GRETCHEN WHITMER

GOVERNOR

S

TATE OF

M

ICHIGAN

DEPARTMENT OF TREASURY

L

ANSING

RACHAEL EUBANKS

STATE TREASURER

P.O. BOX 30471

•

LANSING, MICHIGAN 48909

www.michigan.gov/statetaxcommission

•

517-335-3429

5102 (Rev. 01-19)

Bulletin No. 13 of 2023

October 23, 2023

Property Tax and Equalization Calendar for 2024

TO:

Assessor and Equalization Directors

FROM:

Michigan State Tax Commission

SUBJECT:

Property Tax and Equalization Calendar for 2024

STATE TAX COMMISSION

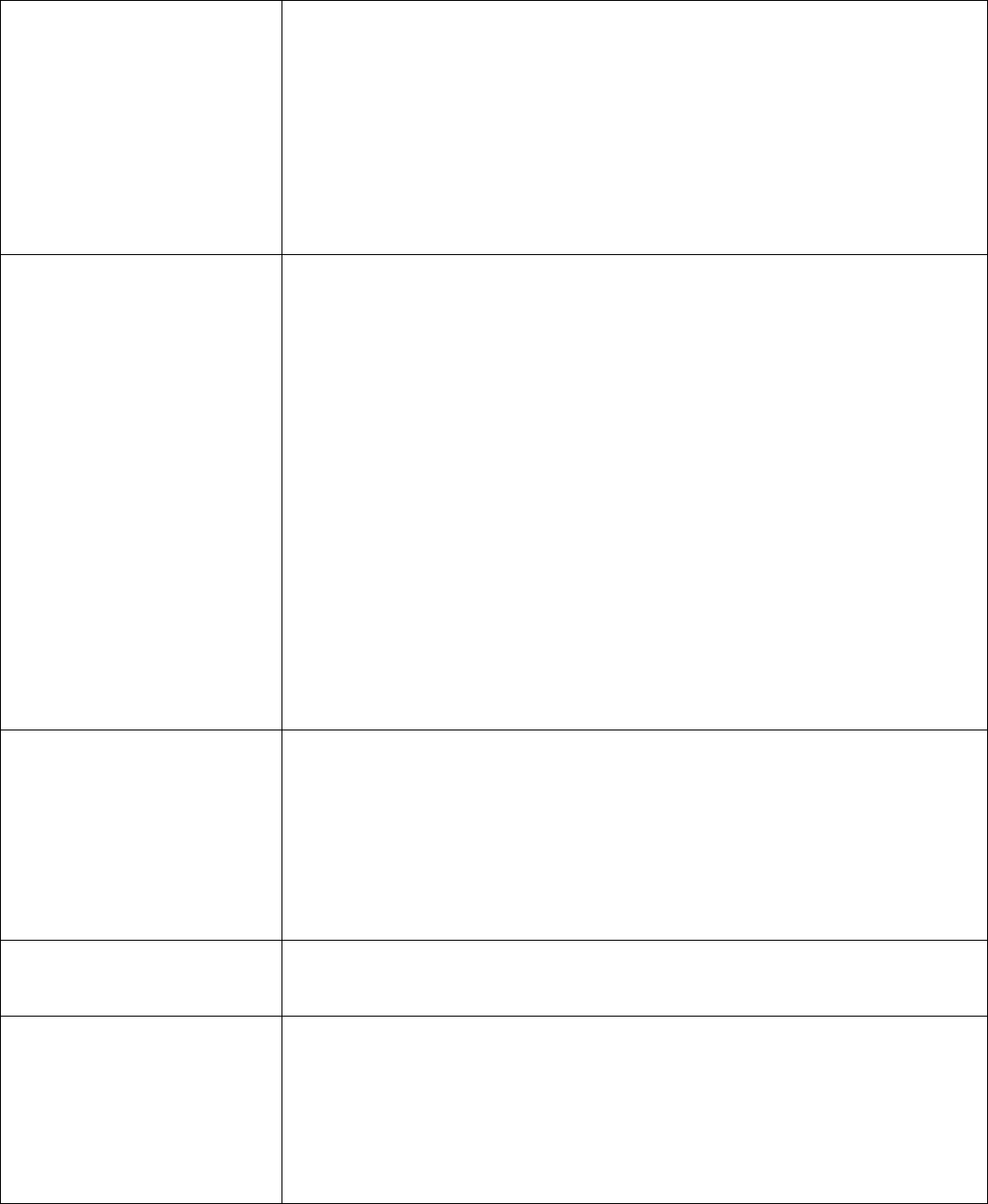

2024 PROPERTY TAX, COLLECTIONS AND EQUALIZATION CALENDAR

This Tax Calendar is being provided as an informational resource for important dates and deadlines

related to assessing, equalization, foreclosures, tax collections, and related topics. It does not cover

every statutory or other deadline that may exist. All statutorily required dates are controlling. Dates

listed in the Tax Calendar that are not directly found in statute, administrative rules, or State Tax

Commission policies are suggested as best practices.

By the 15th day of each

month

County Treasurer must account for and deliver to the State the State

Education Tax collections on hand on the last day of the preceding month.

MCL 211.43(10)

By the 1st day of each

month

County Treasurer must account for and deliver to the State the State

Education Tax collections on hand on or before the 15

th

day of the

immediately preceding month. MCL 211.43(10)

December 1, 2023

Results of equalization studies must be reported to assessors of each

township and city. Responsibilities of the Equalization Director

December 31, 2023

Deadline for an owner that had claimed a conditional rescission of a Principal

Residence Exemption to verify to the assessor that the property still meets

the requirements for the conditional rescission through a second and third

year annual verification of a Conditional Rescission of Principal Residence

Exemption (PRE) (Form 4640). MCL 211.7cc(5). Deadline for a land

contract vendor, bank, credit union or other lending institution that had

claimed a foreclosure entity conditional rescission of a Principal Residence

Exemption to verify to the assessor that the property still meets the

requirements for the conditional rescission through the filing of an annual

verification of a foreclosure entity. MCL 211.7cc(5)

Page 2

December 31, 2023

Cont.

Tax Day for 2024 property taxes. MCL 211.2(2)

All taxes due and liens are canceled for otherwise unsold 2023 tax

foreclosure parcels purchased by the state or transferred to the local unit or

the Michigan Land Bank Fast Track Authority. MCL 211.78m(11) and (12)

January 2, 2024

December 31 is a Sunday

January 1 is a State Holiday

Deadline for counties to file 2023 equalization studies for 2024 starting bases

with the State Tax Commission for all classifications in all units on Form 602

(L-4018P) State Tax Commission Analysis for Equalized Valuation of

Personal Property and Form 603 (L-4018R) State Tax Commission Analysis

for Equalized Valuation of Real Property. STC Rule 209.41(5)

January 10, 2024

Except as otherwise provided in section 9m, 9n, or 9o, Assessors and/or

Supervisors are required to annually send a personal property statement to

any taxpayer they believe has personal property in their possession in their

local unit. Form 632 (L-4175) Personal Property Statements must be sent or

delivered no later than January 10 each year. MCL 211.19(2)(c)

January 25, 2024

Local units with an SEV of $15,000,000 or Less: 2023 taxes collected by

January 10 must be distributed within 10 business days of January 10. MCL

211.43(5)

All other local units: Must distribute 2023 taxes collected within 10 business

days after the 1st and 15th of each month except in March. MCL

211.43(3)(a)

February 1, 2024

Property Services Division staff reviews preliminary forms L4030 and provide

a report to the commission by February 1. STC Rule 209.42(e)

Deadline to submit STC Form 2699 (L-4143) Statement of “Qualified

Personal Property” by a “Qualified Business with the assessor (not later than

February 1). MCL 211.8a(2)

Deadline for notice by certified mail to all properties that are delinquent on

their 2023 property taxes (not later than February 1). MCL 211.78f(1)

Last day for county to send second notice by first class mail to all properties

that have delinquent 2022 taxes. MCL 211.78f

Page 3

February 14, 2024

The governing body may waive the penalty for the homestead property of a

senior citizen, paraplegic, quadriplegic, hemiplegic, eligible service person,

eligible veteran, eligible widow or widower, totally and permanently disabled

or blind persons, if that person has filed a claim for a homestead property tax

credit with the State Treasurer before February 15 (MCL 211.59(3). Also

applies to a person whose property is subject to a farmland/development

rights agreement if they present a copy of the development rights agreement

or verification that the property is subject to the development rights

agreement before February 15. If statements are not mailed by December

31, the local unit may not impose the 3% late penalty charge. MCL 211.44(3)

Last day to pay property 2023 taxes without the imposition of a late penalty

charge equal to 3% of the tax in addition to the property tax administration

fee, if any. MCL 211.44(3)

February 15, 2024

STC reports assessed valuations for DNR lands to assessors. MCL

324.2153(2)

A local unit of government that collects a summer property tax shall defer the

collection of 2023 summer taxes until this date for qualified property owners

who filed intent. MCL 211.51(2)

February 16, 2024

February 19 is a State

Holiday February 18 is a

Sunday February 17 is a

Saturday

Deadline for county equalization director to publish in a newspaper, the

tentative equalization ratios and estimated SEV multipliers for 2024, and to

provide a copy to each assessor and board of review in the county. All

notices of meetings of the boards of review must give the tentative ratios and

estimated multipliers pertaining to their jurisdiction (on or before the third

Monday in February). MCL 211.34a(1)

February 20, 2024

Deadline for payments to municipalities from the Local Community

Stabilization Authority:

Local Community Stabilization Share revenue for county extra-voted millage,

township millage, and other millages levied 100% in December (not later

than February 20). MCL 123.1357(8)(b)

Form 5819 Qualified Heavy Equipment Rental Personal Property Exemption

Claim must be completed and delivered to the assessor of the local unit not

later than February 20 (postmark is acceptable) for each personal property

parcel for which the Qualified Heavy Equipment Rental Personal Property

exemption is being claimed for 2023. MCL 211.9p(2)(e)

Page 4

February 20, 2024

Cont.

Form 5278 Eligible Manufacturing Personal Property Tax Exemption Claim

and Report of Fair Market Value of Qualified New and Previously Existing

Personal Property (Combined Document) must be completed and delivered

to the assessor of the local unit not later than February 20 (postmark is

acceptable) for each personal property parcel for which the Eligible

Manufacturing Personal Property exemption is being claimed for 2023. MCL

211.9m(2)(c)

Form 632 2024 Personal Property Statement must be completed and

delivered to the assessor of the local unit not later than February 20

(postmark acceptable). MCL 211.19(2)

Deadline for taxpayer to file Form 3711 Report of Heavy Earth Moving

Equipment Claimed as Exempt Inventory if a claim of exemption is being

made for heavy earth moving equipment. MCL 211.19(2)

February 28, 2024

Deadline for municipalities to report inaccurate 2023 commercial personal

property and industrial personal property taxable values on Form 5651

Correction of 2023 Personal Property Taxable Values Used for 2023

Personal Property Tax Reimbursement Calculations to the county

equalization director (by February 28). MCL 123.1358(5)(e)

February 29, 2024

The STC shall publish the inflation rate multiplier before March 1. MCL

211.34d(15)

Last day for local treasurers to collect 2023 property taxes. MCL 211.78a

March 1, 2024

County Treasurer commences settlement with local unit treasurers. MCL

211.55

Properties with delinquent 2022 taxes, forfeit to the County Treasurer. MCL

211.78g(1). County Treasurer adds $175 fee per MCL 211.78g(1), as well as

all recording fees and all fees for service of process or notice. MCL

211.78g(3)(d)

Redemptions of 2022 tax-delinquent properties require additional interest at

non-compounded rate of ½% per month from March 1 preceding forfeiture.

MCL 211.78g(3)(b)

County Property Tax Administration Fee of 4% added to unpaid 2023 taxes

and interest at 1% per month. MCL 211.78a(3)

Local units to turn over 2023 delinquent taxes to the County Treasurer. MCL

211.78a(2). On March 1 in each year, taxes levied in the immediately

preceding year that remain unpaid shall be returned as delinquent for

collection. However, if the last day in a year that taxes are due and payable

before being returned as delinquent is on a Saturday, Sunday, or legal

holiday, the last day taxes are due and payable before being returned as

delinquent is on the next business day and taxes levied in the immediately

preceding year that remain unpaid shall be returned as delinquent on the

immediately succeeding business day.

Page 5

March 4, 2024

The 2024 assessment roll shall be completed and certified by the assessor

(on or before the first Monday in March). MCL 211.24

March 5, 2024

The assessor/supervisor shall submit the 2024 certified assessment roll to

the Board of Review (Tuesday after first Monday in March). MCL 211.29(1)

Organizational meeting of Township Board of Review. MCL 211.29.

(Tuesday after first Monday in March). City Board of Review may vary

according to Charter provisions.

March 11, 2024

The Board of Review must meet on the second Monday in March. This

meeting must start not earlier than 9 a.m. and not later than 3 p.m. The

Board of Review must meet one additional day during this week and shall

hold at least three hours of its required sessions during the week of the

second Monday in March after 6 p.m. MCL 211.30. Note: The governing

body of a city or township may authorize an alternative starting date for the

second meeting of the March Board of Review, which can be either the

Tuesday or the Wednesday following the second Monday in March. MCL

211.30(2)

March 14, 2024

Within ten business days after the last day of February, at least 90% of the

total tax collections on hand, must be delivered by the local unit treasurer to

the county and school district treasurers. MCL 211.43(3)(b)

March 31, 2024

Deadline for municipalities to report any errors identified in the 2023 personal

property tax reimbursements on Form 5654 Correction of School Millage

Rates or Other Errors for the 2023 Personal Property Tax Reimbursement

Calculations to the Department of Treasury (by March 31). MCL 123.1358(4)

Deadline for municipalities to report any modifications to the 2013, 2014, or

2015 commercial personal property and industrial personal property taxable

values on Form 5658 Modification of the 2013, 2014, and 2015 Personal

Property Taxable Values Used for the 2023 Personal Property Tax

Reimbursement Calculations to the Department of Treasury (by March 31).

MCL 123.1345(e), (o), and (z)

Deadline for county equalization directors to report any corrected 2023

commercial personal property and industrial personal property taxable

values on Form 5651 Correction of 2023 Personal Property Taxable Values

Used for the 2023 Personal Property Tax Reimbursement Calculations to the

Department of Treasury (by March 31). The 2023 taxable value of

commercial personal property and industrial personal property shall be the

taxable value on May 10, 2023. MCL 123.1358(5)(e)

April 1, 2024

Not later than April 1, local unit treasurers make final adjustment and delivery

of the total amount of tax collections on hand. MCL 211.43(3)(c)

Assessors are required to annually provide parcel information from any Form

5819 Qualified Heavy Equipment Rental Personal Property Exemption Claim

and other parcel information required by the Department of Treasury in a

form and manner required by the Department no later than April 1 of each

year. MCL 211.9p

Page 6

April 1, 2024

Cont.

Assessors are required to annually provide parcel information from any Form

5076 Small Business Property Tax Exemption Claim under MCL 211.9o and

other parcel information required by the Department of Treasury for any

taxpayer with more than $80,000 but less than $180,000 in true cash value

in a form and manner required by the Department no later than April 1 of

each year. MCL 211.9o

Assessors are required to annually provide information from any Form 5277

Affidavit to Rescind Eligible Manufacturing Personal Property Exemption and

other parcel information required by the Department of Treasury in a form

and manner required by the Department no later than April 1 of each year.

MCL 211.9m and 9n

Assessors are required to annually provide information from any Form 5278

Eligible Manufacturing Personal Property Tax Exemption Claim and Report

of Fair Market Value of Qualified New and Previously Existing Personal

Property (Combined Document) and other parcel information required by the

Department of Treasury in a form and manner required by the Department

no later than April 1 of each year. MCL 211.9m and 9n

On or before the first Monday in April, the BOR must complete their review of

protests of assessed value, taxable value, property classification or denial by

assessor of continuation of qualified agricultural property exemption. MCL

211.30a

District or ISD must reach agreement for summer tax collection with

township or city, or county if there is a summer school levy. MCL

380.1613(2)

Last day to pay all forfeited 2021 delinquent property taxes, interest,

penalties and fees, unless an extension has been granted by the circuit

court. If unpaid, title to properties foreclosed for 2021 real property taxes

vests solely in the foreclosing governmental unit. MCL 211.78k

April 3, 2024

The Township Supervisor or assessor shall deliver the completed

assessment roll, with BOR certification, to the county equalization director

not later than the tenth day after adjournment of the BOR or the Wednesday

following the first Monday in April, whichever date occurs first. MCL

211.30(7)

An assessor shall file Form 606 (L-4021) Assessment Roll Changes

Worksheet with the County Equalization Department, and Form 607 (L-4022)

Report of Assessment Roll Changes and Classification (signed by the

assessor) with the County Equalization Department and the STC,

immediately following adjournment of the board of review. (STC Rule

209.26(6a), (6b)). Form 607 (L-4022) must be signed by the assessor of

record.

April 9, 2024

County Board of Commissioners meets in equalization session. (Tuesday

following the second Monday in April each year) MCL 209.5(1) and

211.34(1)

April 15, 2024

Deadline for county treasurers to record Certificates of Forfeiture for the

March 1 forfeiture parcels. MCL 211.78g(2)

Page 7

Deadline for eligible claimants to submit a certified statement and

electronically submit the essential services assessment liability and late

payment penalty in full for the 2023 assessment year. MCL 211.1057(4)

Equalization director files separate Form 2164 (L-4023) Analysis for

Equalized Valuation for each unit in the county with the STC no later than the

third Monday in April. STC Rule 209.41(6); MCL 211.150(4)

The county equalization department assembles the local unit 4626 reports

and submits the data to the e-Equalization site by the third Monday in April.

MCL 207.12.

Allocation Board meets and receives budgets. (on or before the third Monday

in April each year) MCL 211.210

April 30, 2024

Last day of deferral period for winter (December 1) property tax levies, if the

deferral for qualified taxpayers was authorized by the County Board of

Commissioners. MCL 211.59(3)

May 1, 2024

Deadline for filing a Principal Residence Exemption (PRE) Active Duty

Military Affidavit (Form 4660) to allow military personnel to retain a PRE for

up to three years if they rent or lease their principal residence while away on

active duty. MCL 211.7dd

Deadline for Department of Treasury to post the 2024 Millage Rate

Comparison Reports on the Personal Property Tax Reimbursements website

(not later than May 1). MCL 123.1353(5)

Final day for completion of delinquent tax rolls. MCL 211.57(1)

Deadline for filing Form 2599 Claim for Farmland (Qualified Agricultural)

Exemption from Some School Operating Taxes with the local assessor if the

property is NOT classified agricultural or if the assessor asks an owner to file

it to determine whether the property includes structures that are not exempt.

MCL 211.7ee(2)

May 6, 2024

On or before the first Monday in May of each year, the assessing officer of

each township or city shall tabulate the tentative taxable value as approved

by the local board of review and as modified by county equalization for each

classification of property that is separately equalized for each unit of local

government and provide the tabulated tentative taxable values to the county

equalization director on STC Form 4626. MCL 211.34d(2)

The equalization director files a tabular statement of the county equalization

adopted by the County Board of Commissioners on Form 608 (L-4024)

Personal and Real Property - TOTALS prescribed and furnished by the STC

on or before the first Monday in May. STC R209.41(8), MCL 209.5(2)

Page 8

May 6, 2024

Cont.

Deadline for filing official County Board of Commissioners report of county

equalization, Form 608 (L-4024) Personal and Real Property-TOTALS, with

STC (first Monday in May). MCL 209.5(2)

Appeal from county equalization to Michigan Tax Tribunal must be filed

within 35 days after the adoption of the county equalization report by the

County Board of Commissioners. MCL 205.735(3)

Deadline for assessor to file tabulation of Taxable Valuations for each

classification of property with the county equalization director on STC Form

609 (L-4025) Report of Taxable Valuations Including Additions, Losses and

Totals as Approved by the Board of Review to be used in “Headlee”

calculations (first Monday in May). MCL 211.34d(2)

May 13, 2024

Preliminary state equalization valuation recommendations presented by the

Property Services Division staff to the State Tax Commission (second

Monday in May). MCL 209.2(1)

May 15, 2024

Deadline for assessors to report the 2024 taxable value of commercial

personal property and industrial personal property to the county equalization

director (not later than May 15). The 2024 taxable value of commercial

personal property and industrial personal property shall be the taxable value

on May 10, 2024. MCL 123.1353(3)

Not later than this date, the State must have prepared an annual assessment

roll for the state-assessed properties. MCL 207.9(1)

May 20, 2024

Deadline for payments to municipalities from the Local Community

Stabilization Authority:

For underpayment of the 2023 personal property tax reimbursement and

remaining balance of Local Community Stabilization Share revenue (not later

than May 20). MCL 123.1357(8)(d)

May 28, 2024

May 27 is a State Holiday

State Equalization Proceeding - Final State Equalization order is issued by

State Tax Commission (fourth Monday in May). MCL 209.4

May 31, 2024

June 1 is a Sunday

If as a result of State Equalization, the taxable value of property changes, the

Equalization Director shall revise the millage reduction fractions by the

Friday following the fourth Monday in May. MCL 211.34d(2)

Deadline for county equalization directors to report the 2024 taxable value of

commercial personal property and industrial personal property for each

municipality in the county on the Personal Property Summary Report (PPSR)

to the Department of Treasury (not later than May 31). The 2024 taxable

value of commercial personal property and industrial personal property shall

be the taxable value on May 10, 2024. MCL 123.1353(3)

Page 9

May 31, 2024

Cont.

Michigan Tax Tribunal Filing Deadline: Appeals of property classified as

commercial real, industrial real, developmental real, commercial personal,

industrial personal or utility personal must be made by filing a written petition

with the Michigan Tax Tribunal on or before May 31 of the tax year involved.

MCL 205.735a(6). (A petition required to be filed by a day during which the

offices of the tribunal are not open for business shall be filed by the next

business day; MCL 205.735a(8))

June 1, 2024

Deadline for filing Form 2368 Principal Residence Exemption (PRE) Affidavit

for exemption from the 18-mill school operating tax to qualify for a PRE for

the summer tax levy. MCL 211.7cc(2)

Deadline for filing the initial request (first year) of a Conditional Rescission of

Principal Residence Exemption (PRE) (Form 4640) for the summer tax levy.

MCL 211.7cc(5)

Deadline for filing Form 4983 Foreclosure Entity Conditional Rescission of a

Principal Residence Exemption (PRE) to qualify for the summer tax levy.

MCL 211.7cc(5)

Assessment Roll due to County Treasurer if local unit is not collecting

summer taxes. MCL 211.905b(6)(a)

No later than June 1, the County Treasurer delivers to the State Treasurer a

statement listing the total amount of state education tax (SET) not returned

delinquent, collected by the County Treasurer, and collected and remitted to

the County Treasurer by each city or township treasurer, also a statement for

the county and for each city or township of the number of parcels from which

the SET was collected, the number of parcels for which SET was billed, and

the total amount retained by the County Treasurer and by the City or

Township Treasurer. MCL 211.905b(12)

June 2, 2024

Last day to send the first notice to all properties that are delinquent on 2023

taxes. MCL 211.78b

June 3, 2024

Requests are due from a Tax Increment Finance Authority, Local

Development Financing Authority or Downtown Development Authority for

state reimbursements of tax increment revenue decreases as a result of the

MBT reduction in personal property taxes (not later than June 1). Form 4650;

MCL 125.4312b(2); MCL 125.4411b(2); MCL 125.4213c(2)

The Department of Treasury shall rescind for the 2023 assessment year any

Eligible Manufacturing Personal Property (EMPP) exemption described in

MCL 211.9m and 211.9n granted for any parcel for which the essential

services assessment payment in full and any penalty due have not been

received or for which the department discovers that the property is not

eligible (no later than the first Monday in June) MCL 211.1057(5)(a)

Page 10

June 3, 2024

Cont.

County Equalization Director calculates current year millage reduction

fractions including those for inter-county taxing jurisdictions. The completed,

verified Form 612 (L-4028) Millage Reduction Fraction Computation is filed

with the County Treasurer and the STC on or before the first Monday in

June. MCL 211.34d(3).

For the inter-county governmental units covering more than one county, the

County Equalization Director responsible compiles the appropriate taxable

values, completes, and verifies Form 613/L-4028IC, Complete Millage

Reduction Fraction Computation on behalf of inter-county governmental

units.

Deadline for notifying protesting taxpayers in writing of Board of Review

Action (by the first Monday in June). MCL 211.30(4)

June 7, 2024

Deadline for county equalization directors to compile and report the 2024

taxable value of commercial personal property and industrial personal

property for each municipality levying a millage in more than one county on

the Personal Property Inter-County Summary Report (PPSR-IC) to the

Department of Treasury (not later than June 7). The 2024 taxable value of

commercial personal property and industrial personal property shall be the

taxable value on May 10, 2024. MCL 123.1353(3)

Deadline for assessors to report the 2023 and 2024 taxable values for each

renaissance zone on 2024 Renaissance Zone Tax Reimbursement Data

(Form 3369). MCL 125.2692

June 10, 2024

Allocation Board must issue final order not later than the second Monday in

June. MCL 211.216

June 14, 2024

June 15 is a Saturday

June 17, 2024

Requests are due from a Brownfield Redevelopment Authority for state

reimbursements of tax increment revenue decreases as a result of the MBT

reduction in personal property taxes (not later than June 15). Form 4650;

P.A. 154 of 2008. MCL 125.2665a(2)

Deadline for foreclosing governmental units to file petition for tax foreclosure

with the circuit court clerk for the March 1, 2024 forfeitures. MCL 211.78h(1)

Deadline for Tax Increment Finance (TIF) Authorities to file the TIF loss

reimbursement claims - Form 5176 Request for State Reimbursement of Tax

Increment Finance Authority Personal Property TIF Loss for NON-Brownfield

Authorities, Form 5176BR Request for State Reimbursement of Tax

Increment Finance Authority Personal Property TIF Loss for Brownfield

Authorities, or Form 5176ICV Tax Increment Financing Personal Property

Loss Reimbursement for Authorities with Increased Captured Value Loss.

MCL 123.1356a(3)

Page 11

June 17, 2024

Cont.

Deadline for submission of Water Pollution Control PA 451 of 1994 Part 37

(MCL 324.3702 and R 209.76) and Air Pollution Control PA 451 of 1994 Part

59 (MCL 324.5902 and R 209.81) tax exemption applications to the State

Tax Commission. Note: Applications for the above exemption programs

received on or after June 16 shall be considered by the Commission

contingent upon staff availability.

Deadline for the assessor’s report to the STC on the status of each

Neighborhood “homestead” exemption granted under the Neighborhood

Enterprise Zone Act. MCL 207.786(2)

June 24, 2024

Deadline for equalization directors to file tabulation of final Taxable

Valuations with the State Tax Commission on Form 2795 (L-4046) (fourth

Monday in June). MCL 211.27d

June 28, 2024

June 30 is a Sunday

June 29 is a Saturday

Deadline for County Equalization Director to file Interim Status Report of the

ongoing study for the current year. STC Rule 209.41(4)

Township Supervisor shall prepare and furnish the summer tax roll before

June 30 to the Township Treasurer with supervisor’s collection warrant

attached if summer school taxes are to be collected. MCL 380.1612(1)

June 30, 2024

County Treasurer to spread summer SET and County Allocated and Prepare

Tax Roll MCL 211.905b(6)(b). Not later than June 30, the county treasurer or

the state treasurer shall spread the millage levied against the assessment

roll and prepare the tax roll.

Summer Tax Levy for School Millage Detail and Tax Roll. MCL

380.1613(4)(c). Before June 30 the County Treasurer or the treasurer of the

school district or intermediate school district shall spread the taxes being

collected.

July 1, 2024

June 30 is a Sunday

Deadline for classification appeals to STC. MCL 211.34c(6). A classification

appeal must be filed with the STC in writing on Form 2167 (L-4100) Property

Owner Petition for Change of Property Classification (June 30).

Taxes due and payable in those jurisdictions authorized to levy a summer

tax. (Charter units may have a different due date). MCL 211.44a(3) and (4)

July 2, 2024

Deadline for governmental agencies to exercise the right of refusal for 2024

tax foreclosure parcels. (first Tuesday in July) MCL 211.78m(1)

July 16, 2024

The July Board of Review may be convened (Tuesday after the third Monday

in July). MCL 211.53b. The governing body of the city or township may

authorize, by adoption of an ordinance or resolution, one or more of the

following alternative meeting dates for the purposes of this section. An

alternative meeting date during the week of the third Monday in July. MCL

211.53b(9)(b)

July 31, 2024

Form 170-CFT Commercial Facilities Tax Report must be filed with the

Property Services Division on or before July 31 of the year following the tax

year involved.

Page 12

July 31, 2024

Cont.

Form 170-CRA Commercial Rehabilitation Act Tax Report must be filed with

the Property Services Division on or before July 31 of the year following the

tax year involved.

Form 170-OPRA Obsolete Property Rehabilitation Act Tax Report must be

filed with the Property Services Division on or before July 31 of the year

following the tax year involved.

Form 170-IFT Industrial Facilities Tax Report must be filed with the Property

Services Division on or before July 31 of the year following the tax year

involved.

Michigan Tax Tribunal Filing Deadline: Appeals of property classified as

residential real, agricultural real, timber-cutover real or agricultural personal

must be made by filing a written petition with the Michigan Tax Tribunal on or

before July 31 of the tax year involved. MCL 205.735a(6)

August 1, 2024

Deadline for eligible local school districts to file Form 5451 2024 School

District Debt Millage Rate for the 2024 Personal Property Tax

Reimbursement Calculation (by August 1). MCL 123.1353(4)

Deadline for eligible local school districts to file Form 5609 2024 Hold

Harmless Millage Rate for the 2024 Personal Property Tax Reimbursement

Calculation (by August 1). MCL 123.1353(4)

Deadline for a county, township, village, city, or local authority to file Form

5608 Portion of 2023 Essential Services Millage Rate Dedicated for the Cost

of Essential Services (by August 1). MCL 123.1353(7)

Deadline for a municipality to file Form 5613 Millage Rate Correction for the

2024 Personal Property Tax Reimbursement Calculations (by August 1).

MCL 123.1358(4)

August 15, 2024

Deadline to certify 2024 essential services assessment statement and

electronically submit essential services assessment in full to the Department

of Treasury without late payment penalty. MCL 211.1057(3)

August 19, 2024

Deadline for taxpayer to file appeal directly with the Michigan Tax Tribunal if

final equalization multiplier exceeds tentative multiplier and a taxpayer’s

assessment, as equalized, is in excess of 50% of true cash value (by the

third Monday in August). MCL 205.737(7)

September 1, 2024

Last day for county to send notice by first class mail to all properties that

have delinquent 2023 taxes. MCL 211.78c

September 15, 2024

Deadline to amend a previously certified 2024 essential services assessment

statement. MCL 211.2057(4)

Page 13

September 16, 2024

Summer Taxes Due: Summer taxes due, unless property is located in a city

with a separate charter due date (Sept 14). MCL 211.905b(10), MCL

380.1613(4)(e). MCL 211.107

Interest of 1% per month will accrue if the payment is late for the State

Education Tax and County Taxes that are part of the summer tax collection.

MCL 211.905b(9) and 211.44a(6). Note: date may be different depending on

the city charter.

Last day for qualified taxpayers to file intent for 2024 summer tax deferral.

MCL 211.51(7)

September 30, 2024

Not later than September 30 of the second calendar year after the 2022

foreclosure, the county FGU shall submit a written report to its board of

commissioners and the state treasurer identifying any remaining balance and

any contingent costs. MCL 211.78i

Not later than September 30 of the second calendar year after the 2022

foreclosure, the department of treasury shall submit an electronic report to

the house and senate committees with jurisdiction over taxation. MCL

211.78m(8)

Clerk of township or city delivers to supervisor and county clerk a certified

copy of all statements, certificates, and records of vote directing monies to

be raised by taxation of property. MCL 211.36(1)

Financial officer of each unit of local government computes tax rates in

accordance with MCL 211.34d and MCL 211.34 and governing body certifies

that rates comply with Section 31, Article 9, of 1963 Constitution and MCL

211.24e, Truth in Taxation, on Form 614 (L-4029) Tax Rate Request (on or

before September 30). MCL 211.36.

October

County Prosecutor is obligated by statute to furnish legal advice promptly

regarding the apportionment report. A County Board of Commissioners shall

not authorize the levy of a tax unless the governing body of the taxing

jurisdiction has certified that the requested millage has been reduced, if

necessary, in compliance with Section 31 of Article 9 of the State

Constitution of 1963 and MCL 211.34d, 211.37 and 211.34(1). The County

Board also receives certifications that Truth in Taxation hearings have been

held if required. MCL 211.24e

October 1, 2024

County Treasurer adds $15 for each parcel of property for which the 2022

real property taxes remain unpaid. MCL 211.78d

October 15, 2024

The assessor reports the status of real and personal Industrial Facility Tax

property to STC. MCL 207.567(2)

Governmental units report to the STC on the status of each exemption

granted under the Commercial Redevelopment Act. MCL 207.666

Qualified local governmental units report to the STC on the status of each

exemption granted under the Commercial Rehabilitation Act. MCL 207.854

Page 14

October 15, 2024

Cont.

Qualified local governmental units report to the STC on the status of each

exemption granted under the Obsolete Property Rehabilitation Act. MCL

125.2794

The assessor’s annual report of the determination made under MCL

207.783(1) to each taxing unit that levies taxes upon property in the local

governmental unit in which a new facility or rehabilitated facility is located

and to each holder of the Neighborhood Enterprise Zone certificate. MCL

207.783(2)

October 20, 2024

Deadline for payments to municipalities from the Local Community

Stabilization Authority:

Local Community Stabilization Share revenue for county allocated millage

and other millages not levied 100% in December (not later than October 20).

MCL 123.1357(8)(a) and (c)

October 31, 2024

October apportionment session of the County Board of Commissioners to

examine certificates, direct spread of taxes in terms of millage rates to be

spread on Taxable Valuations (not later than October 31). MCL 211.37

Deadline for submission of New Personal Property PA 328 of 1998, Obsolete

Property PA 146 of 2000 (, Commercial Rehabilitation PA 210 of 2005,

Neighborhood Enterprise Zone PA 147 of 1992, Charitable Nonprofit

Housing PA 612 of 2006 (STC approved application and instructions),

Commercial Facilities PA 255 of 1978 and Industrial Facilities PA 198 of

1974 tax exemption applications to the State Tax Commission. Note:

Applications for the above exemption programs received after October 31

shall be considered by the Commission contingent upon staff availability.

November 1, 2024

Deadline for filing Principal Residence Exemption Affidavit (Form 2368) for

exemption from the 18-mill school operating tax to qualify for a PRE for the

winter tax levy (on or before November 1). MCL 211.7cc(2)

Deadline for filing the initial request (first year) of a Conditional Rescission of

Principal Residence Exemption (PRE) (Form 4640) for the winter tax levy.

MCL 211.7cc(5)

Deadline for filing for Foreclosure Entity Conditional Rescission of a Principal

Residence Exemption (PRE) (Form 4983) to qualify for the winter tax levy.

MCL 211.7cc(5)

November 5, 2024

Township Supervisor shall notify Township Treasurer of the amount of

county, state and school taxes apportioned in township to enable treasurer to

obtain necessary bond for collection of taxes (on or before November 5).

MCL 211.43(1)

November 15, 2024

Form 600 (L-4016) Supplemental Special Assessment Report, due to the

STC.

November 28, 2024

Township Treasurer gives County Treasurer a bond running to the county in

the actual amount of county, state and school taxes (on or before November

28). MCL 211.43(2)

Page 15

November 30, 2024

Deadline for payments to municipalities from the Local Community

Stabilization Authority:

Local Community Stabilization Share revenue to municipalities with state

facilities under 1977 PA 289, MCL 141.951 to 141.956 and to municipalities

that incur certain costs of required and allowable health services under 1978

PA 368, MCL 333.2475 (not later than November 30). MCL 123.1357(8)(e)

December 1, 2024

Results of equalization studies must be reported to assessors of each

township and city. Responsibilities of the Equalization Director

County Treasurer delivers to Township Supervisor a signed statement of

approval of the bond and the Township Supervisor delivers the tax roll to the

Township Treasurer. MCL 211.43

2024 winter taxes due and payable to local unit treasurer are a lien on real

property. Charter cities or villages may provide for a different day. MCL

211.40

County Equalization Director submits apportionment millage report to the

STC. MCL 207.12

December 2, 2024

December 1 is a Sunday

Deadline for foreclosing governmental units to transfer list of unsold 2024 tax

foreclosure parcels to the clerk of the city, township, or village in which the

parcels are located (on or before December 1). MCL 211.78m(6)

MTT Note:

Appeal to Michigan Tax Tribunal of a contested tax bill must be filed within

60 days after the mailing of the tax bill that the taxpayer seeks to contest.

MCL 205.735. (Limited to arithmetic errors)

December 10, 2024

The December Board of Review may be convened (Tuesday after the

second Monday in December). MCL 211.53b. The governing body of the city

or township may authorize, by adoption of an ordinance or resolution, one or

more of the following alternative meeting dates for the purposes of this

section: An alternative meeting date during the week of the second Monday

in December. MCL 211.53b(7)

December 31, 2024

The Department of Treasury may appeal the 2024 classification of any

assessable property to the Small Claims Division of the Michigan Tax

Tribunal. MCL 211.34c(7)

Deadline for an owner that had claimed a conditional rescission of a Principal

Residence Exemption to verify to the assessor that the property still meets

the requirements for the conditional rescission through a second and third

year annual verification of a Conditional Rescission of Principal Residence

Exemption (PRE) (Form 4640). MCL 211.7cc(5)

Deadline for a land contract vendor, bank, credit union or other lending

institution that had claimed a foreclosure entity conditional rescission of a

Principal Residence Exemption to verify to the assessor that the property still

meets the requirements for the conditional rescission through the filing of an

annual verification of a foreclosure entity. (MCL 211.7cc(5)

Page 16

December 31, 2024

Cont.

An eligible claimant may appeal an assessment levied, a penalty or

rescission under the Essential Service Assessment Act to the Michigan Tax

Tribunal by filing a petition no later than December 31 in that same tax year.

MCL 211.1057(7)

Tax Day for 2025 property taxes. MCL 211.2(2)

January 2, 2025

December 31 is a State

Holiday

January 1 is a State Holiday

Deadline for counties to file 2024 equalization studies for 2025 starting bases

with State Tax Commission (STC) for all classifications in all units on Form

602 (L-4018P) State Tax Commission Analysis for Equalized Valuation of

Personal Property and Form 603 (L-4018R) State Tax Commission Analysis

for Equalized Valuation of Real Property. STC Rule 209.41(5)