7-100-1975 Rev. 6-2022 Supersedes 7-100-1975 Rev. 7-2020

12 Provide a description of your business operations, products that you sell, and services that you provide. If you have a website, provide

your URL address.

a. Primary business type: c Retailer c Lessor c Wholesaler c Manufacturer c Construction Contractor c Other

If you marked “Lessor”, do you lease motor vehicles to others for periods of longer than 31 days? c Yes c No

b. If your business does not operate year-round, identify the months you operate.

c. How many business establishments do you operate: in Nebraska? in U.S.A.?

d. If you purchased an existing business, identify the previous owner.

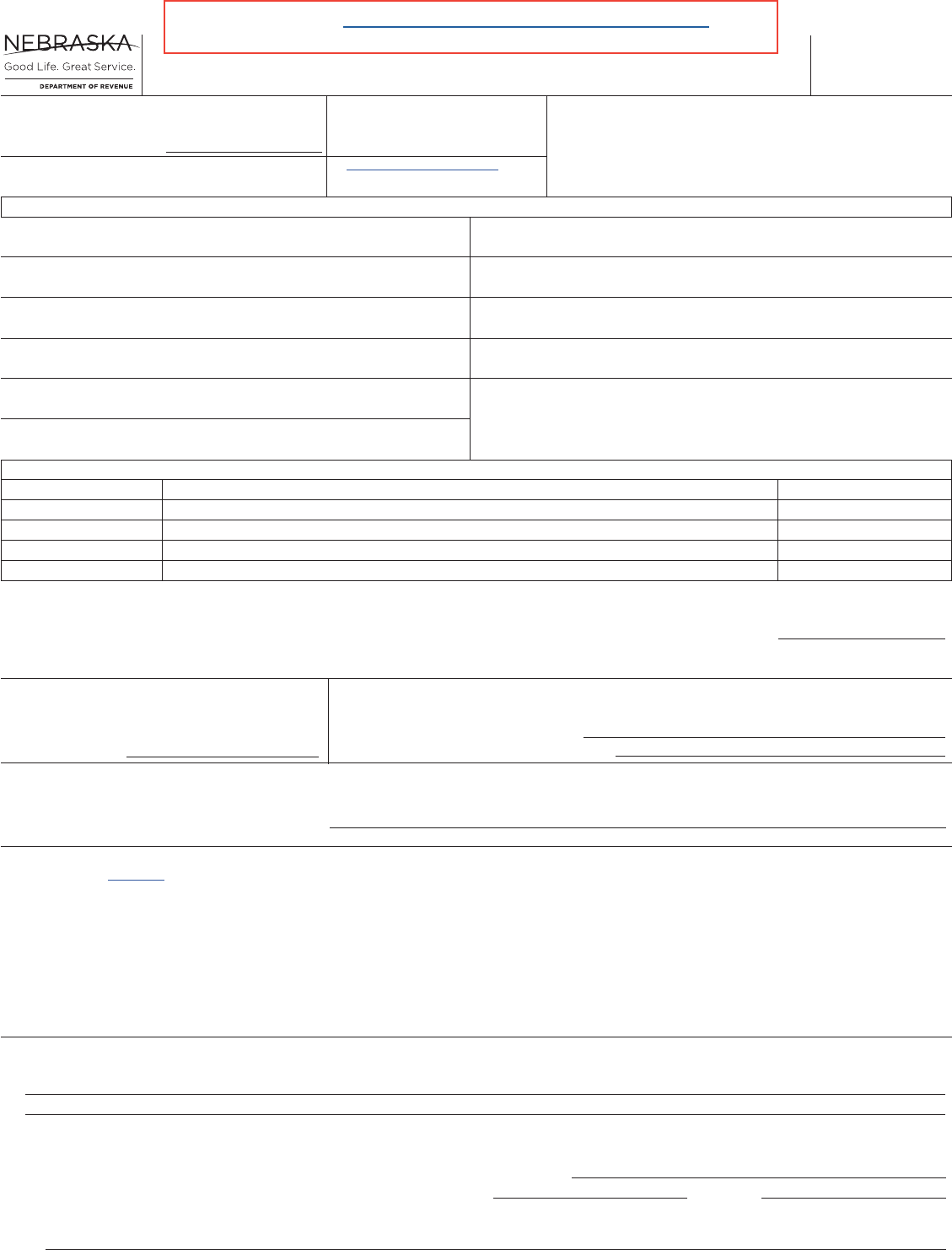

FORM

20

Complete Reverse Side

Name Address City Zip Code Nebraska ID Number

Nebraska Tax Application

11 Reason for Filing Application – Check Appropriate Boxes. If box 3 is checked, you may cancel your old Nebraska ID number on the final

return, on a Form 22, or by providing the number and final date in box 3 below.

(1) c Original Application (3) c Changed Business Entity (To cancel Nebraska ID number (4) c Add Tax Program

(2) c Change in Owners of previous entity, write the ID number and final date here: (5) c Other (attach explanation)

(see When to File ID #_________________________ Date_______________)

instructions) From - To -

c Sole Proprietorship c Sole Proprietorship

c Partnership c Partnership

c Limited Liability Company c Limited Liability Company

c Corporation c Corporation

9 Accounting Period (Type of Year) (see instructions)

(1) c Calendar – January 1 to December 31

(2) c Fiscal – 12 Month Ending

(3) c Fiscal – 52 or 53 Week Ending

8 Accounting Basis

(1) c Cash

(2) c Accrual

(3) c Other

7 Type of Ownership

(1) c Sole Proprietorship (5) c

Foreign Corporation (another state or country)

(9) c Nonprofit Organization

(2) c Partnership (6) c S Corporation (10) c Cooperative

(3) c Nonprofit Corporation (7) c Governmental (11) c Limited Liability Company

(4) c Corporation (8) c Fiduciary (Estate or Trust)

Name Doing Business As (dba) Name

Legal Business Name

Business Street Address (Do Not Use PO Box) Street or Other Mailing Address

City State Zip Code City State Zip Code

Business Email

Name and Location Address of Business (print clearly) Name and Mailing Address

1 Do you hold, or have you previously held a Nebraska

ID number?

c Yes c No

If Yes, provide the number:

2 Federal Employer ID Number (EIN)

3 County of Business Location Within

Nebraska

4 Business Classification Code

Please Do Not Write In This Space

5 Name and Address of Legal Entity/Owner

Is your Nebraska location within the city limits?

(1) c Yes (2) c No

10 Location of Records

(1) c Same as Location Address (3) c Other Address (provide below)

(2) c Same as Mailing Address

6 Identify all Owners and Spouses (if joint ownership), Partners, Members, or Corporate Officers (one of the listed individuals must sign as applicant).

Social Security Number Name, Address, City, State, Zip Code, and Email Address Title, If Corporate Officer

Address City State Zip Code

Please consider registering your NEW business online. Most

permits are available online immediately upon approval.

PRINT

RESET

13 Sales and Use Tax

c Sales Tax Permit — Enter the date of your first sale .................................................................................................. _______________

a. Your filing frequency is based on your estimated annual sales and use tax liability:

(1) c $3,000 or more (monthly) (2) c $900 – $2,999 (quarterly) (4) c Less than $900 (annually)

b. If you have more than one licensed location, your returns will be filed:

(1) c Separate for each location

(2) c

Combined for all locations (monthly e-filing is required),

file application Form 11.

Will you have a paid preparer file your sales or use tax return?

c

Yes

c

No If Yes, attach a Power of Attorney, Form 33.

c Use Tax Permit — Enter the date of your first purchase ............................................................................................ _______________

a. If a sales tax permit has been applied for, do not check this box since use tax is to be reported on the sales and use tax return.

b. Your filing frequency is based on your estimated annual use tax liability:

(1) c $3,000 or more (monthly) (2) c $900 to $2,999 (quarterly) (4) c Less than $900 (annually)

14 Income Tax Withholding and Income Tax

c Income Tax Withholding — Enter the date of the first wages paid ............................................................................. _______________

a. Will your average Nebraska monthly income tax withholding exceed $500? ......... (1) c Yes c No

b. Will your annual Nebraska income tax withholding be less than $500 per year? .. c Yes c No

Have you been allowed to file federal withholding returns annually? ..................... c Yes c No

If you answered Yes to either of the questions in “b,” mark filing frequency preference

...... (2) c Quarterly (4) c Annually

c. Income tax withholding returns will be filed:

(1) c For each separate location (2) c Consolidated for all locations (3) c Consolidated by region or district

d. Will you have a payroll service prepare your returns?

c

Yes

c

No If Yes, attach a Power of Attorney, Form 33.

e. Additional business operations employing Nebraska residents (Attach additional sheet if necessary.)

Nebraska ID Number Business Name Location Address, City, State, Zip Code

Note for LLCs: An LLC will have the same filing status for Nebraska purposes as it does for federal purposes, and

must check either “corporate” or “partnership” below.

c Corporate Income Tax ................................................................................................................................................ _______________

Are you an S Corporation? ..................... (3) c Yes c No

c Partnership Income Tax ............................................................................................................................................. _______________

c Fiduciary Income Tax ................................................................................................................................................. _______________

c Financial Institution Tax (indicate type of institution) .................................................................................................. _______________

(1) c Bank (2) c Savings and Loan (3) c Credit Union (4) c Other (specify):

15 Miscellaneous Tax Programs

c Tire Fee Permit .......................................................................................................................................................... _______________

Your filing frequency is based on your estimated annual taxable tire sales:

(1) c 3,000 tires or more (monthly) (2) c 900 – 2,999 tires (quarterly) (4) c Less than 900 tires (annually)

c Lodging Tax Permit .................................................................................................................................................... _______________

Your filing frequency is based on your estimated annual taxable sales:

(1) c $10,000 or more (monthly) (4) c Less than $10,000 (annually)

c Litter Fee License ...................................................................................................................................................... _______________

If you have more than one licensed location, you must file a combined litter fee return. File application Form 11.

c Severance and Conservation ..................................................................................................................................... _______________

c Prepaid Wireless Surcharge — Note: The filing frequency for this surcharge is the same as sales tax. If you file

a combined sales tax return, you must file a Prepaid Wireless Surcharge Return on a combined basis. ................. _______________

16 Person to contact regarding this application

Authorized Contact Person (please print) Title Email Address Phone Number

Under penalties of law, I declare that I have examined this application, and to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Owner, Partner, Member, Corporate Officer, Title Date Email Address Phone Number

or Person Authorized by Attached Power of Attorney

You may file this tax application online or fax it to 402-471-5927 or mail it to:

Nebraska Department of Revenue, PO Box 98903, Lincoln, NE 68509-8903.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

Month/Day/Year

Month/Day/Year

Read the attached instructions about Nebraska licensing or registration requirements and complete

the information for all tax programs you need to be licensed or registered for.

If you need to report a liability for periods prior to the date of this application, enter the earliest date (month, day, year) you need a return.

(Enter Beginning Date)

Month/Day/Year

(Enter Date of

First Transaction)

Month/Day/Year

When to File. This Form 20 is led to apply for permits, licenses, and registrations required to conduct business in

Nebraska. Also, when owners of an existing business change, a Form 20 needs to be led. A Certicate of Tax Clearance

or Conrmation of Current Tax Liabilities Application, Form 36 should be led when a business is being bought or sold.

A change in your federal employer ID number (EIN) also requires a new Form 20 and assignment of a new Nebraska

IDnumber.

Line 2. Generally, you should have your EIN prior to applying for a Nebraska tax program license. An EIN can be

applied for at irs.gov/businesses. If you are required to have an EIN and you do not have one at the time you submit this

application, you must provide the DOR with your EIN after it is received. When you get your EIN, complete a Nebraska

Change Request, Form22, and put your EIN in box2, and write “Not available at time of application” in box11. A

Form 22 is also used to make any other changes after this Form 20 has been submitted. This includes address, ling

frequency, changes of ofcers, members, or partners, etc.

Line 6. Individuals must provide their Social Security number (SSN), address, and title on this application. This is

mandatory. The SSN or EIN is needed to properly identify you and process your application and other documents. DOR

has the legal right to require this information per Neb. Rev. Stat. §§ 77-2705 and 77-27,119. Submit a Nebraska Change

Request, Form 22, to update ofcers, addresses, or any other changes for this business.

Line 12. Direct sellers (home party and direct sales companies) marketing through independent sales representatives,

sometimes referred to as consultants or distributors, may request a Distributor’s Agreement (DA). This DA allows sales

tax to be collected and remitted by the direct selling company, rather than by each of its independent sales representatives.

Direct selling companies should request a DA in the line 12 area. See Nebraska Sales and Use Tax Reg-1-033, Transient

and Itinerant Sellers.

Construction contractors who repair property annexed to real estate or annex property to real estate must be registered in the

Nebraska Department of Labor’s Contractor Registration Database. Registration is applied for at dol.nebraska.gov. This

Database requires each contractor to elect an option for reporting sales and use tax on building materials. This election will

determine if a sales or use tax permit is needed. See Reg-1-017 Contractors.

Lines 13 and 14d. A Power of Attorney, Form 33, is available on DOR’s website.

Line 16. An authorized contact person designated on line 16 will have the authority to receive the Nebraska ID number

assigned from this application.

Electronic Filing and Payment Information

The tax programs that can be electronically led are identied at Online Filing for Nebraska Business Taxes. All businesses

are encouraged to make payments electronically for all of the tax programs that support this payment option, even though

some of these tax programs do not have an e-le option. Certain taxpayers with annual payments in excess of mandated

thresholds are required to make electronic payments.

Nebraska Licensing or Registration Requirements

Sales and Use Tax

Sales Tax Permit. Every person engaged in business as a retailer making retail sales of taxable property or services in Nebraska

must obtain a sales tax permit for each location in Nebraska (see Reg-1-004, Permits). A separate permit is required for

each retail location. Every remote seller and every Multivendor Marketplace Platform (MMP) with more than $100,000 of

gross sales or 200 or more transactions in Nebraska is engaged in business in Nebraska. Sales of a remote seller through an

MMP count towards the thresholds. Every person, including every MMP making taxable sales in Nebraska, is a retailer,

must hold a Nebraska Sales Tax Permit, and must le a Nebraska and Local Sales and Use Tax Return, Form 10. See the

Sales Tax Regulations for additional information.

Any retailer having at least 80% ownership in more than one licensed location making retail sales in Nebraska may apply

for permission to le a combined sales tax return by ling a Nebraska Combined Filing Application, Form11. All combined

sales and use tax lers must e-le on a monthly basis using DOR’s NebFile program.

Use Tax Permit. Every individual or business, storing, distributing, using, or consuming property or taxable services in

Nebraska, is subject to use tax on taxable purchases when the Nebraska sales tax has not been paid. Obtaining a sales tax

permit allows you to electronically report and pay both sales tax and use tax on a Form 10. If you are not required to have

a sales tax permit, you may apply for a use tax permit.

Income Tax Withholding and Income Tax

Income Tax Withholding. If you have employees or make payments to individuals who are not employees and maintain an

ofce or conduct business in Nebraska, or are considered an employer for federal purposes, you must apply for an income

tax withholding certicate prior to withholding income taxes for Nebraska. See the Withholding Regulations for additional

information. The income tax withholding requirement extends to payments made to all employees, including nonresidents,

for services performed in Nebraska. Income tax withholding may also be required when paying a nonresident of Nebraska

Instructions to Complete Form 20

Free Notification Service to Keep You Aware of Tax Changes and Updates

An easy way to keep informed of additions and updates to the Nebraska Department of Revenue’s (DOR) website

is to sign up for this free notication service. Register now to receive email or text notications about those specic

tax areas of interest that you select.

who is not an employee, for services performed in Nebraska. Gambling winnings and other payments that are subject to

federal income tax withholding are included in the term “wages” and are subject to Nebraska income tax withholding.

Income tax withholding may also be required for certain construction contractors who are not registered on the Contractor

Registration Database at dol.nebraska.gov. Nebraska income tax must also be withheld on pension and annuity payments

which are subject to federal income tax withholding.

Corporation Income Tax. Every business entity subject to federal corporate income tax with Nebraska source income must le

a Nebraska Corporation Income Tax Return, Form1120N. Insurance companies and certain nonprot organizations ling

Federal Forms 990-T, 1120H, or 1120POL, must also le Form 1120N. Corporations and limited liability companies with

Nebraska source income which have elected to le under Subchapter S of the Internal Revenue Code must le a Nebraska

S Corporation Income Tax Return, Form 1120-SN.

Partnership Income Tax. The Nebraska Partnership Return of Income, Form 1065N, must be led by every partnership with

Nebraska source income. Form 1065N must also be led by an LLC which is treated as a partnership for federal income

tax purposes and which derives income from Nebraska sources.

Fiduciary Income Tax. Every duciary of a resident estate or trust must le a Nebraska Fiduciary Income Tax Return,

Form1041N, if the estate or trust is required to le a federal income tax return for the taxable year. A duciary return is

not required for a simple trust if all of the trust’s beneciaries are residents of Nebraska, all of the trust’s income is derived

from sources in Nebraska, and the trust has no federal taxable income.

Financial Institution Tax. Every nancial institution which maintains a permanent place of business in Nebraska and actively

solicits deposits from Nebraska residents must le a Nebraska Financial Institution Tax Return, Form 1120NF. A nancial

institution does not le a Nebraska Corporation Income Tax Return.

Miscellaneous Tax Programs

Tire Fee. Retailers selling new tires for a motor vehicle, trailer, semitrailer, or farm tractor must obtain a tire fee permit.

Only one permit is issued regardless of the number of locations selling new tires (see Nebraska Tire Fee Information Guide).

Lodging Tax. Any person operating a hotel, motel, inn, campground, bed and breakfast, or other lodging facility in Nebraska

must obtain a lodging tax permit for each location. The location address and the county of business location given on this

application must be the actual physical location of the lodging facility, not a management company or ofce location (see

Nebraska and Local Taxes on Lodging Information Guide and GIL 1-19-1 Short-term Rental Licensing, ling, Tax Base,

and Collection Responsibilities for Lodging and Sales Taxes). An MMP must obtain both a sales tax permit and a lodging

tax permit and collect and remit the sales and lodging taxes for all sales they facilitate. The short-term rental owner, referred

to as “Host” is also required to be licensed for sales and lodging taxes.

Litter Fee. Manufacturers, wholesalers, and retailers having annual gross proceeds of $100,000 or more from sales in this

state of products subject to the litter fee must obtain a litter fee license for each place of business. Manufacturers, wholesalers,

or retailers with more than one location must license each location and le a combined litter fee return and report the total

gross proceeds for all locations. A Nebraska Combined Filing Application, Form 11, must be led to obtain a combined

litter fee number (see Nebraska Litter Fee Information Guide).

Severance and Conservation Tax. Every person severing oil or natural gas from the soil of Nebraska must be registered and

pay the severance and conservation tax, unless the oil or gas is sold in Nebraska, and then the rst purchaser must pay the tax.

Nebraska Prepaid Wireless Surcharge. Every person making taxable sales of prepaid wireless telecommunications services,

including sales of prepaid mobile phones and phone cards, and recharging prepaid phones and cards, must be registered to

collect the Nebraska Prepaid Wireless Surcharge.

Each of the following programs has a separate application form, as indicated. These

application forms are all available on the DOR’s website.

Cigarette and Tobacco Products

To obtain a Stamping Agent’s License, Directory License, Tobacco Products License, License to Transport Unstamped

Cigarettes, or to register as a Cigarette Manufacturer or Distributor, you must le a Nebraska Cigarette and Tobacco

Products License and Registration Application, Form 20CT.

Mechanical Amusement Device

Operators and distributors of mechanical amusement devices that are used for a game, contest, or amusement, must le a

Nebraska Tax Application and Return for Mechanical Amusement Device Decals, Form 54.

Bingo, Lottery, Raffle, or Lottery by Pickle Card

To apply for a license to conduct bingo, a lottery by the sale of pickle cards, a lottery with gross proceeds in excess of

$1,000, or a rafe with gross proceeds in excess of $5,000, you must le a Nebraska Application for Bingo, Lottery, Rafe,

or Lottery by Pickle Card, Form 50.

Motor Fuels Taxes

To apply for a motor fuels license you must le a Nebraska Motor Fuels License Application, Form 20MF.