FOR IMMEDIATE RELEASE

Cineplex Q2 2022 Reports Positive Net Income and Strongest Results Since Pandemic Began

TORONTO, Canada, August 11, 2022 (TSX: CGX) - Cineplex Inc. (“Cineplex” or the “Company”) today released its financial

results for the three and six months ended June 30, 2022. Unless otherwise specified, all amounts are in Canadian dollars.

“Cineplex delivered its strongest quarter in over two years, thanks to a great film slate and record-breaking results from across

our diversified businesses,” said Ellis Jacob, President & CEO, Cineplex. “The cumulative success of Top Gun: Maverick,

Doctor Strange in the Multiverse of Madness, and Jurassic World Dominion during the quarter – which saw each film opening

with a domestic box office over $100 million – is a testament to the fact that when strong film product is available, Canadians

return to our theatres in droves. We generated positive net income for the first time since the start of the pandemic. We also

achieved a second quarter record BPP of $12.29 and an all-time quarterly record CPP of $8.84. We also saw very encouraging

results in our other businesses, including an all-time quarterly record adjusted EBITDAaL in Player One Amusement Group and

record second quarter adjusted EBITDAaL in the Location-Based Entertainment business.”

Jacob continued, “in addition to reporting our strongest results since the pandemic began, this quarter we are celebrating a few

other important milestones from across the business, including the expansion of the Scene+ loyalty program and Empire

Company Limited joining Scotiabank and Cineplex as partners. Today, we are also celebrating the one-year anniversary of

CineClub.”

“With respect to the Cineworld litigation, we remain focused on preparations for the Ontario Court of Appeal hearings which are

scheduled for October 12 and 13 of this year. As part of the ongoing efforts to maximize and monetize the value of the

judgement, we have engaged Moelis & Company as financial advisor and Goodmans LLP as lead counsel,” said Jacob.

“As we look forward, we remain confident in the recovery of our businesses, our strong capital management and liquidity, and

our efforts to manage financial uncertainties as we have done during previous economic downturns. The strong quarterly results

aided our compliance with the financial covenant testing for the second quarter of 2022. In anticipation of ongoing film release

shifts caused by COVID-19 related production delays, we have received the support and confidence of our lending group for the

suspension of financial covenant testing in the third quarter of 2022. With the backdrop of recessionary concerns, Cineplex is

well positioned to further capitalize on pent-up consumer demand for affordable out-of-home entertainment,” Jacob concluded.

Second Quarter Financial Results

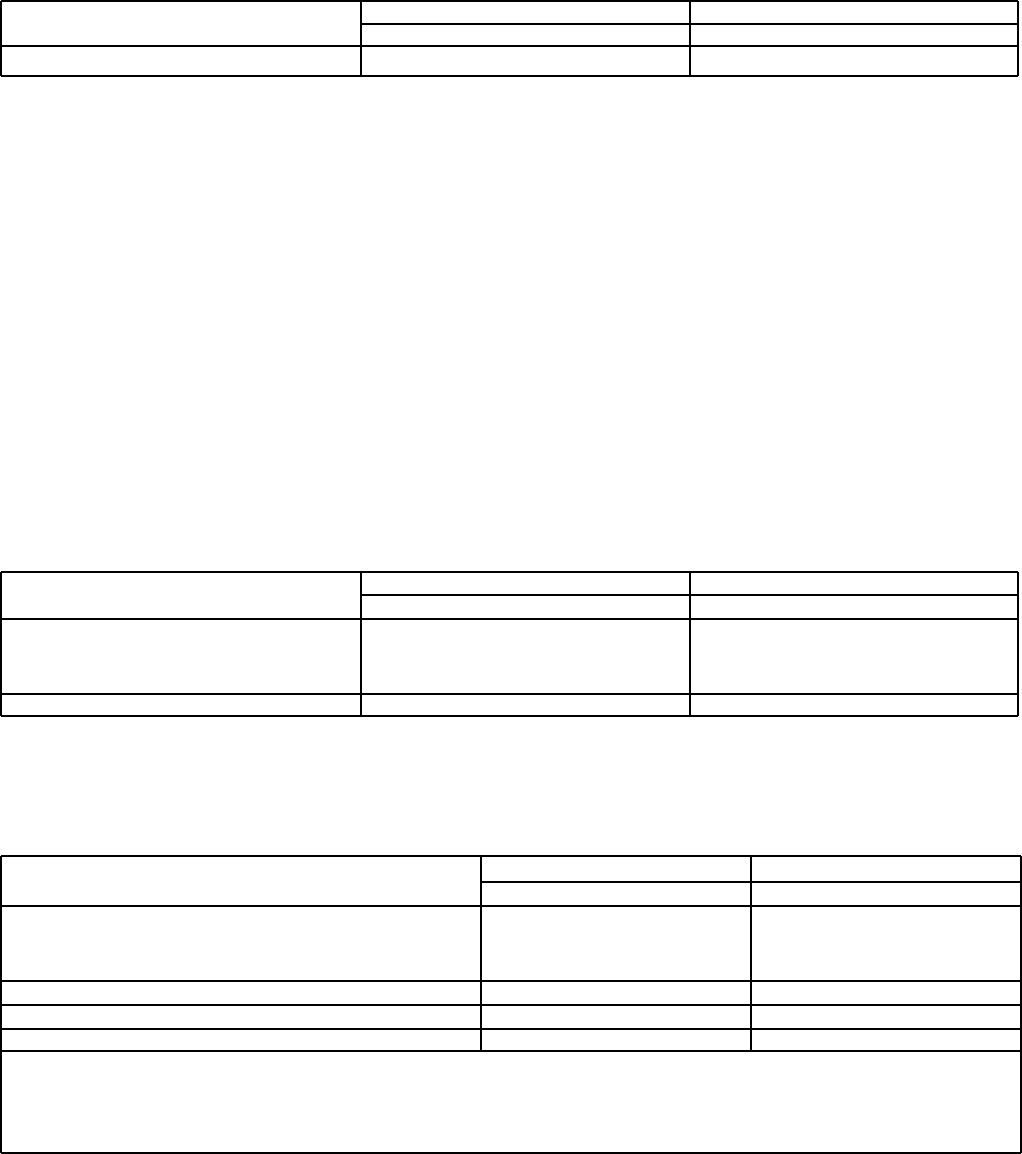

2022 2021 Period over Period Change

(i)

Total revenues $ 349.9 million $ 64.9 million 438.9 %

Theatre attendance 11.1 million 1.1 million 866.2 %

Net income (loss) (ii) $ 1.3 million $ (103.7) million NM

Net income (loss) as a percentage of sales (ii) 0.4 % (159.7) % 160.1 %

Cash provided by (used in) operating activities $ 47.2 million $ 17.1 million 175.2 %

Box office revenues per patron (“BPP”) (iii) $ 12.29 $ 10.89 12.9 %

Concession revenues per patron (“CPP”) (iii) $ 8.84 $ 7.86 12.5 %

Adjusted EBITDA (iii) $ 77.9 million $ (16.9) million NM

Adjusted EBITDAaL (ii) (iii) $ 35.8 million $ (53.2) million NM

Adjusted EBITDAaL margin (ii) (iii) 10.2 % (81.9) % 92.1 %

Adjusted free cash flow (iii) $ 21.8 million $ (65.9) million NM

Adjusted free cash flow per Share (iii) $ 0.345 $ (1.041) NM

Earnings per Share (“EPS”) - basic and diluted (ii) $ 0.02 $ (1.64) NM

Year to Date Financial Results

2022 2021 Period over Period Change

(i)

Total revenues $ 578.6 million $ 106.3 million 444.1 %

Theatre attendance 17.8 million 1.6 million NM

Net loss (ii) $ (40.9) million $ (193.4) million -78.8 %

Net loss as a percentage of sales (ii) (7.1) % (181.9) % 174.8 %

Cash provided by (used in) operating activities $ 41.7 million $ (18.5) million NM

Box office revenues per patron (“BPP”) (iii) $ 12.19 $ 10.44 16.8 %

Concession revenues per patron (“CPP”) (iii) $ 8.83 $ 7.40 19.3 %

Adjusted EBITDA (iii) $ 114.4 million $ (47.0) million NM

Adjusted EBITDAaL (ii) (iii) $ 30.0 million $ (115.3) million NM

Adjusted EBITDAaL margin (ii) (iii) 5.2 % (108.4) % 113.6 %

Adjusted free cash flow (iii) $ 0.1 million $ (144.7) million NM

Adjusted free cash flow per Share (iii) $ 0.002 $ (2.285) NM

Earnings per Share (“EPS”) - basic and diluted (ii) $ (0.65) $ (3.05) -78.7 %

i. Period over period change calculated based on thousands of dollars except percentage and per share values. Changes in percentage amounts are

calculated as 2022 value less 2021 value.

ii. 2022 includes expenses related to the Cineworld Transaction and associated litigation and claims recovery in the amount of $1.2 million (2021 -

$2.6 million) for the second quarter and $1.5 million (2021 - $5.0 million) for the year-to-date.

iii. Adjusted EBITDA, adjusted EBITDAaL, adjusted EBITDAaL margin, adjusted free cash flow per common share of Cineplex, BPP and CPP are

measures that do not have a standardized meaning under generally accepted accounting principles ("GAAP"). These measures as well as other Non-

GAAP other financial measures reported by Cineplex are defined in the 'Non-GAAP and Other Financial Measures' section at the end of this news

release.

Proactive Credit Facility Amendment

On August 10, 2022, Cineplex entered into a fifth amending agreement to the Credit Agreement, (the “Fifth Credit Agreement

Amendment”), which among other things, extended the suspension of financial covenant testing until the fourth quarter of 2022

and liquidity covenant requirement until March 31, 2023. The following is a summary of the key terms of the Fifth Credit

Agreement Amendment:

a. The suspension of financial covenant testing was extended until the fourth quarter of 2022. On resumption of financial

covenant testing in the fourth quarter of 2022:

i. for the fourth quarter of 2022, testing will be based on an annualized calculation of Adjusted EBITDA (as

further adjusted in accordance with the Credit Agreement definitions) based on the actual results for the fourth

quarter multiplied by 4;

ii. for the quarter ending on March 31, 2023, testing will be based on an annualized calculation of Adjusted

EBITDA based on actual results for the fourth quarter of 2022 and the first quarter of 2023 multiplied by 2;

and

iii. for the quarter ending on June 30, 2023, testing will be based on an annualized calculation of Adjusted

EBITDA based on the actual results of the fourth quarter of 2022, the first quarter of 2023 and the second

quarter of 2023 multiplied by 4/3.

b. Thereafter, testing will be based on an annualized calculation of the cumulative Adjusted EBITDA on a trailing four

fiscal quarter basis;

c. The Total Leverage Ratio of 3.75x will apply when financial covenants are reinstated, and will be reduced quarterly by

0.25x until the third quarter of 2023 at which point it will reach a level of 3.00x;

d. The liquidity covenant will continue and be amended requiring available liquidity (as defined) to be maintained at all

times until March 31, 2023 at no less than $100.0 million;

e. The Senior Leverage Ratio to be based on annualized Adjusted EBITDA and set at 1.0x lower than the Total Leverage

Ratio. Senior Leverage Ratio is defined as (i) Total Debt (as defined in the Credit Agreement) less any Notes Payable to

(ii) Adjusted EBITDA; and

f. A fixed charge coverage ratio of greater than 1.25x will continue to apply.

This summary of the Fifth Credit Agreement Amendment is qualified in its entirety by reference to the provisions of the Credit

Agreement which contains a complete statement of those terms and conditions. The Credit Agreement and each of the First,

Second, Third, Fourth and Fifth Credit Agreement Amendment were filed on SEDAR on June 30, 2020, November 13, 2020,

February 8, 2021, January 4, 2022, and August 10, 2022, respectively, for each of Credit Agreement Amendments.

KEY DEVELOPMENTS IN THE SECOND QUARTER OF 2022

The following describes certain key business initiatives undertaken and results achieved during the second quarter of 2022 in

each of Cineplex’s core business areas:

FILM ENTERTAINMENT AND CONTENT

Theatre Exhibition

• Reported second quarter box office revenues of $136.4 million, a $123.9 million increase from 2021 as a result of

increased theatre attendance compared to theatre closures that remained in effect for a majority of the prior year period

due to government mandated restrictions.

• BPP was $12.29, a second quarter record, which increased by $1.40 or 12.9% when compared to the prior year period,

primarily due to an increase in premium offerings in the current period as compared to the prior period which had no 3D

or ScreenX performances, in addition to the VIP auditoriums being closed for the majority of the second quarter of

2021.

• Introduced an online booking fee on June 15, 2022 that applies to tickets purchased through Cineplex’s mobile app and

website that will contribute to Cineplex’s further investment in its digital infrastructure.

Theatre Food Service

• Reported second quarter theatre food service revenues of $98.0 million, an increase of $89.0 million compared to the

prior year period primarily due to a significant increase in theatre attendance.

• CPP was $8.84, an all-time quarterly record, representing an increase of $0.98 or 12.5% when compared to the prior

year period, primarily due to an increase in food service sales at VIP auditoriums which drive a higher CPP and modest

price increases.

Alternative Programming

• During the second quarter, Cineplex hosted the global exclusive free fan event finale of Star Wars Obi-Wan Kenobi

with a live broadcast to an additional nine locations from the Scotiabank Theatre in Toronto. This event also included a

special question and answer session featuring Canadian director Deborah Chow and Canadian actor, Hayden

Christensen.

• Alternative Programming (Cineplex Events) in the second quarter of 2022 included the anime feature Jujutsu Kaisen 0,

Turandot and Hamlet from The Metropolitan Opera, a concert from Twenty One Pilots, the anime feature Seventeen

Power of Love and a two-night event for WWE Wrestlemania 38.

Digital Commerce

• Total registered users for Cineplex Store increased 10% from the prior year period, reaching over 2.2 million registered

users.

MEDIA

• Reported second quarter media revenues of $26.4 million, an increase of $17.0 million or 180.9% as compared to the

prior year period.

Cinema Media

• Reported second quarter cinema media revenues of $18.7 million, an increase of $16.3 million or 675.4% over the prior

year period, due to increases in cinema advertising as a result of reopened theatres and new film releases.

Digital Place-Based Media

• Reported second quarter revenues of $7.7 million, an increase of $0.7 million or 10.3% due to higher project installation

revenues.

AMUSEMENT AND LEISURE

Amusement Solutions

• Reported all-time record revenues in the second quarter of $65.7 million, an increase of $43.5 million or 196.3%

compared to the prior year period primarily due to increases in P1AG amusement revenues from US and Canada route

locations at FEC’s and theatres, and increases in amusement revenues from LBE businesses.

Location-based Entertainment

• Reported all-time record revenues in the second quarter of $28.1 million, including a second quarter record for food

service revenues of $10.2 million, all-time record for amusement revenues of $17.4 million and $0.5 million of media

and other revenues, an increase of $26.0 million compared to the prior year period. The increase was primarily due to

all LBE venues being open without capacity restrictions compared to closures that remained in effect for a majority of

the prior year period.

LOYALTY

• Membership in the Scene+ loyalty program remained flat during the period ended June 30, 2022.

• Announced updates to the Scene+ program, welcoming Empire Company Limited as a co-owner of Scene+, providing

members with increased opportunities to earn and redeem points. Empire will rollout Scene+ across their family of

brands in Atlantic Canada in August 2022, and by early 2023, will be launched across Canada.

CORPORATE

• Celebrated Pride Month with a collection of films available on the Cineplex Store aiming to recognize and amplify

LGBTQ2IA+ voices, with a portion of the proceeds donated to support local Pride celebrations across Canada.

• Partnered with imagineNATIVE, the world’s largest presenter of Indigenous screen content to curate a Cineplex Store

collection to raise awareness of the rich culture, history and experiences of Indigenous people, with a portion of the

proceeds donated to charitable causes.

OPERATING RESULTS FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2022

Total revenues

Total revenues for the three months ended June 30, 2022 increased $285.0 million (438.9%) to $349.9 million as compared to

the prior year period. Total revenues for the six months ended June 30, 2022 increased $472.3 million (444.1%) to $578.6

million as compared to the prior year period. A discussion of the factors affecting the changes in box office, food service, media,

amusement and other revenues for the two periods is provided below.

Non-GAAP and other financial measures discussed throughout this news release, including adjusted EBITDA, adjusted

EBITDAaL, adjusted EBITDAaL margin, adjusted free cash flow, theatre attendance, BPP, premium priced product, same

theatre metrics, CPP, film cost percentage, food service cost percentage and concession margin per patron are defined and

discussed in Non-GAAP and other financial measures section of this news release.

Box office revenues

The following table highlights the movement in box office revenues, theatre attendance and BPP for the quarter and the year to

date (in thousands of dollars, except theatre attendance reported in thousands of patrons and per patron amounts, unless

otherwise noted):

Box office revenues Second Quarter Year to Date

2022 2021 Change 2022 2021 Change

Box office revenues $ 136,372 $ 12,498 991.2 % $ 216,324 $ 16,316 NM

Theatre attendance (i) 11,092 1,148 866.2 % 17,753 1,563 NM

Box office revenue per patron (i) $ 12.29 $ 10.89 12.9 % $ 12.19 $ 10.44 16.8 %

BPP excluding premium priced product (i) $ 10.51 $ 10.09 4.2 % $ 10.50 $ 9.73 7.9 %

Same theatre box office revenues (i) $ 134,709 $ 12,484 979.1 % $ 213,587 $ 16,296 NM

Same theatre attendance (i) 11,013 1,146 861.0 % 17,622 1,560 NM

% Total box from premium priced product (i) 42.4 % 22.8 % 19.6 % 40.2 % 20.2 % 20.0 %

(i) Represents a supplementary financial measure. See Non-GAAP and other financial measures section of this news release.

Box office continuity Second Quarter Year to Date

Box Office

Theatre

Attendance Box Office

Theatre

Attendance

2021 as reported $ 12,498 1,148 $ 16,316 1,563

Same theatre attendance change 107,460 9,868 167,732 16,062

Impact of same theatre BPP change 12,294

—

25,680 —

New and acquired theatres (i) 1,663 78 2,722 129

Disposed and closed theatres (i) (14) (2) (4) (1)

Scene+ points issued presented as marketing costs 2,471 — 3,878 —

2022 as reported $ 136,372 11,092 $ 216,324 17,753

(i) See Non-GAAP and other financial measures section of this news release. Represents theatres opened, acquired, disposed or closed subsequent to the start

of the prior year comparative period and is used to report on Cineplex’s supplementary financial measures.

Second Quarter 2022 Top Cineplex Films 3D % Box Second Quarter 2021 Top Cineplex Films 3D % Box

1 Top Gun: Maverick 21.1 % 1 F9: The Fast Saga 17.3 %

2 Doctor Strange In The Multiverse of Madness

a

20.0 % 2 A Quiet Place Part II 16.0 %

3 Jurassic World Dominion

a

10.4 % 3 The Conjuring: The Devil Made Me Do It 10.2 %

4 Sonic The Hedgehog 2 6.9 % 4 Godzilla Vs. Kong 8.2 %

5 Fantastic Beasts: The Secrets of Dumbledore 5.1 % 5 Cruella 7.9 %

Year to Date 2022 Top Cineplex Films 3D % Box Year to Date 2021 Top Cineplex Films 3D % Box

1 Top Gun: Maverick 13.3 % 1 F9: The Fast Saga 16.2 %

2 Doctor Strange In The Multiverse of Madness

a

12.6 % 2 A Quiet Place Part II 15.0 %

3 The Batman 11.5 % 3 The Conjuring: The Devil Made Me Do It 9.6 %

4 Spider-Man: No Way Home

a

7.7 % 4 Godzilla Vs. Kong 7.7 %

5 Jurassic World Dominion

a

6.6 % 5 Cruella 7.4 %

Second Quarter and Year to Date

Box office revenues increased $123.9 million to $136.4 million during the second quarter of 2022, compared to $12.5 million

recorded in the same period in 2021. This increase was mainly due to a 9.9 million increase in theatre attendance, as Cineplex’s

theatre circuit was open during the quarter at full operating capacity, compared to operating restrictions or closure requirements

that remained in effect for a majority of the prior year period. The release of highly anticipated films also contributed to the

significant increase in box office revenues including Doctor Strange in the Multiverse of Madness and Top Gun: Maverick which

reported a North American gross of $126.7 million during its opening weekend and has become the ninth biggest all-time

grossing film in North America.

BPP for the three months ended June 30, 2022 was $12.29, a second quarter record, representing an increase of $1.40 or 12.9%

from $10.89 reported in the prior year period. This increase was due to increased revenue from premium priced offerings,

accounting for 42.4% of Cineplex’s box office revenues in the second quarter of 2022, as compared to 22.8% in the prior year

period. In the prior year period, there were no 3D or ScreenX performances, and VIP auditoriums were closed for the majority

of the second quarter of 2021. The reorganization of SCENE resulted in a change in revenue recognition leading to higher box

office revenues during the quarter of $2.6 million, a BPP increase of $0.24 with a corresponding increase in marketing costs of

$2.6 million, with respect to Scene+ points issued on box office transactions.

For the year to date period, box office revenues increased $200.0 million to $216.3 million, compared to $16.3 million recorded

in the prior year period. This increase was primarily due to a 16.2 million increase in theatre attendance as Cineplex’s theatre

circuit was open for the entire period with increased operating capacity, compared to operating restrictions or closure

requirements that remained in effect for a majority of the prior year period.

BPP during the year to date period was $12.19, which increased $1.75 or 16.8% from $10.44 reported in the prior year period.

This increase was due to higher percentage of box office revenue from premium priced offering, which accounted for 40.2% of

Cineplex’s box office revenues in the six months ended June 30, 2022, as compared to 20.2% in the prior year period. The

reorganization of SCENE resulted in a change in revenue recognition leading to higher box office revenues during the year to

date period of $4.1 million, a BPP increase of $0.23 with a corresponding increase in marketing costs of $4.1 million, with

respect to Scene+ points issued on box office transactions.

Food service revenues

The following table highlights the movement in food service revenues, theatre attendance and CPP for the quarter and the year to

date (in thousands of dollars, except theatre attendance and same store attendance reported in thousands of patrons and per

patron amounts):

Food service revenues Second Quarter Year to Date

2022 2021 Change 2022 2021 Change

Food service - theatres $ 98,046 $ 9,022 986.7 % $ 156,805 $ 11,561 NM

Food delivery - theatres 2,390 3,676 -35.0 % 5,639 7,454 -24.4 %

Food service - LBE 10,178 516 NM 16,537 687 NM

Food delivery - LBE 23 44 -48.1 % 44 81 -45.9 %

Total food service revenues $ 110,637 $ 13,258 734.5 % $ 179,025 $ 19,783 804.9 %

Theatre attendance (i) 11,092 1,148 866.2 % 17,753 1,563 NM

CPP (i) (ii) $ 8.84 $ 7.86 12.5 % $ 8.83 $ 7.40 19.3 %

Same theatre food service revenues (i) $ 96,446 $ 9,006 970.9 % $ 154,113 $ 11,537 NM

Same theatre attendance (i) 11,013 1,146 861.0 % 17,622 1,560 NM

(i) Represents a supplementary financial measure. See Non-GAAP and other financial measures section of this news release.

(ii) Food service revenue from LBE and delivery is not included in the CPP calculation.

Theatre food service revenue continuity Second Quarter Year to Date

Theatre Food

Service

Theatre

Attendance

Theatre Food

Service

Theatre

Attendance

2021 as reported $ 9,022 1,148 $ 11,561 1,563

Same theatre attendance change 77,523 9,868 118,748 16,062

Impact of same theatre CPP change 7,642 — 20,113 —

New and acquired theatres (i) 1,601 78 2,692 129

Disposed and closed theatres (i) (16) (2) (24) (1)

Scene+ points issued presented as marketing costs 2,274 — 3,715 —

2022 as reported $ 98,046 11,092 $ 156,805 17,753

(i) See Non-GAAP and other financial measures section of this news release. Represents theatres opened, acquired, disposed or closed subsequent to the start

of the prior year comparative period and is used to report on Cineplex’s supplementary financial measures.

Second Quarter and Year to Date

Food service revenues are comprised primarily of concession revenues, which includes food service sales at theatre locations and

through delivery services including Uber Eats and Skip the Dishes. Food service revenues also include food and beverage sales

at The Rec Room and Playdium.

Food service revenues increased by $97.4 million during the second quarter primarily due to the $89.0 million increase in theatre

food service revenues to $98.0 million in the quarter. During the current period, Cineplex’s theatre circuit and LBE businesses

operated without government mandated capacity restrictions and proof of vaccination programs compared to ongoing capacity

restrictions or mandated closure requirements enforced during the prior year period. Food service revenues from LBE

businesses which had two additional locations as compared to the prior year period, increased by $9.7 million during the second

quarter from $0.5 million to $10.2 million, further contributing to the increase in food service revenue. However, as a result of

staffing availability, certain LBE venues were unable to operate at full operating levels, restricting the ability to book group

events, reduced operating hours, and not operating the dining areas at full capacity. CPP for three months ended June 30, 2022

was an all-time quarterly record of $8.84, which increased by $0.98 or 12.5%. Modest prices increases to Cineplex’s core food

service products, two additional VIP theatre locations and film product that appealed to first-run viewers who tend to have a

higher concession spend contributed to the increase in CPP, as compared to the prior year period. VIP auditoriums which drive

higher CPP were closed for the majority of second quarter of 2021. The reorganization of SCENE resulted in a change in

revenue recognition leading to higher concession revenues during the quarter of $2.5 million, a CPP increase of $0.22 with a

corresponding increase in marketing costs of $2.5 million, with respect to Scene+ points issued on concession transactions.

For the year to date period, food service revenues increased by $159.2 million, primarily due to a $145.2 million increase in

theatre food service revenues. The increase in theatre food service revenues is primarily due to increases in theatre attendance

which increased by 16.2 million to 17.8 million. The prior year period was materially impacted by government mandated theatre

and LBE venues closures, restrictions indoor dining and operating restrictions. Contributing to the increase in total food service,

food service revenues from LBE businesses increased $15.9 million during the year to date period from $0.7 million to $16.5

million. CPP during the year to date period was $8.83, which increased by $1.43 or 19.3%. During the prior year period,

government mandated closure requirements and restrictions limited consumer spend resulting in minimal premium purchases

which historically generate higher CPP, contributing to a lower CPP recognized. The reorganization of SCENE resulted in a

change in revenue recognition leading to higher concession revenues during the year to date period of $4.0 million, a BPP

increase of $0.22 with a corresponding increase in marketing costs of $4.0 million, with respect to Scene+ points issued on

concession transactions.

Media revenues

The following table highlights the movement in media revenues for the quarter and the year to date (in thousands of dollars):

Media revenues Second Quarter Year to Date

2022

2021

Change 2022

2021

Change

Cinema media $ 18,700 $ 2,412 675.3 % $ 26,949 $ 4,311 525.1 %

Digital place-based media 7,706 6,989 10.3 % 15,002 14,164 5.9 %

Total media revenues $ 26,406 $ 9,401 180.9 % $ 41,951 $ 18,475 127.1 %

Second Quarter and Year to Date

Total media revenues increased $17.0 million or 180.9% to $26.4 million during the second quarter of 2022 compared to the

prior year period. For the year to date period, total media revenues increased $23.5 million or 127.1% to $42.0 million. The

increase during both periods was due to an increase in Cinema media due to significant increases in pre-show and show-time

advertising revenues, resulting in a quarterly and year to date increase of.$16.3 million and $22.6 million, respectively. During

the prior year periods, theatre closures or operating restrictions remained in effect for a majority of the prior year period

negatively impacting media revenues. Cineplex’s cinema media arrangements are impacted by theatre attendance levels which

drive impressions and ultimately impact media revenue generated by Cineplex. Accordingly, the increase in cinema media

revenue reflects the increase in attendance levels when compared to the prior period. During the second quarter and year to date

periods, digital placed-based media revenues increased $0.7 million and $0.8 million, respectively, compared to the prior year

periods as a result of higher project installation revenues.

Amusement revenues

The following table highlights the movement in amusement revenues for the quarter and the year to date (in thousands of

dollars):

Amusement revenues Second Quarter Year to Date

2022 2021 Change 2022 2021 Change

Amusement - P1AG excluding Cineplex exhibition and LBE (i) $ 45,097 $ 20,446 120.6 % $ 79,936 $ 33,005 142.2 %

Amusement - Cineplex exhibition (i) 3,248 199 NM 5,339 271 NM

Amusement - LBE 17,378 1,539 NM 30,872 2,782 NM

Total amusement revenues $ 65,723 $ 22,184 196.3 % $ 116,147 $ 36,058 222.1 %

(i) Cineplex receives a venue revenue share on games revenues earned at in-theatre game rooms and XSCAPE Entertainment Centres. Amusement -

Cineplex exhibition reports the total of this venue revenue share which is consistent with the historical presentation of Cineplex’s amusement revenues.

Amusement - P1AG excluding Cineplex exhibition and LBE reflects P1AG’s gross amusement revenues, net of the venue revenue share paid to Cineplex

reflected in Amusement - Cineplex exhibition above.

Second Quarter and Year to Date

Amusement revenues increased $43.5 million or 196.3% to an all-time quarterly record of $65.7 million during the second

quarter as compared to the prior year period. The increase was primarily due to a $24.7 million increase in P1AG amusement

revenues from US and Canada route locations at FEC’s and theatres. The increase was also attributable to a $15.8 million

increase in LBE amusement revenues, resulting in an all-time quarterly record of $17.4 million for LBE amusement revenues.

During the period, increased operating activities at P1AG US and Canada route locations at FEC’s and theatres, as well as LBE

businesses, compared to the government mandated closure requirements or capacity restrictions that remained in effect for a

majority of the prior year period, contributed to significant increases in amusement revenues.

For the year to date period, amusement revenues increased $80.1 million or 222.1% to $116.1 million. The increase was

primarily due to a $46.9 million increase in P1AG amusement revenues from US and Canada route locations at FEC’s and

theatres. Further contributing to the increase was a $28.1 million increase in LBE amusement revenues. The current period also

includes two additional locations of The Rec Room, resulting in increased LBE amusement revenues as compared to the prior

year period. The increase is also attributable to increased operating activities as operating restrictions and mandatory closure

requirements were lifted, compared to the government mandated closure requirements or capacity restrictions that remained in

effect for a majority of the prior year period.

Other revenues

The following table highlights the other revenues which includes revenues from the Cineplex Store, online booking fees,

promotional activities, screenings, private parties, corporate events, breakage on gift card sales and revenues from management

fees for the quarter and the year to date (in thousands of dollars):

Other revenues Second Quarter Year to Date

2022

2021

Change 2022

2021

Change

Total other revenues $ 10,740 $ 7,585 41.6 % $ 25,154 $ 15,706 60.2 %

Second Quarter and Year to Date

The increase in other revenues during the second quarter of 2022 and year to date period is primarily due to breakage revenues

relating to higher gift card redemptions and an online booking fee that applies to tickets purchased through Cineplex’s mobile

app and website which was implemented on June 15, 2022.

Film cost

The following table highlights the movement in film cost and the film cost percentage for the quarter and the year to date (in

thousands of dollars, except film cost percentage):

Film cost Second Quarter Year to Date

2022 2021 Change 2022 2021 Change

Film cost $ 69,958 $ 5,611 NM $ 108,974 $ 6,846 NM

Film cost percentage (i) 51.3 % 44.9 % 6.4 % 50.4 % 42.0 % 8.4 %

(i) Represents a supplementary financial measure. See Non-GAAP and other financial measures section of this news release.

Second Quarter and Year to Date

Film cost varies primarily with box office revenues and can vary from quarter to quarter usually based on the relative strength of

the titles exhibited during the period, impacted by film cost terms which vary by title and distributor.

The increase in film cost and film cost percentage in the second quarter of 2022 and year to date over the prior year periods is

due to the release of first run film product including Doctor Strange in the Multiverse of Madness and Top Gun: Maverick. Film

cost percentage increased 6.4% and 8.4% for the second quarter and year to date as compared to the prior year periods due to the

top films in second quarter of 2022 having higher settlement rates and making up a larger percentage of box office revenues.

Cost of food service

The following table highlights the movement in cost of food service and food service cost as a percentage of food service

revenues (“concession cost percentage”) for both theatres and LBE for the quarter and the year to date (in thousands of dollars,

except percentages and margins per patron):

Cost of food service Second Quarter Year to Date

2022 2021 Change 2022 2021 Change

Cost of food service - theatre $ 22,447 $ 2,686 735.8 % $ 35,483 $ 4,019 783.0 %

Cost of food service - LBE 2,888 181 NM 4,709 260 NM

Total cost of food service $ 25,335 $ 2,867 783.7 % $ 40,192 $ 4,279 839.3 %

Theatre concession cost percentage (i) 22.3 % 21.2 % 1.1 % 21.8 % 21.1 % 0.7 %

LBE food cost percentage (i) 28.3 % 32.3 % -4.0 % 28.4 % 33.9 % -5.5 %

Theatre concession margin per patron (i) $ 6.86 $ 6.20 10.6 % $ 6.90 $ 5.83 18.4 %

(i) Represents a supplementary financial measure. See Non-GAAP and other financial measures section of this news release.

Second Quarter and Year to Date

Cost of food service at the theatres varies primarily with theatre attendance, the cost of food and materials purchases as well as

the quantity and mix of offerings sold. Cost of food service at LBE venues varies primarily with the volume of guests who visit

the location as well as the quantity and mix between food and beverage items sold.

The increase in cost of food service during the second quarter of 2022 and year to date period is positively correlated to the

increase in food service revenues recognized during the quarter and year to date period as Cineplex’s theatre circuit and LBE

businesses were open and operating for the entire period, compared to closures or capacity restrictions that remained in effect for

a majority of the prior year period. Theatre concession cost percentage for the second quarter and year to date period remained

flat when compared to the prior year period. LBE food cost percentage decreased for both the second quarter and year to date

period when compared to the prior year period which focused primarily on food delivery service with lower margins.

Depreciation and amortization

The following table highlights the movement in depreciation and amortization expenses during the quarter and the year to date

(in thousands of dollars):

Depreciation and amortization expenses Second Quarter Year to Date

2022

2021

Change 2022 2021 Change

Depreciation of property, equipment and leaseholds $ 23,865 $ 25,197 -5.3 % $ 48,132 $ 51,980 -7.4 %

Amortization of intangible assets and other assets 2,786 2,538 9.8 % 5,411 5,264 2.8 %

Sub-total - depreciation and amortization - other

assets $ 26,651 $ 27,735 -3.9 % $ 53,543 $ 57,244 -6.5 %

Depreciation - right-of-use assets 24,486 25,737 -4.9 % 48,749 52,055 -6.4 %

Total depreciation and amortization $ 51,137 $ 53,472 -4.4 % $ 102,292 $ 109,299 -6.4 %

Second Quarter and Year to Date

Depreciation of property, equipment and leaseholds decreased by $1.3 million, or 5.3% during the quarter compared to the prior

year period, and by $3.8 million or 7.4% for the year to date period compared to the prior year period. The decrease was

primarily due to fully depreciated property, equipment and leaseholds.

The quarterly and year to date increase in amortization of intangible assets and other as compared to the prior year period is due

to software developments and additions.

Depreciation of right-of-use decreased by $1.3 million and $3.3 million during the quarter and year to date period, respectively.

The decrease is primarily due to modifications to lease agreements as a result of COVID-19 which reduced the corresponding

right-of-use asset and related depreciation recognized.

(Gain) loss on disposal of assets

The following table shows the movement in the loss on disposal of assets during the quarter and the year to date (in thousands of

dollars):

(Gain) loss on disposal of assets Second Quarter Year to Date

2022 2021 Change 2022 2021 Change

(Gain) loss on disposal of assets $ (4,650) $ 179 NM $ (4,493) $ (29,881) -85.0 %

Second Quarter and Year to Date

The change in the (gain) loss on disposal of assets for the second quarter as compared to the prior year period was due to the sale

of certain restrictive lease rights for total proceeds of $5.4 million completed during the second quarter, compared to nominal

activity in the prior year period.

The change in the (gain) loss on disposal of assets for the year to date period as compared to the prior year period was due to the

sale of Cineplex’s head office buildings for gross proceeds of $57.0 million completed during the first quarter of 2021.

Other costs

Other costs include three main sub-categories of expenses; theatre occupancy expenses, which capture associated occupancy

costs for Cineplex’s theatre operations; other operating expenses, which include the costs related to running Cineplex’s film

entertainment and content, media, as well as amusement and leisure; and general and administrative expenses, which includes

costs related to managing Cineplex’s operations, including head office expenses. Please see the discussions below for more

details on these categories.

The following table highlights the movement in other costs for the quarter and the year to date (in thousands of dollars):

Other costs Second Quarter Year to Date

2022 2021 Change 2022 2021 Change

Theatre occupancy expenses $ 17,398 $ 5,349 225.3 % $ 29,160 $ 12,131 140.4 %

Other operating expenses 144,021 53,790 167.7 % 254,527 101,596 150.5 %

General and administrative expenses 15,322 14,213 7.8 % 31,406 28,330 10.9 %

Total other costs $ 176,741 $ 73,352 140.9 % $ 315,093 $ 142,057 121.8 %

Theatre occupancy expenses

The following table highlights the movement in theatre occupancy expenses for the quarter and the year to date (in thousands of

dollars):

Theatre occupancy expenses Second Quarter Year to Date

2022 2021 Change 2022 2021 Change

Cash rent paid/payable (i) $ 36,931 $ 25,530 44.7 % $ 72,763 $ 47,752 52.4 %

Other occupancy 18,259 12,204 49.6 % 33,159 26,511 25.1 %

One-time items (ii) (678) (2,237) -69.7 % (1,283) (3,219) -60.1 %

Total theatre occupancy including cash lease payments $ 54,512 $ 35,497 53.6 % $ 104,639 $ 71,044 47.3 %

Cash rent paid/payable related to lease obligations (iii) (37,114) (30,148) 23.1 % (75,479) (58,913) 28.1 %

Theatre occupancy as reported $ 17,398 $ 5,349 225.3 % $ 29,160 $ 12,131 140.4 %

(i) Represents the cash payments for theatre rent paid or payable during the quarter.

(ii) One-time items include amounts related to both theatre rent and other theatre occupancy costs including real estate taxes, business taxes and common

area maintenance. They are isolated here to illustrate Cineplex’s theatre rent and other theatre occupancy costs excluding these one-time, non-recurring

items.

(iii) Cash rent paid/payable that has been reallocated to offset the lease obligations.

Theatre occupancy continuity Second Quarter Year to Date

Occupancy Occupancy

2021 as reported $ 5,349 $ 12,131

Impact of new and acquired theatres 353 673

Impact of disposed theatres 133 570

Same store rent change (i) 6,878 16,317

One-time items 1,558 1,936

Decrease in subsidies 9,313 13,647

Other 781 452

Impact of IFRS 16:

Cash rent related to lease obligations (6,967) (16,566)

2022 as reported $ 17,398 $ 29,160

(i) Represents a supplementary financial measure. See Non-GAAP and other financial measures section of this news release.

Second Quarter and Year to Date

Theatre occupancy expenses increased $12.0 million or 225.3% during the second quarter of 2022 compared to the prior year

period. This increase was primarily due to the reduction in subsidies received as a result of the reopening of Cineplex’s

businesses. The increase was also attributable to higher theatre rent related expenses including common area maintenance and

taxes incurred as Cineplex’s theatres were open during the period. During the prior year period, Cineplex recognized lower

theatre occupancy expenses as a majority of theatres were closed or operating at far below normal capacity levels. Same-store

rent increased $6.9 million primarily due to rent relief measures negotiated with landlord partners which were $6.7 million

higher in the prior year period. Cineplex was able to reduce theatre occupancy expenses through the recognition of realty tax and

rent subsidies of $0.4 million (2021 - $9.9 million).

For the year to date period, theatre occupancy expenses increased $17.0 million or 140.4% compared to the prior year. This

increase was primarily due to increased theatre rent related expenses, including common area maintenance and taxes, as

Cineplex’s theatres were permitted to operate in the current period at a greater capacity compared to the prior year period.

During the prior year period, Cineplex recognized lower theatre occupancy expenses as a majority of theatres were closed or

operating at far below normal capacity levels. Same-store rent increased $16.3 million primarily due to rent relief measures

negotiated with landlord partners, which were $17.4 million higher in the prior year period. Similarly, due to the reopening of

Cineplex’s businesses, Cineplex received a lower amount of subsidy relief when compared to the prior year period and

recognized realty tax and rent subsidies of $6.9 million (2021 - $20.8 million).

Other operating expenses

The following table highlights the movement in other operating expenses during the quarter and the year to date (in thousands of

dollars):

Other operating expenses Second Quarter Year to Date

2022

2021

Change 2022

2021

Change

Theatre payroll $ 37,175 $ 5,473 579.2 % $ 53,472 $ 9,108 487.1 %

Theatre operating expenses 26,184 8,078 224.2 % 48,539 17,431 178.5 %

Media 12,017 7,959 51.0 % 22,196 16,243 36.7 %

P1AG 36,979 19,687 87.8 % 66,833 35,257 89.6 %

LBE (i) 16,885 3,939 328.7 % 28,007 7,757 261.1 %

LBE pre-opening (ii) — 678 NM — 906 NM

SCENE 4,663 5,654 -17.5 % 18,504 10,398 78.0 %

Marketing 2,458 1,123 118.9 % 3,820 2,240 70.5 %

Scene+ point issuance 5,126 — 100.0 % 8,121 — 100.0 %

Other (iii) 6,621 5,630 17.6 % 13,549 11,150 21.5 %

Other operating expenses including cash lease payments $ 148,105 $ 58,221 154.4 % $ 263,043 $ 110,490 138.1 %

Cash rent paid/payable related to lease obligations (iv) (4,084) (4,431) -7.8 % (8,516) (8,894) -4.3 %

Total other operating expenses $ 144,021 $ 53,790 167.7 % $ 254,527 $ 101,596 150.5 %

(i) Includes operating costs of LBE locations. Overhead relating to management of LBE portfolio are included in the ‘Other’ line.

(ii) Includes pre-opening costs of LBE.

(iii) Other category includes overhead costs related to LBE and other Cineplex internal departments.

(iv) Cash rent paid/payable that has been reallocated to offset the lease obligations.

Other operating expenses continuity Second Quarter Year to Date

2021 as reported $ 53,790 $ 101,596

Impact of new and acquired theatres 1,043 1,601

Impact of disposed theatres (116) (161)

Same theatre payroll change (i) 30,979 43,344

Same theatre operating expenses change (i) 17,974 30,805

Media operating expenses change 4,058 5,954

P1AG operating expenses change 17,292 31,576

LBE operating expenses change 12,946 20,250

LBE pre-opening change (678) (906)

SCENE change (991) 8,106

Marketing change 1,335 1,580

Scene+ point issuance change 5,126 8,121

Other 916 2,283

Impact of IFRS 16:

Cash rent related to lease obligations 347 $ 378

2022 as reported $ 144,021 $ 254,527

(i) See Non-GAAP and other financial measures section of this news release. These are measures included as part of Cineplex’s supplementary financial

measure calculations.

Second Quarter and Year to Date

Other operating expenses increased $90.2 million or 167.7% during the second quarter of 2022 compared to the prior year

period. The increase was primarily driven by increases in same store theatre payroll and theatre operating expenses of $31.0

million and $18.0 million, respectively, as Cineplex’s theatres were permitted to operate for the entire period as compared to

extended closures in effect during the prior year period. Cineplex also recognized P1AG other operating expenses of $37.0

million, an increase of $17.3 million when compared to the prior year period. During the second quarter of 2022, government

mandated closure requirements and capacity restrictions were lifted, resulting in increased operating activities at P1AG US and

Canadian route locations at FEC’s and theatres. The lifting of government-imposed restrictions also resulted in increased

operations at LBE businesses leading to a $12.9 million increase in LBE other operating expenses when compared to the prior

year period. Cineplex also recognized a $1.0 million decrease in SCENE operating costs, and a $5.1 million increase in

marketing expenses relating to the presentation of the cost of issuance of Scene+ points. Despite the lifting of government

mandated restrictions in the current period, Cineplex received $1.2 million (2021 - $15.8 million) of subsidies, which offset

theatre payroll, non-theatre rent, realty tax and utilities.

For the year to date, the overall increase in other operating expenses from the prior year resulted from the reopening of

Cineplex’s theatres, LBE businesses and P1AG US and Canada route locations at FEC’s and theatres as compared to the closure

requirements and capacity restrictions that remained in effect for a majority of the prior year period. The increase was primarily

driven by increases in same theatre payroll and theatre operating expenses of $44.4 million and $31.1 million, respectively, as

Cineplex’s theatres operated for the entire period as compared to government mandated restrictions and closures in the prior

year. Similarly, due to increased operating activities at P1AG US and Canadian route locations at FEC’s and theatres, Cineplex

also recognized P1AG other operating expenses of $66.8 million, an increase of $31.6 million when compared to the prior year.

LBE businesses were permitted to operate at increased capacity due to the lifting of government mandated restrictions, resulting

in a $20.3 million increase in LBE other operating expenses when compared to the prior year. Cineplex also recognized a $8.1

million increase in SCENE operating costs, and a $8.1 million increase in marketing expenses relating to the presentation of the

cost of issuance of Scene+ points. Cineplex received $21.9 million (2021 - $30.2 million) of subsidies in the current period,

comprised of $19.5 million (2021 - $24.7 million) of payroll subsidies of which $14.6 million (2021 - $13.1 million) was offset

against theatre payroll, and $2.4 million (2021 - $5.5 million) of non-theatre rent, realty tax and utility subsidies.

General and administrative expenses

The following table highlights the movement in general and administrative (“G&A”) expenses during the quarter and the year to

date, including share-based compensation costs, and G&A net of these costs (in thousands of dollars):

G&A expenses Second Quarter Year to Date

2022

2021

Change 2022

2021

Change

G&A excluding the following items $ 13,916 $ 9,924 40.2 % $ 26,604 $ 20,082 32.5 %

Restructuring 12 16 -25.0 % 1,453 476 205.3 %

Transaction / Litigation costs 1,235 2,591 -52.3 % 1,489 5,021 -70.3 %

LTIP (i) 352 1,795 -80.4 % 2,093 3,099 -32.5 %

Option plan 399 445 -10.3 % 916 844 8.5 %

G&A expenses including cash lease payments $ 15,914 $ 14,771 7.7 % $ 32,555 $ 29,522 10.3 %

Cash rent paid/payable included as part of lease obligations (ii) (592) (558) 6.1 % (1,149) (1,192) -3.6 %

G&A expenses as reported

$ 15,322 $ 14,213 7.8 % $ 31,406 $ 28,330 10.9 %

(i) LTIP includes the expenses for RSUs and PSUs, as well as the expense for the executive and Board deferred share unit plans.

(ii) Cash rent paid/payable that has been reallocated to offset the lease obligations.

Second Quarter and Year to Date

G&A expenses increased $1.1 million during the second quarter of 2022 compared to the prior year period. Cineplex recognized

$2.8 million of labour subsidies in the second quarter of 2021, and none in the second quarter of 2022, contributing to a net

increase of $3.4 million in head office payroll expenses. Cineplex incurred $1.2 million (2021 - $2.6 million) of expenses related

to litigation and claims recovery arising from the Cineworld Transaction during the quarter.

G&A expenses for the year to date period increased $3.1 million compared to the prior year period. The change was primarily

due to $7.5 million higher head office payroll expenses due to $3.7 million lower labour subsidies received. Cineplex received

$2.0 million of labour subsidies in 2022, compared to $5.7 million received in 2021. Cineplex incurred year to date costs relating

to litigation and claims recovery arising from the Cineworld Transaction of $1.5 million (2021 - $5.0 million).

NET INCOME (LOSS), EBITDA AND ADJUSTED EBITDAaL (see Non-GAAP and other financial measures section of

this news release)

The following table presents net loss, EBITDA, adjusted EBITDA and adjusted EBITDAaL for the three and six months ended

June 30, 2022 as compared to the prior year period (expressed in thousands of dollars, except adjusted EBITDAaL margin):

NET LOSS, EBITDA AND ADJUSTED

EBITDAaL

Second Quarter Year to Date

2022 2021 Change 2022 2021 Change

Net income (loss) $ 1,313 $ (103,704) NM $ (40,912) $ (193,392) -78.8 %

Net income (loss) as a percentage of sales 0.4 % (159.7) % 160.1 % (7.1) % (181.9) % 174.8 %

EBITDA $ 80,963 $ (17,700) NM $ 113,926 $ (20,224) NM

Adjusted EBITDA $ 77,939 $ (16,902) NM $ 114,414 $ (47,007) NM

Adjusted EBITDAaL $ 35,764 $ (53,165) NM $ 30,045 $ (115,255) NM

Adjusted EBITDAaL margin 10.2 % (81.9) % 92.1 % 5.2 % (108.4) % 113.6 %

Second Quarter and Year to Date

Net income and adjusted EBITDAaL for the second quarter of 2022 was $1.3 million and $35.8 million, respectively, as

compared to a net loss of $103.7 million and an adjusted EBITDAaL loss of $53.2 million, respectively, in the prior year period.

The removal of operating restrictions on Cineplex’s theatres and LBE venues across Canada, resulted in significantly improved

performance when compared to the prior year period.

Net loss and adjusted EBITDAaL for the six months ended June 30, 2022 was $40.9 million and $30.0 million, respectively, as

compared to a net loss of $193.4 million and an adjusted EBITDAaL loss of $115.3 million, respectively, in the prior year

period. The movement in both net loss and adjusted EBITDAaL was due to the removal of operating restrictions on Cineplex

theatres and LBE venues across Canada, compared to operating restrictions that remained in effect for a majority of the prior

year period.

ADJUSTED FREE CASH FLOW (see Non-GAAP and other financial measures section of this news release)

For the second quarter of 2022, adjusted free cash flow per common share of Cineplex was $0.35 as compared to $(1.04) in the

prior year period. Adjusted free cash flow per Share for the second quarter of 2022 and year to date period increased mainly due

to significantly improved operating results with the easing of COVID-19 restrictions on Cineplex’s theatres and LBE businesses.

During the current period, Cineplex’s businesses were permitted to operate at increased capacity levels as remaining government

restrictions were lifted, compared to extended closure periods that remained in effect for a majority of the prior year resulting in

significantly reduced operations.

NON-GAAP AND OTHER FINANCIAL MEASURES

National Instrument 52-112, Non-GAAP and Other Financial Measures Disclosure (“NI 52-112”) imposes obligations regarding

disclosure of non-GAAP financial measures, non-GAAP ratios, and other financial measures. Cineplex reports on certain non-

GAAP measures, non-GAAP ratios, supplementary financial measures and total segment measures that are used by management

to evaluate Cineplex’s performance. The following measures included in this news release do not have a standardized meaning

under GAAP and may not be comparable to similar measures provided by other issuers. Cineplex includes these measures

because its management believes that they assist investors in assessing financial performance. These non-GAAP and other

financial measures are used throughout this news release and are defined below.

NON-GAAP FINANCIAL MEASURES

Non-GAAP financial measures are defined in 52-112 as a financial measure disclosed that (a) depicts the historical or expected

future financial performance, financial position or cash flow of an entity, (b) with respect to its composition, excludes an amount

that is included in, or includes an amount that is excluded from, the composition of the most directly comparable financial

measure disclosed in the primary financial statements of the entity, (c) is not disclosed in the financial statements of the entity,

and (d) is not a ratio, fraction, percentage or similar representation.

NON-GAAP RATIO

A non-GAAP ratio is defined by 52-112 as a financial measure disclosed that (a) is in the form of a ratio, fraction, percentage or

similar representation, (b) has a non-GAAP financial measure as one or more of its components, and (c) is not disclosed in the

financial statements.

The below are non-GAAP financial measures or non-GAAP ratios that are reported by Cineplex.

EBITDA, ADJUSTED EBITDA AND ADJUSTED EBITDAaL

Management defines EBITDA as earnings before interest income and expense, income taxes and depreciation and amortization

expense. Adjusted EBITDA excludes the change in fair value of financial instrument, gain on disposal of assets, foreign

exchange, the equity income (loss) of CDCP, and impairment, depreciation, amortization, interest and taxes of Cineplex’s other

joint ventures and associates. Adjusted EBITDAaL modifies adjusted EBITDA to deduct current period cash rent paid or

payable related to lease obligations. During the year, Cineplex agreed to a variety of arrangements with landlords to reduce or

defer cash rent paid or payable as a result of the impact of COVID-19.

Subsequent to the adoption of IFRS 16, Leases, by Cineplex effective January 1, 2019, the calculation of EBITDA no longer

includes a charge for amounts paid or payable with respect to leased property and equipment. Given the majority of Cineplex’s

businesses are carried on in leased premises, Cineplex introduced the measure of adjusted EBITDAaL which includes a

deduction for cash rent paid/payable related to lease obligations. Cineplex’s management believes that adjusted EBITDAaL is an

important supplemental measure of Cineplex’s profitability at an operational level and provides analysts and investors with

comparability in evaluating and valuing Cineplex’s performance period over period. EBITDA, adjusted for various unusual

items, is also used to define certain financial covenants in Cineplex’s Credit Facilities. Management calculates adjusted

EBITDAaL margin by dividing adjusted EBITDAaL by total revenues.

EBITDA, adjusted EBITDA and adjusted EBITDAaL are non-GAAP measures generally used as an indicator of financial

performance and they should not be seen as a measure of liquidity or a substitute for comparable metrics prepared in accordance

with GAAP. Cineplex’s EBITDA, adjusted EBITDA and adjusted EBITDAaL may differ from similar calculations as reported

by other entities and accordingly may not be comparable to EBITDA, adjusted EBITDA or adjusted EBITDAaL as reported by

other entities.

Adjusted Free Cash Flow

Free cash flow is a non-GAAP measure generally used by Canadian corporations as an indicator of financial performance and it

should not be viewed as a measure of liquidity or a substitute for comparable metrics prepared in accordance with GAAP.

Standardized free cash flow adjusts the amount of cash from operating activities to deduct capital expenditures net of proceeds

on sale of assets in ordinary business operations. Standardized free cash flow is a non-GAAP measure recommended by the

CICA in its 2008 interpretive release, Improved Communication with Non-GAAP Financial Measures: General Principles and

Guidance for Reporting EBITDA and Free Cash Flow, and is designed to enhance comparability. Adjusted free cash flow is also

a non-GAAP measure used by Cineplex to modify standardized free cash flow to exclude certain cash flow activities and to

measure the amount available for activities such as repayment of debt, dividends to owners and investments in future growth

through acquisitions. Beginning with the MD&A for the three months ending March 31, 2019, Adjusted free cash flow included

repayments of lease obligations that represented the principal portion of rent expenses that were included in net income

calculation prior to the adoption of accounting standard IFRS 16, Leases, by Cineplex effective January 1, 2019. Given that the

materiality of the principal portion of the rent expenses and comparability of adjusted free cash flow disclosure for comparative

periods, adjusted free cash flow also adjusts standard free cash flow to deduct principal amount of repayment of lease obligation.

Cineplex presents standardized free cash flow and adjusted free cash flow per Share because they are key measures used by

investors to value and assess Cineplex. Management of Cineplex defines adjusted free cash flow as standardized free cash flow

adjusted for certain items, and considers adjusted free cash flow the amount available for distribution to Shareholders.

Standardized free cash flow is defined by the CICA as cash from operating activities as reported in the GAAP financial

statements, less total capital expenditures minus proceeds from the disposition of capital assets other than those of discontinued

operations, as reported in the GAAP financial statements; and dividends, when stipulated, unless deducted in arriving at cash

flows from operating activities. The standardized free cash flow calculation excludes common dividends and others that are

declared at the Board’s discretion.

SUPPLEMENTARY FINANCIAL MEASURES

Supplementary financial measures are financial measures that are not (a) presented in the financial statements and (b) is, or is

intended to be, disclosed periodically to depict the historical or expected future financial performance, financial position or cash

flow, that is not a non-GAAP financial measure or a non-GAAP ratio as defined in the instrument. The below are supplementary

financial measures that Cineplex uses to depict its financial performance, financial position or cash flows.

Earnings per Share Metrics

Cineplex has presented basic and diluted earnings per share net of this item to provide a more comparable earnings per share

metric between the current periods and prior year periods. In the non-GAAP and other financial measure, earnings is defined as

net income or net loss attributable to Cineplex excluding the change in fair value of financial instruments.

Per Patron Revenue Metrics

Cineplex reviews per patron metrics as they relate to box office revenue and theatre food service revenue such as BPP, CPP, BPP

excluding premium priced product, and concession margin per patron, as these are key measures used by investors to value and

assess Cineplex’s performance, and are widely used in the theatre exhibition industry. Management of Cineplex defines these

metrics as follows:

Theatre Attendance: Theatre attendance is calculated as the total number of paying patrons that frequent Cineplex’s theatres

during the period.

BPP: Calculated as total box office revenues divided by total paid theatre attendance for the period.

BPP excluding premium priced product: Calculated as total box office revenues for the period, less box office revenues from

3D, 4DX, UltraAVX, VIP ScreenX and IMAX product; divided by total paid theatre attendance for the period, less paid theatre

attendance for 3D, 4DX, UltraAVX, VIP, ScreenX and IMAX product.

CPP: Calculated as total theatre food service revenues divided by total paid total theatre attendance for the period.

Premium priced product: Defined as 3D, 4DX, UltraAVX, IMAX, ScreenX and VIP film product.

Theatre concession margin per patron: Calculated as total theatre food service revenues less total theatre food service cost,

divided by theatre attendance for the period.

Same Theatre Analysis

Cineplex reviews and reports same theatre metrics relating to box office revenues, theatre food service revenues, theatre rent

expense and theatre payroll expense, as these measures are widely used in the theatre exhibition industry as well as other retail

industries.

Same theatre metrics are calculated by removing the results for all theatres that have been opened, acquired, closed or otherwise

disposed of subsequent to the start of the prior year comparative period. For the three months ended June 30, 2022 the impact of

two locations that have been opened or acquired and four locations that have been closed or otherwise disposed of have been

excluded, resulting in 153 theatres being included in the same theatre metrics. For the six months ended June 30, 2022 the impact

of one location that has been opened or acquired and five locations that have been closed or otherwise disposed of have been

excluded, resulting in 153 theatres being included in the same theatre metrics.

Cost of sales percentages

Cineplex reviews and reports cost of sales percentages for its two largest revenue sources, box office revenues and food service

revenues as these measures are widely used in the theatre exhibition industry. These measures are reported as film cost

percentage and concession cost percentage, respectively, and are calculated as follows:

Film cost percentage: Calculated as total film cost expense divided by total box office revenues for the period.

Theatre concession cost percentage: Calculated as total theatre food service costs divided by total theatre food service revenues

for the period.

LBE food cost percentage: Calculated as total LBE food costs divided by total LBE food service revenues for the period.

Lease-related cash saving

Quantified savings negotiated with landlords as a result of the COVID-19 disclosures.

Certain information included in this news release contains forward-looking statements within the meaning of applicable

securities laws. These forward-looking statements include, among others, statements with respect to Cineplex’s objectives, goals

and strategies to achieve those objectives and goals, as well as statements with respect to Cineplex’s beliefs, plans, objectives,

expectations, anticipations, estimates and intentions. The words “may”, “will”, “could”, “should”, “would”, “suspect”,

“outlook”, “believe”, “plan”, “anticipate”, “estimate”, “expect”, “intend”, “forecast”, “objective” and “continue” (or the

negative thereof), and words and expressions of similar import, are intended to identify forward-looking statements. Forward-

looking statements also include, statements pertaining to:

• Cineplex’s outlook, goals, expectations and projected results of operations, including factors and assumptions

underlying Cineplex’s projections regarding the duration and impact of a novel strain of coronavirus

(“COVID-19”) pandemic on Cineplex, the movie exhibition industry and the economy in general, as well as

Cineplex’s response to the pandemic related to the closure or operational restrictions of its theatres and location-

based entertainment (“LBE”) venues, employee reductions and other cost-cutting initiatives and increased

expenses relating to safety measures taken at its facilities to protect the health and well-being of guests and

employees;

• Cineplex’s expectations with respect to liquidity and capital expenditures, including its ability to meet its ongoing

capital, operating and other obligations, and anticipated needs for, and sources of, funds; and

• Cineplex’s ability to execute cost-cutting and revenue enhancement initiatives in response to the COVID-19

pandemic.

The COVID-19 pandemic has had an unprecedented impact on Cineplex, along with the rest of the movie exhibition industry and

other industries in which Cineplex operates, including material decreases in revenues, results of operations and cash flows. The

situation continues to evolve and the social and economic effects are widespread. As an entertainment and media company that

operates spaces where guests gather in close proximity, Cineplex’s business has been significantly impacted by the actions taken

to control the spread of COVID-19. These actions included, among other things, the introduction of vaccine passports or proof

of vaccination mandates, social distancing measures and restrictions including those on capacity. During the second quarter of

2022, as COVID-19 cases declined across the country, restrictions relating to capacity limits, vaccine passports and mask

mandates were lifted in all of the markets in which Cineplex operates, providing clearer visibility for Cineplex’s business and the

return to normalcy. Cineplex is actively monitoring the situation and is adapting its business strategies as the impact of the

COVID-19 pandemic evolves.

By their very nature, forward-looking statements involve inherent risks and uncertainties, including those described in

Cineplex’s Annual Information Form (“AIF”), and MD&A for the year ended December 31, 2021 (“Annual MD&A”) and in

this news release. Those risks and uncertainties, both general and specific, give rise to the possibility that predictions, forecasts,

projections and other forward-looking statements will not be achieved. Certain material factors or assumptions are applied in

making forward-looking statements and actual results may differ materially from those expressed or implied in such statements.

Cineplex cautions readers not to place undue reliance on these statements, as a number of important factors, many of which are

beyond Cineplex’s control, could cause actual results to differ materially from the beliefs, plans, objectives, expectations,

anticipations, estimates and intentions expressed in such forward-looking statements. These factors include, but are not limited

to the movie exhibition industry and the economy in general, as well as Cineplex’s response to the COVID-19 pandemic as

related to the closure or capacity restrictions of its theatres and LBE venues, employee reductions and other cost-cutting

initiatives, and increased expenses relating to safety measures taken at its facilities to protect the health and well-being of

customers and employees; Cineplex’s expectations with respect to liquidity and capital expenditures, including its ability to meet

its ongoing capital, operating and other obligations, and anticipated needs for, and sources of, funds; Cineplex’s ability to

execute cost-cutting and revenue enhancement initiatives in response to the COVID-19 pandemic; risks generally encountered in

the relevant industry, competition, customer, legal, taxation and accounting matters; the outcome of the litigation surrounding

the termination of the Cineworld transaction; and diversion of management time on litigation related to the Cineworld

transaction.

The foregoing list of factors that may affect future results is not exhaustive. When reviewing Cineplex’s forward-looking

statements, readers should carefully consider the foregoing factors and other uncertainties and potential events. Additional

information about factors that may cause actual results to differ materially from expectations and about material factors or

assumptions applied in making forward-looking statements may be found in the “Risks and Uncertainties” section of Cineplex’s

MD&A.

Cineplex does not undertake to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by applicable Canadian securities law. Additionally, Cineplex undertakes no obligation

to comment on analyses, expectations or statements made by third parties in respect of Cineplex, its financial or operating

results or its securities. All forward-looking statements in this news release are made as of the date hereof and are qualified by

these cautionary statements. Additional information, including Cineplex’s AIF and Annual MD&A, can be found on SEDAR at

www.sedar.com.

You are cordially invited to participate in a conference call with the management of Cineplex (TSX: CGX) to review our second

quarter. Ellis Jacob, President and Chief Executive Officer and Gord Nelson, Chief Financial Officer, will host the call

scheduled for:

Cineplex Inc. Q2 2022 Earnings Webcast:

Date: Thursday, August 11, 2022

Time: 10:00 a.m. Eastern Daylight Time

Audio Webcast: Audience URL https://events.q4inc.com/attendee/339303405

Pre-registration available.

An archive of the webcast will be available at https://corp.cineplex.com/investors after the webcast for a

limited time.

Please note, analysts who cover the Company, should use the dial-in option to participate in the live question period:

1-226-828-7575 (Local) or 1-833-950-0062 (Canada Toll-free), access code 200573. All attendees should join the event

5-10 minutes prior to the scheduled start time. Media are welcome to join the call in listen-only mode.

- 30 -

About Cineplex

Cineplex (TSX:CGX) is a top-tier Canadian brand that operates in the Film Entertainment and Content, Amusement and Leisure,

and Media sectors. Cineplex offers a unique escape from the everyday to millions of guests through its circuit of over 170 movie

theatres and location-based entertainment venues. In addition to being Canada’s largest and most innovative film exhibitor, the

company operates Canada’s favourite destination for ‘Eats & Entertainment’ (The Rec Room) and complexes specially designed

for teens and families (Playdium). It also operates successful businesses in digital commerce (CineplexStore.com), alternative

programming (Cineplex Events), cinema media (Cineplex Media), digital place-based media (Cineplex Digital Media “CDM”)

and amusement solutions (Player One Amusement Group “P1AG”). Providing even more value for its guests, Cineplex is a joint

venture partner in Scene+, Canada’s largest entertainment loyalty program.

Proudly recognized as having one of the country’s Most Admired Corporate Cultures, Cineplex employs approximately 10,000

people in its offices across Canada and the United States. To learn more visit Cineplex.com or download the Cineplex App.

For further information:

Investor Relations contact:

Mahsa Rejali

Executive Director, Corporate Development & Investor Relations

Media Relations contact:

Sarah Van Lange

Vice President, Communications, Content & Social Media

Cineplex Inc.

Consolidated Balance Sheets

(expressed in thousands of Canadian dollars)

June 30,

December 31,

2022 2021

Assets

Current assets

Cash and cash equivalents $ 26,584 $ 26,938

Trade and other receivables 66,498 80,679

Income taxes receivable 2,713 1,984

Inventories 29,893 24,899

Prepaid expenses and other current assets 15,322 13,365

Fair value of interest rate swap agreements 482 —

141,492 147,865

Non-current assets

Property, equipment and leaseholds 435,462 464,439

Right-of-use assets 733,166 768,675

Fair value of interest rate swap agreements 3,482 —

Interests in joint ventures 2,475 7,423

Intangible assets 80,871 81,651

Goodwill 635,686 635,545

Derivative financial instrument 3,640 9,240

$ 2,036,274 $ 2,114,838

Cineplex Inc.

Consolidated Balance Sheets … continued

(expressed in thousands of Canadian dollars)

June 30, December 31,

2022 2021

Liabilities

Current liabilities

Accounts payable and accrued expenses $ 146,399 $ 157,950

Income taxes payable 1,923 1,945

Deferred revenue and other 275,598 293,206

Lease obligations 98,354 101,058

Fair value of interest rate swap agreements — 8,063

522,274 562,222

Non-current liabilities

Share-based compensation 4,597 4,940

Long-term debt 782,421 739,211

Fair value of interest rate swap agreements — 6,160

Lease obligations 967,191 1,004,465

Post-employment benefit obligations 9,206 9,973

Other liabilities 6,911 7,590

1,770,326 1,772,339

Total liabilities 2,292,600 2,334,561

Shareholders’ deficit

Share capital 852,661 852,465

Deficit (1,192,306) (1,151,394)

Hedging reserves and other (131) (131)

Contributed surplus 83,640 80,027

Cumulative translation adjustment (190) (690)

Total shareholders’ deficit (256,326) (219,723)

$ 2,036,274 $ 2,114,838

Cineplex Inc.

Consolidated Statements of Operations

(expressed in thousands of Canadian dollars, except per share amounts)

Three months ended June 30, Six months ended June 30,

2022 2021 2022 2021

Revenues

Box office $ 136,372 $ 12,498 $ 216,324 $ 16,316

Food service 110,637 13,258 179,025 19,783

Media 26,406 9,401 41,951 18,475

Amusement 65,723 22,184 116,147 36,058

Other 10,740 7,585 25,154 15,706

349,878 64,926 578,601 106,338

Expenses

Film cost 69,958 5,611 108,974 6,846

Cost of food service 25,335 2,867 40,192 4,279

Depreciation - right-of-use assets 24,486 25,737 48,749 52,055

Depreciation and amortization - other assets 26,651 27,735 53,543 57,244

(Gain) loss on disposal of assets (4,650) 179 (4,493) (29,881)

Other costs 176,741 73,352 315,093 142,057

Share of loss (income) of joint ventures and associates 384 1,052 (302) 3,466

Interest expense - lease obligations 14,739 14,741 29,443 29,100

Interest expense - other 13,812

23,895

17,899 23,895 31,564

Interest income (38) (108) (68) (134)

Foreign exchange (623) 365 (389) 595

Loss (gain) on financial instruments recorded at fair value 1,770 (800) 5,600 (800)

348,565 168,630 620,237 296,391

Income (loss) before income taxes 1,313 (103,704) (41,636) (190,053)

Income tax (recovery) expense

Current — — (724) 3,339

Net income (loss)

$ 1,313 $ (103,704) $ (40,912) $ (193,392)

Net income (loss) per share - basic $ 0.02 $ (1.64) $ (0.65) $ (3.05)

Net income (loss) per share - diluted $ 0.02 $ (1.64) $ (0.65) $ (3.05)

Cineplex Inc.

Consolidated Statements of Comprehensive Income (Loss)

(expressed in thousands of Canadian dollars)

Three months ended June 30, Six months ended June 30,

2022 2021 2022 2021

Net income (loss) $ 1,313 $ (103,704) $ (40,912) $ (193,392)

Other comprehensive income (loss)

Items that will be reclassified subsequently to net income:

Foreign currency translation adjustment 917 (480) 500 (908)

Other comprehensive income (loss) 917 (480) 500 (908)

Comprehensive income (loss) $ 2,230 $ (104,184) $ (40,412) $ (194,300)

Cineplex Inc.

Consolidated Statements of Changes in Equity

(expressed in thousands of Canadian dollars)

For the periods ended June 30, 2022 and 2021

Share

capital

Contributed

surplus

Hedging

reserves and

other

Cumulative

translation

adjustment Deficit Total

January 1, 2022 $ 852,465 $ 80,027 $ (131) $ (690) $ (1,151,394) $ (219,723)

Net loss — — — — (40,912) (40,912)

Other comprehensive income — — — 500 — 500

Total comprehensive loss

— —

— 500 (40,912) (40,412)

Share option expense — 916 — — — 916

PSU/RSU expense — 2,780 — — — 2,780

Issuance of shares on exercise of options 196 (83) — — — 113

June 30, 2022 $ 852,661 $ 83,640 $ (131) $ (190) $ (1,192,306) $ (256,326)

January 1, 2021 $ 852,379 $ 75,882 $ (131) $ (502) $ (903,394) $ 24,234

Net loss — — — — (193,392) (193,392)

Other comprehensive loss — — — (908) — (908)

Total comprehensive loss — — — (908) (193,392) (194,300)

Share option expense — 844 — — — 844

PSU/RSU expense — 974 — — — 974

Settlement for cancelled options — (60) — — — (60)