2022

Annual Report

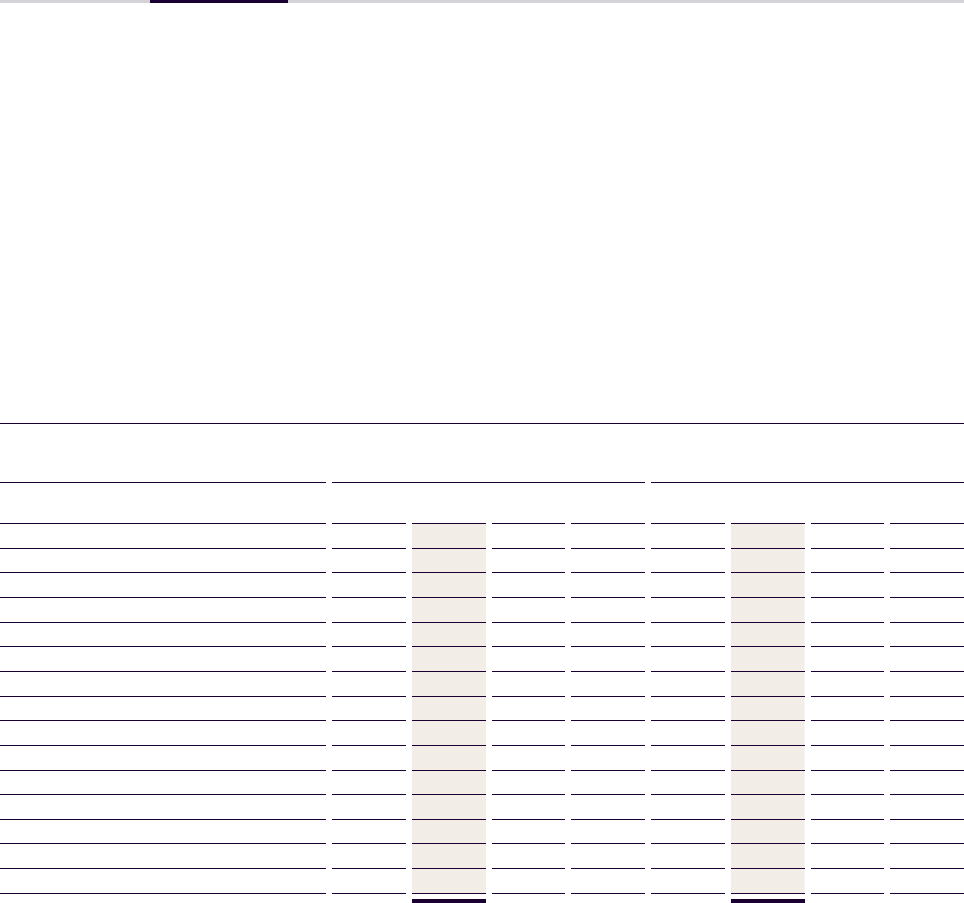

Key Financial Figures at a Glance

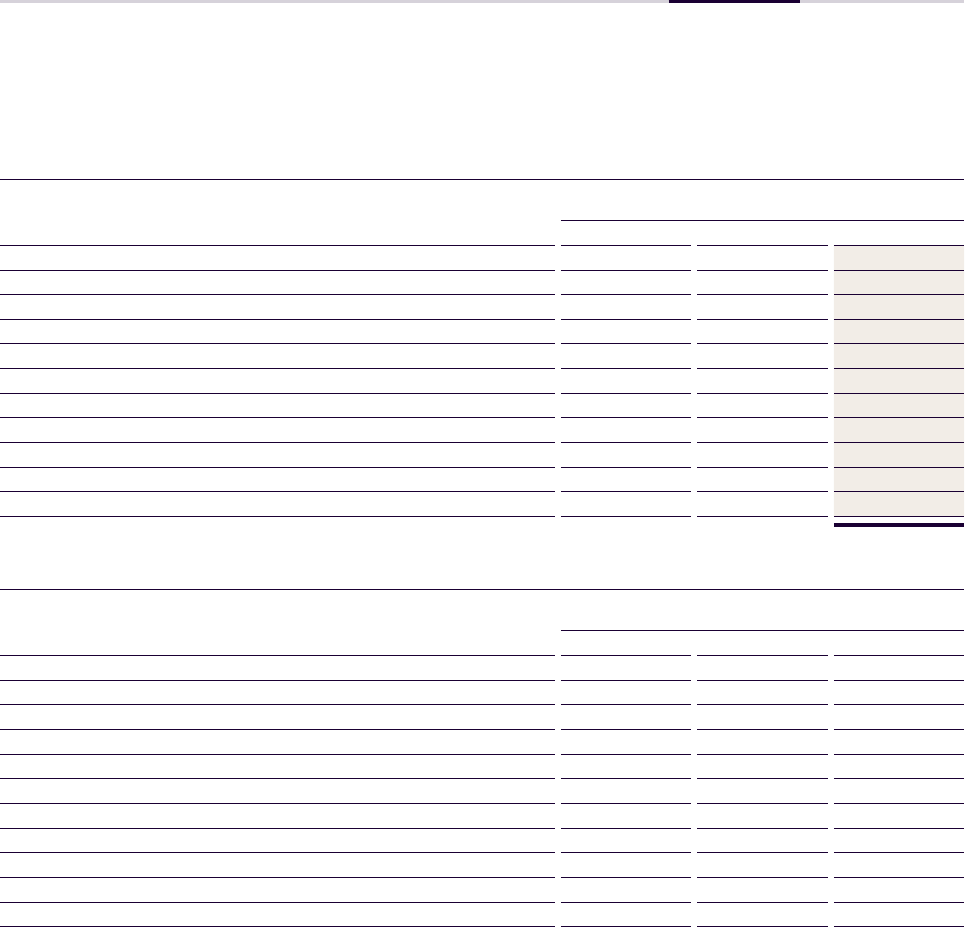

Consolidated Income Statement

2022 2021

Change

in %

Change

in % (fx adj.)

Sales EUR m 19,429.3 14,382.5 35.1 27.7

Operating gross profit EUR m 4,319.0 3,379.0 27.8 20.3

Operating EBITDA EUR m 1,808.6 1,344.6 34.5 26.7

Operating EBITDA/operating gross profit % 41.9 39.8

Operating EBITA EUR m 1,511.7 1,081.9 39.7 31.5

Operating EBITA/operating gross profit % 35.0 32.0

Profit after tax EUR m 902.5 461.4 95.6

Basic earnings per share EUR 5.74 2.90

Diluted earnings per share EUR 5.74 2.89

Consolidated Balance Sheet

Dec. 31, 2022 Dec. 31, 2021

Total assets EUR m 11,373.0 10,195.5

Equity EUR m 4,802.7 3,995.3

Working capital EUR m 2,588.6 2,109.8

Net financial liabilities EUR m 2,049.7 2,070.3

Consolidated Cash Flow

2022 2021

Net cash provided by operating activities EUR m 956.7 388.6

Payments to acquire intangible assets

and property, plant and equipment EUR m –267.2 –199.3

Free cash flow EUR m 1,005.1 439.5

Key Data on the Brenntag Shares

2022 2021

Share price EUR 59.72 79.58

No. of shares (unweighted) 154,500,000 154,500,000

Market capitalization EUR m 9,227 12,295

Free float % 100.00 100.00

2Annual Report 2022 Brenntag SE

Brenntag is the global market leader in chemicals

and ingredients distribution. The company holds a

central role in connecting customers and suppliers

of the chemical industry. With its two global divi-

sions Brenntag Essentials and Brenntag Specialties

the company provides a full-line portfolio of indus-

trial and specialty chemicals and ingredients as

well as tailor-made application, marketing and

supply chain solutions, technical and formulation

support, comprehensive regulatory know-how and

digital solutions for a wide range of industries.

Brenntag operates a global network of about

600locations in 72 countries. With its global work-

force of more than 17,500employees Brenntag

generated sales of EUR 19,4 billion in 2022.

Company

Profile

3Brenntag SEAnnual Report 2022

Letter

from the CEO

4Annual Report 2022 Brenntag SE

CEO LETTER

“Brenntag delivered another outstanding

performance in 2022, achieving record

results. Global presence, a comprehensive

portfolio of products and services, and

strong supplier relationships are the

pillars of our resilience and capabilities.”

Your Brenntag delivered another outstanding performance in 2022,

achieving record results. The basis for this is our business model,

which remains highly resilient even and especially in an extremely

difficult macroeconomic environment with a war ongoing in Europe.

A war which, until a little more than a year ago, we considered un-

thinkable and which throws into question many of the supposed

certainties and assumptions on which we base our business activ-

ities. We, the Board of Management, strongly condemn Russia’s in-

vasion of Ukraine and the continuing war. We were quick to take the

necessary steps after the war started and wound down our business

in and with Russia and Belarus. For another year, particularly heavy

demands were placed on society, industry and Brenntag, too. The

effects were diverse and clearly felt. The sharp rise in energy costs

as a result of the war led to substantial changes in supply and de-

mand, especially in Europe. Numerous manufacturers had to cut

back production or – at least temporarily – stop it completely.

Chemical base materials were in short supply, while others were

only available at increased prices. On top of this, there were further

lockdowns in China as a result of the COVID-19 pandemic, which

once again resulted in bottlenecks at ports and a shortage of con-

tainers. We repeatedly faced disrupted supply chains and the flow

of supplies had to be rethought.

Thanks to our robust business model and our global presence, how-

ever, we were able to supply our customers to the usual standard of

reliability. Reliability that is due especially to the untiring efforts and

outstanding performance of our employees around the globe. Their

expertise and commitment enabled Brenntag to act quickly, find

creative solutions and overcome the challenges. I would like to most

sincerely thank all our employees for that.

Our comprehensive transformation program “Project Brenntag”

also made a significant contribution to our success in financial year

2022. We worked consistently to implement our numerous initiatives

and can say with some degree of pride that we achieved and even

exceeded our ambitious goals a year earlier than planned. By the

end of 2022, the program had generated EUR 249 million in addi-

tional annual operating EBITDA, exceeding the original target of

EUR 220 million for financial year 2023.

Dear ladies and gentlemen,

dear shareholders,

5Annual Report 2022 Brenntag SE

CEO LETTER

Global presence, a comprehensive portfolio of products and services,

and strong supplier relationships are the pillars of our resilience and

capabilities. They are also reflected in our 2022 financial figures.

Last year, Brenntag lifted sales by 27.7% to just over EUR19.43 bil-

lion and generated operating gross profit of around EUR 4.32 billion,

an increase of 20.3%. Our operating EBITDA rose by 26.7% to just

over EUR 1.81 billion.

Our two divisions, Brenntag Specialties and Brenntag Essentials,

both contributed to this remarkable success by delivering an excel-

lent performance and mostly organic growth. As forecasted,

Brenntag Specialties grew at a stronger rate. Operating gross

profit rose by 24.8% to around EUR 1.68 billion. Operating EBITDA

was up by 32.1% to just under EUR 780 million. Brenntag Essentials

also showed a strong performance across all regions. Operating

gross profit grew by 17.7% year on year to around EUR 2.61 billion.

The division generated operating EBITDA of around EUR 1.15 billion,

an increase of 27.6%.

Brenntag has its sights set firmly on further growth and last Novem-

ber presented the “Strategy to Win” with that aim in mind. Our new

growth strategy, including ambitious medium-term targets for 2026,

is the next phase of our company’s transformation and builds con-

sistently on the foundations laid by “Project Brenntag” and the

achievements to date. The strategy involves individual growth plans

for Brenntag Specialties and Brenntag Essentials. Applying these

divisional strategies and leveraging our company’s global footprint

and fundamental strengths, we will further develop the differenti-

ated profiles of our two divisions and propel their growth above the

market growth rate.

Our “Strategy to Win” also sets out a clear program for the compa-

ny’s digital, data-driven transformation. We see Digital.Data.Excel-

lence (DiDEX) as a key growth driver for our Group. We will drive ef-

ficiency at all levels of our organization and develop Brenntag into

a data- and technology-driven business that uses its wealth of data

to develop new business opportunities and smart, innovative solu-

tions and thus generate further growth. We are evolving into an ag-

ile, flexible and, ultimately, the preferred business partner in the

chemical and ingredients distribution ecosystem.

6Annual Report 2022 Brenntag SE

CEO LETTER

Brenntag has the ambition and the skills to shape the future of our

industry. This vision is what drives us. It is also expressed in our new

global branding, which we presented together with the “Strategy to

Win” in November 2022. Strategy, vision and brand – together, they

are a clear signal to our business partners, shareholders and em-

ployees that we forge ahead as global market leader, assuming

responsibility, setting standards and further distancing ourselves

from our competitors.

We are pleased that our strategic growth plan and the new brand

have also received very good feedback from you, our shareholders.

Your reassurance that we are on the right track boosts and moti-

vates us and all our employees.

Industry leadership is also our aspiration when it comes to sustain-

ability: ESG is a top priority in our activities and an essential part of

our growth strategy. As global market leader, we have undertaken

to promote a sustainable future. In publishing our “Future Sustain-

able Brenntag” strategy and vision in April 2022, we set ourselves

an ambitious ESG agenda. This includes achieving net-zero emis-

sions by 2045, increasing the extent to which we use sustainability

criteria to steer our product portfolio and driving sustainability in

our supply chains.

Workplace safety and the health of our global workforce of over

17,500 employees are of paramount importance to us. Our aim by

2030 is to achieve an accident rate (Total Recordable Injury Rate

(TRIR)) of less than 2.0 and prevent serious accidents completely. In

order to achieve this, we stepped up our efforts last year through a

series of new internal campaigns to promote safety and raise aware-

ness. I am very pleased that the measures are paying off: The TRIR,

which still stood at 3.1 in 2021, dropped to 2.7 in the reporting period.

In order to achieve our ambitious growth targets, Brenntag has

always focused on growth through acquisitions, too. The global

chemical distribution market remains highly fragmented and offers

us numerous opportunities for consolidation. Last year, we invested

EUR 184 million in acquisitions in important focus industries and

growth markets. Our strong financial profile, which we continued to

work on in 2022, puts the company in a comfortable position in

terms of financing and gives us sufficient scope for further acquisi-

tions that create value. As part of the “Strategy to Win”, we have

therefore also increased the range for strategic M&A investments

to between EUR 400 and 500 million a year. We remain committed

to our principles: We are a very disciplined acquirer, have set our-

selves strict hurdles and concentrate on maximizing value creation.

7Annual Report 2022 Brenntag SE

CEO LETTER

We are equally reliable in our dividend policy. Since its stock market

listing in 2010, Brenntag has always increased the dividend it pays,

and will build on that again for the twelfth year in succession. At the

General Shareholders’ Meeting, we will propose that a dividend of

EUR 2.00 per share be paid for financial year 2022. This dividend will

afford you, Brenntag’s shareholders, an appropriate and attractive

share in our company’s tremendous success.

Reliability, stability and innovation are the values that guide our

actions. Last year, we demonstrated once again that we have the

ability to adapt to volatile market conditions. Brenntag is resilient

and able to grow even in this environment. Maintaining this resil

-

ience remains an ongoing task – for 2023 as well. We anticipate that

we will be working in a difficult operating environment again. Gen-

eral geopolitical, macroeconomic and operating conditions will

remain challenging. Nevertheless, we expect the situation to grad-

ually return to normal in the course of the year. Against this back-

ground, we expect the Brenntag Group’s operating EBITA

1)

for 2023

as a whole to be between EUR 1,300 million and EUR 1,500 million,

equivalent to operating EBITDA of between EUR 1,600 million and

EUR 1,800 million.

Dear shareholders, we would like to thank you for your loyalty and

your trust. These will continue to be what motivates us to make

Brenntag an even more valuable company.

Essen, March 7, 2023

Dr. Christian Kohlpaintner

Chief Executive Officer

1)

As of 2023, operating EBITA will be the Brenntag Group’s key performance indicator.

8Annual Report 2022 Brenntag SE

CEO LETTER

Brenntag on the Stock Market

The deteriorating, recessionary conditions also impacted on

Germany’s leading index, the DAX, and resulted – unsurpris-

ingly – in a negative annual performance. The DAX closed cal-

endar year 2022 at 13,924 points, a loss of 12.4%. In the course

of the year, the index failed to regain the annual high of 16,272

points attained on January 5, 2022 and on September 29,

2022 reached its annual low at 11,976 points.

Very early on, Brenntag has put in place a global crisis man-

agement system to protect the health and safety of its work-

force and business partners, and in the course of the pan-

demic continually modified this system in line with local

developments in the various regions of the world. As part of

our responsibility as an employer, we implemented strict and

forward-looking safety and hygiene measures at all sites. In

accordance with the statutory options, the General Share-

holders’ Meeting in 2022 was held as a purely virtual event.

Geopolitical uncertainties, the difficult macroeconomic envi-

ronment and the ongoing problems with the COVID-19 pan-

demic, especially in China, had a significant impact on global

capital markets in 2022. The rise in commodity and energy

prices exacerbated by the war in Ukraine, together with sub-

stantial cost increases on the procurement side and in per-

sonnel expenses, acted as an additional drag on the business

sector and, in Europe especially, led to a sharp decline in

business activity.

Moreover, the increasingly restrictive monetary policy of

national and supranational central banks caused the general

economic development to weaken, followed by deep turmoil

on the global capital markets. Overall, equity markets

responded to this large number of headwinds by marking

down prices significantly and ended calendar year 2022 on

sharp losses in the double-digit percentage range.

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

10Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

BRENNTAG ON THE STOCK MARKET

Brenntag share price performance

Global developments also impacted on Brenntag SE shares.

In a difficult macroeconomic environment and amid a high

level of economic uncertainty, Brenntag shares fell by 25%

(23.4% including the dividend payment) over the course of

the year.

The Brenntag Group's operating profit performance in calen-

dar year 2022 was more than offset by general market devel-

opments and expectations. In both the Brenntag Essentials

division and the Brenntag Specialties division, the company

was able to increase its operating EBITDA by a clear margin.

In the context of the “Project Brenntag” transformation pro-

gram, Brenntag SE achieved some major successes and

secured the expected contributions to earnings a year earlier

than originally planned. The new corporate strategy, which

was presented at the Capital Markets Day 2022 in London,

was well received by capital markets participants. The “Strat-

egy to Win” envisages a doubling of the annual M&A spend to

around EUR 400 to 500 million, differentiated strategies for

both Brenntag Essentials and Brenntag Specialties divisions,

and the integration of Digital.Data.Excellence (DiDEX) as a

growth driver.

Brenntag shares marked their annual high at EUR 81.08 on

January 4, 2022 and failed to regain this level during the

course of the year in an environment of falling equity markets.

Brenntag SE shares found their annual low on October 12 at

EUR 55.70, at almost the same time as our benchmark indices

reached their lows.

In particular, the strong rises in commodity and energy prices

in the context of the Ukraine war led to increased price pres-

sure and higher stock volatility. Many chemical manufacturers

saw their business performance decline and this was reflected

in partly sharp price declines on the capital markets.

Brenntag SE shares were also affected by these trends in the

general industry environment and likewise dropped over the

course of the year, despite the good operating performance.

An additional cause of buyer reluctance among investors was

Brenntag SE’s announcement in November 2022 that it was

in preliminary takeover talks of a larger distribution compet-

itor. At the end of 2022, the shares closed at EUR 59.72. In Jan-

uary 2023, Brenntag SE ended the early talks regarding a

potential takeover. Brenntag shares have since made a

noticeable recovery.

65

70

75

80

85

90

95

100

105

Dec.Nov.Oct.Sep.Aug.Jul.Jun.MayApr.Mar.Feb.Jan.

■

Brenntag ■ DAX ■ STOXX Europe 600 Chemicals

1.01 Brenntag share price performance (Indexed)

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

11Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

BRENNTAG ON THE STOCK MARKET

Reference data on the Brenntag shares

As at December 31, 2022, the subscribed capital of Brenntag SE

totaled EUR 154.5 million. The share capital is divided into

154,500,000 no-par value registered shares, each with a

notional value of EUR 1.00.

Since going public in 2010, Brenntag shares have been listed

in Deutsche Börse AG’s Prime Standard segment. Since June

2010, Brenntag shares had been part of the MDAX, the sec-

ond-largest German share index. Since September 2021,

Brenntag SE has been listed on the DAX.

With a market capitalization of EUR 9,137 million at the end of

2022, Brenntag shares ranked 32nd among all listed compa-

nies in Germany, according to the Deutsche Börse AG criteria.

Brenntag shares are included in major international indices

such as selected MSCI indices and the STOXX Europe 600,

which tracks the performance of the 600 largest companies

from 17 European countries, as well as in various sector indi-

ces such as the STOXX Europe 600 Chemicals. In addition,

Brenntag shares are included in various sustainability indices

such as the DAX 50 ESG and the DAX ESG Target Index.

Dec. 31, 2022 Dec. 31, 2021

Number of shares 154,500,000 154,500,000

WKN A1DAHH A1DAHH

ISIN DE000A1DAHH0 DE000A1DAHH0

Trading symbol BNR BNR

Market segments Regulated Market/

Prime Standard

Regulated Market/

Prime Standard

Trading venues Xetra and all

German regional

exchanges

Xetra and all

German regional

exchanges

Selected indices

DAX, MSCI, Stoxx Europe 600,

STOXX Europe 600 Chemicals,

DAX 50 ESG, DAX ESG Target

1.02 Key data on the shares

Brenntag in dialogue with the capital market

Our Investor Relations activities aim to deliver a fair and

transparent communication policy that provides equal treat-

ment to all stakeholders. Through openness and transpar-

ency, we aspire to increase awareness of our company as an

attractive investment and further develop Brenntag’s stand-

ing on the capital market. We communicate our company’s

business performance and strategy continuously, promptly

and reliably. This further strengthens investors’ confidence in

Brenntag and helps to ensure that our shares are adequately

valued on the capital market.

In 2022, we again attached significant importance to per-

sonal contact with capital market participants. The Board of

Management and the Investor Relations team were in con-

stant dialog with investors and analysts worldwide. Capital

market activities were further expanded. We discussed the

company’s business performance in detail in numerous meet-

ings at international roadshows or investor conferences and

at the General Shareholders’ Meeting.

The Investor Relations team made use of a variety of formats

to communicate with investors, both virtually and in person.

The corporate governance roadshow in February 2022 is wor-

thy of note. In the course of this multi-day roadshow, Doreen

Nowotne, Chair of the Supervisory Board of Brenntag SE,

answered questions about the composition of the Board of

Management and the Supervisory Board, the independence

of the Supervisory Board members, the Board of Management

remuneration system and the role of ESG within Brenntag SE

together with the Head of Corporate Investor Relations.

In February 2023, the company conducted a further road-

show on corporate governance. Here, the Chair of the Super-

visory Board of Brenntag SE, Doreen Nowotne, and Richard

Ridinger, Member of the Supervisory Board, presented

changes to the Board of Management remuneration system

in the context of the new corporate strategy as well as human

resources and succession planning on the Supervisory Board,

among other things.

In November 2022, the management of Brenntag SE pre-

sented the new Group strategy, “Strategy to Win”, at the Cap-

ital Markets Day 2022 in London. You can find a video recording

of the event on our website in the section Investor Relations.

In addition to the above-mentioned activities, the Board of

Management and the Investor Relations team regularly pro-

vided institutional investors, analysts and retail investors with

information on Brenntag SE in numerous discussions.

This year, we will continue to present the company at numer-

ous roadshows and capital market events. You will find the

latest list of dates in our financial calendar in the Investor

Relations Section of the Brenntag website at www.brenntag.

com/financial_calendar.

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

12Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

BRENNTAG ON THE STOCK MARKET

Shareholder structure

As at February 28, 2023, notification had been received from

the following shareholders under Section 33 of the German

Securities Trading Act (WpHG) that their share of the voting

rights exceeded the 3% or 5% threshold:

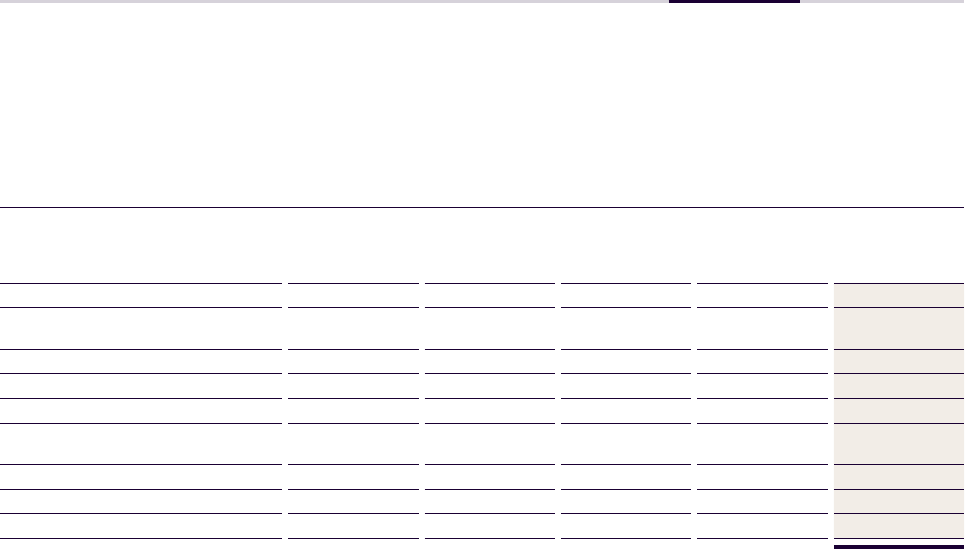

Shareholder

Interest

in %

Date of

notification

BlackRock, Inc. >5 Feb. 06. 2023

The Capital Group Companies, Inc. >5 Jun. 15, 2022

Ameriprise Financial, Inc. >3 Feb. 21. 2023

Flossbach von Storch AG >3 Dec. 22, 2022

Wellington Management Group >3 Dec. 19, 2022

GIC Private Limited >3 Dec. 15, 2022

EuroPacific Growth Fund >3 Nov. 29, 2022

Kühne Holding AG

1)

>3 May 18, 2022

Burgundy Asset Management

2)

>3 Oct. 16 ,2018

1.03 Shareholder structure

1)

Details of person subject to the notification obligation: Klaus-Michael Kühne

2)

Details of person subject to the notification obligation: Hugh Anthony Arrell

All voting rights notifications are published on the company’s

website at www.brenntag.com/voting_rights_announcements.

At the time of reporting, 100% of Brenntag shares were held

in free float as defined by Deutsche Börse. Based on the data

collected most recently (December 31, 2022), more than 93%

of the identified shares are held by institutional investors and

organizations.

Directors’ dealings

In financial year 2022, 14 transactions were reported in

directors’ dealings notifications (managers’ transactions).

These can be viewed at any time on the Brenntag website at

www.brenntag.com/managerstransactions.

Analysts’ opinions

Brenntag is continuously monitored and rated by a large

number of international financial analysts. Currently (as at:

February 28, 2023), 22 banks regularly publish research

reports on our company’s latest performance and issue rec-

ommendations. Eighteen analysts have a buy recommenda-

tion and three have a hold recommendation on the Brenntag

shares. There is no sell recommendation at the present time.

One analyst firm is currently reorganizing their coverage and

does not issue a recommendation or price target for the

Brenntag shares. Many analysts value Brenntag highly as a

growth stock with strong cash flow generation. Furthermore,

following the successful implementation of “Project

Brenntag”, they see additional potential in the implementa-

tion of the next phase of the company’s transformation,

Brenntag’s “Strategy to Win”. As at February 20, 2023, the

average share price target was EUR 87.14.

1.04 Shareholdings of institutional investors by region

1)

1)

Data collected as at December 31, 2022; Source: Nasdaq

1.05 Analysts’ opinions

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

13Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

BRENNTAG ON THE STOCK MARKET

20.1%

UK & Ireland

18.0%

Continental

Europe

12.0%

Germany

7.6%

Rest of World

42.4%

North America

3

Neutral

18

Buy

Analysts covering Brenntag SE

■

Baader Helvea

■

Bank of America

■

Bankhaus Metzler

■

Barclays

■

Berenberg Bank

■

Citigroup

■

Credit Suisse

■

Deutsche Bank

■

DZ Bank

■

Exane BNP Paribas

■

Goldman Sachs

■

HSBC

■

J. P. Morgan Cazenove

■

Jefferies

■

Kepler Cheuvreux

■

LBBW

■

Morgan Stanley

■

Oddo BHF

■

Societe Generale

■

Stifel

■

UBS

■

Warburg Research

Up-to-date information on this can be found on our website

at www.brenntag.com/analysts_opinions.

Creditor Relations

Brenntag has an extremely strong, long-term financial profile.

We have a capital structure that enables the Group to cover

its potential financing requirements at all times, including in

a difficult capital market environment. This gives us a high

degree of security, independence and financial flexibility. The

most important component in the financing structure of

Brenntag SE is the Group-wide syndicated loan agreement.

In addition, two bonds and a promissory note transaction are

currently outstanding with very favorable terms, underscoring

Brenntag SE’s high credit standing.

This strong credit profile maintained by Brenntag is reflected

in investment grade ratings from the two international rating

agencies Standard & Poor’s and Moody’s. Standard & Poor’s

assigns a “BBB” rating (outlook: positive). Standard & Poor’s

last raised the outlook from “stable” to “positive” in September

2021. Moody’s last raised Brenntag SE’s rating to "Baa2" (out-

look: stable) in March 2021. Previously, Moody’s had assigned

Brenntag a "Baa3" rating (outlook: positive).

In August 2022, Brenntag issued promissory notes totaling

around EUR 640 million. The promissory notes comprise a

total of seven tranches with tenors of three, five and seven

years and carrying both fixed and floating interest rates.

Alongside euro-denominated tranches totaling EUR 390 mil-

lion, the company also issued US dollar-denominated

tranches totaling USD 250 million. The transaction marks the

company’s first promissory note issue. The cash inflow from

the transaction will be used to generally fund the Brenntag

Group’s business development. Brenntag’s promissory note

placement in financial year 2022 confirmed its outstanding

market access in a challenging capital market environment,

optimized the currency mix and maturity profile of its liabili-

ties, and thus bolstered its solid financing.

Bond 2025 Bond 2029

Issuer Brenntag Finance B.V. Brenntag Finance B.V.

Listing Luxembourg

stock exchange

Luxembourg

stock exchange

ISIN XS1689523840 XS2394063437

Aggregate principal amount EUR m 600 500

Denomination EUR 1,000 100,000

Minimum transferrable amount EUR 100,000 100,000

Coupon % 1.125 0.500

Interest payment annual 27 Sep. 6 Oct.

Maturity Sep. 27, 2025 Oct. 6, 2029

1.06 Key data on the bonds of the Brenntag Group

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

14Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

BRENNTAG ON THE STOCK MARKET

General shareholders’ meeting

The virtual, ordinary General Shareholders’ Meeting of

Brenntag SE was held in Essen on June 9, 2022. With atten-

dance at around 80%, the shareholders were very well repre-

sented. The General Shareholders’ Meeting confirmed all res-

olutions proposed by the Board of Management and the

Supervisory Board with a large majority in each case. At the

General Shareholders’ Meeting, shareholders reelected Mr.

Wijnand P. Donkers and Mr. Ulrich M. Harnacke as members

of the Supervisory Board. Shareholders also passed resolu-

tions on various capital transactions, such as creating the

authorization for a share buyback program and an authori-

zation to issue a bond with warrants. The proposal to pay a

dividend of EUR 1.45 per share was approved, representing a

7.0% increase compared with the previous year.

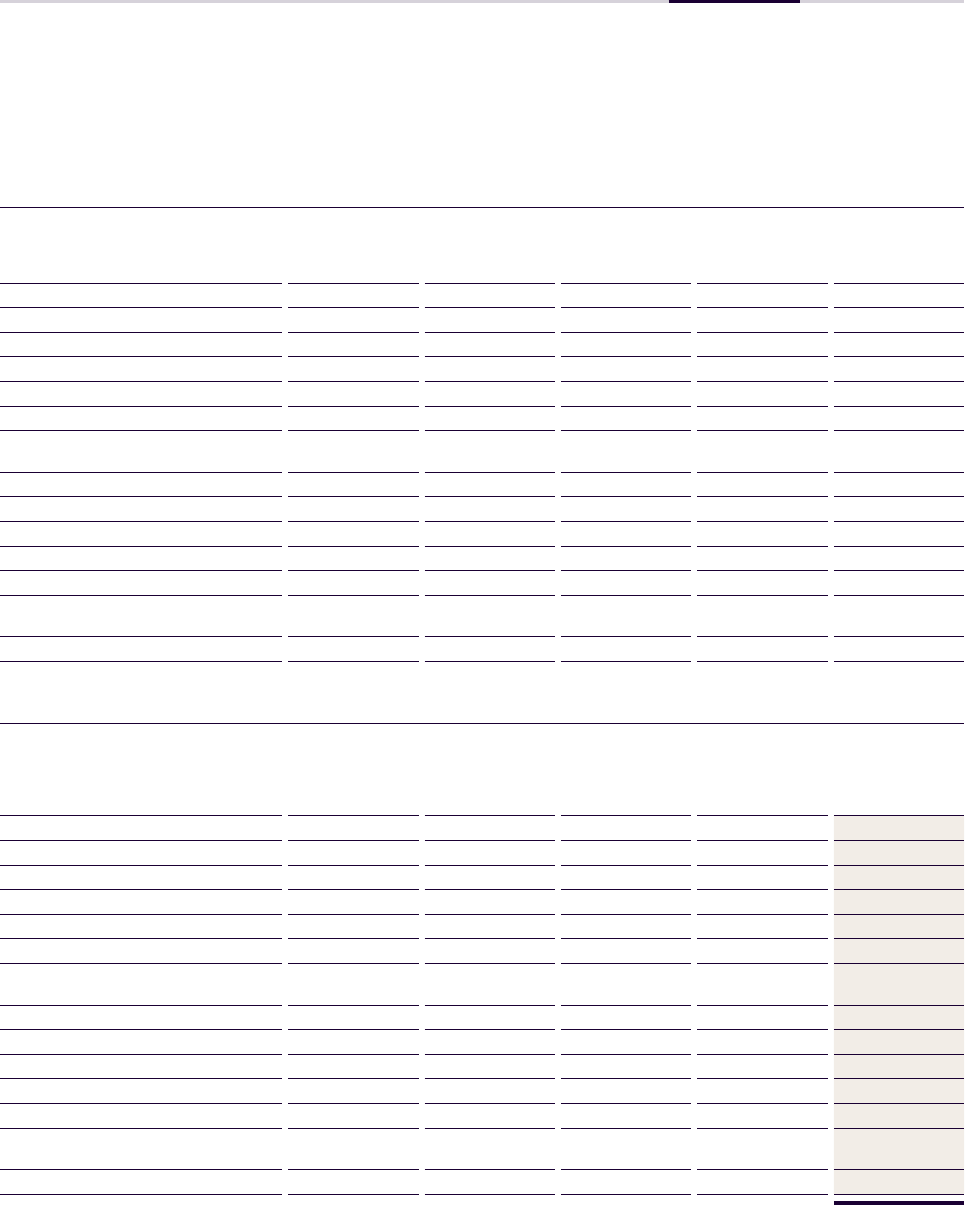

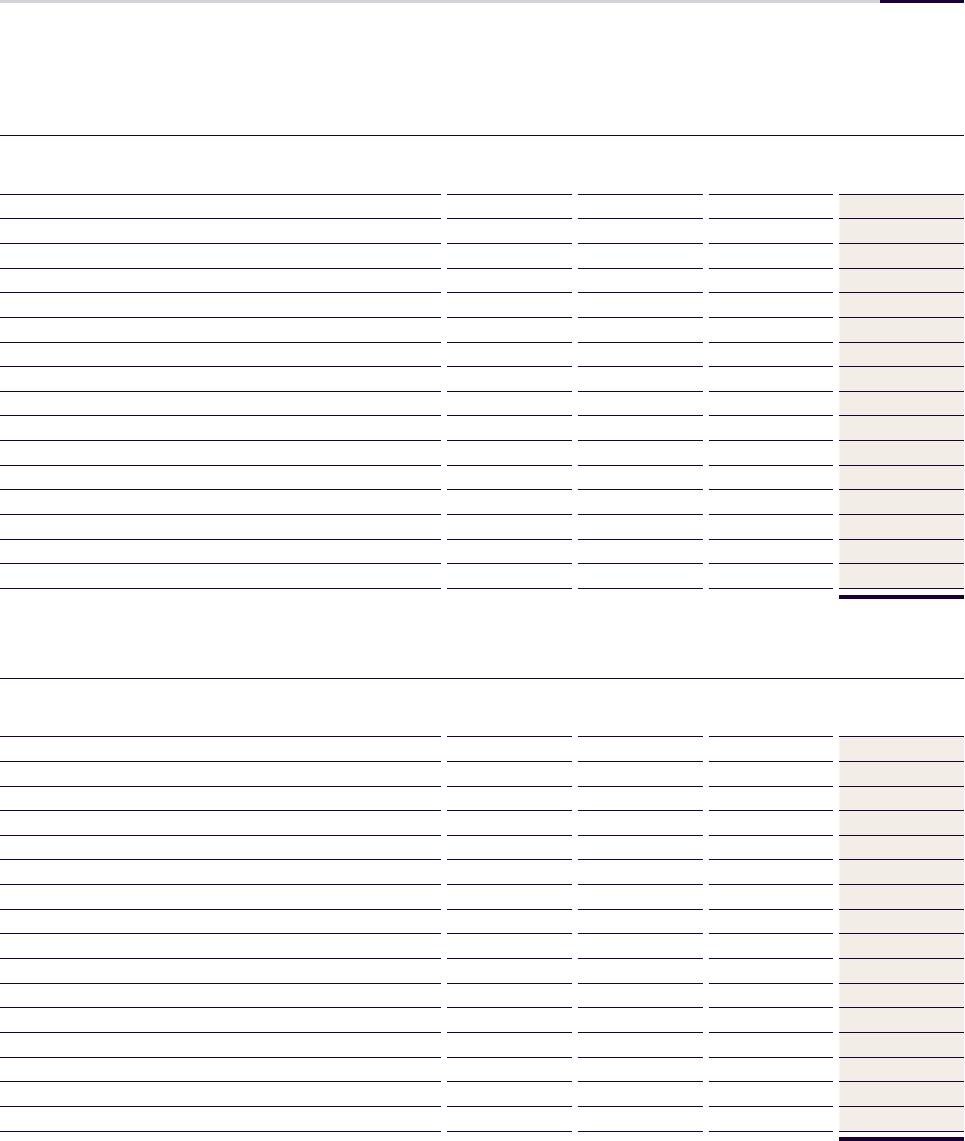

Attractive dividend proposal for 2022

Since going public in 2010, the company has paid its share-

holders a higher dividend each year. Since the stock market

flotation in 2010, the average annual dividend increase of the

Brenntag share, including the current dividend proposal, has

been 12.8% per annum, meaning that the absolute dividend

has increased by 325.5% overall.

Brenntag intends to increase the dividend for its shareholders

for financial year 2022, too. The Board of Management and

the Supervisory Board will recommend to shareholders at the

General Shareholders’ Meeting in June 2023 a dividend pay-

ment of EUR 2.00 per share. Subject to its approval at the

General Shareholders’ Meeting, this will be the twelfth con-

secutive dividend increase since the stock market flotation in

2010. The payout ratio on the basis of the consolidated profit

after tax attributable to shareholders of Brenntag SE would

therefore be 35%. With this payout ratio, which is in line with

capital market communications, we are allowing sharehold-

ers to participate in the company’s extraordinarily positive

earnings and cash flow development.

1.07 Dividend performance

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

15Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

BRENNTAG ON THE STOCK MARKET

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

1.80

2.00

2.20

2022202120202019201820172016201520142013201220112010

0.47

0.67

0.80

0.87

0.90

1.00

1.05

1.10

1.20

1.25

1.35

1.45

2.00

(Proposal)

in % 1 year 3 years 5 years 10 years

Brenntag shares

1)

–23.4 9.6 4.9 8.4

DAX –12.3 1.7 1.5 6.2

STOXX Europe 600 Chemicals –14.3 6.1 6.5 8.4

1.09 Average annual performance of Brenntag shares and relevant benchmark indices in percent

1)

Received dividends reinvested. Due to rounding, the absolute totals may differ.

0

100

200

300

400

500

600

2022202120202019201820172016201520142013201220112010

■ Brenntag ■ DAX ■ STOXX Europe 600 Chemicals

Historical performance

1.08 Historical performance

1)

of Brenntag shares compared with the DAX (Mar. 29, 2010 to Dec. 31, 2022)

1)

Share price performance including dividends

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

16Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

BRENNTAG ON THE STOCK MARKET

Dec. 31, 2022 Dec. 31, 2021

No. of shares 154,500,000 154,500,000

Dividend (in EUR) 2.00

6)

1.45

Dividend yield (in %)

1)

3.30 1.80

Payout ratio (in %) 35.00 50.00

Earnings per share (in EUR)

2)

5.74 2.90

Book value per share (in EUR)

3)

30.80 25.30

XETRA closing price (in EUR) 59.72 79.58

XETRA high (in EUR) 81.08 86.80

XETRA low (in EUR) 55.70 64.26

XETRA average price (in EUR) 68.21 76.83

Average daily trading volumes

XETRA and Frankfurt

Shares 444,560 314,019

EUR k 30,267,458 24,087,647

Market capitalization

(in EUR m)

4)

9,227 12,295

Price-earnings ratio

5)

10.40 27.40

1.10 Key data on the Brenntag shares

1)

Dividend/closing price x 100.

2)

Profit attributable to shareholders of Brenntag SE/number of shares.

3)

Equity attributable to shareholders of Brenntag SE/number of shares.

4)

Market capitalization at year-end.

5)

Closing price/earnings per share.

6)

As per the proposal for the appropriation of profit presented by the Board of

Management and the Supervisory Board, subject to approval at the General

Shareholders’ Meeting on June 15, 2023.

Service for shareholders

You can find comprehensive information on Brenntag SE and

the Brenntag shares on the Investor Relations website. In

addition to financial reports and presentations, it also con-

tains all the key dates on the financial calendar. The confer-

ence calls on the quarterly and annual financial statements

are recorded and offered in audio format. Shareholders and

interested parties can register by e-mail to be placed on the

investor mailing list. The Investor Relations team would also

be happy to help you in person.

Telephone: +49 (0) 201 6496 2100

Fax: +49 (0) 201 6496 2003

E-mail: IR@brenntag.de

Web: www.brenntag.com/investor_relations

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

17Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

BRENNTAG ON THE STOCK MARKET

In the 2022 reporting period, Brenntag made clear progress in imple-

menting the transformation initiated in 2020, while at the same time

successfully overcoming the operational challenges arising from

macroeconomic conditions.

At the end of 2022 – that is, a year earlier than planned – Brenntag

was able to announce that the goals of “Project Brenntag”, the first

chapter in our transformation, had already been achieved and even

exceeded. The two global divisions Brenntag Specialties and

Brenntag Essentials were thus fully established, providing the basis

for the next phase of the company’s transformation, which it initiated

in November by adopting the “Strategy to Win”. The focus is now pri-

marily on strengthening the two divisions’ market position and devel-

oping the business model into a data- and technology-driven one.

The war in Ukraine has not only brought endless suffering to millions

of people; it has also led to severe geopolitical, energy policy and

economic turmoil. The resulting scarcity of transport capacity,

product shortages and high inflation have impacted significantly on

business operations. In these times, our business partners value

Brenntag’s reliability and delivery capability, which we demonstrated

once again thanks to our unrivaled global position and the dedicated

efforts of the entire organization. On behalf of the entire Supervisory

Board, I would like to say a big thank-you to all Brenntag employees

for their outstanding performance during the past financial year.

Cooperation between the Board of Management and

Supervisory Board

Due to the large number of projects and challenges, the Board of

Management and the Supervisory Board worked together very

closely in the reporting period. The Supervisory Board of Brenntag SE

performed the duties assigned to it by law, by the company’s Arti-

cles of Association and by its rules of procedure with the utmost

diligence. The members of the Supervisory Board regularly advised

the Board of Management in its management of the company and

monitored its activities. The Board of Management provided the

Supervisory Board with timely and comprehensive information on

all issues of relevance to the company.

Dear ladies and gentlemen,

dear shareholders,

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

19Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

The points of focus here included the review and monitoring of the

development and implementation status of the transformation, i.e.

in particular the progress in implementing “Project Brenntag” and

the development of the “Strategy to Win”, the further development

of the corporate culture and the sustainability strategy, including

their embedding in operating activities, the capital allocation strat-

egy and specific acquisition projects. Other recurring topics on the

agenda at the Supervisory Board meetings in the financial year

2022 included the exceptional macroeconomic challenges due to

the war in Ukraine, the strains on global supply chains and the asso-

ciated substantial price increases. Moreover, the Supervisory Board

regularly turned its attention to global site and process safety and

advised the Board of Management on the further development of

safety standards, particularly with regard to accident prevention.

The Supervisory Board was also kept up to date on the risk position,

including risk management, deviations from plan and compliance

matters.

The Supervisory Board had ample opportunity to address in depth,

examine, discuss and consult on the reports from and resolutions

proposed by the Board of Management. In doing so, the Supervisory

Board always satisfied itself that at any time the company was

managed in an effective, proper and lawful manner. In addition, the

Supervisory Board was directly involved in all decisions of funda-

mental importance to the company at an early stage and discussed

those decisions with the Board of Management in detail.

The Supervisory Board held five ordinary meetings in the 2022

reporting period, one of which took place virtually. In addition, three

extraordinary meetings were held, two of them in the form of video

conferences and one in person. Despite the large number of Super-

visory Board meetings, we achieved the highest possible atten-

dance rate of 100% at the ordinary and extraordinary Supervisory

Board meetings. Mr. Ridinger was excused for being absent from

one meeting of the Audit Committee, so the overall attendance rate

at the committee meetings was 99%.

On five matters, the Supervisory Board took decisions by circular

resolution. Those decisions concerned personnel matters, the 2021

remuneration report, the convening of the General Shareholders’

Meeting on June 9, 2022, the continued development of the business

responsibility plan and the engagement of PricewaterhouseCoopers

GmbH Wirtschaftsprüfungsgesellschaft (PwC), Düsseldorf, as audi-

tor for the combined separate non-financial report for 2022.

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

20Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

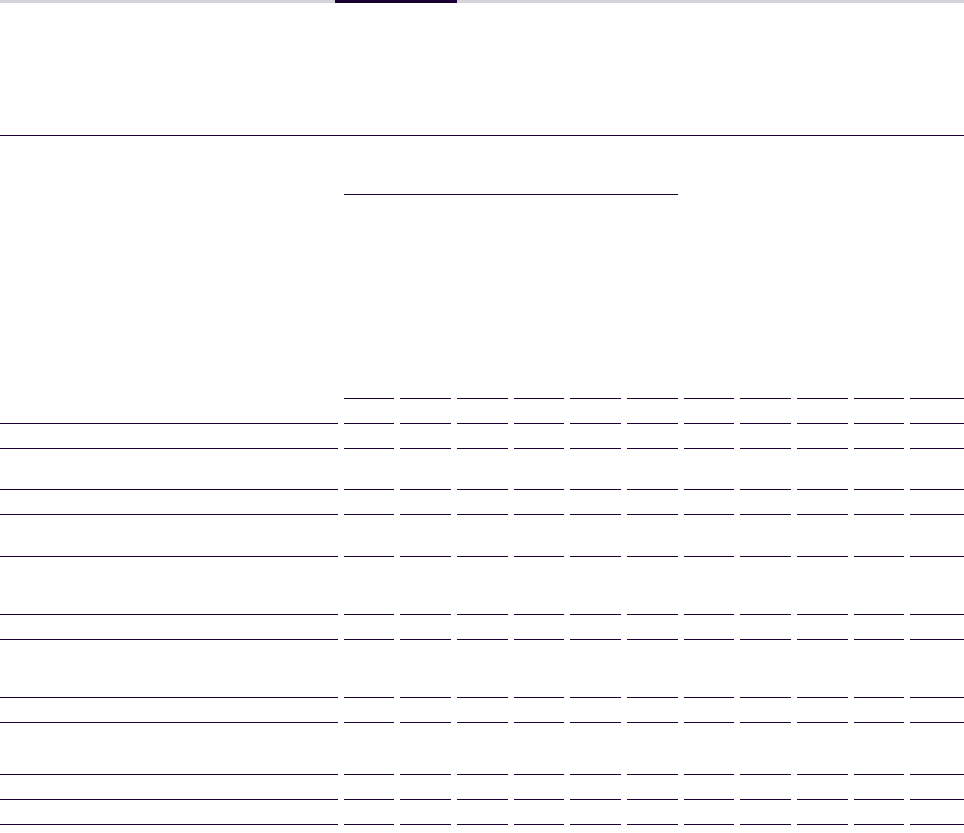

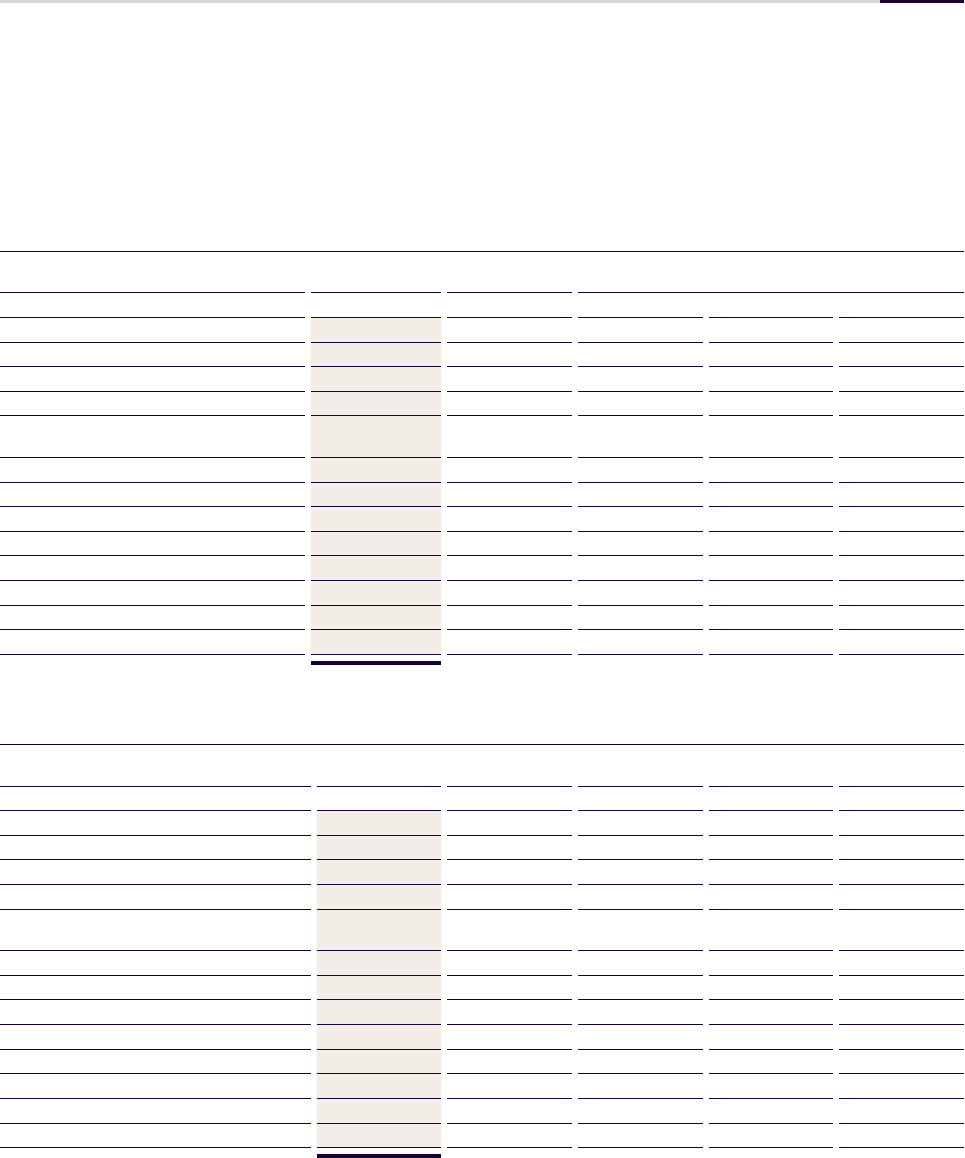

The following table contains a detailed overview of the Supervisory

Board members’ attendance at Supervisory Board and committee

meetings:

Name

Ordinary

Supervisory Board

meetings

Extraordinary

Supervisory Board

meetings

Meetings of the

Audit Committee

Meetings of the

Presiding and

Nomination

Committee

Meetings of the

Transformation and

Sustainability

Committee

Doreen Nowotne 5/5 3/3 – 12/12 9/9

Dr. Andreas Rittstieg 5/5 3/3 – 12/12 –

Stefanie Berlinger 5/5 3/3 8/8 – –

Wijnand P. Donkers 5/5 3/3 – 12/12 9/9

Ulrich M. Harnacke 5/5 3/3 8/8 – –

Richard Ridinger 5/5 3/3 7/8 – 9/9

1.11 Meeting attendance in 2022

The members of the Board of Management participated in the

Supervisory Board meetings. However, the Supervisory Board also

met regularly without the Board of Management. In the reporting

period, the Supervisory Board also consulted a total of seven times,

usually in connection with a Supervisory Board meeting, without the

Board of Management in attendance.

The members of the Supervisory Board were also available to

advise the Board of Management between the meetings and placed

particular emphasis on intense dialog. Thus, in 2022, two recluse

meetings were held in physical form, where the Board of Manage-

ment and the Supervisory Board spent two days consulting on and

discussing matters relating to the company’s strategic develop-

ment in greater depth. In addition, there was regular interaction on

current topics between the Chair of the Supervisory Board and the

Chair of the Board of Management. With regard to strategy devel-

opment, other members of the Supervisory Board also coordinated

individually with the Board of Management on specific issues.

Due to the intensive cooperation, the Supervisory Board was able

to consult with the Board of Management on the company’s future

strategic direction and to decide on business transactions and

measures presented by the Board of Management and requiring the

Supervisory Board’s approval.

In order to perform its duties efficiently, the Supervisory Board has

established various committees that prepare for discussions

and resolutions on the Supervisory Board or can adopt resolutions

themselves. Further information on the duties of the Supervisory

Board can be found in the section “Working Practices of the Board

of Management and Supervisory Board as well as the Composition

and Working Practices of their Committees” in the Corporate

Governance Statement. For information on the topics and resolu-

tions, please refer to the following section, “Topics Addressed in the

Supervisory Board Meetings”.

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

21Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

Topics addressed in the Supervisory Board meetings

On March 8, 2022, the Supervisory Board held its first ordinary meet-

ing. The focus of this meeting was on the 2021 consolidated finan-

cial statements of Brenntag SE, on which both the Board of Man-

agement and the appointed auditors, PwC, reported in detail. The

Audit Committee informed the Supervisory Board about its review

and discussion of the consolidated and annual financial state-

ments. After reviewing the documents and determining that there

were no objections to be raised, the Supervisory Board approved the

consolidated financial statements of Brenntag SE for the financial

year 2021 and the annual financial statements of Brenntag SE,

which were thus adopted. This was followed by a detailed report on

general market conditions, strategy development and selected

compliance matters. The Supervisory Board also dealt with the fur-

ther development of global site and process safety and the devel-

opment of the Digital.Data.Excellence initiative. With regard to sus-

tainability, the Board of Management presented the ESG targets

achieved in 2021. It also put forward the specific ESG targets for

2022 and the newly developed medium- and long-term sustainabil-

ity strategy, including further medium- and long-term ESG targets.

Finally, there was also in-depth discussion of the implications of the

war in Ukraine. In this context, the Supervisory Board and the Board

of Management discussed Brenntag’s business in Russia and pos-

sible consequences. In addition, a crisis team was set up to monitor

the situation. The Supervisory Board supported the Board of Man-

agement’s decision to suspend all imports and exports to and from

Russia and Belarus in an orderly manner and to discontinue and

wind up business operations in Russia until further notice.

At its second ordinary meeting, held in the form of a video confer-

ence on April 22, 2022, the Supervisory Board turned its attention to

the combined separate non-financial report. The Audit Committee

and the appointed auditors, PwC, Düsseldorf, presented and

explained the results of their limited assurance engagement on the

combined separate non-financial report. The Supervisory Board fol-

lowed the Audit Committee’s recommendation and approved the

combined separate non-financial report.

The Supervisory Board held its third ordinary meeting on June 9, 2022

after the ordinary General Shareholders’ Meeting. The Board of

Management provided information on the current status of business

and reported in particular on the effects of the war in Ukraine on

Brenntag’s business performance. In addition, the Board of Manage-

ment presented the results of a global safety and process analysis

across all sites and discussed the next steps with the Supervisory

Board. The meeting also focused on discussion and approval of a

project to support the Digital.Data.Excellence strategy, which entails

investments in Brenntag’s IT systems and programs aimed at

improving digital capacities and capabilities. Furthermore, the Board

of Management informed the Supervisory Board about the progress

on IT security in a comprehensive report. The Supervisory Board also

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

22Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

discussed projects related to mergers & acquisitions and the devel-

opment status of the growth strategies for the Brenntag Specialties

and Brenntag Essentials divisions. The Board of Management

reported on the status of the sustainability strategy’s development

and discussed the planned internal carbon management program

with the Supervisory Board. Finally, the Board of Management pro-

vided information on risk management and compliance matters.

At its fourth ordinary meeting on September 7, 2022, the Supervisory

Board dealt once again with the development of the “Strategy to

Win”. One focus of discussion was the corporate culture that had

been developed and the associated requirements for the profile of

skills and expertise for Brenntag managers. Furthermore, the Super-

visory Board advised the Board of Management on the further differ-

entiation of the divisional strategies. The Supervisory Board learned

about current business performance and approved a multi-year

partnership with Salesforce to enable Brenntag to offer its customers

and suppliers an effortless, data-driven and personalized user expe-

rience and thus fundamentally improve collaboration with custom-

ers and suppliers. Finally, on the topic of mergers & acquisitions, the

Supervisory Board addressed strategic questions related to a possi-

ble acquisition in respect of synergy- and evaluation-related issues.

At a total of three extraordinary meetings on October 18, 2022,

October 27, 2022 and November 14, 2022, one of which was held in

person, the Board of Management presented various potential

acquisition projects to the Supervisory Board. In particular, discus-

sions at these three extraordinary meetings covered matters relat-

ing to strategic direction, integration and effects of the possible

downturn in the macroeconomic environment on the evaluation

and financing of the potential acquisition projects. In addition at the

extraordinary meetings on October 18, 2022 and October 27, 2022,

the developed “Strategy to Win” was presented by the Board of

Management and discussed in depth with the Supervisory Board.

At the meeting on October 27, 2022, the Supervisory Board approved

the acquisition of all shares in Globe Chemical LLC based in Odessa,

Texas, USA, from Gravity Oilfield Services LLC. At the same meeting,

the Supervisory Board also approved the takeover of the Life

Science and Coatings business of Australian specialty distributor

Ravenswood.

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

23Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

At the fifth and final ordinary meeting of the reporting period on

December 13, 2022, the Board of Management informed the Super-

visory Board about the next steps to implement the adopted “Strat-

egy to Win”. Besides the Board of Management’s presentation on

the third-quarter results of the Brenntag Specialties and Brenntag

Essentials divisions, another focal point of the meeting was the 2023

budget planning, which the Supervisory Board approved after con-

sulting with the Board of Management in depth and discussing the

trend in economic conditions. The Board of Management also pre-

sented the non-financial objectives for 2023, which were likewise

approved by the Supervisory Board. This was followed by status

reports on accident statistics and accident prevention. In addition,

Global Human Resources presented information on succession

planning and talent development. The Supervisory Board discussed

the steps in the selection procedure, the outcome of the procedure

and the Audit Committee’s recommendation of a statutory auditor

and group auditor, and decided to propose at the 2023 General

Shareholders’ Meeting that Deloitte GmbH Wirtschaftsprüfungs-

gesellschaft, Düsseldorf, be elected as statutory auditor and group

auditor for the financial year 2023. The Supervisory Board also

decided on the updated versions of the rules of procedure for the

Supervisory Board, the Board of Management and the Audit

Committee, and also amended the rules of procedure for the Trans-

formation and Sustainability Committee so as to reflect the latest

changes to the recommendations of the German Corporate Gover-

nance Code and the progress in developing the corporate strategy.

In this context, the Transformation Committee was renamed Trans-

formation and Sustainability Committee so as to reflect the shift in

the focus of its activities. Finally, the Supervisory Board decided on

the annual declaration of conformity with the German Corporate

Governance Code.

Supervisory Board Committee activities

In the financial year 2022, the Supervisory Board had a total of three

committees: the Audit Committee, the Presiding and Nomination

Committee, and the Transformation and Sustainability Committee.

Their respective chairs reported on the current work of the commit-

tees in the Supervisory Board meetings.

The Audit Committee, composed of Mr. Ulrich M. Harnacke (Chair),

Ms. Stefanie Berlinger and Mr. Richard Ridinger in the reporting

period, held a total of eight meetings. Four meetings were held in

person and four meetings virtually. The composition of the Audit

Committee meets the latest requirements and recommendations

regarding the financial expertise of the committee members under

the German Stock Corporation Act and the German Corporate Gov-

ernance Code, as Mr. Ulrich M. Harnacke has expertise in financial

statement auditing and special knowledge and experience in the

application of accounting principles and internal control and risk

management systems. Ms. Stefanie Berlinger likewise has appro-

priate expertise in financial statement auditing.

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

24Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

Key topics addressed by the Audit Committee included the prepa-

rations for the audit of the annual financial statements, the consol-

idated financial statements, the management report and the Group

management report as well as the proposal for the appropriation

of profit and the review of the quarterly financial statements, the

half-year report and the quarterly statement. The statutory auditor

reported to the Audit Committee without undue delay on all findings

and issues arising in the course of the statutory audit that were of

importance to the duties of the Supervisory Board. In addition, the

statutory auditor provided notification or noted in the audit report

that it had not identified any facts while performing the statutory

audit that would result in a (further) deviation from the declaration

of conformity with the German Corporate Governance Code sub-

mitted by the Board of Management and the Supervisory Board.

Bearing in mind the recommendations of the German Corporate

Governance Code, the Supervisory Board has set out these princi-

ples in the Audit Committee rules of procedure and in particular

stipulated that the Audit Committee conduct a regular assessment

of the statutory audit. At its meetings, the Audit Committee dealt

extensively with the switch from regional to divisional reporting in

connection with the transformation project “Project Brenntag”.

The Audit Committee also gave detailed attention to the work and

findings of Internal Audit, the effectiveness of the internal control

system and the risk management system, and the further develop-

ment of the compliance management system. Further topics cov-

ered at the meetings included the review of the combined separate

non-financial report for the financial year 2021. In addition, the Audit

Committee consulted with the Board of Management and the rele-

vant department on the future structure of the combined separate

non-financial report. Following the election of PwC as statutory

auditor at the General Shareholders’ Meeting in the reporting period

and its statement to the Audit Committee that there are no circum-

stances that would call into question its impartiality, the Audit

Committee assured itself of the auditors’ required independence

and issued the audit engagement. There was also regular interaction

between the Audit Committee – in particular the Chair – and the

auditors outside of the meetings.

In the reporting period, the Audit Committee put the audit of the

annual financial statements of Brenntag SE, the consolidated finan-

cial statements and the combined management report for the

financial year 2023 out to public tender in accordance with the EU

provisions reforming statutory audit, doing so a year earlier than

required by law. On the initiative of the Chair of the Audit Committee,

a working group was established to select the statutory auditor. The

working group ensured that the tender procedure was carried out in

a fair, transparent and non-discriminatory manner in accordance

with Article 16 of the EU Regulation. Following a careful review of the

proposals submitted and presentations from the teams from the

audit firms submitting proposals, including in Brenntag SE’s princi-

pal finance departments abroad, the Audit Committee decided to

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

25Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

recommend to the Supervisory Board that it propose at the 2023

General Shareholders’ Meeting that Deloitte GmbH Wirtschafts-

prüfungsgesellschaft, Düsseldorf, be elected as statutory auditor

and group auditor for the financial year 2023.

The Presiding and Nomination Committee was composed of the

Chair of the Supervisory Board, Ms. Doreen Nowotne, as well as

Dr.Andreas Rittstieg and Mr. Wijnand P. Donkers. In the reporting

period, the Committee met a total of twelve times. Three meetings

were held in person and nine meetings virtually. In particular, the

Presiding and Nomination Committee dealt with personnel matters,

short-term and long-term succession planning on the Board of

Management, the preparations for Supervisory Board resolutions on

the definition of the variable remuneration for the Board of Manage-

ment and the review of the remuneration system for the Board of

Management.

Another main focus was the succession planning of the Supervisory

Board, the review of the Supervisory Board’s profile of skills and

expertise, and the preparations for the Supervisory Board’s propos-

als for the election of Supervisory Board members for the General

Shareholders’ Meeting in 2022 and 2023. In this context, the Com-

mittee was supported by an external adviser. In selecting possible

candidates, the Presiding and Nomination Committee gave partic-

ular consideration to the targets adopted by the Supervisory Board

for its composition, including the profile of skills and expertise and

the diversity policy for the Supervisory Board.

The Transformation and Sustainability Committee, composed of

Ms.Doreen Nowotne (Chair), Mr. Wijnand P. Donkers and Mr. Richard

Ridinger in the reporting period, held a total of nine meetings. Six

meetings were held in person and three meetings virtually. In addi-

tion to the meetings, four informal video conferences took place

with the Board of Management in connection with potential acqui-

sition projects. At the meetings in the reporting period, the Commit-

tee dealt in detail with the implementation of “Project Brenntag”, for

which the company was able to announce at the end of the report-

ing period that the goals had been successfully achieved ahead of

schedule. In the second half of the reporting period especially, the

Committee’s focus shifted to the development and preparation of

the subsequent strategy project. In this context, the committee

dealt with the continued development of the two divisions’ strategic

direction, digitalization and the development of an ambitious sus-

tainability strategy by establishing new and ambitious medium-

and long-term targets, and prepared the relevant topics and reso-

lutions for the Supervisory Board meetings. In December 2022, the

Committee was renamed the “Transformation and Sustainability

Committee”. In future, it will allocate more time and attention to

discussing and monitoring the implementation of the company’s

sustainability strategy.

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

26Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

German Corporate Governance Code

In connection with the further transformation and implementation

of Brenntag’s new corporate culture, the Supervisory Board of

Brenntag SE regularly discussed the requirements and principles of

reliable and sustainable corporate governance and their imple-

mentation within the company. On December 13, 2022, the Super-

visory Board decided on new rules of procedure for the Board of

Management, the Supervisory Board and its committees so as to

reflect the changes resulting from the new version of the German

Corporate Governance Code. On December 13, 2022, the Supervi-

sory Board and the Board of Management jointly submitted a new

declaration of conformity, which appears both on Brenntag’s

website under Corporate Governance Code and in the corporate

governance statement.

Good corporate governance also includes regularly assessing how

effectively the Supervisory Board as a whole and its committees

perform their duties. The Supervisory Board continuously assesses

the effectiveness with which the duties of the Supervisory Board

and its committees are performed. The assessment usually com-

prises multiple steps and starts, for example, by establishing the

points of focus, such as the frequency, organization and structuring

of meetings and committees, the scope and nature of the informa-

tion provided, communication within the Supervisory Board and

with the committees, and cooperation between the Board of Man-

agement and the Supervisory Board. The efficiency review usually

finishes by specifying objectives and setting out a schedule and

multiple follow-up meetings for a regular joint review of the objec-

tives and individual feedback. An external adviser monitors and

assists with the assessment from time to time. Building on the last

detailed efficiency review in 2021, the Supervisory Board scrutinized

the continued effectiveness of its activities in the second half of

2022. Particular emphasis was placed on examining the long-term

implementation and maintenance of the objectives set, also bear-

ing in mind the current and changing requirements on the Super-

visory Board and the committees. The Supervisory Board thus ful-

filled its intention from 2021 to conduct a more regular review on an

annual basis so as to continually assess and improve the effective-

ness of its work. The next self-assessment is scheduled for 2023.

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

27Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

Brenntag SE aims to be as transparent as possible in communicat-

ing with the capital market. As Chair of the Supervisory Board, I am

authorized under section 5.4 (1) of the Supervisory Board’s rules of

procedure to discuss Supervisory Board-specific issues with inves-

tors, provided this is in the company’s interests and in compliance

with the applicable laws. Regular dialog with shareholders and

potential investors is of great importance to us. As Chair of the Super-

visory Board, I fulfilled this responsibility in particular at a multi-day

corporate governance roadshow in February 2022. The discussions

covered topics such as the composition of the Board of Management

and the status and further development of ESG within Brenntag SE.

I notified the Supervisory Board of all the main topics covered in

those discussions and kept the Chief Executive Officer fully informed.

In accordance with the German Corporate Governance Code, the

Supervisory Board informs the General Shareholders’ Meeting of any

conflicts of interest that have arisen among Supervisory Board

members. The members of the Board of Management and the

Supervisory Board are required to report any conflicts of interest to

me as Chair of the Supervisory Board without undue delay. No such

conflicts of interest were disclosed in the entire reporting period and

we can once again confirm our belief that all members of the Super-

visory Board can be regarded as independent of the company.

In the reporting period, the members of the Supervisory Board

undertook training and professional development measures appro-

priate to their duties on the Board to enable them to best carry out

their activities on the Supervisory Board. Training and development

measures included participation in specific events for Supervisory

Board members by the leading audit firms as well as other confer-

ences and professional events, for example on relevant regulatory

changes. The points of focus spanned corporate governance, sus-

tainability, financial and non-financial reporting, compliance and

risk management. As well as attending training events, the mem-

bers of the Supervisory Board were actively involved in associations

and networks such as the German Audit Committee Network, Finan-

cial Experts Association e.V., Deutsche Schutzvereinigung für Wert-

papierbesitz, the Applied Governance Circle and the Audit Commit-

tee Institute. In accordance with the law and the recommendation

of the German Corporate Governance Code, Brenntag SE bore the

cost of all Supervisory Board training measures to the extent that

these provided Brenntag-specific knowledge. Brenntag also

assisted the members of the Supervisory Board in organizing suit-

able trainings, such as a workshop on current regulatory changes

around ESG in August 2022. In addition, new members of the Super-

visory Board receive selectively compiled information materials

before taking up their position to enable them to prepare for their

activities. Further information on corporate governance at Brenntag

can be found in the Corporate Governance Statement.

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

28Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

Review and adoption of the annual financial statements,

approval of the consolidated financial statements,

proposal for the appropriation of profit

The annual financial statements of Brenntag SE for the year ended

December 31, 2022 and the combined Group management report

and management report of Brenntag SE were prepared by the

Board of Management in accordance with the provisions of the

German Commercial Code (HGB) and the German Stock Corpora-

tion Act (AktG), and the consolidated financial statements in accor-

dance with the principles of the International Financial Reporting

Standards (IFRSs) as adopted in the EU and the supplementary pro-

visions of the German Commercial Code applicable pursuant to

Section 315e HGB. PricewaterhouseCoopers GmbH Wirtschafts-

prüfungsgesellschaft (PwC), Düsseldorf, the auditors elected by the

General Shareholders’ Meeting and appointed by the Supervisory

Board, audited and issued an unqualified auditors’ report on the

annual financial statements of Brenntag SE, the combined Group

management report and management report of Brenntag SE, and

the consolidated financial statements.

The annual financial statements of Brenntag SE, the consolidated

financial statements and the combined Group management report

and management report of Brenntag SE as well as the auditors’

audit reports were available to all members of the relevant body in

good time ahead of the Audit Committee meeting on February 28,

2023 and the Supervisory Board meeting on March 7, 2023. The

financial statement documents were discussed in detail on the

Audit Committee and on the Supervisory Board, in both cases in the

presence of the auditors, who gave a report. Following the prelimi-

nary review by the Audit Committee and the final result of the Super-

visory Board’s own review during its meeting on March 7, 2023, there

were no objections to be raised. The Supervisory Board endorses the

findings of the audit and approved the above-mentioned financial

statements prepared by the Board of Management. The annual

financial statements were thus adopted on March 7, 2023. The

Supervisory Board endorsed the Board of Management’s proposal

to use the distributable profit to pay a dividend of EUR 2.00 per

dividend-bearing no-par value share.

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

29Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

Brenntag SE is required to prepare a combined separate non-finan-

cial report for the financial year 2022. By way of a circular resolution

passed on December 21, 2022, the Supervisory Board instructed

PwC to perform a limited assurance engagement on the non-

financial reporting. All Supervisory Board members received the

combined separate non-financial Group report (“NfR”) and PwC’s

practitioner’s report on the limited assurance engagement on the

non-financial reporting (“Practitioner’s Report”) at an early stage.

The NfR and PwC’s Practitioner’s Report were discussed in detail by

the Audit Committee. The auditors from PwC took part in these

discussions and presented and explained the results of their review.

On the basis of its own review of the NfR, the Supervisory Board

passed a resolution on March 7, 2023 not to raise any objections to

the NfR or the Practitioner’s Report and to approve the findings of

PwC’s review.

Composition of the Board of Management

and Supervisory Board

There were no changes in the composition of the Supervisory Board

of Brenntag SE in the 2022 reporting period. We are delighted that

Mr. Wijnand P. Donkers and Mr. Ulrich M. Harnacke were reelected.

Ihave been Chair of the Supervisory Board since June 10, 2020 and

intend to retain this position until the end of my current mandate.

Mr. Richard Ridinger then intends to stand for the position of Chair

of the Supervisory Board.

There was one change in the composition of the Board of Manage-

ment in the reporting period. With effect from April 1, 2022, the

Supervisory Board appointed Dr. Kristin Neumann to the Board of

Management of Brenntag SE. She took up the position of Group

Chief Financial Officer. Dr. Kristin Neumann has many years’ expe-

rience at global companies. In her role, she is responsible for

Accounting, Controlling, Investor Relations, Legal, Shared Services,

Tax, Treasury and Insurance. Dr. Kristin Neumann succeeds Mr.Georg

Müller, who, with effect from February 2, 2022, stepped down

as Chief Financial Officer by mutual agreement. Dr. Christian

Kohlpaintner is still Chief Executive Officer on the five-member

Board. Besides Mr. Ewout van Jarwaarde, who holds the position of

Chief Transformation Officer on the Board of Management, the

Board members also include Mr. Steven Terwindt, who leads the

Brenntag Essentials division. Mr. Henri Nejade, who was responsible

for the Brenntag Specialties division in the reporting period, has

decided not to extend his service agreement with Brenntag when it

ends on June 30, 2023. The Supervisory Board would like to sincerely

thank Mr. Henri Nejade for his notable contribution to Brenntag’s

success and wish him all the best for his personal and professional

future. As of April 1, 2023, Mr. Michael Friede will take over the

position of Brenntag Specialties Chief Operating Officer. We are

pleased to have attracted to Brenntag an executive with interna-

tional experience and profound market knowledge.

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

30Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

Thanks to the outstanding efforts and considerable dedication of

our employees, we were able to master the economic challenges in

the reporting period, while at the same time taking a significant

step forward on our transformation journey. On behalf of the entire

Supervisory Board, I would like to sincerely thank all Brenntag

employees, the Global Leadership Team and the entire Board of

Management for this exceptional achievement.

On behalf of the Supervisory Board

Doreen Nowotne

Chair

Essen, March 2023

REMUNERATION

REPORT

NON-FINANCIAL

REPORT

MANAGEMENT

REPORT

CONSOLIDATED

FINANCIAL STATEMENTS

FURTHER

INFORMATION

31Brenntag SEAnnual Report 2022

TO OUR

SHAREHOLDERS

REPORT OF THE SUPERVISORY BOARD

Corporate Governance Statement

Brenntag has always attached great importance to good

corporate governance. As a globally operating DAX40-listed

company, we are particularly aware of our responsibility and

our obligations in this area. The Board of Management and

Supervisory Board jointly issue the corporate governance

statement pursuant to Sections 289f and 315d of the German

Commercial Code (HGB) and report on the principles of

responsible corporate governance at Brenntag, each being

responsible for the parts of the report that relate to them. In

accordance with Principle 23 of the German Corporate Gov-

ernance Code in its current version of April 27, 2022, the cor-

porate governance statement is the central instrument of

corporate governance reporting.

Corporate Governance

Commitment to responsible corporate

governance

As in previous years, in this reporting year the Board of Man-

agement and the Supervisory Board thoroughly examined

corporate governance and the requirements of the German

Corporate Governance Code (“GCGC”). On the basis of these

deliberations, they issued, on December 13, 2022, the follow-

ing declaration of conformity with the recommendations of

the GCGC of December 16, 2019 and of April 27, 2022:

“Declaration by the Board of Management and the Supervi-

sory Board of Brenntag SE in accordance with Article 9 para.

1 lit. c) ii) SE-VO in conjunction with section 161 of the German

Stock Corporation Act (Aktiengesetz)

The Board of Management and the Supervisory Board of

Brenntag SE are obliged to resolve a Declaration of Confor-

mity in accordance with Article 9 para. 1 lit. c) ii) SE-VO in con-

junction with Section 161 of the German Stock Corporate Act

(Aktiengesetz). The last Declaration of Conformity has been

resolved on December 14, 2021. As of this time, the German

Corporate Governance Code in the version dated March 20,

2020 (“GCGC 2020”) was still in place. On June 27, 2022, a new