can affect the model equilibrium,

these spillovers will affect the previous results derived for pegs and imperfect pass-through

economies. The equivalency with the impulse response of output in the benchmark economy

will break down.

To see this, consider the following postulated relationship between tradable output and the

base real interest rate (log-linear approximation around initial steady state in hats),

ˆ

Y

T t

= α

ˆ

R

∗

t

, (15)

where

α <

0. Such a relationship is often embedded into open economy models through

a modeling of export demand (e.g, see Gal´ı and Monacelli, 2016).

16

Intuitively, the home

economy’s ability to sell its export good to the base (or any economy pegged to the base)

is now demand constrained. This demand is not perfectly elastic, but depends on the state

of consumption demand in the base economy, which in turn depends on the base real rate.

Equation 15 is just a reduced-form expression of this dependence.

Then the following holds:

Proposition 5 (spillovers in a peg). Consider the log-linear equilibrium of a hard peg economy

with spillovers (i.e., extended with Equation 15), and the log-linear equilibrium of the benchmark

economy with a domestic policy shock described in subsection 2.3. Assume real GDP is

constructed with constant and identical aggregation weights in the two economies. Denote the

response of real GDP in a peg to a unit and i.i.d. base economy interest rate shock with

γ

p

, and

the response of real GDP in the benchmark economy to a unit and i.i.d. domestic policy shock

with β, as in Equation 1. Then,

β = γ

p

− α

P

T

Y

T

P Y

+ (1 − ζ)

P

N

Y

N

P Y

. (16)

The spillover emerges through two channels: (i) through the direct effect of foreign real

interest rates on tradable-output, and (ii) through a wealth effect. Home consumers reduce

their consumption of tradable goods because their endowment of tradable output also falls.

Because of nominal rigidity, and fixed exchange rates, non-tradable consumption co-moves with

tradable consumption. Hence this additional decline in tradable consumption propagates into

the demand for non-tradable goods.

16

Note that

α

can be positive in models with endogenous production of tradable goods (see subsubsection 2.6.2).

We think the case of

α <

0 is more realistic in a world where contractionary policy shocks in the U.S. economy

have contractionary spillovers into rest of the world.

13

A corollary of Proposition 5 applies to an imperfect pass-through economy.

Corollary 1. Consider the log-linear equilibrium of a small open imperfect pass-through economy

(extended with Equation 15 and the log-linear equilibrium of the benchmark economy with a

domestic policy shock described in subsection 2.3. Assume real GDP is constructed with constant

and identical aggregation weights in the two economies. Denote the response of real GDP in the

imperfect pass-through economy to a unit, i.i.d. base economy interest rate shock with

γ

p

, and

the response of real GDP in the benchmark economy to a unit, i.i.d. domestic policy shock with

β. Then,

β =

γ

p

λ

− α

P

T

Y

T

P Y

+ (1 − ζ)

P

N

Y

N

P Y

.

To sum up, this last result shows that the same logic applies to the continuum of regimes

from hard peg (

λ

= 1) to pure float (

λ

= 0), with appropriate scaling of responses by

λ

. Thus,

for estimation purposes, we may draw on information from any economy within this continuum,

not just those with regimes at the extremes.

2.7. Model implications for econometric identification

The final model just introduced, with spillovers, explains how base country monetary policy

can affect the output of tradable goods (via export demand shifts) as well as the output of

nontradable goods (via interest arbitrage and conventional domestic demand shifts). These

spillover effects onto smaller open economies depend on the share of tradable output in their

GDP. Using the insights and notation from the model, in this section we explore its implications

for the identification of our impulse responses.

Disciplining the spillover coefficient. As in Equation 43 in the appendix, we assume

imperfect pass-through of base rates into home rates. In regression form, this can be expressed

as

ˆ

R

n

t

= λ

ˆ

R

∗

t

+ v

t

, (17)

where, as before,

ˆ

R

n

t

, and

ˆ

R

∗

t

are in deviations from steady state, and

λ ∈

[0

,

1] is the pass-

through coefficient, and is possibly different for country-time pairs nominally classified as

pegs

versus

floats

. We omit the constant term without loss of generality and we assume that

v

t

is a

well-behaved, white noise error term. For now, it is convenient to leave more complex dynamic

specifications aside to convey the intuition simply.

14

Similarly, Equation 16 in regression form can be expressed as in Equation 2

ˆ

Y

t

=

ˆ

R

n

t

β +

ˆ

R

∗

t

θ + u

t

, (18)

where here too

ˆ

Y

t

,

ˆ

R

n

t

, and

ˆ

R

∗

t

are deviations from steady state. For now, we leave unspecified

whether

ˆ

Y

t

belongs to a peg or a float. Note that under Equation 16, we have

θ =

P

T

Y

T

P Y

|{z}

≡Φ

+(1 − ζ)

P

N

Y

N

P Y

| {z }

≡1−Φ

α , (19)

that is, sum of (i) the share of tradable export output in GDP, which we denote Φ =

P

T

Y

T

/P Y

,

scaled by the parameter

α

, which determined how

ˆ

R

∗

t

affects tradable output, add (ii) the share

of non-tradable output in GDP scaled by the parameters

α

and 1

− ζ

, which determined how

reduction in tradable output affects consumption and savings. However, in commonly seen

calibrations in the literature,

ζ

is set at about 0

.

96. Hence, to a first approximation, the second

channel is negligible with 1 − ζ ≈ 0.04, and we will neglect it below.

In reality, there are two main reasons we might expect

θ →

0. One is that output is

dominated by non-tradables. In the JST database for advanced economies, over 150 years of

history, tradable export shares are 30% at most, and usually in the 10%–20% range, so Φ

≤

0

.

3

is a reasonable upper bound. Next is

α

, the spillover effect of base country rates

ˆ

R

∗

t

on tradable

export demand at home. It is fair to assume that this effect will be at most as strong as the

effect of domestic rates on tradable output, so

α ≤ β

. These observations allow us to derive

bounds on the true value of β when there are, potentially, spillover effects.

IV estimator with no spillovers. Our data come from two subpopulations, pegs and floats,

which principally differ in the degree to which

λ →

1. In practice we hesitate to impose the

same parameters across both subpopulations thus allowing for different

γ

and

λ

, so the reduced

form regressions are

ˆ

Y

t

= D

P

t

ˆ

R

∗

t

γ

P

+ D

F

t

ˆ

R

∗

t

γ

F

+ η

t

, (20)

ˆ

R

n

t

= D

P

t

ˆ

R

∗

t

λ

P

+ D

F

t

ˆ

R

∗

t

λ

F

+ v

t

, (21)

where D

P

t

= 1 for pegs, 0 otherwise, and similarly D

F

t

= 1 for floats, 0 otherwise.

In other words, if there are no spillovers, the IV estimator of

β

will be the ratio of the

weighted average of the γ over the weighted average of the λ: we will be estimating a “model

average” β using information from both of the two subpopulations, pegs and floats.

15

IV estimator with spillovers. What happens if

θ ̸

= 0? In that case, we provide a bound

for the possible values that

θ

= Φ

α

can take based on our model, as we discussed earlier. The

share of tradables in GDP is directly measurable and, as we argued above, falls typically in the

range Φ ∈ [0.1, 0.3] in the JST database. As we discussed earlier, we assume that effect of

ˆ

R

∗

t

on tradable output is no larger than the effect of

ˆ

R

n

t

; that is, we impose as the conservative

upper bound implied by α = β.

Based on these assumptions, we can write

θ

= Φ

β

and employ the calibrated range of values

of Φ. Then it is easy to see that one can transform the original Equation 18 to get

ˆ

Y

t

= (

ˆ

R

n

t

+

ˆ

R

∗

t

Φ)β + u

t

, (22)

and one can estimate

β

with this expression using instrumental variables along the lines just

discussed using the subpopulations of pegs and floats, that is, with the first stage given by

Equation 21.

To sum up, in the empirical work that follows, we will be focused on estimating the following

IV model,

ˆ

Y

t

= (

ˆ

R

n

t

+

ˆ

R

∗

t

Φ)β + u

t

, (23)

ˆ

R

n

t

= D

P

t

ˆ

R

∗

t

λ

P

+ D

F

t

ˆ

R

∗

t

λ

F

+ v

t

, (24)

which we have shown will recover the true reference impulse response for the benchmark model

based on impulse responses for pegs and floats. Conley, Hansen, and Rossi (2012) derive a

generic spillover correction in IV estimation that is closely related to the results presented here.

We elaborate on this point in the empirical sections below.

3. Data and series construction

The empirical features motivating our analysis rest on two major international and historical

databases. Data on macro aggregates and financial variables, including assumptions on exchange

rate regimes and capital controls, can be found in

www.macrohistory.net/data

. This database

covers 17 advanced economies reaching back to 1870 at annual frequency. Detailed descriptions

of the sources of the variables contained therein, their properties, and other ancillary information

are discussed in Jord`a, Schularick, and Taylor (2017) and Jord`a, Schularick, and Taylor (2020),

as well as references therein. Importantly, we will rely on a similar construction of the

trilemma instrument discussed in Jord`a, Schularick, and Taylor (2016), and more recently

Jord`a, Schularick, and Taylor (2020). This will be the source of exogenous variation in interest

rates. The instrument construction details will become clearer in the next section.

16

The second important source of data relies on the work by Bergeaud, Cette, and Lecat (2016)

and available at

http://www.longtermproductivity.com

. This historical database adds to

our main database observations on capital stock (machines and buildings), hours worked,

and number of employees, and the Solow residuals (raw TFP). In addition, we construct

time-varying capital and labor utilization corrected series using the procedure discussed in Imbs

(1999) with the raw data from Bergeaud, Cette, and Lecat (2016) to construct our own series

of utilization-adjusted TFP. We went back to the original sources so as to filter out cyclical

variation in input utilization rates in the context of a richer production function that allows for

factor hoarding. We explain the details of this correction in Appendix F.

17

Guided by our model and identification strategy as discussed in the previous section, we

divide our sample into three subpopulations of country-year observations. The bases will refer

to those economies whose currencies serve as the currency anchor for the subpopulation of

pegging economies, labeled as the pegs. Other economies, the floats, allow their exchange to be

freely determined by the market.

Base and peg country codings can be found in Jord`a, Schularick, and Taylor (2020, Table

1 and Appendix A), and are based on updates to older, established definitions (Obstfeld,

Shambaugh, and Taylor, 2004, 2005; Shambaugh, 2004; Ilzetzki, Reinhart, and Rogoff, 2019).

A country

i

is defined to be a peg at time

t

, denoted with the dummy variable

D

P

i,t

= 1, if

it maintained a peg to its base at dates

t −

1 and

t

. This conservative definition serves to

eliminate opportunistic pegging, and it turns out that transitions from floating to pegging

and vice versa represent less than 5% of the sample, the average peg lasting over 20 years.

Interestingly, pegs are, on average, more open than floats.

18

Finally, let

D

F

i,t

= 1

− D

P

i,t

denote

a non-peg, i.e., float. The choice of exchange rate regime is treated as exogenous, and indeed

we find zero predictability of the regime based on macroeconomic observables in our advanced

economy sample. Regimes are also highly persistent in this sample which excludes emerging and

developing countries, in contrast to the findings of limited persistence for the full cross-section

of countries as in Obstfeld and Rogoff (1995b).

Based on this discussion, we construct an adjusted instrument as follows using a cleaning

regression (Romer and Romer, 2004). Let ∆

R

i,t

denote changes in country

i

’s short-term

nominal interest rate, let ∆

R

b(i,t),t

denote the change in short term interest rate of country

i

’s

base country

b

(

i, t

), and let

∆

˜

R

b(i,t),t

denote its predictable component explained by a vector of

17

Our construction of productivity assumes misallocation related-wedges are absent. We have not yet found

the data to take into account markups or sectoral heterogeneity in our productivity estimates. See Basu and

Fernald (2002) and Syverson (2011) for extensive discussions on what determines productivity.

18

In the full sample, the capital openness index averages 0.87 for pegs (with a standard deviation of 0.21)

and 0.70 for floats (with standard deviation 0.31). After WW2 there is essentially no difference between them.

The average is 0.76 for pegs and 0.74 for floats with a standard deviation of 0.24 and 0.30 respectively. See

Jord`a, Schularick, and Taylor (2020) for further details on the construction of the instrument.

17

Figure 1:

IV construction: residualized component ∆

b

R

b(i,t),t

of base country interest rates in the

historical sample

-4 -2 0 2 4 6

Residualized base country change in interest rate

1900 1920 1940 1960 1980 2000 2020

United Kingdom

Hybrid (U.K., U.S., France)

United States

Germany

Notes: ∆

b

R

b(i,t),t

= (∆

R

b(i,t),t

−∆

˜

R

b(i,t),t

) where

b

(

i, t

) denotes the base for country

i

at time

t

and the final term is the predicted

interest rate from a cleaning regression. See text.

base country macroeconomic variables. The list of controls used to construct

c

∆i

b(i,t),t

include

log real GDP; log real consumption per capita; log real investment per capita; log consumer

price index; short-term interest rate (usually a 3-month government bill); long-term interest rate

(usually a 5-year government bond); log real house prices; log real stock prices; and the credit

to GDP ratio. The variables enter in first differences except interest rates. Contemporaneous

terms (except for the left-hand side variable) and two lags are included.

Hence, using the notation from the previous section, denote ∆

b

R

b(i,t),t

= (∆

R

b(i,t),t

−∆

˜

R

b(i,t),t

).

In Figure 1, we display these constructed base-country interest rate residuals for the four types

of base as in Obstfeld, Shambaugh, and Taylor (2005) and Jord`a, Schularick, and Taylor

(2020): the United Kingdom during the classical Gold Standard era before WW1, a hybrid

base consisting of an average of U.K., France and U.S. short rates in the interwar years, the

United States after WW2, and Germany from the start of the European Monetary System

in the 1970s. These base countries are assumed to not take into account the state of the

economy in the smaller countries which are pegging to them. For the pegs we use one of these

bases, as appropriate; for the floats, we follow Ilzetzki, Reinhart, and Rogoff (2019); Obstfeld,

Shambaugh, and Taylor (2005); and Shambaugh (2004) to determine the appropriate base.

Note that in the historical eras before the 1970s there do not exist data on private-sector or

central bank forecasts of future macroeconomic variables, so we cannot include these in the

18

control set. However, in section 7, we discuss evidence from an alternate identification approach

by Miranda-Agrippino and Ricco (2021) that controls for both private-sector expectations and

central bank forecasts. We would argue that the monetary residuals appear reasonable; for

example, policy in various base countries is seen to be tight in the late 1920s before the Great

Crash; around 1980 in the era of tightening by Volcker and P¨ohl; just before 2000 in the U.S.

under the Greenspan Fed, or again in 2006 under the Bernanke Fed.

Finally, since countries in a given year may not be perfectly open to capital flows, we

then scale the base shock, adjusting for capital mobility using the capital openness index of

Quinn, Schindler, and Toyoda (2011), denoted

k

i,t

∈

[0

,

1]. The resulting trilemma instruments

adjusted for capital mobility, following Jord`a, Schularick, and Taylor (2020), are thus defined as

z

j

i,t

≡ D

j

i,t

k

i,t

∆

b

R

b(i,t),t

; j = P, F , (25)

where P refers to pegs and F refers to floats.

4. Consistent long-horizon impulse responses

In thinking about the propagation of a shock, especially to distant horizons, it is generally

considered good practice to allow for generous lag structures—and in the limit, allowing

for possibly infinite lags. Infinite dimensional models have a long tradition in econometric

theory and form the basis for many standard results. For example, Berk (1974) considers the

problem of estimating the spectral density of an infinite order process using finite autoregression.

In multivariate settings, Lewis and Reinsel (1985) establish the consistency and asymptotic

normality of finite order approximations to an infinite order multivariate system. Kilian (1998)

shows that the finite sample biases of the underlying finite order autoregressions can induce

severe bias on impulse response bootstrap inference based on vector autoregressions (VARs).

In empirical practice, the well-known biases arising from impulse responses estimated with

finite VARs are further aggravated by having to choose relatively short lag lengths due to the

parametric loads required in their estimation as Kuersteiner (2005) shows. The solution that

we pursue in this paper to avoid these issues, however, is to calculate impulse responses using

local projections instead.

Suppose the data are generated by an invertible, reduced-form, infinite moving average

process or

V MA

(

∞

)—the well-known impulse response representation. Invertibility here means

that the space of the vector

y

t

spans the space of the residual vector,

ϵ

t

, and that the process can

alternatively be expressed as a reduced-form, infinite vector autoregression or

V AR

(

∞

). This

assumption allows for very general impulse response trajectories with potentially interesting

dynamics at long-horizons.

19

We set aside any discussion on identification since the main issues discussed here do not

depend on it. Let

y

t

=

∞

X

h=0

B

h

ϵ

t−h

; h = 0, 1, . . . ; B

0

= I , (26)

be the

V MA

(

∞

) representation of the m-dimensional vector

y

t

(without loss of generality, we

omit the constant term). Under the well-known general invertibility assumptions explicitly

stated in Appendix D, the V AR(∞) is

y

t

=

∞

X

j=1

A

j

y

t−j

+ ϵ

t

; j = 1, 2, . . . . (27)

The moving average matrices, B

h

, and the autoregressive matrices, A

j

, follow the well-known

recursion due to Durbin (1959) given by

B

h

= A

1

B

h−1

+ A

2

B

h−2

+ . . . + A

k

B

k−h

+ A

k+1

B

k−h−1

+ . . . + A

h−1

B

1

+ A

h

| {z }

remainder term

. (28)

Lewis and Reinsel (1985) established that, under standard regularity assumptions, a

V AR

(

p

)

provides consistent estimates of

A

1

, . . . , A

p

with

p, T → ∞

as long as

p

grows at a rate

p

2

/T →

0.

There are two practical implications of this result. First, if the truncation lag is too small,

k < p

,

the consistency assumption fails and hence, based on Equation 28, we will obtain inconsistent

impulse response estimates B

h

, even when h is relatively small.

The second and more subtle implication is the following. Suppose that indeed the truncation

lag is chosen so that

k

=

p

and hence the consistency condition is met. Then, as is clear from

Equation 28, estimates of the impulse response for horizons

h

= 1

, . . . , k

will be consistently

estimated, but not for horizons

h > k

=

p

. The reason is that for

h > k

=

p

, the expression for

B

h

involves the terms

B

1

, . . . , B

k−h−1

, A

k+1

, . . . , A

h

(i.e., the remainder term in Equation 28),

which have been truncated and hence their omission introduces inconsistency.

What about local projections? We extend the proof in Lewis and Reinsel (1985) in Appendix

D. We show that local projections are consistent for any horizon

h

, even when the lag structure

is truncated as long as

p, T → ∞

at rate

p

2

/T →

0. Lusompa (2019) derives a related result in

the context of generalized least-squares inference of local projections. Relatedly, Montiel Olea

and Plagborg-Møller (2021) use similar asymptotic arguments to show how lag-augmented

local projections provide asymptotically valid inference for both stationary and non-stationary

data over a wide range of response horizons. More recently Xu (2023) shows that in infinite

dimensional settings, local projections achieve semiparametric efficiency.

20

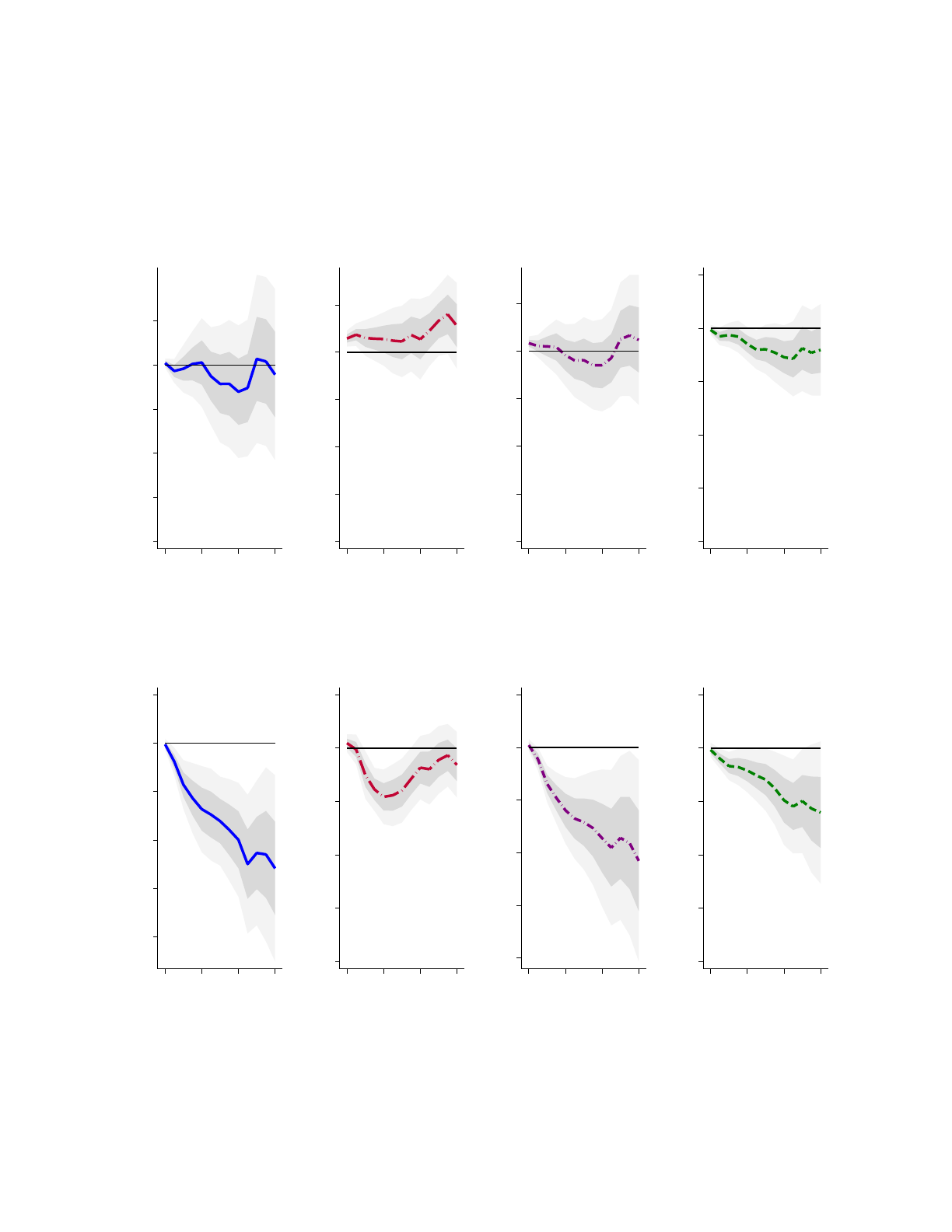

Figure 2:

Estimating cumulative responses: autoregressive versus local projection biases at long

horizons.

(a) True responses

-.6 -.4 -.2 0 .2

0 5 10 15 20 25

Horizon

Impulse

Cumulative

(b) Lag truncation: 3, 6, 9, and 12 lags

-.6 -.4 -.2 0 .2

0 5 10 15 20 25

Horizon

True LP AR(3)

AR(6) AR(9) AR(12)

Notes: Sample size: 1,000. Monte Carlo replications: 1,000. The shaded error bands are 1 and 2 standard error bands based on the

local projection Monte Carlo average. LP refers to cumulative local projections using 2 lags. AR(k) refers to impulse responses

cumulated from an autoregressive model with k = 3, 6, 9, and 12 lags. See text.

Basically, local projections are direct estimates of the impulse response (moving average)

coefficients. Truncating the lag structure, even when

h > k

, has asymptotically vanishing

effects on the consistency of the estimator. Truncated VARs on the other hand, have to

be inverted to construct the impulse response. Hence the impulse response depends on the

entire dynamic specification of the VAR. The cumulation of small sample inconsistencies over

increasing horizons can pile up and turn into non-negligible distortions to the impulse response,

specially at long horizons.

Of course, the solution would be to specify the VAR truncation lag,

k

, to be large as

the impulse response horizon (as long as

k

2

/T →

0). Setting aside the parametric burden

imposed in the estimation, this may not be enough to address the second of the practical issues

highlighted earlier, namely the truncation of the remainder term in Equation 28. To illustrate

these issues, Figure 2 shows a simple Monte Carlo exercise. We generate an MA process whose

coefficients are determined by the impulse response function displayed in panel (a). The implied

cumulative response is also shown, as this is the object of interest in our application. This

impulse response is meant to loosely mimic the shape of the responses we find later in the

paper. In cumulative terms, a shock has transitory, but long-lived effects on the variable.

19

19

Further details on the setup of the Monte Carlo exercise along with the specifics of how the two panels of

21

Panel (b) of Figure 2 hence shows Monte Carlo averages from estimates of the cumulative

response from a simple AR model with 3, 6, 9, and 12 lags versus local projections using only 2

lags—a considerable handicap for the local projection. Again, to mimic the empirical analysis,

we assume a sample with 1,000 observations (results with 300 observations yield nearly identical

results). We repeat the experiment 1,000 times. The error bands displayed are the one and two

standard error bands of the local projection Monte Carlo averages.

As is evident from the figure, given the long-lived dynamics of our experiment, truncating

below 12 lags generates cumulative effects that are relatively short-lived and far off the true

response. The reason is that fewer than 12 lags would generally capture the early stages of the

impulse response, where not much action has yet taken place, but it would miss entirely the

undoing of the dynamics of periods 1–12 that follows in periods 13–24.

In contrast, local projections provide quite a close estimate of the response even though the

truncation lag is quite severe. As we increase the AR lag length to 12 (the point at which the

original negative dynamics die-off as panel (a) illustrates), the AR model with 12 lags picks up

the shape of the response very nicely though it gets into trouble once the horizon goes beyond

12 lags, and especially at the tail end, as the theory predicted. In contrast, local projections

continue to approximate the response well, even at those long horizons.

Consider our application, which involves 9 variables. A 9-dimensional vector autoregression

with 12 lags (as in the Monte Carlo application) involves 108 regressors per equation. The

correct lag length, which is 24 in our D.G.P. involves a whopping 216 regressors. Compare

that to the 18 regressors for the local projection. Further, note that even truncating the AR

at 12 lags is really on the boundary of the order needed to capture the main features of the

theoretical impulse response given the D.G.P. Typical information criteria, specially commonly

used Bayesian (or Schwartz) information criteria, will tend to select lag lengths that are entirely

too small (see Kuersteiner, 2005). Even if long lag lengths are selected, the parametric loads

make the task of analyzing the data across subsamples (as we do) even more difficult or often

times, impossible.

5. The data show that monetary shocks have long-lived effects

The empirical approach from this point forward relies on local projections, estimated with

instrumental variables (LPIV), based on Equation 23 and Equation 30. The instruments,

adjusted for capital mobility, are

z

P

i,t

and

z

F

i,t

, as defined earlier, and we estimate the following

Figure 2 are generated are in Appendix D.

22

(cumulative) impulse responses for the baseline, no spillover case (Φ = 0 in Equation 19),

y

i,t+h

− y

i,t−1

= α

i,h

+ ∆

ˆ

R

i,t

β

h

+ x

i,t

γ

h

+ u

i,t+h

, (29)

∆R

i,t

= κ

i

+ z

P

i,t

λ

P

+ z

F

i,t

λ

F

+ x

i,t

ζ + v

it

, (30)

for

h

= 0

,

1

, . . . , H

;

i

= 1

, . . . , N

;

t

=

t

0

, . . . , T

, where

y

i,t+h

is the outcome variable, log real

GDP, for country

i

observed

h

periods from today,

α

i,h

are country fixed effects at horizon

h

,

∆

ˆ

R

i,t

refers to the instrumented change in the short-term interest rate (usually government

bills), our stand-in for the policy rate;

β

h

is the cumulative impulse response function of variable

y for country i at horizon h relative to its value at horizon −1; and x

i,t

collects all additional

controls including lags of the outcome and interest rates, as well as lagged values of other macro

aggregates.

20

Moreover, we control for global business cycle effects through a global world

GDP control variable to parsimoniously soak up common global fluctuations. We calculate

heteroscedasticity and autocorrelation robust Driscoll and Kraay (1998) standard errors.

Table 1 reports the first-stage regression of the pegging country’s short term interest rate

∆R

i,t

on the instruments

z

P

i,t

, z

F

i,t

and controls

x

i,t

, country fixed effects and robust standard

errors. The interest-rate passthrough is roughly 0.6 for pegs and 0.25 for floats. Thus, neither

represents a hard peg or a pure float corner case, further bolstering the case for studying the

more general imperfect pass-through case discussed earlier. Both instruments are statistically

significant. We find that the peg instrument,

z

P

i,t

, has a

t

-statistic close to 9 in the full and

post-WW2 samples and is therefore not a weak instrument. The float instrument,

z

F

i,t

, has a

t

-statistic close to 3 in the full and post-WW2 samples, a weaker instrument, as one would

expect. Nevertheless, we show that our results are robust to excluding the weaker instrument.

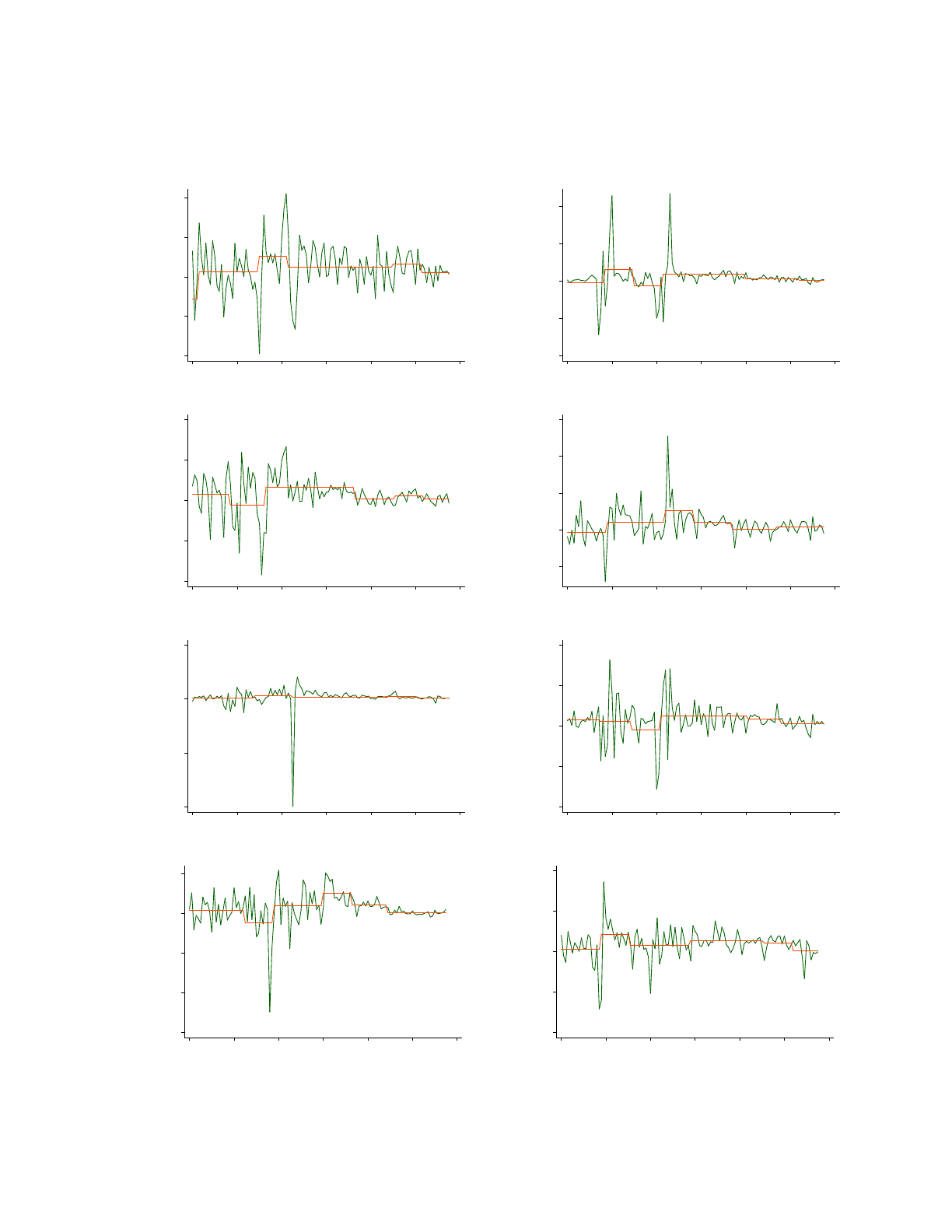

5.1. Main results

The main findings in our paper are shown by the response of real GDP to a shock to domestic

interest rates. We display these results graphically in Figure 3. This figure is organized into

two columns, charts (a) and (c) refer to full sample results, and columns (b) and (d) to the

post-WW2 sample. In addition, the top row—charts (a) and (b)—is based on using the peg and

float instruments, whereas the second row—charts (c) and (d)—only use the peg instrument

20

The list of domestic macro-financial controls used include log real GDP; log real consumption per capita;

log real investment per capita; log consumer price index; short-term interest rate (usually a 3-month government

security); long-term interest rate (usually a 5-year government security); log real house prices; log real stock prices;

and the credit to GDP ratio. The variables enter in first differences except for interest rates. Contemporaneous

terms (except for the left-hand side variable) and two lags are included. We control for contemporaneous values

of other macro-financial variables for two purposes a) base rate movements might be predictable by current

home macro-conditions, and b) we wanted to impose restrictions in the spirit of Cholesky ordering whereby real

GDP is ordered at the top. Results are robust to excluding contemporaneous home-country controls.

23

Figure 3: Baseline response to 100 bps shock: Real GDP.

(a) Full sample: 1900–2015.

-8 -6 -4 -2 0 2

Percent

0 4 8 12

Year

(b) Post-WW2 sample: 1948–2015.

-8 -6 -4 -2 0 2

Percent

0 4 8 12

Year

(c) Full sample: 1900–2015,

using only the peg IV.

-8 -6 -4 -2 0 2

Percent

0 4 8 12

Year

(d) Post-WW2 sample: 1948–2015,

using only the peg IV.

-8 -6 -4 -2 0 2

Percent

0 4 8 12

Year