CONSUMER FINANCIAL PROTECTION BUREAU | OCTOBER 2023

Report of the CFPB

Education Loan

Ombudsman

1 CONSUMER FINANCIAL PROTECTION BUREAU

Table of contents

Table of contents ..............................................................................................................1

Executive summary .......................................................................................................2

1 Federal student loans ...............................................................................................5

1.1 Background ................................................................................................ 5

1.2 Problems with access to customer service representatives...................... 8

1.3 Servicer errors............................................................................................ 9

1.4 Problems accessing cancellation and discharge ......................................15

2 Private student loans ..............................................................................................17

2.1 Background ...............................................................................................17

2.2 Problems accessing cancellation and discharge ......................................17

2.3 Direct lending by colleges.........................................................................21

3 Recommendations...................................................................................................24

4 Contact Information.................................................................................................26

Appendix A: Complaint Trends................................................................................27

Appendix B: Student Loan Trends ..........................................................................31

2 CONSUMER FINANCIAL PROTECTION BUREAU

Executive summary

This report analyzes the 9,284 student loan complaints submitted by consumers from

September 1, 2022, through August 31, 2023.

1

Complaints submitted to the CFPB suggest that

across the federal and private student loan markets, failures on the part of industry participants

are excluding some borrowers from protections and benefits intended for them under law.

Three out of four complaints received by CFPB about student loans during this period were

related to the servicing and collection of federal student loan debt. Borrowers submitted more

complaints on this topic compared to recent years.

2

The uptick coincides with ongoing systemic

changes to the federal student loan system,

3

borrowers anticipating the return to repayment of

federal student loans for the first time in over three years,

4

and increased financial precarity

among borrowers.

5

However, student loan servicers were simultaneously responsible for

transferring millions of accounts, implementing new policies to reduce monthly payments, and

addressing long-standing servicing failures including inadequate customer service and errors in

basic loan administration.

6

Complaints submitted by federal student loan borrowers reveal a number of key risks and

challenges, including:

7

1

Of these complaints, 75 percent were related to federal student loans and the remaining 25 percent were related to

private student loans. See Appe ndi x A for a more detailed analysis of 2022-2023 complaint trends.

2

See Appendix A for more detail about complaint trends.

3

See Section 1.1 for more information about changes to the student loan system that have occurred since March

2020.

4

U.S. Department of Education, Office of Federal Student Aid, Prepare for Student Loan Payments to Restart,

(accessed Oct. 15, 2023), https://studentaid.gov/manage-loans/repayment/prepare-payments-restart. This website

states that “Your first payment is due in October 2023.”

5

CFPB research shows that about one in five student loan borrowers have risk factors suggesting they may struggle as

scheduled payments resume. Thomas Conkling and Christa Gibbs, Office of Research blog: Update on student loan

borrowers as payment suspension set to expire, (Jun. 7, 2023), https://www.consumerfinance.gov/about-

us/blog/office-of-research-blog-upd a te -on-student-loan-borrowers-as-payment-suspension-set-to-expire/.

6

Consumer Financial Protection Bureau, Supervisory Highlights: Student Loan Servicing Special Edition, Issue 27

(Sep. 2022), https://files.consumerfinance.gov/f/documents/cfpb_student-loa

n-servicing-supervisory-highlights-

special-edition_report_2022-09.pdf; Consumer Financial Protection Bureau, Did you get a notice that your student

loans are transferring to a new servicer? Learn more about what this means for you (Sep. 3, 2021),

https://www.consumerfinance.gov/about-us/b

log/student-l oans-transferring-to-new-servi cer-le arn-what-this-

means-for-you/.

7

The CFPB recognizes that risks to borrowers may have continued to evolve now that the payment pause has ended.

3 CONSUMER FINANCIAL PROTECTION BUREAU

1. Customer service problems. Consumers reported long hold times, application

processing times, and incorrect information regarding payment amounts and due dates.

2. Errors related to basic loan administration. Complaints reveal a pattern of

servicer errors related to monthly payment amounts, payment histories, refunds, interest

accrual, and credit reporting.

3. Problems accessing loan cancellation. Borrowers reported that servicers

inaccurately processed applications or requests for loan cancellation programs for which

they were eligible, including closed school and borrower defense to repayment (BDR)

discharges, Public Service Loan Forgiveness (PSLF), and income-driven repayment

(IDR) related cancellations. Even where consumers ultimately received the appropriate

cancellation, processes were significantly delayed and borrowers frequently received

inaccurate information.

Roughly one in four complaints received by the CFPB during this period was related to private

student loan debt. For this group, complaints suggested key consumer risks, including:

4. Problems accessing loan cancellation. Private student loan borrowers reported

having trouble receiving accurate information about and applying for loan cancellation

through bankruptcy, death, or claims that the underlying educational provider engaged

in fraudulent or other illegal conduct.

8

5. Misleading origination tactics and coercive debt collection practices related

to private student loans, including institutional debts. Borrowers reported being

misled about the types of financial products their schools recommended for them and

also submitted complaints about experiencing debt collection practices such as transcript

withholding.

9

8

Where a school defrauds a borrower, the Holder Rule allows the borrower to bring a claim or defense on the basi s of

the school’s action, such as to challenge the validity of the loan under available law. See 16 C.F.R. Part 433.

The FTC

has explicitly stated that the Holder Rule applies to higher education fi nanci ng. See Federal Trade Commission, Staff

Guidelines on Trade Regulation Rule Concerning Preservation of Consumers’ Claims and Defenses, 9 (May 4, 1976)

https://www.ftc.gov/system/files/documents/rules/holder-due-course-rule/760504hidcrule.pdf (

noting the rule

applies to transactions for “vocational training”).

9

Consumer Financial Protection Bureau, Supervisory Highlights: Student Loan Servicing Special Edition, Issue 27

(Sep. 2022), https://files.consumerfinance.gov/f/documents/cfpb_student-lo

an-servi cing-supervisory-highlights-

special-editi on_report_2022-09.pdf.

4 CONSUMER FINANCIAL PROTECTION BUREAU

This report discusses key consumer risks and makes recommendations to address them to

improve borrower outcomes.

10

While the body of the report primarily focuses on complaints

submitted to the CFPB this year, the appendices contain additional information on complaint

and market trends over time.

Many of the challenges highlighted in this report are not new. Complaints submitted to the

CFPB suggest that fundamental problems that have been documented in the student loan

program persist.

11

Robert G. Cameron

Education Loan Ombudsman

10

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Act”) established a Private Student Loan

Ombudsman (Ombudsman) within the Consumer Financial Protection Bureau (CFPB) and requires the Ombudsman

to prepare an annual report describing the activities and effectiveness of the Ombudsman during the preceding year.

See 12 U.S.C. § 5535. This report is drafted pursuant to the Act.

11

See, e.g., Consumer Financial Protection Bureau, CFPB Sues Nation’s Largest Student Loan Company Navient for

Failing Borrowers at Every Stage of Repayment, (Jan. 18, 2017), https://www

.consumerfinance.gov/about-

us/newsroom/cfpb-sues-nations-l argest-student-loan-company-navient-failing-borrowers-every-stage-rep ayment/.

See also, e.g., Consumer Financial Protection Bureau, Supervisory Highlights: Student Loan Servicing Special

Edition, Issue 27 (Sep. 2022), https://files.consumerfinance.gov/f/documents/cfpb_student-loa

n-servicing-

supervisory-highlights-special-edition_report_2022-09.pdf.

5 CONSUMER FINANCIAL PROTECTION BUREAU

1 Federal student loans

1.1 Background

The federal student loan portfolio grew to include over $1.643 trillion in outstanding loans

representing more than 92 percent of all student loans outstanding.

12

For the year ending

August 31, 2023, the CFPB handled almost 6,400 federal student loan complaints.

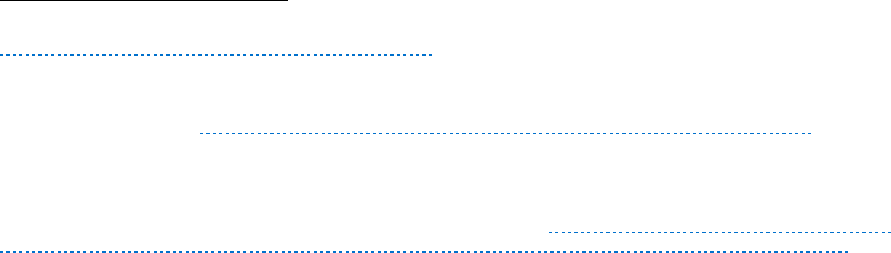

Overall, complaint volume related to federal student loans was higher than in recent years, and

the uptick coincides with ongoing systemic changes to the federal student loan system (Figure

1), borrowers anticipating the return to repayment of federal student loans for the first time in

over three years,

13

and increased financial precarity among student loan borrowers.

14

12

U.S. Department of Education, Office of Federal Student Aid, Federal Student Aid Portfolio Summary,

https://studentaid.gov/data-center/student/portfolio. S

ee Appendix B for more detailed information on student loan

trends.

13

U.S. Department of Education, Office of Federal Student Aid, Prepare for Student Loan Payments to Restart,

(accessed Oct. 15, 2023), https://studentaid.gov/manage-loans/repayment/prepare-payme nts-restart. This website

states that “Your first payment is due in October 2023.”

14

CFPB research shows that about one in five student loan borrowers have risk factors suggesting they may struggle

as scheduled payments resume. Thomas Conkling and Christa Gibbs, Office of Research blog: Update on student

loan borrowers as payment suspension set to expire, (Jun. 7, 2023), https://www.consumerfinance.gov/about-

us/blog/office-of-research-blog-upd a te -on-student-loan-borrowers-as-payment-suspension-set-to-expire/.

6 CONSUMER FINANCIAL PROTECTION BUREAU

FIGURE 1 TOTAL QUARTERLY STUDENT LOAN COMPLAINT VOLUME, 2018 – 2023

15

Since March 2020, the Department of Education has announced and implemented several

program changes. These include temporary “waivers” of certain program requirements for

Public Service Loan Forgiveness (PSLF) and income-driven repayment (IDR), increasing the

number of borrowers eligible for cancellation;

16

a new IDR plan (called Saving on Valuable

15

Analysis of complaints submitted to the CFPB about student loans. The Federal Student Aid Ombudsman at the

U.S. Department of Education (ED) also received over 100,000 complaints in FY 2022, but that group of complaints

is outside of the scope of this report. For a discussion of those complaints and associated trends, see, e.g., U.S.

Department of Education, Office of Federal Student Aid, FY 2022 Annual Report, (Jan. 23, 2023),

https://www2.ed.gov/about/reports/annual/2022report/fsa-report.pdf

, a

t 138-155.

16

U.S. Department of Education, Department of Education Announces Actions to Fix Longstanding Failures in the

Student Loan Programs, (April 19, 2022), https://www.ed.gov/news/press-r

eleases/department-education-

announces-actions-fix-l ongstand ing-failu res-student-loanprogramshttps://www.ed.gov/news/press-

releases/department-edu ca ti on-announces-actions-fix-longstanding-failures-stu de nt-loanprograms; U.S.

Department of Education, U.S. Department of Education Announces Transformational Changes to the Public

7 CONSUMER FINANCIAL PROTECTION BUREAU

Education, or SAVE) to lower monthly payments and interest accrual for many borrowers;

17

and

the “Fresh Start” program to temporarily waive some of the impacts of student loan default and

to provide borrowers with at least one defaulted federal loan with an easier path out of default.

18

In addition, certain servicers

19

exited the federal student loan program while ED ended its

contracts with private collection agencies (PCAs).

20

Servicers are responsible for accurately

implementing these changes, processing borrower payments and applications, and complying

with federal consumer financial laws.

Complaints reveal that borrowers are reaching out to servicers and encountering widespread

problems that prevent them from getting the information they need, enrolling in IDR plans, or

accessing loan cancellations.

21

Consumers reported experiencing long hold times, delays in

processing applications, and incorrect information regarding payment amounts and due dates.

Further, they reveal significant servicer errors including inaccurate payment histories and

delayed refunds that are owed to borrowers. The following sections discuss the consumer

complaints received by the CFPB during this period as they relate to those issues.

Service Loan Forgiveness Program, Will Put Over 550,000 Public Service Workers Closer to Loan Forgiveness,

(Oct. 6, 2021), https://www.ed.gov/news/press-r

eleases/us-department-education-announces-transformational-

changes-public-service-loan-forgiveness-program-will-put-over-550000-public-service-workers-closer-loan-

forgiveness; U.S. Department of Education, Office of Federal Student Aid, The Limited PSLF Waiver Opportunity

Ended on Oct. 31 2022, (accessed Oct. 5, 2023), https://studentaid.gov/announcements-events/pslf-limited-waiver.

17

88 Fed. Reg. 43820 (Jul. 10, 2023) (to be codified at 34 C.F.R. § 682, 685). 88 FR 43820. The final rule on the

SAVE Plan was published on July 10, 2023, and as such, represents a small portion of the period for this report.

18

U.S. Department of Education, Office of Federal Student Aid, A Fresh Start for Federal Student Loan Borrowers in

Default, (accessed Feb. 16, 2023), https://studentaid.gov/announcements-events/default-fre sh-start.

19

See, e.g., U.S. Department of Education, Office of Federal Student Aid, (LOANS-22-06) Public Service Loan

Forgiveness Program Transitioning from FedLoan Servicing to MOHELA (Updated Dec. 14, 2022), (Jun. 3, 2022),

https://fsapartners.ed.gov/k nowledge-c

enter/library/electronic-announcements/2022-06-03/public-service -loan-

forgiveness-p rogram-transi tioni ng-fedloan-servi cing-mohel a-updated-dec-14-2022.

20

Prior to the collections pause, administrative wage garnishments imposed on federally owned student loans were

administered by third-party private collection agencies (PCAs). However, on November 8, 2021, the Department of

Education announced that PCAs would no longer manage federal defaulted l oans.

Instead, management would b e

transferred to the Department of Education Default Resolution Group (DRG), indicating that the future default

recovery processes may differ in significant ways from the pre-2021 status quo. See U.S. Department of Education,

Office of Federal Student Aid, COVID-19 Relief: Loans in Default, (accessed Jan. 26, 2023),

https://studentaid.gov/announcements-events/covid-19/default

.

21

See Appendi x A for a more detailed analysis of the top issues raised in consumer complaints during this period.

8 CONSUMER FINANCIAL PROTECTION BUREAU

1.2 Problems with access to customer service

representatives

As federal student loan borrowers are now required to make payments for the first time in over

three years, it is important that borrowers are able to get help from customer service

representatives to answer questions, resolve account issues, and enroll in payment plans and

other programs. Complaints suggest that hold times for reaching customer service

representatives at federal student loan servicers are long enough that many borrowers simply

give up. These hold times impede borrowers’ ability to address questions and errors on their

accounts. In addition, some borrowers report that once they get through to customer service

representatives, they receive inaccurate information.

For instance, one borrower waited on the phone for more than two hours and explained that this

delay made it difficult for them to access their benefits:

I have repeatedly emailed and messaged [my servicer] for a month without any response.

Their hold times for a phone call are in excess of two hours. It is not possible

to communicate with my loan provider to request a refund and forbearance.

(Emphasis added)

While attempting to reduce their payments by enrolling in an IDR plan, another borrower

experienced lengthy hold times, disconnected calls, and problems logging into their online

account, suggesting that some borrowers may be encountering difficulty accessing self-help

tools in addition to live customer service:

I tried numerous times from June to September 6, 2023, to speak to a customer

representative so that I can reenroll in the IDR and to enroll in IDR-SAVE. I gave their

automatic questioning system my information; they transfer me to the customer

representative department, but I get no answer. After holding the phone for more

than an hour, it cuts off. This happened numerous times, I tried to log into my

account, an error message says that it cannot recognize my email, Therefore,

I cannot access nor reset my password to enter my account. Customer

Representatives do not answer me their student loan client to give me assistance and

information. (Emphasis added)

Another borrower reported in August 2023 that:

9 CONSUMER FINANCIAL PROTECTION BUREAU

I cannot get ahold of my loan servicer. I have tried a half dozen times. Either the phone line

is disconnected, the chat service doesn't work, or the wait is 960 minutes. I cannot adjust

my payments or do anything unless they talk with me.

Other times, borrowers report that they receive incorrect information from representatives. For

example, one borrower was told by their servicer that the servicer would not participate in

SAVE, even though servicers are obligated to place eligible borrowers into this plan:

I write in regard to inaccurate billing practices of [my servicer]. I was told that they will

not participate in SAVE on Federal Loans, have refused reimbursement of overpayments

made during Covid forbearance, and stated they will "restart" my max repayment timeline

from day 1.

These reported hold times, systems problems, and inaccuracies are meaningful impediments for

borrowers trying to access benefits that they are entitled to under the law. Although the

Department of Education has implemented an “on-ramp” program to help borrowers who miss

payments avoid default, these policies do not fully address the potential harms of customer

service issues. For instance, some borrowers may make payments that are larger than necessary,

miss out on making qualifying payments towards PSLF or IDR cancellation, or accrue interest

due to poor customer service.

1.3 Servicer errors

Borrowers submitted complaints about a host of servicer errors including incorrectly calculated

repayment amounts, lost or inaccurate payment histories, and lost refunds. These types of

errors can lead to borrowers paying more than they owe on their loans or missing out on key

benefits and protections to which they are entitled. Borrowers also report that challenges with

hold times and other customer service issues compound the problems created by servicing

errors, making them more difficult for them to resolve.

1.3.1 Problems in income-driven repayment plan enrollment

IDR plans can provide eligible borrowers with an opportunity to reduce their monthly payments

based on their income and family size, and borrowers enrolled in IDR can have their debt

cancelled after making a certain number of qualifying payments. Some borrowers who were

enrolled in a specific IDR plan (called the “REPAYE” plan) are being automatically converted to

enrollment in the new plan (called the “SAVE” plan). But complaints reveal that some

10 CONSUMER FINANCIAL PROTECTION BUREAU

borrowers, including those who have been automatically enrolled in the SAVE plan, have

received incorrect information and inflated payment amounts during that process.

For example, some borrowers reported that their payments incorrectly increased:

22

During the COVID loan repayment pause, my student loan servicer was automatically

switched from [servicer 1] to [servicer 2] because I applied for Public Student Loan

Forgiveness (PSLF). I was on an income driven repayment plan, REPAYE, prior to my

servicer being switched. My monthly payment under REPAYE prior to my servicer

switching from [servicer 1] to [servicer 2] was $199.22. Per the CARES act, I am not

required to recertify my income for my income driven repayment plan until at least 6

months after student loan repayments restart on 9/31/23, after the COVID pause. I have

therefore not submitted any information for income recertification. My monthly

payment amount should therefore be unchanged at $199.22 until I am

required to recertify my income. Despite this, my monthly payment amount is

listed at $3,210.99 on the main page of my … account.

I called [my servicer] on 8/1/23 and [was unable to get my payment amount changed, so I]

messaged [my servicer] on 8/1/23 with the same questions, and received a response on

8/4/23 that since I made a phone call that same day, they assumed the matter had been

resolved. I messaged back that same day on 8/4/23, and reiterated my same question, as it

had never been addressed. On 8/8/23, I received a response from [my servicer]

stating that based on the information I provided with my income driven

repayment application, my monthly payment amount calculated was

$3,210.99, and if I felt that was inaccurate I could call to recertify my income.

My income driven repayment application was processed in 2018 when I first applied, and I

have never reapplied or attempted to switch repayment plans since then. Again, I am

not required to recertify my income until at least 6 months after student loan

repayments are scheduled to resume after the covid pause. I have provided no

income recertification documentation from which this value has been

calculated. Furthermore, though it lists $3,210.99 as the monthly repayment amount on

the main account page … when I further click into IDR repayment plans under my account,

it actually lists my appropriate monthly payment of $199.22. (Emphases added)

22

During the payment pause, interest should not have accrued on federal student loans. Once payments resumed,

interest should have started to accrue on September 1, 2023, and the payment amounts should be accurate with the

first payment due date scheduled on or after October 1, 2023.

11 CONSUMER FINANCIAL PROTECTION BUREAU

Enrolling in IDR plans is a key protection that helps borrowers ensure that their payments are

affordable. Servicer errors that prevent borrowers from enrolling in IDR plans or provide

inaccurate information about basic loan details such as payment amounts can complicate the

repayment process and lead to unnecessarily high payments that put financial strain on

borrowers, missed payments, and a lack of trust in the student loan servicing program.

1.3.2 Incomplete and inaccurate payment histories

Several loan cancellation programs, including IDR and PSLF, require borrowers to make a

certain number of payments to qualify for cancellation. Borrowers submitted complaints that

their servicers’ records include incomplete or incorrect payment histories, which can make it

difficult and, in some cases, impossible for borrowers to access protections to which they are

legally entitled.

Loan transfers often cause inaccurate or incomplete payment histories.

23

When a loan is

transferred, transferring servicers send data about the loan and its complete payment history to

the receiving servicer. Often, these servicers operate on different loan management systems.

24

Errors occur when a borrower’s data are lost or corrupted as a result of poor data management

or incorrect data mapping—the process whereby the sending servicer and receiving servicer

agree on what specific data elements mean. These errors are compounded by subsequent

transfers making it nearly impossible for servicers or consumers to determine the full account

history. This results in incorrect billing statements, lost progress toward forgiveness, and

difficulty in correcting past billing errors.

25

23

Consumer Financial Protection Bureau, Supervisory Highlights: Student Loan Servicing Special Edition, Issue 27

(Sep. 2022), https://files.consumerfinance.gov/f/documents/cfpb_student-lo

an-servi cing-supervisory-highlights-

special-edition_re port_2022-09.pdf, at 11.

24

Consumer Financial Protection Bureau, Supervisory Highlights: Student Loan Servicing Special Edition, Issue 27

(Sep. 2022), https://files.consumerfinance.gov/f/documents/cfpb_student-lo

an-servi cing-supervisory-highlights-

special-edition_report_2022-09.pdf, at 5-6.

25

See, e.g., Consumer Financial Protection Bureau, Did you get a notice that your student loans are transferring to a

new servicer? Learn more about what this means for you (Sep. 3, 2021), http

s://www.consumerfinance.gov/about-

us/blog/student-loans-transferring-to-new-servicer-learn-what-this-me ans-for-you/. See also, e.g., Consumer

Financial Protection Bureau, Consumer Financial Protection Bureau Settles with Conduent Education Servi ces (May

1, 2019), https://www.consumerfinance.gov/abo

ut-us/newsroom/bureau-se ttl es-conduent-education-

services/#:~:text=Among%20other%20things%2C%20the%20consent,pay%20a%20%243.9%20million%20fine.

12 CONSUMER FINANCIAL PROTECTION BUREAU

These problems are particularly pervasive in the federal student loan portfolio where over 20

million loans have been transferred from one servicer to another since March 2020 (see Figure

2).

FIGURE 2 BORROWER ACCOUNTS BY SERVICER, 2016-2023

26

Complaints suggest that many borrowers struggle to track down basic documentation or make

corrections to their payment histories after their account is transferred. Furthermore, borrowers

report that resolving issues related to recently transferred loans can be difficult because they are

often bounced back and forth between the sending servicer and the receiving servicer.

For example, one borrower reported that they were unable to access a complete payment history

after their loan transferred from one servicer to another:

[Servicer 1] transferred their servicing of my student loans to [Servicer 2] in January of

2022. However, they did not transfer any of my payment history. I spoke with customer

service help at [Servicer 1] this week and they said the history transfer would be

forthcoming. Today I received a copy of my alleged payment history from [Servicer 1].

However, I graduated in 2015 and there is no payment history before 2018.

My loans were consolidated in 2016 and I have never defaulted on a payment.

It feels like they are lying about me and trashing my credit and work history

26

CFPB analysis of data provided by the U.S. Department of Education, Office of Federal Student Aid.

13 CONSUMER FINANCIAL PROTECTION BUREAU

in order to keep me from getting my loans forgiven in the future. (Emphasis

added)

Another borrower reported that when their loan was transferred, their repayment plan was

changed and they have been unable to resolve the issue despite reaching out to their servicer

repeatedly. This borrower reported that they were eligible for a payment of $0, but their servicer

told them that their payment was over $2,500 and was unable to get the error fixed even after

speaking with a customer service representative:

I enrolled in REPAYE income-driven repayment plan for my federal student loans on

6/8/2023. I recertified this repayment plan on December 13, 2022 as is required on an

annual basis. The Federal Government transitioned all borrowers enrolled in the REPAYE

plan to the SAVE plan, therefore, my loans are now enrolled in the SAVE repayment plan.

Per this plan, my monthly payments should be calculated based on my adjusted gross

income from the most recent tax year at the time of recertification. I recertified in 2022,

therefore, my monthly payments should be calculated based on my 2021

annual gross income of $5,170 and amount to $0/month.

My loan servicer … has erroneously calculated my monthly payment

beginning 8/31/2023 to be $2,521.80/mo. This is incorrect. I called … customer

service today, 8/22/2023, to inquire about the basis for the monthly payment. The

representative could not justify the monthly payment calculation nor did the

representative recalculate my monthly payment correctly. I was directed to re-enroll in

SAVE, however, I am already enrolled in this plan. (Emphases added)

As these complaints reveal, transfer-related errors are difficult and time consuming for

consumers to correct. In these situations, consumers challenges are compounded and prolonged

by long call hold times and poor customer service. When borrowers do not recognize these

errors or struggle to correct inaccurate account information, they may end up paying much more

than what they should under IDR plans or, even worse, paying on loans that should be canceled.

1.3.3 Delays and other problems processing refunds

Between March 2020 and September 2023, the Department of Education did not require

borrowers to make payments on loans it held.

27

Certain borrowers, such as those who elected to

make payments during this period, were entitled to a refund of those payments. However, some

27

U.S. Department of Education, Office of Federal Student Aid, COVID-19 Emergency Relief and Federal Student

Aid Webpage, (accessed Oct. 18, 2023), https://studentaid.gov/announcements-events/covid-19.

14 CONSUMER FINANCIAL PROTECTION BUREAU

borrowers who requested refunds report that they never received their refund checks or faced

unreasonably long delays.

For example, one consumer stated that:

On February 9th, 2023 I requested a student loan payment refund in the amount of

$1342.86 from [my servicer] under the Covid 19 payment pause. On February 13th, I

checked my account with [my servicer] and my balance had increased by the refund

amount. I previously filed a complaint with CFPB and received a response from [my

servicer] on May 26, 2023 regarding my refund. In the response, [my servicer] stated that

they would manually request the refund and I should see the refund sometime in June

2023. In July, I still had not received the refund and I reached out to [my servicer] about it.

I was told to wait another 30 days. It has now been 6 months and I still do not have

my refund, yet [my servicer] continues to show my balance as if the refund

was sent to me. (Emphasis added)

Another borrower reported that they requested a refund but never received it:

I requested a refund from my loan provider … around August of 2022 for the payments I

made during the pandemic (which totaled to about $9,000). I checked my account in

December 2022 and the balance on my loans was back to the original amount from before

the pandemic. I called [my servicer] around January of 2023 and was told that the refund

was still processing and would take a long time to receive the check. I called again in June

2023 and they told me I was misinformed before and that my check was actually issued in

October 2022. So they said they would reissue the refund check, but couldn't tell me how

long I'd be waiting before receiving anything. It has been almost a year since

requesting and I'm getting different stories from them. I'm not sure where my

money is or if they've actually issued the refund, but this has been extremely

frustrating and disappointing. (Emphasis added)

For many borrowers, these refunds are critical, and delays or failures to deliver refunds can have

substantial financial consequences for borrowers who may rely on these funds to pay down

other debt or afford other essential goods or services.

15 CONSUMER FINANCIAL PROTECTION BUREAU

1.4 Problems accessing cancellation and discharge

Borrowers with federal student loans reported difficulty accessing loan cancellation programs

for which they were eligible, including closed school discharge, PSLF, and IDR.

28

In some cases,

denials appear to have been the result of basic servicing errors and, in other cases, servicers

failed to inform borrowers about cancellation options for which they might be eligible. Indeed,

during the same period this report covers, CFPB examiners identified unfair and abusive acts or

practices related to servicers’ wrongful denials of IDR, PSLF, and Teacher Loan Forgiveness

applications.

29

For example, one borrower reported that they had not been able to access cancellation through

the PSLF program due to errors in their payment history, payment processing delays, payment

plan enrollment, and consolidation issues:

… I was a public school teacher for 26 years. I am eligible for the PSLF. I had

been denied PSLF in 2017 … and was not provided with any detail about why I was not

eligible or what I could do to meet the PSLF guidelines. During the summer of 2022 … [we]

faxed my PSLF form and the loan consolidation form … I waited from October 2022 to

March 2023, for my forms to be processed. I was told I needed to wait 30, then 60, then 90

days … I have now been advised that I am waiting for prior payment counts from my prior

[my servicer] to be updated in the National Student Loan Data system. I have been

informed that this is done manually and may take until 2024. The false promises of 30, 60

or 90 day processing for the PSLF is not relevant if my prior payment counts cannot be

calculated until 2024 … My PSLF form was submitted in October 2022 and it is July 2023

and I am now waiting for manual counts of payments to be made to prove my PSLF

eligibility. I made on-time payments monthly since 2007, and have far exceeded

the 10 year PSLF requirement … (Emphasis added)

Another borrower, reported that their application for PSLF based on periods of service with the

U.S. Army was not processed in a timely manner, despite multiple attempts at submitting the

paperwork:

28

U.S. Department of Education, Office of Federal Student Aid, Student Loan Forgiveness Webpage, (accessed Oct.

15, 2023), https://studentaid.gov/manage-loans/forgiveness-cancellation.

29

Consumer Financial Protection Bureau, Supervisory Highlights: Student Loan Servicing Special Edition, Issue 27,

(Sep. 2022), https://files.consumerfinance.gov/f/documents/cfpb_student-lo

an-servi cing-supervisory-highlights-

special-edition_report_2022-09.pdf.

16 CONSUMER FINANCIAL PROTECTION BUREAU

I am having difficulty getting my PSLF payment count updated with [my servicer]. I

currently have 12 student loans with [my servicer]. They were transferred from [my prior

servicer] in August of 2022. When they were transferred, [my servicer] told me in a on

their website not to resubmit any PSLF documents since they would receive them from [my

prior servicer] and process them accordingly. [My prior servicer] had already processed

them.

After waiting months for the documents to be processed, I called [my servicer] and I was

informed that while they did in fact have the documents, it would be beneficial for me to

resubmit them … I resubmitted the documents with additional employment information in

December of 2022 …

It has been 8 months since [my servicer] has received the documents to

process my PSLF application. It should not take this long to process PSLF and I don't

appreciate not being informed that my documents have been cancelled. I am being told

that it can take a long time, and while I understand that and am being patient, it is almost

time for me to recertify and resubmit documents for the next year … (Emphasis added)

Overall, complaints indicate that errors and incorrect information provided by servicers can

prevent borrowers from accessing loan cancellation programs and other discharge opportunities

that they are eligible for. The Department of Education has made several policy changes aimed

at increasing borrowers’ ability to use loan cancellation programs, and complaints suggest that

student loan servicers’ actions are hindering or delaying those efforts.

17 CONSUMER FINANCIAL PROTECTION BUREAU

2 Private student loans

2.1 Background

The private student loan portfolio includes $132 billion in outstanding debt, representing

roughly eight percent of the total outstanding student debt.

30

Typically, private student loans

offer fewer flexibilities and more limited discharge opportunities than federal student loans.

31

During this period, one in four complaints to the CFPB about student loan issues were related to

private student loan debt, which is disproportionate to the amount of debt they represent.

32

Complaints suggest that industry participants’ failures are precluding borrowers from accessing

protections and benefits.

2.2 Problems accessing cancellation and discharge

2.2.1 Cancellation due to school misconduct

Over the past decade, administrative and judicial findings established that certain schools

illegally defrauded their students, including by failing to provide the education or job prospects

that they tell students they will provide.

33

Students who took out loans to attend such schools

are frequently eligible for cancellation. For instance, federal student loan borrowers who have

been defrauded by their schools can apply to discharge federal loans through a program called

borrower defense to repayment (BDR).

34

Since 2021, the Department of Education has

discharged over $22 billion in federal student loans for over 1.3 million borrowers who were

30

See Appendix B for more detailed information on the total outstanding student loan volume.

31

For a more detailed discussion, see, e.g., Consumer Financial Protection Bureau, Private Student Loans, (Aug. 19,

2012), https://files.consumerfinance.gov/f/documents/cfpb_education-loan-ombudsman_report_2022-10.pdf.

32

See Appendix A for more detailed information about complaint trends during this period.

32

See Appendix A for more detailed information about complaint trends during this period.

33

See, e.g., U.S. Department of Education, Office of Federal Student Aid, Apply for Borrower Defense Loan

Discharge Webpage, (accessed Oct. 15, 2023), https://studentaid.gov/borrower-defense/.

34

See 34 C.F.R. §§ 685.206, 685.222.

18 CONSUMER FINANCIAL PROTECTION BUREAU

cheated by their schools, saw their institutions precipitously close, or are covered by related

court settlements.

35

While private student loan borrowers cannot access the BDR program, they do have certain

rights to challenge the repayment of loans that were based on fraudulent representations. The

FTC’s Holder-in-Due-Course Rule (Holder Rule) requires all covered transactions, including

education financing, to include mandated language acknowledging that if the seller fails to

satisfy its obligations, the borrower can refuse to repay the loan, regardless of who holds the

contract.

36

Many private student loans thus include a contractual guarantee in the promissory

note that the borrower can assert against any subsequent loan holder any claim they have

against their school. If borrowers have federal loans discharged under BDR, it will often involve

underlying facts and circumstances that demonstrate fraudulent conduct that could be the basis

for a claim under the Holder Rule.

Private student loan borrowers submitted complaints to the CFPB that their lenders have

refused to discharge their private student loans or even so much as consider their claims, even

after the federal loans they took out for the same education have been discharged under the

Department of Education’s BDR process.

37

Complaints also continue to indicate that holders of

private student loan contracts are not engaging with borrowers’ claims of deception and abuse at

schools, even where other law enforcement actors reached conclusive findings on their claims.

For example, one borrower reported that, even after their federal student loans were cancelled

due to misconduct by their institution, they still owed their private student loans:

I have a private student loan with [loan holder] … The school is closed … There was a

lawsuit against the school and we the students won. My federal student loans were

35

U.S. Department of Education, Biden-Harris Administration Announces an Additional $9 Billion in Student Debt

Relief, (Oct. 4, 2023), https://www.ed.gov/news/press-r

eleases/b iden-harri s-administration-announces-addi tional-

9-billion-student-debt-

relief#:~:text=The%20Biden%2DHarris%20administration%20announced,automatic%20relief%20for%20borrower

s%20with.

36

16 C.F.R. Part 433. A borrower’s successful challenge to the validity of a loan under the Holder Rule would result in

the discharge or cancellation of the debt by the current loan holder and appropriate corrections to credit reporting.

The FTC has explicitly stated that the Holder Rule applies to higher education financing. See Federal Trade

Commission, Staff Guidelines on Trade Regulation Rule Concerning Preservation of Consumers’ Claims and

Defenses, 9 (May 4, 1976),

https://www.ftc.gov/system/files/documents/rules/holder-du

e-course-

rule/760504hidcrule.pdf (noting the rule applies to transactions for “vocational training”).

37

This issue was also identified and discussed at length in the 2022 Report of the Education Loan Ombudsman. See

Consumer Financial Protection Bureau, Report of the CFPB Education Loan Ombudsman, (Oct. 2022),

https://files.consumerfinance.gov/f/documents/cfpb_education-l oan-ombudsman_report_2022-10.pdf, at 34-5

3.

19 CONSUMER FINANCIAL PROTECTION BUREAU

removed completely … I do Not have a transcript, a degree, anything from the school due

to the fraudulent activities they did. [Loan holder] is not looking into this matter

and is ignoring my concerns and responses … Please help! (Emphasis added)

The private student loan company responded, but in the process provided misleading

information about the borrower’s ability to make these claims:

… T

o further explain, in reference to your private loans, there’s no discharge program

available at this time for students who claim a defense to repay a private loan due to

misinformation or the quality of education they received at their school. We’re not able to

respond to any information or guidance provided by a customer’s school, financial aid

advisor, or other financial advisor. You are welcome to review your Loan

Agreement for any additional legal remedies that may be available to you.

(Emphasis added)

Similarly, a second borrower reported that they had been unable to access relief using the

Holder Rule provision in their private student loan promissory note:

I attended [for-profit school] from 2005 to 2008 and I was successful in discharging my

federal student loans through the Borrower Defense to Repayment program … [W]hich

was established to provide student debt relief to students who were misled, defrauded, or

otherwise harmed by predatory colleges and universities – often, for-profit schools … But

the program only covers federal student loans. Private student loans are not eligible for

Borrower Defense relief, and [loan holder] refused to discharge my private loans. I

believe I am entitled to cancellation of my private student loans under the

“Holder Rule” theory. This rule requires that loans disbursed by commercial entity

through a lender’s or creditor’s relationship with that entity include a provision in the loan

promissory note that allows a borrower to raise the same claims and defenses against the

lender that they could raise against the commercial entity. (Emphasis added)

In the case that a school commits fraud, it is often the borrower’s contractual right to assert a

claim against the loan holder and seek a discharge of that loan. Complaints, however, have

indicated that various private loan servicers provide misleading information about borrowers’

rights, either dissuading the borrower from pursuing these claims or functionally limiting their

ability to do so. These complaints raise questions about whether private student loan servicers

are operating in compliance with loan promissory notes, and they suggest that borrowers who

have the right to exercise defense to collection efforts are being forced to continue to pay on

their loans.

20 CONSUMER FINANCIAL PROTECTION BUREAU

2.2.2 Bankruptcy

On March 13, 2023, the CFPB issued a bulletin to address improper collection attempts by

servicers of certain student loans after they had been discharged in bankruptcy.

38

As the bulletin

explains, after a debtor files for bankruptcy, a judge issues a discharge order that releases a

debtor from personal liability for all debts unless they are exempted. Some types of student

loans—including federal student loans and private student loans that meet the definition of a

“qualified education loan”—are not discharged by these general court orders.

39

But some private

student loans that do not meet the definition of a “qualified education loan,” such as loans made

to attend schools or programs whose borrowers may not access Title IV aid and loans made in

excess of the cost of attendance, are covered by the general discharge order.

Accordingly, the bulletin details CFPB examiners’ determination that student loan servicers

engaged in an unfair act or practice, in violation of the Dodd-Frank Act, when they resumed

collection of debts that were discharged by bankruptcy courts. Since publishing the bulletin, the

CFPB has worked to ensure that companies maintain policies and procedures to determine

whether loans are dischargeable in bankruptcy and whether, in the absence of such policies,

companies have made collection attempts on loans that were discharged via bankruptcy court.

Complaints continue to reflect that servicers are providing inaccurate information to borrowers

about loan eligibility for bankruptcy discharge. For example, a borrower was provided incorrect

information and told that neither federal nor private student loans are dischargeable unless

undue hardship can be proven.

I filed bankruptcy in December 2021, which was discharged in February 2022. This

included my [private education loan]. The loan was removed from my credit report but

then was put back on and into repayment in April of 2022. They are still trying to

collect on this loan, even though it was discharged. I have tried to talk to [my

servicer] but they keep telling me that it's not eligible for discharge with no explanation as

to why not. (Emphasis added)

38

Consumer Financial Protection Bureau, Bulletin 2023-01: Unfair Billing and Collection Practices After

Bankruptcy Discharges of Certain Student Loan Debts, (Mar. 16, 2023),

https://files.consumerfinance.gov/f/documents/cfpb_unfair-b

illing-collection-bankru ptcy-student-loan-debt_2023-

01.pdf. See also, e.g., Robert Cameron, Busting myths about bankruptcy and private student loans (Apr. 12, 2022),

https://www.consumerfinance.gov/about-us/blog/busting-myths-about-b ankrup tcy-and-private-stu de nt-loans/.

39

The Bankruptcy Code requires borrowers wi th the se obligations to demonstrate that the debt would impose an

undue hardship throu gh an adversarial proceeding.

21 CONSUMER FINANCIAL PROTECTION BUREAU

The company responded by incorrectly stating that no education-related loans are dischargeable

unless there is a showing of undue hardship and an adversary proceeding:

It is important to understand that neither federal nor private loans are

dischargeable under current bankruptcy laws unless undue hardship can be

proven. As of this date, we have no record that your student loans were discharged by

means of an adversary proceeding. Therefore, you are still obligated to repay this loan.

(Emphasis added)

Servicers cannot ignore bankruptcy orders and should develop policies and procedures to

ensure that they are not illegally collecting on loans discharged in bankruptcy.

2.3 Direct lending by colleges

Some private education loans are offered by institutions of higher education, including both for-

profit schools and non-profit schools. These loans are typically not affiliated with federal student

loan programs administered by the U.S. Department of Education. The CFPB is concerned about

the borrower experience with institutional loans because of past abuses at schools where

students were subjected to high interest rates and strong-arm debt collection practices. Schools

have not historically been subject to the same servicing and origination oversight as traditional

lenders.

The CFPB has taken enforcement actions on predatory lending related to colleges

40

and

conducted examinations of colleges’ in-house lending programs.

41

In September 2022, the CFPB

reported examiners’ findings that certain institutions maintained a blanket policy of withholding

transcripts in connection with the extension of credit.

42

Such withholding constitutes an abusive

40

See, e.g., Consumer Financial Protection Bureau, CFPB Sues For-Profit College Chain ITT For Predatory Lending,

(Feb. 26, 2014), https://www.consumerfinance.gov/about-u

s/newsroom/cfpb-sues-for-profi t-col le ge-chai n-itt-for-

predatory-lending/. See also, e.g., Consumer Financial Protection Bureau, CFPB Wins Default Judgment Against

Corinthian Colleges for Engaging in a Predatory Lending Scheme, (Oct. 28, 2015),

https://www.consumerfinance.gov/about-us

/newsroom/cfpb-wins-default-ju dgme nt-agai nst-corinthi an-col leges-

for-engaging-in-a-predatory-lending-scheme/

41

See, e.g., Consumer Financial Protection Bureau, Consumer Financial Protection Bureau to Examine Colleges’ In-

House Lending Practices, (Jan. 20, 2022), https://www.consumerfinance.gov/about-u

s/newsroom/consumer-

financial-protection-bureau-to-examine-colleges-in-house-lending-practices/.

42

Consumer Financial Protection Bureau, Supervisory Highlights: Student Loan Servicing Special Edition, Issue 27,

(Sep. 2022), https://files.consumerfinance.gov/f/documents/cfpb_student-lo

an-servi cing-su pe rvisory-highlights-

special-edition_report_2022-09.pdf.

22 CONSUMER FINANCIAL PROTECTION BUREAU

act under the Consumer Financial Protection Act in certain cases.

43

In September 2023, the

CFPB released a report highlighting consumer risks related to tuition payment plans offered by

colleges, which are often marketed as low-risk, no-cost alternatives to student loans but often

feature high costs for late payment, coercive debt collection tactics including transcript

withholding, and more.

44

Consumer complaints reveal that some students were misled about financial products offered by

their schools. For instance, one borrower reported that they were misled about the income-share

agreement (ISA) that their school offered in partnership with a third-party lender. The borrower

submitted a complaint stating that they did not receive required disclosures and that they were

told the ISA would not affect their credit when in fact it did.

I am writing to file a complaint against [my servicer], [school], and [lender] for

attempting to collect money from me on an illegal contract, an Income Share Agreement …

[T]he ISAs they employed are considered private education loans under 12

C.F.R. 1026.46(b)(5). The ISAs … did not include the required disclosures

outlined in 12 C.F.R. 1026.46(b)(5) … [The school] misrepresented the nature

of these ISAs in their marketing and business practices, and was not a

properly licensed lender when the loan contract was signed … [The school]

provided a private education loan that did not conform to federal consumer financial laws.

… I was misled by their representations that the ISA was not a loan and would not affect

my credit. The contract for this loan states in bold print that, “THIS IS NOT A LOAN OR

CREDIT” and “THIS INCOME SHARE AGREEMENT IS NOT A LOAN OR CREDIT. THIS

AGREEMENT IS NOT AN ASSIGNMENT OF WAGES” … Despite the contract stating

that it was not a loan or credit product, my credit report shows an account

from [my servicer] categorized as either “student loan” or “education loan …”

(Emphasis added)

Other borrowers wrote to the CFPB about debt collection experiences related to debts they owe

to their schools. One borrower reported that transcript withholding prevented them from

getting the additional training they needed:

43

Consumer Financial Protection Bureau, Supervisory Highlights: Student Loan Servicing Special Edition, Issue 27,

(Sep. 2022), https://files.consumerfinance.gov/f/documents/cfpb_student-lo

an-servi cing-supervisory-highlights-

special-editi on_report_2022-09.pdf, at 8-9; 12 U.S.C. § 5331.

44

Consumer Financial Protection Bureau, Tuition Payment Plans in Higher Education, (Sep. 14, 2023),

https://www.consumerfinance.gov/data-re search/rese arch-reports/tuition-payment-p lans-in-higher-education/.

23 CONSUMER FINANCIAL PROTECTION BUREAU

I owe University of [State] a balance of $2500.00 dollars … I have been notified that I am

going to lose my job in the near future … I have tried to enroll in other schools to become

trained in another skill before I lose my job. I called the University of [State] to obtain my

transcripts and they are withholding them from me. The other schools will not accept

unofficial copies of transcripts. I have tried to set up a payment plan with

[University of State] and ask that they go ahead and release my transcripts

and they are refusing to do that as well. I am stuck in a terrible situation. I am

getting ready to be unemployed and am unable to further my skills … I do not deny owing

the debt and fully intend to repay … I tried to complete an official withdraw with

[University of State] too avoid incurring the debt and was told it was too late to do so. I

tried to avoid this situation, my 21 year old brother was very sick with cancer at that time

and I could not focus on my studies … (Emphasis added)

Another borrower reported that a balance they owed to their college simply had no promissory

note and appeared to be governed by a separate enrollment agreement:

I am writing to file against the school [College] … [and Servicer]. This school has had

numerous court cases for deceptive practices and fraudulent actions. I submitted a

borrower defense application to the Department of Education in March 2018 and recently

it was approved with 100% student loans forgiven … However, I am writing about the

institutional … in-house financing loans associated with [college] … There is no

corresponding promissory note as this balance was interest free accounts

receivable. This balance would have been covered under an enrollment

agreement … (Emphasis added)

Consumer complaints reveal that borrowers are sometimes misled by information that schools

or third-party service providers give them about financial products. Borrowers express

confusion and experience harm when there is a mismatch between their repayment expectations

and the terms stated in their original loan documents. When colleges extend credit, it is they

must provide adequate disclosures and follow federal consumer protection laws.

24 CONSUMER FINANCIAL PROTECTION BUREAU

3 Recommendations

Overall, complaints submitted to the CFPB suggest that there are fundamental problems related

to student loan servicing that jeopardize borrowers’ ability to make payments, achieve loan

cancellation, or receive other protections they are entitled to under federal law.

Recommendations for policymakers, law enforcement, and industry participants include:

Ensuring that federal student loan borrowers can access all protections intended

for them under the law:

Federal student loan servicers should correct processes and eliminate long hold times,

processing delays, and basic errors. Furthermore, servicers should ensure that all federal

student loan borrowers can access loan cancellation options for which they are eligible

and that these programs are implemented consistent with the law and Department of

Education policy.

Policymakers, regulators, and law enforcement officials should remain vigilant to

consumer complaints about servicing failures that create barriers to federal benefits and

protections. Misinformation, delays, and errors in processing deprive consumers of the

benefits and protections afforded to them under law. Detecting servicer failures is critical

to effectively holding industry participants accountable for violations of the law or

contractual obligations.

Ensuring that loan holders and servicers of private student loans do not collect

debt where it may no longer be legally owed or where the debt was previously

discharged:

Regulators and law enforcement should examine whether holders and servicers of

private student loans have policies and procedures to accurately disclose and manage the

contractual protections required by the Holder Rule.

45

After a decade of private and

government actions compiling evidence that predatory schools coerced students to take

on debt through fraudulent means, holders and servicers must honor these defenses to

collection.

45

See also Consumer Financial Protection Bureau, Report of the CFPB Education Loan Ombudsman, (Oct. 2022),

https://files.consumerfinance.gov/f/documents/cfpb_education-l oan-ombudsman_report_2022-10.pdf, at 54.

25 CONSUMER FINANCIAL PROTECTION BUREAU

Companies should ensure that they are not illegally collecting on loans discharged in

bankruptcy.

Companies should also proactively provide accurate and actionable information about

whether borrowers’ student loans are eligible for discharge in bankruptcy without an

adversarial proceeding.

Having access to the terms and conditions of a loan is a basic protection for both current

and prospective borrowers. Loan holders and servicers should post promissory notes

online so that prospective and current borrowers can understand the terms and

conditions of their credit.

Using consumer complaints to develop policies and procedures when they reveal

systematic problems:

The CFPB continues to receive complaints about the same issues, suggesting that loan

holders and servicers are responding to individual complaints but failing to make

systemic changes that address broadly applicable problems. Industry participants should

use consumer complaints to identify and address systemic consumer protection issues

within their organizations and remediate all similarly situated consumers.

26 CONSUMER FINANCIAL PROTECTION BUREAU

4 Contact Information

To reach the CFPB’s Education Loan Ombudsman:

By phone (844) 611-4260

By email Education_Loan_Ombudsman@cfpb.gov

By mail Consumer Financial Protection Bureau

Attn: Education Loan Ombudsman

1700 G Street NW

Washington, DC 20552

To submit a complaint:

Online c

onsumerfinance.gov/complaint

By phone 180+ languages, M-F 8am-8pm EST

Toll-Free: (855) 411-CFPB (2372)

TTY/TDD: (855) 729-CFPB (2372)

By mail Consumer Financial Protection Bureau

PO Box 2900

Clinton, Iowa 52733

By fax (855) 237-2392

Press and media requests:

By email press@consumerfinance.gov

Congressional inquiries:

By phone (202) 435-7960

27 CONSUMER FINANCIAL PROTECTION BUREAU

APPENDIX A: COMPLAINT TRENDS

Monitoring consumer complaints is one of the CFPB’s primary functions. Complaints provide

insights into problems consumers experience and can serve as an early indicator of issues in the

financial marketplace. Complaint analyses support the CFPB’s work to supervise companies,

enforce federal consumer financial laws, propose rules, and develop tools to empower

consumers to make informed financial decisions.

The CFPB analyzes complaints in several ways to identify trends and possible consumer harm.

For example, the CFPB monitors complaint volume across multiple categories, such as product,

issue, sub-product, sub-issue, company, and company response, among others. The CFPB

analyzes complaint volume across time and by geographic area, as well as by self-identified

characteristics, such as servicemember status and age.

While complaint volume and context are important, some of the most valuable information is

found in the narrative text that both consumers and companies provide during the complaint

process. The CFPB analyzes the narrative text consumers provide in their complaints, frequently

augmenting traditional qualitative analysis with automated methods. Similarly, the Bureau

analyzes the text companies provide in their responses to consumers and in the documents

provided to support their responses. Analyzing text from consumers and companies provides a

more complete understanding of issues and a clearer idea of how companies respond to those

issues.

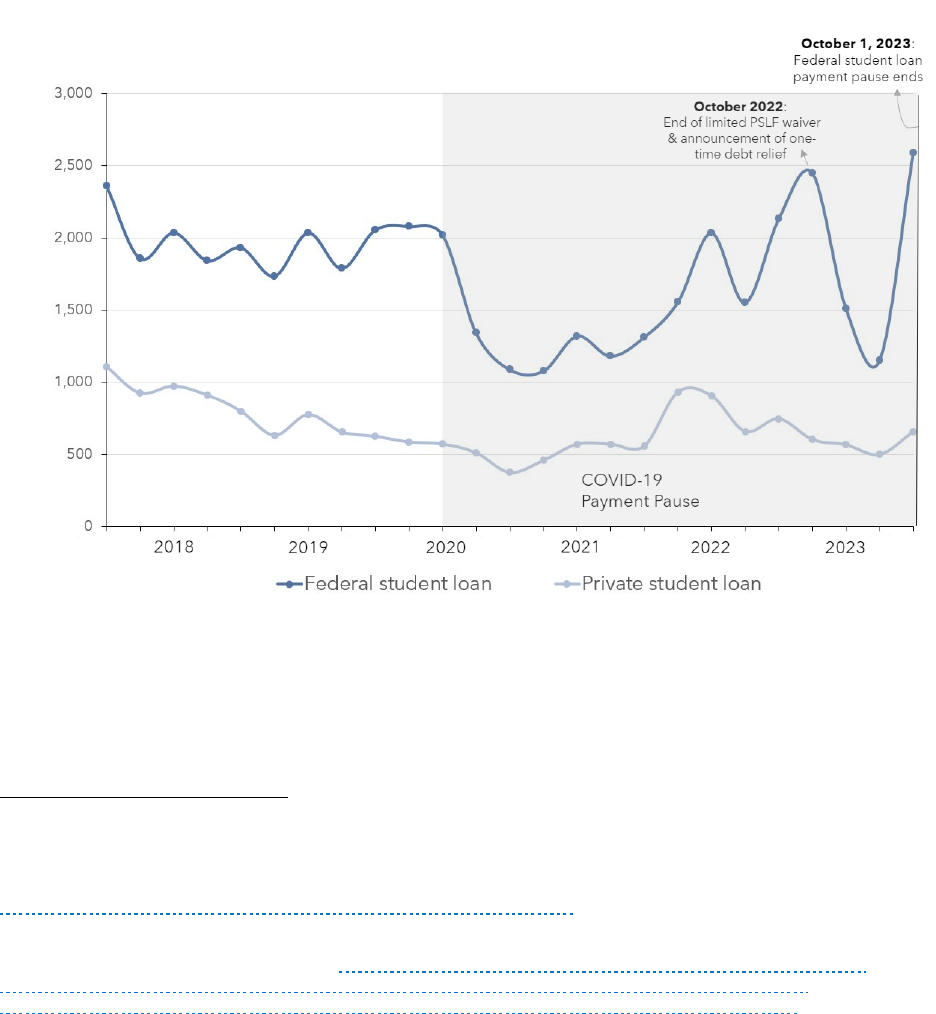

During the period of September 1, 2022 through August 31, 2023 of the 9,284 student loan

complaints received, 6,934 were related to federal student loans and 2,350 were related to

private student loans (Figure 3). The number of overall complaints has increased compared to

the previous year. The number and share of complaints about federal student loans has

increased compared to the previous year, while the number and share of complaints about

private student loans has decreased.

28 CONSUMER FINANCIAL PROTECTION BUREAU

FIGURE 3 COMPLAINT VOLUME, SEPTEMBER 2022 – AUGUST 2023

The distribution of complaints on federal student loans during the current period differed

compared to the previous year (Figure 4). More complaints were received at the beginning

(September and October 2022) and end (July and August 2023) of the current reporting period.

During the prior reporting period, more complaints were received during the middle (December

2022 to February 2023). Year-over-year, total student loan-related complaints increased just

over 10 percent, federal student loan-related complaints increased just over 27 percent, and

private student loan-related complaints decreased around 21 percent.

FIGURE 4 YEAR-OVER-YEAR COMPARISON OF COMPLAINT VOLUME, BY MONTH AND LOAN TYPE

29 CONSUMER FINANCIAL PROTECTION BUREAU

Student loan borrower complaints most frequently involve dealing with a lender or servicer and,

more specifically, receiving bad information about a loan and having problems with how

payments are handled. MOHELA was the top subject of federal student loan complaints

received by the CFPB during this period, followed by EdFinancial, Nelnet, Maximus, and

PHEAA (Figure 5).

FIGURE 5 ORGANIZATIONS WITH THE MOST FEDERAL STUDENT LOAN COMPLAINTS, SEPTEMBER

2022 – AUGUST 2023

Almost nine in ten complaints about federal student loans involved problems consumers had

while dealing with their servicer (Figure 6).

FIGURE 6 CONSUMER-IDENTIFIED ISSUES IN FEDERAL STUDENT LOAN COMPLAINTS BY

ORGANIZATION, SEPTEMBER 2022 – AUGUST 2023

30 CONSUMER FINANCIAL PROTECTION BUREAU

Navient was the top subject of private student loan complaints received by the CFPB during this

period, followed by the SLM Corporation (also known as Sallie Mae), Nelnet, PHEAA, and

Discover (Figure 7).

46

FIGURE 7 TOP RECIPIENTS OF STUDENT LOAN COMPLAINTS, SEPTEMBER 2022 - AUGUST 2023

Consumer complaints most frequently concerned dealing with a lender or servicer (Figure 8).

FIGURE 8 CONSUMER-IDENTIFIED ISSUES IN PRIVATE STUDENT LOAN COMPLAINTS BY

ORGANIZATION, SEPTEMBER 2022 – AUGUST 2023

46

The figures below are based on complaints sent to companies or organizations and data exported from the public

Consumer Comp l aint Database (CCDB) as of Sep. 1, 2023.

31 CONSUMER FINANCIAL PROTECTION BUREAU

APPENDIX B: STUDENT LOAN TRENDS

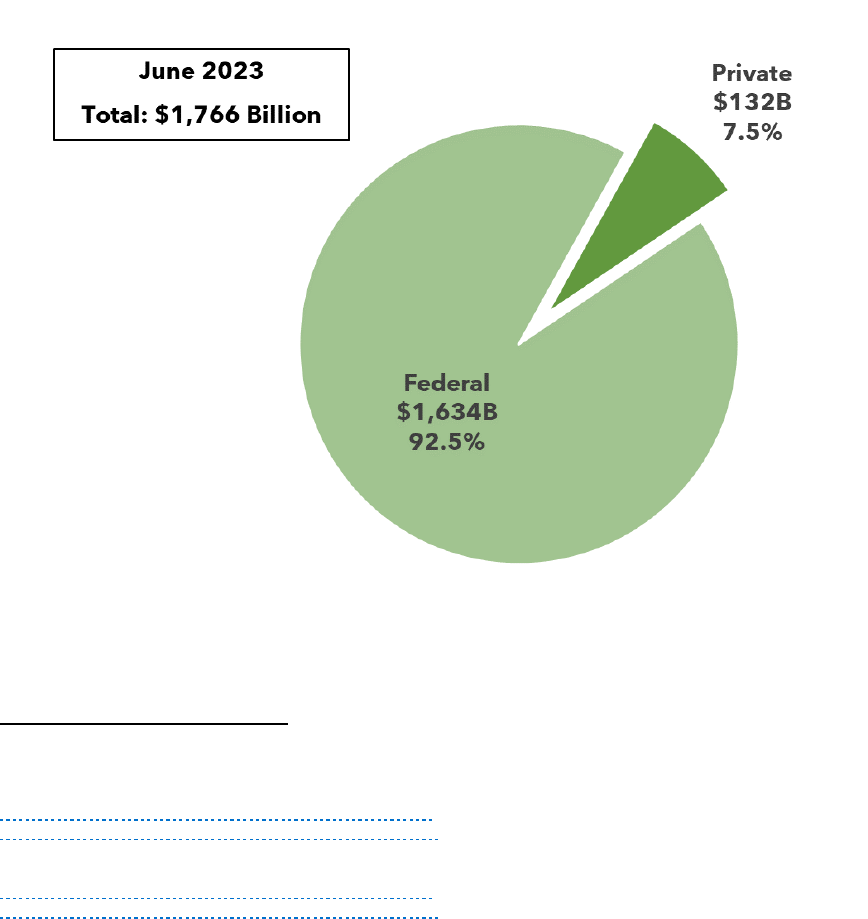

The Department of Education is the dominant player in the student loan industry (Figure 10).

Borrowers collectively owe $1,766 billion in outstanding student loans, of which $132 billion are

owed to private education lenders (issued by banks, credit unions, state-sponsored agencies, and

other non-bank lenders).

47

FIGURE 9 TOTAL OUTSTANDING STUDENT LOAN VOLUME, JUNE 2023

48

47

The total private stu de nt l oan volume is derived b y subtracting the total portfolio amount reported by the Office of

Federal Student Aid from the total amount of education debt reported by the Federal Reserve Board’s G19 dataset.

U.S. Department of Education, Office of Federal Student Aid, Federal Student Aid Portfolio Summary,

https://studentaid.gov/data-center/student/portfolio

; F

ederal Reserve, G19 Consumer Credit Series (Oct. 6, 2023),

https://www.federal reserve.gov/releases/g19/current/. Chart updated Sep. 7, 2023.

48

U.S. Department of Education, Office of Federal Student Aid, Federal Student Aid Portfolio Summary,

https://studentaid.gov/data-center/student/portfolio; F

ederal Reserve, G19 Consumer Credit Series (Oct. 6, 2023),

https://www.federal reserve.gov/releases/g19/current/. Chart updated Sep. 7, 2023.

32 CONSUMER FINANCIAL PROTECTION BUREAU

The chart below reveals the growth in student loan debt over time (Figure 11). Since 2009, the

share of household debt attributed to student loans has grown substantially, from 22 percent to

37 percent, making it the largest single source of household debt (excluding primary mortgage

balances).

FIGURE 10 NON-MORTGAGE DEBT BALANCES (JUNE 2008- JUNE 2023)

49

49

Federal Reserve Bank of New York, Consumer Credit Panel/Equifax: Total Debt Balance and its Composition

(Aug. 8, 2023), https://www.newyorkfed.org/microeconomics/databank.html. Chart updated S

ep. 7, 2023.

33 CONSUMER FINANCIAL PROTECTION BUREAU

Due to the federal student loan payment pause, delinquent balances were at a historically low

level as of June 2023 (Figure 12).

FIGURE 11 DELINQUENT BALANCES AS A SHARE OF TOTAL OUTSTANDING LOAN BALANCES, 2009 -

2023

34 CONSUMER FINANCIAL PROTECTION BUREAU

As of March 2023, borrowers owed over $1.6 trillion in federal student loan debt (Figure 13).

FIGURE 12 TOTAL FEDERAL STUDENT LOANS OUTSTANDING BY TYPE

50

50

U.S. Department of Education, Office of Federal Student Aid, Federal Student Aid Portfolio Summary,

https://studentaid.gov/data-center/student/portfolio. Chart u

pdated Sep. 7, 2023.

35 CONSUMER FINANCIAL PROTECTION BUREAU

The average federal student loan burden was $37,645 at the end of the June 2023 and has

grown relatively steadily since 2012 (Figure 14).

FIGURE 13 AVERAGE OUTSTANDING FEDERAL STUDENT LOAN BALANCE PER BORROWER

51

51

U.S. Department of Education, Office of Federal Student Aid, Federal Student Aid Portfolio Summary,

https://studentaid.gov/data-center/student/portfolio. C

hart updated Sep. 7, 2023.

36 CONSUMER FINANCIAL PROTECTION BUREAU

Tighter underwriting of private loans following the Great Recession, the introduction of the

federal graduate PLUS program in 2006, and post-origination flexibilities (e.g., IDR and

discharge opportunities) provided to federal borrowers have eroded the demand for private

loans in recent years (Figure 15). Sallie Mae is top issuer of in-school private student loans. Top

refinance lenders include SoFi and Earnest, a division of Navient.

FIGURE 14 NON-FEDERAL STUDENT LOAN ORIGINATIONS BY LOAN TYPE

52

Note: The College Board stopped disaggregating non-federal origination volume by type of issuer,

ef f ective with the 2016-17 academic year.

52

CollegeBoard, Trends in Student Aid 2016, https://research.collegeboard.org/media/pdf/trends-stu de nt-aid-2016-

full-report.pdf, at p. 9, Table 2, “Total Student Aid”; Coll ege Board, Trends in College Pricing and Student Aid 2022,

https://research.collegeboard.org/media/pdf/trends-in-college-pricing-student-aid-2022.pdf, at p. 31, Figure SA-1,

“Total Student Aid”; Enterval Analytics, Private Student Loan Report (Jun. 27, 2023),

https://www.enterval.com/media/files/enterva

l/psl /enterval-private-stu de nt-loan-report-2023-

q1.pdf?v=20230627T195956. Charts updated Sep. 7, 2023.