THIRD QUARTER

September 30, 2022

2022

LETTER TO SHAREHOLDERS

Dear fellow shareholders,

I am pleased to report that the third quarter marked another significant step in the resurgence of

Cineplex and the theatrical exhibition industry. The North American box office reached $1.9

billion during the quarter, which was 44 per cent higher than Q3 2021. Leading the box office was

Minions: Rise of Gru, Thor: Love and Thunder, and the continued success of Top Gun: Maverick.

Top Gun which has become one of only six films to ever exceed $700 million in North America.

Leading up to the quarter, Cineplex – and the industry as a whole – anticipated limited Hollywood

content in August and September as result of pandemic related production delays. In response, we

undertook a series of targeted marketing initiatives to drive attendance and diversify our film slate

by increasing focus on international products where Cineplex consistently takes an industry

leading market share in North America. In addition, our commitment to growing our diversified

businesses continues to deliver results, including an all-time quarterly record adjusted EBITDAaL

in the P1AG and Location-Based Entertainment businesses.

The momentum at the box office combined with growth in our diversified businesses fueled the

third quarter year-over-year revenue increase of 36 per cent, and adjusted EBITDAaL of $20.4

million, which constitutes a 90 per cent growth when compared to the same quarter last year.

This quarter we are celebrating a few important milestones from across the business, including

the overwhelming turnout for National Cinema Day on September 3, 2022, where we welcomed

over half a million guests, which proved to be Cineplex’s busiest day so far in 2022 and third

busiest day in the last five years. Also, during the quarter, we welcomed Empire Company

Limited to the Scene+ loyalty program as co-owners alongside Cineplex and Scotiabank, and we

have seen strong membership growth in recent months. We are also excited about the addition of

Home Hardware Stores Limited as a Scene+ loyalty partner with a launch expected to take place

in the summer of 2023.

With respect to the Cineworld litigation, on September 7, 2022, Cineworld filed for Chapter 11

Bankruptcy in the United States and the following day, the US Bankruptcy Court ordered a

worldwide stay of all enforcement proceedings against Cineworld. We attempted to lift the stay

with respect to the ongoing appeal in Ontario, but our request was denied, and the litigation is on

hold for now. With that said, we continue to work closely with our advisors to monetize and

maximize the judgement claim.

As we look forward, we are excited about opening the first location of our new entertainment

concept, Junxion, later this year in Winnipeg. Our studio partners and non-traditional studios

recognize the underlying importance of an exclusive theatrical window, and we look forward to a

robust film slate of blockbuster titles for the remainder of the year and into 2023. In closing, we

remain focused on maximizing value across all our businesses and driving shareholder returns.

Sincerely,

Ellis Jacob

President and CEO

MANAGEMENT’S DISCUSSION AND ANALYSIS

November 9, 2022

The following management’s discussion and analysis (“MD&A”) of Cineplex Inc. (“Cineplex”) financial condition

and results of operations should be read together with the consolidated financial statements and related notes of

Cineplex (see Section 1, Overview of Cineplex). These financial statements, presented in Canadian dollars, were

prepared in accordance with Canadian generally accepted accounting principles (“GAAP”), defined as

International Financial Reporting Standards (“IFRS”) as set out in the Handbook of the Canadian Institute of

Chartered Professional Accountants.

Unless otherwise specified, all information in this MD&A is as of September 30, 2022 and all amounts are in

Canadian dollars.

MANAGEMENT’S DISCUSSION AND ANALYSIS CONTENTS

Section Contents Page

1 Overview of Cineplex 3

2 Cineplex's businesses and strategy 12

3 Overview of operations 13

4 Results of operations 17

5 Balance sheets 35

6 Liquidity and capital resources 37

7 Adjusted free cash flow and dividends 44

8 Share activity 45

9 Seasonality and quarterly results 47

10 Related party transactions 49

11 Significant accounting judgments and estimation uncertainties 49

12 Accounting policies 51

13 Risks and uncertainties 52

14 Controls and procedures 62

15 Subsequent events 63

16 Outlook 63

17 Non-GAAP and other financial measures 66

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 1

Non-GAAP and Other Financial Measures

Cineplex reports on certain non-GAAP measures, non-GAAP ratios, supplementary financial measures and total

segments measures that are used by management to evaluate the performance of Cineplex. In addition, non-GAAP

measures are used in measuring compliance with debt covenants. Non-GAAP measures do not have standardized

meaning under GAAP and may not be comparable to similar measures provided by other issuers. Cineplex includes

these measures because management believes that they assist investors in assessing financial performance. The

definition, calculation and reconciliation of non-GAAP measures are provided in Section 17, Non-GAAP and other

financial measures.

Forward-Looking Statements

Certain information included in this MD&A contains forward-looking statements within the meaning of applicable

securities laws. These forward-looking statements include, among others, statements with respect to Cineplex’s

objectives, goals and strategies to achieve those objectives and goals, as well as statements with respect to

Cineplex’s beliefs, plans, objectives, expectations, anticipations, estimates and intentions. The words “may”, “will”,

“could”, “should”, “would”, “suspect”, “outlook”, “believe”, “plan”, “anticipate”, “estimate”, “expect”,

“intend”, “forecast”, “objective” and “continue” (or the negative thereof), and words and expressions of similar

import, are intended to identify forward-looking statements. Forward-looking statements also include, statements

pertaining to:

• Cineplex’s outlook, goals, expectations and projected results of operations, including factors and

assumptions underlying Cineplex’s projections regarding the duration and impact of a novel strain of

coronavirus (“COVID-19”) pandemic on Cineplex, the movie exhibition industry and the economy in

general, as well as Cineplex’s response to the pandemic related to the closure or operational

restrictions of its theatres and location-based entertainment (“LBE”) venues, employee reductions and

other cost-cutting initiatives and increased expenses relating to safety measures taken at its facilities to

protect the health and well-being of guests and employees;

• Cineplex’s expectations with respect to liquidity and capital expenditures, including its ability to meet

its ongoing capital, operating and other obligations, and anticipated needs for, and sources of, funds;

and

• Cineplex’s ability to execute cost-cutting and revenue enhancement initiatives in response to the

COVID-19 pandemic.

The COVID-19 pandemic has had an unprecedented impact on Cineplex, along with the rest of the movie exhibition

industry and other industries in which Cineplex operates, including material decreases in revenues, results of

operations and cash flows. As an entertainment and media company that operates spaces where guests gather in

close proximity, Cineplex’s business has been significantly impacted by the actions taken to control the spread of

COVID-19. These actions included, among other things, the introduction of vaccine passports or proof of

vaccination mandates, social distancing measures and restrictions including those on capacity. During the second

quarter of 2022, as COVID-19 cases declined across the country, restrictions relating to capacity limits, vaccine

passports and mask mandates were lifted in all of the markets in which Cineplex operates, providing clearer

visibility for Cineplex’s business and the return to normalcy. Cineplex is actively monitoring the situation and is

adapting its business strategies as the impact of the COVID-19 pandemic evolves.

By their very nature, forward-looking statements involve inherent risks and uncertainties, including those described

in Cineplex’s Annual Information Form (“AIF”), and MD&A for the year ended December 31, 2021 (“Annual

MD&A”) and in this MD&A. Those risks and uncertainties, both general and specific, give rise to the possibility

that predictions, forecasts, projections and other forward-looking statements will not be achieved. Certain material

factors or assumptions are applied in making forward-looking statements and actual results may differ materially

from those expressed or implied in such statements. Cineplex cautions readers not to place undue reliance on these

statements, as a number of important factors, many of which are beyond Cineplex’s control, could cause actual

results to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates and intentions

expressed in such forward-looking statements. These factors include, but are not limited to the movie exhibition

industry and the economy in general, as well as Cineplex’s response to the COVID-19 pandemic as it related to the

closure or capacity restrictions of its theatres and LBE venues, employee reductions and other cost-cutting

initiatives, and increased expenses relating to safety measures taken at its facilities to protect the health and well-

being of customers and employees; Cineplex’s expectations with respect to liquidity and capital expenditures,

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 2

including its ability to meet its ongoing capital, operating and other obligations, and anticipated needs for, and

sources of, funds; Cineplex’s ability to execute cost-cutting and revenue enhancement initiatives in response to the

COVID-19 pandemic; risks generally encountered in the relevant industry, competition, customer, legal, taxation

and accounting matters; the outcome of the litigation surrounding the termination of the Cineworld transaction

(described below); and diversion of management time on litigation related to the Cineworld transaction.

The foregoing list of factors that may affect future results is not exhaustive. When reviewing Cineplex’s forward-

looking statements, readers should carefully consider the foregoing factors and other uncertainties and potential

events. Additional information about factors that may cause actual results to differ materially from expectations and

about material factors or assumptions applied in making forward-looking statements may be found in the “Risks and

Uncertainties” section of this MD&A.

Cineplex does not undertake to update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by applicable Canadian securities law. Additionally,

Cineplex undertakes no obligation to comment on analyses, expectations or statements made by third parties in

respect of Cineplex, its financial or operating results or its securities. All forward-looking statements in this MD&A

are made as of the date hereof and are qualified by these cautionary statements. Additional information, including

Cineplex’s AIF, can be found on SEDAR at www.sedar.com.

1. OVERVIEW OF CINEPLEX

Cineplex (TSX:CGX) is a top-tier Canadian brand that operates in the Film Entertainment and Content, Amusement

and Leisure, and Media sectors. Cineplex offers a unique escape from the everyday to millions of guests through its

circuit of over 170 movie theatres and location-based entertainment venues. In addition to being Canada’s largest

and most innovative film exhibitor, the company operates Canada’s favourite destination for ‘Eats &

Entertainment’ (The Rec Room) and complexes specially designed for teens and families (Playdium). It also operates

successful businesses in digital commerce (CineplexStore.com), alternative programming (Cineplex Events), cinema

media (Cineplex Media), digital place-based media (Cineplex Digital Media “CDM”) and amusement solutions

(Player One Amusement Group “P1AG”). Providing even more value for its guests, Cineplex is a partner in Scene

LP, the operator of the Scene+ loyalty program, Canada’s largest entertainment and lifestyle loyalty program.

Cineplex’s theatre circuit is concentrated in major metropolitan and mid-sized markets. As of September 30, 2022,

Cineplex owned, leased or had a joint venture interest in 1,637 screens in 158 theatres from coast to coast as well as

13 LBE venues in six provinces.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 3

Cineplex

Theatre locations and screens at September 30, 2022

Province

Locations Screens

3D Digital

Screens UltraAVX

IMAX

Screens (i)

VIP

Auditoriums

D-BOX

Auditoriums

Recliner

Auditoriums

Other

Screens (ii)

Ontario 66 710 350 41 13 48 48 108 11

Quebec 17 220 88 10 3 9 7 17 1

British Columbia 25 236 125 16 3 20 16 43 2

Alberta 20 213 114 20 2 16 16 83 6

Nova Scotia 10 87 43 1 1 — 2 — 1

Saskatchewan 6 54 28 3 1 3 3 16 1

Manitoba 5 49 26 1 1 3 2 — 1

New Brunswick 5 41 20 2 — — 2 — —

Newfoundland &

Labrador 2 14 9 — 1 — 1 — —

Prince Edward Island 2 13 6 — — — 1 — —

TOTALS 158 1,637 809 94 25 99 98 267 23

Percentage of

screens 49 % 6 % 2 % 6 % 6 % 16 % 1 %

(i) All IMAX screens are 3D enabled. Total 3D screens including IMAX screens are 834 screens or 51% of the circuit.

(ii) Other screens includes 4DX, Cineplex Clubhouse and ScreenX.

Cineplex - Theatres, screens and premium offerings in the last eight quarters

2022 2021 2020

Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4

Theatres 158 159 159 160 161 160 161 162

Screens 1,637 1,640 1,640 1,652 1,656 1,651 1,657 1,667

3D Digital Screens 809 809 810 815 816 816 816 819

UltraAVX Screens 94 94 94 94 94 94 94 94

IMAX Screens 25 25 24 25 25 25 25 25

VIP Auditoriums 99 99 99 99 94 89 84 84

D-BOX Locations 98 98 98 98 98 98 98 98

Recliner Screens 267 267 267 267 262 258 253 253

Other Screens 23 22 22 22 19 19 19 19

Cineplex - LBE - at September 30, 2022 and 2021 2022 2021

Province The Rec Room Playdium The Rec Room Playdium

Ontario 4 2 4 2

Alberta 3 — 3 —

Manitoba 1 — 1 —

Newfoundland & Labrador 1 — 1 —

British Columbia 1 — 1 —

Nova Scotia — 1 — 1

TOTALS 10 3 10 3

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 4

1.1 RECENT DEVELOPMENTS

COVID-19 business impacts, risks and liquidity

In early 2020, the outbreak of COVID-19 was confirmed in multiple countries throughout the world and on March

11, 2020, it was declared a global pandemic by the World Health Organization (“WHO”). In response, Cineplex

immediately introduced enhanced cleaning protocols and reduced theatre capacities to promote social distancing. By

mid-March 2020, each of Canada’s provinces and territories had declared a state of emergency resulting in, among

other things, the mandated closure of non-essential businesses, restrictions on public gatherings and quarantining of

people who may have been exposed to the virus. On March 16, 2020, Cineplex announced the temporary closure of

all of its theatres and LBE venues across Canada, as well as substantially all route locations operated by P1AG. On

August 21, 2020, Cineplex reopened its entire circuit of theatres and LBE venues, however, theatre operations and

LBE venues were continuously impacted by additional government mandated restrictions and closures over the next

several quarters.

As of July 17, 2021, Cineplex had reopened its entire circuit of theatres subject to capacity restrictions, in some

cases after months of extended closure periods. The reopening included Cineplex’s then 161 theatre locations,

encompassing 1,656 screens across Canada including 18 VIP Cinemas locations. As restrictions were temporarily

eased in markets in which Cineplex operated, Cineplex also reopened its LBE venues across Canada as well as route

locations operated by P1AG. All theatres, LBE venues and P1AG route locations continue to operate with enhanced

safety and cleaning measures to ensure the safety of Cineplex’s employees and customers.

Effective December 18, 2021, due to the rise of the Omicron variant, capacity restrictions were reinstated in Ontario,

Cineplex’s largest market, limiting indoor capacity to 50% along with prohibiting the consumption of concessions in

theatres. Theatres in Quebec were also mandated to temporarily close effective December 20, 2021. During the

beginning of the first quarter of 2022, social gathering restrictions were further modified or reinstituted in several

key markets in which Cineplex operates, resulting in theatre closures in Ontario. Cineplex was also required to

temporarily close or reduce capacity in other provinces. Effective January 29, 2022, January 31, 2022 and February

7, 2022, theatres in New Brunswick, Ontario and Quebec were permitted to reopen at reduced capacity levels,

respectively. During the second quarter of 2022, all remaining capacity restrictions and mask mandates were

removed in all markets in which Cineplex operates theatres and LBE venues across Canada. Cineplex is currently

operating at full capacity but is continuously monitoring for any government directives on operating capacities.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 5

To mitigate the negative impact of COVID-19 and support its long-term stability, Cineplex has undertaken a variety

of measures including:

Liquidity measures:

• June 2020: entered into the First Credit Agreement Amendment with The Bank of Nova Scotia as

administrative agent of Cineplex’s seventh amended and restated credit agreement (as amended, the “Credit

Facilities”) providing certain financial covenant relief in light of the COVID-19 pandemic and its impact on

Cineplex’s business (Section 6.4, Long-term debt);

• July 2020: issued convertible unsecured subordinated debentures (the “Debentures”) for net proceeds of

$303.3 million (Section 6.4, Long-term debt);

• November 2020: entered into the Second Credit Agreement Amendment providing further financial

covenant relief (Section 6.4, Long-term debt);

• December 2020: entered into an agreement to enhance and expand the SCENE loyalty program receiving

$60.0 million with respect to the reorganization;

• January 2021: completed the sale and leaseback transaction of Cineplex’s head office buildings located at

1303 Yonge Street and 1257 Yonge Street, Toronto, Ontario for gross proceeds of $57.0 million;

• January 2021: filed tax returns for the 2020 taxation year claiming a $62.6 million recovery of income taxes

paid in prior periods (all of which had been received by December 31, 2021);

• February 2021: entered into the Third Credit Agreement Amendment providing further financial covenant

relief (Section 6.4, Long-term debt);

• February 2021: issued 7.50% senior secured second lien notes due February 26, 2026 (the “Notes Payable”)

for net proceeds of $243.3 million (Section 6.4, Long-term debt);

• December 2021: entered into the Fourth Credit Agreement Amendment providing further financial

covenant relief (Section 6.4, Long-term debt); and

• August 2022: entered into the Fifth Credit Agreement Amendment providing further financial covenant

relief (Section 6.4, Long-term debt).

Cost reduction and subsidy measures:

• temporary layoffs of all part-time and full-time hourly employees as well as a number of full-time

employees who chose a temporary layoff rather than a salary reduction during the second quarter of 2020,

and additional temporary layoffs of part-time employees beginning in December 2021 and further

expanding into the first quarter of 2022;

• reduced full-time employee salaries by agreement with such employees during the second and third

quarters of 2020;

• suspended or deferred current capital spending, reviewing all capital projects to consider either deferral or

cancellation;

• reduced non-essential discretionary operational expenditures (such as spending on marketing, travel and

entertainment);

• implemented a more stringent review and approval process for all outgoing procurement and payment

requests;

• continued negotiations with landlords for cash payments in exchange for the sale of contractual rights or

negotiating rent relief, including abatements, reductions and deferrals;

• worked with major suppliers and other business partners to modify the timing and quantum of certain

contractual payments;

• reviewed and applied for government subsidy programs where available, including municipal and

provincial property tax and energy rebates or subsidies;

• applied for the ongoing Canada Emergency Wage Subsidy (“CEWS”), which was launched by the

Government of Canada, providing a variable subsidy for employee wages incurred from March 2020 to

October 23, 2021;

• applied for the ongoing Canada Emergency Rent Subsidy (“CERS”), which was launched by the

Government of Canada as a result of government mandated lockdowns, providing a variable subsidy for

rent and other occupancy-related costs incurred from September 27, 2020 through October 23, 2021;

• applied for Canada’s Tourism and Hospitality Recovery Program (“THRP”) which began on October 24,

2021 and provided wage and rent subsidies for businesses that have faced revenue losses, with a subsidy

rate of up to 75% until March 12, 2022 and 37.5% until May 7, 2022;

• continued evaluation of Cineplex’s eligibility under other relief programs; and

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 6

• continued the suspension of dividends.

As some of Cineplex’s largest expenses, such as film cost and cost of food services, are fully variable, during the

closure of its theatres and LBE venues Cineplex focused on reducing its largest fixed and semi-fixed expenses,

including those attributed to theatre and LBE payroll and occupancy. Cineplex remains focused on identifying

opportunities to extract value under its existing lease agreements.

Since the closure of its theatres and LBE venues in March 2020, Cineplex diligently prepared for their safe

reopening, carefully re-examining all of its buildings and processes and implementing an industry-leading program

with end-to-end health and safety protocols. In June 2021, Cineplex introduced its VenueSafe program, which

encompasses all of Cineplex’s health and safety protocols, in accordance with Canada’s public health guidelines.

With the VenueSafe seal of approval, Cineplex believes that guests can feel confident in the company’s commitment

to provide a safe and comfortable environment to be entertained in both our theatres and other entertainment venues.

While the specific protocols will evolve over time, VenueSafe will remain across all of Cineplex’s venues as health

and safety remain a top priority and top of mind for our guests. For further details refer to www.cineplex.com/

Global/health-and-safety, www.therecroom.com/healthandsafety and www.playdium.com/healthandsafety.

With the uncertainty of future government-imposed restrictions and the potential long-term effect that the pandemic

may have on Cineplex’s businesses, COVID-19 may continue to have a prolonged material negative impact on

Cineplex’s operations and return to profitability.

As expected, box office results during the third quarter were impacted by delays in film releases due to COVID-19

production delays. In spite of this, Top Gun: Maverick, became one of six films to exceed $700 million in North

America and the fifth largest domestic film of all-time, earning $1.5 billion globally up to September 30, 2022,.

Minions: The Rise of Gru was released during the third quarter, generating $107.0 million during its North American

opening weekend and earning $366.1 million since its release up to September 30, 2022. Marvel’s Thor: Love and

Thunder was also released during the third quarter, generating $144.2 million during its North American opening

weekend and earning $343.2 million in North America since its release up to September 30, 2022. Lastly, Avatar,

which is the highest grossing film of all time, was re-released during the third quarter and generated $15.1 million in

North America during the first week of its re-release. This speaks highly of the demand for its highly anticipated

sequel, Avatar: The Way of Water, which will be released during the fourth quarter of 2022.

As at September 30, 2022, Cineplex had a cash balance of $28.9 million and $199.6 million available under its

Revolving Facility subject to the liquidity covenants set forth in the Credit Facilities as amended (Section 6.4, Long-

term debt). Combined with the continued focus on reducing costs and capital expenditures, management believes

that it has adequate liquidity to fund operations in the regions in which Cineplex operates.

Cineworld Transaction and Bankruptcy Filing

On December 15, 2019, Cineplex entered into an arrangement agreement (the “Arrangement Agreement”) with

Cineworld Group plc (“Cineworld”), pursuant to which an indirect wholly-owned subsidiary of Cineworld agreed to

acquire all of the issued and outstanding common shares of Cineplex Inc. (“Cineplex”) for $34.00 per share in cash

(the “Cineworld Transaction”). The Cineworld Transaction was to be implemented by way of a statutory plan of

arrangement under the Business Corporation Act (Ontario).

On June 12, 2020, Cineworld delivered a notice (the “Termination Notice”) to Cineplex purporting to terminate the

Arrangement Agreement. In the Termination Notice, Cineworld alleged that Cineplex took certain actions that

constituted breaches of Cineplex’s covenants under the Arrangement Agreement including failing to operate its

business in the ordinary course. In addition, Cineworld alleged that a material adverse effect had occurred with

respect to Cineplex. Cineworld’s repudiation of the Arrangement Agreement was acknowledged by Cineplex and

the Cineworld Transaction did not proceed. Cineplex vigorously denied Cineworld’s allegations.

On July 3, 2020, Cineplex announced that it had commenced an action in the Ontario Superior Court of Justice (the

“Court”) against Cineworld and 1232743 B.C. Ltd. seeking damages arising from what Cineplex claimed was a

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 7

wrongful repudiation of the Arrangement Agreement. The claim sought damages, including the approximately $2.18

billion that Cineworld would have paid upon the closing of the Cineworld Transaction for Cineplex’s securities,

reduced by the value of the Cineplex securities retained by its security holders, as well as compensation for other

losses including the loss to Cineplex of expected synergies, the failure of Cineworld to repay or refinance Cineplex’s

approximately $664.0 million in debt, and transaction expenses. Cineplex also advanced alternative claims for

damages for the loss of benefits to its security holders, and to require Cineworld to disgorge the benefits it

improperly received by wrongfully repudiating the Cineworld Transaction.

A trial of the action commenced before the Court on September 13, 2021 and continued until November 4, 2021.

On December 14, 2021, the Court released its decision in the action. The Court held that Cineplex did not breach

any of its covenants in the Arrangement Agreement, and that Cineworld had no basis for terminating the

Arrangement Agreement. The Court held that Cineworld breached the Arrangement Agreement and repudiated the

transaction to acquire Cineplex, which actions precluded Cineplex from seeking specific performance and entitled

Cineplex to monetary damages. The Court awarded damages for breach of contract to Cineplex in the amount of

$1.24 billion on account of lost synergies, and $5.5 million for transaction costs, exclusive of pre-judgment interest

(the “Judgment”). The Court also held that Cineplex’s shareholders did not have any rights under the Arrangement

Agreement to enforce the agreement or sue Cineworld for any breach. The Court also denied Cineworld’s

counterclaim against Cineplex.

On January 12, 2022, Cineworld filed a Notice of Appeal with the Court of Appeal for Ontario and on January 27,

2022, Cineplex filed its Notice of Cross Appeal (the “Appeal”). The Appeal was originally scheduled to be heard on

October 12 and 13, 2022. On September 7, 2022, Cineworld and certain of its subsidiaries (the “Cineworld Parties”)

filed a petition in the United States Bankruptcy Court for the Southern District of Texas, (the “U.S. Bankruptcy

Court”), commencing bankruptcy proceedings under Chapter 11 of the United States Bankruptcy Code (“Chapter

11”). On September 8, 2022, the U.S. Bankruptcy Court granted relief requested by the Cineworld Parties in the

Chapter 11 proceedings, including an order confirming and enforcing a worldwide stay of all enforcement

proceedings by Cineworld’s creditors. Cineworld took the position that the Appeal was therefore stayed. On

September 9, 2022, Cineplex filed an emergency motion with the U.S. Bankruptcy Court, seeking to lift the stay

with respect to the Appeal. Cineplex’s emergency motion was heard on September 28, 2022, at which time the U.S.

Bankruptcy Court declined Cineplex’s requested relief, without prejudice to Cineplex’s ability to seek such relief at

a later date. On September 30, 2022, on consent of counsel for Cineplex and Cineworld, the Court of Appeal for

Ontario adjourned the Appeal until a date to be determined. Accordingly, the hearing of Appeal has been delayed.

Cineplex continues to evaluate and advance all options against Cineworld to maximize and monetize the value of the

Judgment. As part of these ongoing efforts, Cineplex has engaged Moelis & Company, a leading global investment

bank with significant expertise in these areas, as financial advisors, and Goodmans LLP, as lead counsel. Cineplex

has also been appointed as a member of the unsecured creditors’ committee in the Cineworld Parties’ Chapter 11

proceedings.

While the Judgment and next steps are a key focus for Cineplex and its advisors, due to uncertainties inherent in

appeals and Cineworld’s insolvency proceedings, it is not possible for Cineplex to predict the timing or final

outcome of the Appeal. Further, even if the Appeal by Cineworld is not successful, Cineworld may not have the

ability to pay the full amount of any damages or costs awarded by the Court. Therefore, no amount has been accrued

as a receivable.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 8

1.2 FINANCIAL HIGHLIGHTS

Financial highlights Third Quarter Year to Date

(in thousands of dollars, except theatre attendance in

thousands of patrons and per share and per patron

amounts) 2022 2021 Change (i) 2022 2021 Change (i)

Total revenues $ 339,837 $ 250,380 35.7 % $ 918,438 $ 356,718 157.5 %

Theatre attendance 11,084 8,272 34.0 % 28,837 9,835 193.2 %

Net income (loss) (ii) $ 30,857 $ (33,552) NM $ (10,055) $ (226,944) -95.6 %

Net income (loss) as a percentage of sales (ii) 9.1 % (13.4) % 22.5 % (1.1) % (63.6) % 62.5 %

Cash provided by operating activities $ 5,811 $ 52,023 -88.8 % $ 47,526 $ 33,524 41.8 %

Box office revenues per patron (“BPP”) (iii) $ 11.25 $ 11.38 -1.1 % $ 11.83 $ 11.23 5.3 %

Concession revenues per patron (“CPP”) (iii) $ 8.35 $ 8.58 -2.7 % $ 8.65 $ 8.39 3.1 %

Adjusted EBITDA (iv) $ 63,094 $ 48,606 29.8 % $ 177,508 $ 1,599 NM

Adjusted EBITDAaL (ii) (iv) $ 20,430 $ 10,762 89.8 % $ 50,475 $ (104,493) NM

Adjusted EBITDAaL margin (ii) (v) 6.0 % 4.3 % 1.7 % 5.5 % (29.3) % 34.8 %

Adjusted free cash flow (iv) $ 1,568 $ (5,753) NM $ 1,667 $ (150,485) NM

Adjusted free cash flow per share (v) $ 0.025 $ (0.091) NM $ 0.026 $ (2.376) NM

Earnings per share (“EPS”) - basic (ii) $ 0.49 $ (0.53) NM $ (0.16) $ (3.58) -95.5 %

EPS - diluted (ii) $ 0.43 $ (0.53) NM $ (0.16) $ (3.58) -95.5 %

(i) Throughout this MD&A, changes in percentage amounts are calculated as 2022 value less 2021 value.

(ii) 2022 includes expenses related to the Cineworld Transaction and associated litigation and claims recovery in the amount of $1.2 million

(2021 - $4.1 million) for the third quarter and $2.7 million (2021 - $9.1 million) for the year-to-date.

(iii) Represents a supplementary financial measure. See Section 17, Non-GAAP and other financial measures.

(iv) Represents a non-GAAP financial measure. See Section 17, Non-GAAP and other financial measures.

(v) Represents a non-GAAP ratio. See Section 17, Non-GAAP and other financial measures.

Total revenues for the third quarter of 2022 increased by 35.7%, or $89.5 million to $339.8 million as compared to

the prior year period. For the first time since the start of the COVID-19 pandemic, Cineplex’s entire circuit of

theatres and LBE venues were open and operating without any government mandated restrictions for the entirety of

the third quarter of 2022. In the prior year period, Cineplex had only reopened its entire circuit of theatres and LBE

venues fully as of July 17, 2021, subject to capacity restrictions and under operating restrictions with the

introduction of proof of vaccination programs in September of 2021.

Despite the third quarter box office being negatively impacted by delays in film releases, the continued success of

Top Gun: Maverick, and the release of highly anticipated films during the third quarter of 2022 including Thor: Love

and Thunder, contributed to a theatre attendance increase of 2.8 million to 11.1 million as compared to 8.3 million in

the prior year period. As a result of the increase in attendance, box office revenues increased 32.5% to

$124.7 million and food service revenues increased 31.5% to $105.2 million in the third quarter of 2022, as

compared to the prior year period. Amusement revenues increased by 30.5% or $16.3 million to an all-time quarterly

record of $69.6 million in the third quarter, primarily from P1AG route operations including family entertainment

centres (“FEC”) locations and theatres in the United States and Canada and the growth in the results from The Rec

Room and Playdium. Media revenues of $25.2 million were mainly from cinema media and network management

and services. As a result of the growth in total revenue, adjusted EBITDAaL increased by $9.7 million (89.8%) to

$20.4 million and adjusted free cash flow per share increased from a loss in the prior year period of $(0.091) to a

positive adjusted free cash flow per share of $0.025 in the current period. Cineplex’s income increased from a

reported loss of $33.6 million in the prior year period to an income position of $30.9 million, with net income per

share increasing from a $0.53 loss in the prior year period to an earnings per share of $0.49 in the current period.

Cineplex recognized a gain of $50.1 million in the third quarter on the disposition of its 1/6th interest in Scene+,

leaving a 1/3rd ownership interest in Scene+ (Section 4.2, Operating Results, (Gain) loss on disposal of assets).

Despite ongoing film release shifts caused by COVID-19 related production delays, operating results reflect the

strong reopening of Cineplex’s businesses as total revenues for the year to date period increased by $561.7 million

(157.5%) to $918.4 million as compared to the prior year period. Adjusted EBITDAaL for the year to date period

was $50.5 million as compared to a loss of $104.5 million in the prior year period and adjusted free cash flow per

share was $0.026 during the year to date period, compared to a loss in the prior year of $2.376. Cineplex’s net loss

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 9

decreased from a reported loss of $226.9 million in the prior year period to a loss of $10.1 million in the year to date

period, with a net loss per share decreasing from $3.58 in the prior year period to a net loss of $0.16 during the year

to date period.

The reorganization of SCENE in December 2020 resulted in the cost of Scene+ points issued being recognized as

marketing costs, as opposed to reductions of revenue prior to this. During the third quarter of 2022, Cineplex

recognized an increase in box office and concession revenues of $2.2 million and $2.3 million, respectively ($4.5

million total). During the year to date period, Cineplex recognized an increase in box office and concession revenues

of $6.3 million and $6.3 million, respectively ($12.6 million total). The change in revenue recognition led to an

increase in both BPP and CPP of approximately $0.20 each, during the third quarter and an increase of $0.22 each

during the year to date period. There was a corresponding increase in marketing costs during the third quarter and

year to date period of $4.5 million and $12.6 million, respectively, including other sales transactions with respect to

the Scene+ points issued, resulting in no impact on Cineplex’s net income (loss).

1.3 KEY DEVELOPMENTS IN THE THIRD QUARTER OF 2022

The following describes certain key business initiatives undertaken and results achieved during 2022 in each of

Cineplex’s core business areas:

FILM ENTERTAINMENT AND CONTENT

Theatre Exhibition

• Reported third quarter box office revenues of $124.7 million, an increase of $30.6 million (32.5%) from

$94.1 million due to a 34.0% increase in theatre attendance.

• Celebrated National Cinema Day on September 3, 2022, welcoming approximately 550,000 guests across

the theatre exhibition circuit, representing the largest attendance for a single day for the year to date, and

the third largest attendance for a single day in the last five years, following Avengers: Endgame that opened

in April 2019 and Avengers: Infinity War that opened in April 2018.

• BPP was $11.25, $(0.13) or 1.1% lower than $11.38 reported during the prior year period. The decrease

was primarily due to product offerings at discounted prices on National Cinema Day.

• Opened British Columbia’s second ScreenX auditorium at Cineplex Cinemas Langley.

Theatre Food Service

• Reported third quarter theatre food service revenues of $92.5 million, an increase of $21.6 million (30.4%)

compared to the prior year period primarily due to a 34.0% increase in theatre attendance.

• National Cinema Day held on September 3, 2022, resulted in the second highest grossing food service

revenue day of 2022.

• CPP was $8.35, representing a decrease of $0.23 or 2.7% when compared to the prior year period, primarily

due to the impact of National Cinema Day held on September 3, 2022, attracting discount seekers, resulting

in lower average consumer spend and purchase incidence among total guests visiting Cineplex’s theatre

circuit on that day.

Alternative Programming

• Alternative Programming (Cineplex Events) in the third quarter of 2022 featured the return of violinist and

conductor André Rieu’s summer concerts from Maastricht, Netherlands, the faith-based film Lifemark, and

the return of stage events to the big screen with the National Theatre’s production of Prima Facie starring

Jodie Comer.

• Cineplex Distribution (Cineplex Pictures) released the anime hit Dragon Ball Super: Super Hero, along

with three international films Chili Laugh Story (China), The Killer (South Korea) and Khetet Mazinger

(Egypt).

• Featured numerous strong performing international films, including Chhalla Mud Ke Nahi Aaya (Punjabi),

Laal Singh Chaddha (Hindi) and Maid in Malacanang (Tagalog), of which Cineplex represented 80.0%,

42.0% and 37.5%, respectively, of the total North American market share.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 10

Digital Commerce

• Total registered users for Cineplex Store increased 7% from the prior year period, reaching approximately

2.3 million registered users.

MEDIA

• Reported third quarter media revenues of $25.2 million, an increase of $11.2 million or 79.4% as compared

to the prior year period.

Cinema Media

• Reported third quarter cinema media revenues of $15.1 million, an increase of $8.5 million or 127.4% over

the prior year period, due to increases in cinema advertising as a result of increased theatre attendance and a

return by advertisers to cinema.

Digital Place-Based Media

• Reported third quarter revenues of $10.1 million, an increase of $2.7 million or 36.5% due to increased

advertising at digital out of home networks and higher project installation revenues.

AMUSEMENT AND LEISURE

• Reported all-time quarterly record revenues in the third quarter of $69.6 million, an increase of $16.3

million or 30.5% compared to the prior year period.

Player One Amusement Group

• Reported third quarter record revenues of $45.5 million, an increase of $10.1 million or 28.4% compared to

the prior year period. Adjusted EBITDAaL during the third quarter was an all-time quarterly record of $9.0

million, an increase of $2.0 million or 28.4% compared to the prior year period. The increase in revenues

and adjusted EBITDAaL were primarily due to increases in P1AG amusement revenues from US and

Canada route locations at FEC’s and theatres, along with an increase in distribution sales.

Location-based Entertainment

• Reported all-time record revenues in the third quarter of $31.0 million, an increase of $9.3 million or 42.5%

compared to the prior year period. The current period included a third quarter record for food service

revenues of $10.4 million, all-time quarterly record amusement revenues of $20.2 million and $0.5 million

of media and other revenues. Adjusted EBITDAaL for the third quarter was an all-time quarterly record of

$9.7 million, an increase of $0.5 million or 5.6% compared to the prior year period. The increase in

revenues and adjusted EBITDAaL were primarily due to all LBE venues being open during the entire

period compared to the prior year period that was subject to capacity restrictions.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 11

LOYALTY

• Membership in the Scene+ loyalty program increased to 10.8 million members during the period ended

September 30, 2022.

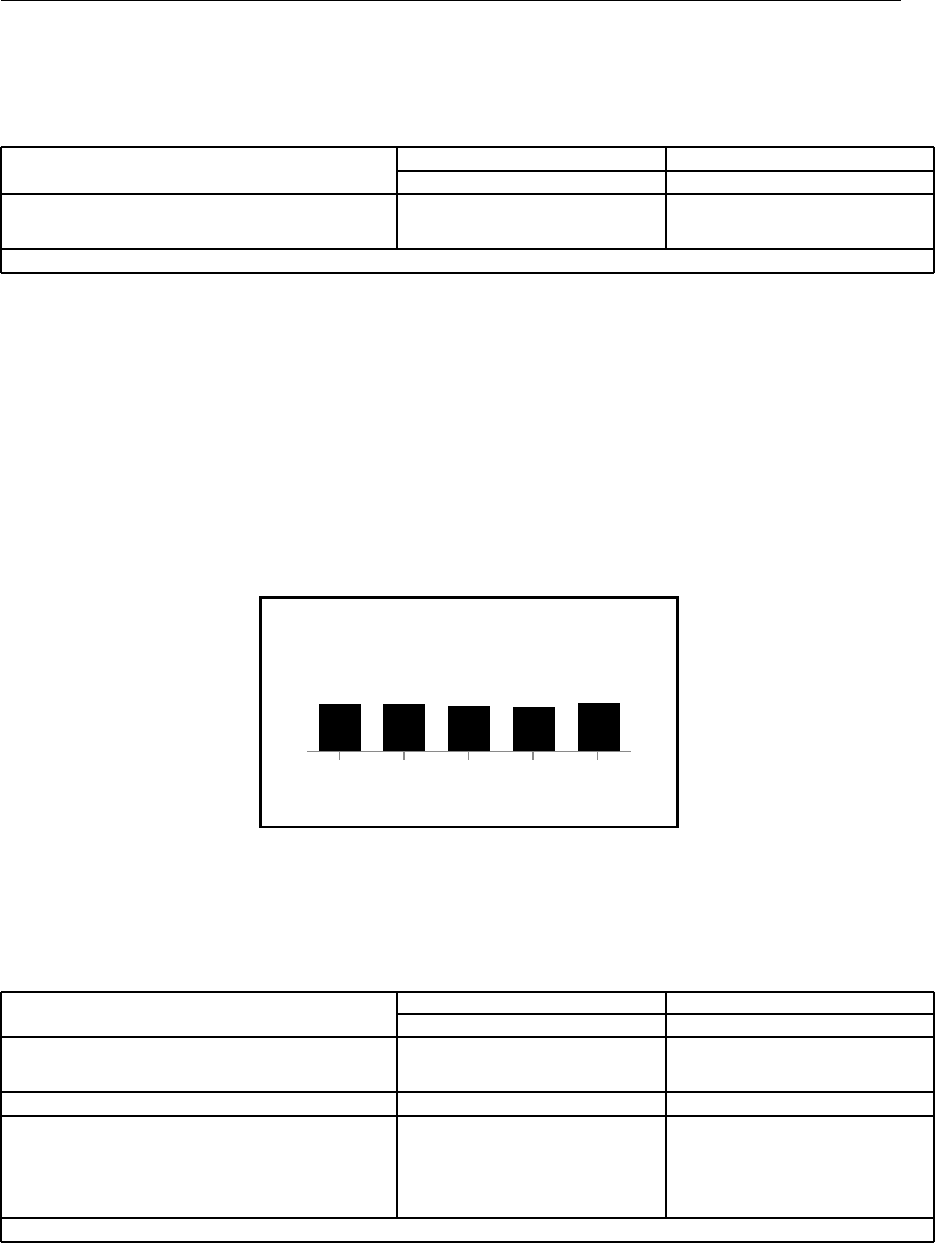

Scene+ Members

(millions)

9.4

10.1

10.5 10.5

10.8

Q3 18 Q3 19 Q3 20 Q3 21 Q3 22

• Welcomed Empire Company Limited as a co-owner of Scene+ during the third quarter, providing members

with increased opportunities to earn and redeem points through Empire’s family of brands firstly in Atlantic

Canada on August 11, 2022, in Western Canada on September 22, 2022, and across Canada by early 2023.

• Recognized a gain of $50.1 million on the disposition of its 1/6th ownership interest in Scene+, leaving a

1/3rd ownership interest in Scene+ with the satisfaction of specific non-financial milestones related to the

reorganization of Scene+.

• Announced that Home Hardware Stores Limited will be joining Scene+ with a launch expected to take

place in the summer of 2023, providing members with additional opportunities to earn and redeem points.

CORPORATE

• In recognition of National Indigenous Peoples Day, Cineplex donated $1 from every movie ticket sold, plus

every purchase on the Cineplex Store, at The Rec Room and Playdium, to imagineNATIVE, the world’s

largest presenter of Indigenous screen content.

• Commemorated National Day for Truth and Reconciliation on September 30, 2022 by partnering with the

Orange Shirt Society to raise awareness and honour Indigenous communities through Pre-Show content

and through donations to the Orange Shirt Society.

• Fundraised and sponsored local Pride celebrations across Canada, including employee participation in

select Pride parades, as well as made a corporate donation to Rainbow Railroad in support of LGBTQ2IA+

programs.

• Donated the proceeds raised during National Accessibility Week to the Canadian Paralympic Committee,

an organization with a mission ensuring that people, programs, and equipment are in place so that

Canadians with disabilities can be active in sports.

2. CINEPLEX’S BUSINESS AND STRATEGY

Cineplex’s mission statement is “Passionately delivering exceptional experiences.” All of its efforts are focused on

this mission and it is Cineplex’s goal to consistently provide guests and customers with exceptional experiences.

Cineplex’s operations are primarily conducted in four main areas: film entertainment and content, media,

amusement and leisure, and location-based entertainment, all supported by the Scene+ loyalty program. Cineplex’s

key strategic areas of focus include the following:

• Continue to enhance and expand Cineplex’s presence as an entertainment destination for Canadians in-

theatre, at-home and on-the-go;

• Capitalize on core media strengths and infrastructure to provide continued growth of Cineplex’s media

business both inside and outside theatres;

• Develop and scale amusement and leisure concepts by extending existing capabilities and infrastructure;

• Drive growth within businesses by leveraging opportunities to optimize value, realize synergies,

implement customer-centric technology and leverage big data across the Cineplex ecosystems; and

• Pursue opportunities that capitalize on Cineplex’s core strengths.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 12

Cineplex uses the Scene+ loyalty program and database as a strategic asset to link these areas of focus and drive

customer acquisition and spending across all lines of business.

Diversified Entertainment and Media Company

Key elements of this strategy include going beyond movies to reach customers in new ways and maximizing

revenue per patron. Cineplex has implemented in-theatre initiatives to improve the overall entertainment experience,

including increased premium offerings, enhanced in-theatre services, alternative pricing strategies, continued

development of the Scene+ loyalty and CineClub subscription programs, and initiatives in theatre food service such

as optimizing and adding product offerings and improving service execution. The ultimate goal of these in-theatre

customer service initiatives is to maximize revenue per patron and increase the frequency of movie-going at

Cineplex’s theatres.

While box office revenues (which include alternative programming) typically account for the largest portion of

Cineplex’s revenues, Cineplex has diversified its revenue streams through expanded theatre food service offerings,

cinema media, digital place-based media, amusement and leisure, the Cineplex Store, promotions and other revenue

streams which have increased as a share of total revenues.

3. OVERVIEW OF OPERATIONS

Revenues

Cineplex generates revenues primarily from box office and food service sales. These revenues are affected primarily

by theatre attendance levels and by changes in BPP and CPP. Box office revenue represented 36.7% of revenue in

the third quarter of 2022.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 13

The following table presents the revenue mix for comparative years:

Revenue mix % by period Q3 2022 Q3 2021 Q3 2020 Q3 2019 Q3 2018

Box office 36.7 % 37.6 % 23.8 % 42.5 % 44.9 %

Food service 31.0 % 31.9 % 25.3 % 30.0 % 29.9 %

Media 7.4 % 5.6 % 21.0 % 10.3 % 8.6 %

Amusement 20.5 % 21.3 % 21.7 % 13.9 % 13.9 %

Other 4.4 % 3.6 % 8.2 % 3.3 % 2.7 %

Total 100.0 % 100.0 % 100.0 % 100.0 % 100.0 %

Cineplex has four reportable segments, film entertainment and content, media, amusement and leisure and location-

based entertainment. The reportable segments are business units offering differing products and services and are

managed separately due to their distinct natures and are based on the information used by Cineplex’s chief operating

decision makers.

Revenue mix % by year

Third Quarter Year to Date

2022 2021 2022 2021

Film Entertainment and Content 70.2 % 71.5 % 70.5 % 64.6 %

Media 7.3 % 5.6 % 7.2 % 9.1 %

Amusement and Leisure 13.4 % 14.2 % 13.7 % 19.2 %

LBE 9.1 % 8.7 % 8.6 % 7.1 %

Total 100.0 % 100.0 % 100.0 % 100.0 %

A key component of Cineplex’s business strategy is to position itself as the leading exhibitor in the Canadian market

by focusing on providing customers with an exceptional entertainment experience. For periods in 2020 and 2021,

Cineplex focused on optimizing revenues during the COVID-19 closures by offering a catalog of classic film

products along with new releases and expanding product offerings through the Cineplex Store. In addition, prior to

COVID-19, as a result of Cineplex’s focus on diversifying the business beyond the traditional movie exhibition

model, its revenue mix has shifted from box office revenue to other revenue sources.

The commercial appeal of the films and alternative content released during a given period, and the success of

marketing as well as promotion for those films by film studios, distributors and content providers all drive theatre

attendance. BPP is affected by the mix of film and alternative content product that appeals to certain audiences (such

as children or seniors who pay lower ticket prices), ticket prices during a given period and the appeal of available

premium priced product that increases BPP. While BPP is impacted by CineClub, the Cineplex Tuesdays program

and the Scene+ loyalty program, these programs are designed to increase theatre attendance frequency at Cineplex’s

theatres. Cineplex’s main focus is to drive incremental visits to theatres, to employ a ticket price strategy which

takes into account the local demographics at each theatre and to maximize BPP through premium offerings.

Food service revenues are comprised primarily of concession revenues, arising from food and beverage sales at

theatre locations, as well as food and beverage sales at LBE venues including The Rec Room and Playdium. In

addition, food service revenues include home delivery serviced by Uber Eats and Skip the Dishes. CPP represents

theatre food service revenues divided by theatre attendance, and is impacted by the theatre food service product mix,

theatre food service prices, film genre, promotions, discounts for CineClub members, and the Scene+ loyalty

program. CPP can fluctuate from quarter to quarter depending on the genre of film product playing. Cineplex

believes the Scene+ and CineClub programs drive incremental purchase incidence, increasing overall revenues.

Cineplex focuses primarily on growing CPP by optimizing the product offerings, improving operational excellence

and strategic pricing to increase purchase incidence and transaction value. Food service revenues from LBE include

food and beverage revenues from the various bars and restaurants located throughout the venues.

Media revenues include both cinema media (Cineplex Media) and digital place-based media (Cineplex Digital

Media) revenues. Cineplex Media generates revenues primarily from selling pre-show and show-time advertising in

Cineplex’s theatres as well as other circuits through representation sales agreements. Cineplex’s media advertising

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 14

arrangements are impacted by theatre attendance levels which drive impressions and ultimately impact media

revenue generated by Cineplex. Additionally, Cineplex Media sells media placements throughout Cineplex’s circuit

including digital poster cases, as well as sponsorship and advertising in LBE venues. Cineplex Media also sells

digital advertising for cineplex.com, the Cineplex mobile app and on third party networks operated by Cineplex

Digital Media. Cineplex Digital Media designs, installs, maintains and operates digital signage networks in four

verticals including digital out of home (“DOOH”) (in public spaces such as shopping malls and office towers), quick

service restaurants, financial institutions and retailers. Cineplex Digital Media revenue is impacted by mall

attendance which affect impressions and revenue generated.

Amusement revenues include amusement solutions revenues from P1AG, which supplies and services all the games

in Cineplex’s theatre circuit while also supplying equipment to third party arcades, amusement parks and centres,

bowling alleys and theatre circuits across Canada and the United States, in addition to owning and operating FECs.

Additionally, included in amusement revenues are revenues generated by Cineplex’s XSCAPE Entertainment

Centres and game rooms in theatres as well as revenues generated at LBE venues.

Cineplex generates other revenues from the Cineplex Store, online booking fees, promotional activities, screenings,

private parties, corporate events and breakage on gift card sales.

Cost of Sales and Expenses

Film cost represents the film rental fees paid to distributors for films exhibited in Cineplex’s theatres. Film costs are

calculated as a percentage of box office revenue and are dependent on various factors including the performance of

the film. Film costs are accrued on the related box office receipts at either mutually agreed-upon terms established

prior to the opening of a film, or estimated terms where a mutually agreed settlement is reached upon conclusion of

a film’s run, depending upon the film licensing arrangement. There can be significant variances in film cost

percentage between quarters due to, among other things, the concentration of box office revenues amongst the top

films in the period with stronger performing films typically having a higher film cost percentage.

Cost of food service represents the cost of concession items and other theatre food service items sold, and varies

with changes in concession and other theatre food service revenues as well as the quantity and mix of concession

and other food service offerings sold. Cost of food and beverages sold at LBE is also included in cost of food

service.

Depreciation - right-of-use assets, represents the depreciation of Cineplex’s right-of-use assets related to leases.

Depreciation is calculated on a straight-line basis from the date of commencement of the lease to the earlier of the

end of the useful life of the asset or the end of the lease term.

Depreciation and amortization - other, represents the depreciation and amortization of Cineplex’s property,

equipment and leaseholds, as well as certain of its intangible assets. Depreciation and amortization are calculated on

a straight-line basis over the useful lives of the assets.

Loss (gain) on disposal of assets represents the gain recognized on assets or components of assets that were sold or

otherwise disposed.

Other costs are comprised of theatre occupancy expenses, other operating expenses and general and administrative

expenses. These categories are described below.

Theatre occupancy expenses include lease related expenses, percentage rent, property related taxes, business related

taxes and insurance and exclude cash rent accounted for as obligations or interest under IFRS 16, Leases.

Other operating expenses consist of fixed and variable expenses, with the largest component being theatre salaries

and wages. Although theatre salaries and wages net of subsidies (CEWS and THRP) include a fixed cost component,

these expenses vary in relation to revenues as theatre staffing levels are adjusted to handle fluctuations in theatre

attendance. Other components of this category include marketing which includes the cost of Scene+ points issued,

advertising, media, amusement and leisure (including P1AG and LBE), loyalty, digital commerce, supplies and

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 15

services, utilities and maintenance. To the extent these costs are variable, they can be managed with changes in

business volumes.

General and administrative expenses are primarily costs associated with managing Cineplex’s business, including

film buying, marketing and promotions, operations and theatre food service management, accounting and financial

reporting, legal, treasury, design and construction, real estate development, communications and investor relations,

information systems and administration. Included in these costs are payroll (including Cineplex’s Omnibus Incentive

Plan costs), occupancy costs related to Cineplex’s corporate offices, professional fees (such as public accountant and

legal fees) and travel and related costs. Cineplex maintains general and administrative staffing and associated costs

at a level that it deems appropriate to manage and support the size and nature of its theatre and LBE portfolio and its

business activities.

Accounting for Joint Arrangements

The financial statements incorporate the operating results of joint arrangements in which Cineplex has an interest

using either the equity accounting method (for joint ventures and associates) or recognizing Cineplex’s share of the

assets, liabilities, revenues and expenses in Cineplex’s consolidated results (for joint operations).

Under IFRS 11, Cineplex’s 50% share of one IMAX auditorium in Ontario, its 78.2% interest in the Canadian

Digital Cinema Partnership (“CDCP”), 50% interest in YoYo’s Yogurt Cafe (“YoYo’s”), and 33.3% interest in

Scene+ are classified as joint ventures or associates. Through equity accounting, Cineplex’s share of the results of

operations for these joint ventures and associates are reported as a single item in the statements of operations, ‘Share

of income of joint ventures and associates’. Theatre attendance for the IMAX auditorium held in a joint venture is

not reported in Cineplex’s consolidated theatre attendance as the line-by-line results of the joint venture are not

included in the relevant lines in the statement of operations.

In addition to the joint ventures which are equity accounted, Cineplex consolidates its 50% share of assets,

liabilities, revenues and expenses of its joint operation, which includes Scene GP, and up to December 12, 2021,

Scene LP.

As part of the ongoing reorganization of Scene GP (“SCENE”) which began in December 2020, Cineplex and its

loyalty partner launched Scene+ on December 13, 2021 and as a result, Cineplex began equity accounting for its

50% economic interest in Scene LP, the operator of the Scene+ loyalty program.

In the fourth quarter of 2020, Cineplex announced that it had entered into an agreement with its existing partner

Scotiabank to enhance and expand the SCENE loyalty program. Cineplex received $60.0 million in December 2020

from its existing partner with respect to the agreement to reorganize the program and reposition it for future growth.

In conjunction with the agreement, Cineplex’s ownership in Scene+ was reduced to 33.3%. As a result of the

December 13, 2021 step in the reorganization, Cineplex equity accounts for its interest in Scene LP, and continues to

consolidate 50% of Scene GP which subsequent to December 12, 2021 holds the deferred revenue obligation for

SCENE points issued up to December 12, 2021. During the third quarter of 2022, Empire Company Limited became

a one-third partner of Scene+ and Cineplex continues to maintain a 33.3% interest in Scene+.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 16

4. RESULTS OF OPERATIONS

4.1. SELECTED FINANCIAL DATA

The following table presents summarized financial data for Cineplex for the three and nine months ended September

30, 2022 and 2021 (expressed in thousands of dollars except shares outstanding, per share data and per patron data,

unless otherwise noted):

Three months

ended

September 30,

2022

Three months

ended

September 30,

2021

Variance

(%)

Nine months

ended

September 30,

2022

Nine months

ended

September 30,

2021

Variance

(%)

Box office revenues $ 124,700 $ 94,114 32.5 % $ 341,024 $ 110,430 208.8 %

Food service revenues 105,193 79,971 31.5 % 284,218 99,754 184.9 %

Media revenues 25,224 14,060 79.4 % 67,175 32,535 106.5 %

Amusement revenues 69,607 53,319 30.5 % 185,754 89,377 107.8 %

Other revenues 15,113 8,916 69.5 % 40,267 24,622 63.5 %

Total revenues 339,837 250,380 35.7 % 918,438 356,718 157.5 %

Film cost 66,356 45,838 44.8 % 175,330 52,684 232.8 %

Cost of food service 24,839 16,362 51.8 % 65,031 20,641 215.1 %

Depreciation - right-of-use assets 23,277 25,151 -7.5 % 72,026 77,206 -6.7 %

Depreciation and amortization - other assets 26,079 28,297 -7.8 % 79,622 85,541 -6.9 %

(Gain) loss on disposal of assets (49,848) 22 NM (54,341) (29,859) 82.0 %

Other costs (a) 185,048 139,527 32.6 % 500,141 281,584 77.6 %

Costs of operations 275,751 255,197 8.1 % 837,809 487,797 71.8 %

Net income (loss) $ 30,857 $ (33,552) NM $ (10,055) $ (226,944) -95.6 %

Adjusted EBITDA (i) (v) $ 63,094 $ 48,606 29.8 % $ 177,508 $ 1,599 NM

Adjusted EBITDAaL (i) (v) $ 20,430 $ 10,762 89.8 % $ 50,475 $ (104,493) NM

(a) Other costs include:

Theatre occupancy expenses 17,714 15,638 13.3 % 46,874 27,769 68.8 %

Other operating expenses 150,441 108,694 38.4 % 404,968 210,290 92.6 %

General and administrative expenses (v) 16,893 15,195 11.2 % 48,299 43,525 11.0 %

Total other costs $ 185,048 $ 139,527 32.6 % $ 500,141 $ 281,584 77.6 %

EPS - basic (v) $ 0.49 $ (0.53) NM $ (0.16) $ (3.58) -95.5 %

EPS - diluted (v) $ 0.43 $ (0.53) NM $ (0.16) $ (3.58) -95.5 %

Total assets $ 2,089,732 $ 2,108,846 -0.9 % $ 2,089,732 $ 2,108,846 -0.9 %

Long-term debt (iv) $ 825,043 $ 734,046 12.4 % $ 825,043 $ 734,046 12.4 %

Shares outstanding at period end 63,362,713 63,343,113 — % 63,362,713 63,343,113 — %

Adjusted free cash flow per share (ii) $ 0.025 $ (0.091) NM $ 0.026 $ (2.376) NM

Box office revenue per patron (iii) $ 11.25 $ 11.38 -1.1 % $ 11.83 $ 11.23 5.3 %

Concession revenue per patron (iii) $ 8.35 $ 8.58 -2.7 % $ 8.65 $ 8.39 3.1 %

Film cost as a percentage of box office revenues 53.2 % 48.7 % 4.5 % 51.4 % 47.7 % 3.7 %

Theatre attendance (in thousands of patrons) (iii) 11,084 8,272 34.0 % 28,837 9,835 193.2 %

Theatre locations (at period end) 158 161 -1.9 % 158 161 -1.9 %

Theatre screens (at period end) 1,637 1,656 -1.1 % 1,637 1,656 -1.1 %

(i) Represents a non-GAAP financial measure. See Section 17, Non-GAAP and other financial measures.

(ii) Represents a non-GAAP ratio. See Section 17, Non-GAAP and other financial measures.

(iii) Represents a supplementary financial measure. See Section 17, Non-GAAP and other financial measures.

(iv) Represents the principal component as presented on the financial statements net of any equity component and unamortized costs of long-

term debt, Debentures, and Notes Payable. Excludes share-based compensation, lease obligations, fair value of interest rate swap agreements,

post-employment benefit obligations and other liabilities.

(v) 2022 includes expenses related to the Cineworld Transaction and associated litigation and claims recovery in the amount of $1.2 million

(2021 - $4.1 million) for the third quarter and $2.7 million (2021 - $9.1 million) for the year-to-date.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 17

4.2. OPERATING RESULTS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2022

Total revenues

Total revenues for the three months ended September 30, 2022 increased $89.5 million (35.7%) to $339.8 million as

compared to the prior year period. Total revenues for the nine months ended September 30, 2022 increased $561.7

million (157.5%) to $918.4 million as compared to the prior year period. A discussion of the factors affecting the

changes in box office, food service, media, amusement and other revenues for the period is provided below.

Non-GAAP and other financial measures discussed throughout this MD&A, including adjusted EBITDA, adjusted

EBITDAaL, adjusted store level EBITDAaL, adjusted EBITDAaL margin, adjusted store level EBITDAaL margin,

adjusted free cash flow, theatre attendance, BPP, premium priced product, same theatre metrics, CPP, film cost

percentage, food service cost percentage and concession margin per patron are defined and discussed in Section 17,

Non-GAAP and other financial measures.

Box office revenues

The following table highlights the movement in box office revenues, theatre attendance and BPP for the quarter and

the year to date (in thousands of dollars, except theatre attendance reported in thousands of patrons and per patron

amounts, unless otherwise noted):

Box office revenues Third Quarter Year to Date

2022 2021 Change 2022 2021 Change

Box office revenues $ 124,700 $ 94,114 32.5 % $ 341,024 $ 110,430 208.8 %

Theatre attendance (i) 11,084 8,272 34.0 % 28,837 9,835 193.2 %

Box office revenue per patron (i) $ 11.25 $ 11.38 -1.1 % $ 11.83 $ 11.23 5.3 %

BPP excluding premium priced product (i) $ 9.90 $ 10.21 -3.0 % $ 10.27 $ 10.13 1.4 %

Same theatre box office revenues (i) $ 123,369 $ 93,079 32.5 % $ 336,902 $ 109,361 208.1 %

Same theatre attendance (i) 11,015 8,198 34.4 % 28,630 9,757 193.4 %

% Total box from premium priced product (i) 36.5 % 30.4 % 6.1 % 38.9 % 28.9 % 10.0 %

(i) Represents a supplementary financial measure. See Section 17, Non-GAAP and other financial measures.

Box office continuity Third Quarter Year to Date

Box Office

Theatre

Attendance Box Office

Theatre

Attendance

2021 as reported $ 94,114 8,272 $ 110,430 9,835

Same theatre attendance change 31,975 2,816 211,541 18,873

Impact of same theatre BPP change (2,630)

—

11,178 —

New and acquired theatres (i) 697 36 3,419 165

Disposed and closed theatres (i) (401) (40) (366) (36)

Scene+ points issued presented as marketing costs 945 — 4,822 —

2022 as reported $ 124,700 11,084 $ 341,024 28,837

(i) See Section 17, Non-GAAP and other financial measures. Represents theatres opened, acquired, disposed or closed subsequent to the start of

the prior year comparative period and is used to report on Cineplex’s supplementary financial measures.

Third Quarter 2022 Top Cineplex Films 3D % Box Third Quarter 2021 Top Cineplex Films 3D % Box

1 Thor: Love and Thunder

a

18.2 % 1

Shang-Chi and The Legend Of The Ten Rings

a

17.7 %

2 Minions: The Rise of Gru

a

18.2 % 2

Free Guy

a

9.9 %

3 Top Gun: Maverick 11.6 % 3

Black Widow

a

9.9 %

4 Bullet Train 5.8 % 4

The Suicide Squad 7.6 %

5 Elvis 5.1 % 5

Jungle Cruise

a

7.3 %

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 18

Year to Date 2022 Top Cineplex Films 3D % Box Year to Date 2021 Top Cineplex Films 3D % Box

1 Top Gun: Maverick 12.6 % 1

Shang-Chi And The Legend Of The Ten Rings

a

15.0 %

2 Doctor Strange In The Multiverse of Madness

a

7.9 % 2

Free Guy

a

8.4 %

3 The Batman 7.2 % 3

Black Widow

a

8.4 %

4 Thor: Love and Thunder

a

6.8 % 4

F9: The Fast Saga 7.2 %

5 Minions: The Rise of Gru

a

6.8 % 5

The Suicide Squad 6.5 %

Third Quarter and Year to Date

Box office revenues increased $30.6 million to $124.7 million during the third quarter of 2022, compared to $94.1

million recorded in the same period in 2021. This increase was due to a 2.8 million increase in theatre attendance, as

Cineplex’s theatre circuit was open, operating without capacity restrictions during the quarter, compared to the prior

year period that was not fully open until July 17, 2021, was subject to capacity restrictions and had operating

restrictions with the introduction of proof of vaccination programs in September 2021. Despite box office revenues

being impacted by shifts in film releases due to production delays, the release of highly anticipated films also

contributed to the significant increase in box office revenues. This included the continued success of Top Gun:

Maverick which has exceeded $700.0 million in North America and has become the fifth largest domestic film of

all-time, Thor: Love and Thunder and Minions: The Rise of Gru.

BPP for the three months ended September 30, 2022 was $11.25, representing an decrease of $0.13 or 1.1% from

$11.38 reported in the prior year period. The decrease in BPP was primarily due to National Cinema Day on

September 3; admission was $3.00 for all films including all premium priced product and represented 5% of the

attendance for the third quarter, reducing BPP by $0.43. The reorganization of SCENE resulted in a change in

revenue recognition leading to higher box office revenues during the quarter of $2.2 million, a BPP increase of

$0.20 with a corresponding increase in marketing costs of $2.2 million, with respect to Scene+ points issued on box

office transactions.

For the year to date period, box office revenues increased $230.6 million to $341.0 million, compared to $110.4

million recorded in the prior year period. This increase was primarily due to a 19.0 million increase in theatre

attendance as Cineplex’s theatre circuit was open for the entire period with increased operating capacity, compared

to closure requirements or operating restrictions that remained in effect for a majority of the prior year period.

BPP during the year to date period was $11.83, which increased $0.60 or 5.3% from $11.23 reported in the prior

year period. This increase was partially due to higher percentage of box office revenue from premium priced

offerings, which accounted for 38.9% of Cineplex’s box office revenues in the nine months ended September 30,

2022, as compared to 28.9% in the prior year period. The reorganization of SCENE resulted in a change in revenue

recognition leading to higher box office revenues during the year to date period of $6.3 million, a BPP increase of

$0.22 with a corresponding increase in marketing costs of $6.3 million, with respect to Scene+ points issued on box

office transactions.

Box Office Revenue per

Patron

$10.07 $10.16

$9.30

$11.38

$11.25

Q3 18 Q3 19 Q3 20 Q3 21 Q3 22

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 19

Box Office Revenues

(millions)

$173.3

$177.9

$14.5

$94.1

$124.7

Q3 18 Q3 19 Q3 20 Q3 21 Q3 22

Theatre Attendance (millions)

17.2

17.5

1.6

8.3

11.1

Q3 18 Q3 19 Q3 20 Q3 21 Q3 22

Food service revenues

The following table highlights the movement in food service revenues, theatre attendance and CPP for the quarter

and the year to date (in thousands of dollars, except theatre attendance and same store attendance reported in

thousands of patrons and per patron amounts):

Food service revenues Third Quarter Year to Date

2022 2021 Change 2022 2021 Change

Food service - theatres $ 92,520 $ 70,945 30.4 % $ 249,325 $ 82,506 202.2 %

Food delivery - theatres 2,285 2,599 -12.1 % 7,924 10,053 -21.2 %

Food service - LBE 10,373 6,402 62.0 % $ 26,910 7,089 279.6 %

Food delivery - LBE 15 25 -40.8 % 59 106 -44.2 %

Total food service revenues $ 105,193 $ 79,971 31.5 % $ 284,218 $ 99,754 184.9 %

Theatre attendance (i) $ 11,084 $ 8,272 34.0 % 28,837 9,835 193.2 %

CPP (i) (ii) $ 8.35 $ 8.58 -2.7 % $ 8.65 $ 8.39 3.1 %

Same theatre food service revenues (i) $ 91,184 $ 70,046 30.2 % $ 245,229 $ 81,563 200.7 %

Same theatre attendance (i) 11,015 8,198 34.4 % 28,630 9,757 193.4 %

(i) Represents a supplementary financial measure. See Section 17, Non-GAAP and other financial measures.

(ii) Food service revenue from LBE and delivery is not included in the CPP calculation.

Theatre food service revenue continuity Third Quarter Year to Date

Theatre Food

Service

Theatre

Attendance

Theatre Food

Service

Theatre

Attendance

2021 as reported $ 70,945 8,272 $ 82,506 9,835

Same theatre attendance change 24,063 2,816 157,770 18,873

Impact of same theatre CPP change (3,752) — 1,355 —

New and acquired theatres (i) 726 36 3,418 165

Disposed and closed theatres (i) (288) (40) (264) (36)

Scene+ points issued presented as marketing costs 826 — 4,540 —

2022 as reported $ 92,520 11,084 $ 249,325 28,837

(i) See Section 17, Non-GAAP and other financial measures. Represents theatres opened, acquired, disposed or closed subsequent to the start of

the prior year comparative period and is used to report on Cineplex’s supplementary financial measures.

Third Quarter and Year to Date

Food service revenues are comprised primarily of concession revenues, which includes food service sales at theatre

locations and through delivery services including Uber Eats and Skip the Dishes. Food service revenues also include

food and beverage sales at The Rec Room and Playdium.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2022 THIRD QUARTER REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 20