Agenda

2:30 PM

Introduction Bruce Flatt

2:40 PM

Overview and Financial Outlook Nick Goodman

3:10 PM

Real Estate Update Brian Kingston

3:30 PM

Insurance Solutions Sachin Shah

3:50 PM

Q&A Bruce Flatt

Nick Goodman

Brian Kingston

Sachin Shah

Introduction

Bruce Flatt, Chief Executive Officer

Information in this presentation is qualified by the Notice to Recipients and Endnotes included in this presentation

To summarize

• Brookfield Corporation is a Premier Global Wealth Manager for institutions and individuals

• We manage capital for our investors, global sovereigns, institutions and private individuals

through our asset management, wealth distribution, and insurance channels

• We are uniquely positioned to invest for our clients in the backbone of the global economy

• Our moat is widening as we further scale and diversify the business

• The permanent capital base of $140 billion backs one of the largest pools of discretionary

capital globally. This enables us to differentiate our capital

• Our $74 of Net Asset Value per share should compound at 17% to $163 by 2028 – allowing

investors a large margin of safety

1. See Notice to Recipients and Endnotes, including endnotes 1 to 3.

4

In the last 12 months, we…

Successfully listed our Manager

Grew our insurance assets to $100 billion

Raised nearly $75 billion of capital

Delivered strong operating results

Enhanced our deployable capital to nearly $120 billion

1. See Notice to Recipients and Endnotes, including endnote 4.

5

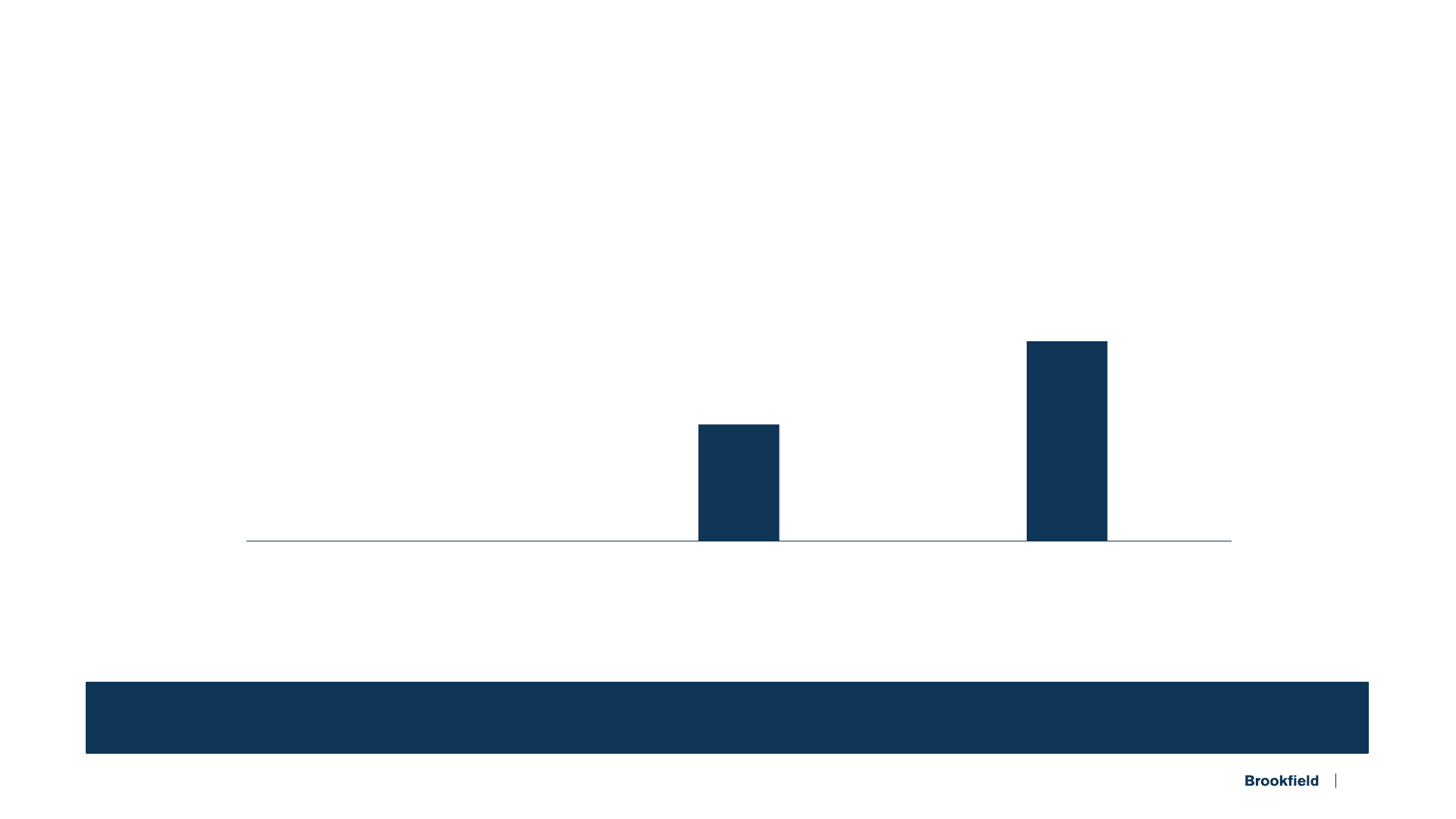

$74

Plan Value per Share Cash Distributions for our Manager Spin-Off

2022

2023

We achieved a 13% total return since last year

$74

$83

13%

Total

Return

6

You received $9 in distributions and still have $74 of Value working for you!!

2023

2028

$74

$163

Over the next five years, we should be able to deliver a

total annualized return on invested capital of 17%

Plan Value per Share

1. See Notice to Recipients and Endnotes, including endnotes 1 to 3.

17%

Total

Return

7

Your $74 per share should grow to $163 of Net Asset Value

We continue to position Brookfield

as the Premier Global Wealth Manager

– for institutions and individuals

8

Our goal is to compound wealth, while taking moderate risk, for…

Institutions Pension Plans Countries Individuals

& Families

9

Scale

Perpetual

Capital

Flexible

Insurance

Float

Diversified

Global

Manager

$140B

Capital

$100B

Float

$850B

AUM

We have one of the largest pools of

discretionary capital globally

1. See Notice to Recipients and Endnotes, including endnotes 2 to 4.

10

Global Secular

Trends

The current environment favors Brookfield

Investment

Backdrop

Scarcity of

Capital

Three D’s Our access to

capital is strong

Our deep operating

expertise differentiates us

11

Global footprint

Large & flexible

permanent capital base

Deep investment &

operating expertise

Established reputation

as a superior partner

Now more than ever, our significant competitive advantages

are differentiating the franchise

12

Enabling us to execute on major transactions even in a volatile market

13

On their own,

each of our businesses has a

strong foundation for growth…

14

But when the different parts

work together, what we can achieve

is significantly larger…

15

And allocating cash flows and

recycling capital should

significantly enhance returns

16

With the Corporation at the heart of everything we do…

Asset

Management

Insurance

Solutions

Operating

Businesses

BN

17

~$140B perpetual

capital base

Strategic

growth

Stable and growing

annual cash flow of $5B

Capital Appreciation Cash Reinvestment

& Recycling

Building Our Next

Global Champion

An investment in BN captures ALL of the value Brookfield creates

18

Following the successful listing of our

Manager, the spotlight has shifted to

our privately held businesses

19

The components of the business that are not

otherwise already separately covered are our…

Insurance Business, which has $100 billion of assets and growing

Our portfolio of high-quality real estate, which is world class

Carried Interest, which generates significant cash flow for us and

is our hidden jewel that lies in plain sight

1. See Notice to Recipients and Endnotes, including endnote 4.

20

We have never been better positioned

to enhance value…

Our goal continues to be delivering

15%+ returns over the longer term

21

Our Asset Management business…

• Is more diverse and growing faster than ever

• Has an investment track record that has delivered excellent returns

to clients over a long period of time

• Is well positioned around global secular tailwinds of capital deployment

• Has resilient cash flows, with best-in-class, long-term annuity-like revenues

22

to

$440B >$1T

Fee-Bearing Capital

Our goal is to surpass $1 trillion

of fee-bearing capital

1. See Notice to Recipients and Endnotes, including endnote 5.

Our Insurance Solutions business is growing rapidly

• Our goal is to deliver strong growth but take moderate risk – we limit insurance risk

and enhance returns with investment performance

• Our deep industry relationships and investment expertise position this business

as the partner of choice for regulated insurance companies

• Synergies with the broader investment platform and access to capital

should enable substantial growth while still achieving 20%+ equity returns

• The flexibility of our capital and our strong reputation should accelerate growth

now that we are at scale

1. Brookfield estimate. See Notice to Recipients and Endnotes.

24

$500B

Insurance Assets

We plan on reaching $500 billion

of insurance assets

to

$100B

1. Brookfield estimate. See Notice to Recipients and Endnotes, including endnote 4.

Our Operating Businesses are best-in-class

• We deploy our capital across our global champions that generate inflation-

protected, stable, predictable and growing annual free cash flows

• Our strategies allow us to compound capital at 15%+ on a baseline basis

• We have a proven track record of strong-risk adjusted returns and have

delivered resilient cash flows across market cycles

• Each business is self-funding with deep access to public and private pools

of capital

26

But, as in most businesses, Cash Reinvestment

is the secret to long-term returns

• Over the next five years, we plan to generate

~$45 billion of cash

• We have no restrictions on where to deploy this cash

• We focus on allocating our free cash flows to optimize

the business over the longer term and recycling capital

to sustain long-term growth and returns

• We also have $60 billion of listed securities that can be

turned to cash if required

~$45B

1. See Notice to Recipients and Endnotes, including endnote 6.

27

Our capital will be opportunistically allocated toward the following…

Investing to support our current businesses

Selectively building new businesses

Being ready for strategic transactions

Opportunistically doing share buybacks of BN, or our other securities

28

Global Wealth of individuals is our next frontier to add capital

• This is one of the fastest growing pools of capital globally

• We are pushing growth in wealth distribution – Brookfield Oaktree

Wealth Solutions

• We are now delivering solutions to the middle market with insurance products

• Soon we will launch our High-Net-Worth global channel to manage wealth for

individuals who are seeking increased exposure to our type of assets

29

Our goal is to be the Premier Global Wealth Manager

Reinvestment of

Cash Generated

Our Existing

Businesses

Bringing it all together, the Corporation’s value is driven by

30

We are well positioned to compound

our capital by ~20% per year

over the next five years…

31

1. See Notice to Recipients and Endnotes, including endnotes 1 to 3.

And grow our moat significantly

32

1. See Notice to Recipients and Endnotes, including endnotes 1 to 3.

Value Per

Share

$74 $163

Overview and Financial Outlook

Nick Goodman, President

Information in this presentation is qualified by the Notice to Recipients and Endnotes included in this presentation

Agenda

Agenda

01

Summary

02

Review of the Past

03

Our Business

04

Looking Forward

05

Bringing It All Together

Summary

In summary

• Our capital base has grown to ~$140 billion with $120 billion of equity

• We generate $5 billion of cash flow per year

• We are well positioned to grow earnings at 20%+ annually over the next five years

• Our goal is still to generate 15%+ total returns over the long term

1. See Notice to Recipients and Endnotes, including endnotes 1 to 3, 5.

36

In summary (cont’d)

• Our private businesses will be significant contributors to our growth

• Our goal is to be the Premier Global Wealth Manager of choice

• The current trading price offers a large margin of safety for an investor

• Our ESG principles are embedded within our operations

37

Review of the Past

For the 12 months ended June 30

($ millions)

2022 2023

Asset Management

$

2,419 $ 2,483

Insurance Solutions 85 634

Operating Businesses 1,528 1,512

$

4,032 $ 4,629

Corporate costs and other (651) (551)

Distributable earnings before realizations

$

3,381 $ 4,078

Per share

$

2.09 $ 2.56

We delivered strong growth over the past year…

21%

22%

39

1. See Notice to Recipients and Endnotes, including endnote 16.

For the 12 months ended June 30

($ millions)

2022 2023

Distributable earnings before realizations

$

3,381 $ 4,078

Realized carried interest, net 463 755

Disposition gains from principal investments 567 134

Distributable earnings

$

4,411 $ 4,967

Per share

$

2.73 $ 3.13

…and continue to generate predictable, growing distributable earnings

13%

15%

40

1. See Notice to Recipients and Endnotes, including endnote 16.

Over the last twelve months, we have returned ~$15 billion

of capital to our shareholders

($ billions)

2023

Regular Dividends

$ 0.7

Special Dividend

13.1

Opportunistic Share Repurchases

1

0.7

Capital Returned

$ 14.5

41

1. Opportunistic share repurchases include $0.2 billion completed post June 30, 2023.

Underpinned by our conservative balance sheet, high levels of liquidity

and strong access to capital across the business

$11B long-term debt

~$5B perpetual preferred equity

~$120B perpetual common equity

Conservative Capitalization Strong Corporate Liquidity

~$140B

$5B

Cash,

financial assets and

undrawn facilities

~$60B

Listed securities

42

1. Figures as at June 30

th

.

$2.5B

$2.6B

$3.8B

$4.3B

$5.1B

2019 2020 2021 2022 2023

Actuals

We are ahead of our baseline plans from five years ago

~$17.8B

Five-Year Cumulative Projection

~$18.3B

Five-Year Cumulative Actuals

15%

CAGR

1. Figures as at June 30

th

.

43

Assess climate impact

from underwriting

through exit

Operate one of the world’s

largest pure-play renewable

power platforms

Align with

industry-leading

ESG frameworks

Remain committed

to a diverse and

inclusive workplace

NZAM

Net Zero

Asset Managers

Diversity in

Action Initiative

Our existing businesses demonstrate that sound ESG practices

are key to creating long-term value

44

Published our inaugural TCFD disclosure

Raised $15B for our Brookfield Global Transition strategy

75% of independent board of directors are female

40% of our employee population is ethnically diverse

100% of Brookfield Properties U.S. office portfolio

committed to be powered by clean energy by 2026

…as evidenced by our continued progress

Net Zero

by 2050 or sooner

45

As at June 30

($ billions, unless otherwise stated)

2023

Asset Management

$

85

Insurance Solutions 8

Operating Businesses 45

$

138

Debt and preferred capital (18)

Total plan value

$

120

Total plan value per share

$

74

Our plan value today is $120 billion or $74 per share…

24x

DE Multiple

(Today)

15x

Average DE

Multiple

(Next Five Years)

1. See Notice to Recipients and Endnotes, including endnotes 2, 3, 5 and 7.

46

$74

2022 2023

Plan Value per Share Cash and Special Distributions

…resulting in a 13% total return since last year

13%

Total

Return

$74

$83

You received $9 of distributions and still have the same value as before!

1. Multiple of 25x on fee-related earnings in 2022. See Notice to Recipients and Endnotes, including endnotes 2 and 3.

47

Carried

Interest

We grew our intrinsic value in line with our plan five years ago

Plan Value per Share

$74

Asset

Management

Insurance

Solutions

Operating

Businesses

14%

CAGR

2018 2023

$39

1. 2018 was adjusted for the impact of the 3-for-2 stock split on April 1, 2020. Multiple of 20x was applied to fee-related earnings in 2018.

2. See Notice to Recipients and Endnotes, including endnotes 2 and 3.

48

2018–2023

Growth in plan value

14%

Average dividend yield and benefit of spin

-offs 4%

Total Compound Annual Return

18%

Achieving a total return in excess of our target

1. See Notice to Recipients and Endnotes, including endnotes 2 and 3.

49

800

2800

4800

6800

8800

10800

12800

1.5

11.5

21.5

31.5

41.5

51.5

61.5

BN BN NAV S&P 500

Our shares have still delivered 19% returns over the past 20 years –

merely having the Price trade at Value brings that return to 23%

2003

2023

$34

10%

Annualized

Return

19%

Annualized

Return

1

$74

1. Represents total compounded return, with dividends reinvested.

2. See Notice to Recipients and Endnotes, including endnotes 2 and 3.

50

As at June 30

($ per share, unless otherwise stated)

Intrinsic Value

Total Plan Value $ 74

Equity Market Capitalization (34)

Discount to Plan Value 55%

Our Price versus Value discrepancy offers a large margin of safety;

or substantial upside from today

11x

Trading

DE Multiple

(Today)

7x

Average Trading

DE Multiple

(Next Five Years)

1. See Notice to Recipients and Endnotes, including endnotes 2, 3 and 5.

51

Our Business

Asset Management

(BAM)

Insurance Solutions

(BNRE)

Operating Businesses

(BEP/BIP/BBU/BPG)

$85B $8B $45B

Leading global alternative

asset management business

Global insurance

solutions business

Portfolio of global, scale

operating champions

Our perpetual capital base of ~$140B is generating

over $5B of cash flows annually

1. See Notice to Recipients and Endnotes, including endnotes 2, 3 and 7.

53

As at June 30, 2023

(Billions) (Per Share)

Public Holdings

$ 60

Private Holdings

78

Debt and preferred capital

(18)

Intrinsic Value

$ 120 $ 74

The intrinsic value of our existing businesses is

$120 billion or $74 per share…

54

A

B

B

1. See Notice to Recipients and Endnotes, including endnotes 2 and 3.

As at June 30, 2023

(Billions) (Per Share)

BAM − 75% $ 40

BEP − 47% 9

BIP − 27% 8

BBU − 65% 3

Public Holdings $ 60 $ 37

A. Our public holdings are straightforward and transparent

55

These are all listed!

As at June 30, 2023

(Billions) (Per Share) Valuation Method

Asset Management

Direct Investments

$

14 Fair value under IFRS

Carried Interest 32 Multiple of target carry

Real Estate

Core 14 Fair value under IFRS

Transitional & Development 10 Fair value under IFRS

Insurance Solutions 8 Multiple of spread earnings

Private Holdings

$

78 $ 48

B. We value our private holdings at $78 billion or $48 per share

1. See Notice to Recipients and Endnotes, including endnotes 2, 3 and 7.

56

Asset

Management

A) Direct investments Generating excellent returns

B) Carried interest Will generate significant cash

earnings

Real Estate Premium portfolio Strong Net Operating Income

performance

Insurance Premium returns

and growth

20% Return on Equity

Our focus for you today is to explain our private businesses

57

1A. Asset Management –

Direct Investments

58

Directly on our balance sheet we have

$14 billion of direct investments

in funds managed by BAM

59

1. Figures as at June 30

th

.

…targeting strong long-term returns

60

1. Current Investment is as at June 30, 2023. See Notice to Recipients and Endnotes, including endnotes 8 and 9.

Target Return

($ billions)

Original

Investment

Capital Returned

To Date

Current

Investment Gross Net

BSREP I

$ 1.6 $ 2.8 $ 0.3 ~20% ~16%

BSREP II

2.7 2.7 2.2 ~20% ~16%

BSREP III

3.6 0.9 4.2 ~20% ~16%

BSREP IV

1.8 0.1 1.7 ~20% ~16%

Oaktree Investments

2.1 ‒ 2.1 ~15% ~10%

Private Equity Investments

1.7 0.7 1.1 ~20% ~15%

Other Funds and Co-Investments n/a n/a 2.1 ~15% ~11%

Total $ 13.7

1B. Asset Management –

Carried Interest

61

Carried interest is our share of the

profits we earn for our clients

62

By way of an example…

Fund size $ 20B

Target return 20%

Management fee rate (1.5%)

Net return 18.5%

Carried interest rate 20%

Margin 70%

Annual carried interest, net $ 520M per year

63

A

Carry-Eligible

Capital

Investment

Performance

Carried Interest

Rate & Margin

Key inputs of carried interest

B

C

64

A

$47B

$72B

$122B

$144B

$176B

$220B

2018 2019 2020 2021 2022 2023

36%

CAGR

Our carry-eligible capital has grown by a 36% CAGR over five years

65

1. Figures as at June 30

th

.

Our funds are tracking to meet or exceed their target returns

B

66

1. Reflects performance of flagship funds and similar strategies. See Notice to Recipients and Endnotes, including endnotes 9 to 11.

2. Target Real Estate gross and net returns include only the Brookfield Strategic Real Estate Funds target returns. Target Private Equity gross and net returns include BCP II to VI.

Target Return IRR

As at June 30, 2023

Fund

Fund

History

Number of

Vintages Gross Net Gross Net

Infrastructure/Renewable Power 13 years 5 13% 11% 16% 13%

Private Equity 22 years 6 21% 18% 28% 22%

Real Estate 17 years 7 20% 16% 23% 19%

Credit 35 years 12 15% 10% 22% 16%

Transition 2 years 1 13% 10% n.m. n.m.

Our carried interest rate and margin are consistent

60%

Margin

20%

Carried Interest Rate

C

67

1. Carried interest rate and margin are based on Brookfield’s flagship funds.

$1B

$3B

2023 2028

Net

$0.8B

$3B

2023 2028

Net

Annual Generated Carry

Realized Carry

$2B

$7B

$6B

$1B

…our carry potential is expected to continuously grow

over the next five years

2023 2028

19%

CAGR

Carry-Eligible Capital

$527B

$220B

68

1. As at and for the last twelve months ended June 30, 2023. Carried interest figures are presented gross of costs. See Notice to Recipients and Endnotes, including endnotes 5 and 12.

29%

CAGR

36%

CAGR

Monetization activity has ramped up significantly over the last five years

~$30B

2023

~$10B

2018

69

1. Figures as at June 30

th

.

$0.5B

$0.5B

$1.5B

$1.1B

$1.2B

2019 2020 2021 2022 2023

2019 2020 2021 2022 2023

2018 IR Day Projections Actual

~$4.8B

Five-Year Cumulative Actuals

~$3.1B

Five-Year Cumulative Projection

With that, we significantly exceeded our five-year plans for realized carry

70

1. Figures as at June 30

th

.

Looking forward, our carried interest is diversified across asset classes,

risk profiles and strategies – this reduces volatility

36%

23%

17%

14%

10%

Real Estate Infrastructure Private Equity Renewable Power & Transition Credit and Other

71

1. See Notice to Recipients and Endnotes, including endnote 8.

1.3

2.2

2.5

2.8

2.8

2.6

2.1

1.7

1.0

1.2

0.8

0.9

1.4

2.4

$1.3B

$2.2B

$2.5B

$2.8B $2.8B

$2.9B $2.9B

$2.6B

$2.4B

$3.6B

2024 2025 2026 2027 2028 2029 2030 2031 2032 2033

Realized Carried Interest on Funds Raised to Date Realized Carried Interest on Funds to Be Raised

$6 billion

On Funds to Be Raised

$20 billion

On Funds Raised to Date

1.0

72

1. Figures as at June 30

th

. See Notice to Recipients and Endnotes, including endnote 8.

Driving growth in net realized carried interest to BN

We value carry as a multiple of target carried interest

plus accumulated unrealized carry

Target Carried

Interest

An Industry Multiple

(10x currently)

Accumulated Unrealized

Carried Interest

Carry we expect to earn

assuming the fund achieves

the target return, annualized

on a straight-line basis

Accumulated carry generated

based on fund performance

to date, assuming funds are

liquidated at current values

Reflecting franchise value

X

73

Our carried interests are our hidden jewel in plain sight…

but NONE

of this is recorded in our accounts

As at June 30, 2023

($ billions)

Multiple Intrinsic Value

Target carried interest, net $ 2.6 10x $ 26

Accumulated unrealized carried interest, net 5.9 6

Total carried interest $ 32

74

1. See Notice to Recipients and Endnotes, including endnotes 2 and 3.

We value our carried interest at $32 billion

($ billions)

NPV of carried interest to be realized from existing funds $ 14

NPV of carried interest to be realized from future funds (Franchise Value) 18

Total carried interest $ 32

~50% of value is derived from existing private funds

75

1. See Notice to Recipients and Endnotes, including endnotes 2 and 3.

• Carry is very meaningful, real, and not a matter of if, but when it turns to cash

• We value our carry at $32 billion today

• Carry should provide $26 billion of cash flow over the next 10 years alone

Key Takeaways on Carry

76

1. See Notice to Recipients and Endnotes, including endnotes 2, 3 and 8.

Carry is our hidden jewel in plain sight

Also, our plan value does NOT ascribe

any value to the Corporation’s ability to

drive earnings growth from the

reinvestment of excess cash flow, but…

77

$0B

$0.7B

$1.2B

2020 30-Jun-23 2023

For example, in just over three years, we have built an

insurance business that generates ~20% cash returns on equity

Distributable Earnings

2020 Pro-forma

Committed Growth

1

…and provides significant strategic value to the broader franchise

June 30,

2023

78

1. See Notice to Recipients and Endnotes, including endnote 14.

Looking Forward

To summarize

• Our global champions provide stable and growing cash flows for the business

• Growth in DE over the next five years is driven by:

• Carried interest will provide us with meaningful earnings, above and beyond our

recurring free cash flows

• Plan Value is expected to be $163 per share in five years, generating a total return

of 17% from the Value of $74 today

• Your entry point today can lead to even better returns, as you can acquire shares

at a cheaper Price versus the compounding Value

80

1. See Notice to Recipients and Endnotes, including endnotes 1 to 3 and 5.

1) Asset Management 2) Insurance Solutions 3) Cash Reinvestment at BN

Our franchise is stronger, and its

value proposition is better than ever

81

To summarize, in five years, we plan to

Grow Distributable Earnings per share by

Increase Plan Value per share by

Deliver annual Total Returns per share of

25%

CAGR

17%

CAGR

17%

82

1. See Notice to Recipients and Endnotes, including endnotes 1 to 3 and 5.

Our Asset Management business should deliver 18% growth without

multiple expansion

As at June 30

($ billions, except percentages)

2023 2028

BAM

Fee-related earnings

1

$ 2.2 $ 4.8

Fee-bearing capital 440 1,014

Margin 55−60% 60%+

Distributable earnings

1

2.2 5.0

17%

CAGR

18%

CAGR

18%

CAGR

83

1. Represents LTM figures as at June 30, 2023.

2. See Notice to Recipients and Endnotes, including endnote 5.

Our Insurance Solutions business is scaling rapidly

84

1. 2023 assets exclude the impact of the recently announced acquisitions. See Notice to Recipients and Endnotes, including endnote 5.

As at June 30

($ billions, except percentages)

2023 2028

Assets $ 45 $ 250

Spread earnings ~2% ~2%

Distributable operating earnings $ 0.7 $ 3.9

41%

CAGR

40%

CAGR

Strong track record of

risk-adjusted returns

15%

IRR Over ~35 Years

Compounding value

appreciation

~$5B

Target Annual

Capital Appreciation

Resilient and growing

cash distributions

~$1.5B

Annual DE

Our Operating Businesses continue to grow their cash flows and

compound in value

85

Operating Businesses Asset Management

Insurance Solutions Realized Carried Interest

2024–2028

$43B

Over the next five years, our free cash flow should be ~$45 billion

86

1. See Notice to Recipients and Endnotes, including endnotes 5 and 15.

($ billions)

2024–2028

Distributable earnings

$ 43

Less: regular dividends paid to shareholders

(3)

Excess cash flow

$ 40

…leading to significant excess cash flow to invest into new opportunities

87

1. See Notice to Recipients and Endnotes, including endnotes 5, 6 and 15.

Absent investment opportunities,

capital will be available to return to shareholders

Reinvestment of excess cash should add ~$3 billion of cash flows

over the next five years

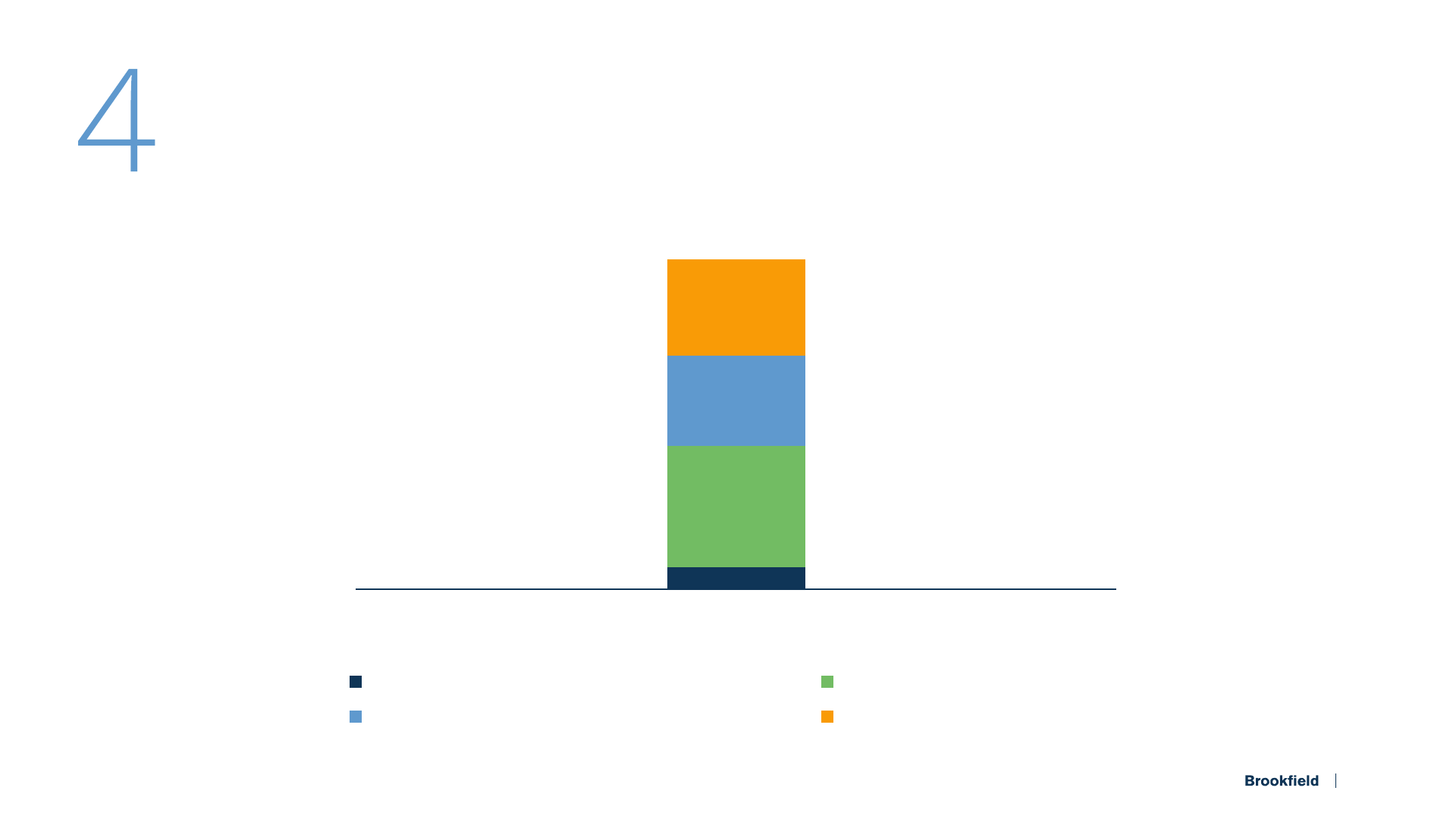

Distributable Earnings Before Realizations

Operating Businesses Asset Management

Insurance Solutions Cash Reinvestment

$3.8B

$10.3B

22%

CAGR

2023 2028

88

1. See Notice to Recipients and Endnotes, including endnote 5.

Carried interest will generate meaningful cash flow and

as a result, DE should be ~$14 billion in 2028

Distributable Earnings

Operating Businesses Asset Management Insurance Solutions

Cash Reinvestment Realized Carried Interest

$4.5B

$13.6B

25%

CAGR

2023 2028

89

1. See Notice to Recipients and Endnotes, including endnote 5.

25%

CAGR

Growth in DE for BN is driven by

21%

Cash Reinvestment

35%

Insurance Solutions

2%

Operating Businesses

42%

Asset Management

90

1. See Notice to Recipients and Endnotes, including endnote 5.

• We have many levers to access liquidity from the

markets

• Our businesses are predominantly financed with asset-

level debt that has recourse only to the asset and has

no cross-collateralization

• We align financing with the long-term hold periods of

our businesses to withstand market cycles

8%

Debt to

Plan Value Ratio

Our balance sheet and funding model will remain

conservatively capitalized going forward

91

1. Figures as at June 30

th

.

Bringing It All Together

$2.86

$8.41

Operating Businesses Asset Management Insurance Solutions

Cash Reinvestment Realized Carried Interest

DE

$2.38

$6.34

2023 2028

DE Before Realizations

2023 2028

$ per share

If we achieve this plan, DE before realizations and DE per share should

increase at a 22% and 25% CAGR, respectively, over the next five years

22%

CAGR

25%

CAGR

93

1. See Notice to Recipients and Endnotes, including endnote 5.

$34

$74

$163

25

28

26

$10

2023

Market Price

2028

Plan Value

17%

Total

Return

2023

Plan Value

Plan Value per share should increase to $163 by 2028

Asset

Management

Insurance

Solutions

Cash

Reinvestment

Carried

Interest

94

1. See Notice to Recipients and Endnotes, including endnotes 1 to 3.

For example, given the entry point, if we liquidated the company in 2028,

then we could provide you a 37% return (prior to tax)!!

37%

Total

Return

In conclusion

• Our franchise is stronger, and our investment proposition is better than ever

• BN captures all the earnings generated across the franchise and drives additional

growth through proven cash reinvestment

• We are well positioned to grow earnings at 20%+ per annum over the next five years

• This is all underpinned by a very conservative balance sheet and strong liquidity

• We are set up to deliver 15%+ per share total returns over the long term

95

1. See Notice to Recipients and Endnotes, including endnote 5.

Real Estate Update

Brian Kingston, Chief Executive Officer

In summary

97

• Our real estate business is performing extremely well

• Our core portfolio continues to outperform the overall market

• We continue to execute value creation in our transitional & development portfolio

• A resilient economy drives demand for land and housing

• We completed all 2023 refinancings with minimal liquidity impacts and anticipate

the same moving forward

• And expect to continue delivering strong cash flow and compounding of capital for BN

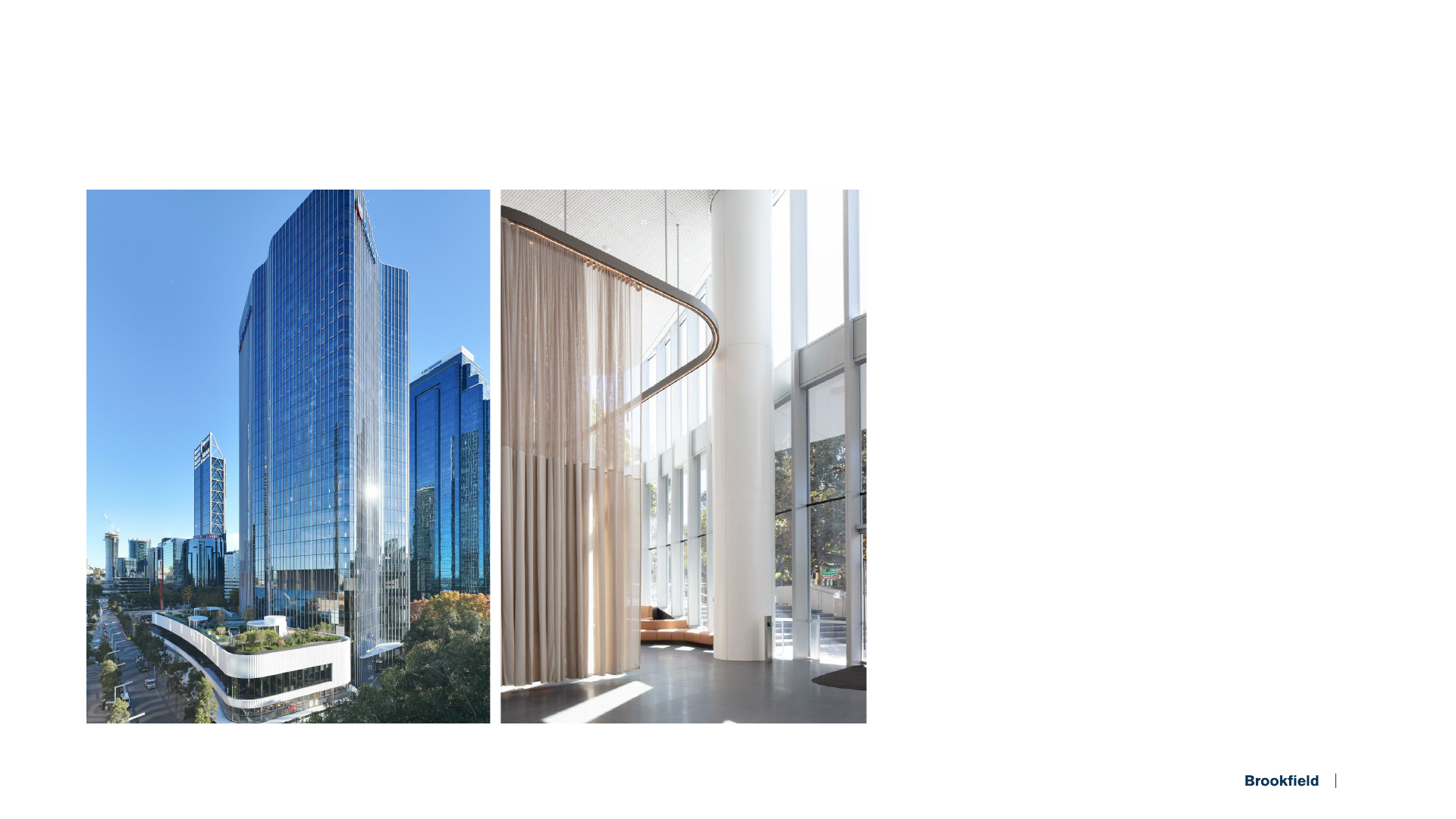

$24 billion of capital invested in real estate

Premier Core

Brookfield Place, New York

$14B

Transitional & Development

One The Esplanade, Perth

$7B

Residential

Wendell Falls Community, NC

$3B

98

Premier Core: Irreplaceable portfolio of 29 trophy mixed-use precincts

99

Luxury Retail

$6.7B

$14B

Luxury Urban Retail

$750M

Premier Office

$5.2B

Luxury Residential & Hotels

$1.6B

47%

8%

41%

4%

With strong underlying fundamentals

100

49%

LTV

96%

Occupancy

8 years

Lease Life

6%

SS NOI Growth

10

Trophy Commercial

Complexes

19

Irreplaceable

Shopping Centers

Robust same-store net operating income growth driven by…

Occupancy

Gains

Contractual

Rent Escalators

Mark-to-Market

Leases

101

Our debt maturities are well laddered

102

3%

16% 16%

15%

50%

2023 2024 2025 2026 2027+

Core Debt Maturities

$7.5 billion core office & mixed-use business

95%

Occupancy

4%

SS NOI Growth

9 years

Lease Life

100%

Zero Emissions Electricity

by 2026

Europe &

Middle East

$3B

55%

LTV

North

America

$4.5B

103

10 trophy commercial complexes…

As of June 30, 2023

Asset Asset Value Equity Value

Occupancy WALT

Premier Office

New York

Brookfield Place $ 4,519 $ 1,899 94% 8

Manhattan West 3,779 1,814 98% 10

300 Madison Avenue 1,232 435 100% 11

Grace Building 963 509 100% 10

London

Canary Wharf 3,410 1,303 93% 11

100 Bishopsgate 2,010 448 96% 16

Toronto

Brookfield Place 912 471 98% 6

Bay Adelaide Centre 841 463 98% 10

Other

Brookfield Place Dubai 699 381 92% 7

Potsdamer Platz Berlin 606 306 88% 6

Total

$ 18,971 $ 8,029

95% 9

Preferred shares & bonds

$ (2,800)

Total Equity Premier Office

$ 5,229

104

As of June 30, 2023

Asset City Asset Value Equity Value Occupancy WALT

Luxury Residential & Hotels

The Eugene New York $ 529 $ 215 95% N/A

Pendry Manhattan West New York 159

104

N/A N/A

Canary Wharf Residential London 2,145 1,308 94% N/A

Total $ 2,833 $ 1,627 95% N/A

Luxury Urban Retail

Brookfield Place Retail New York $ 449

$ 142

94% 7

Manhattan West Retail New York 226

142

98% 14

Canary Wharf Retail London 569 466 96% 7

Total $ 1,244 $ 750 96% 8

…and ancillary mixed-use

105

Occupancy Average RSF

BFPL NY

94% $ 73

Sub-Market

76% $ 57

Investment spotlight: Brookfield Place New York

Five-building, eight million sf mixed-use redevelopment

106

$4.5B

Stabilized

Value

6.5%

Discount

Rate

1.1M sf

Leases Signed

1

(at all-time record rents)

1. Leases signed in the last 18 months

Investment spotlight: Canary Wharf – London

20 million sf mixed-use precinct, including office, retail, homes & leisure space

128 Acres

Total Size

of Estate

$6.1B

Asset Value

$3.1B

Equity Value

2.3K+

Apartments

1M sf

Retail

8M sf

Office +

Lab Space

107

Canary Wharf

City of London

London City Airport

1991: DLR

1999: JUBILEE

2022: ELIZABETH LINE

Evolution of CWG 3.0

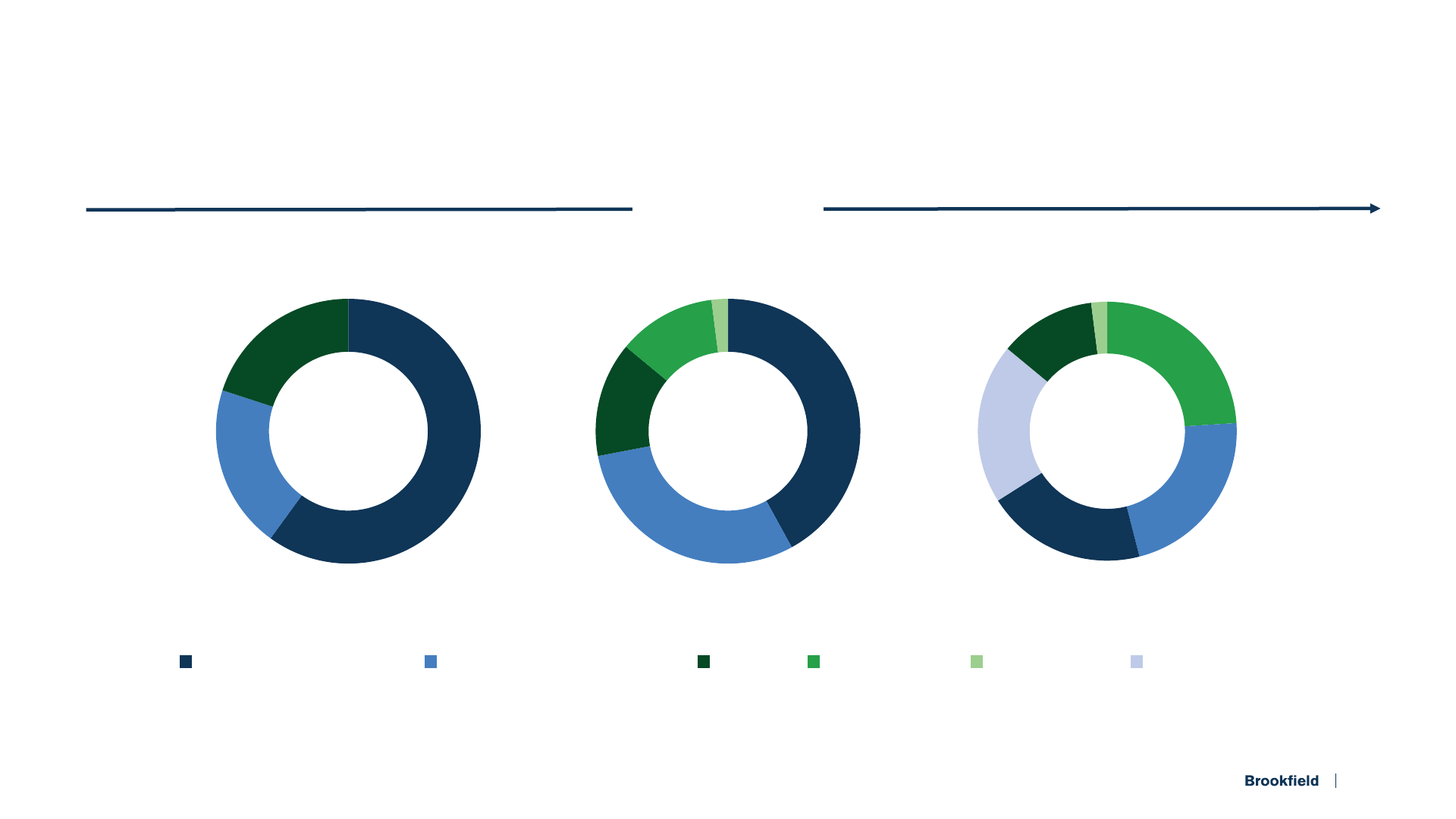

109

42%

30%

14%

12%

2%

TODAY

24%

22%

20%

20%

12%

2%

CWG

3.0

60%20%

20%

2010

% of Value

20%

22%

12%

24%

2%

20%

Financial Services Other Office Tenants Retail Multifamily Hospitality Life Sciences

$6.7 billion core retail business

97%

Total Leased

10%

SS NOI Growth

6.2%

Discount Rate

41%

LTV

HI

CO

VA

NV

IL

NJ

CA

OH

MA

FL

NY

70%

Interim 2030 GHG

Emissions Intensity

Reduction Target

United States

19

Malls

111

19 irreplaceable shopping centers

As of June 30, 2023

Asset City Asset Value Equity Value Sales per sf

Luxury Retail

Ala Moana Center Honolulu $ 2,445 $ 1,346 $ 1,516

Park Meadows Lone Tree 1,285 644 1,015

730 Fifth Avenue New York 1,222 597 -

Tysons Galleria McLean 1,143 754 2,088

Fashion Show Las Vegas 1,025 643 1,050

The Grand Canal Shoppes Las Vegas 1,016 569 1,422

Oakbrook Center Oak Brook 904 697 1,279

Willowbrook Wayne 812 482 923

North Star Mall San Antonio 782 516 1,001

The Woodlands Mall Houston 778 364 822

Others (9) Multiple 4,348 2,671 1,003

Total $ 15,760 $ 9,283 $ 1,148

Preferred shares & bonds

$ (2,600)

Total Equity Luxury Retail

$ 6,683

112

$958

$1,148

Pre-pandemic Today

Tenant Sales PSF

1

$125

$131

Pre-pandemic Today

In Place Rent PSF

1

Continue to achieve strong performance in our core retail portfolio

113

+20%

Miami Design District, FL

Oakbrook Center, IL

+5%

1. Growth rate between 2019 and 2022 for tenants under 10k SF

Foot traffic increased +8% YTD compared to 2022

Investment spotlight: Tysons Galleria – McLean, VA

Largest and most productive assortment of luxury retail in the

Washington Metropolitan Area (sales of $2,088 per sf

1

)

114

Asset Name, Location

+45%

SS NOI Growth

vs. Pre-Pandemic

2022

$30M

+76%

Tenant Sales

1

Increase

vs. Pre-Pandemic

+4.8%

In-Place Rent Growth

1

vs. Pre-Pandemic

1. Tenants <10k SF

2023

$110M

Projected

Sales Volume

Transitional & Development: Maximize returns through a development

or buy-fix-sell strategy

Alderwood

Lynnwood, WA

Lilia Waikiki

Honolulu, Hawaii

One Leadenhall

London, UK

$7B

Equity Value

180

Properties

51%

LTV

5 years

Lease Life

116

Investment spotlight: One The Esplanade – Perth, Australia

29-story mixed-use development

Market-leading sustainability credentials

• 6 Star Green Star Rating, including use of ‘green’

concrete that reduces CO

2

emissions

• First building in Australia to secure IWBI Well

Gold Core Rating

Significant Value Realized

Acquired in May 2019, sold 75% in 2020-21

$80M

Development Profit

100%

Leased (15-Year Lease)

5% cap rate

Record Sale for Perth Office

978.3%

Gross IRR

1

5.5x

Gross MOC

1

$18M

Equity Invested

1

1. Returns as at June 30, 2023. See Notice to Recipients and Endnotes

117

Asset Name, Location Asset Name, Location

97%

Total Retail

Occupancy

34%+

Reduction in Energy

Consumption Since 2014

+20%

Increase in Mall Tenant

Sales per sf vs. 2019

Investment spotlight: Alderwood Mall – Lynnwood, WA

Redevelopment of vacant anchor box into a mixed-use asset with

328 market-rate apartments and approximately 80,000 sf of new retail

Asset Name, Location

Nov. 2021

Grand Opening of Sears

Anchor Redevelopment

Before: Vacant Sears Box After: Alderwood Multifamily Development

95%

Multifamily Occupancy

at Rents Above Pro Forma

118

Residential: Create value through home building, lot sales and

development of commercial zones

$510M

Annual Operating Cash Flow*

2,340

Annual Home Sales*

83K

Lots in

20 Markets

2,330

Annual Lot Sales*

14%

Return on Equity*

* Figures represent LTM.

United

States

$2B

Canada

$1B

119

Real estate outlook

120

($ billions)

Today 2028

Equity Growth Sales Reinvest Future

Core

$ 14 3 (5) 1 $ 13

T&D

7 0 (7) 1 1

Residential

3 0.5 (3) 0.5 1

Total

$ 24B 3.5 (15) 2.5 $ 15B

In conclusion

121

• Strong fundamentals and tenant demand

• Short-term interest rates impact cash flows but not long-term values

• We have a well-laddered debt maturity profile to weather market volatility

• Real Estate will continue to generate compelling returns for Brookfield

Insurance Solutions

Sachin Shah, Chief Executive Officer

Executive Summary

123

• After three years, we have the base of a world class insurance business

• There is a compelling macroeconomic backdrop for this business

• We have built out the capabilities to scale from here

• Access to BAM’s investment expertise is a key differentiator to delivering outsized

returns on BN’s invested capital

• With very little extra capital we should be able to achieve $5B of earnings annually

• By 2026 the value of this business should be $30B

Macroeconomic tailwinds present

significant growth opportunities

for insurers

124

Over the next 20 years…

125

1. Source: Bloomberg.

$7T

Shortfall in

retirement

savings

>40%

Of the elderly

population to be

financially vulnerable

50%

Increase in U.S.

65+ population over

the next 20 years

We are building a long-term

yield plus growth business

126

Our distributable earnings

and capital generation

are growing quickly

127

Our path to $100 billion in assets positions us well

Pension Risk

Transfer

Multi-line Direct Origination

Specialty P&C

Scaled Annuity

Platform

$2B

AUM

$45B

AUM

$50B

AUM

$100B

AUM

Reinsurance

$15B

AUM

2020

2021

2022

2023

2023–2024

128

Our liabilities have an embedded cost advantage

129

~ 10

< $100K

average account size

< 4%

average cost of funds

year average life

1. See Notice to Recipients and Endnotes, including endnote 13.

While maintaining a low risk profile

A/A-

Rated operating

platform

1

$30B

Liquidity

BBB+

Investment Portfolio

Benefitting our Policyholders

130

1. S&P, Fitch, AM Best.

2. See Notice to Recipients and Endnotes, including endnote 13.

Our asset base is turning over quickly

~ 4 years

~ 10 years

Assets

Liabilities

131

At the perfect time…

132

The rate environment is highly constructive

Rates are

normalizing

Credit is an

attractive asset class

Banks continue

to retreat

133

We have the leading Investment Franchise

perfectly aligned with Insurance

Infrastructure Real Estate

Credit

That generates over $50 billion of proprietary credit deal flow annually

134

• Public Credit

• Real Estate Senior Credit

• Infrastructure Senior Debt

• Credit Secondaries

• Performing Credit

• Opportunistic Credit

• Direct Lending

• Consumer Finance

• Land Leases

• NAV Lending

• Royalties

• Core Real Estate

• Core Infrastructure

• Core-plus Infrastructure

• Value-add Transition

135

Our credit franchise is growing

Driving market leading investment yields

Assets $100 billion

Investment yield ~6%

Costs ~4%

Spread 2%

Annual cash yield $2 billion

Which we should be able to achieve by 2026

136

1. See Notice to Recipients and Endnotes, including endnotes 5 and 13.

To summarize where we are today

• The business we have today has $100 billion in assets and can generate $2 billion

of Distributable Earnings in the near term

• We have an unparalleled investment franchise to deploy the capital

• A highly scalable operating platform to deliver future growth

• Low-risk approach with long-duration liabilities and substantial liquidity

137

PLUS, we are still in the

early stages of our growth plan

138

Repeatable annual annuity franchise

Leading annuity platform Operating synergies

Best-in-class claims management

Trusted brand recognition

139

We have a market leading annuity engine driving our organic growth

Run-rate annuity generation

1

$20+

$10–12

Brookfield capabilities

140

1. See Notice to Recipients and Endnotes, including endnotes 5 and 13.

We can write $20 billion of long-duration annuities annually

with our in-house platform and operational capabilities

Operations can support $100 billion of net new assets in five years

$2B

Run-rate

distributable

earnings

1

10x

Initial

insurance

leverage

$20B

Annual

self-funded

growth

141

1. See Notice to Recipients and Endnotes, including endnote 5.

Which can be self-funded through re-investment of earnings

The foundation is in place to significantly grow our assets

through organic and inorganic channels

$20B

In net annuity

sales annually

$10-15B

PRT

$10-15B

Large-Block

Reinsurance

$100B

Self-Funded

Reinsurance

Growth Capital

142

1. See Notice to Recipients and Endnotes, including endnote 5.

Setting the business up to more

than double again

143

Contributing over $5 billion of Distributable Earnings

Today

Asset

Rotation

Annuities

Reinsurance

& Other

$5B

$2B

AEL

Argo

725

$1.2B

Today

Fully Ramped

~2026

$4B

2030

Self-Funded

2030

Total

144

1. See Notice to Recipients and Endnotes, including endnotes 5 and 13.

Brookfield Reinsurance will contribute

significant value to BN

for decades

145

Stable, recurring investment income

Predictable, low risk liabilities

Diversified source of earnings

Perpetual capital

Significant, self-funded growth

Supporting a 15x earnings multiple

146

Our business is positioned to drive outsized returns which should result

in higher quality earnings and a strong valuation multiple

$18B$8B

Pro-forma known

acquisitions

June 30, 2023

147

1. See Notice to Recipients and Endnotes, including endnotes 3 and 7.

Our strategic initiatives have driven a meaningful value uplift

Pro-Forma 2026 2030

Earnings $ 1.2B $ 2B $ 5B

Multiple 15x 15x 12x

Valuation $ 18B $ 30B $ 60B

Per BN share $ 11 $ 19 $ 37

Our business profile supports a compelling value proposition

148

1. See Notice to Recipients and Endnotes, including endnotes 3 and 13.

Which we believe is ascribed little value in BN's share price today

In a few short years, we have created a market leading insurance franchise

• Grown from zero to $100 billion in assets

• Have a credible path to $2 billion of DE

• Redeployed assets to earn attractive returns on BN’s invested capital

• Established a platform that can self-fund significant growth and double again

• Delivering significant and growing value to BN shareholders

And we are still in the early innings of Brookfield’s next global champion

149

1. Our outlook on the equity value and respective shares of Brookfield is based on (i) net generated carried interest, (ii) a 10x multiple to net target carried interest, as adopted by management in its business

planning, and (iii) our accumulated unrealized carried interest balance.

2. The value of our carried interest within our Plan Value assumes a 70% and 50% margin on gross generated carried interest, for Brookfield and Oaktree, respectively. Brookfield's estimates reflect the

appropriate multiple applied to carried interest in the alternative asset management industry based on, among other things, industry reports. These factors are used to translate earnings metrics into value in

order to measure performance and value creation for business planning purposes. The value of our capital within our Plan Value represents blended value, which is the quoted value of listed investments and

IFRS value of unlisted investments. We primarily value our real estate business by using fair value under IFRS, which we revalue on a quarterly basis, and comparable market data for our North American

residential business. In addition, we reflect our Insurance Solutions business based on management’s view of the fair value of this business.

3. Illustrative Plan Value analysis is not intended to forecast or predict future events, but rather to provide information utilized by Brookfield in measuring performance for business planning purposes, based on

the specific assumptions and other factors described herein and in our Notice to Recipients.

4. Insurance assets are presented pro-forma for the recently announced acquisitions, including the American Equity Life and Argo Group transactions.

5. References to growth in or future expectations for Distributable Earnings Before Realizations, Distributable Earnings, Fee-Bearing Capital, Fee Revenues, Annual Generated Carry, Accumulated Unrealized

Carry, Realized Carry and Carry-Eligible Capital are illustrative only. Actual results may vary materially and are subject to market conditions and other factors and risks, as well as certain assumptions, that are

set out in our Notice to Recipients.

6. Growth in Plan Value relating to cash retained includes cashflow from our existing businesses and realized carried interest. Excess cash flows are generally reinvested at 8%. Capitalization and dividends paid

out during the period assume a constant capitalization level and 7% annual growth.

7. The 2023 value of our Insurance Solutions business represents the intrinsic value as at June 30, 2023, excluding the impact of the recently announced acquisitions.

8. The actual realized returns on current unrealized investments may vary materially and are subject to market conditions and other factors and risks that are set out in our Notice to Recipients.

9. The target returns set forth herein are for illustrative and informational purposes only. Target gross returns are based on historical performance for similar investment strategies and the manager’s expectations

regarding the returns that it will underwrite for the types of investment opportunities that it expects to be available for the fund. There can be no assurance that the manager will be able to source investment

opportunities that it can underwrite in line with the target gross returns, or that the underwritten returns for any of the fund’s investments will be achieved. Target gross returns do not reflect fund expenses,

management fees or carried interest (or equivalent fees), which reduce an investor’s returns whereas target net includes these items. Due to various risks, uncertainties, and changes (including changes in

economic, operational, political or other circumstances), the actual performance of the fund could differ materially from the target returns set forth herein. In addition, industry experts may disagree with the

assumptions used in presenting the target returns. No assurance, representation or warranty is made by any person that the target returns will be achieved, and undue reliance should not be put on them.

Additional information about the assumptions used in determining the target returns are available upon request. Prior performance is not indicative of future results and there can be no guarantee that the fund

will achieve the target returns or be able to avoid losses.

Endnotes

152

10. Performance metrics are presented for flagship and predecessor funds along with similar strategies and do not include all Brookfield or Oaktree funds. Composite returns presented are calculated by

aggregating total cash flows of such funds, using the same information used to calculate the returns for each individual fund. “Gross IRR” and “Gross Investment Multiple” reflect performance before fund

expenses, management fees and carried interest (or equivalent fees), which would reduce an investor’s return. The actual realized returns on current unrealized investments may differ materially from the

returns shown herein, as it will depend on, among other factors, future operating results, the value of the asset and market conditions at the time of dispositions, any related transactions costs and the time and

manner of sale, all of which may differ from the assumptions on which the valuations contained herein are based. “Net IRR” and “Net Investment Multiple” take into account fund expenses, management fees

and carried interest (or equivalent fees) and take into account the effects of leverage incurred at the fund-level through the use of a subscription secured credit facility to temporarily fund investments and meet

working capital needs. As a result, “Net IRR” and “Net Investment Multiple presented may be materially higher than what they would have been without the use of such facility. The returns in this presentation

are hypothetical and do not represent the investment performance or the actual accounts of any investors or any funds. The investments included in calculating the performance presented were made through

different fund structures and therefore, may have different applicable fee and expense rates and do not represent returns actually achieved by any investor. Returns are subject to other factors and risks as set

out in our Notice to Recipients.

11. Gross IRR on current Brookfield private funds is on existing carry eligible funds, excluding open-ended funds and funds categorized as “Other” in Brookfield’s Q2 2023 Supplemental Information available at

brookfield.com.

12. Current gross realized carried interest expectations are illustrative only. Actual results may vary materially and are subject to market conditions and other factors and risks, as well as certain assumptions, that

are set out in our Notice to Recipients.

13. Insurance Solutions asset and liability values, including the impact of recently announced acquisitions.

14. Distributable Operating Earnings from our Insurance Solutions business are presented pro-forma for the recently announced acquisitions.

15. Growth in free cashflow includes growth in distributions from listed investments, assuming dividend growth in line with historical distribution rate growth over the plan period, and 5% growth in corporate costs,

and assumes current capitalization. Actual results may vary materially and are subject to market conditions and other factors and risks that are set out in our Notice to Recipients.

16. 2023 and 2022 figures are adjusted for the special distribution of 25% of our asset management business that we completed in December 2022.

153

Endnotes

INVESTOR DAY 2023 – NOTICE TO RECIPIENTS

Brookfield is not making any offer or invitation of any kind by communication of this document to the recipient and under no circumstances is it to be construed as a prospectus or an advertisement.

Except where otherwise indicated herein, the information provided herein is based on matters as they exist as of June 30, 2023 and not as of any future date, is subject to change, and, unless required by law, will

not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing or changes occurring after the date hereof.

Unless otherwise noted, all references to “$” or “Dollars” are to U.S. Dollars.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This presentation contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of the U.S. Securities Act of 1933, the U.S.

Securities Exchange Act of 1934, and “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and in any applicable Canadian securities regulations.

Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, include, but are not limited to, statements which reflect management’s

expectations regarding the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook of

Brookfield Corporation and its affiliates, as well as the outlook for North American and international economies for the current fiscal year and subsequent periods. Often, but not always, forward-looking information

can be identified by the use of forward-looking terminology such as “expects,” “likely,” “anticipates,” “plans,” “believes,” “estimates,” “seeks,” “intends,” “targets,” “projects,” “forecasts,” or negative versions thereof

and other similar expressions, or future or conditional verbs such as “may,” “will,” “should,” “would” and “could.” In particular, the forward-looking statements contained in this presentation include statements

referring to the impact of current market or economic conditions on our businesses, the future state of the economy or securities market, the expected future trading price of our shares or financial results, the

results of future fundraising efforts, the expected growth, size or performance of future or existing strategies, future investment opportunities, or the results of future asset sales. In addition, forward-looking

statements contained in this presentation include statements regarding recently announced acquisitions by our Insurance Solutions business, including the anticipated timing and value of such transaction and the

impact that such transaction may have on Brookfield and its shareholders. The transaction will be subject to the satisfaction of a number of conditions, including regulatory approvals, and, as such, there can be

no certainty that the transactions will close as anticipated within the expected timelines.

Below are certain of the forward-looking statements that are contained in this presentation and a number of assumptions underlying them.

Where this presentation refers to realized carried interest or carried interest, carried interest for existing funds is based on June 30, 2023, carry eligible capital or carried interest for future funds is based

on Brookfield’s estimates of future fundraising as at June 30, 2023, as described below. In addition, this presentation assumes that existing and future funds meet their target gross return. Target gross returns are

typically 20+% for opportunistic funds; 13% to 15% for value-add funds; 12% to 15% for credit and core plus funds. Fee terms vary by investment strategy (carried interest is approximately 15% to 20% subject to

a preferred return and catch-up) and may change over time. This presentation assumes that capital is deployed evenly over a four-year investment period and realized evenly over three years of sales. The year

in which such sales commence varies by investment strategy and ranges from year 6 to year 10.

Where this presentation refers to the growth in fee-bearing capital we assume that flagship funds are raised every two to three years based on historical fund series and non-flagship funds are raised annually

within certain strategies, and in other strategies every two to three years. Unless otherwise stated, we assume that growth in fund series’ sizes remains consistent with historical growth rates. This presentation

also assumes that distributions are based on fund realizations evenly over the last years of fund life. The year in which such sales commence varies by investment strategy.

References to distribution, growth, market valuation, and issuances relating to perpetual affiliates, include the following assumptions: (i) BEP and BIP grow over the plan period in line with historical

distribution rate growth, assuming current yield; (ii) BBU share price grows at a 12% annual rate; and (iii) total listed partnership capitalization includes issuances related to shares, debt and preferred equity for

BIP and BEP.

Notice to Recipients

154

Where this presentation refers to growth in fee-related earnings, growth is in accordance with growth in fee-bearing capital. The management fees for BEP are based on fixed fees on initial capitalization and an

additional fee of 1.25% on the amount in excess of initial capitalization. Management fees for BIP and BBU are 1.25% of total capitalization. Fee terms for private funds vary by investment strategy (generally,

within a range of approximately 1-2%). The incentive distribution rights of the perpetual affiliates are based on growth over the plan period in line with historical distribution rate growth as described above. Other

fees include the BBU performance fee assuming a 10% BBU annual share price growth. We use a combined margin rate in the range of 55% – 65% on fee revenues for planning purposes.

Although we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and

expectations, the reader should not place undue reliance on forward- looking statements and information because they involve known and unknown risks, uncertainties and other factors, many of which are beyond

our control, which may cause our and our subsidiaries’ actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such

forward-looking statements and information.

Some of the factors, many of which are beyond Brookfield’s control and the effects of which can be difficult to predict, but may cause actual results to differ materially from those contemplated or implied by forward-

looking statements include, but are not limited to: (i) investment returns that are lower than target; (ii) the impact or unanticipated impact of general economic, political and market factors in the countries in which

we do business including as a result of COVID-19 and the related global economic shutdown; (iii) the behavior of financial markets, including fluctuations in interest and foreign exchange rates; (iv) global equity

and capital markets and the availability of equity and debt financing and refinancing within these markets; (v) strategic actions including dispositions; the ability to complete and effectively integrate acquisitions into

existing operations and the ability to attain expected benefits; (vi) changes in accounting policies and methods used to report financial condition (including uncertainties associated with critical accounting

assumptions and estimates); (vii) the ability to appropriately manage human capital; (viii) the effect of applying future accounting changes; (ix) business competition; (x) operational and reputational risks;

(xi) technological change; (xii) changes in government regulation and legislation within the countries in which we operate; (xiii) governmental investigations; (xiv) litigation; (xv) changes in tax laws; (xvi) ability to

collect amounts owed; (xvii) catastrophic events, such as earthquakes, hurricanes, or pandemics/epidemics; (xviii) the possible impact of international conflicts and other developments including terrorist acts and

cyberterrorism; (xix) the introduction, withdrawal, success and timing of business initiatives and strategies; (xx) the failure of effective disclosure controls and procedures and internal controls over financial

reporting and other risks; (xxi) health, safety and environmental risks; (xxii) the maintenance of adequate insurance coverage; (xxiii) the existence of information barriers between certain businesses within our

asset management operations; (xxiv) risks specific to our business segments including our real estate, renewable power, infrastructure, private equity, insurance solutions, and credit; and (xxv) factors detailed

from time to time in our documents filed with the securities regulators in Canada and the United States.

We caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on our forward-looking statements, investors and others should carefully consider the foregoing

factors and other uncertainties and potential events. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements or information in this presentation, whether as

a result of new information, future events or otherwise.

Notice to Recipients (cont’d)

155

CAUTIONARY STATEMENT REGARDING PAST AND FUTURE PERFORMANCE AND TARGET RETURNS

Past performance is not indicative nor a guarantee of future results. There can be no assurance that comparable results will be achieved in the future, or that future investments or fundraising efforts will be similar

to the historic results presented herein (because of economic conditions, the availability of investment opportunities or otherwise). Any information regarding prior investment activities and returns contained herein

has not been calculated using generally accepted accounting principles and has not been audited or verified by an auditor or any independent party.

The target returns set forth herein are for illustrative and informational purposes only and have been presented based on various assumptions made by Brookfield, any of which may prove to be incorrect. There

can be no assurance that targeted returns, fundraising efforts, diversification, or asset allocations will be met or that an investment strategy or investment objectives will be achieved. Due to various risks,

uncertainties and changes (including changes in economic, operational, political or other circumstances) beyond Brookfield’s control, the actual performance of the funds and the business could differ materially

from the target returns set forth herein. In addition, industry experts may disagree with the assumptions used in presenting the target returns.

Any changes to assumptions could have a material impact on projections and actual returns. Actual returns on unrealized investments will depend on, among other factors, future operating results, the value of the

assets and market conditions at the time of disposition, legal and contractual restrictions on transfer that may limit liquidity, any related transaction costs and the timing and manner of sale, all of which may differ

from the assumptions and circumstances on which the valuations used in the prior performance data contained herein are based. Accordingly, the actual realized returns on unrealized investments may differ

materially from the returns indicated herein.

No assurance, representation or warranty is made by any person that the target returns will be achieved, and undue reliance should not be put on them. Prior performance is not indicative of future results and

there can be no guarantee that the funds will achieve the target returns or be able to avoid losses.

STATEMENT REGARDING USE OF NON-IFRS MEASURES

This presentation contains references to financial measures that are calculated and presented using methodologies other than in accordance with International Financial Reporting Standards (“IFRS”), as issued by

the International Accounting Standards Board (“IASB”). We utilize these measures in managing the business, including for performance measurement, capital allocation and valuation purposes and believe that

providing these performance measures on a supplemental basis to our IFRS results is helpful to investors in assessing the overall performance of our businesses. These financial measures should not be

considered as the sole measure of our performance and should not be considered in isolation from, or as a substitute for, similar financial measures calculated in accordance with IFRS. We caution readers that

these non-IFRS financial measures or other financial metrics may differ from the calculations disclosed by other businesses and, as a result, may not be comparable to similar measures presented by other issuers

and entities. For a more fulsome discussion regarding our use of non-IFRS measures and their reconciliation to the most directly comparable IFRS measures refer to our documents filed with the securities

regulators in Canada and the United States.

OTHER CAUTIONARY STATEMENTS

This presentation includes estimates regarding market and industry data that is prepared based on management's knowledge and experience in the markets in which we operate, together with information obtained

from various sources, including publicly available information and industry reports and publications. While we believe such information is reliable, we cannot guarantee the accuracy or completeness of this

information and we have not independently verified any third-party information.

The information in this Investor Presentation does not take into account your investment objectives, financial situation or particular needs and nothing contained herein should be construed as legal, business or tax

advice. Each prospective investor should consult its own attorney, business adviser and tax advisor as to legal, business, tax and related matters concerning the information contained herein.

Notice to Recipients (cont’d)

156